Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

US Oil and Gas: Will Higher Production Levels Overwhelm Weakening Demand?

Investors remain strongly bearish on petroleum prices, even as confidence grows that the U.S. Federal Reserve will cut interest rates to boost consumer and business spending. Last week, fund managers returned to selling oil futures and options, as the brief rally from the previous week quickly lost steam and negative sentiment took hold once again. Hedge funds and other money managers offloaded 48 million barrels across the six major futures and options contracts in the week ending August 20. This marks the sixth time in seven weeks that funds have been sellers, reducing their positions by a staggering 346 million barrels since early July, based on data from exchanges and regulators.

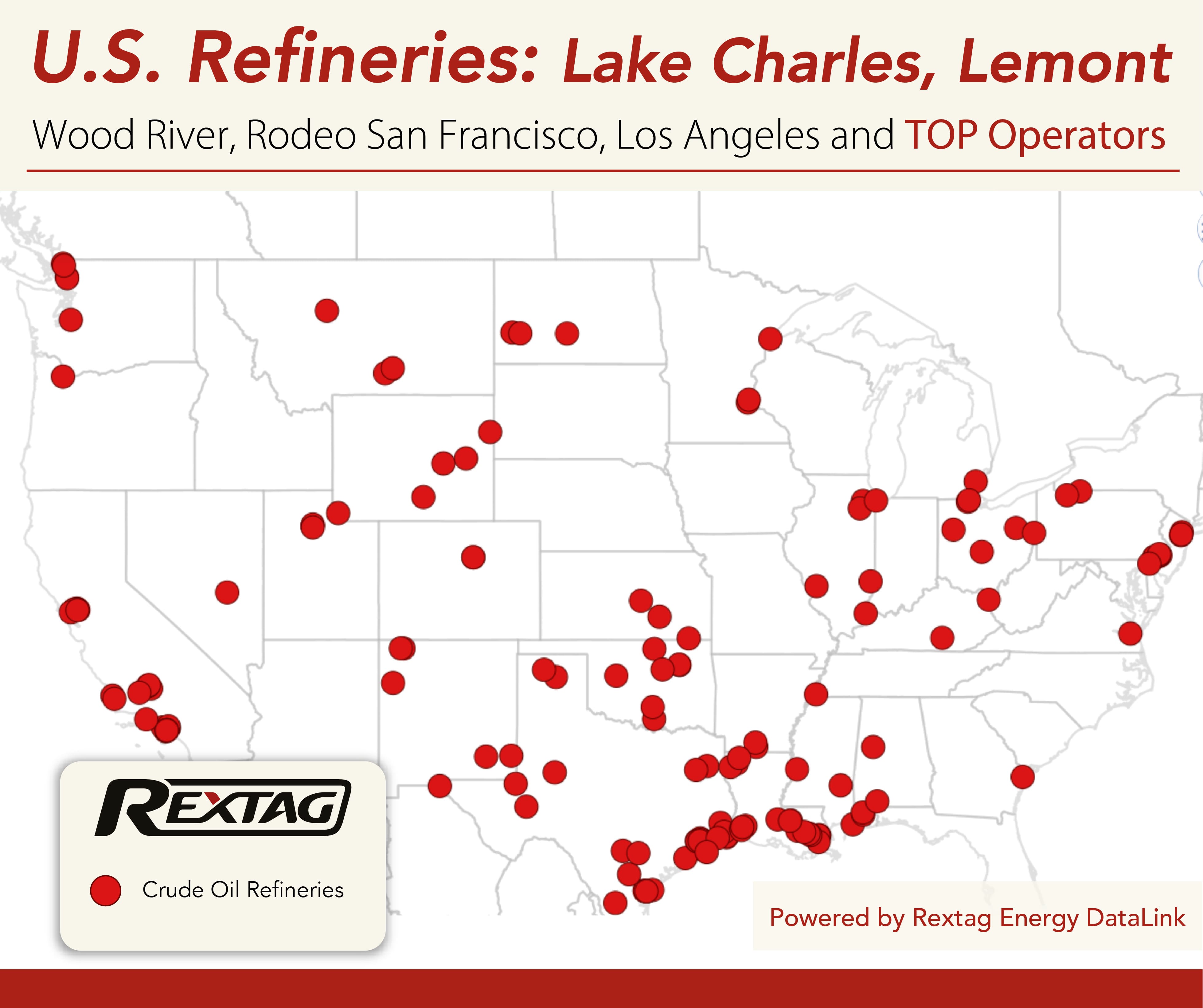

U.S. Refineries: Lake Charles, Lemont, Wood River, Rodeo San Francisco, Los Angeles and TOP Operators

U.S. crude oil refining capacity experienced a notable boost this year, climbing 1.5% to reach 18.38 million barrels per day. The recent expansion includes Exxon Mobil's Beaumont, Texas, refinery, which underwent a significant increase of approximately 250,000 barrels per day. As of the start of 2023, there were 124 active oil refineries nationwide. After a two-year downturn due to decreased demand during the COVID-19 pandemic, U.S. refining capacity saw a significant rebound. In 2023 alone, capacity surged by over 100,000 barrels per day to reach 18.1 million, although this still trails the peak of 18.98 million barrels per day seen in 2019.

US Leads Global Oil and Gas Production, US Drillers Cut Rigs Again and 1.4 Million BBL Decrease

The U.S. has overtaken Saudi Arabia and Russia to become the world's largest oil and gas producer. In 2024, America's oil output has surpassed last year's record by 1.4%, reaching new heights. Even as oil-producing countries in the Middle East cut back, the U.S. continued to ramp up production after a downturn in 2020, establishing itself as a dominant force in the global market. In terms of numbers, U.S. oil production jumped from an average of 2.93 million barrels per day in 2023 to 13.12 million barrels per day in 2024, marking a significant 7.1% increase.

Significant Rise in U.S. Crude Oil and Gasoline Inventory Levels

This week, the American Petroleum Institute (API) reported that U.S. crude oil stocks increased by 7.168 million barrels, ending February 16. This rise exceeded analysts' expectations of a 4.298 million barrel increase. Last week, the API noted an 8.52 million barrel jump in crude inventories.

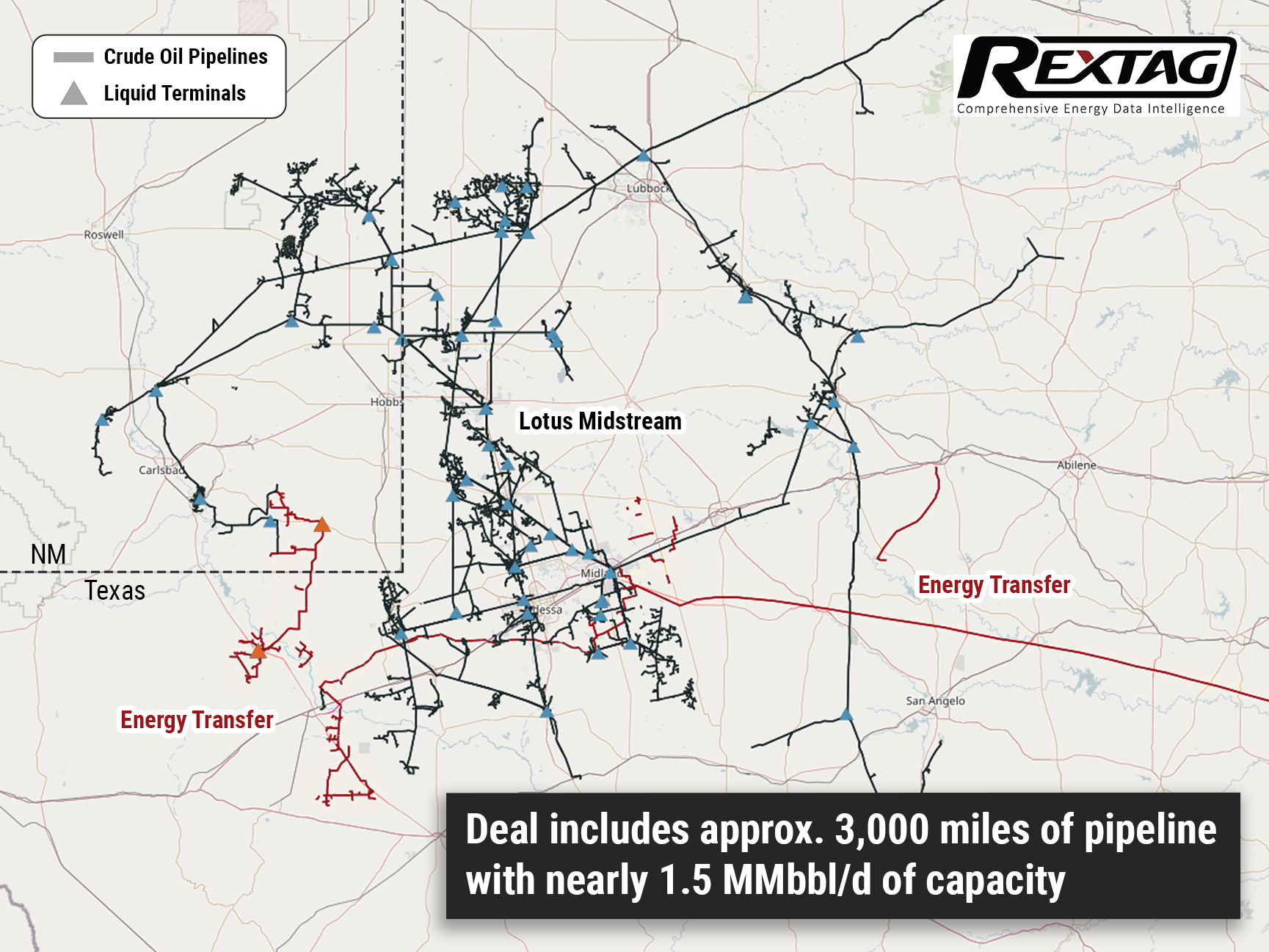

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

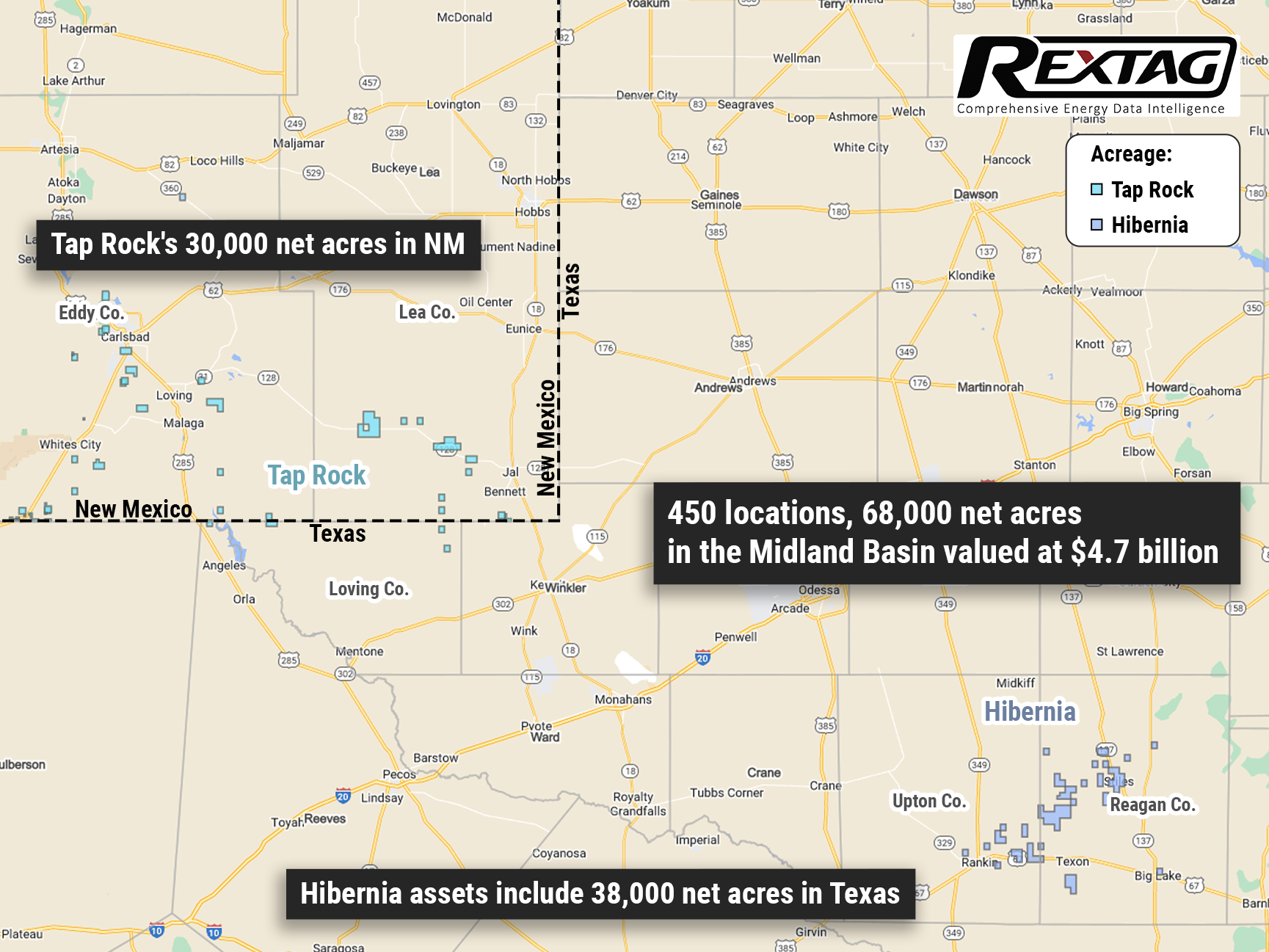

Civitas Makes $4.7B Entry into Permian Basin

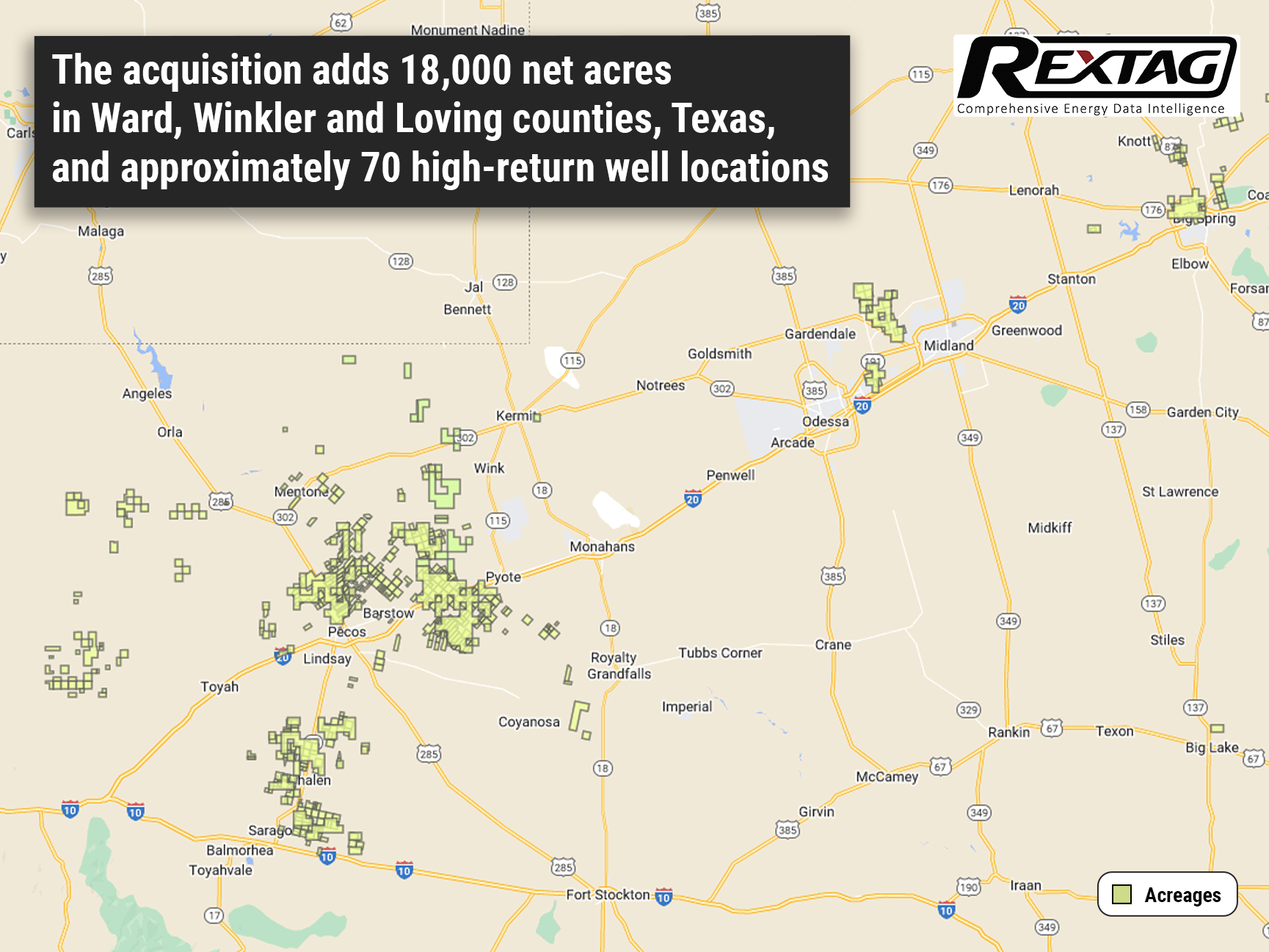

Civitas Resources Expands into Denver-Julesburg Basin through $4.7B Cash and Stock Deals for NGP's Tap Rock and Hibernia. Civitas Resources has recently secured two definitive agreements to expand its presence in the Permian Basin's Midland and Delaware basins. The company will achieve this expansion through the acquisition of two private exploration and production companies, namely Hibernia Energy III LLC and Tap Rock Resources LLC. The total value of the deal, paid in both cash and stock, amounts to $4.7 billion. Both Hibernia Energy III LLC and Tap Rock Resources LLC are supported by NGP Energy Capital Management LLC. These acquisitions reflect the increasing demand for oil and gas reserves in the Permian Basin, with companies specializing in the region actively seeking new opportunities. Currently, Civitas Resources' primary production operations are focused in the Denver-Julesburg Basin (D-J Basin).

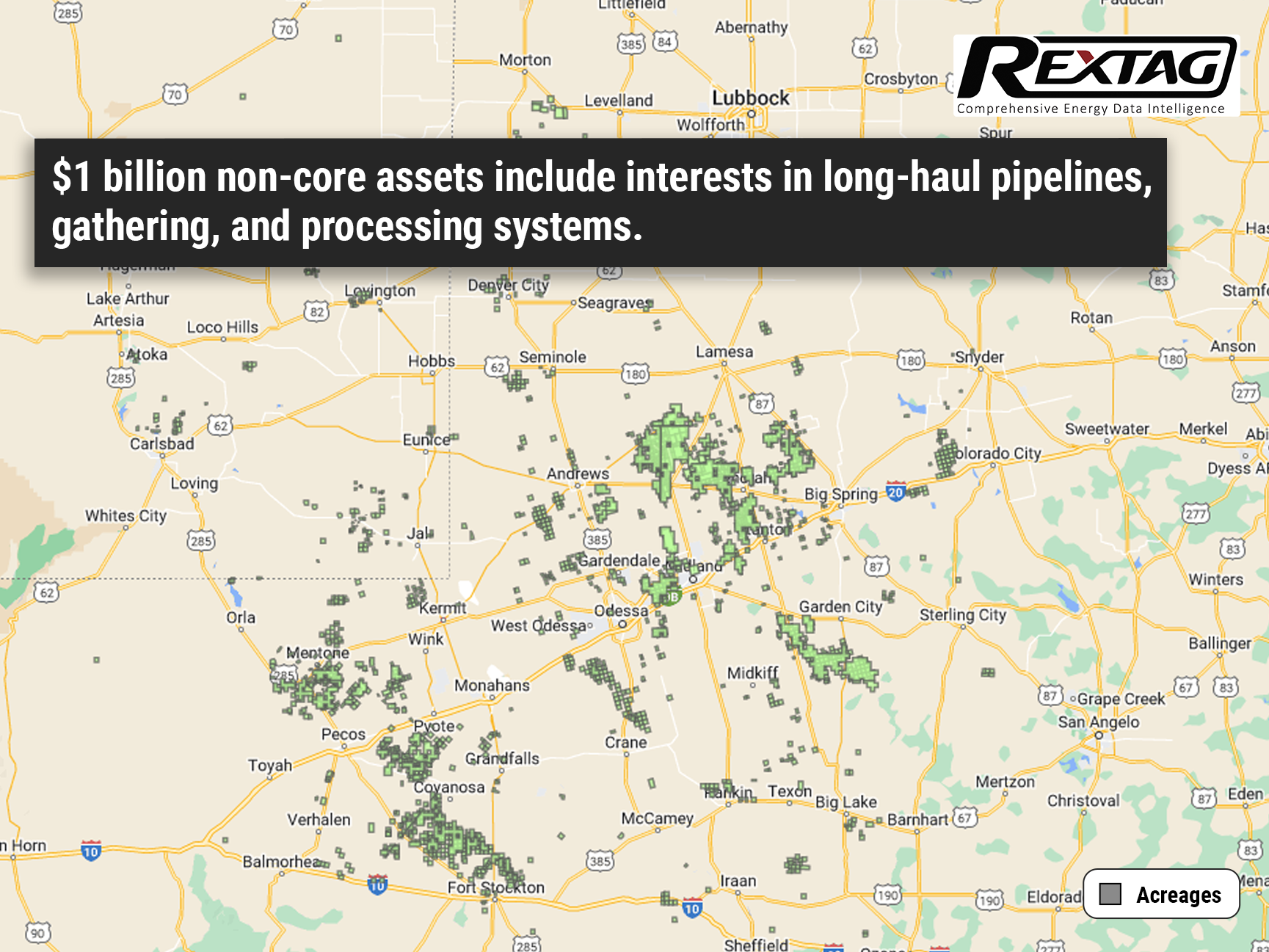

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

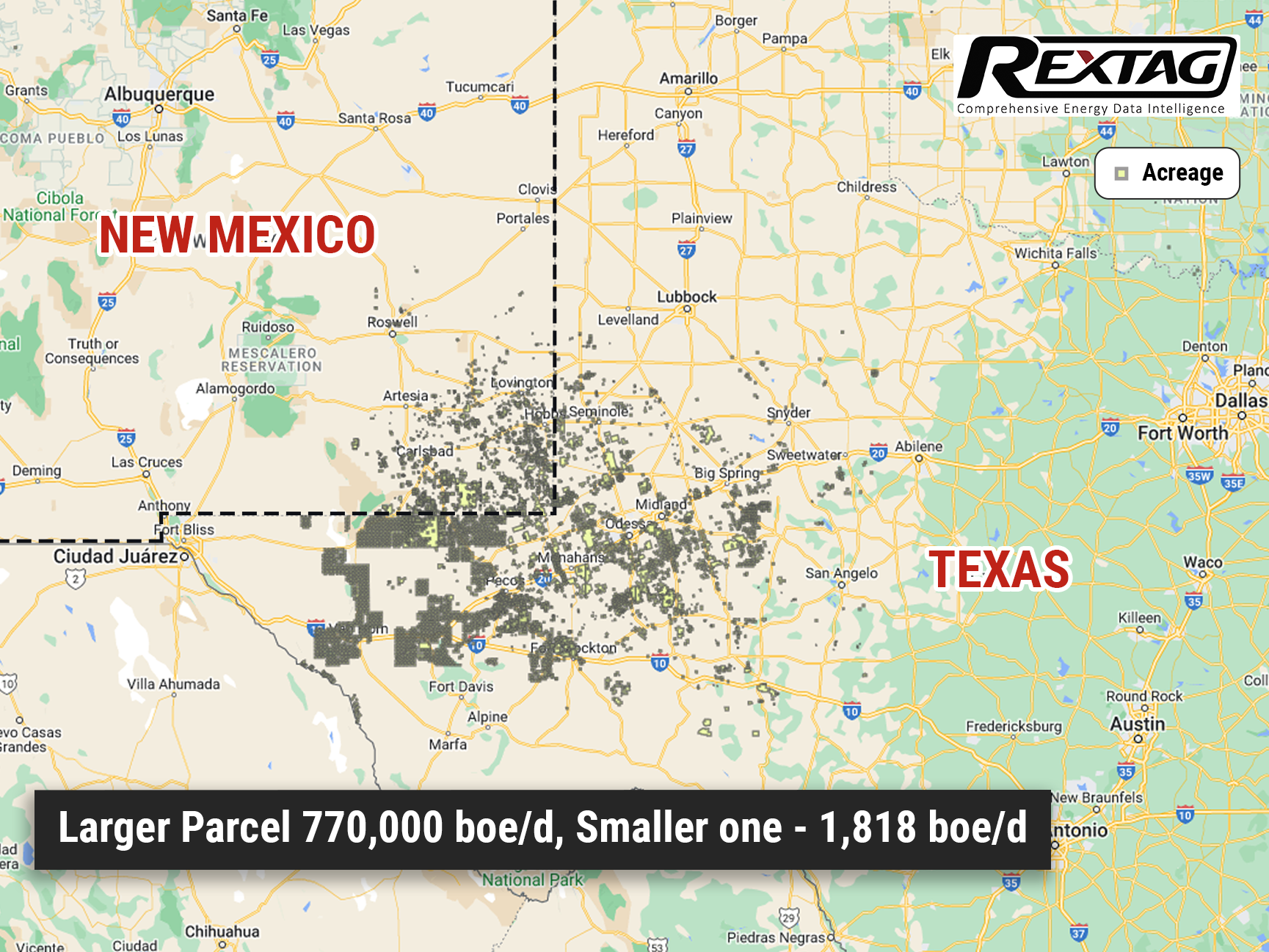

Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas

According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas. As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets. Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

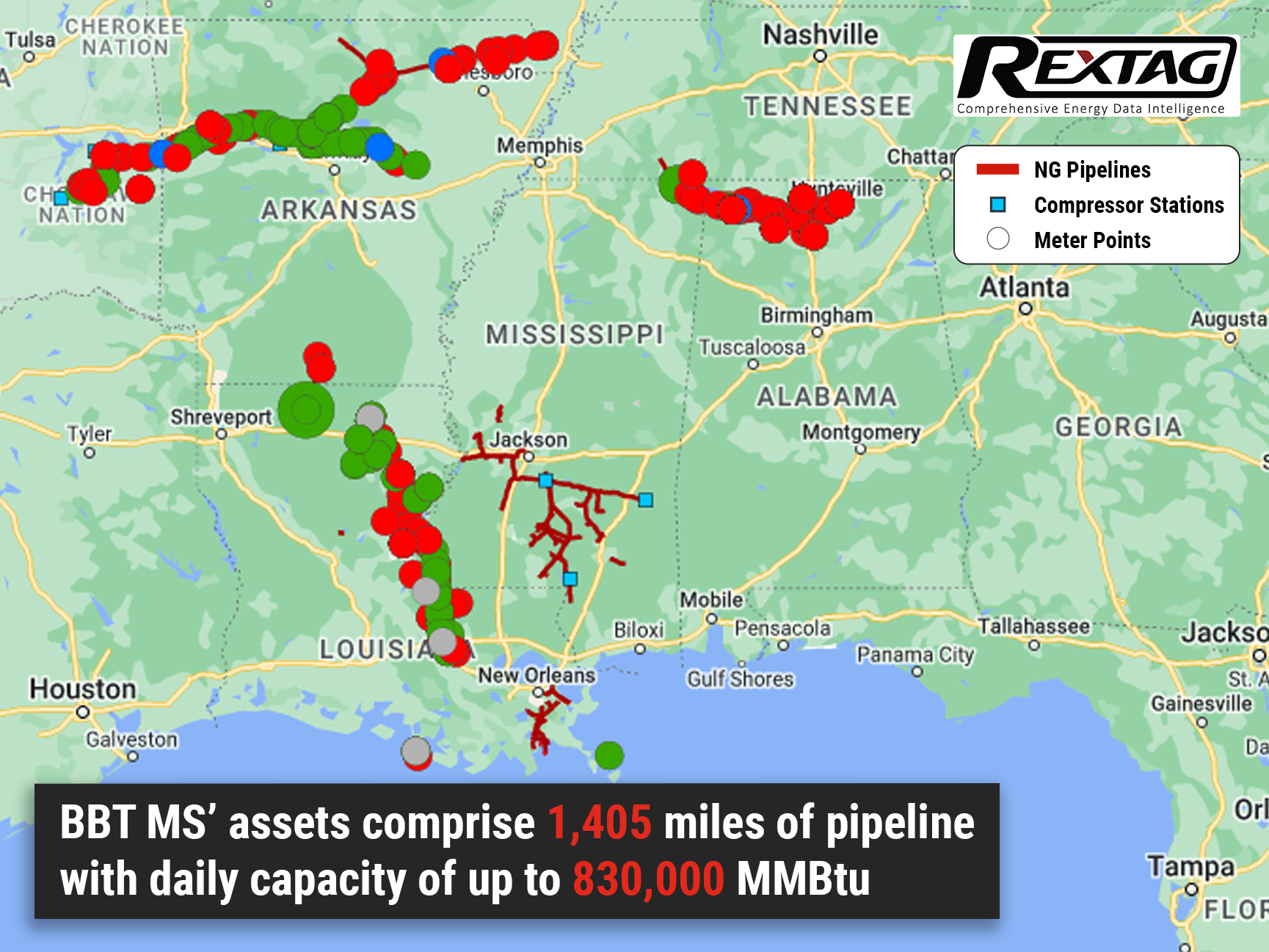

Black Bear Roars with Success: Mississippi Gas Gathering Assets Sold

Skye MS LLC purchased a package deal from Black Bear, which included over 120 miles of natural gas pipelines and eight active metered locations. Black Bear Transmission LLC, based in Houston, successfully finalized the sale of gas gathering assets owned by BBT Mississippi LLC (BBT MS) to Skye MS LLC of Columbia, Mississippi. The specific amount of the transaction remains undisclosed. BBT MS is the proud owner and operator of a fee-based, natural gas transmission system that efficiently supplies gas to utility, industrial, and power generation customers. It facilitates the connection of wellhead production in Mississippi to regional long-haul pipelines.

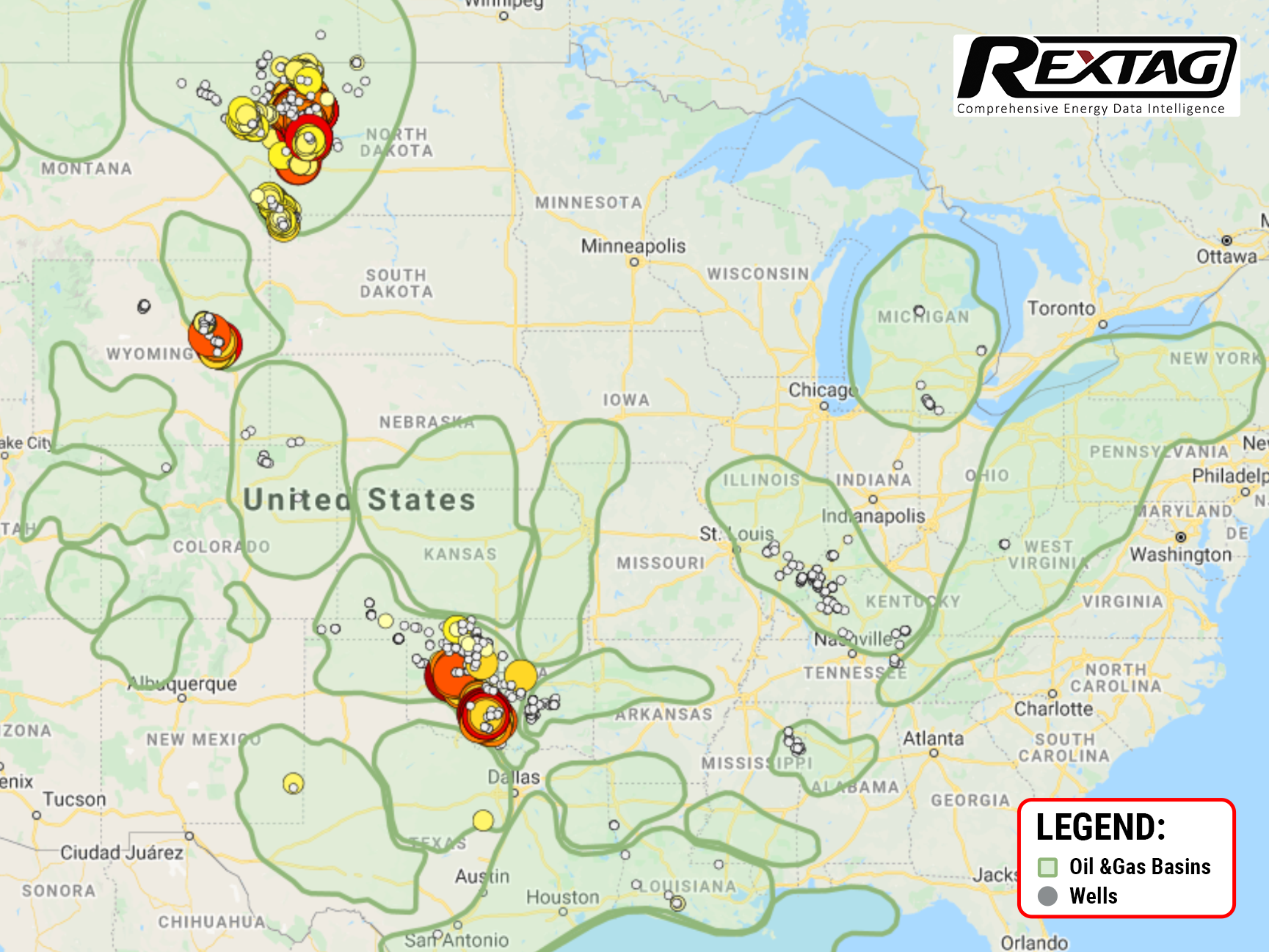

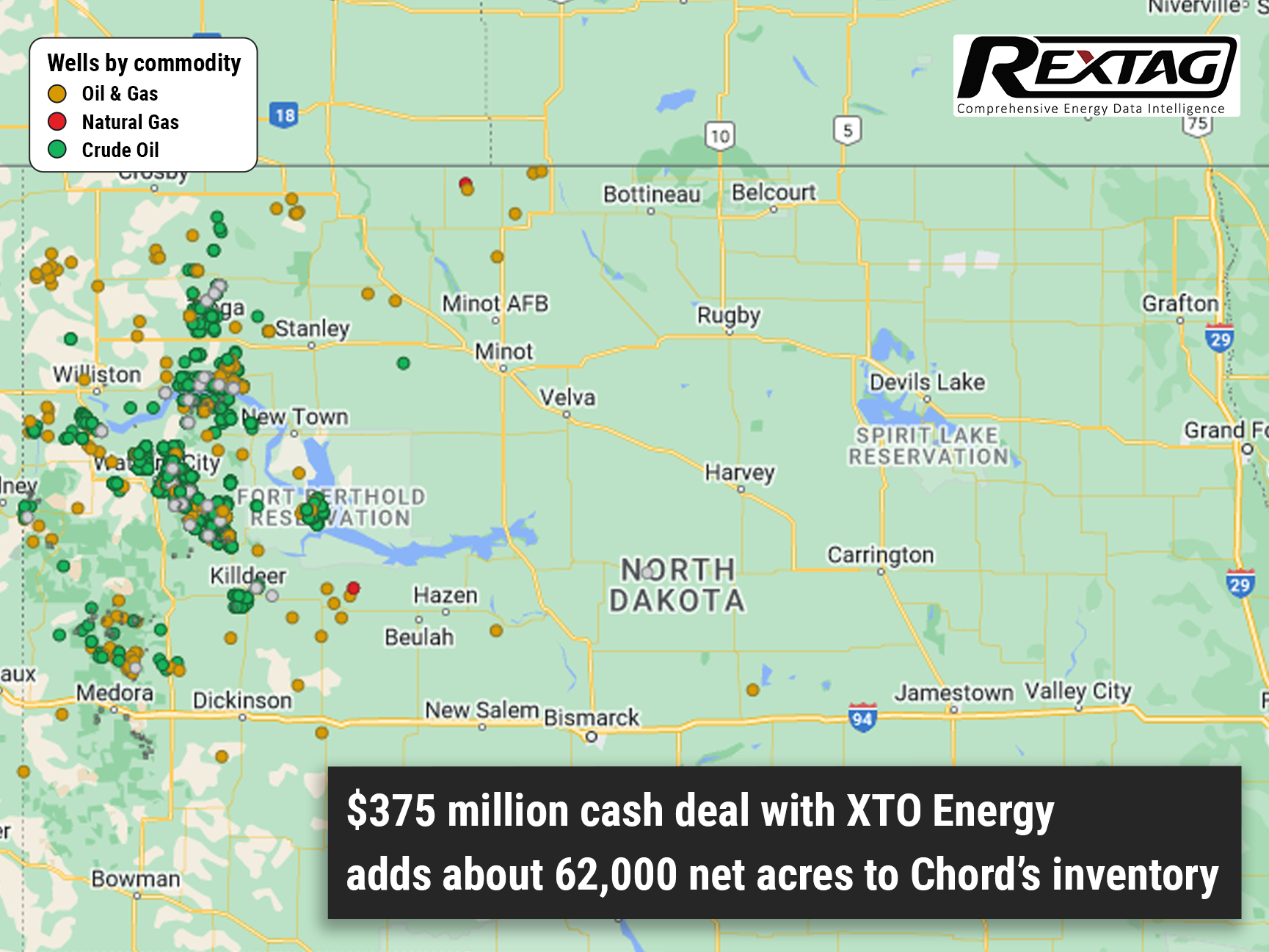

Chord Energy Corp. Expands Williston Basin Footprint with $375 Million Acquisition from Exxon Mobil

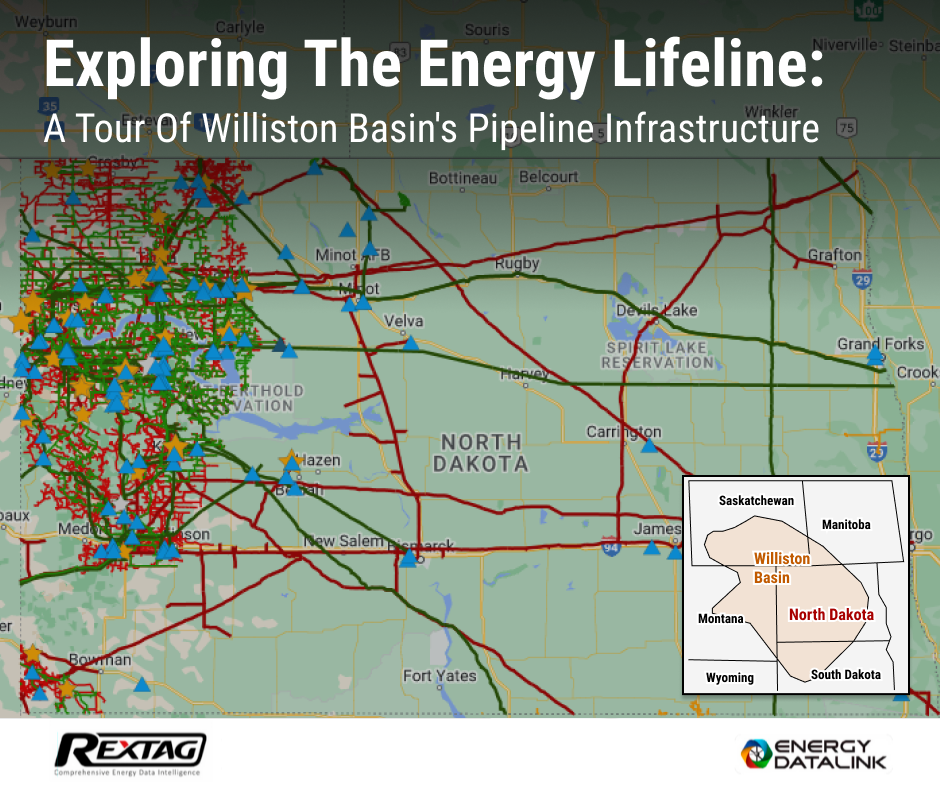

Chord Energy Corp.'s subsidiary has entered into an agreement to purchase assets in the Williston Basin from Exxon Mobil, and its affiliates for $375 million. Chord Energy, a US independent company, is strategically expanding its presence in the Williston Basin of Montana and the Dakotas. While industry attention remains fixated on the Permian Basin, Chord Energy recognizes the potential of the Williston Basin and is capitalizing on the opportunity to enhance its reserve portfolio. Chord Energy successfully completed the acquisition of 62,000 acres in the Williston Basin from XTO Energy for a substantial cash consideration of $375 million.

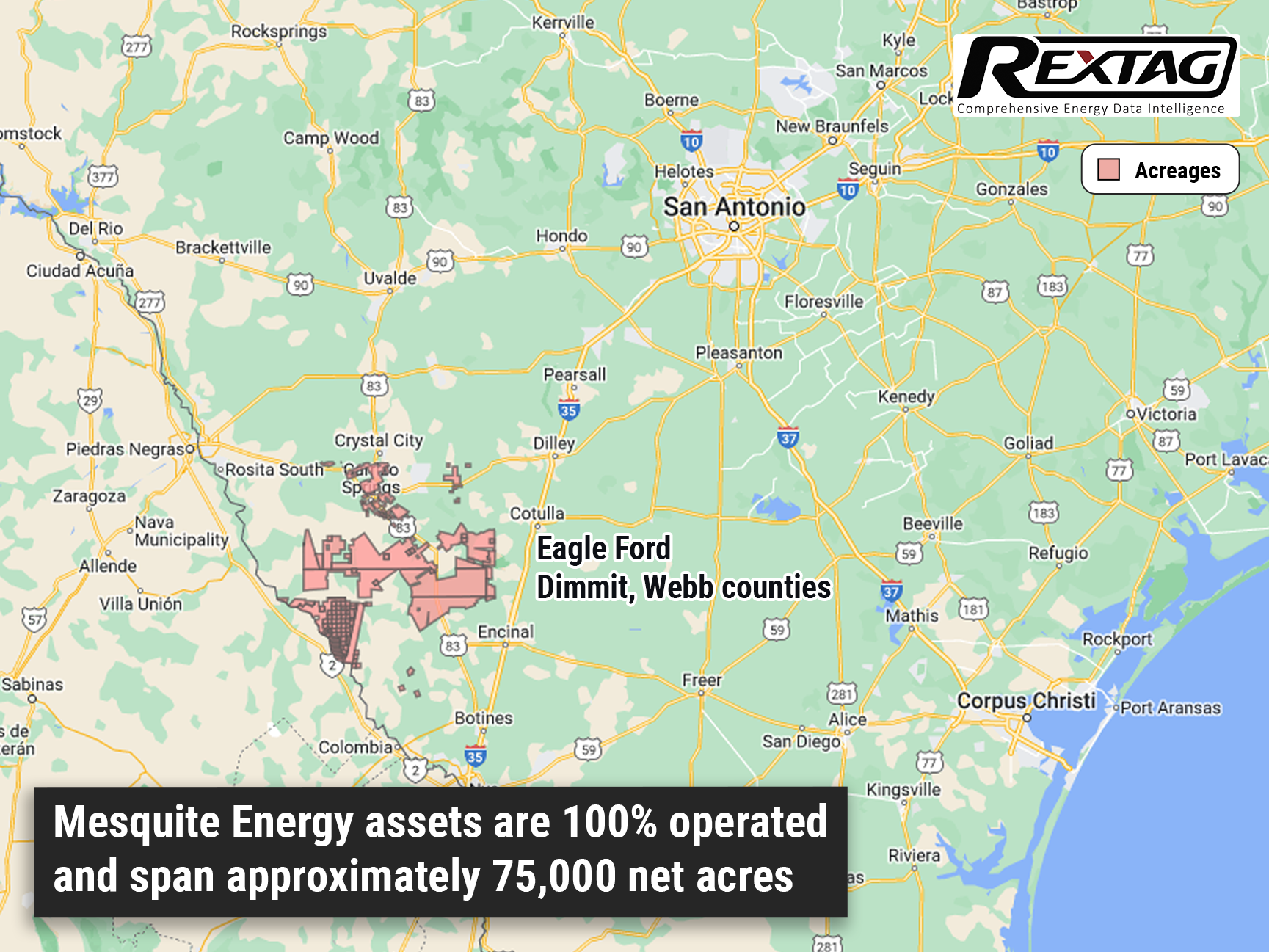

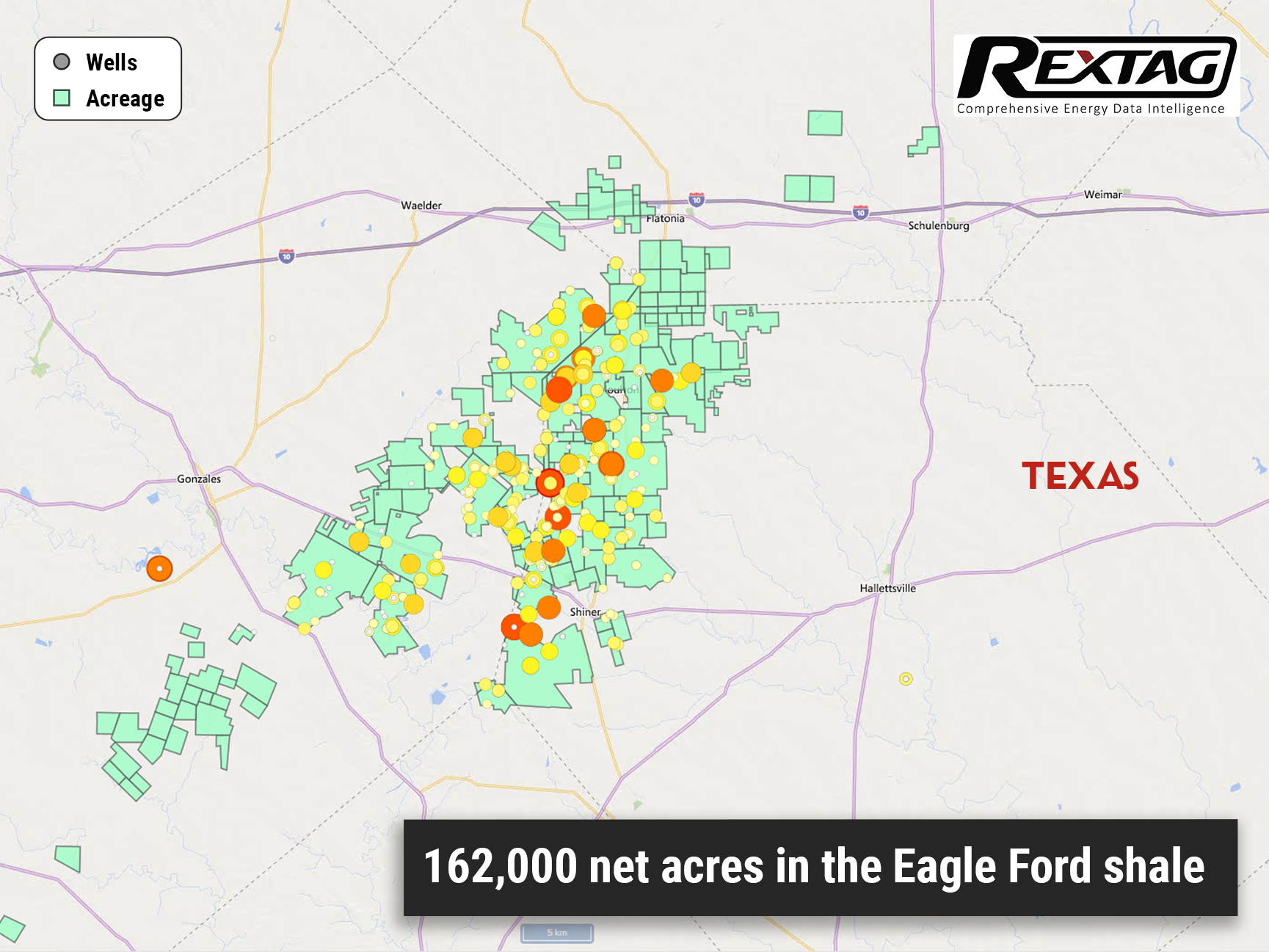

Crescent Energy Boosts Portfolio with Eagle Ford Acquisition: Expands Non-Operated Assets

Big announcement! Crescent Energy is set to bolster its inventory in the play by acquiring operated and working interests from Mesquite Energy. Crescent Energy Co. seals a $600 million cash deal to acquire assets in the Eagle Ford Shale from Mesquite Energy Inc. (formerly Sanchez Energy).

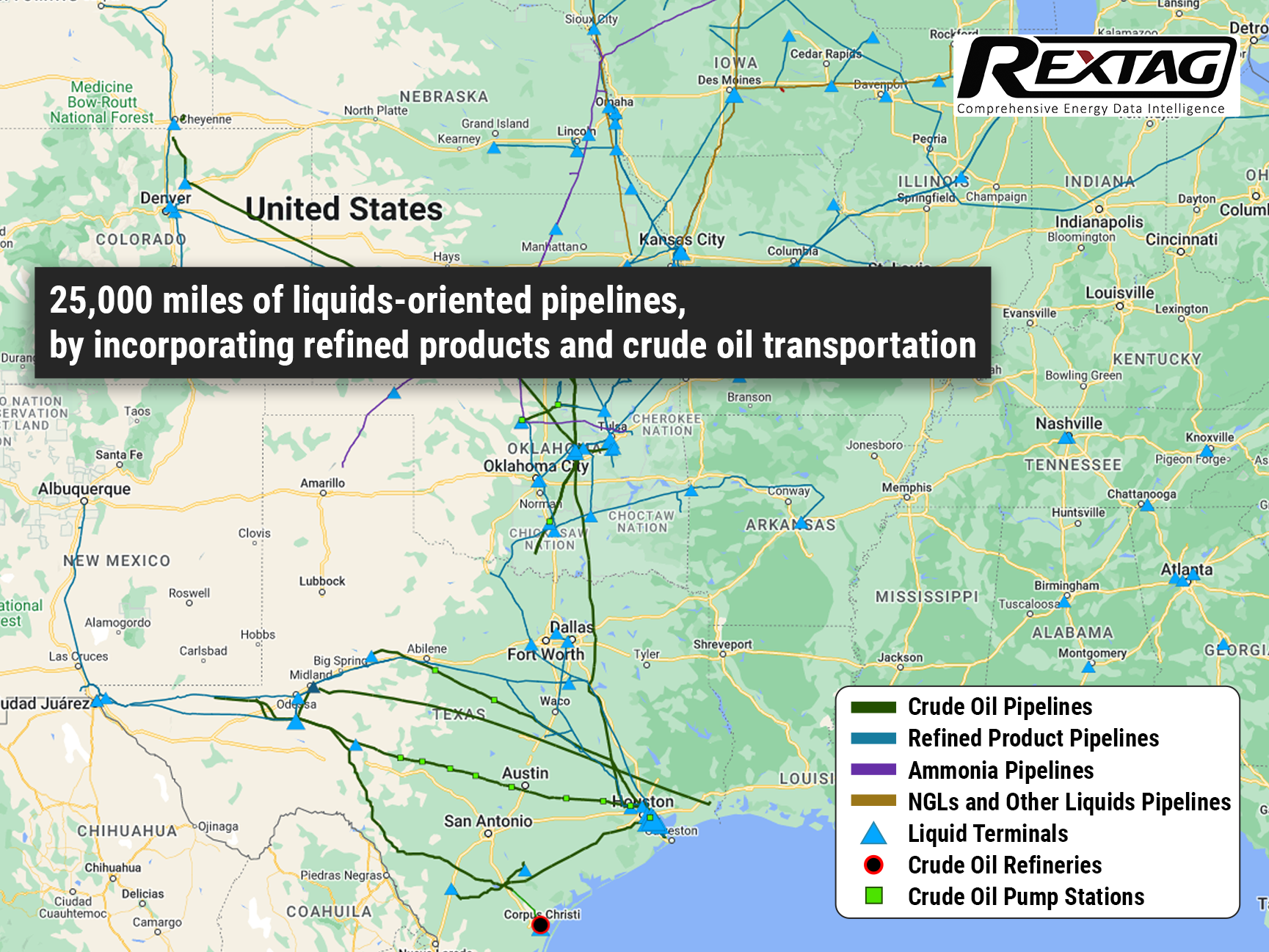

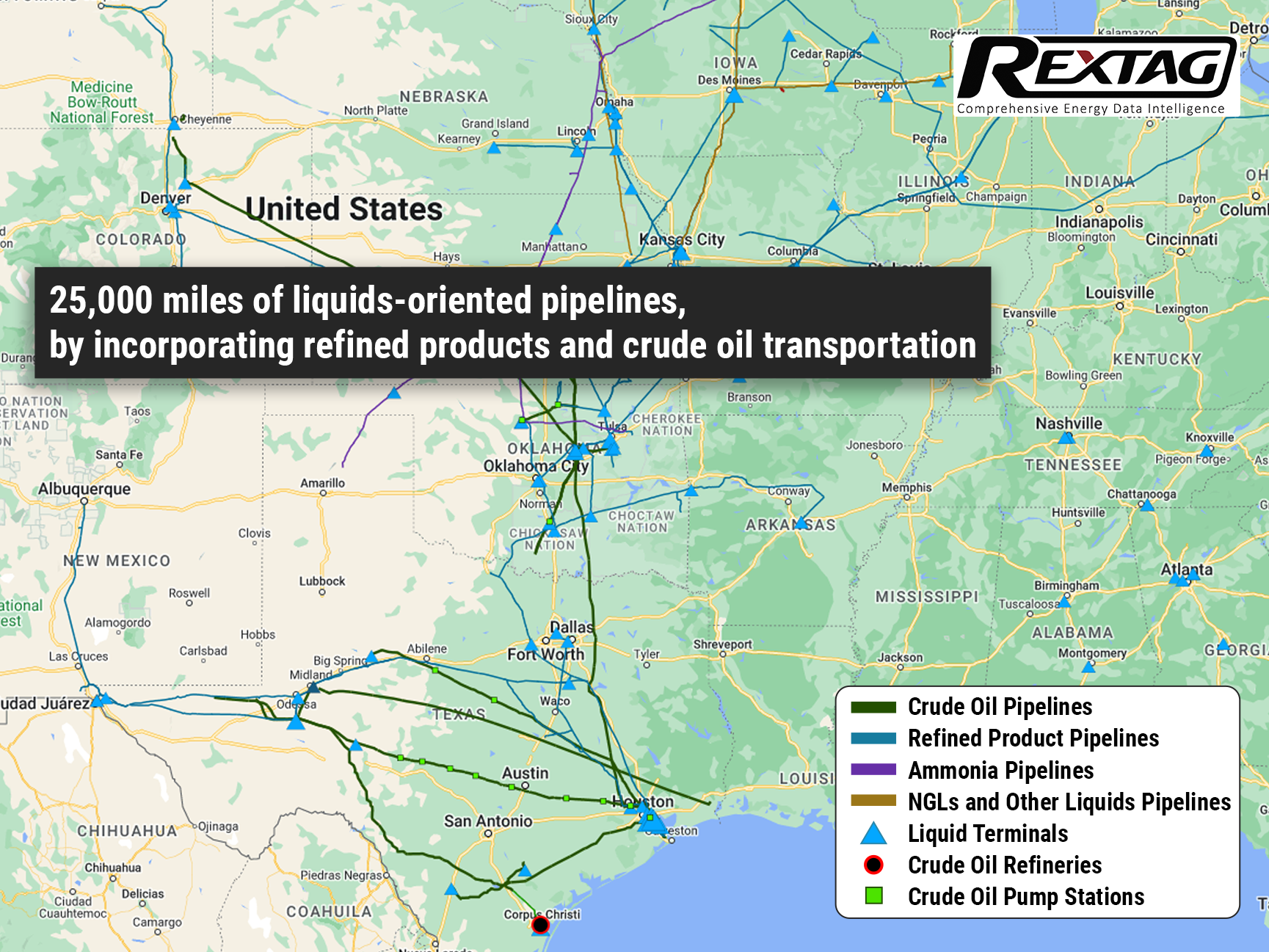

ONEOK Buys Magellan for $18.8 Billion: Overview of the Huge M&A Deal in the Pipeline Industry

In May, ONEOK (OKE) made an announcement regarding its acquisition of Magellan Midstream Partners LP (MMP) for a total value of $18.8 billion, which includes cash and stocks. This move drew attention as it positions ONEOK, primarily known for its involvement in the provision, gathering, and processing of Natural Gas (NG), to become one of the largest pipeline companies in the United States. The acquisition also allows ONEOK to expand its services by including Oil (CL), another significant energy commodity.

Global Oil Supply and Demand Trends Overview: Insights from Rextag

Global oil supply and demand saw notable changes in April 2023. Liquids demand declined by 0.7 MMb/d to 99.9 MMb/d, with gains in China and Europe offset by reduced demand in Japan and the Middle East. OPEC 10 production remained stable at 29.5 MMb/d, while Saudi Arabia increased output by 0.3 MMb/d. Non-OPEC production declined slightly, Russian production dropped further, and US shale production remained steady. Combined production in Iran, Venezuela, and Libya remained unchanged. Commercial inventories increased, and OPEC+ implemented production cuts. Economic sentiment remains uncertain amid rising global inflation.

Revolutionary Merger: ONEOK Set to Unleash $18.8 Billion Acquisition of Magellan Midstream Partners

ONEOK Inc. and Magellan Midstream Partners LP have announced a merger agreement that will result in the formation of a formidable midstream company headquartered in Tulsa, Oklahoma. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

Callon Acquires $1.1 Billion Delaware Assets and Bows Out of Eagle Ford - Here's What You Need to Know

Callon is set to purchase Percussion Petroleum's Delaware assets for $475 million while selling its Eagle Ford assets to Ridgemar for $655 million. In a strategic step to optimize its operations, Callon Petroleum recently made headlines by sealing two deals on May 3, totaling a staggering $1.13 billion. The company is taking confident steps to bolster its presence in the Delaware Basin while bidding farewell to its stake in the Eagle Ford Shale.

Permian Resources Secures a Major Deal in the Thriving Delaware Basin

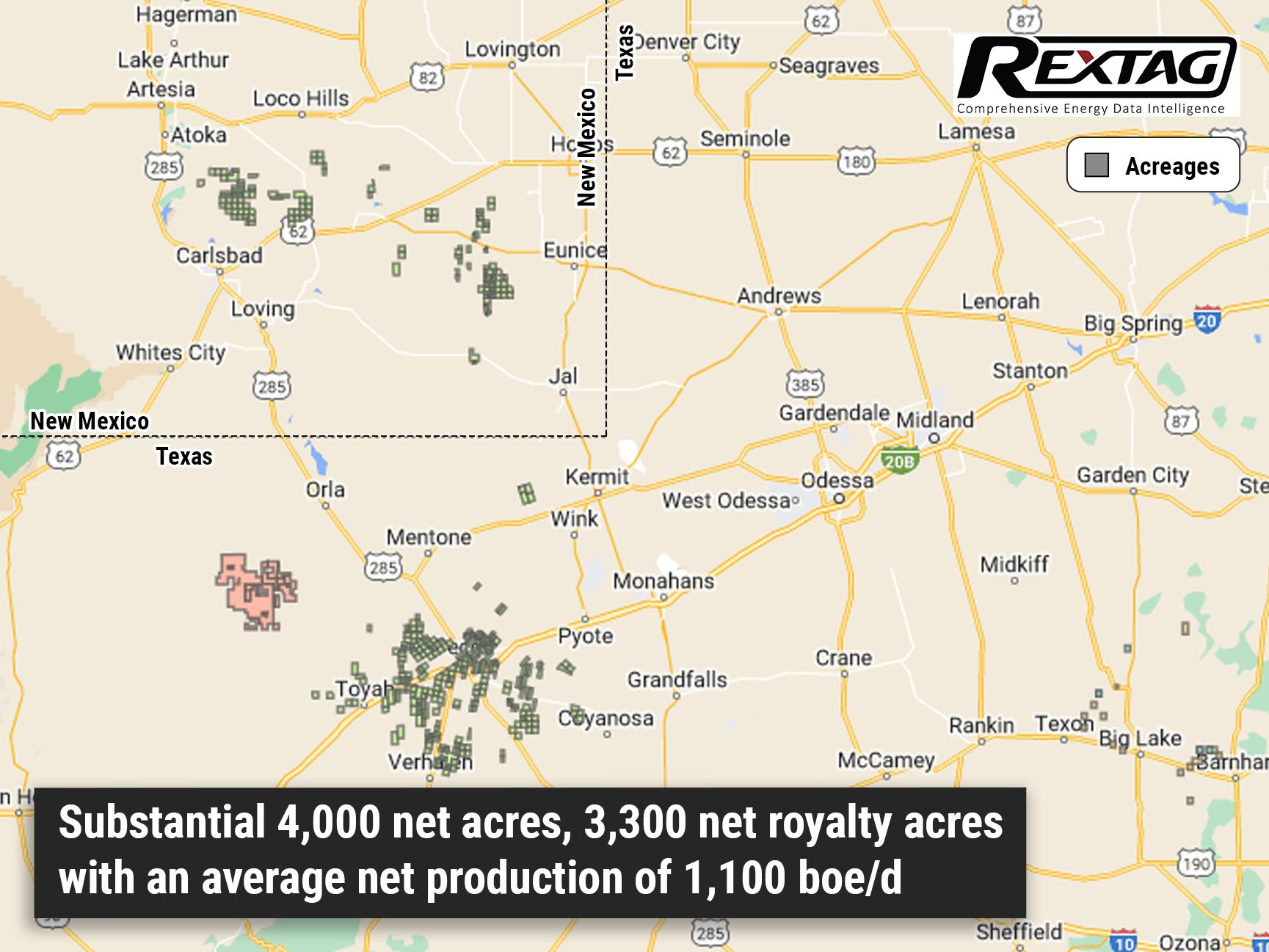

Permian Resources bolsters dominance in the Delaware Basin with strategic land acquisitions, expanding its portfolio by over 5,000 net leasehold acres and 3,000 royalty acres. In a stunning display of growth and strategic maneuvering, Permian Resources Corp., based in Midland, Texas, has made waves in the first quarter by securing a series of deals worth over $200 million in the highly sought-after Delaware Basin. This move solidifies their position as a player in the region.

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

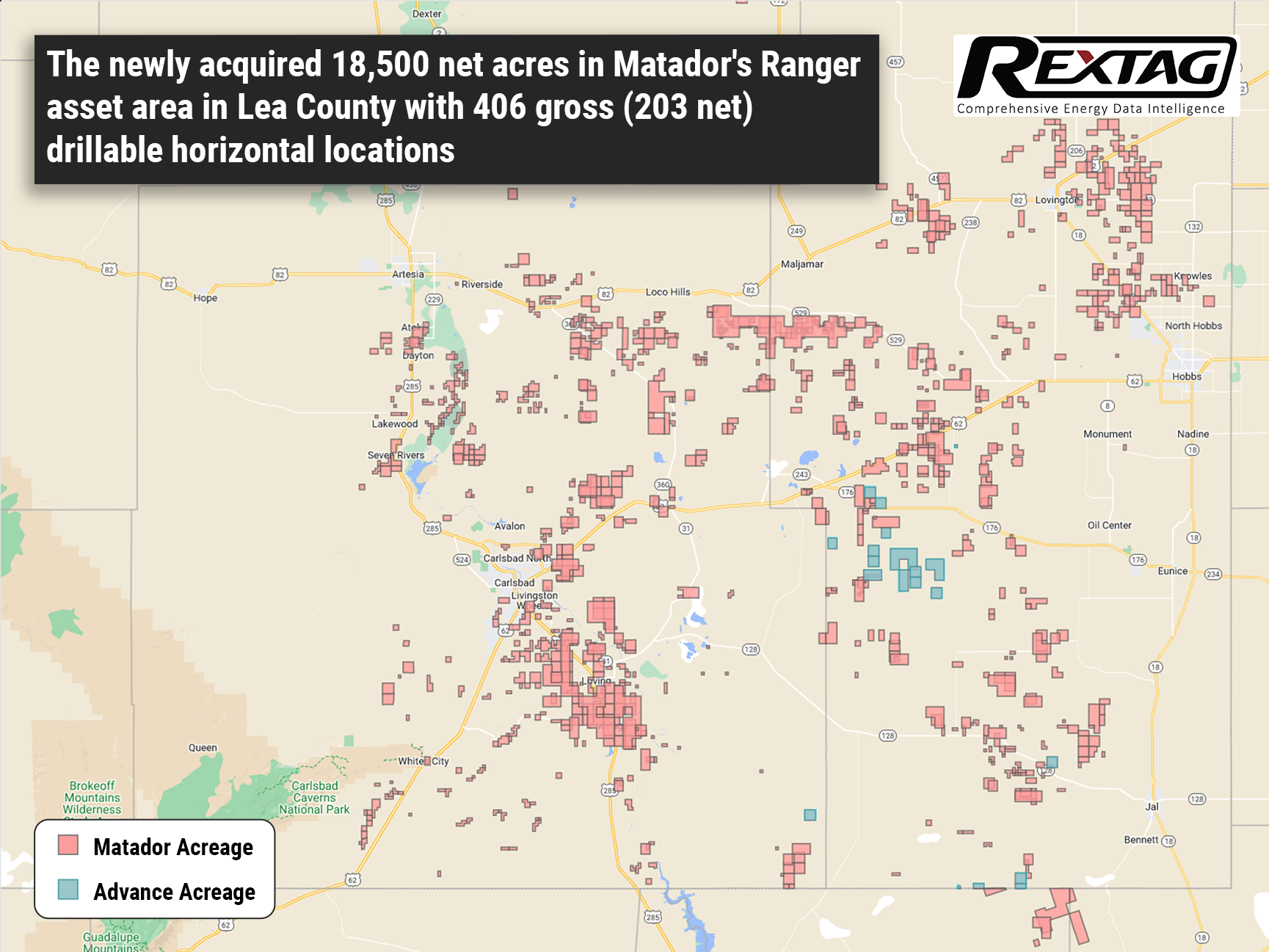

Matador Acquires Additional Land in Delaware from Advance Energy for $1.6 Billion

Matador Resources Co. is making a big move in the oil and gas industry by acquiring Advance Energy Partners Holdings LLC, a major player in the northern Delaware Basin. The acquisition, which comes with a hefty price tag of at least $1.6 billion in cash, includes valuable assets in Lea County, N.M., and Ward County, Texas, as well as key midstream infrastructure.

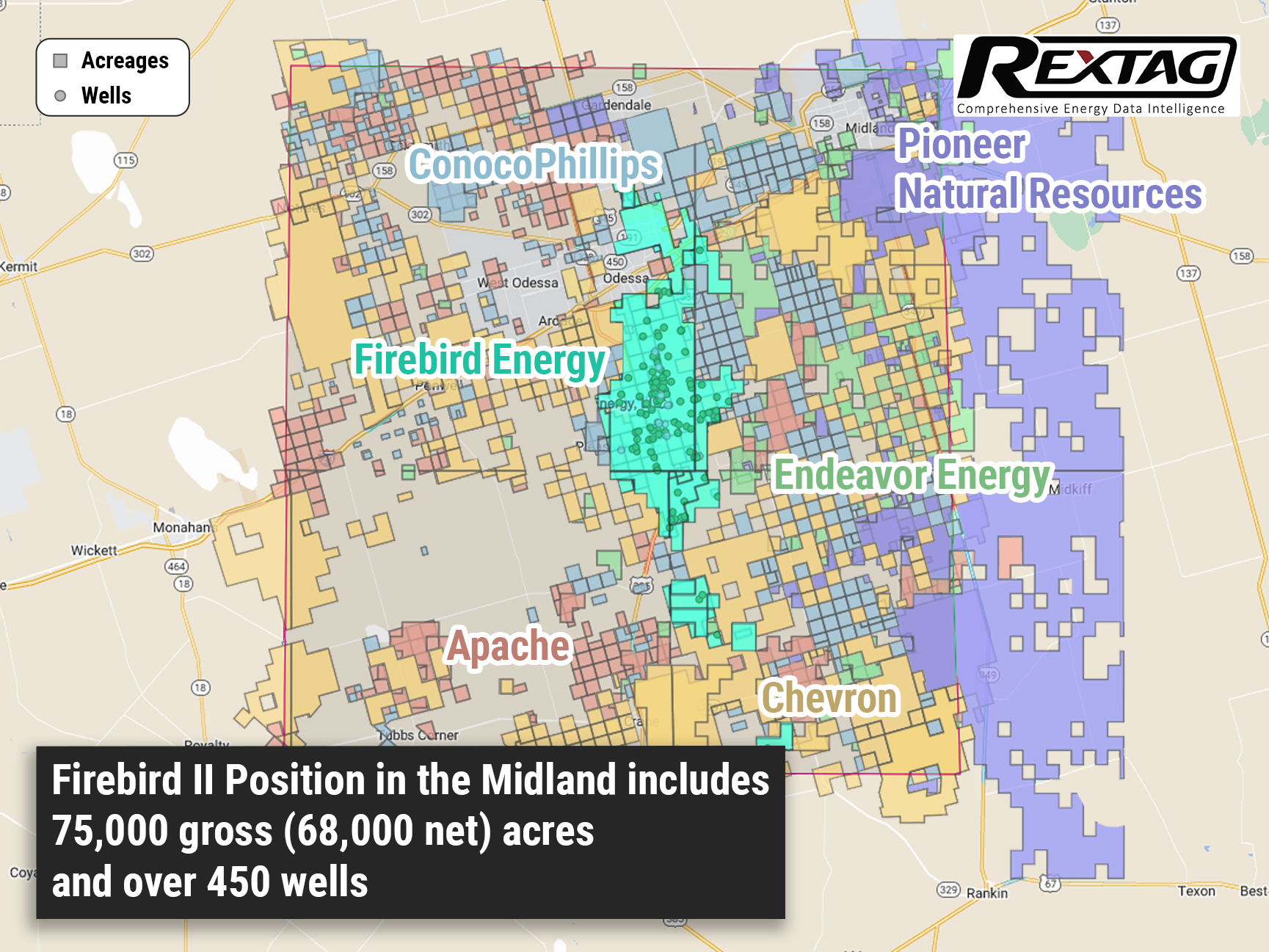

Breaking Barriers FireBird II, Empowered by Quantum Technology, Surpasses $500MM Funding Milestone for Permian Ventures

Following the success of FireBird Energy's $1.75 billion sale to Diamondback last year, the emergence of FireBird II signals a new chapter in the Permian Basin. Get ready for some exciting news from the energy industry. FireBird Energy II, the new player in the Permian Basin, has just secured $500 million in equity funding to fuel their acquisitions. With backing from the esteemed private equity firm Quantum Energy Partners, FireBird Energy II is poised to make waves in the industry.

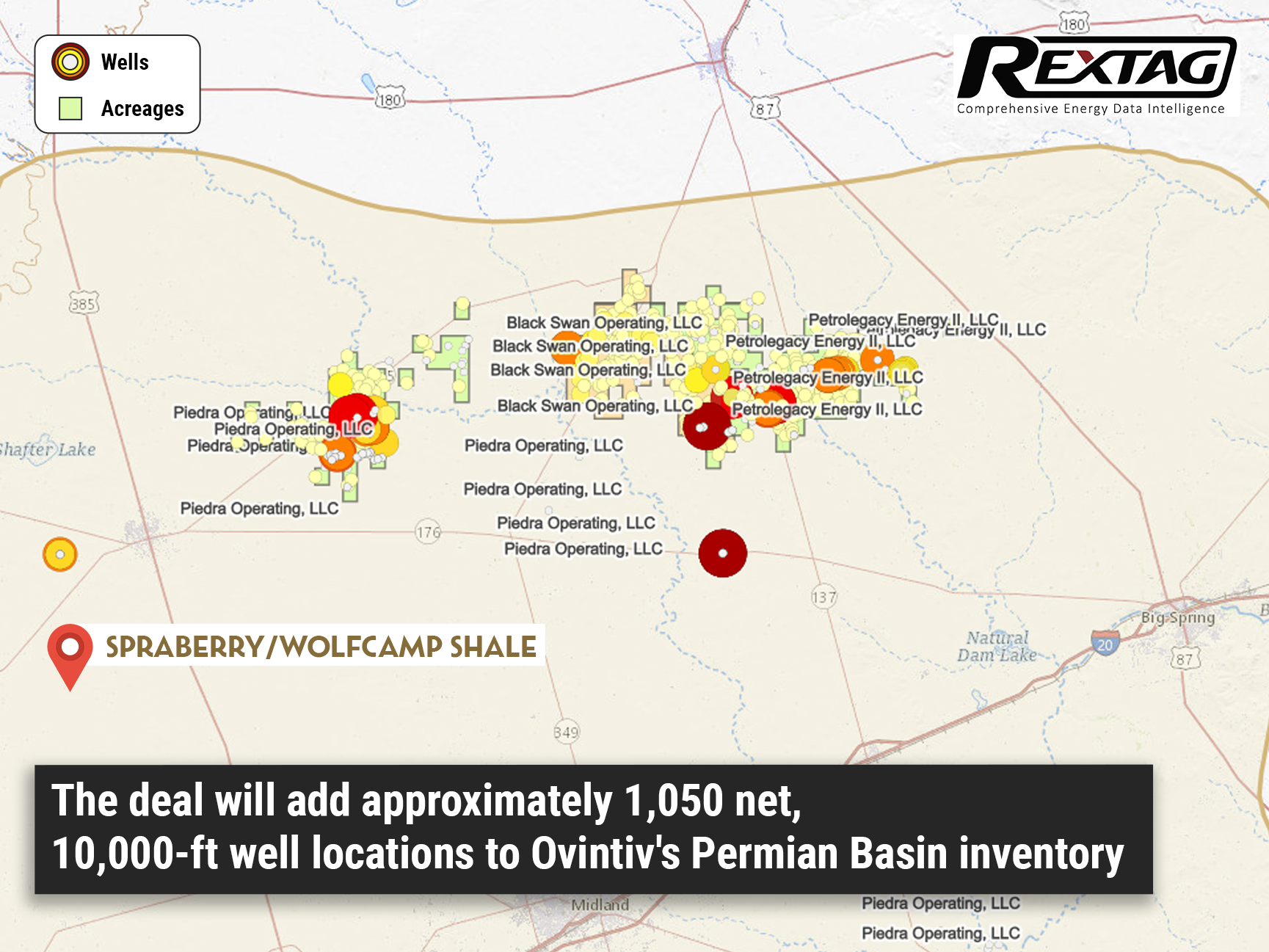

Multi-Billion Dollar Deal: Ovintiv to Expand Midland Basin Portfolio with EnCap Acquisition and Exit Bakken

Ovintiv Strikes Billion-Dollar Oil Deal, Doubling Production in Permian Basin with EnCap's Black Swan, PetroLegacy, and Piedra Resources. The deal, which was approved unanimously by Ovintiv's board, is slated to close on June 30. With over $5 billion in transactions announced on April 3, Ovintiv is set to expand its oil production by snatching up 65,000 net acres in the core of the Midland Basin. The deal with EnCap will give them a strategic edge in Martin and Andrews counties, Texas, with approximately 1,050 net, 10,000-ft well locations added to their inventory.

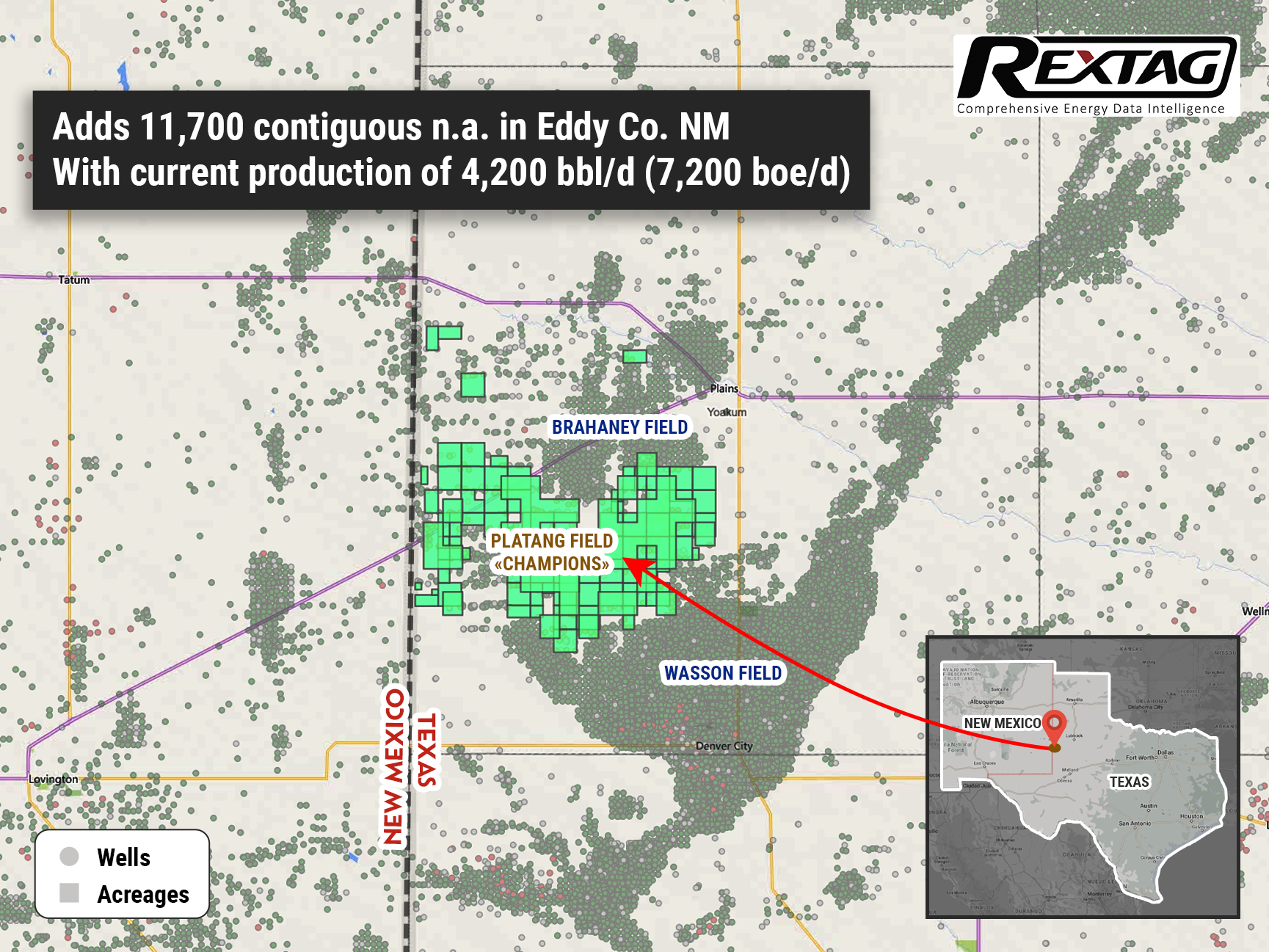

Riley Permian Secures $330 Million Acquisition in Thriving New Mexico: A Strategic Move with Promising Returns

In a big move for Riley Permian, the company has just closed a deal to acquire top-of-the-line oil and gas assets in the heart of New Mexico. The acquisition, which was made in February, saw Riley Permian snapping up these highly sought-after resources from none other than Pecos Oil & Gas LLC for $330 million.

Massive Energy Deal Alert: Energy Transfer to Acquire Lotus Midstream in Permian Basin for $1.45 Billion!

Energy Transfer's recent acquisition of Lotus Midstream's infrastructure for $1.45 billion is a remarkable feat that is bound to shake up the energy industry. This strategic move grants Energy Transfer access to the highly prized Centurion Pipeline, as well as an additional 3,000 miles of crude gathering and transportation pipelines. These pipelines span across the vast Permian Basin of West Texas, stretching all the way from New Mexico and culminating at the bustling energy hub of Cushing, Oklahoma.

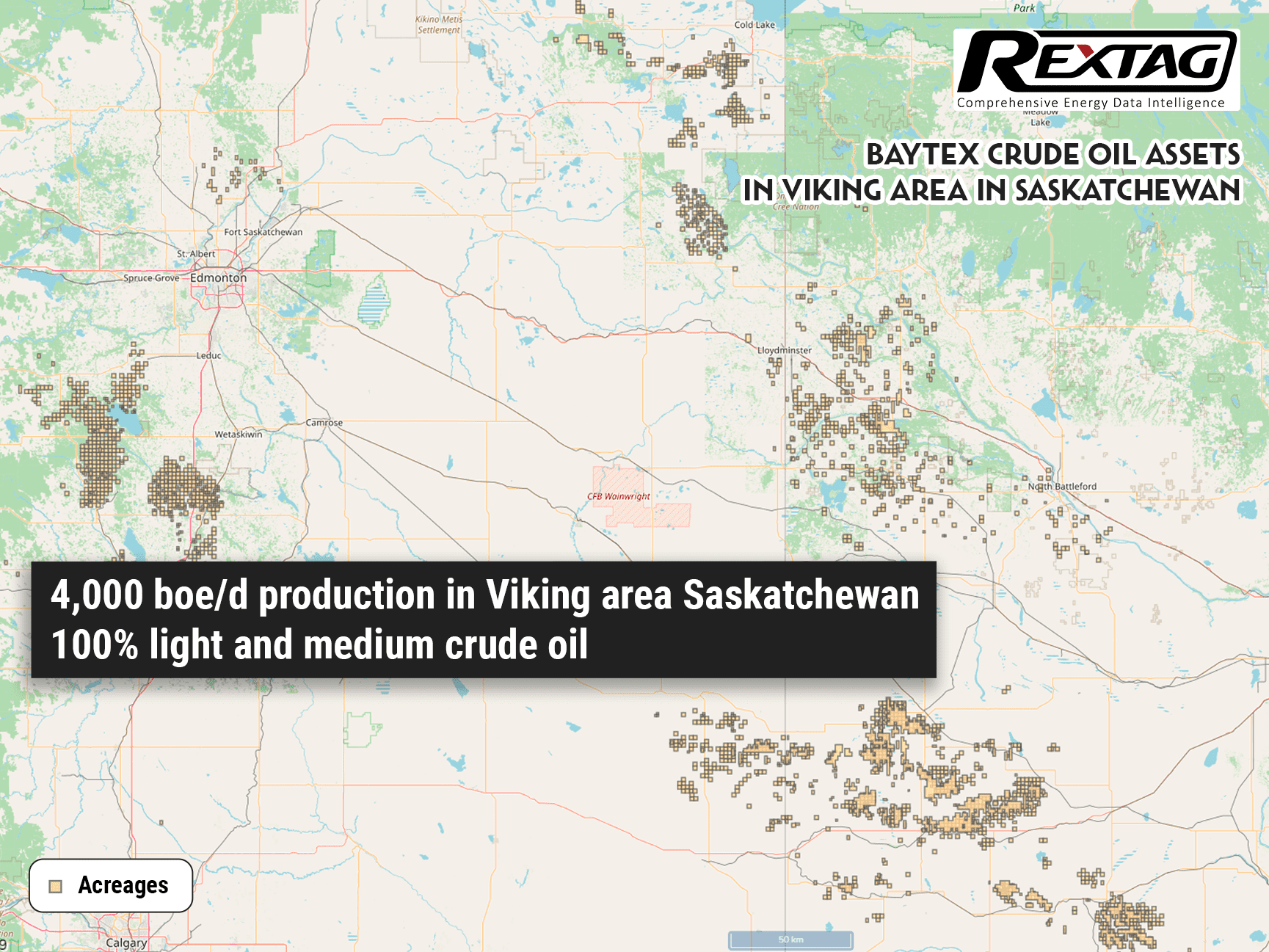

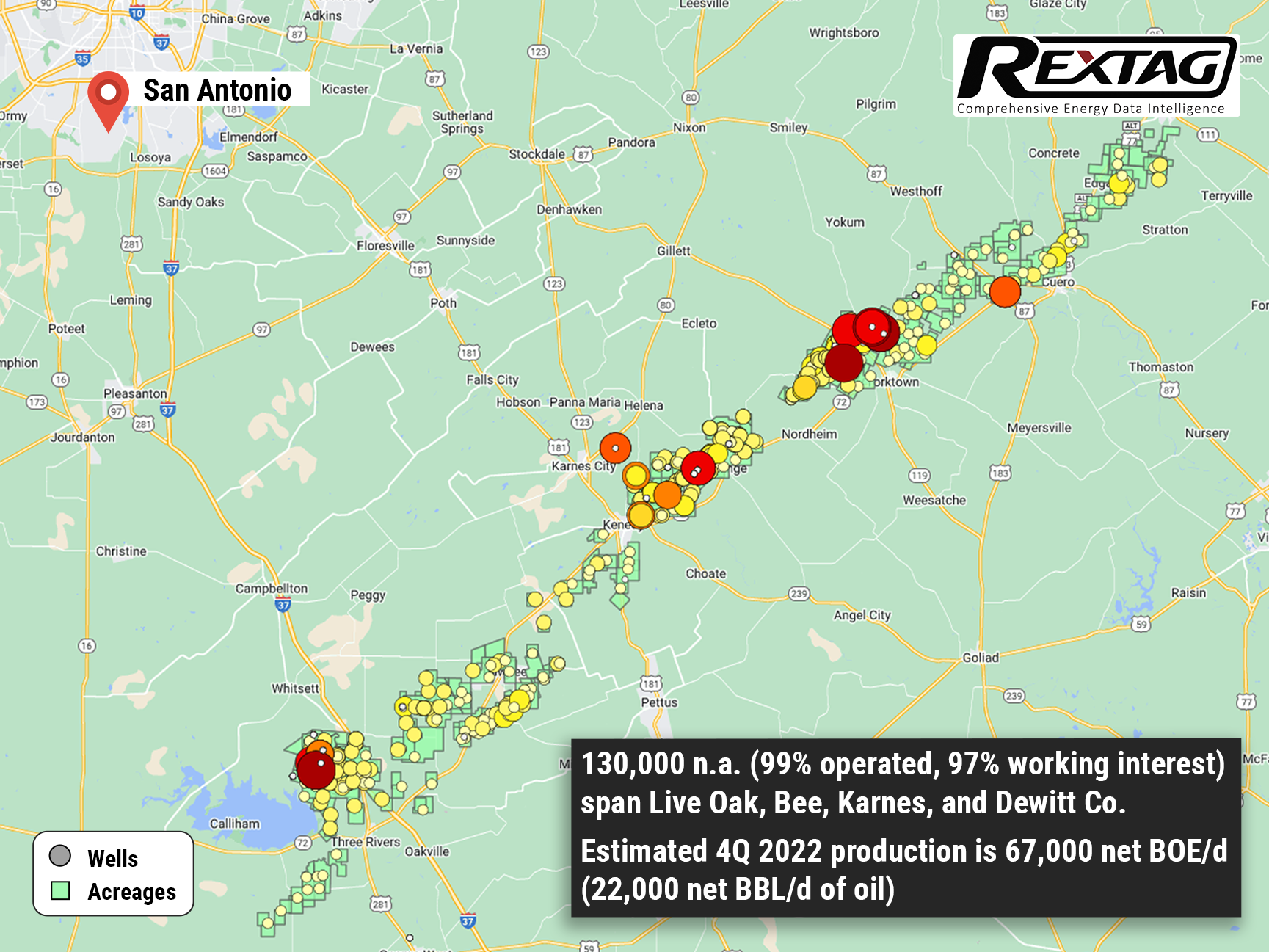

Energy Giant Baytex Makes a Bold Move: Snaps Up Ranger Oil in $2.5 Billion Deal

Baytex Energy Group has announced that it will acquire Eagle Ford exploration and production company, Ranger Oil, for approximately $2.5 billion in cash and stock, which includes taking over the company's existing debt. Upon the successful closure of the acquisition, Baytex will have a controlling stake of approximately 63% in the newly merged company, leaving Ranger shareholders with around 37%. This significant move is in line with a trend of substantial mergers and acquisitions in the Eagle Ford area, with Marathon Oil, Devon Energy, and Chesapeake Energy among the companies involved in recent transactions.

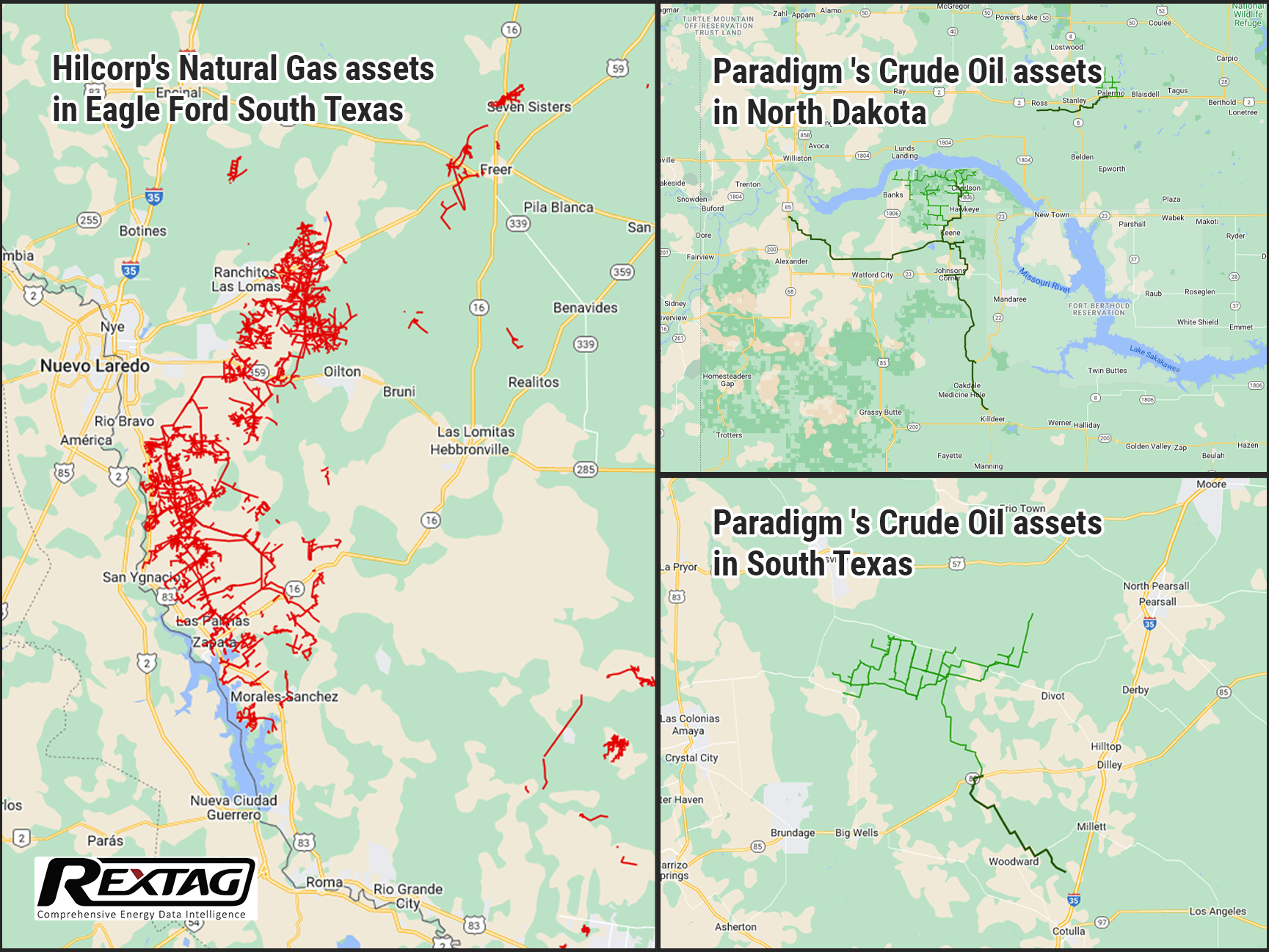

Fueling Up for Success: Harvest Midstream, Hilcorp's Affiliate, to Acquire Bakken and Eagle Ford Assets from Paradigm

Harvest Midstream, a Hilcorp affiliate, is set to acquire three midstream gathering systems that serve the Bakken, as well as system located in the Eagle Ford. Harvest, an affiliate of Hilcorp Energy Corp, has entered into an agreement to purchase three Bakken midstream gathering systems and one in the Eagle Ford from Paradigm. Paradigm is set to sell these midstream assets to Harvest in the near future.

Enbridge agreed to acquire the Tres Palacios gas storage facility in Texas for $335 million

Enbridge acquired Tres Palacios natural gas storage facility in Texas for $335 million, adding approximately 35 Bcf of natural gas storage to their portfolio. The facility uses salt caverns for storage and has a gas header pipeline system that spans 62 miles and links to 11 major gas pipelines. Crestwood Equity Partners LP intends to divest its interests in Tres Palacios by the second quarter.

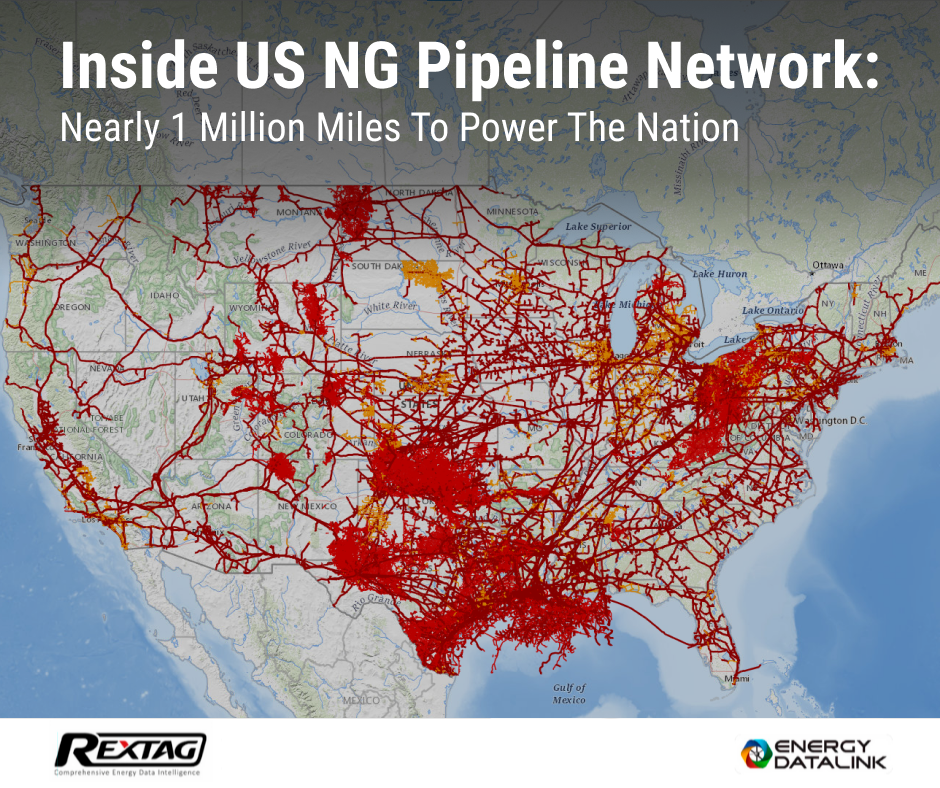

U.S. Natural Gas Pipelines Infrastructure Overview by Rextag

The U.S. natural gas pipeline network is a complex system of pipelines that transport natural gas from production areas to consumers across the country. The pipeline network consists of three main types of pipelines: gathering pipelines, transmission pipelines, and distribution pipelines. Gathering pipelines are small-diameter pipelines that transport natural gas from production wells to processing facilities or larger transmission pipelines. Transmission pipelines are large-diameter pipelines that transport natural gas over long distances, sometimes across multiple states. Distribution pipelines operate at low pressure and are located in or near urban areas. They are often referred to as "utility pipelines" because they are typically owned and operated by local gas utility companies.

$5 Billion Returns for ConocoPhillips’ Shareholders as Prices Grow

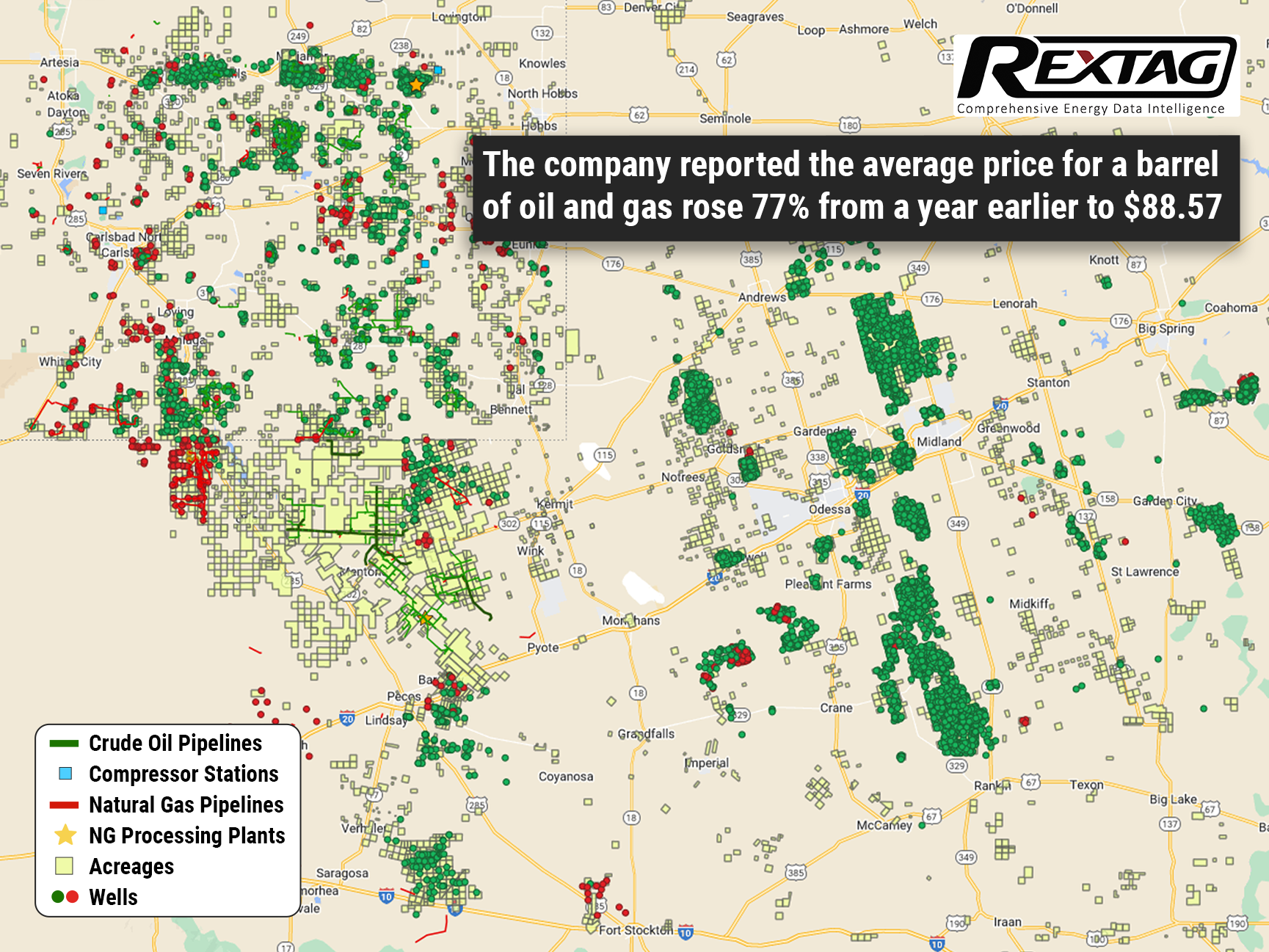

Shareholder’s payout target was increased by 50% after the largest U.S. independent oil producer surpassed Wall Street’s earnings estimates on growing energy prices, said Houston-based Conoco Phillips Co. on Aug. 4. Due to Western sanctions on major producer Russia throttling energy supply amid a rebound in demand from pandemic lows, oil and gas #prices have soared. Crude has been trading more than 25% higher since the start of the year and results also benefited from high natural gas prices. Meanwhile, shares were down a fraction, to $91.03, in early trading but are up about 26% year to date. Conoco Phillips stated, that the average price obtained for a barrel of oil and gas accelerated 77% from a year earlier to $88.57. The company acknowledges that it has not hedged any of its oil and gas sales to make the most of higher market prices. The capacity of 1.69 million boe/d was in line with Wall Street estimates, however, the company expected the current quarter’s output would be between 1.71 million and 1.76 million boe/d.

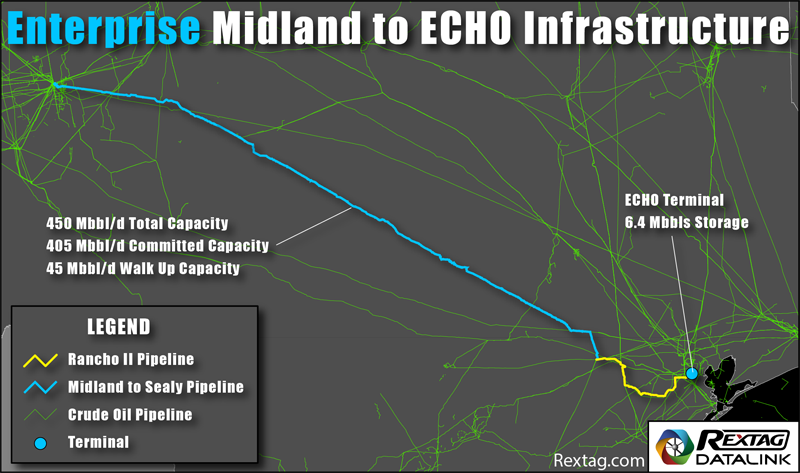

Magellan Reported Volume Changes on Its LongHorn and BridgeTex Pipelines

According to a July 28 report, Magellan Midstream Partners LP stated that the volumes in the last quarter on the Longhorn and BridgeTex pipelines that carry crude from the Permian Basin to Houston dropped dramatically since shippers likely exported barrels, meanwhile, refined product volumes grew on pandemic demand recovery. Volumes on the 450-mile (724-km) Magellan’s wholly-owned Longhorn crude oil pipeline from West Texas to Houston averaged approximately 200,000 bbl/d in the three months ended June 30 in contrast with 260,000 bbl/d in the same period the year before. A joint venture, the BridgeTex crude pipeline from the Permian to Magellan’s East Houston terminal dropped to 215,000 bbl/d from virtually 315,000 bbl/d in the year-ago period. However, volumes on the most prominent common carrier refined products pipeline system in the U.S. increased 3% partly because of pandemic demand recovery. Income from oil storage plunged as a steeply risen-in-price market made holding barrels less attractive and following contract expirations while operating expenses grew $28 million.

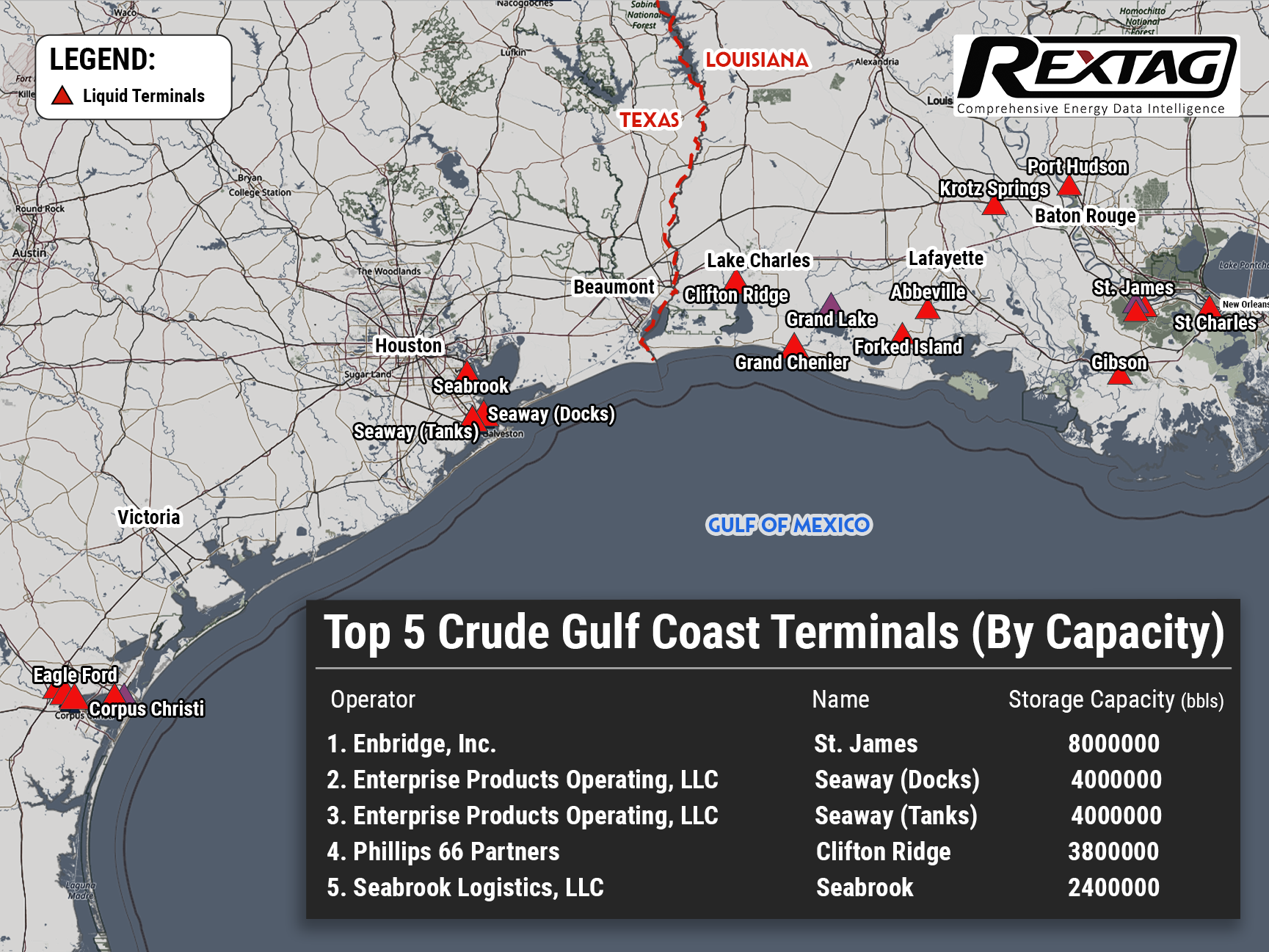

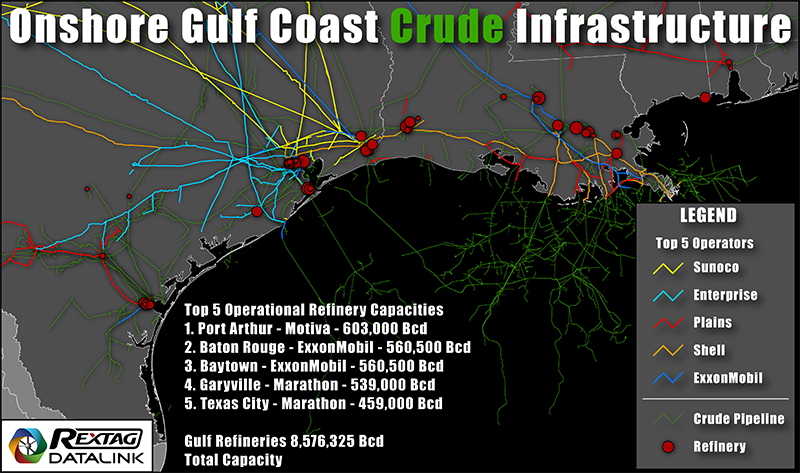

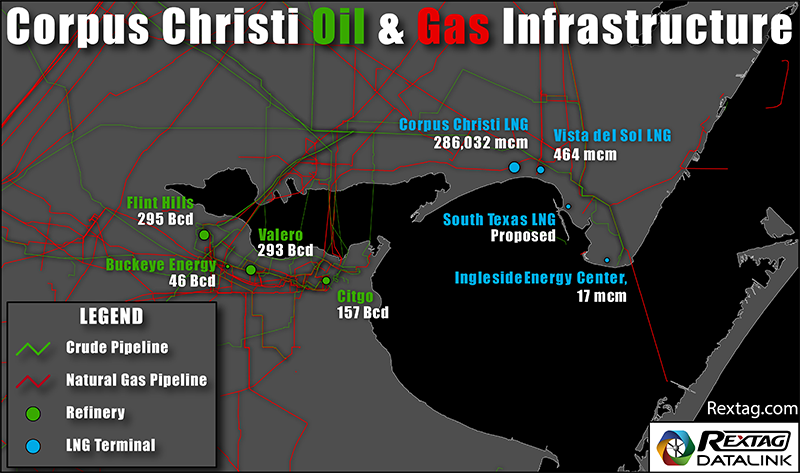

Growing Export of US Crude Oil Is Expected to Set Record This Quarter

On 27 June, the analysts at Kpler spread the word that the exports of crude oil from the U.S. Gulf Coast could break a record 3.3 MMbbl/d this quarter as Europe has regard to U.S. crude which can outweigh sanctioned Russian oil. Due to Washington's decision to release 180 MMbbl of oil from the nation's Strategic Petroleum Reserve, U.S. exports have increased in the last three months, as it has flooded the domestic market. Exports to Europe are anticipated averaging approximately 1.4 MMbbl/d this quarter, about 30% higher than the year-ago quarter, meanwhile, export to Asia is set to decrease to less than 1 MMbbl/d. Despite that the U.S. has lost about 1 MMbbl/d of refining capacity since 2020, it also boosted exports thanks to the government’s intervention to back crude supplies which has had consequences in growth in exports. Throughput via the Port of Corpus Christi has grown by more than 150,000 bbl/d and has become 1.86 MMbbl/d. Nevertheless, Port of Houston exports also have been increasing since the third quarter of last year, they remain below pre-pandemic levels.

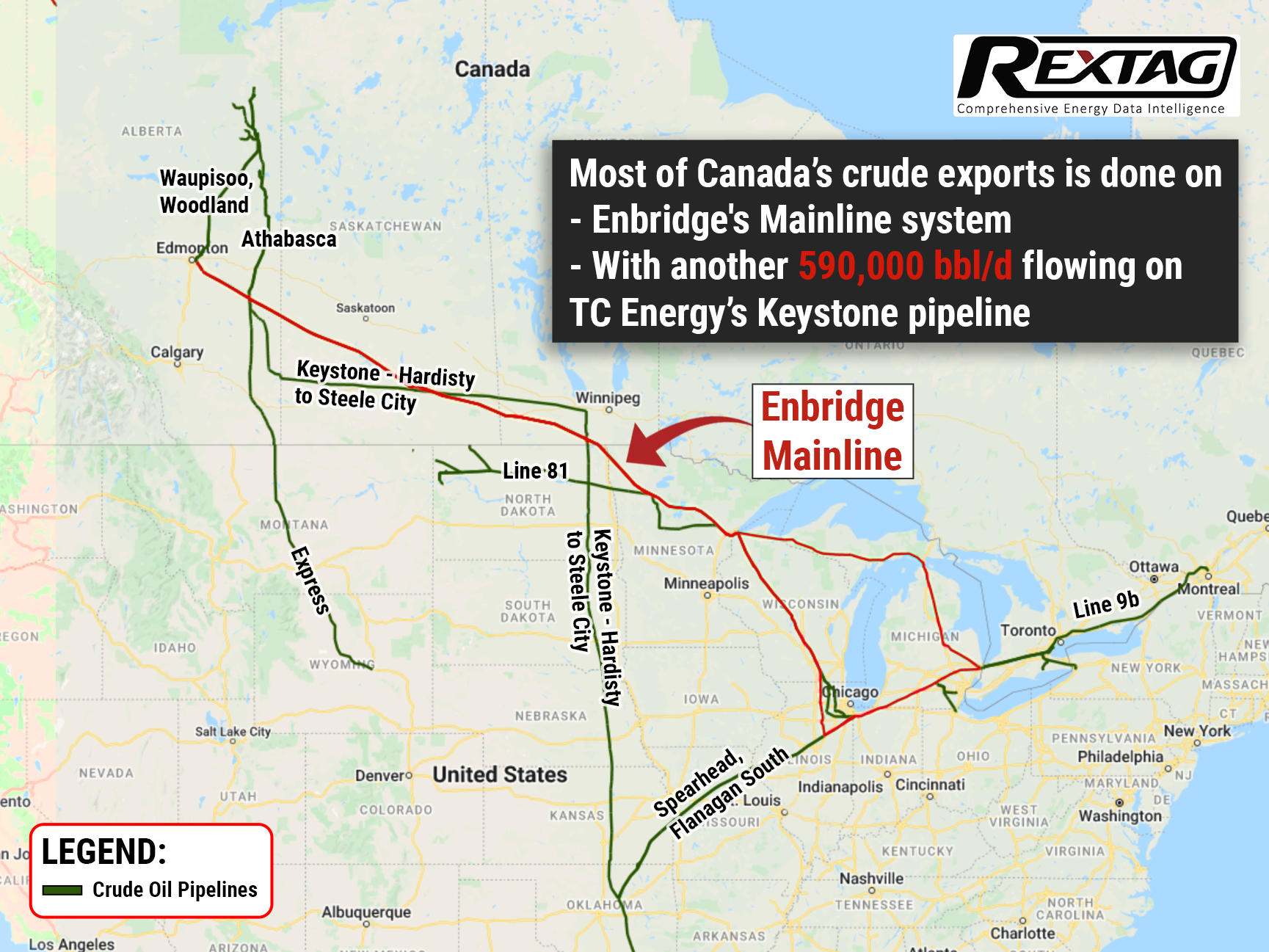

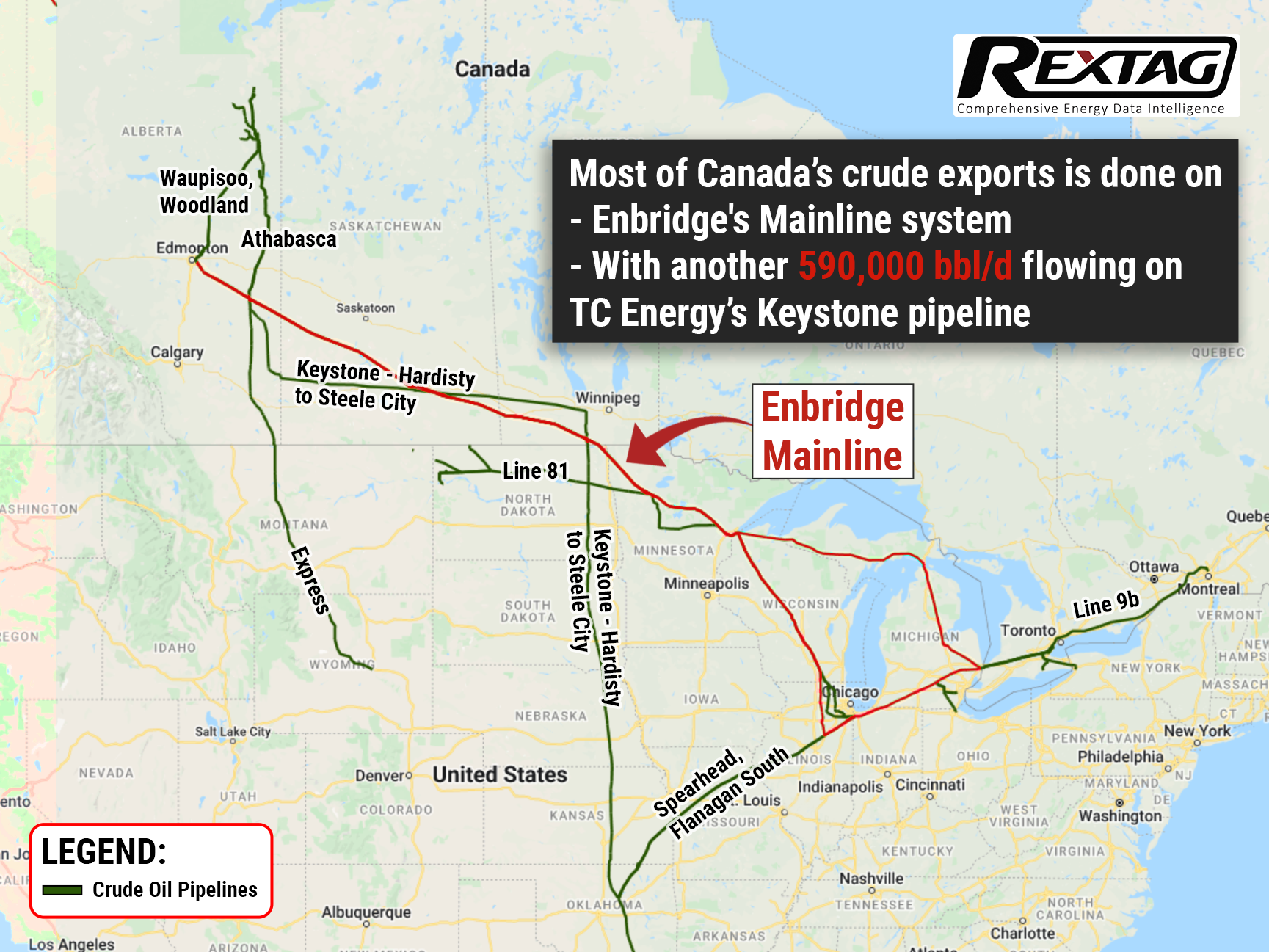

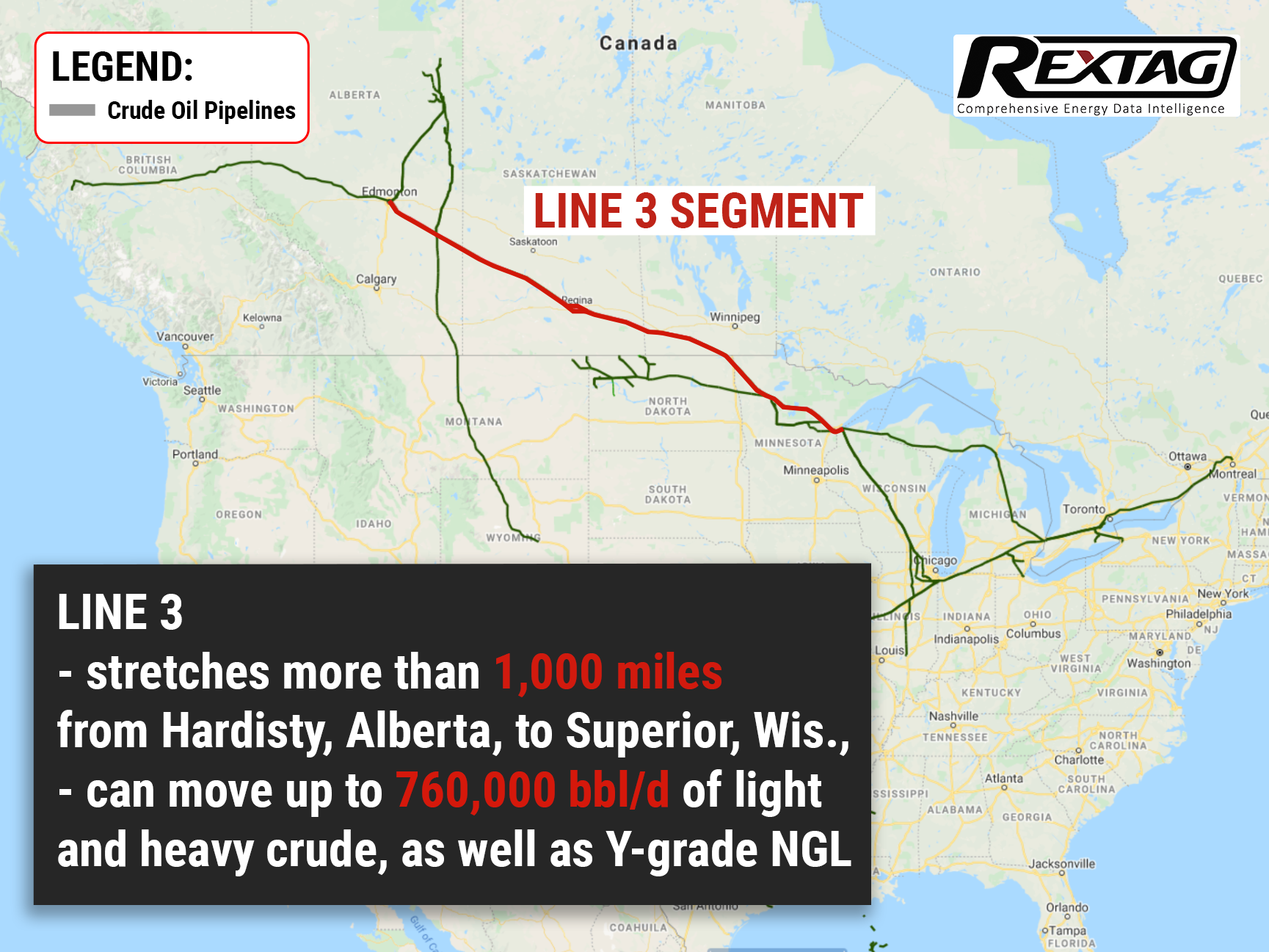

Inconvenient Time for Canadian Crude: US Gulf Coast Is Glutted

Canadian heavy crude, being deeply discounted for several years due to a lack of pipelines, is eventually trading like a “North American” grade, moving in tandem with U.S. sour crudes sold on the GulfCoast thanks to Enbridge’s expansion of its 3 pipeline late last year. Meanwhile, the Gulf is full of sour crude over Washington’s largest-ever release from the Strategic Petroleum Reserve (SPR) that will amount to 180 MMbbl during six months, trying to tame exorbitant fuel prices after the Russian invasion of Ukraine. The market is flooded with millions of barrels of sour crude from storage caverns in Louisiana and Texas. At the world’s biggest heavy crude refining center, U.S. Gulf Coast, heavy grades like Mars and Poseidon are languishing. According to U.S. Energy Information Administration (EIA) data, Canada exports around 4.3 MMbbl/d to the United States, whereas until last year demand to ship crude on export pipelines increased capacity, leaving barrels bottlenecked in Hardisty.

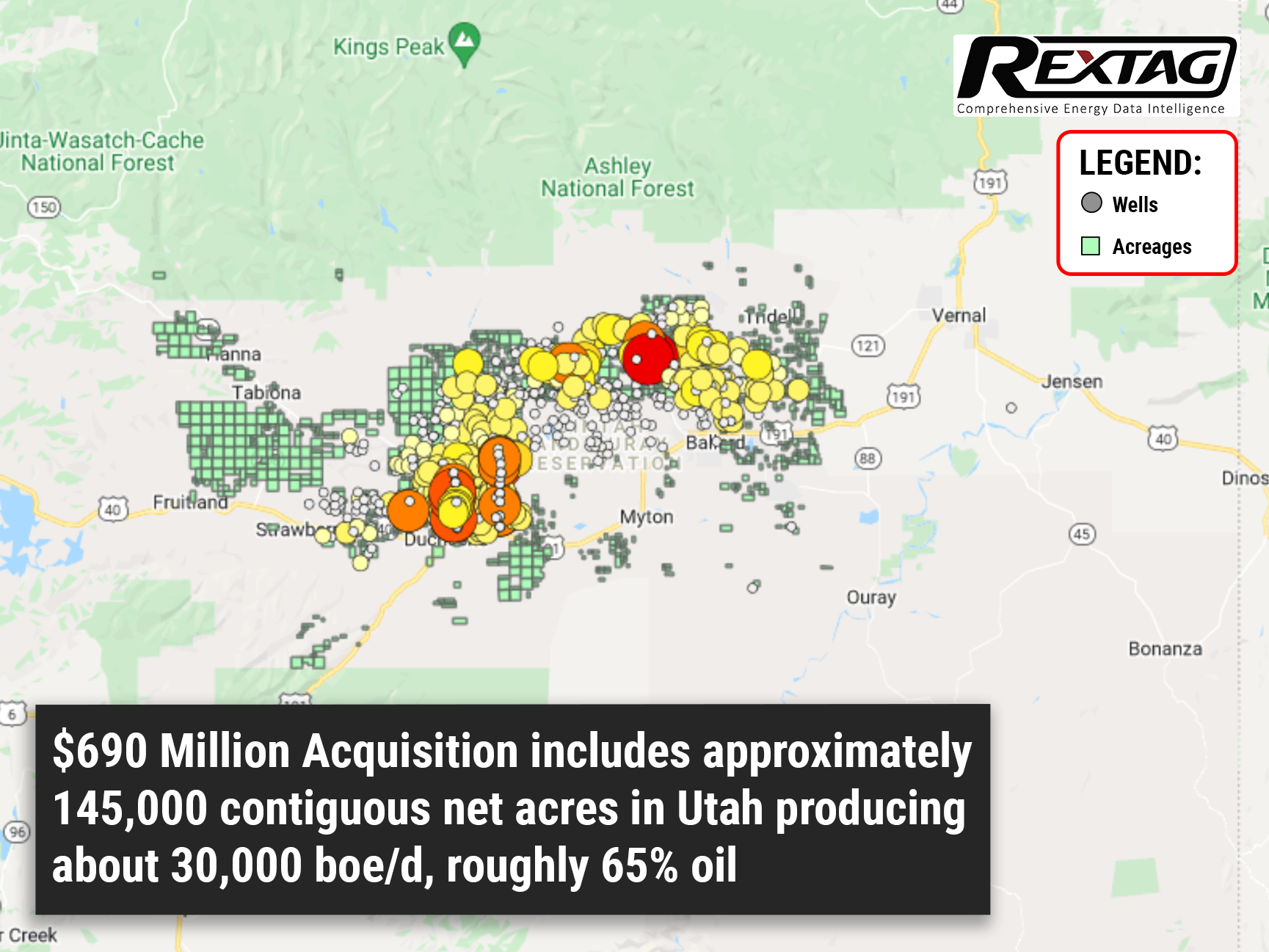

$690 Million Deal Moves Ahead: Crescent Energy to Complete Purchase of EP Energy's Uinta Assets

Crescent Energy closed the acquisition of Uinta Basin assets in Utah that were previously owned by EP Energy for $690 million, a few hundred million dollars below the original price. The accretive deal increases Crescent's Rockies position and adds significant cash flow and a portfolio of high-quality oil-weighted undeveloped sites. In addition to its acquired Uinta assets, Crescent's pro forma year-end 2021 provided reserves totaled 598 million boe, of which 83% was developed, 55% was liquid, and its provided PV-10 was $6.2 billion.

As Countries Shun Russian Crude, Canada Plans to Boost Its Oil Exports

Canada is looking at ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its reliance on Russian oil At the moment, oil exports from Canada to the U.S. are approximately 4 million barrels of oil per day, with a portion reexported to other countries. At the end of 2021 Canadian oil companies exported a record amount of crude from the U.S. Gulf Coast, mostly to big importers India, China, and South Korea. And this will only increase in the future.

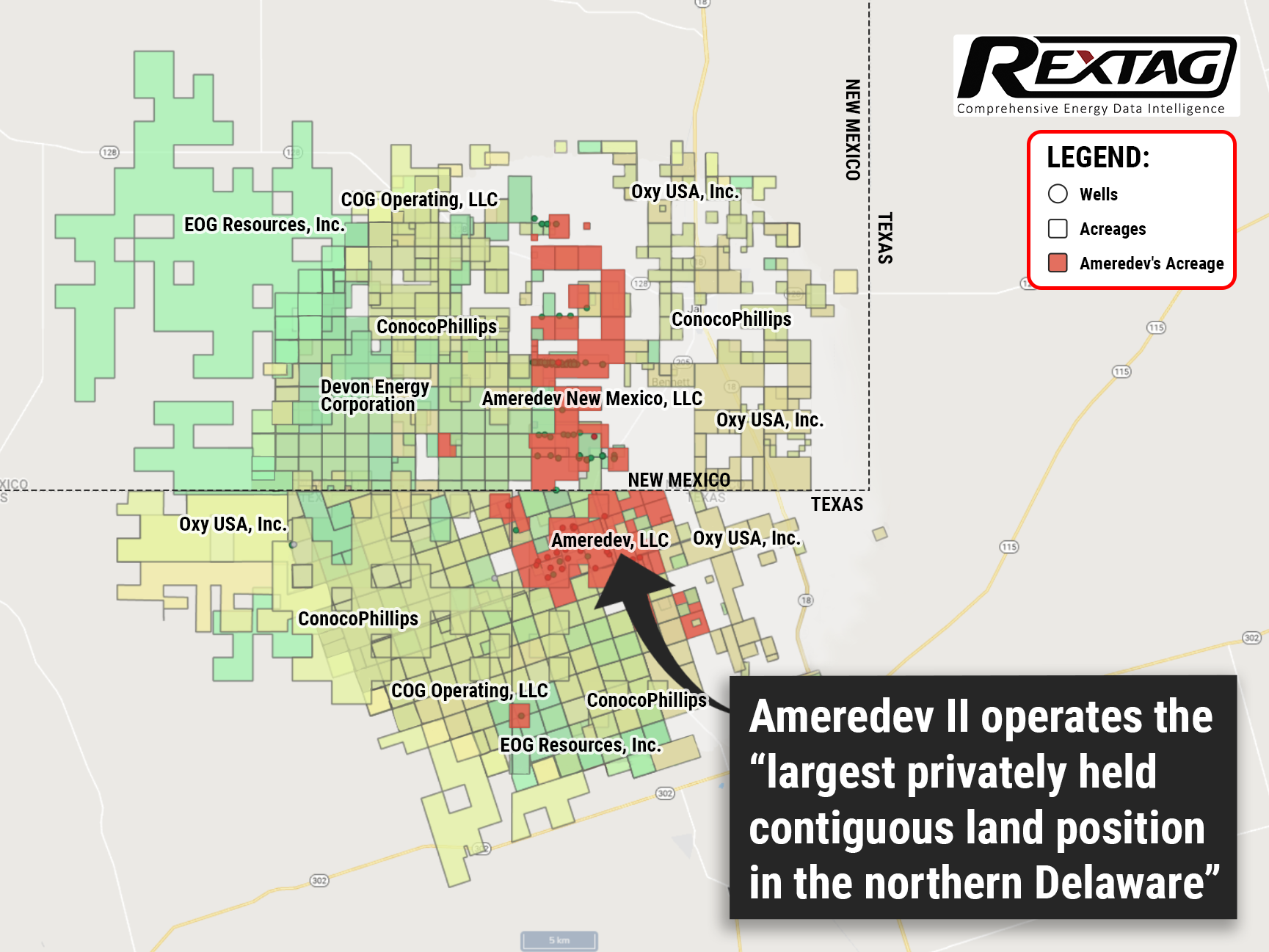

Major: Ameredev II Oil Producer to be Sold for $4 Billion by EnCap

In light of the conflict in Ukraine, buyout firms are currently scurrying to make cash from the U.S. crudeprices reaching their highest level since 2008. And one of the largest privately-owned US-based oilproducers may be up for sale. EnCap Investments looks to sell its portfolio company Ameredev II for over $4 billion including debt. It’s important to note, however, that both EnCap and Ameredev II alike are staying tight-lipped on the matter.

Continental Resources Raises Dividends Following a Quarter of Profit

The future of shale is looking bright: economic recovery and a spike in travel lifted oil prices to multi-year highs, helping Continental Resources to a fourth-quarter profit that exceeded Wall Street expectations. Coming off such a high note, the company plans to increase its dividend rates by 15% to 23 cents per share!

Delays Are Finally Over: Enbridge Reports Strong Third Quarter 2021

Enbridge Inc. finally delivered on several of its long-overdue promises, including the $4 billion Line3 Replacement project. Which consisted of replacing an existing 34-inch pipe with a new 36-inch one for 13 miles in North Dakota, 337 miles in Minnesota, and 14 miles in Wisconsin. Midstream companies, in general, had a stunning Q3. It was the first quarter in two years that no midstream index members cut their dividends.

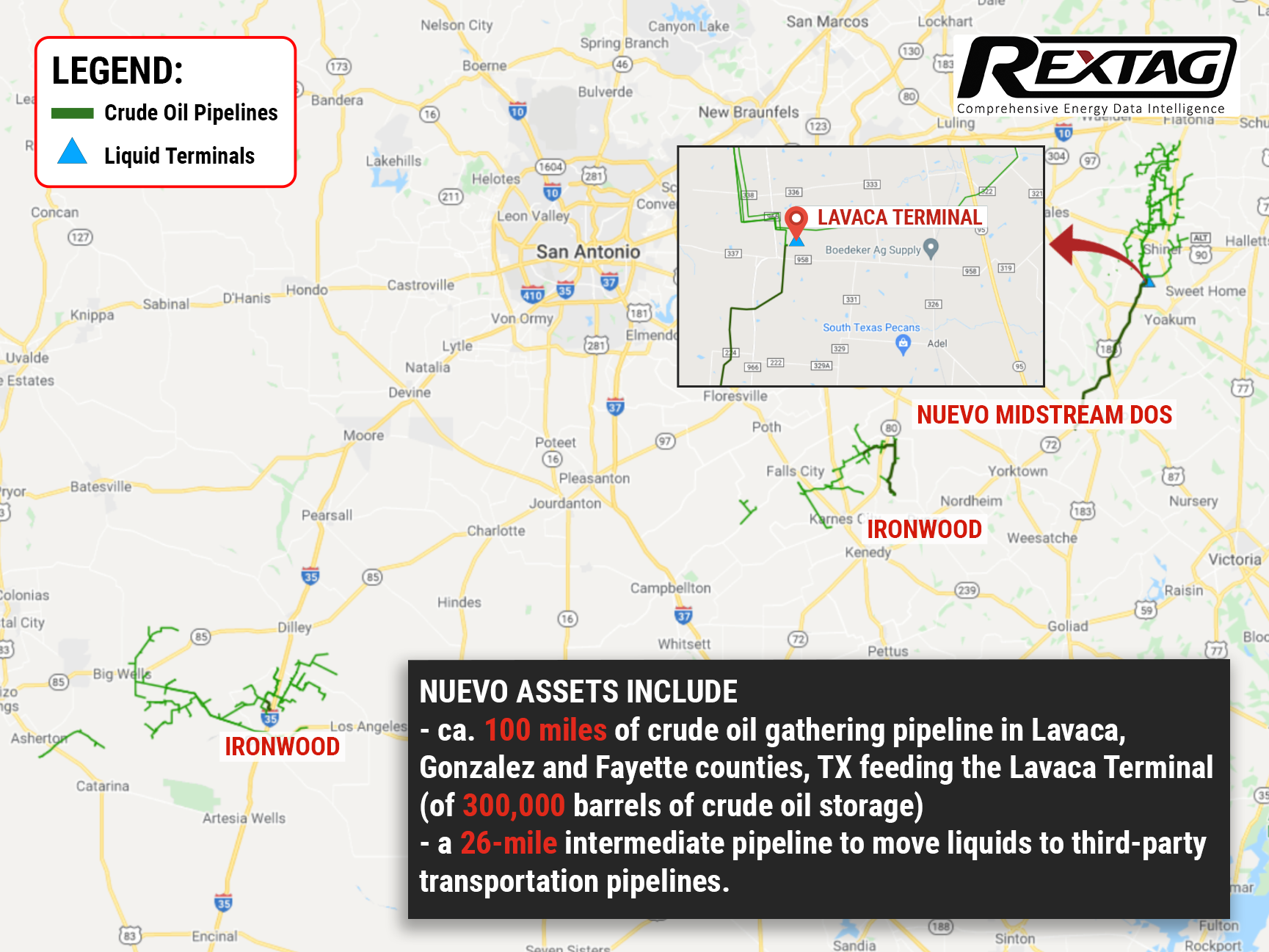

Expansion Is The Goal: Ironwood II Completes Asset Merger And Assumes Management of Nuevo Midstream Dos’ Eagle Ford Assets

Ironwood Midstream expanded its operations in the Eagle Ford region through its merger with Nuevo Midstream. Thanks to this, Ironwood II has increased its crude oil and natural gas throughput capacities in the famous shale to approximately 400,000 bbl/d and 410 MMcf/d, respectively. With 390 miles of pipelines, the company manages 245,000 acres of dedicated land.

Restructuration is in a full-speed: Comstock to sell Bakken for $154 million

Comstock Resources decided to go through with asset divestment, selling its Bakken Shale actives for $150M to Northern Oil and Gas. The proceeds from these sales will be reinvested by Comstock Resources Inc. into the Haynesville Shale, at which point the company may acquire additional leasehold and fund drilling activities starting in 2022. Meanwhile, Northern clearly gunning for the pack leading position in the Texas shale play, but whether they succeed or not is remains to be seen.

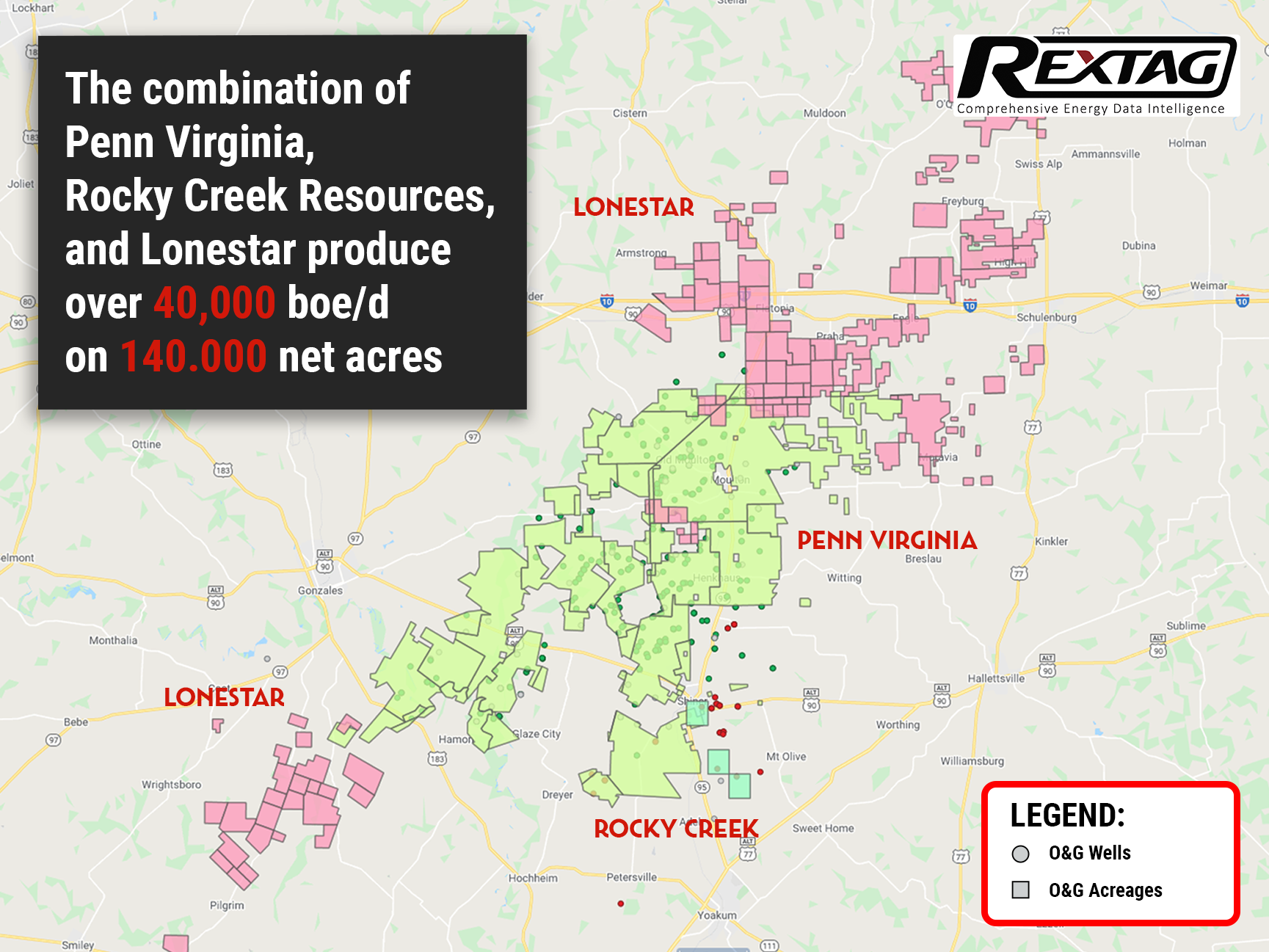

There is a new guy on the block: Penn Virginia rebrands to Ranger Oil

Penn Virginia announced a rebranding to Ranger Oil on 6 Oct. following the close of the Lonestar acquisition. This Texas oil & gas giant reinvents itself anew, shifting its energy development in the lone star state towards safer and more efficient oil and gas operations. The company's consolidated assets now amount to over 140,000 net acres strategically positioned in the Eagle Ford play of south Texas, making it one of the biggest players. It is anticipated that the full rebranding will be complete by the year-end of 2021. For the full rundown of the situation visit our blog.

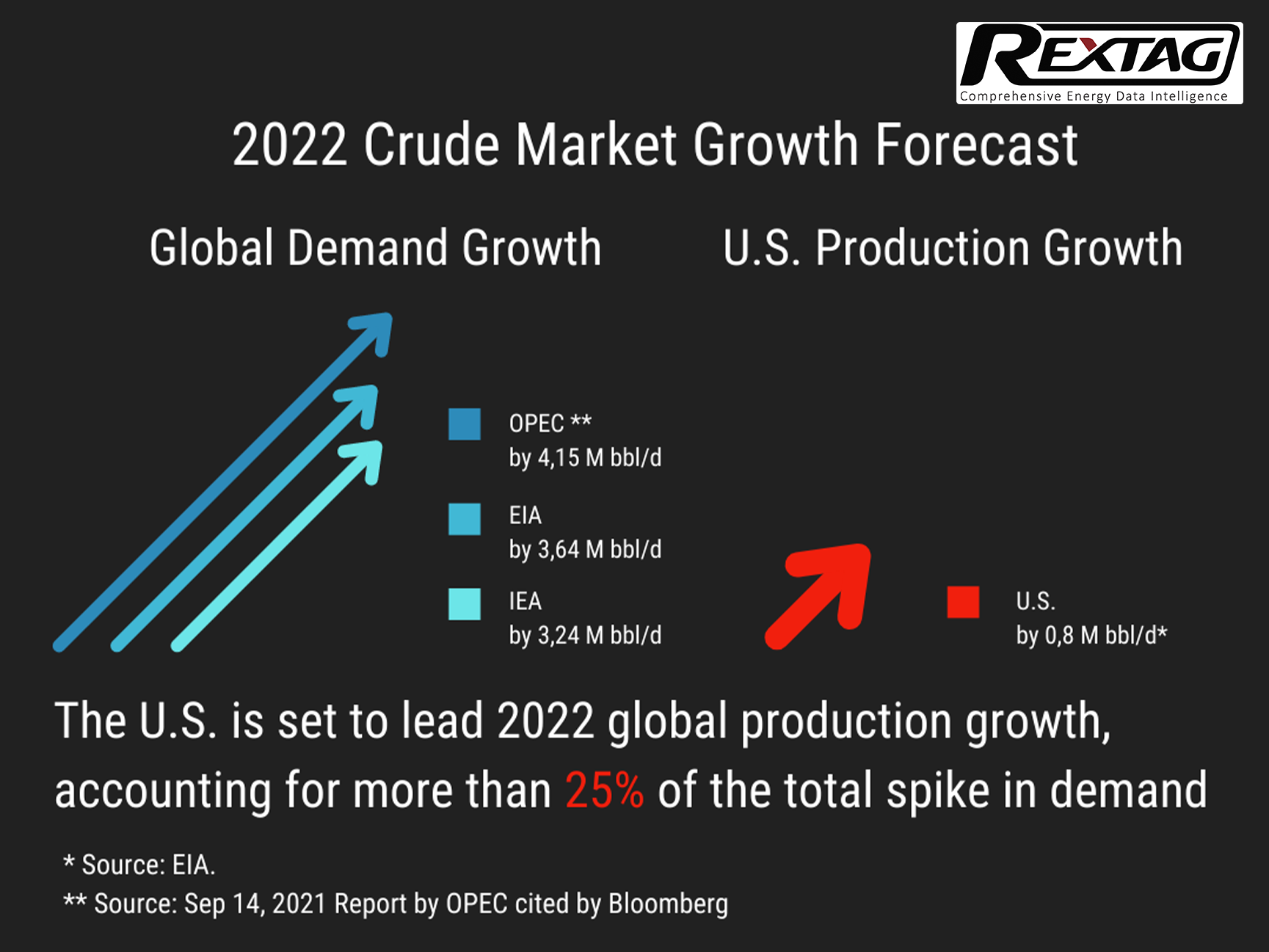

The growth of the U.S. oil and gas industry in 2022 will come from smaller companies and private businesses

Forecast: Bank of America expects to see a major bump in US crude oil production in 2022. Such growth from a non OPEC member will impact world oil market balances in times of tight supplies. Still, crude prices should hold well above $70/bbl next year and could, potentially, jump as high as $100/bbl. By 2022, oil output is expected to grow by 800,000 bbl/d, and more than half of that growth will come from #privately-held producers. For a more in-depth analysis of the forecast check out our blog.

A major U.S. shale oil producer is looking to start a land selloff in the lone star state

Pioneer Natural resources is looking to divest properties in the lone star state. According to Rextag, Pioneer’s Delaware assets on sale have a trailing 12 month production of just over 22 MBOE against a total Permian Basin production of almost 212 MBOE. (The sale, if it happens, will effectively lead to a 10% decrease of Pioneer’s asset base in terms of the previous year's production.)

.jpg)

.png)

.png)