Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

From Peanuts to Richest Oil Tycoon in America: Autry Stephens Built an Empire, his net worth is...

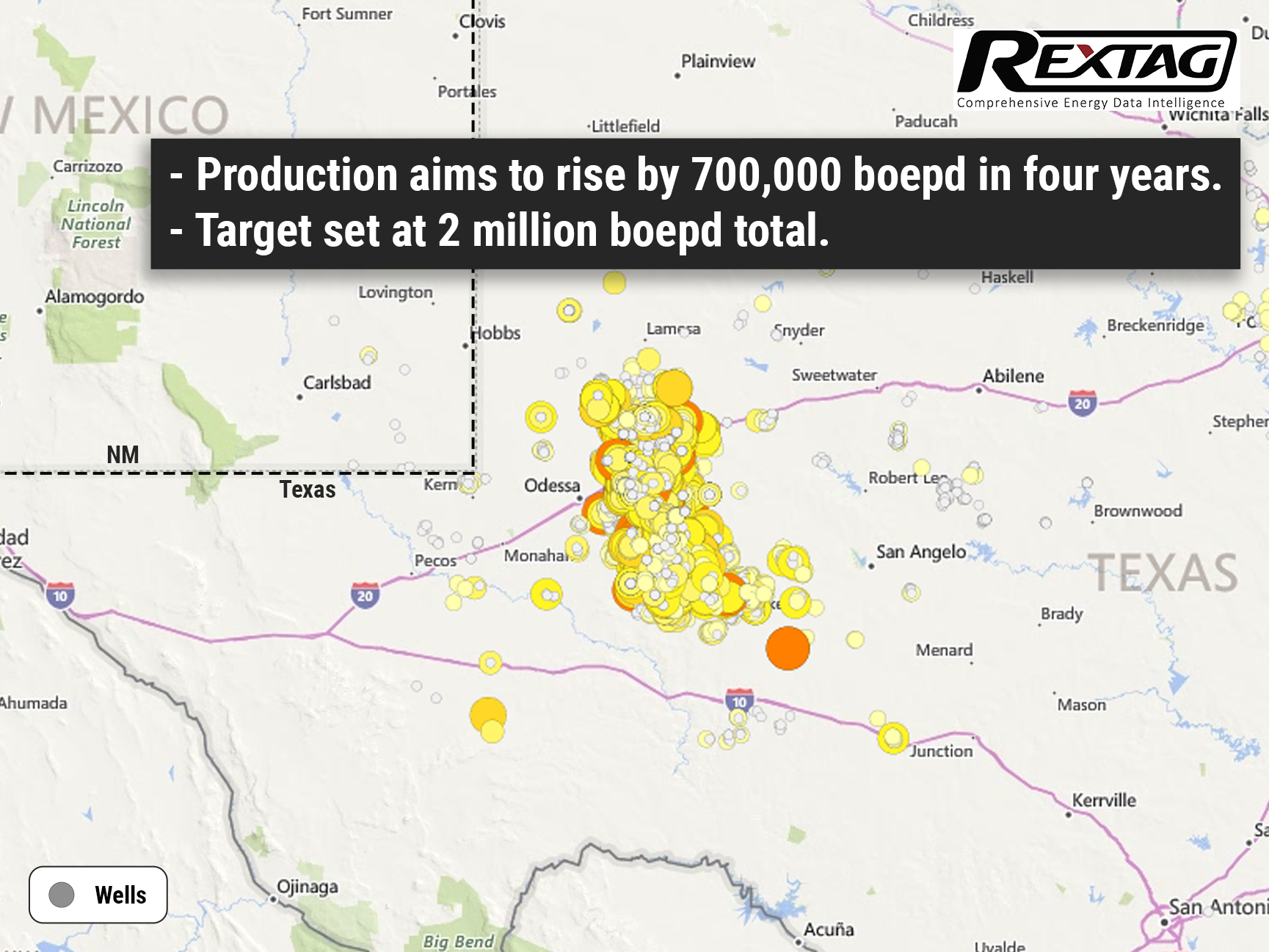

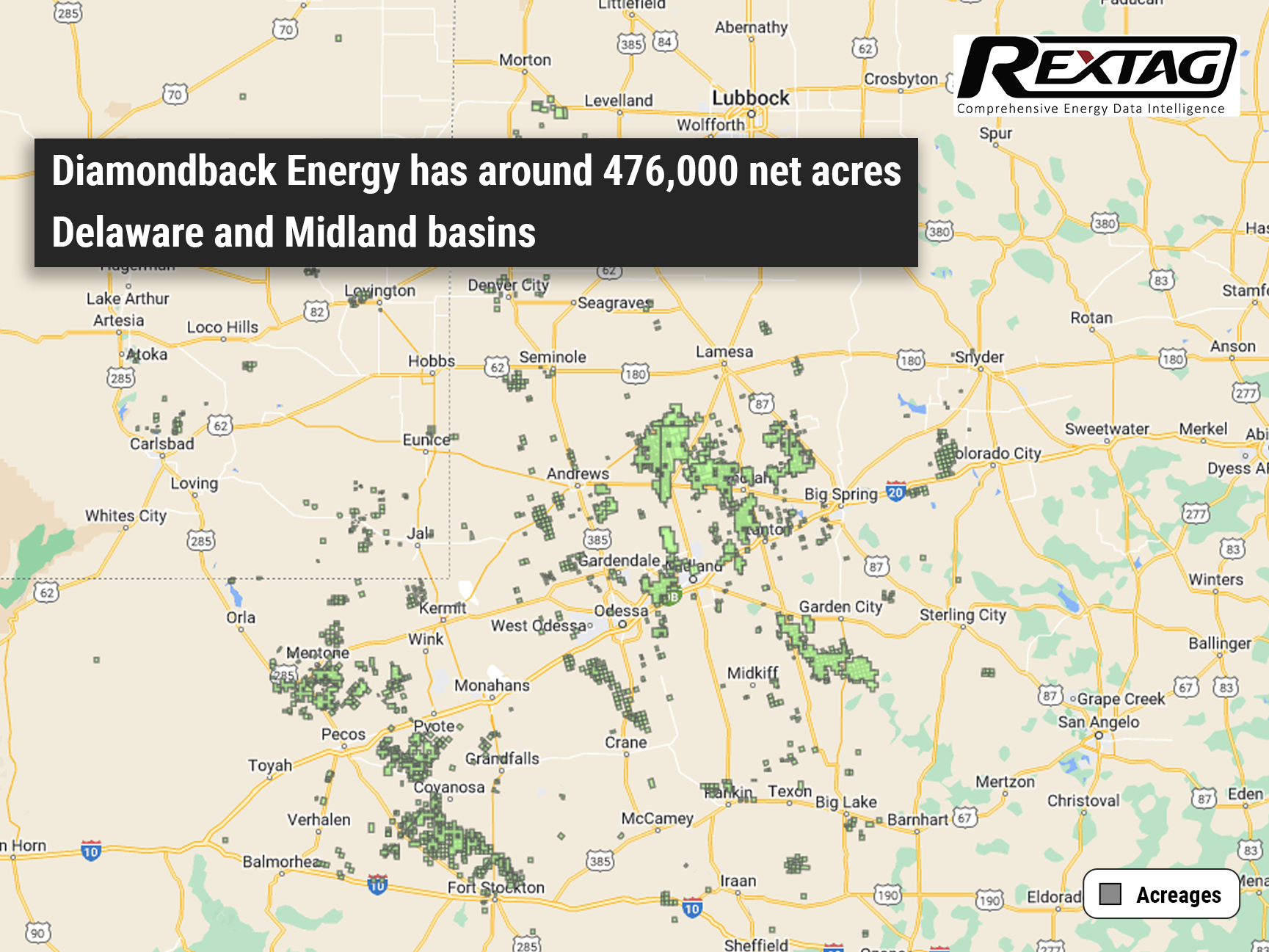

Diamondback Energy is buying Autry Stephens's company, Endeavor Energy Resources, for $26 billion. This deal (learn more) will make Stephens the richest oil driller in the U.S., with a $25.9 billion fortune, jumping him up to 64th place on a list of the world's richest people. He'll be wealthier than other big names in oil, like Harold Hamm with $15.4 billion and Jeff Hildebrand with $17 billion. However, Charles and Julia Koch are still richer, but their money comes from different businesses, not just oil.

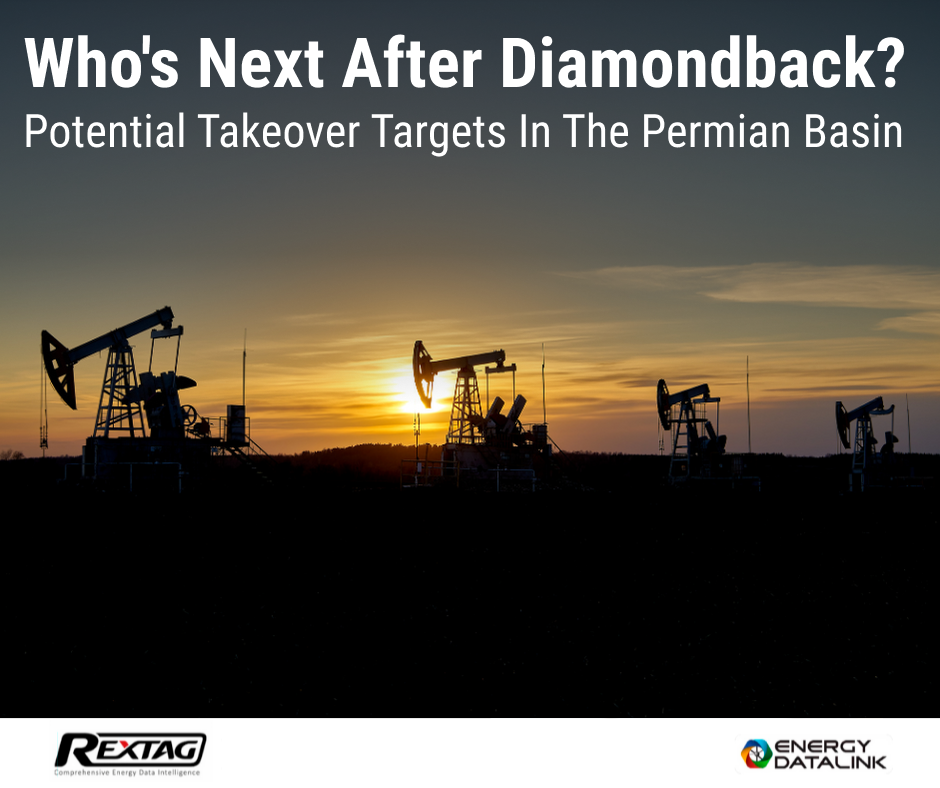

Oil and Gas: Diamondback and Endeavor's $26 Billion Merger Redefines Permian Basin

Diamondback's buyout of Endeavor happened about four months after ExxonMobil and Chevron made huge deals, with Exxon buying Pioneer Natural Resources for $59 billion and Chevron getting Hess for $53 billion. Even though 2023 was a slow year for company buyouts and mergers, with the total deals at $3.2 trillion (the lowest since 2013 and 47% less than the $6 trillion peak in 2021), the energy sector was still active. Experts think this buzz in energy deals is because these companies made a lot of money in 2022.

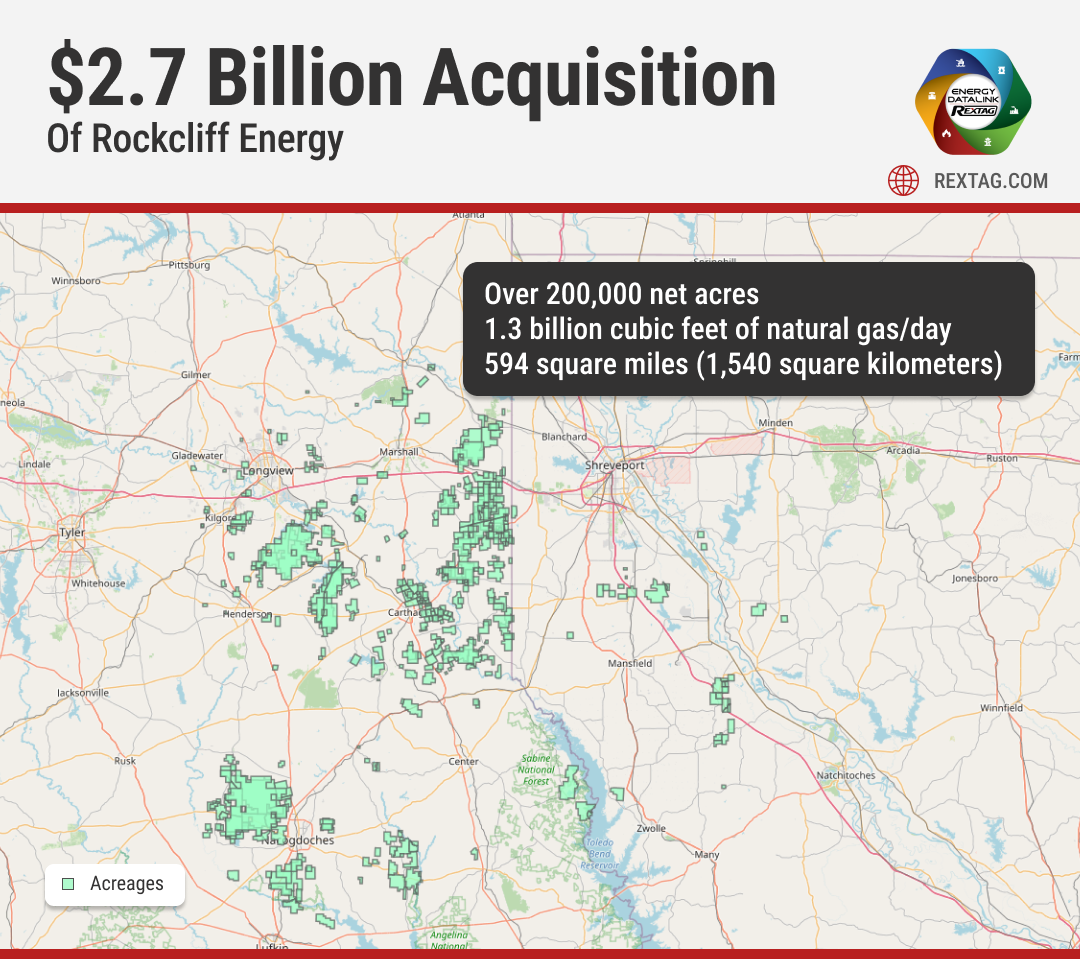

Select Water Solutions Acquires Haynesville and Rockies Assets

Select Water Solutions, a leader in water and chemical services for the energy industry has bought key water assets in the Haynesville Shale and Rockies for $90 million. This deal adds 450,000 barrels per day of capacity with disposal wells and treatment facilities, boosting Select's operations.

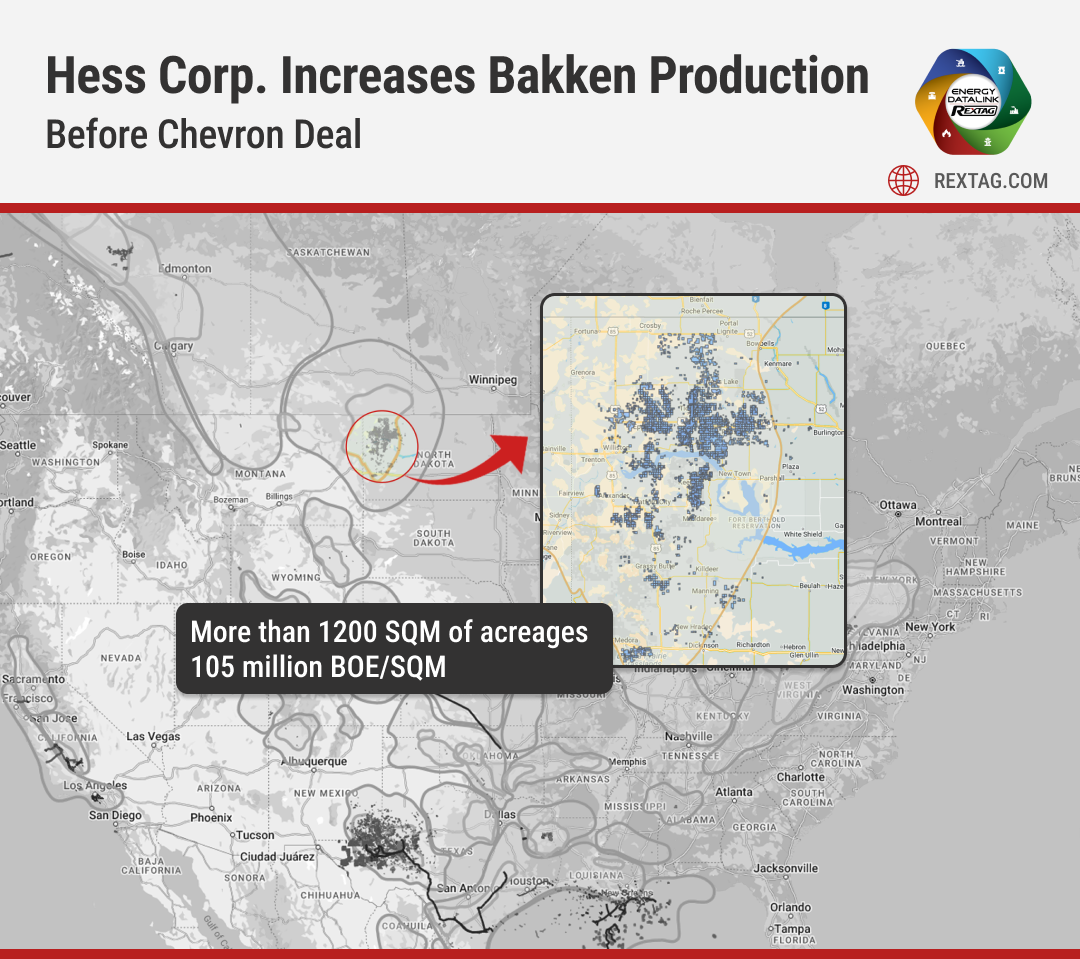

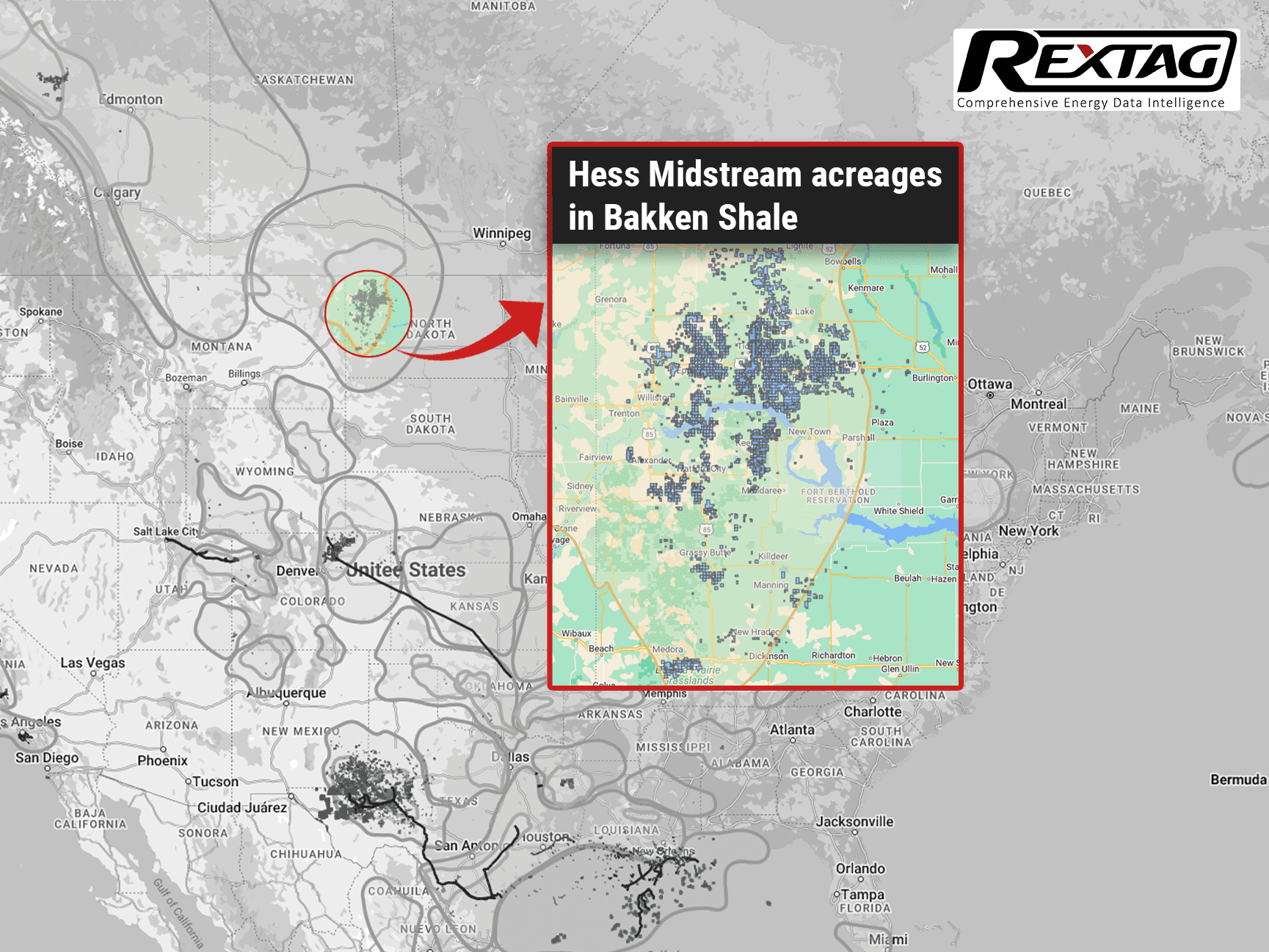

Hess Corp. Increases Drilling Activity Before Chevron Takeover

Hess Corp. is in the final stages of a major sale to Chevron, with increased drilling and production in the Bakken region noted in the last quarter. Hess announced its fourth-quarter net production in the Bakken reached 194,000 barrels of oil equivalent per day (boe/d), a slight increase from the third quarter's 190,000 boe/d and a significant 23% rise from the 158,000 boe/d seen in the fourth quarter of the previous year. This growth is attributed to more drilling and the impact of the previous year's severe winter weather.

Santander, Lloyds Implicated in Helping Iranian Entity Sidestep Western Sanctions

A state-owned petrochemical company from Iran was operating from an office located near Buckingham Palace. Reports suggest that Santander UK and Lloyds Banking Group, two big UK banks, are involved in managing accounts for companies that reportedly helped Iranian organizations avoid US sanctions. These banks are said to have supported companies linked to an Iranian petrochemical company, which has been facing sanctions from Western countries since 2018.

Bakken's Tipping Point: Grayson Mill's Potential Fall After Chevron-Hess

The Permian Basin, a big oil area, is not seeing as many deals as before because lots of companies have already joined together. Now, experts think these companies might start looking for new places to invest in the U.S. One area getting attention is the Bakken play. Chevron Corp. has just made a big step there by buying Hess Corp. for $60 billion. Another company, Grayson Mill Energy, which got some help from a Houston investment firm EnCap Investments LP, might also be up for sale soon, worth about $5 billion.

Occidental, CrownRock Merger Under Regulatory Review: 2024 Update

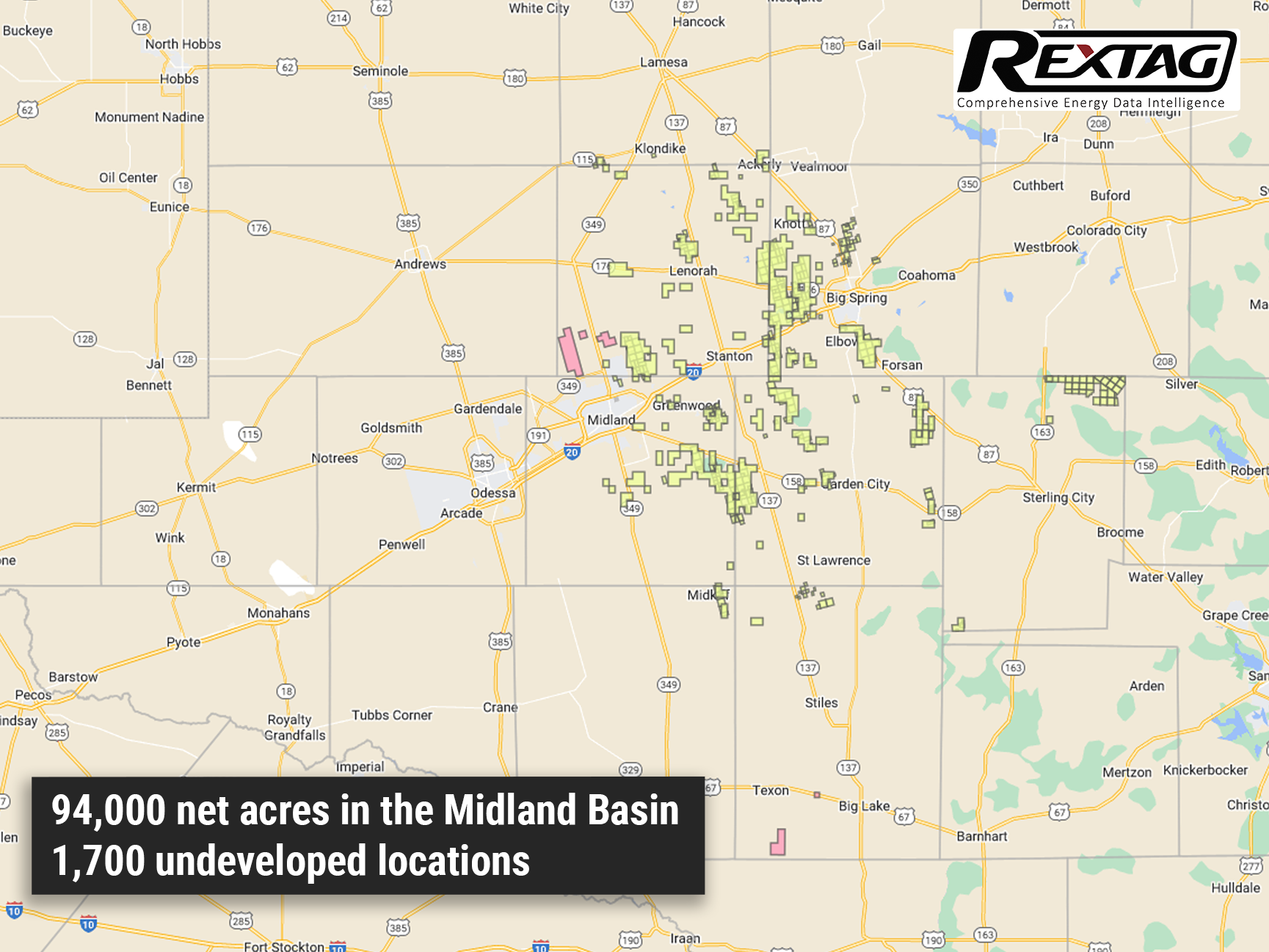

CrownRock's 94,000+ net acres acquisition complements Occidental's Midland Basin operations, valued at $12.0 billion. This expansion enhances Occidental's Midland Basin-scale and upgrades its Permian Basin portfolio with ready-to-develop, low-cost assets. The deal is set to add around 170 thousand barrels of oil equivalent per day in 2024, with high-margin, sustainable production.

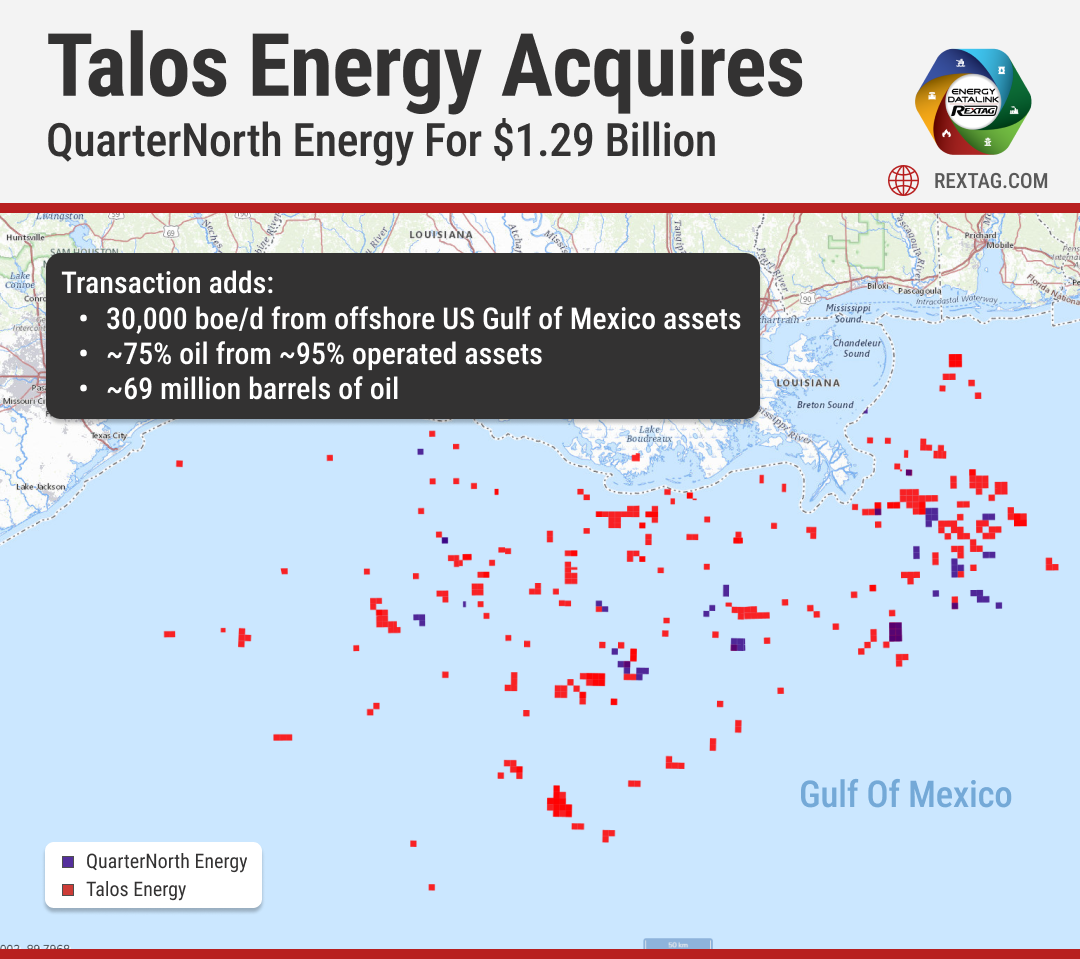

Talos Energy Confirms $1.29 Billion Takeover of QuarterNorth Energy

Houston-based Talos Energy Inc. has made a deal to buy QuarterNorth Energy Inc. for $1.29 billion. QuarterNorth is a company that explores and produces oil in the Gulf of Mexico and owns parts of several big offshore fields. This purchase will add more high-quality deepwater assets to Talos's business, which are expected to bring steady production and new opportunities for growth. The deal should immediately benefit Talos's shareholders and help the company reduce its debt faster.

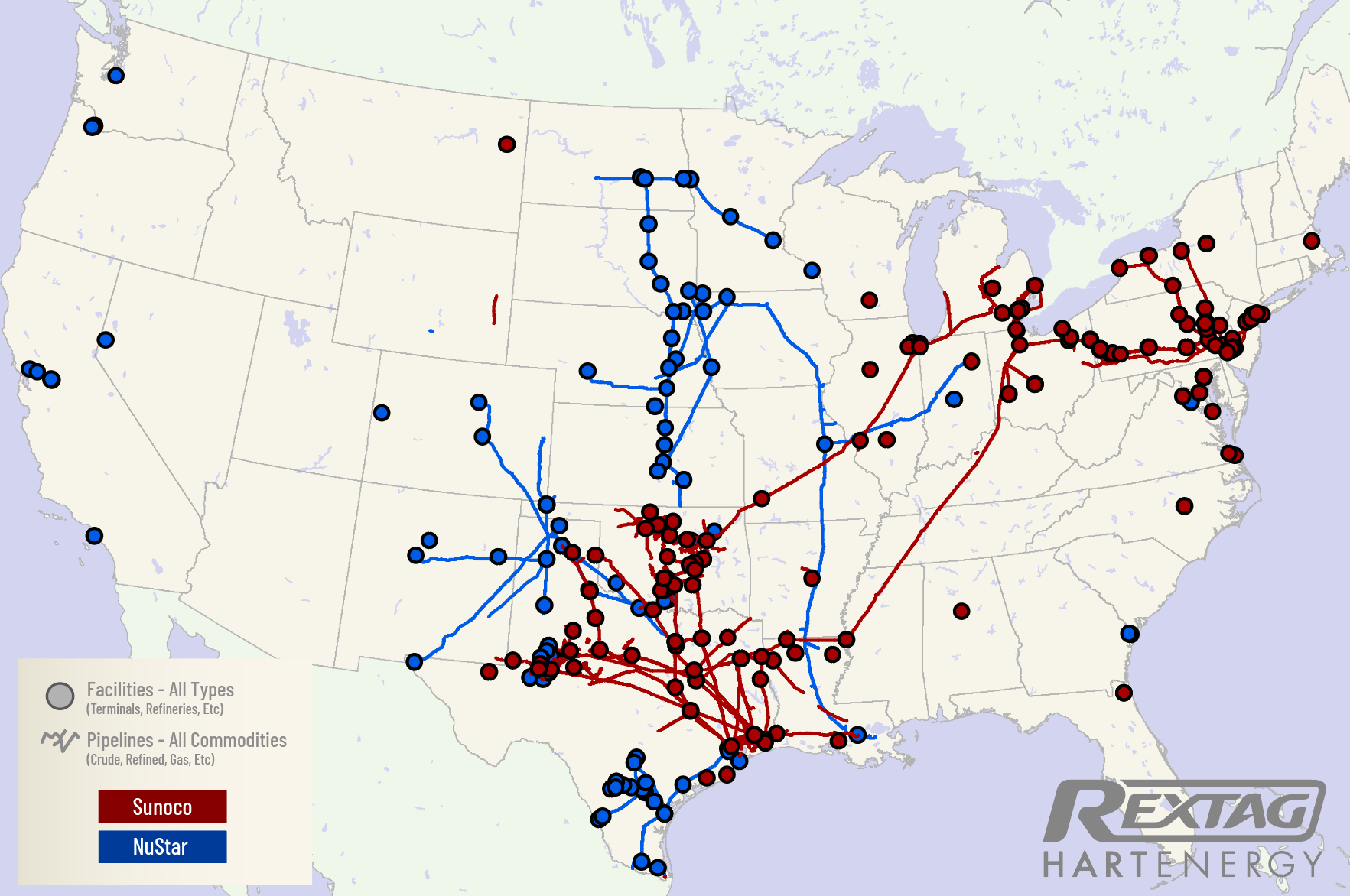

Dallas-Based Sunoco Buys NuStar Energy for $7.3 Billion

Sunoco, a gas station company based in Dallas, will buy NuStar Energy, a major operator of liquid storage and pipelines, for $7.3 billion. The acquisition of NuStar Energy by Sunoco not only enlarges Sunoco's fuel distribution business but also moves it into the crude oil middle market, especially in the important Permian Basin area.

Welcome 2024: A Look Back at 2023 Top Oil and Gas Sector Deals

2023 was quite a year for the oil and gas sector, with some big deals making the news. In the US, giants like ExxonMobil and Chevron grabbed headlines with their plans to acquire companies like Pioneer and Hess. Internationally, ADNOC wasn't left behind, expanding its reach as well. As we ring in the new year, let's recap the biggest oil and gas deals of 2023.

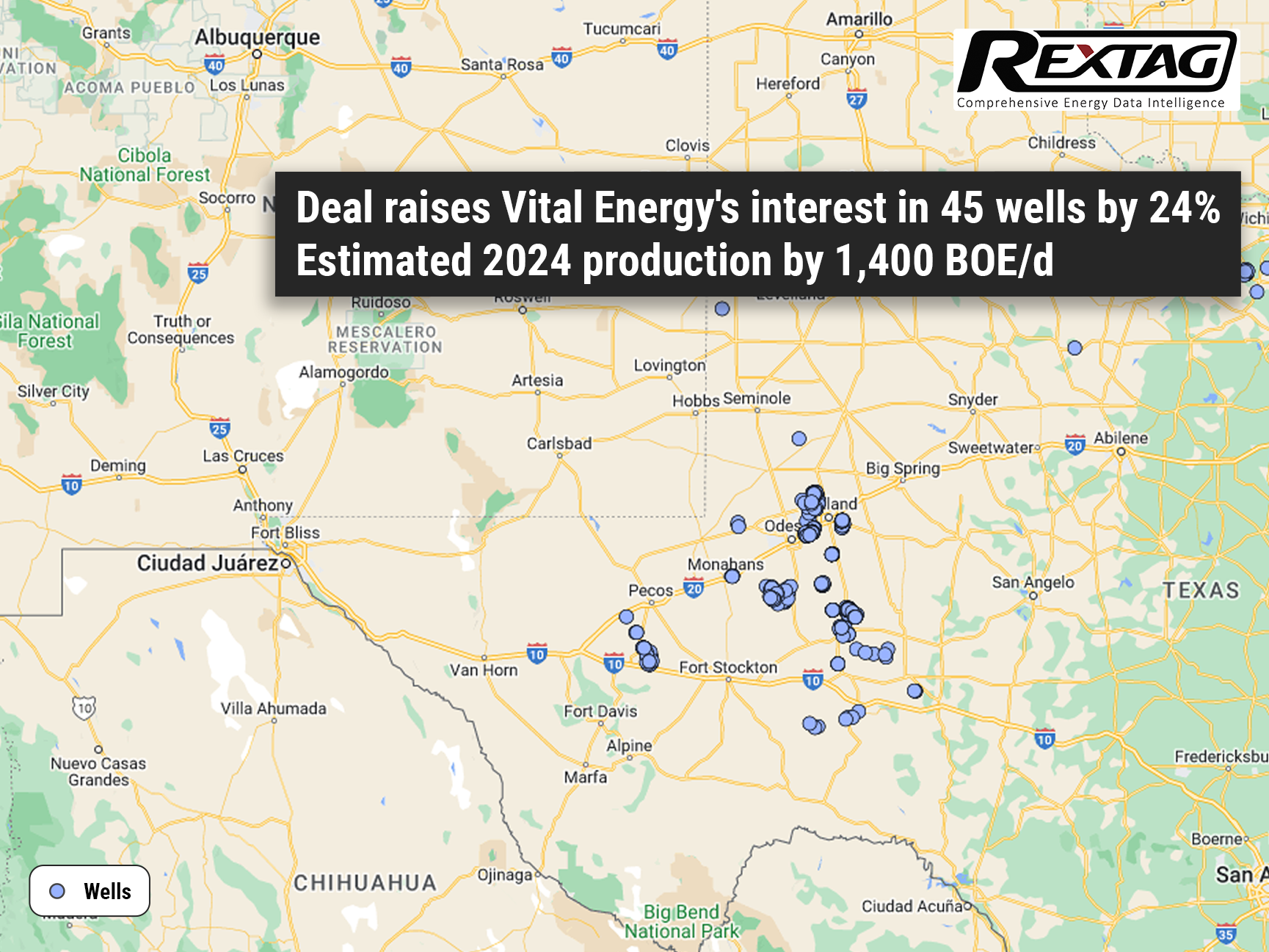

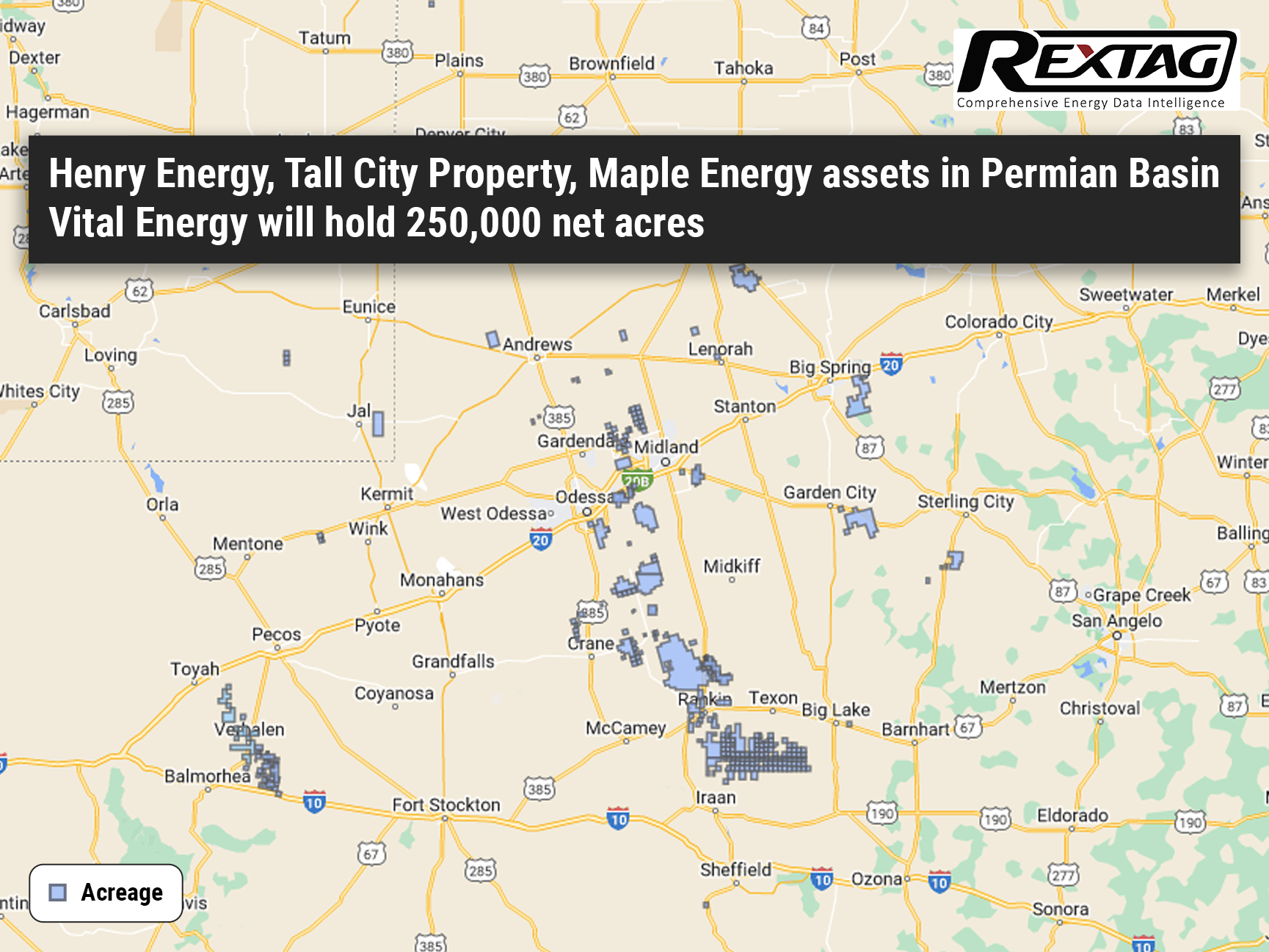

Vital Energy Expands Permian Basin Footprint with New Working Interest Acquisitions

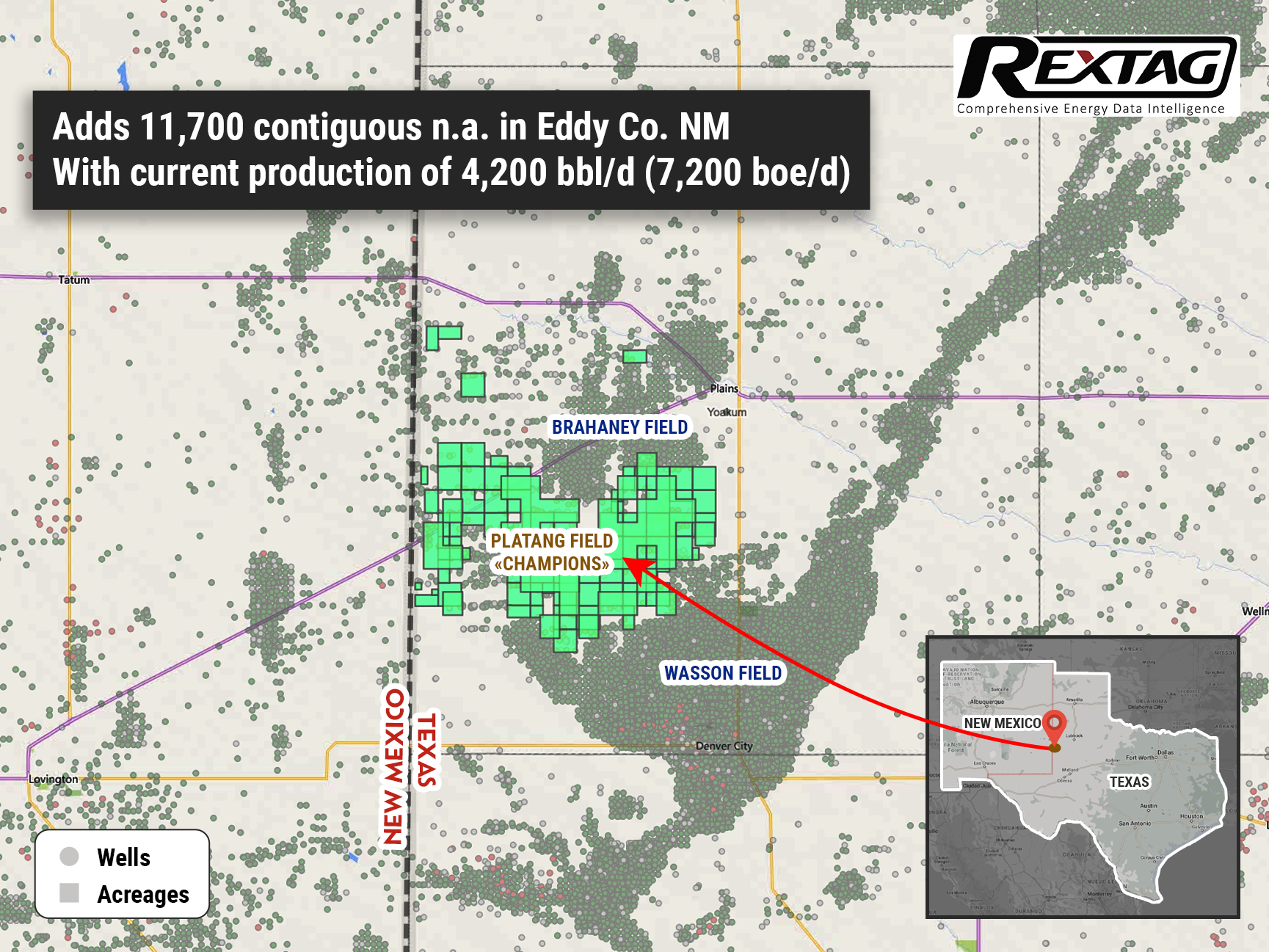

Vital Energy, an independent energy firm, recently expanded its holdings in the Permian Basin by purchasing additional working interests in prime production assets for approximately $55 million. These newly acquired assets were originally part of a larger transaction involving Henry Energy, Moriah Henry Partners, and Henry Resources.

Rudolf reindeer VS. Transcontinental Pipeline - Which one moves the presents faster

Well, it’s a Christmas ❄️time again. We all know Rudolf, the hero of Christmas, guiding Santa's sleigh through the night. And then there’s this massive Transcontinental pipeline (Transco), stretching thousands of miles, sending gas all over the place. It's like comparing grandkid's toy car with a real monster truck. So, who's faster in the present-delivery? Rudolf’s magic or Transco's might? That's a tough one, but we'll leave that for you to decide while we kick back with some eggnog.

Christmas tree and Santa Against Permian Methane Emissions

Once upon a Christmas, Santa Claus, while checking his list, noticed something different. Far away in Texas, there was a place called the Permian Basin, not filled with snow, but with oil fields. These fields were letting out a gas called methane, which wasn't good for the air. Santa, always caring for our planet, decided this year he'd do something about it. So, he set off on a special journey, with his bag of toys and a plan to help the Earth. Let's join Santa on this unique adventure as he tries to make the Permian Basin a bit greener this Christmas.

Sale of Texas Panhandle Assets by Unit Corporation Now Complete

Unit Corporation (OTCQX: UNTC) has successfully completed the sale of some of its non-core oil and gas assets located in the Texas Panhandle. This sale, involving assets known as the "Divested Assets," resulted in the company receiving $50 million in cash at the time of closing. This amount may be adjusted later according to the terms of the sale agreement.

Pembina (PBA) to Acquire Enbridge's Joint Ventures for $2.3 Billion - C$3.1 Billion

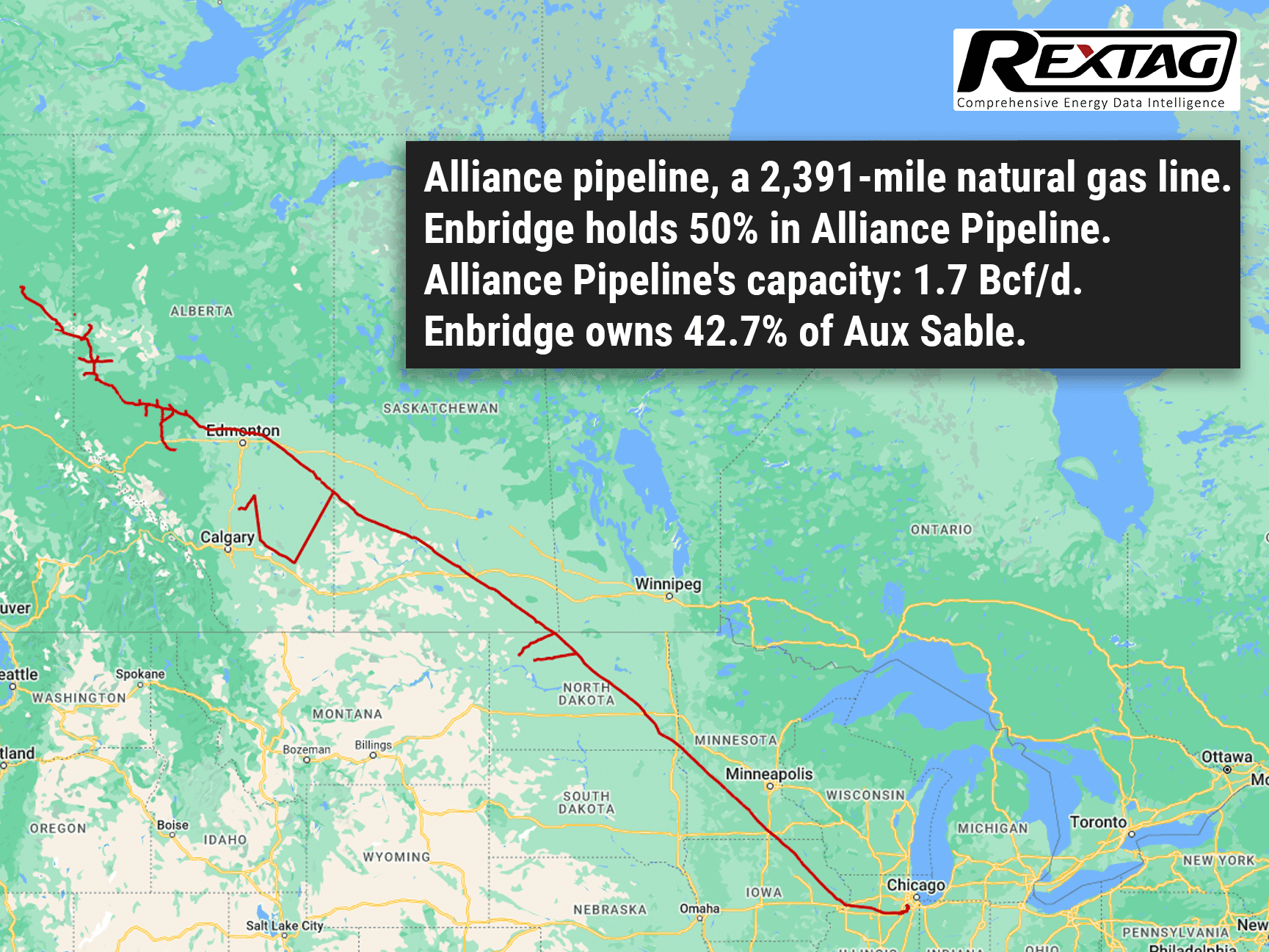

Pembina Pipeline Corporation PBA, a well-known player in the Canadian midstream sector, recently announced its plan to acquire Enbridge Inc.'s remaining shares in the Alliance Pipeline, Aux Sable pipelines, and NRGreen joint ventures. The deal, valued at C$3.1 billion or US$2.3 billion, marks a key step for Pembina in asserting its leadership in North America's natural gas transportation sector. This strategic acquisition is expected to considerably boost Pembina's growth and profitability in the coming years.

Occidental's Asset Cuts After CrownRock's $12 Billion Deal

Occidental Petroleum is expanding its reach in the Midland Basin and targeting deeper drilling in the Barnett area through its significant $12 billion purchase of CrownRock LP. CrownRock, a collaboration between CrownQuest Operating LLC and Lime Rock Partners, is recognized for its prime land holdings in the Permian Basin. This acquisition brings over 94,000 net acres and 1,700 undeveloped drilling spots in the Midland Basin to Occidental's portfolio.

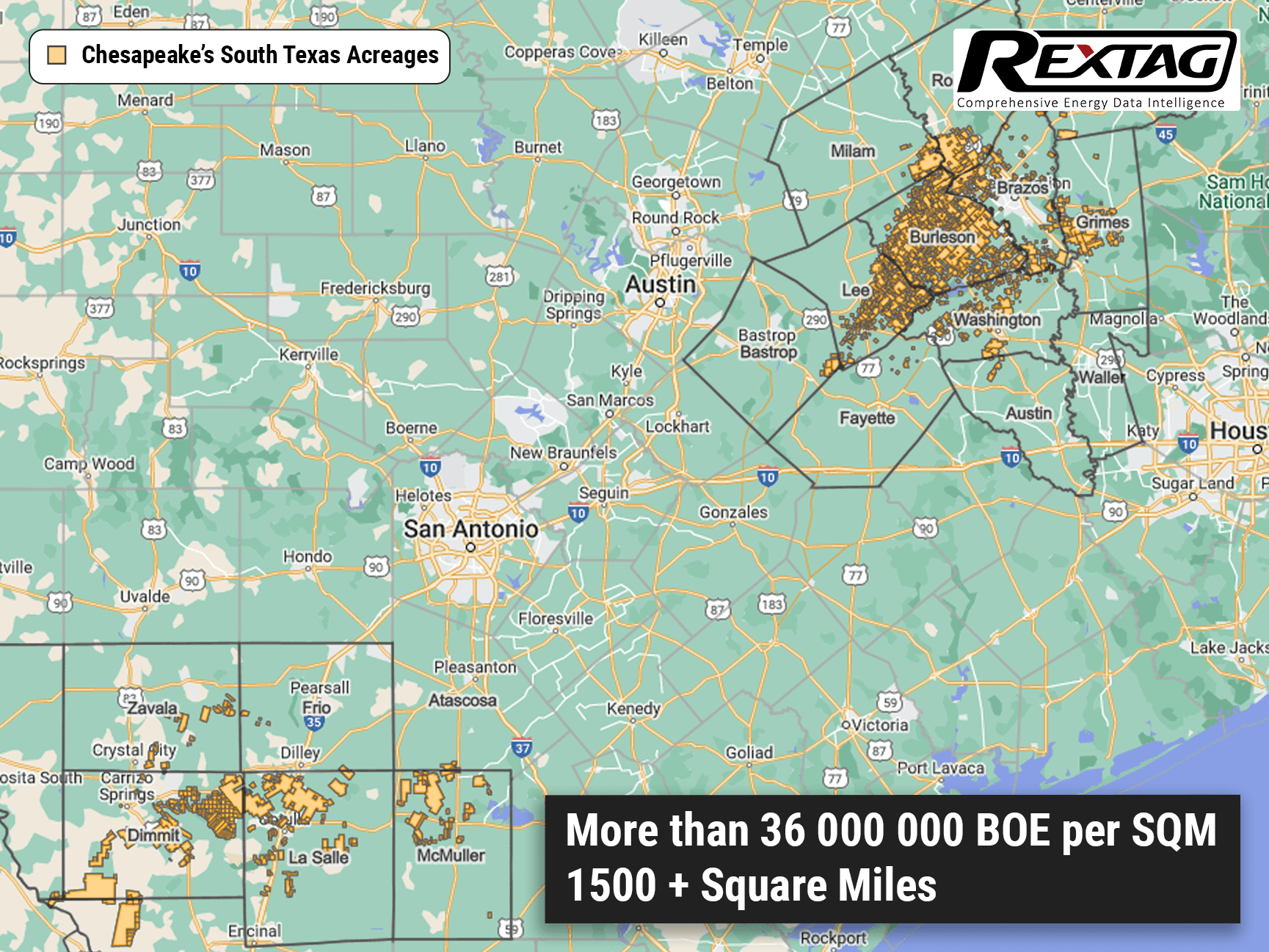

SilverBow Successfully Completes $700MM Purchase of Chesapeake’s South Texas Holdings

SilverBow Resources Inc. finished buying Chesapeake Energy Corp.'s oil and gas areas in South Texas. They agreed to this $700 million deal back in August. The deal included SilverBow paying $650 million in cash when the deal was closed. They will also pay another $50 million in cash a year later, with some usual changes in the amount. Chesapeake might get an additional $50 million later, depending on the prices of oil and gas in the future. SilverBow paid for this big purchase with the money they had, by borrowing from their credit line, and by selling more of their second lien notes.

Tenaris Acquires Mattr's Pipe Coating Division for $166 Million

Tenaris has successfully finalized the purchase of Mattr's Pipe Coating Division, previously known as Shawcor, for a total of $182.6 million. This figure includes working capital and $16.9 million in cash. Announced back on August 14, 2023, the acquisition has now received the green light from regulatory bodies in both Mexico and Norway.

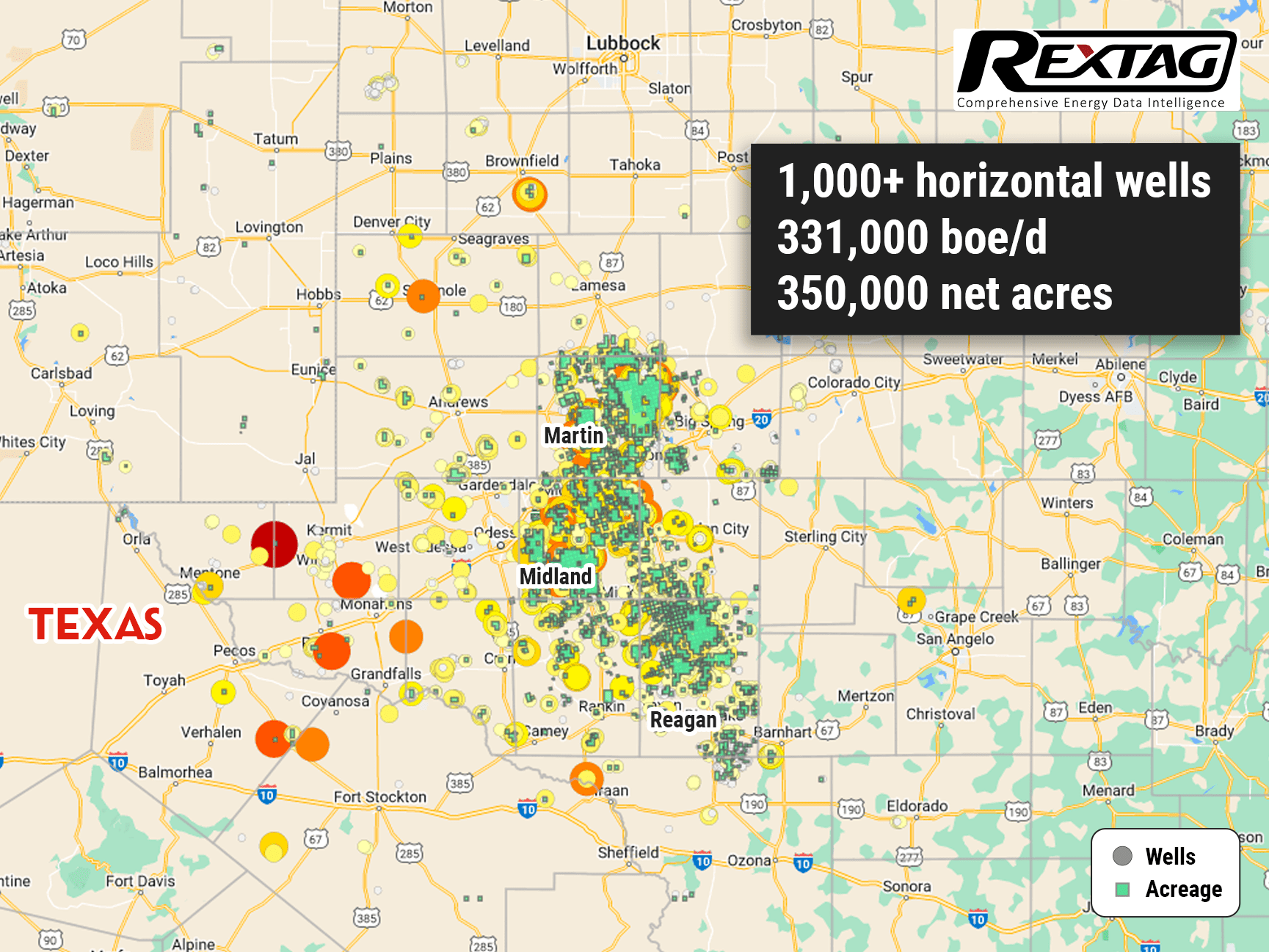

Anticipated Growth: Endeavor Energy's Value Nearing $30 Billion

This summer, J.P. Morgan Securities highlighted Endeavor Energy Resources as the Midland Basin's standout in mergers and acquisitions, suggesting its value might approach $30 billion. Endeavor Energy Resources, a privately-owned entity in Midland focusing solely on its operations, has seen a significant uptick in production. It now boasts a production rate of 331,000 barrels of oil equivalent per day (boe/d), marking a 25% increase from the previous year.

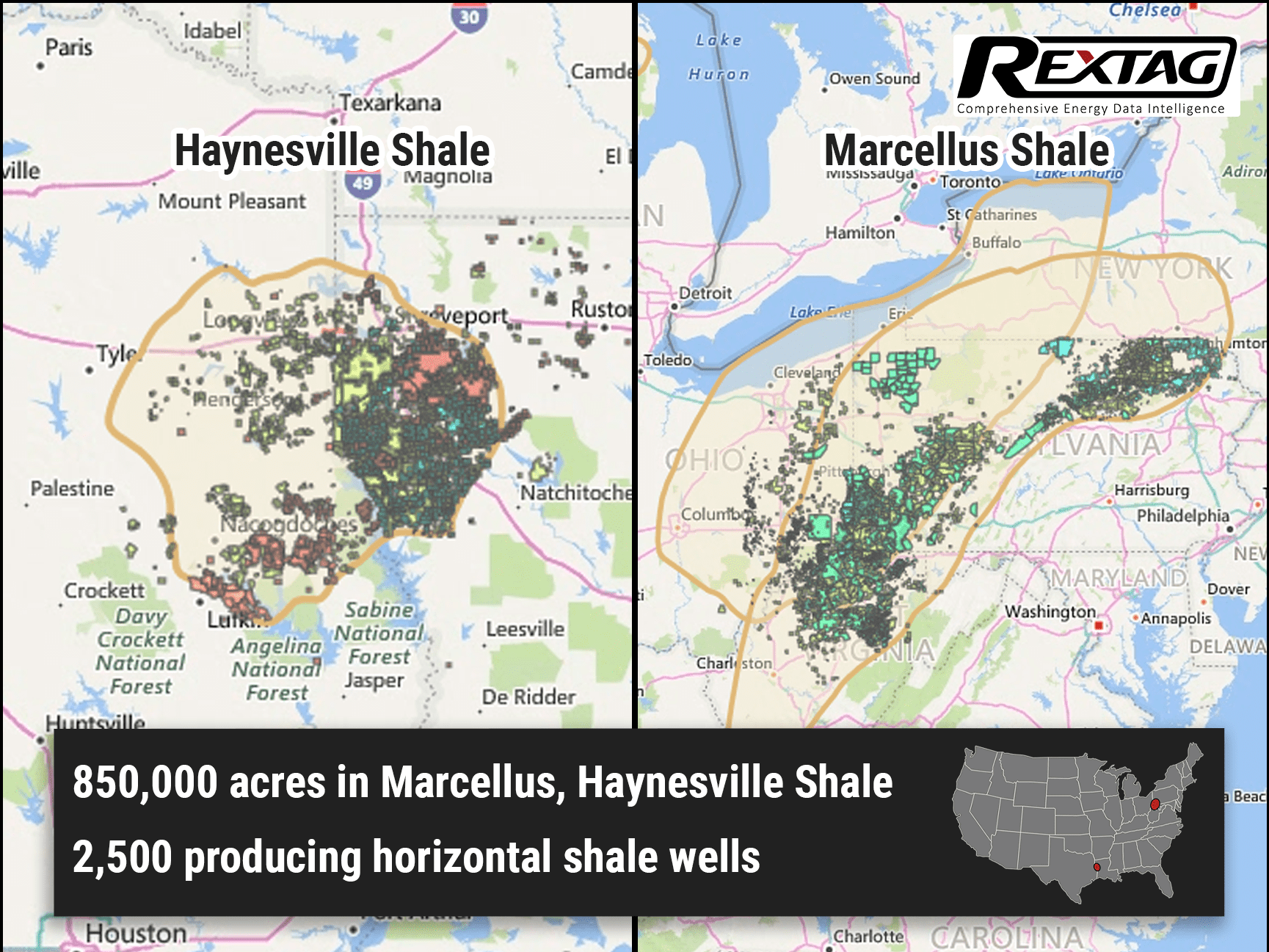

WhiteHawk Energy Expands Portfolio with $54 Million Marcellus Shale Natural Gas Asset Purchase

WhiteHawk Energy has recently completed a significant acquisition in the Marcellus Shale, investing $54 million. This deal has effectively doubled their mineral and royalty ownership in the Marcellus Shale, particularly in Greene and Washington counties in Pennsylvania. This region is noted for its high-quality natural gas reserves. WhiteHawk’s Marcellus assets now encompass approximately 475,000 gross unit acres, featuring production from about 1,315 horizontal shale wells. In addition to this, they own interests in 72 wells-in-progress, 64 permitted wells, and nearly 900 undeveloped Marcellus locations. This acquisition is expected to double WhiteHawk's net revenue interest in each well within its Marcellus holdings.

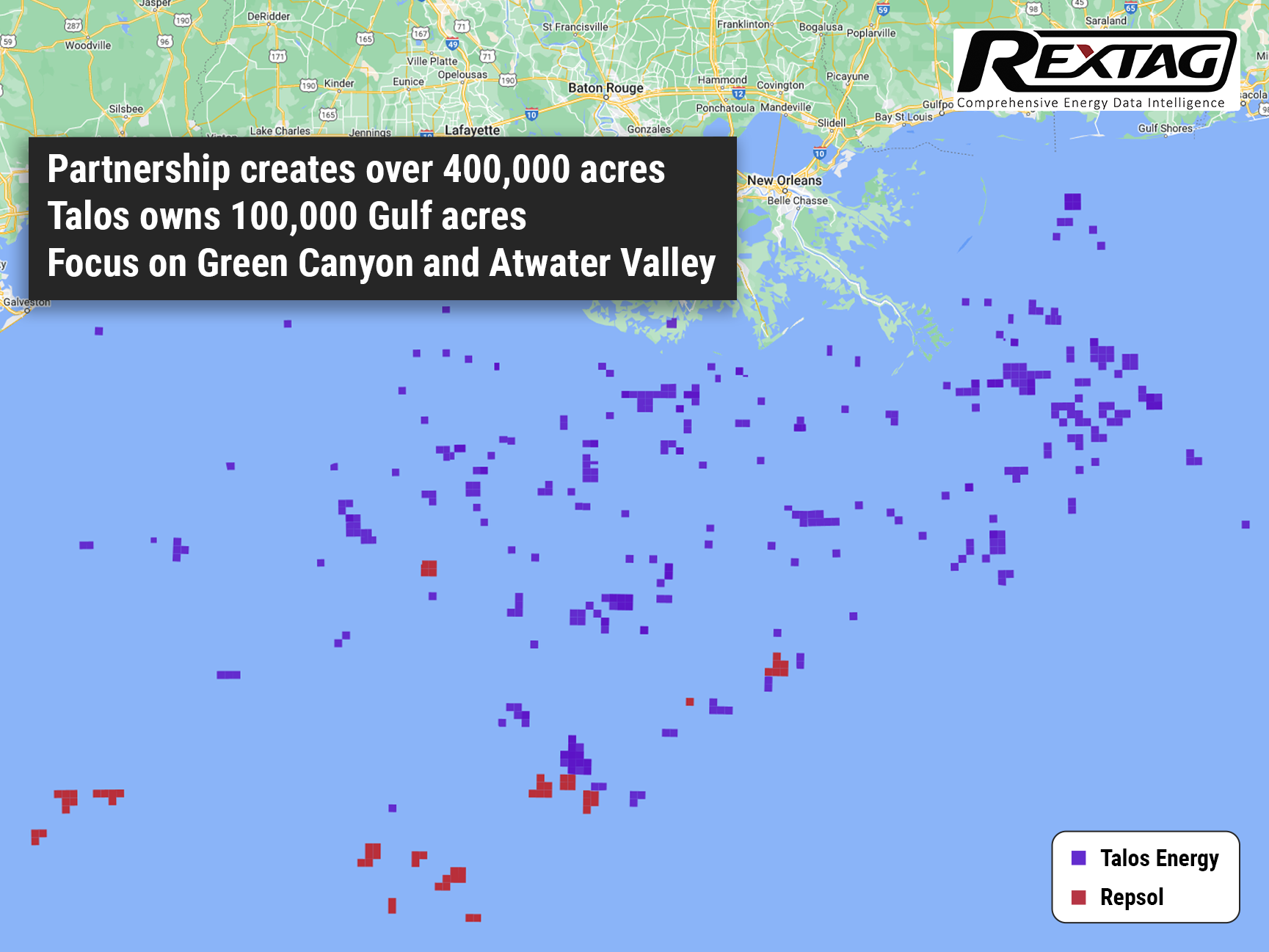

Talos Energy and Repsol Join Forces in Gulf Exploration JV

alos Energy and Repsol have formed a partnership, each owning 50-50, to reexamine seismic data in a shared area to identify where to drill in the coming years. Tim Duncan, the CEO of Talos, sees this as a strategic use of land they acquired from EnVen Energy Corp to enhance its value. Talos Energy is putting to use the land they bought from EnVen Energy Corp for $1.1 billion. CEO Tim Duncan talked about this on November 7, explaining that it's a smart move because the government has delayed a big decision on new ocean drilling areas. By teaming up with Repsol, Talos plans to work on the land they already have, about 100,000 acres, so they don't have to wait for new permits.

Kinder Morgan Invests $1.8 Billion in South Texas Gas Infrastructure

Kinder Morgan's strategic acquisition of STX Midstream from NextEra is a significant move to enhance its infrastructure capabilities in South Texas. The area is witnessing an upsurge in natural gas production and demand, particularly towards Mexico and the Gulf Coast markets. The 462-mile pipeline system, which is highly contracted with an average contract length of over eight years, is expected to generate about $181 million in EBITDA for 2023.

Crescent Point Acquires Hammerhead for $1.86 Billion for Expansion in Montney Shale

Crescent Point Energy Corp has finalized a deal to acquire Hammerhead Energy Inc. for approximately $1.86 billion. This strategic acquisition significantly expands Crescent Point's drilling locations within the Montney Shale region in Alberta, Canada, positioning the company as a stronger competitor in one of North America's most resource-rich oil areas.

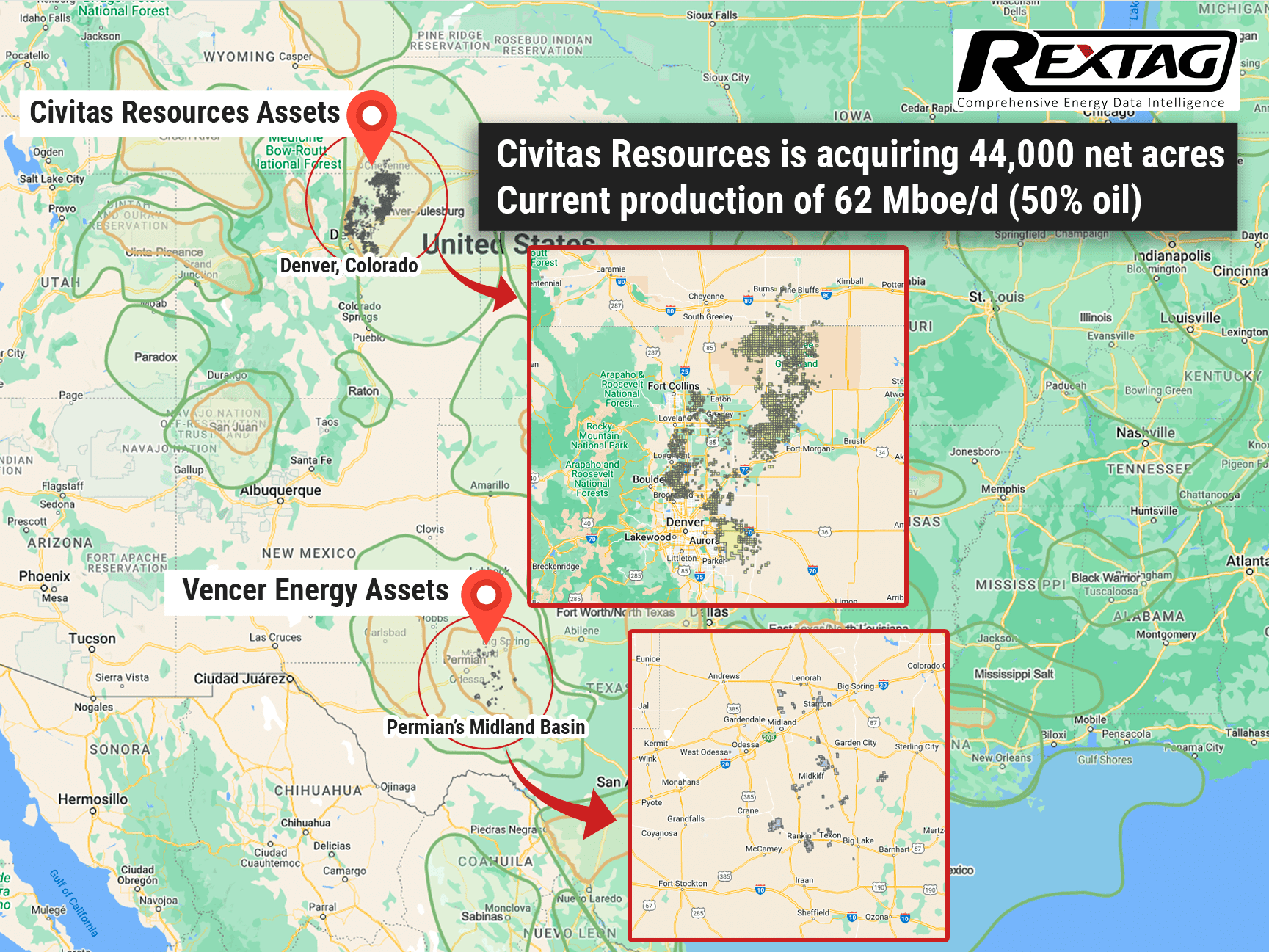

Civitas Resources Advances with Midland Assets in a $2.1 Billion Agreement

Denver-rooted Civitas Resources, Inc. concluded an arrangement to acquire Vencer Energy's assets in the Midland Basin from Vitol for an approximate $2.1 billion. The $2.1 billion arrangement between Civitas Resources and Vencer Energy is a strategic maneuver that enlarges Civitas' presence in the resource-rich Permian Basin. By securing approximately 44,000 net acres, Civitas not only acquires a substantial asset but also amplifies its production capacity by 62 to 62.5 Mboe/d. The transaction, which is anticipated to complete in January, is perceived as a cost-effective acquisition that markedly enhances Civitas Resources’ scale in the Permian Basin.

Peyto Completes $468MM Purchase of Repsol's Canadian Assets

Peyto Exploration & Development Corp., a notable natural gas producer in Canada, has secured a significant acquisition deal with Repsol, a Spanish energy conglomerate, for its Canadian assets at $468 million. This acquisition is a deviation from Peyto's traditional approach of smaller, bolt-on acquisitions, reflecting a strategic evolution aimed at positioning the company to take advantage of the anticipated changes in North America's ability to export oil and gas by 2025.

Equitrans Midstream Collaborates with US Regulator on MVP Project Contract

he PHMSA mandates Equitrans to clearly detail the progression measures for the Mountain Valley Pipeline completion. Equitrans Midstream, overseeing the Mountain Valley Pipeline (MVP) in Virginia's Jefferson National Forest, has committed to enhanced safety protocols following a consent order from the Pipeline and Hazardous Materials Safety Administration (PHMSA). As part of the agreement, Equitrans and MVP LLC have vowed to transparently detail the pipeline's progression, aiming to bolster public trust.

Exxon Mobil and Pioneer Merge in $60 Billion Deal to Dominate Shale Market

Exxon Mobil (XOM.N) has reached an agreement to acquire its domestic competitor, Pioneer Natural Resources (PXD.N). This all-stock transaction, which places a valuation of $59.5 billion on the deal, promises to establish Exxon as the preeminent producer in the U.S.'s most extensive oilfield. At a valuation of $253 per share, this merger brings together the prowess of Exxon, America's largest oil entity, with Pioneer, a standout performer that has risen to prominence during the shale boom.

Expro Unites with PRT Offshore in a Landmark $106 Million Deal

Expro recently announced its acquisition of PRT Offshore. This deal enhances Expro's technological capabilities in subsea well access, especially in North and Latin America. Additionally, it promotes the expansion of PRT Offshore's equipment in Europe, Sub-Saharan Africa, and the Asia Pacific. Michael Jardon, Expro's CEO, sees this collaboration offering considerable growth for PRT Offshore. He highlighted the combined potential to deliver better integrated offshore solutions. The entire deal, which includes Expro shares, stands at an approximate value of $106 million. RBC Capital Markets acted as the financial adviser for Expro in this transaction.

Mexico Pacific LNG: A New Export Era Anchored by Permian Gas

Natural gas from the U.S. Permian Basin is set to be the primary source for Mexico's Pacific's Saguaro Energía LNG facility. Located in Puerto Libertad, Sonora, the Saguaro Energía LNG export facility will feature three processing trains. The site is primed for potential expansion with plans for three additional trains of similar capacity. Its strategic Pacific Coast location offers a 55% shorter shipping route to Asia, providing significant savings and reduced carbon emissions.

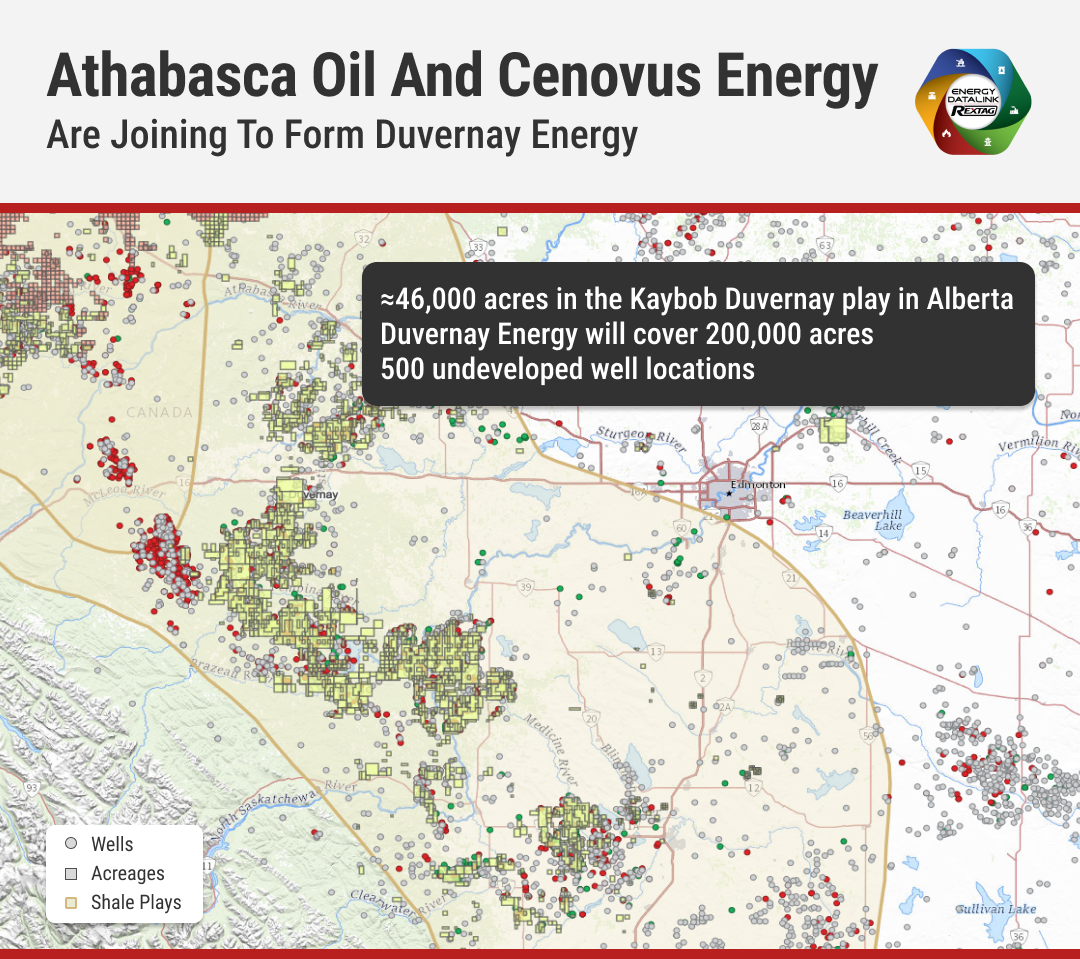

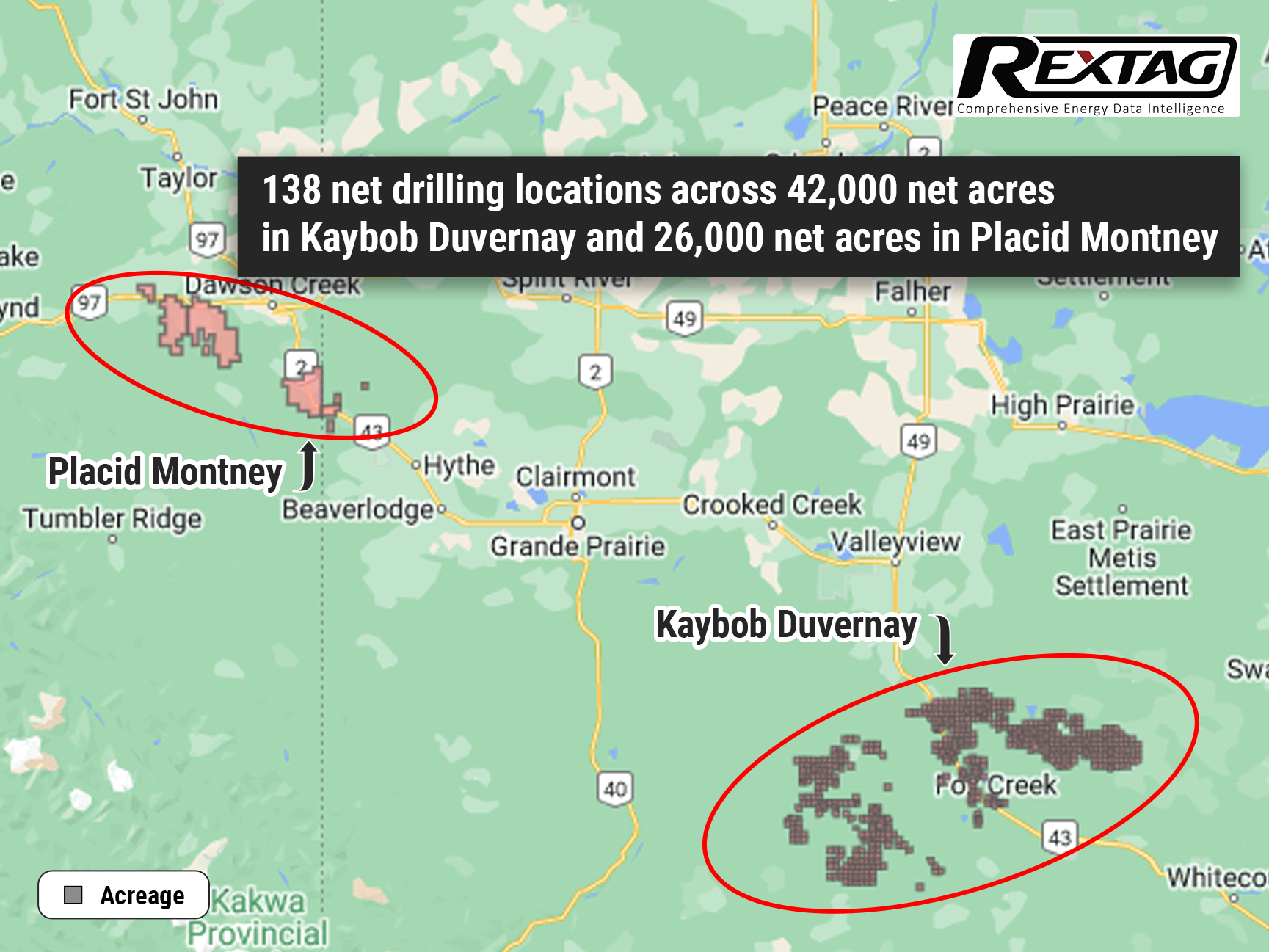

Non-Core Canadian Assets of Murphy Oil Successfully Divested for $104M

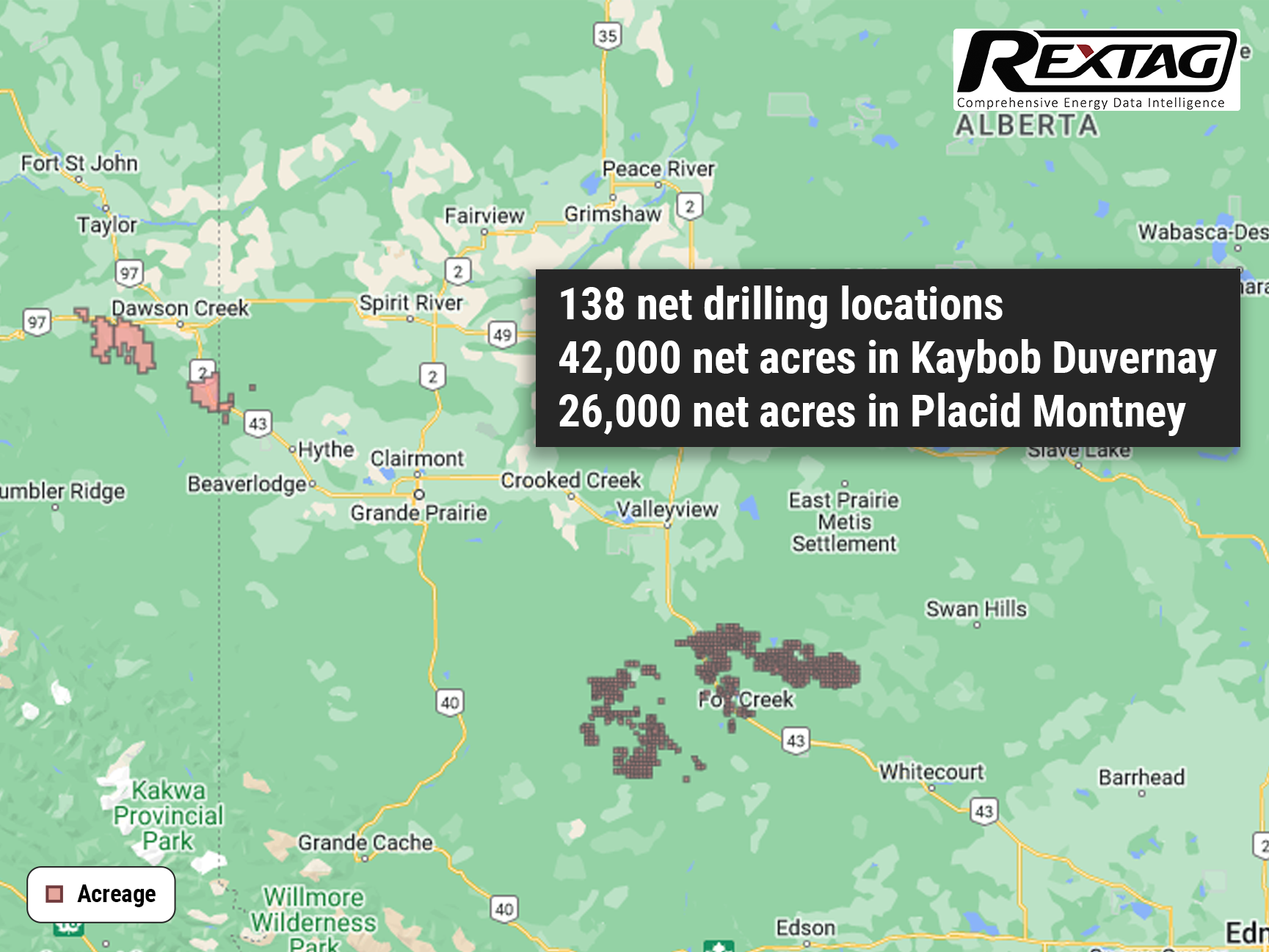

Houston-based Murphy Oil Corp. has successfully concluded the divestiture of its non-core operated assets located across its Western Canadian terrain, including the assets in the Kaybob Duvernay region and the complete non-operated Placid Montney position through a subsidiary. The divestiture was initially made public in August and was concluded. The transaction yielded cash proceeds of around US$104 million (CA$141 million), slightly lower than the originally anticipated US$112 million.

Baker Hughes Confirms a Third Weekly Decline in US Oil and Gas Rigs

In a recent announcement, energy services firm Baker Hughes stated that U.S. energy companies have decreased the number of operating oil and gas rigs for the third successive week. This development marks the first such consistent reduction since early September. As of October 6, the count for oil and gas rigs, considered a precursor to future production levels, has seen a decline by four, positioning it at 619. This is the lowest figure recorded since February of the preceding year. The overall rig count has decreased by 143 or 19% when compared to last year's statistics.

Decarbonization with Profit: Strategy Revealed by Shell's New Energies US CEO

Energy firms like Shell are facing the challenge of delivering cost-effective energy, reducing emissions, and enhancing shareholder value. Shell pursues its 2050 net-zero emission target, Wright highlighted the company's efforts to deliver greener energy solutions in line with increasing demand. This includes reconfiguring its energy and chemical facilities and earmarking between $10 billion to $15 billion for investment in low-carbon sectors by 2025.

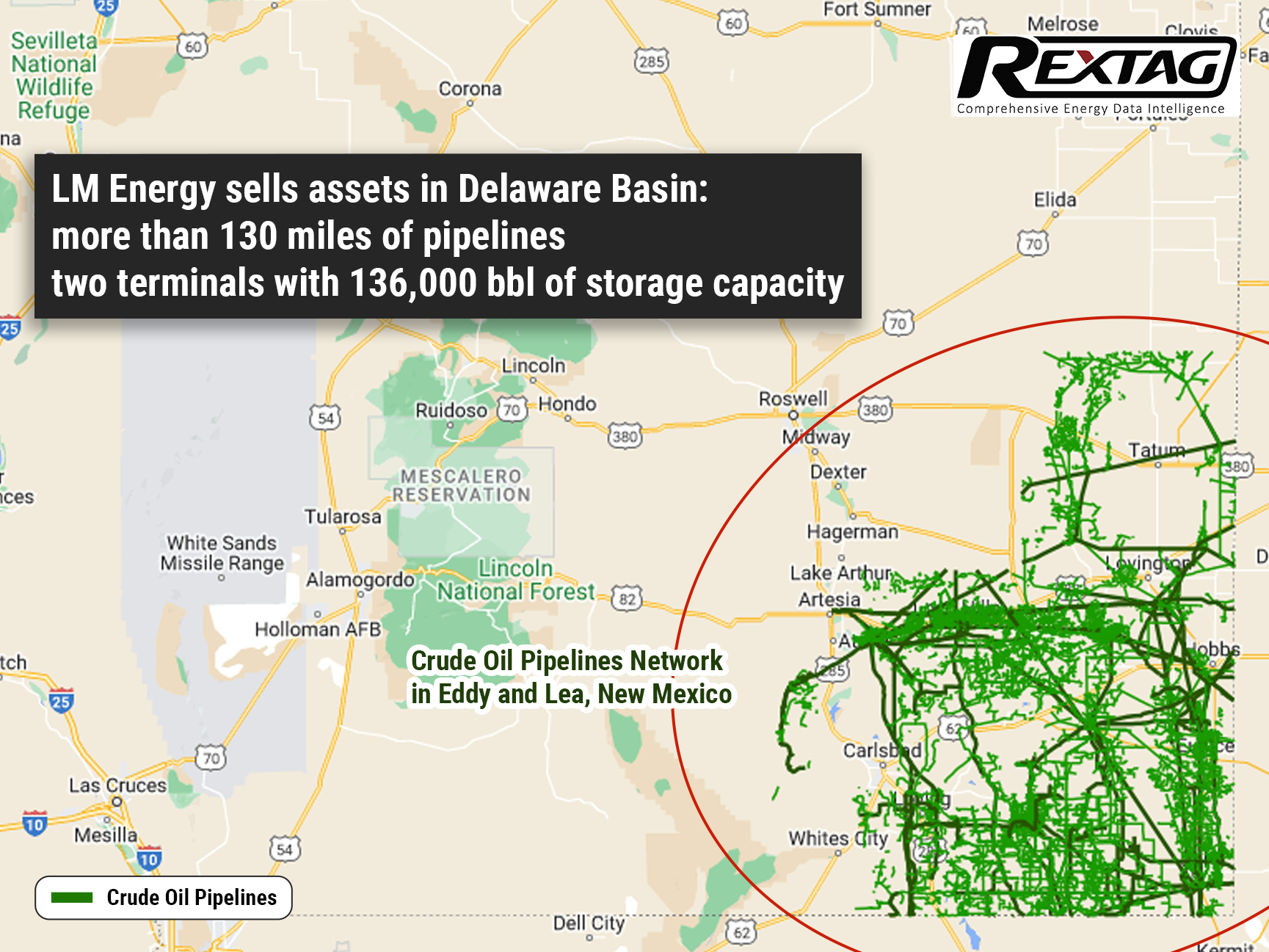

LM Energy Unloads 130 Miles of Pipelines in New Mexico Oil Gathering Asset Sale

LM Energy Holdings is set to sell assets including over 130 miles of pipelines, terminals, and other facilities in Eddy and Lea, New Mexico, Delaware Basin. LM Energy Holdings LLC has concluded definitive agreements to divest subsidiaries and assets associated with its Touchdown Crude Oil Gathering System situated in Eddy and Lea counties, New Mexico. The purchasing entity and financial particulars remain undisclosed.

Lycos Energy Inc. Secures Durham Creek Exploration Ltd. & $25M Equity Financing

Lycos Energy Inc. has solidified a conclusive agreement to procure Durham Creek Exploration Ltd., a prominent heavy oil producer, for a total of CA$22.5 million. Lycos Energy Inc. is delighted to disclose the conclusion of a definitive agreement to acquire Durham Creek Exploration Ltd., an independent, private heavy oil producer. This acquisition, by way of a plan of arrangement, is valued at $22.5 million, comprising $12.5 million in cash and 2.8 million Lycos common shares, each valued at $3.55. The Acquisition will be financed through a $25 million bought deal equity financing.

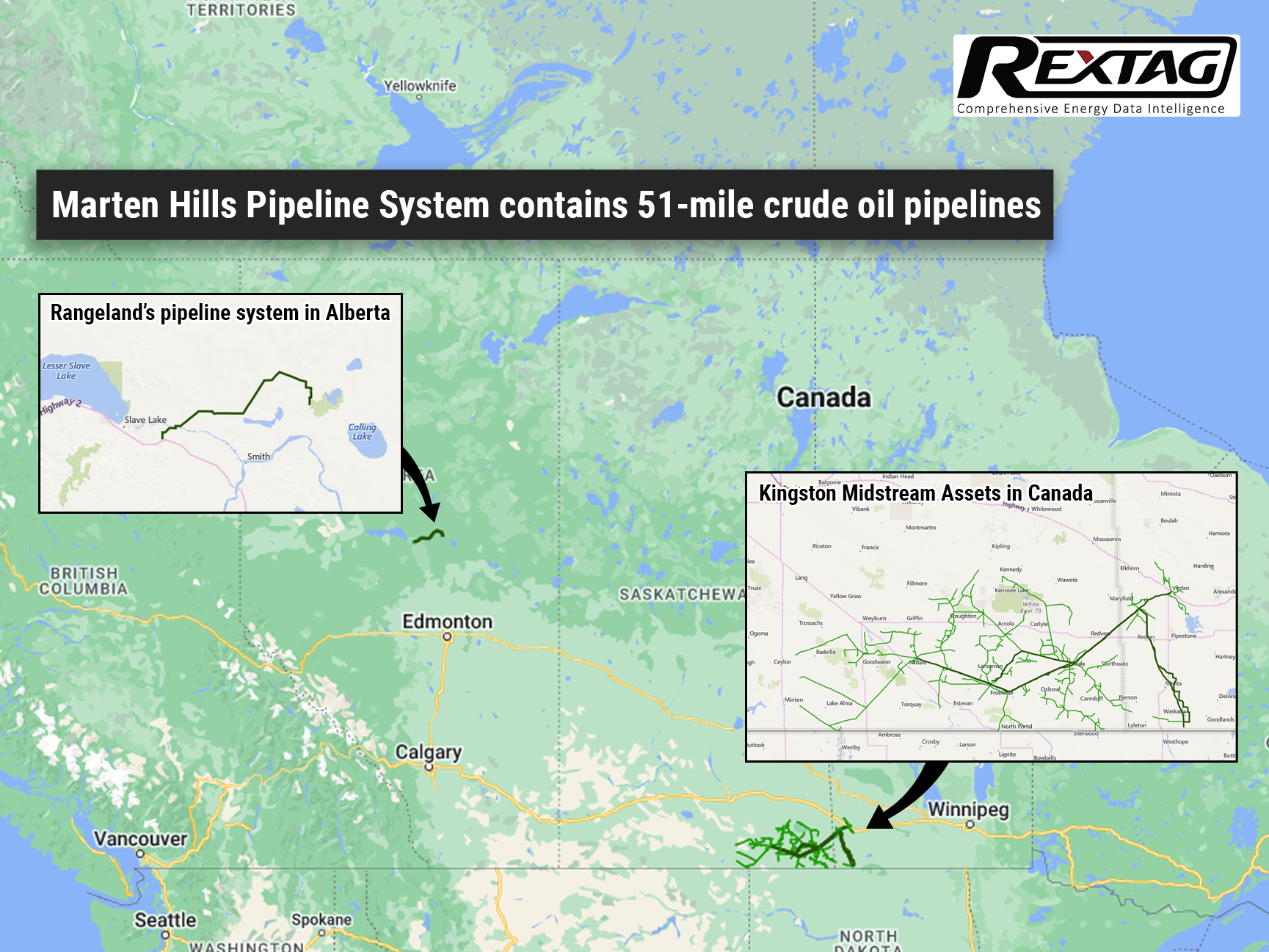

Kingston Midstream Secures Deal to Acquire Clearwater Assets from Rangeland Midstream Canada

Rangeland Energy has agreed to sell Rangeland Midstream Canada to Kingston Midstream Alberta and remains committed to future Canadian midstream investments. Texas-based Rangeland Energy, supported by financial partner EnCap Flatrock Midstream, has inked a deal to sell its Canadian subsidiary, Rangeland Midstream Canada Ltd., to Calgary's Kingston Midstream Alberta Ltd. for cash.

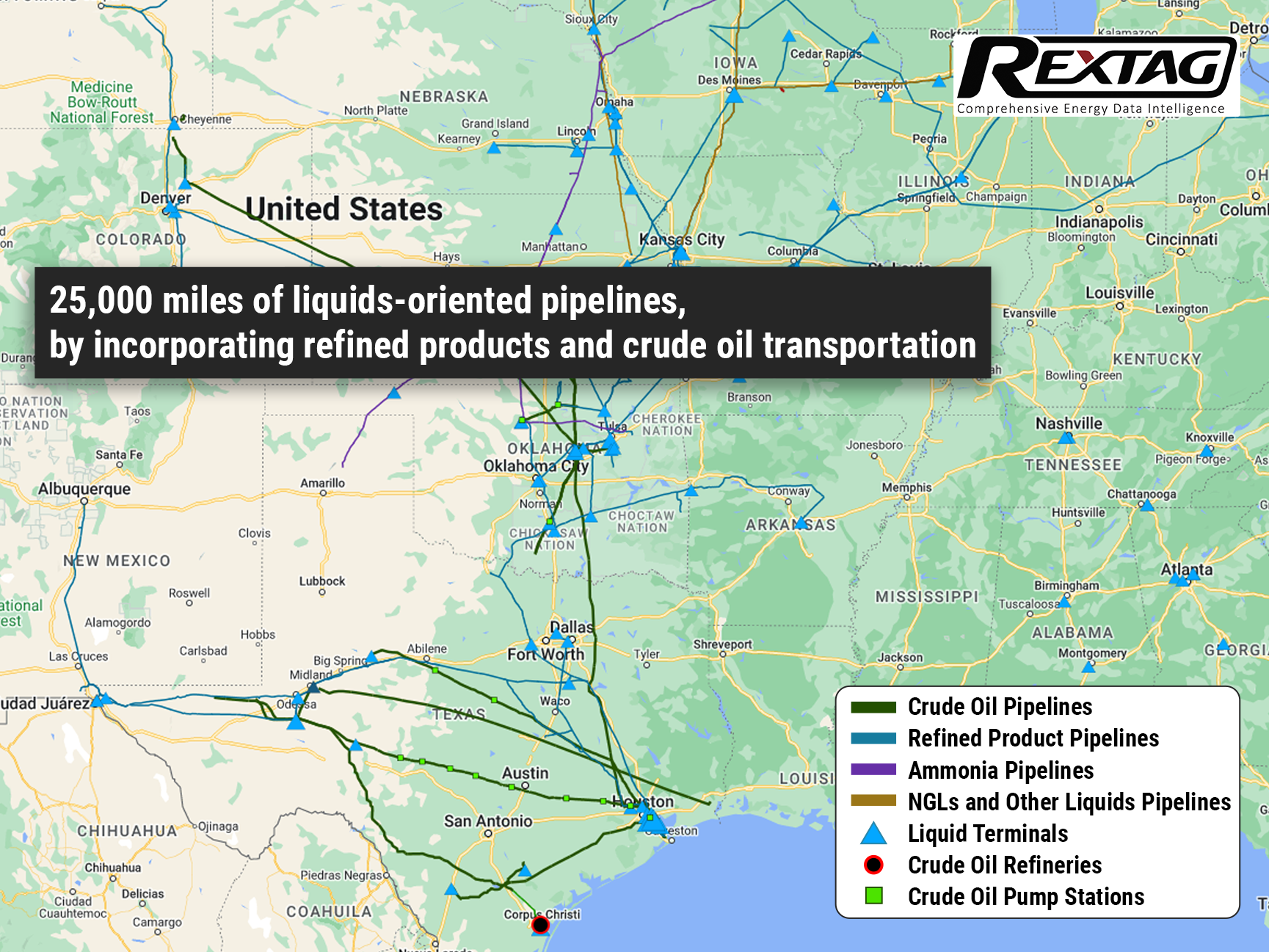

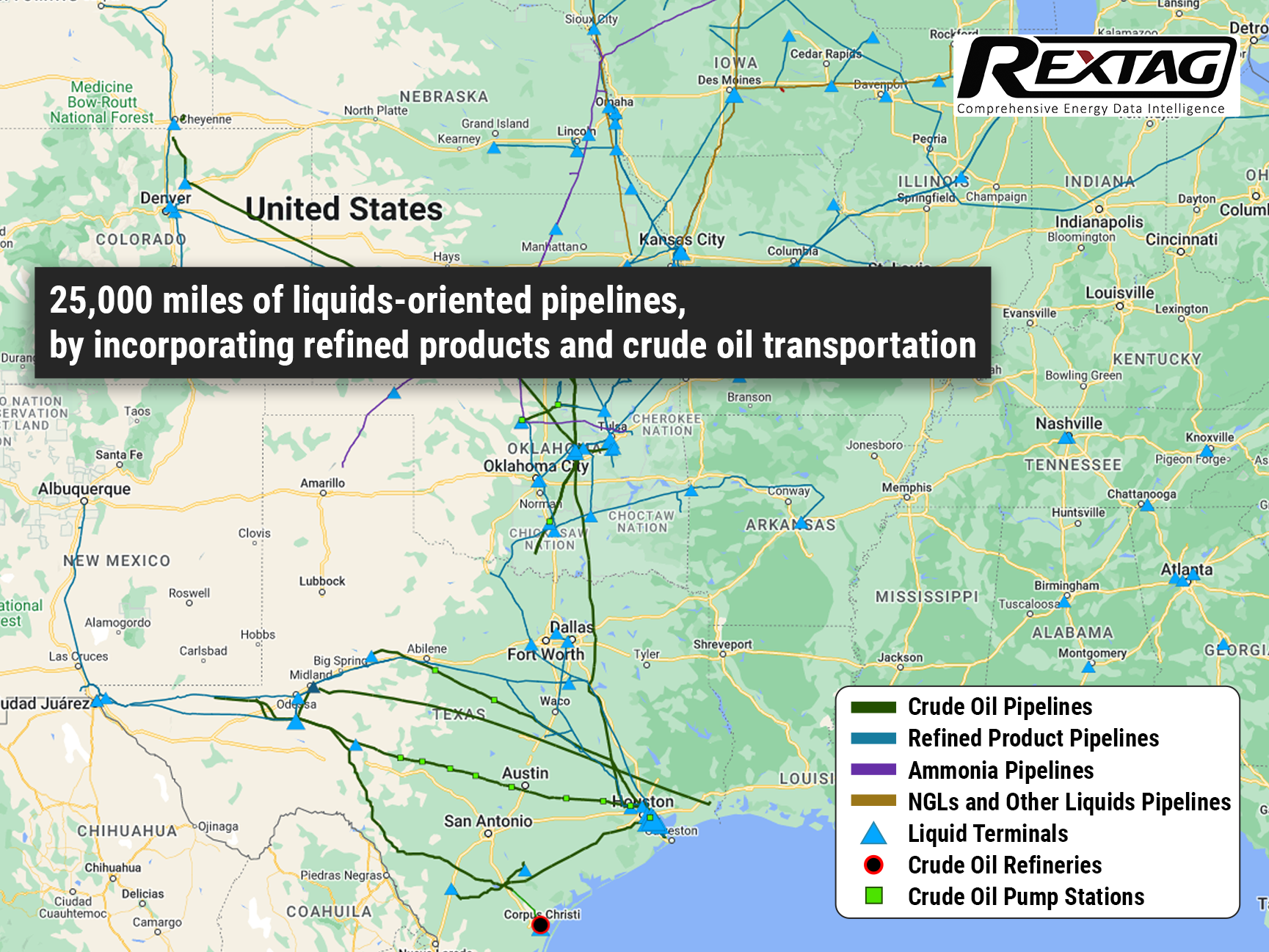

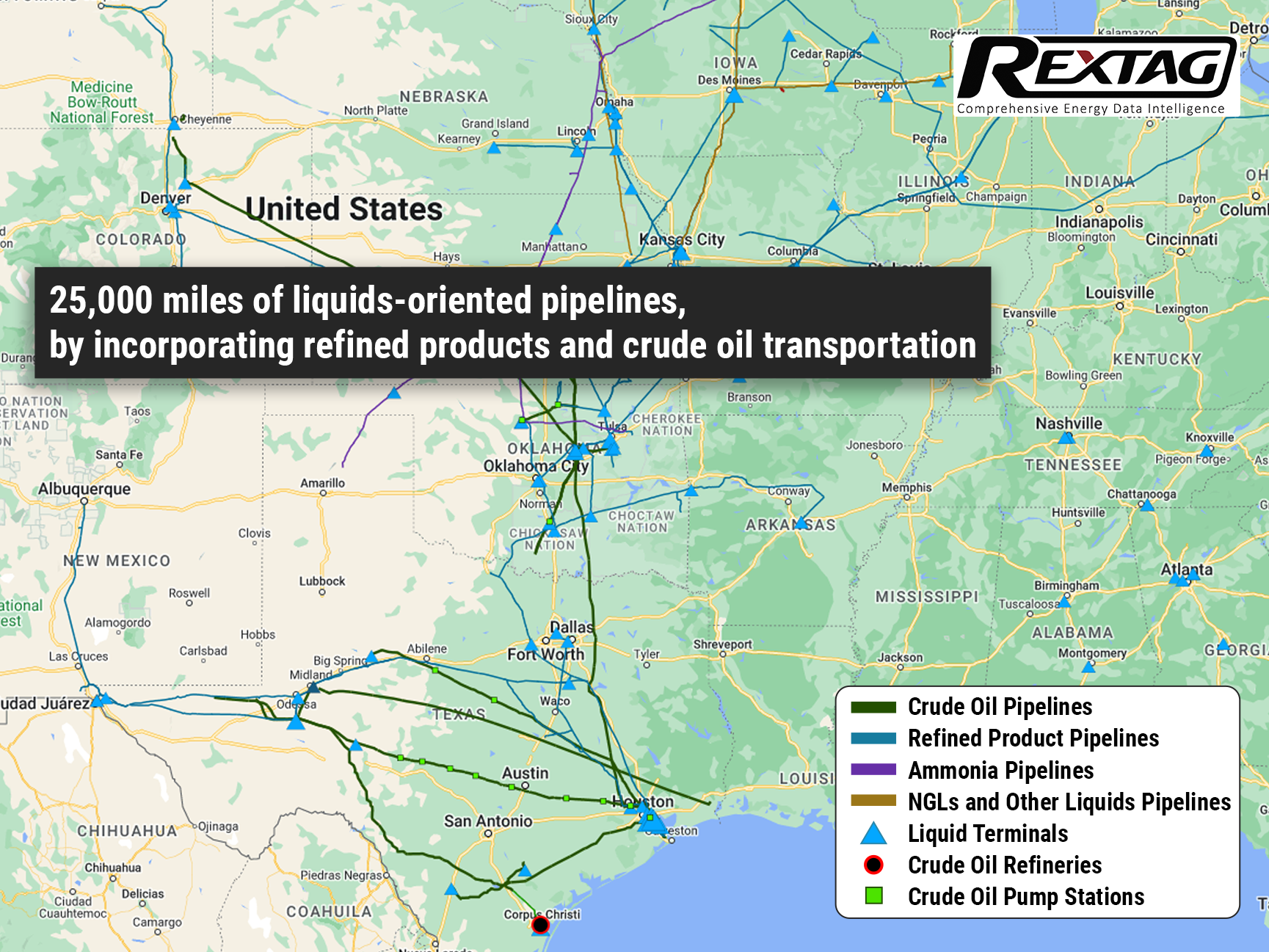

ONEOK Finalizes Purchase of Magellan Midstream Partners

The merger between ONEOK and Magellan received approval from Magellan shareholders, securing just 55% of the total votes at Magellan’s meeting on Sept. 21. ONEOK Inc. has successfully concluded the acquisition of Magellan Midstream Partners LP on Sept. 25. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

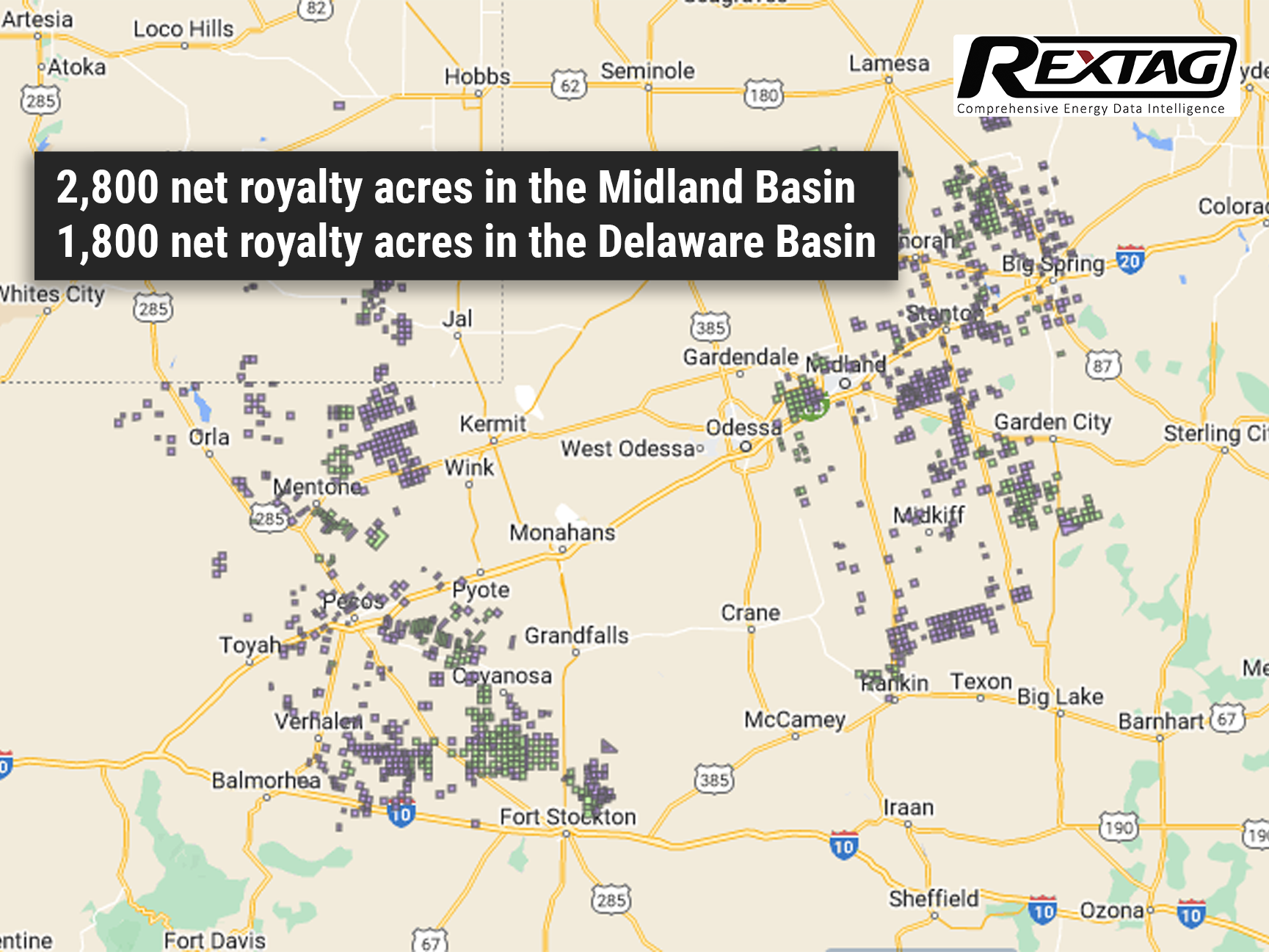

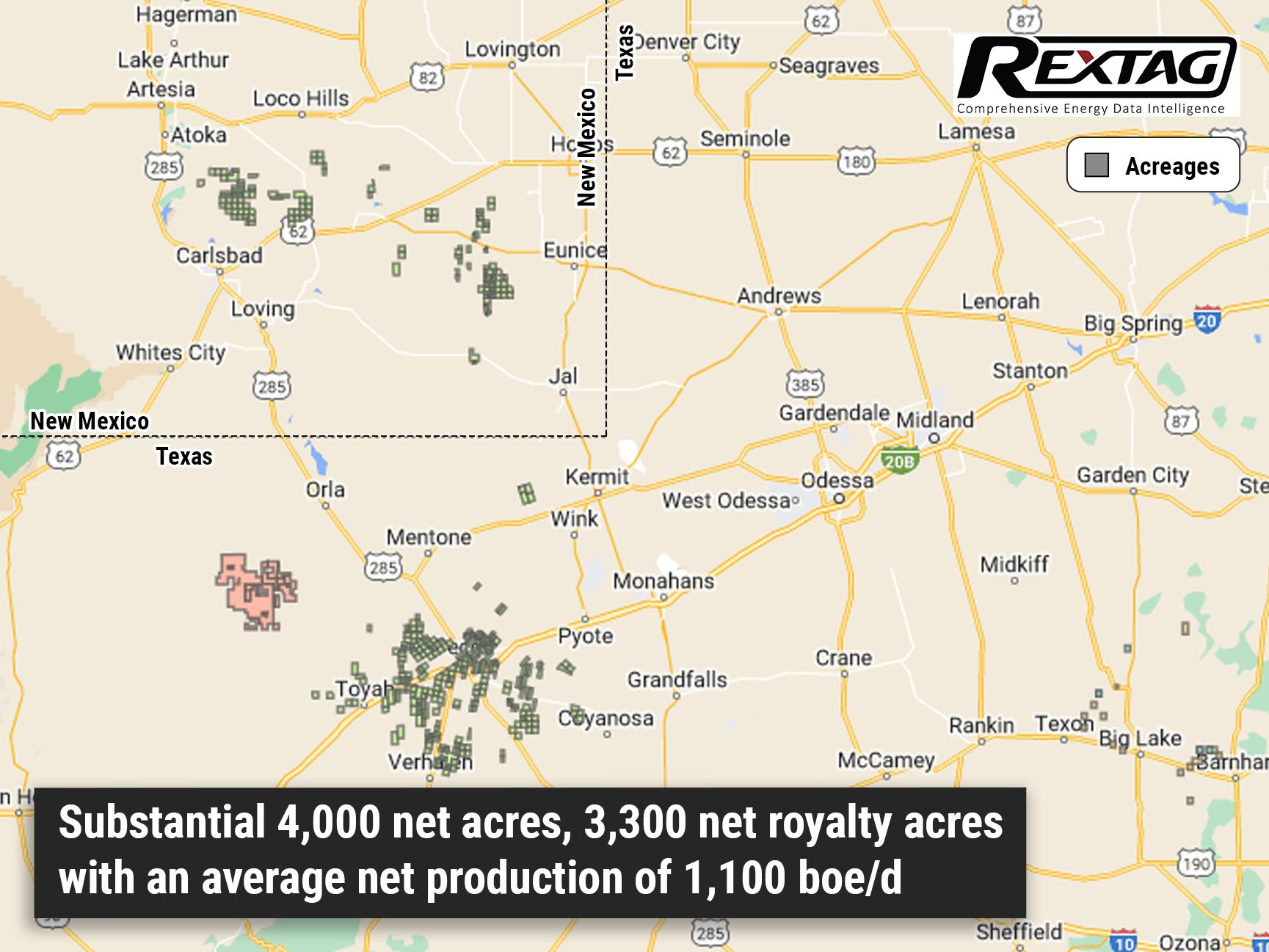

Diamondback's Viper Energy Acquires $1 Billion in Royalty Interests in the Permian Basin

Viper Energy's deal, comprised of cash and equity, secures an additional 2,800 net royalty acres in the Midland Basin and 1,800 in the Delaware Basin. Viper Energy Partners LP, a Diamondback Energy Inc. subsidiary, has inked a deal to acquire mineral and royalty interests in the Permian Basin. The deal, valued at around $1 billion, is with Warwick Capital Partners and GRP Energy Capital. Viper was established by Diamondback with the purpose of owning, purchasing, and capitalizing on oil and natural gas assets in North America, specifically targeting mineral and royalty interests.

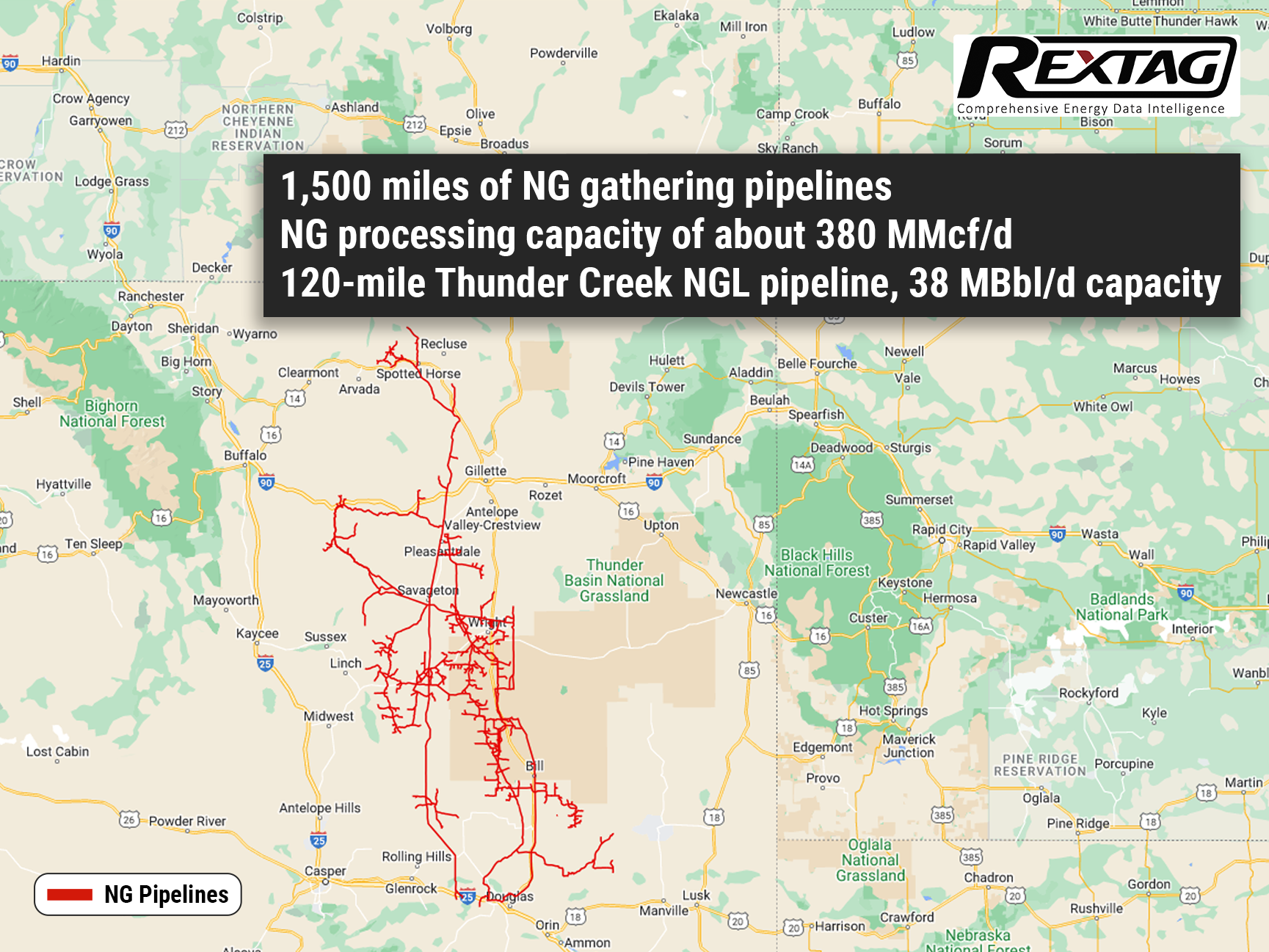

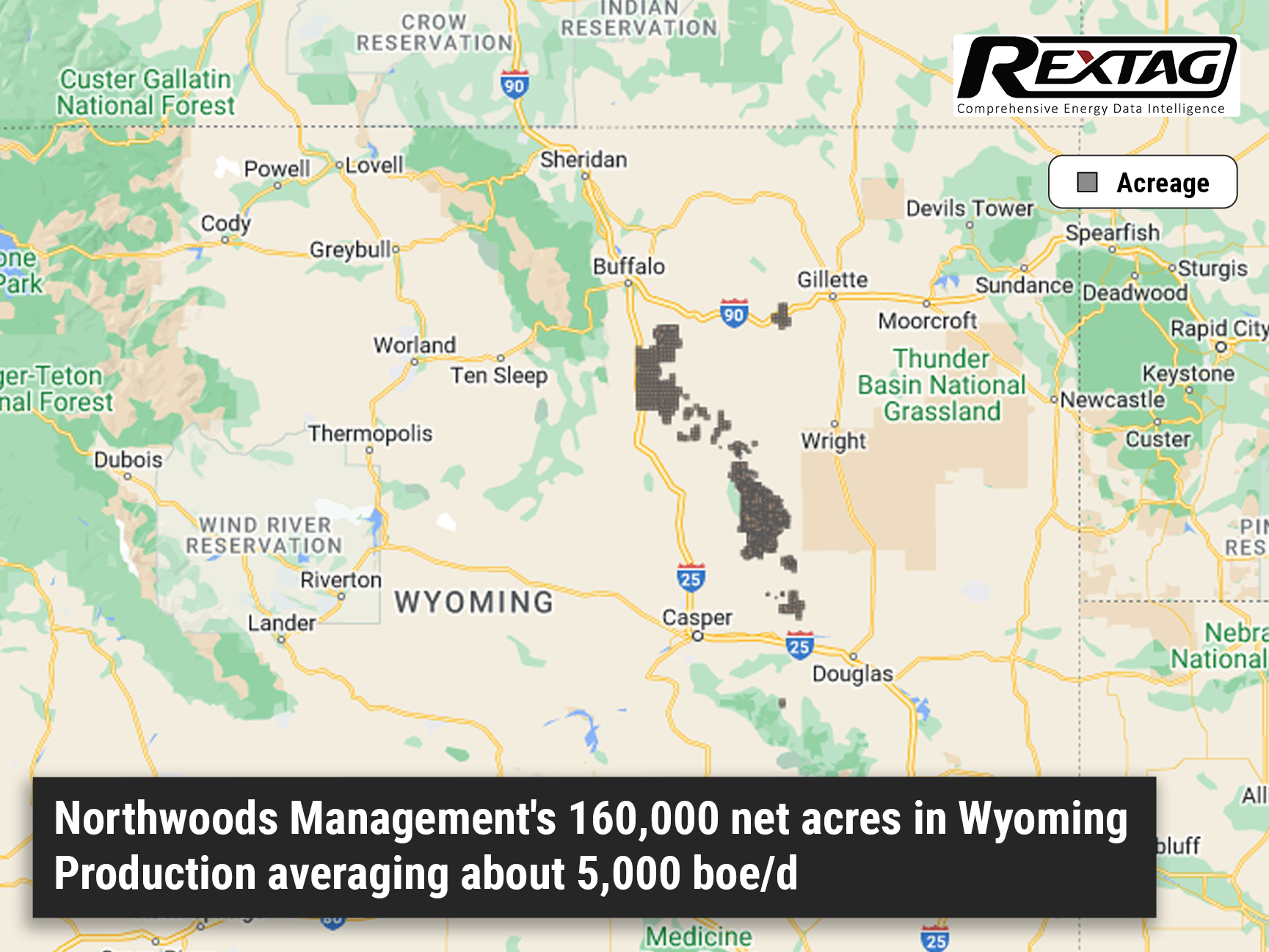

Western Expands Powder River Footprint with $885M Acquisition

Western Midstream will acquire Meritage Midstream's Powder River Basin assets, including gas gathering and an NGL pipeline, for $885 million in cash. A subsidiary of Western Midstream Partners LP is set to acquire Meritage Midstream Services II LLC in an $885 million all-cash transaction, marking a significant expansion in the Powder River Basin for the company.

Tivoli Services Acquires Barnett NTX Pipeline from Phillips 66

Tivoli Services finalized the purchase of the NTX pipeline system from Phillips 66, backed by a long-term transportation services agreement. Tivoli Services LLC, a branch of Tivoli Midstream LLC, completed the purchase of the NTX oil pipeline system in the Barnett Shale from Phillips 66 affiliates, according to press release by Tivoli Midstream. The financial terms remain undisclosed.

AltaGas to Purchase Tidewater Midstream Assets in $480 Million Deal

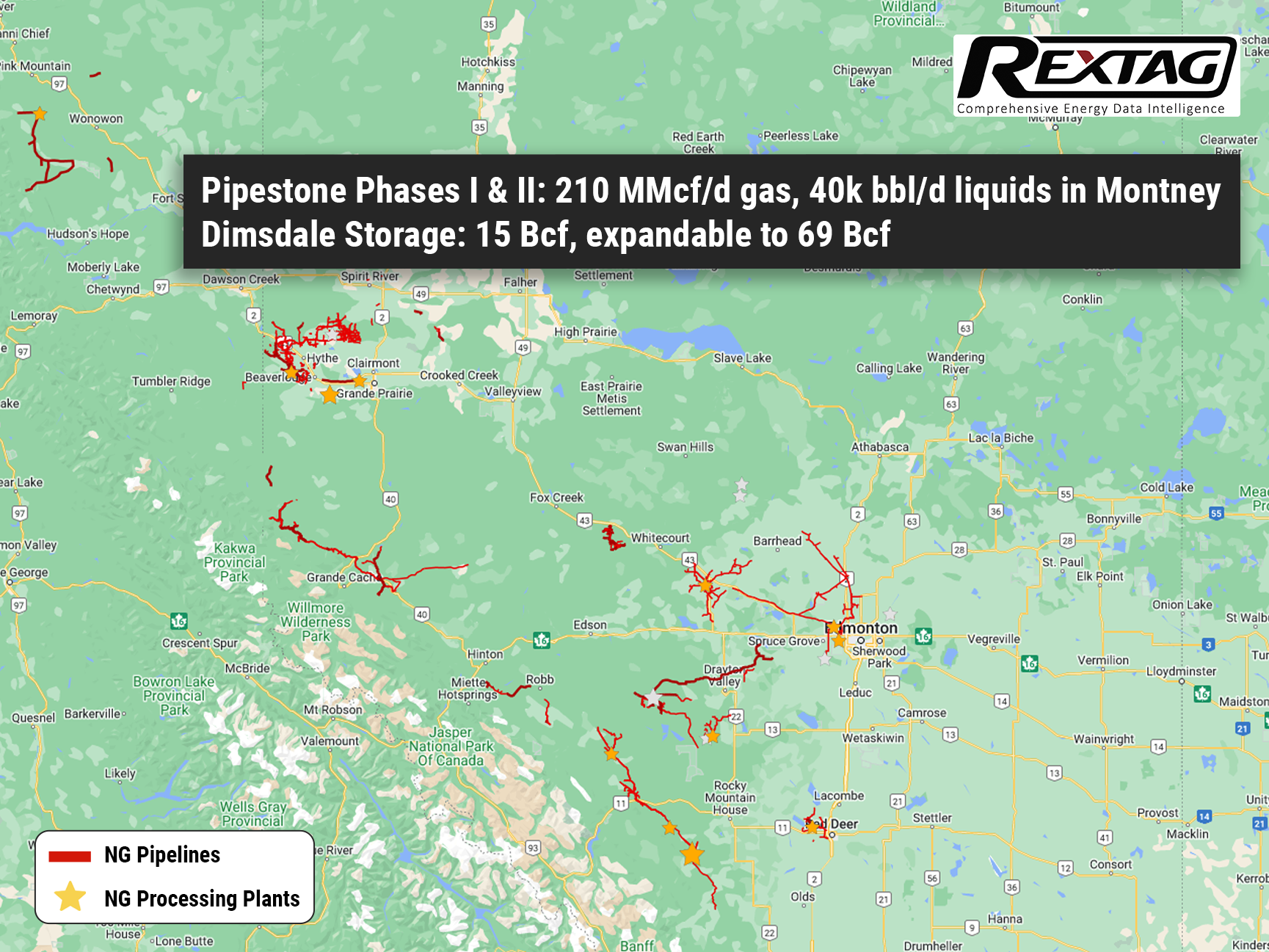

AltaGas announced plans to acquire Tidewater's Phase 1 and II expansions of the Pipestone Natural Gas Processing Plant, a truck terminal, and related pipelines. Recently AltaGas Ltd. revealed that it had finalized a deal with Tidewater Midstream and Infrastructure Ltd. to purchase an array of midstream assets, storage solutions, and terminals for a sum of CA$650 million (approximately US$480 million).

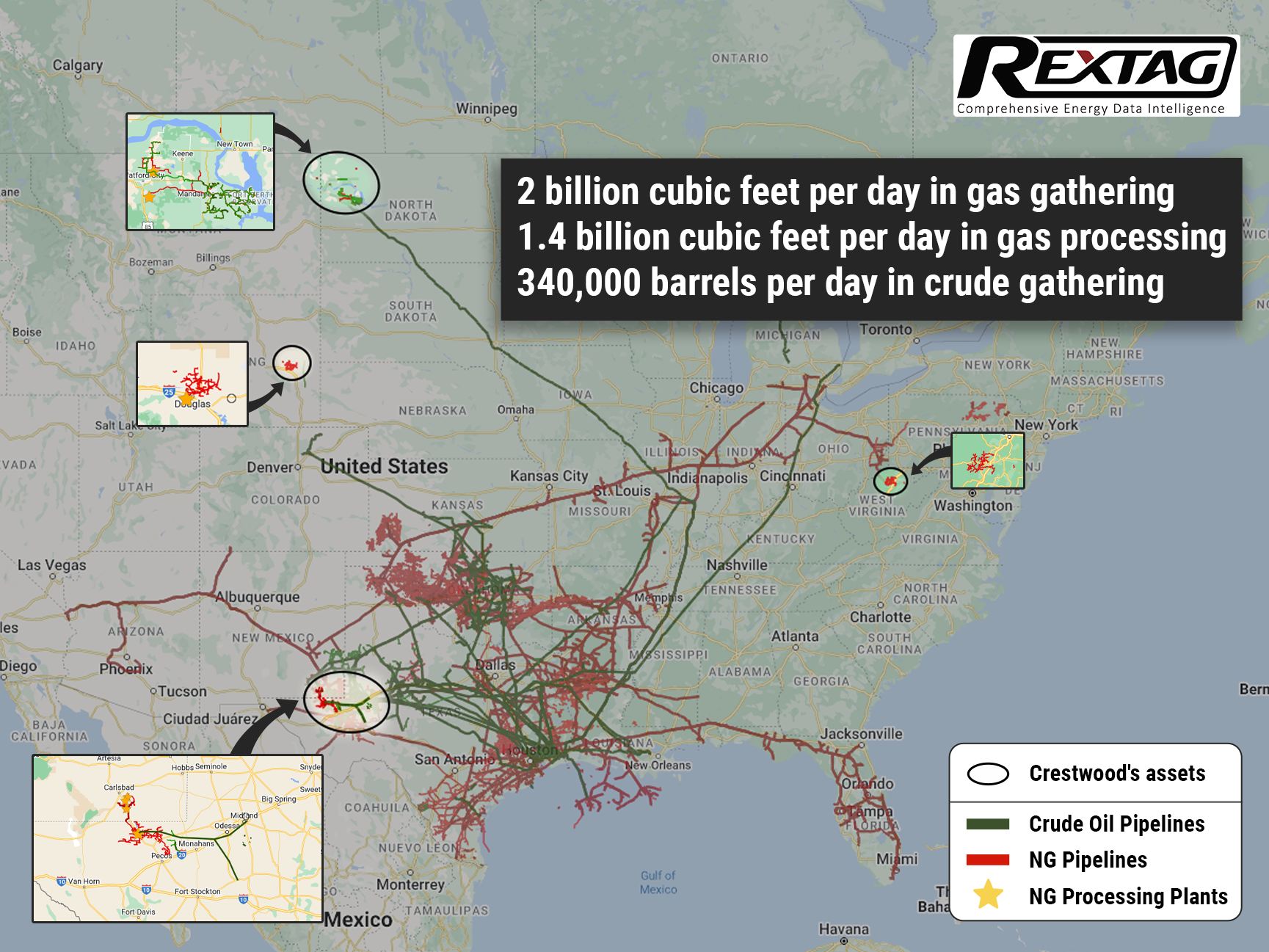

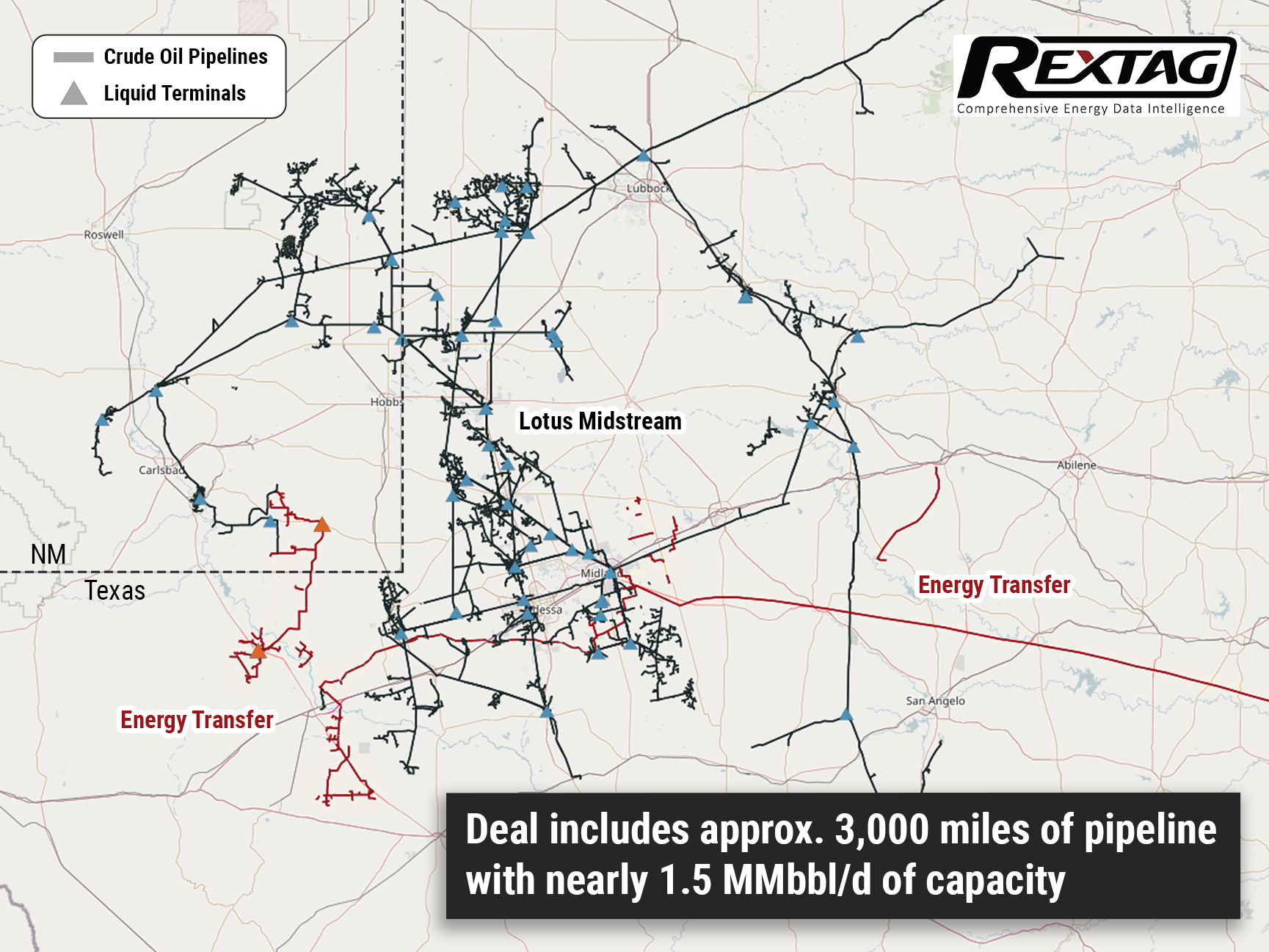

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

EQT Completes Long-Awaited $5.2 Billion Acquisition of Tug Hill and XcL Midstream

EQT disbursed roughly $2.4 billion in cash and issued 49.6 million shares of its common stock to acquire the Tug Hill and XcL Midstream assets. On August 22, EQT Corp. announced the completion of its long-delayed acquisition of XcL Midstream, following extensive Federal Trade Commission (FTC) reviews. The final purchase, post-price adjustments, consisted of about $2.4 billion in cash and 49.6 million EQT common shares. The cash component was financed through a $1.25 billion term loan, $1 billion from existing cash reserves, and a previously escrowed $150 million deposit.

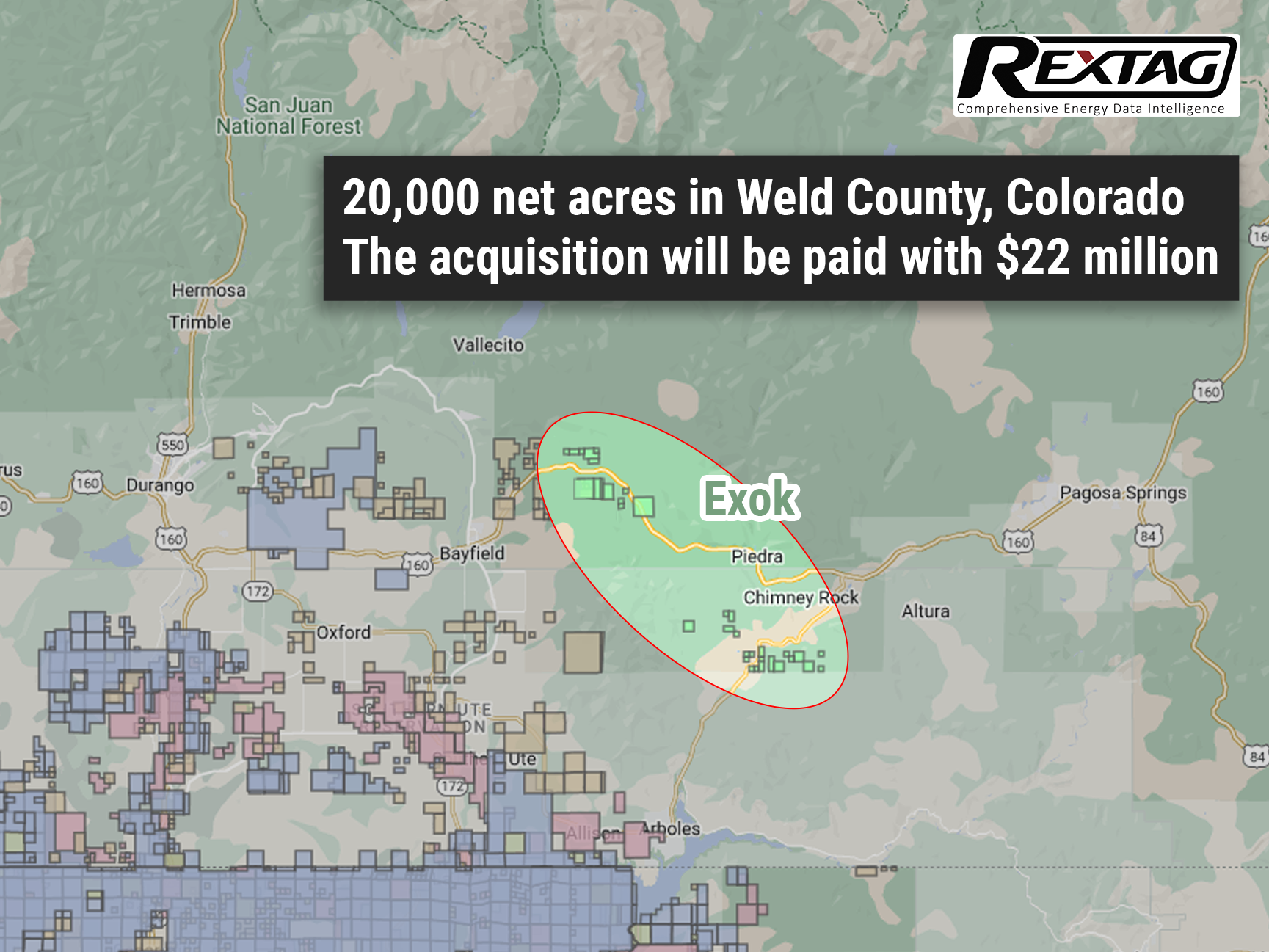

Prairie Operating Expands Acreage in the Denver-Julesburg Basin

Prairie Operating Co. buys 20K+ acres in Weld County, CO, expanding its footprint in the core of the Denver-Julesburg Basin. The evaluation report reveals that the land has more to offer beyond the initial findings and that hundreds of additional locations are viable for drilling in the future beyond an initial five-year program. On August 21, Prairie Operating disclosed findings from an external, independent assessment focused on its inactive holdings in Weld County.

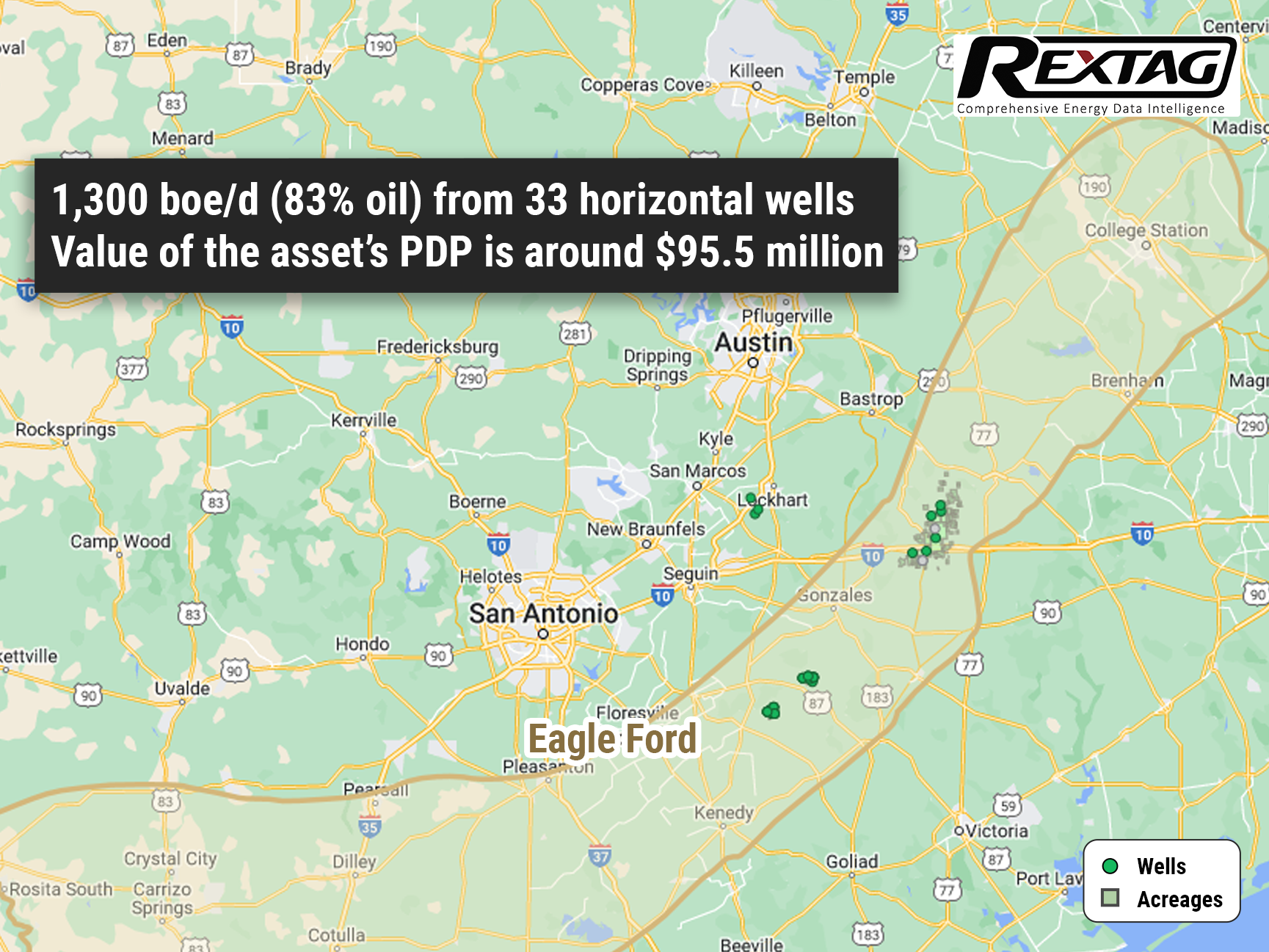

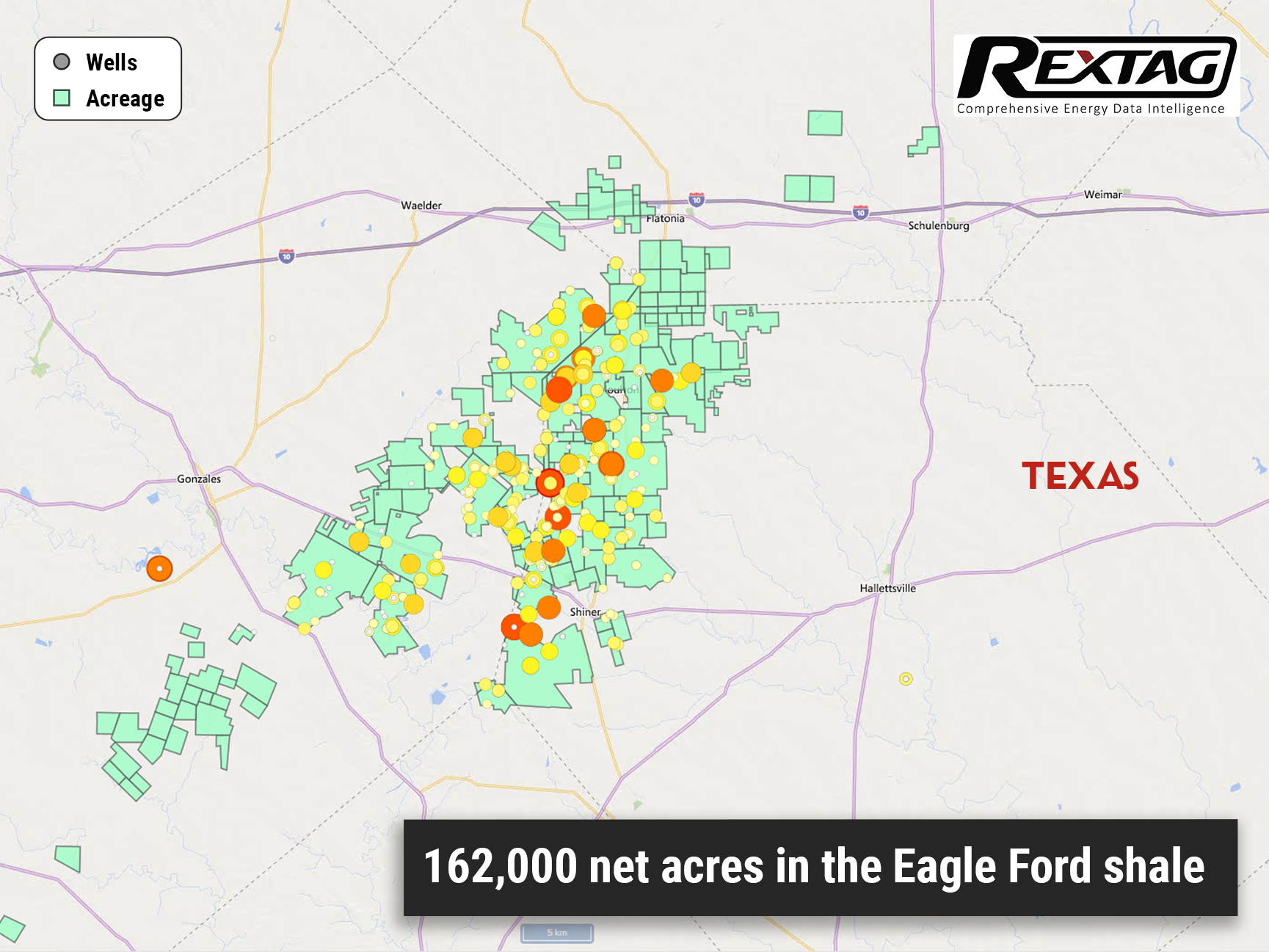

Earthstone Offers Eagle Ford Assets for Sale, Considers Departure from South Texas

Earthstone Energy is selling Eagle Ford locations to concentrate on the Permian Basin, streamlining its exploration and production focus. Earthstone Energy Inc., based in The Woodlands, Texas, is putting an Eagle Ford asset on the market as the company focuses on divesting non-core properties and directing investment towards the Permian Basin. The assets that Earthstone is planning to sell include production and land in northeast Karnes County, Texas, as well as in southern Gonzales County, Texas, as outlined in the marketing documents. For the sales process, Earthstone has engaged Opportune Partners LLC to serve as its exclusive financial adviser.

WhiteHawk Energy Secures $100M Finance Facility for Core Natural Gas Asset Acquisition

WhiteHawk Energy LLC completed its second Haynesville Shale mineral and royalty acquisition of the year, spanning northwestern Louisiana and eastern Texas. WhiteHawk also secured a $100 million acquisition finance facility from an undisclosed "top tier institution." The company will utilize $20 million from this facility to fund the Haynesville purchase from Mesa Minerals Partners II LLC

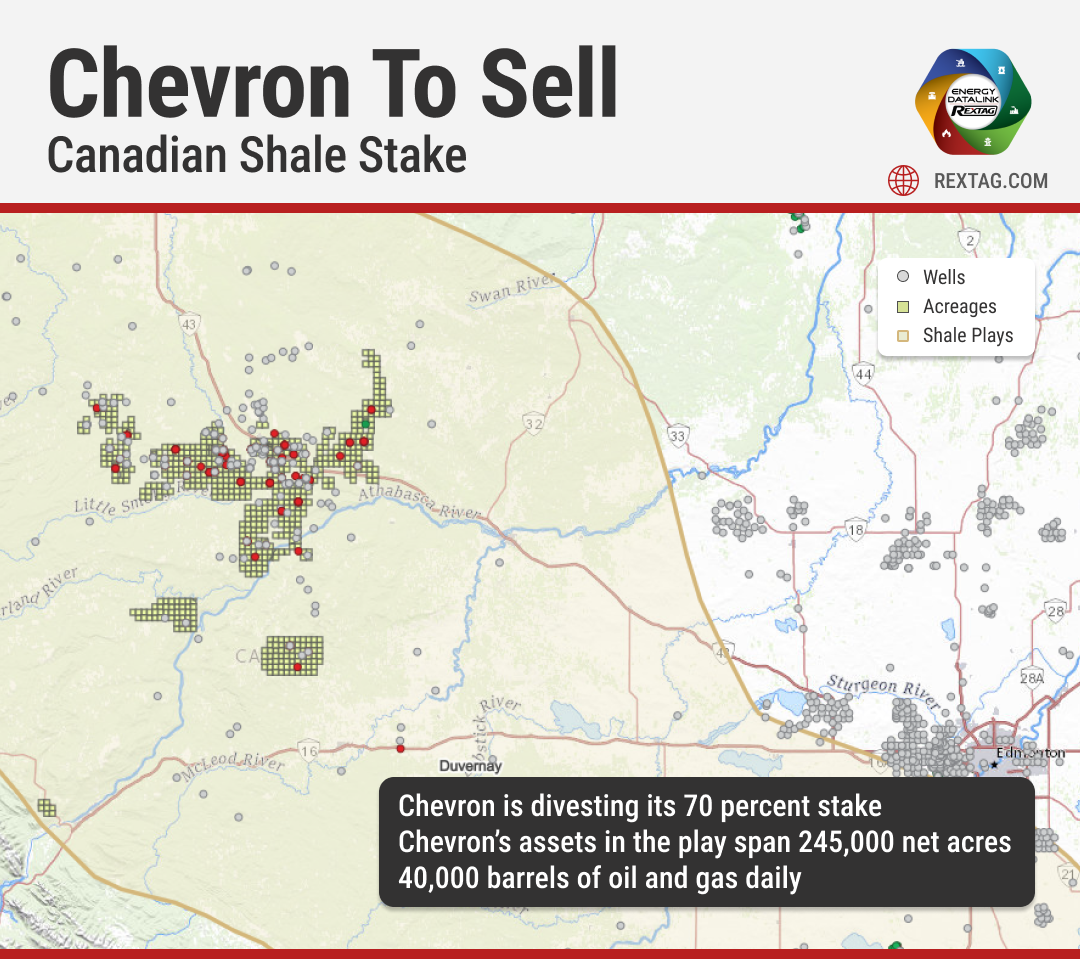

Chevron (CVX) Set to Purchase PDC Energy for $6.3B

Chevron Corp. has finalized the acquisition of PDC Energy Inc.'s land holdings in the Denver-Julesburg and Permian basins. Chevron Corporation (CVX) has announced its intention to acquire PDC Energy, Inc. (PDCE) in an all-stock deal valued at $6.3 billion. Under the agreement terms, PDC stockholders will receive 0.4638 Chevron shares for each PDCE share, bringing the total enterprise value to $7.6 billion, inclusive of debt. The acquisition is seen as a strategic step to enhance Chevron's position in vital U.S. production basins, unlocking new opportunities and potentially driving higher returns. As part of the agreement, Chevron will issue around 41 million shares of common stock at the deal's closure. Both Chevron's and PDC Energy's boards of directors have unanimously approved the acquisition.

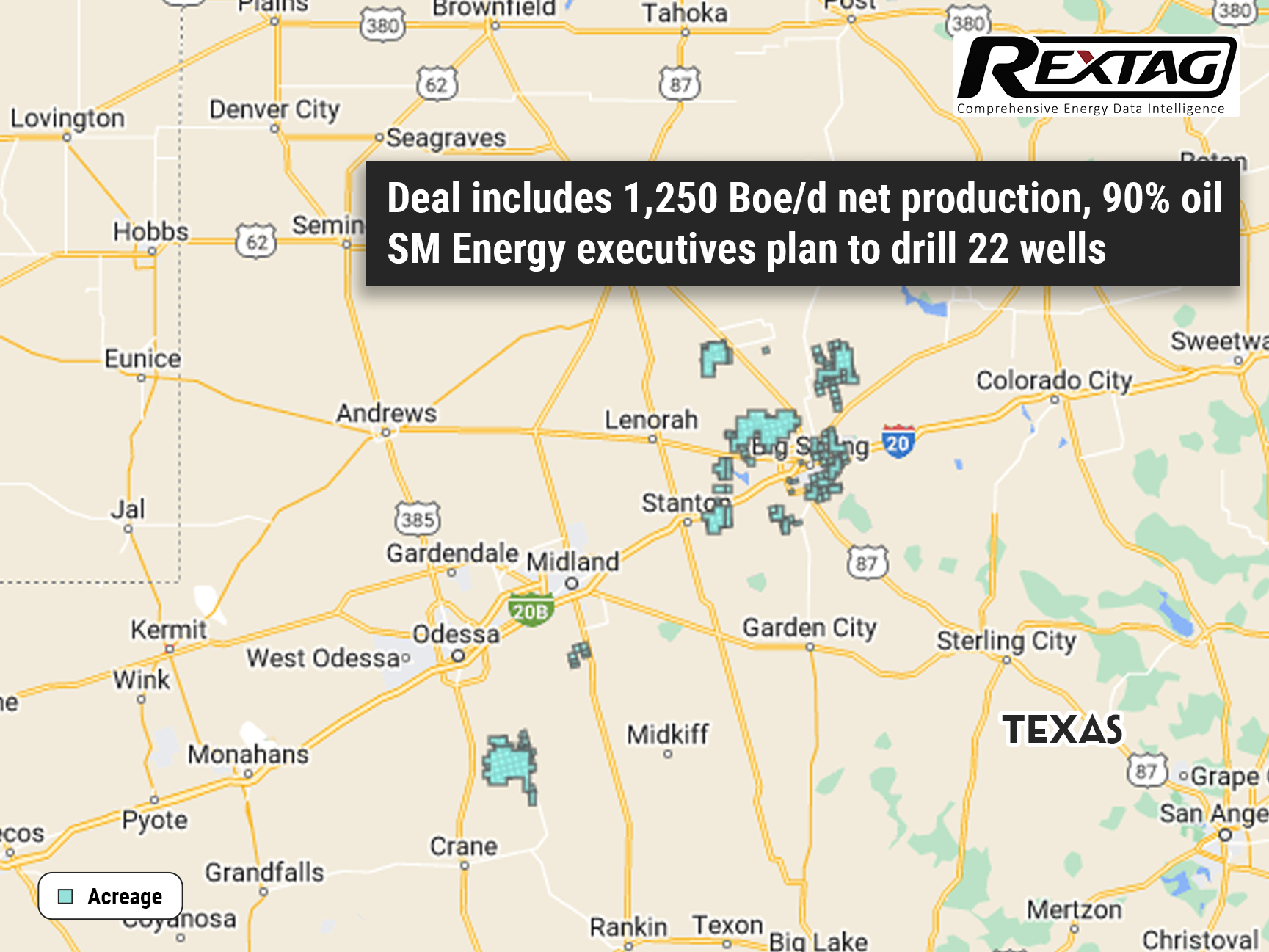

SM Energy Acquires 20,000 Acres in Texas for $90.6M

SM Energy acquired 20,000 net acres in Dawson and north Martin counties in Texas, completing the transaction in cash. SM Energy Co., based in Denver, intends to expand on its success from the second quarter by increasing its drilling and completion activities in the coming quarter. This plan also includes preparations to develop the newly acquired land in the Midland basin. In June, the company's president and CEO, Herb Vogel, along with his team, raised their target for total oil and gas production for the second quarter to 13.9 MMboe, up from 13.4 MMboe. They exceeded this target, reaching nearly 14.1 MMboe, with oil making up 42% of that figure. During the quarter, SM Energy drilled 17 wells, with 12 located in South Texas and five in the Midland basin. They also completed 25 wells, 17 of which were in the Midland basin.

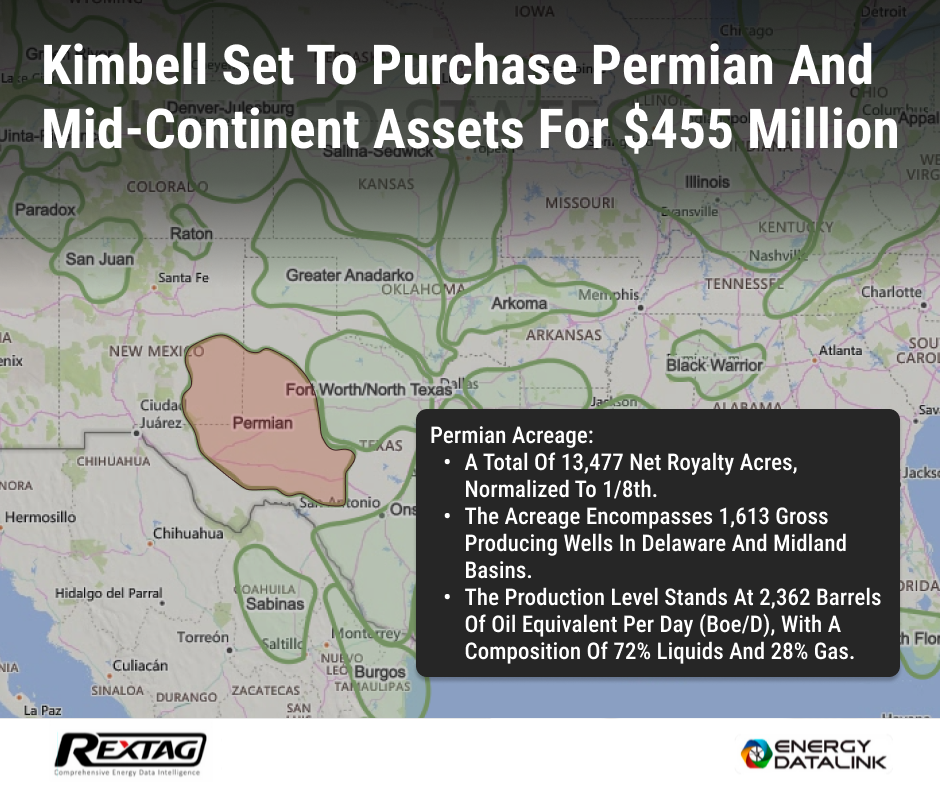

Kimbell Set to Purchase Permian and Mid-Continent Assets for $455 Million

Kimbell Royalty Partners' acquisition adds land in Delaware & Midland basins, enhancing its lead in production, active rigs, DUCs, permits & undrilled inventory. Kimbell Royalty Partners LP has recently announced a landmark deal, the largest in its history, to expand its foothold in the oil and gas industry. The company has agreed to purchase Permian Basin and Midcontinent assets for a staggering $455 million in cash from a private seller.

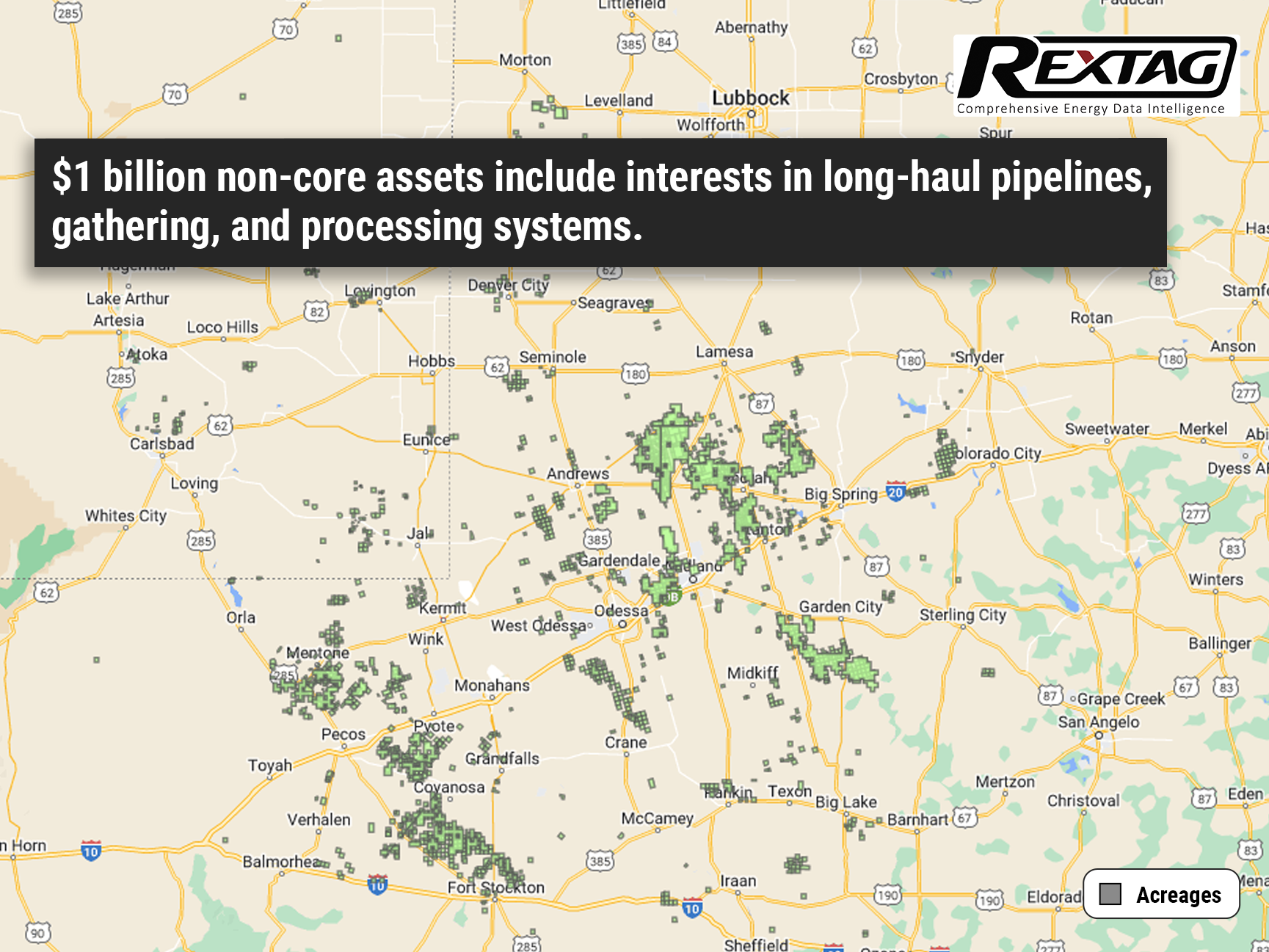

Diamondback Sells More After Hitting $1B Target

Diamondback Energy sold more midstream assets in Q2 as part of a $1B plan to shed non-core assets, reducing debt in the Permian Basin. In July, Texas-based Diamondback Energy Inc. sold a 43% stake in the OMOG crude oil system, revealing this in its Q2 earnings on July 31. OMOG JV LLC, running 400 miles of pipelines and 350,000 bbl of storage in Midland, Martin, Andrews, and Ector counties, was detailed in Diamondback's filings. The sale provided $225 million in gross proceeds. Diamondback has announced or completed $1.1 billion in non-core asset sales since initiating the program. Initially aimed at raising $500 million, the 2023 target was increased to $1 billion.

Murphy Oil Plans to Sell Less Essential Canadian Assets for $112 Million

Murphy Oil has entered into a purchase and sale agreement to sell a section of its Kaybob Duvernay assets and entire Placid Montney assets. A subsidiary of Murphy Oil Corp. has entered into an agreement to sell a "non-core segment" of its operated Kaybob Duvernay assets and its entire non-operated Placid Montney assets to a private company, as stated in the company's earnings report released on August 3rd. The transaction is set to take effect from March 1, 2023, and the closing is expected to be finalized in the third quarter of the same year.

TC Energy sells 40% Stake in Columbia Gas Pipeline Systems for $3.9 Billion to GIP

Calgary-based pipeline operator TC Energy is selling a 40% stake in its natural gas pipeline systems for $3.9 billion as part of its efforts to reduce debt. TC Energy Corporation (TRP) has agreed to sell a 40% stake in its Columbia Gas Transmission and Columbia Gulf Transmission systems to Global Infrastructure Partners (GIP). This move will help TC Energy reduce its debt and establish a valuable long-term partnership with GIP, a prominent infrastructure investor.

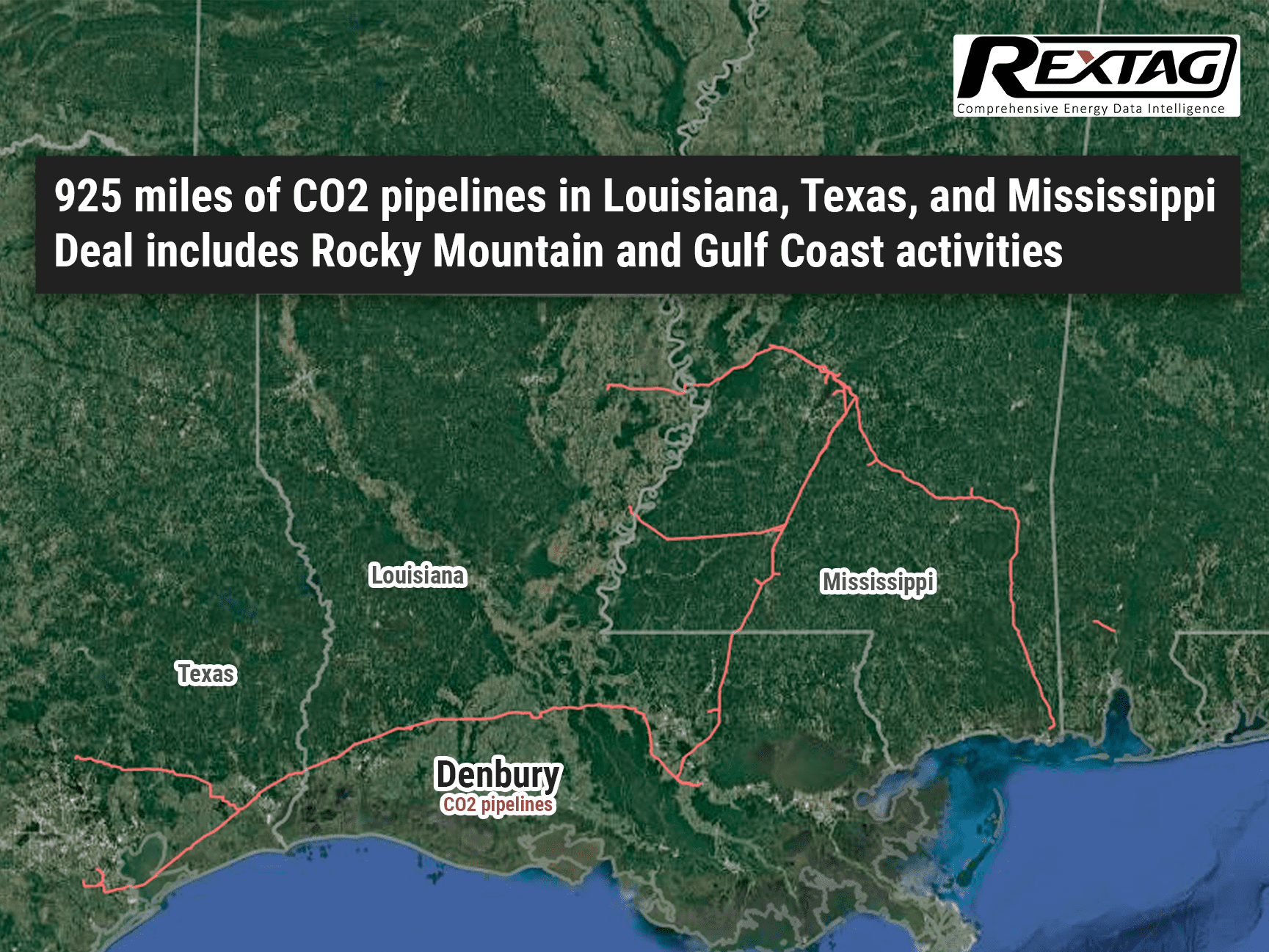

ExxonMobil Acquires Denbury and Enhances carbon, capture, and storage efforts

ExxonMobil's joined assets speed up their Low Carbon Solutions business, offering better decarbonization options for customers. ExxonMobil's top CCS network supports their commitment to low carbon value chains, like hydrogen and biofuels. The transaction synergies will cut over 100 MTA of emissions, leading to strong growth and returns. Exxon Mobil Corporation revealed that it will acquire Denbury Inc., a company specializing in carbon capture, utilization, and storage (CCS) solutions and enhanced oil recovery. $4.9 billion deal will be completed through an all-stock transaction. Darren Woods, Chairman and CEO said “Acquiring Denbury reflects our determination to profitably grow our Low Carbon Solutions business by serving a range of hard-to-decarbonize industries with a comprehensive carbon capture and sequestration offering”.

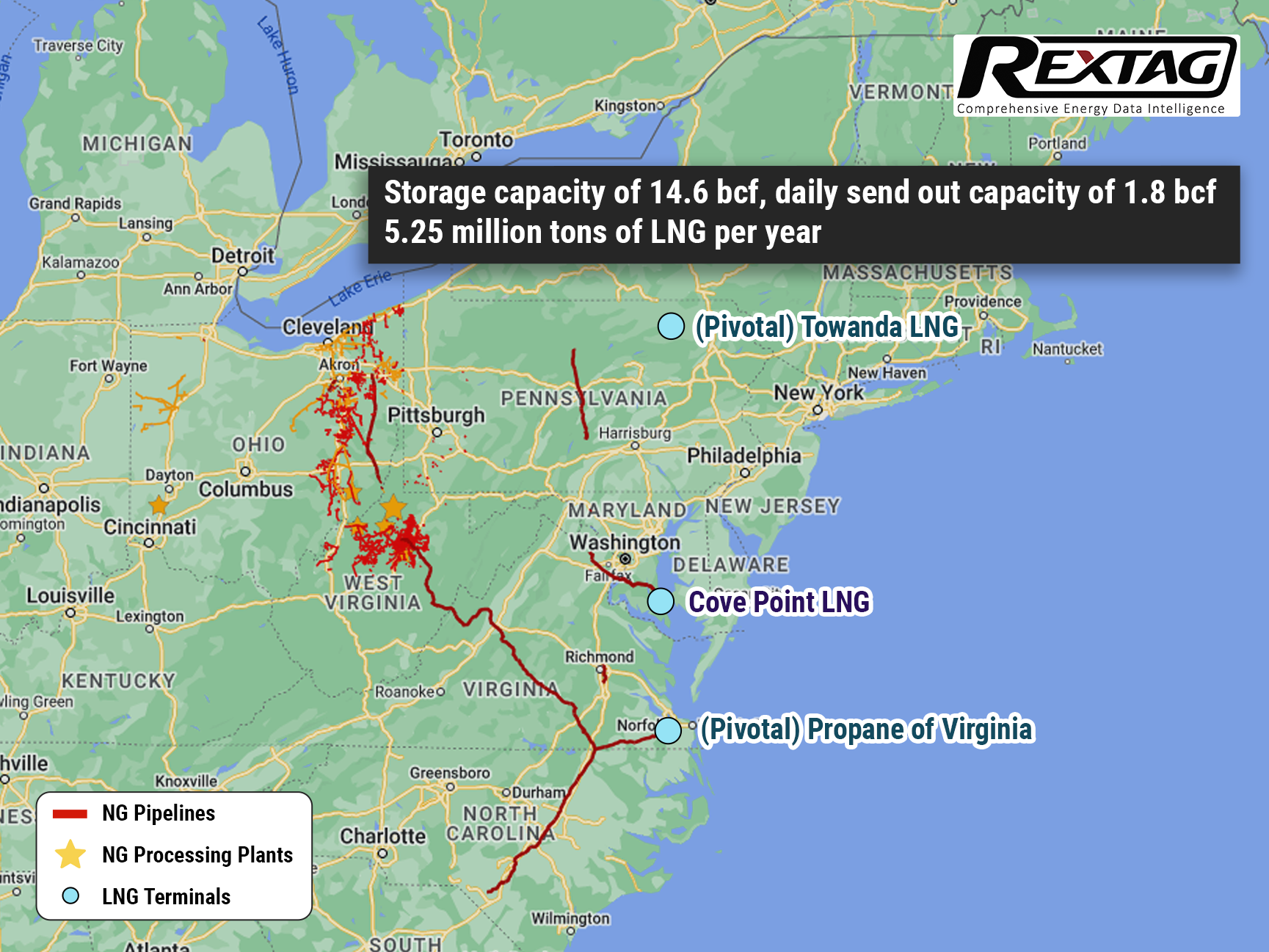

Warren Buffett’s Berkshire Hathaway Energy Acquires $3.3 Billion Stake in LNG Terminal

One of Warren Buffett's Berkshire Hathaway subsidiaries is set to raise its ownership in the Cove Point liquefied natural gas (LNG) export terminal located in Maryland. This comes after the company signed a substantial $3.3 billion agreement with Dominion Energy. Under the agreement, Dominion Energy has agreed to sell its 50 percent noncontrolling limited partner interest in Cove Point LNG to Berkshire Hathaway Energy. Berkshire Hathaway Energy is the current operator of the facility and already holds a 100 percent general partner interest and a 25 percent limited partner interest.

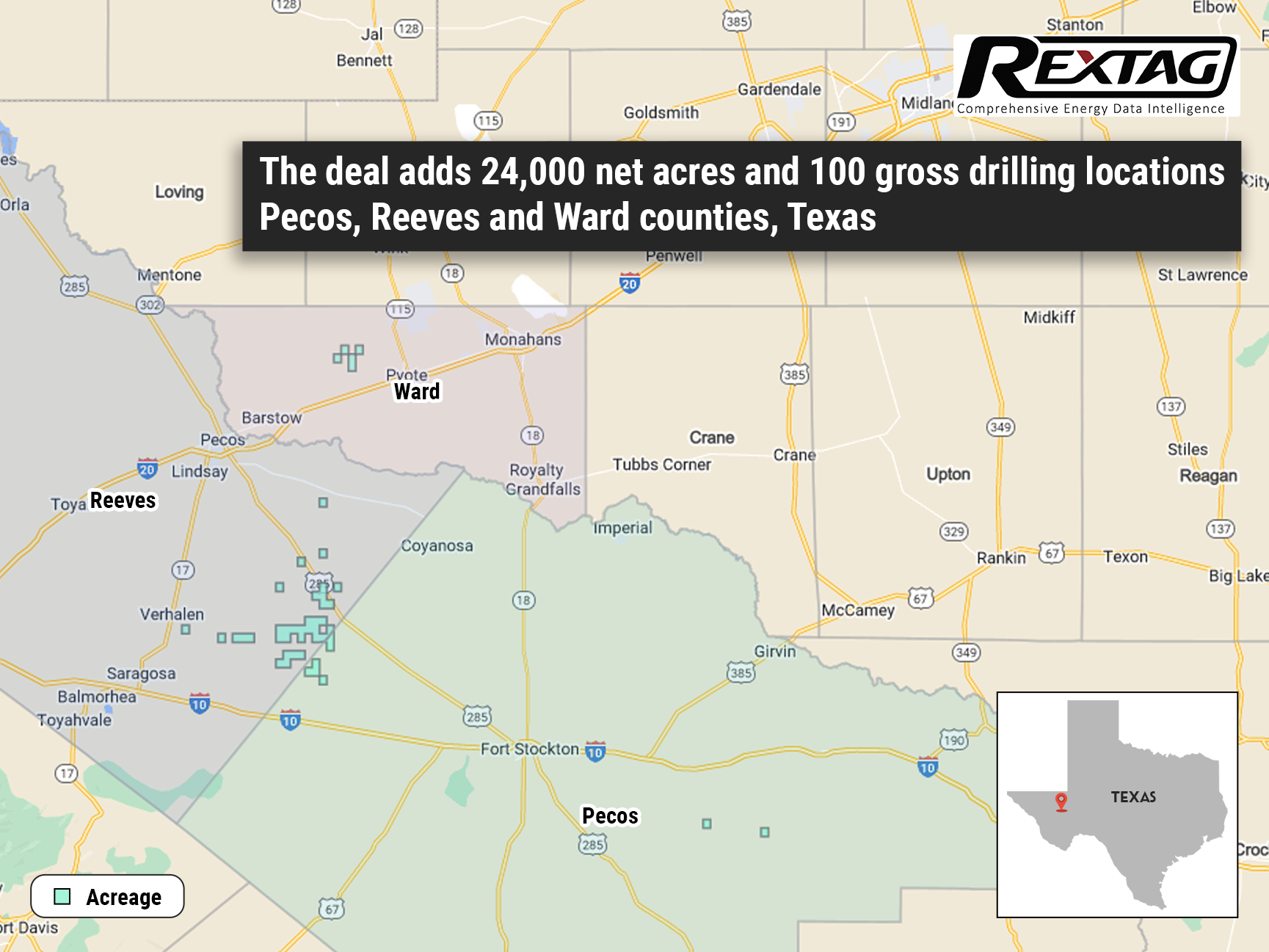

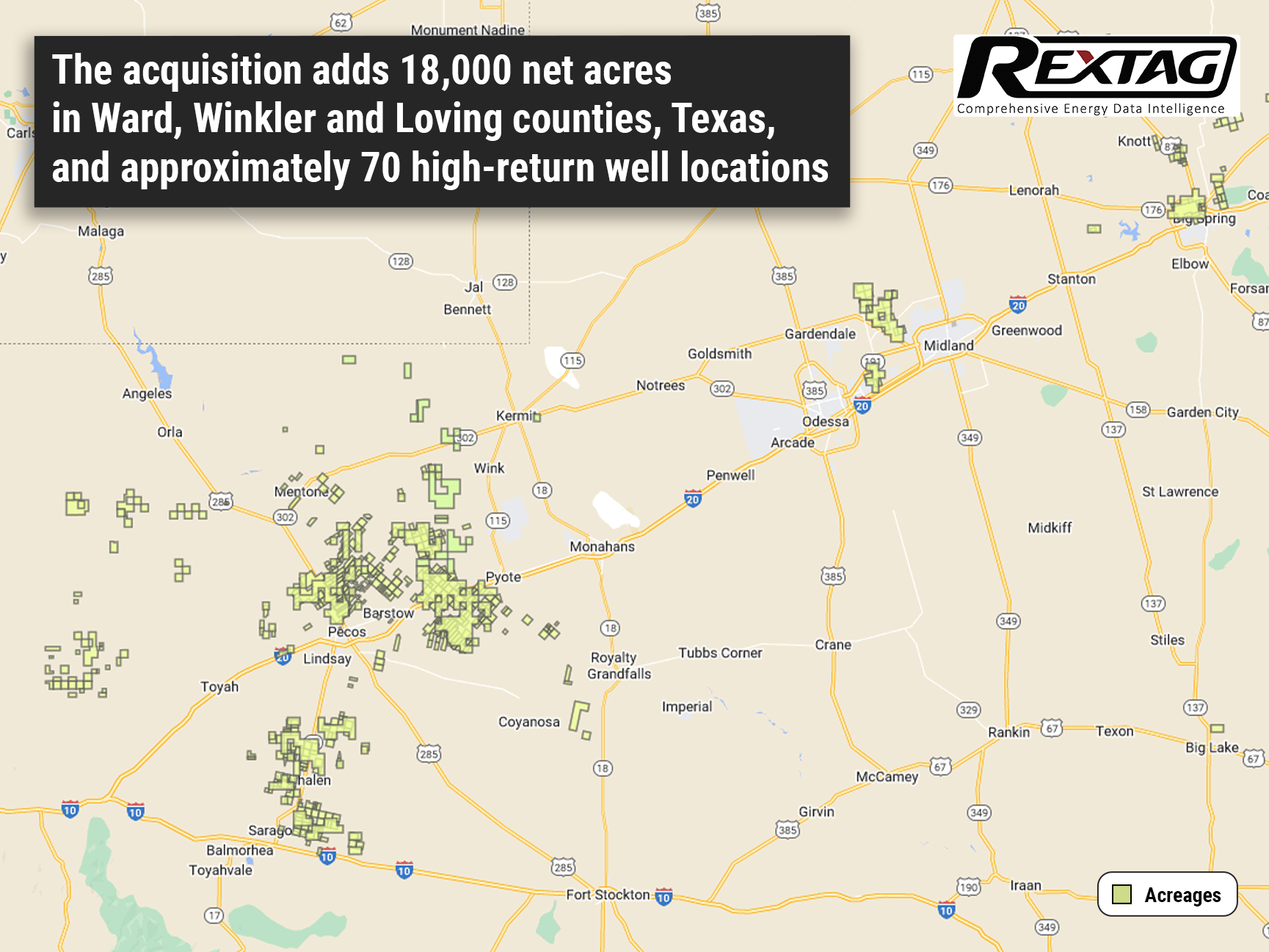

Vital Energy Raises Production Outlook and Capital Spending with Significant Permian Basin Acquisition

Vital Energy’s deal adds 24,000 net acres and 100 gross drilling locations in Texas, growing its Permian Basin footprint to around 198,000 net acres. Vital Energy is revising its projections for oil and gas production and capital spending upward following the successful acquisition of a substantial area in the Permian Basin. The company has gained around 24,000 net acres and 100 gross drilling locations in Texas. As a result of this deal, Vital Energy is now increasing its full-year production and capital spending guidance.

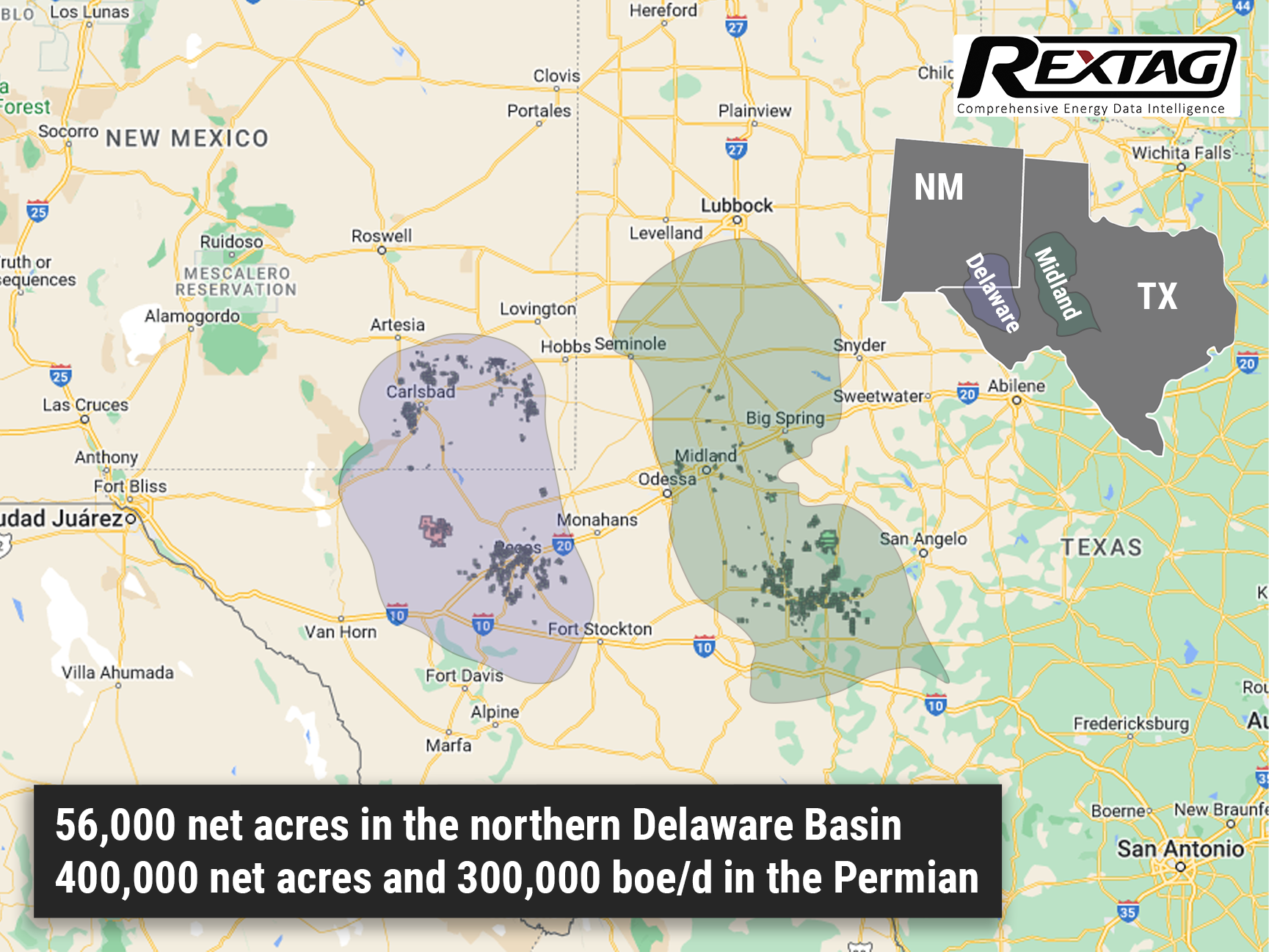

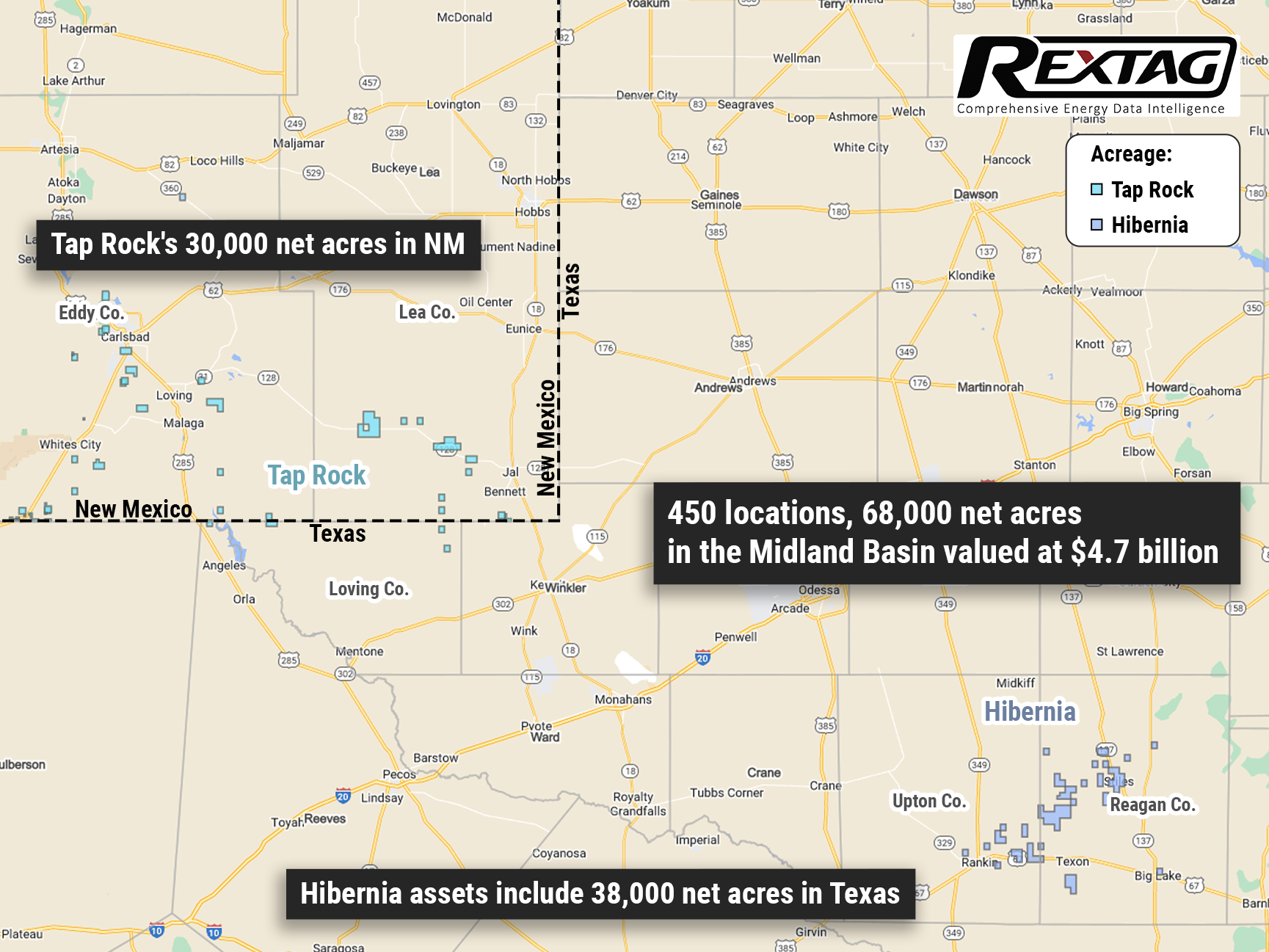

Civitas Makes $4.7B Entry into Permian Basin

Civitas Resources Expands into Denver-Julesburg Basin through $4.7B Cash and Stock Deals for NGP's Tap Rock and Hibernia. Civitas Resources has recently secured two definitive agreements to expand its presence in the Permian Basin's Midland and Delaware basins. The company will achieve this expansion through the acquisition of two private exploration and production companies, namely Hibernia Energy III LLC and Tap Rock Resources LLC. The total value of the deal, paid in both cash and stock, amounts to $4.7 billion. Both Hibernia Energy III LLC and Tap Rock Resources LLC are supported by NGP Energy Capital Management LLC. These acquisitions reflect the increasing demand for oil and gas reserves in the Permian Basin, with companies specializing in the region actively seeking new opportunities. Currently, Civitas Resources' primary production operations are focused in the Denver-Julesburg Basin (D-J Basin).

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

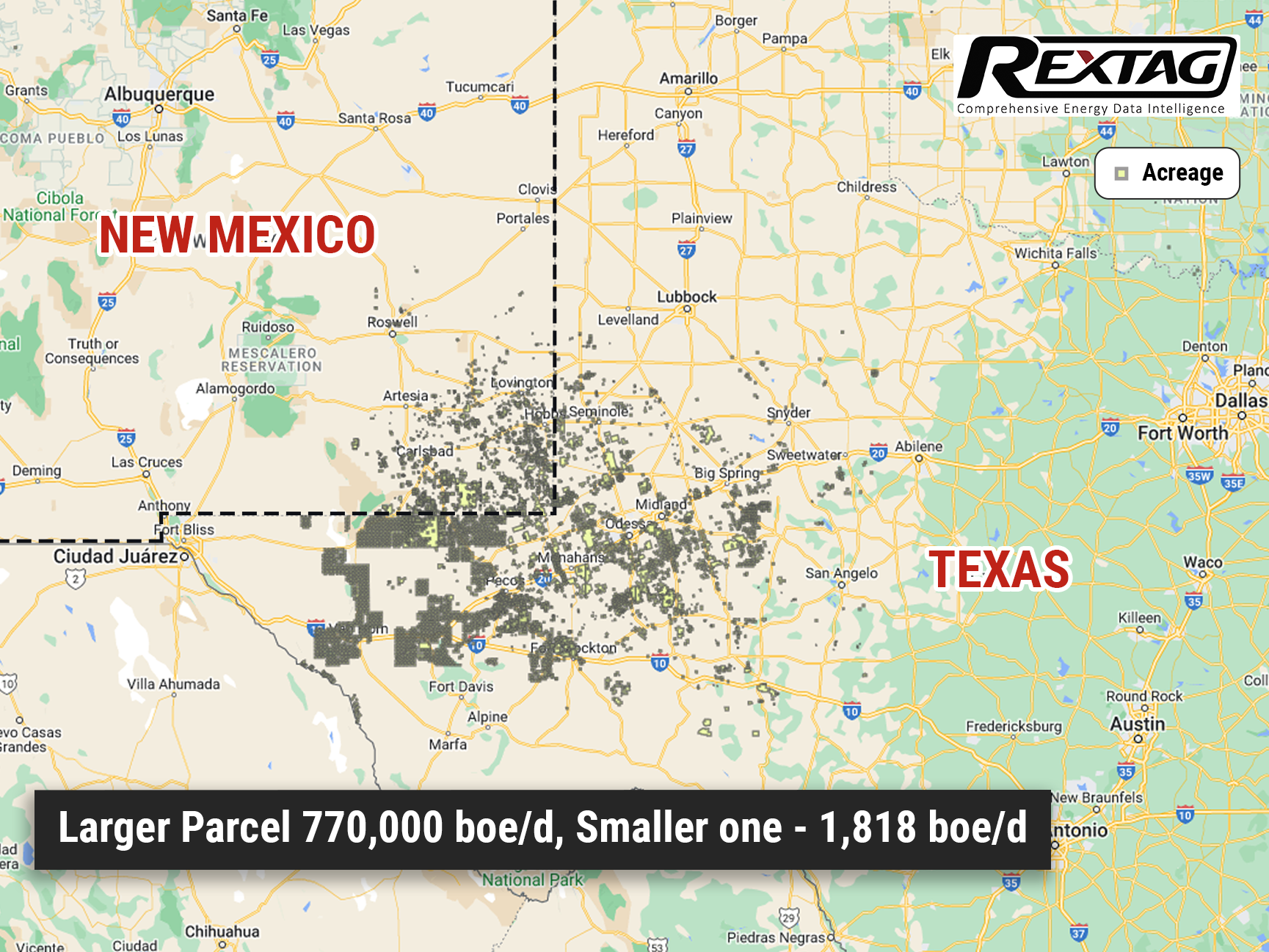

Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas

According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas. As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets. Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

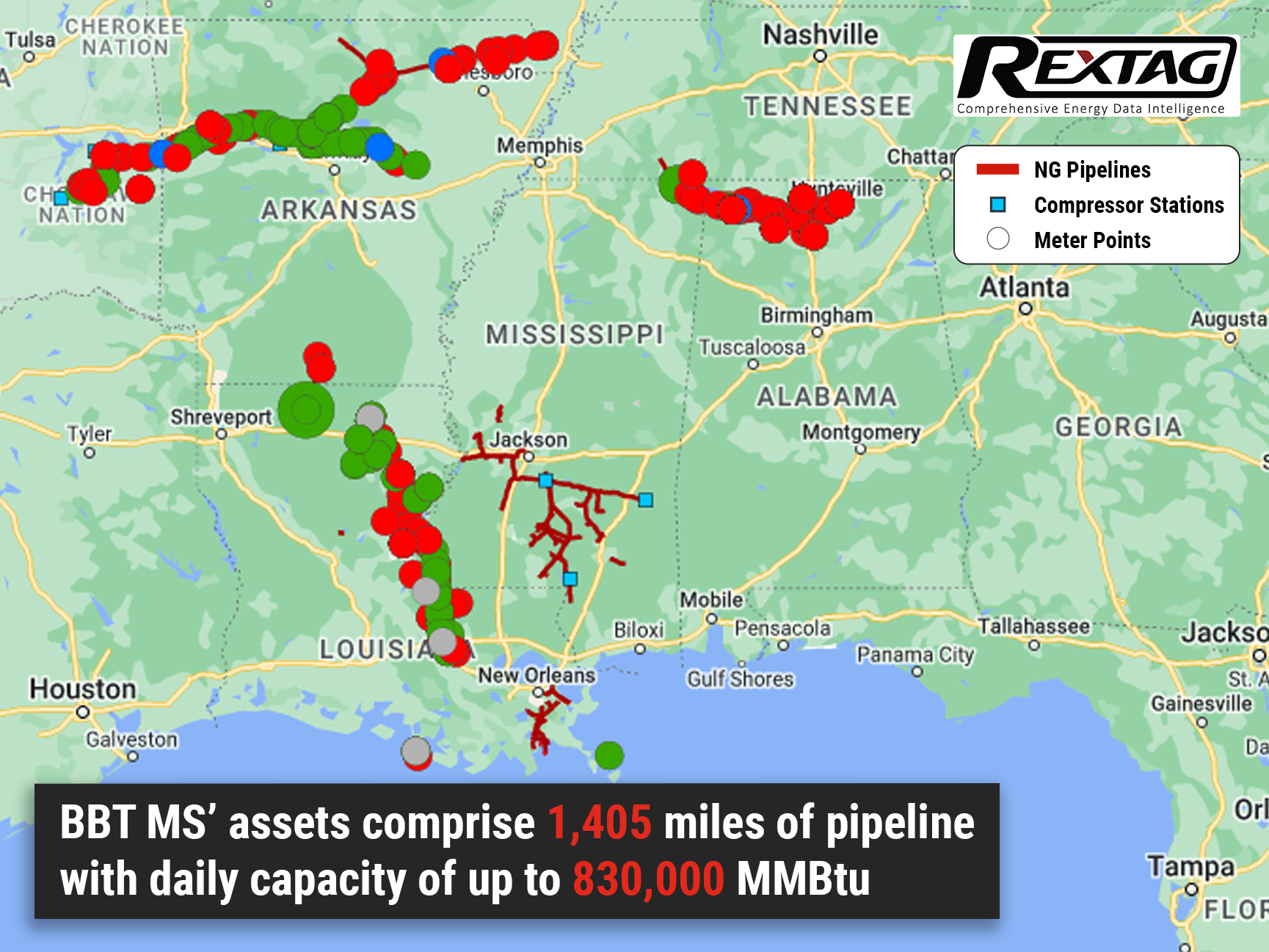

Black Bear Roars with Success: Mississippi Gas Gathering Assets Sold

Skye MS LLC purchased a package deal from Black Bear, which included over 120 miles of natural gas pipelines and eight active metered locations. Black Bear Transmission LLC, based in Houston, successfully finalized the sale of gas gathering assets owned by BBT Mississippi LLC (BBT MS) to Skye MS LLC of Columbia, Mississippi. The specific amount of the transaction remains undisclosed. BBT MS is the proud owner and operator of a fee-based, natural gas transmission system that efficiently supplies gas to utility, industrial, and power generation customers. It facilitates the connection of wellhead production in Mississippi to regional long-haul pipelines.

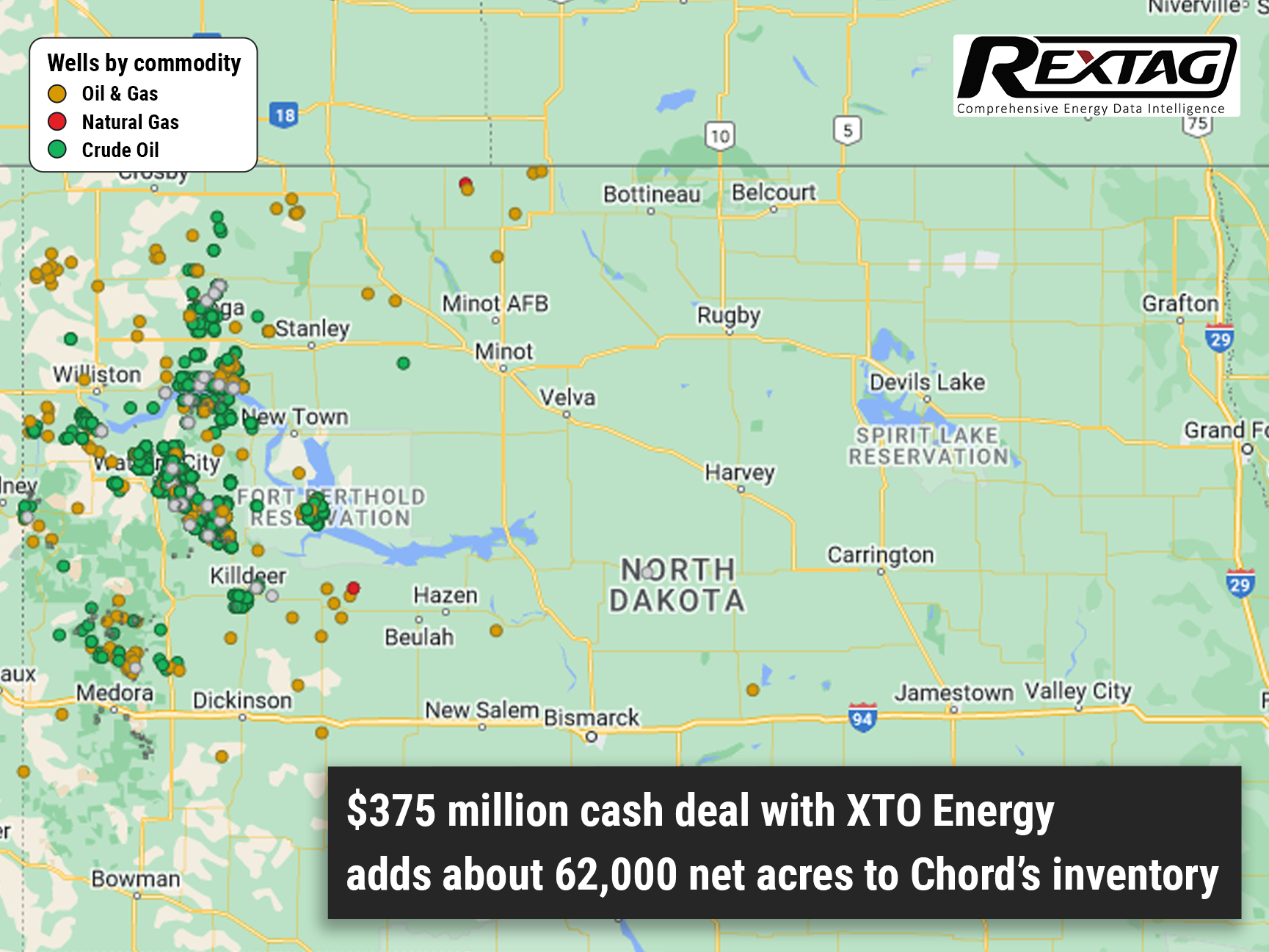

Chord Energy Corp. Expands Williston Basin Footprint with $375 Million Acquisition from Exxon Mobil

Chord Energy Corp.'s subsidiary has entered into an agreement to purchase assets in the Williston Basin from Exxon Mobil, and its affiliates for $375 million. Chord Energy, a US independent company, is strategically expanding its presence in the Williston Basin of Montana and the Dakotas. While industry attention remains fixated on the Permian Basin, Chord Energy recognizes the potential of the Williston Basin and is capitalizing on the opportunity to enhance its reserve portfolio. Chord Energy successfully completed the acquisition of 62,000 acres in the Williston Basin from XTO Energy for a substantial cash consideration of $375 million.

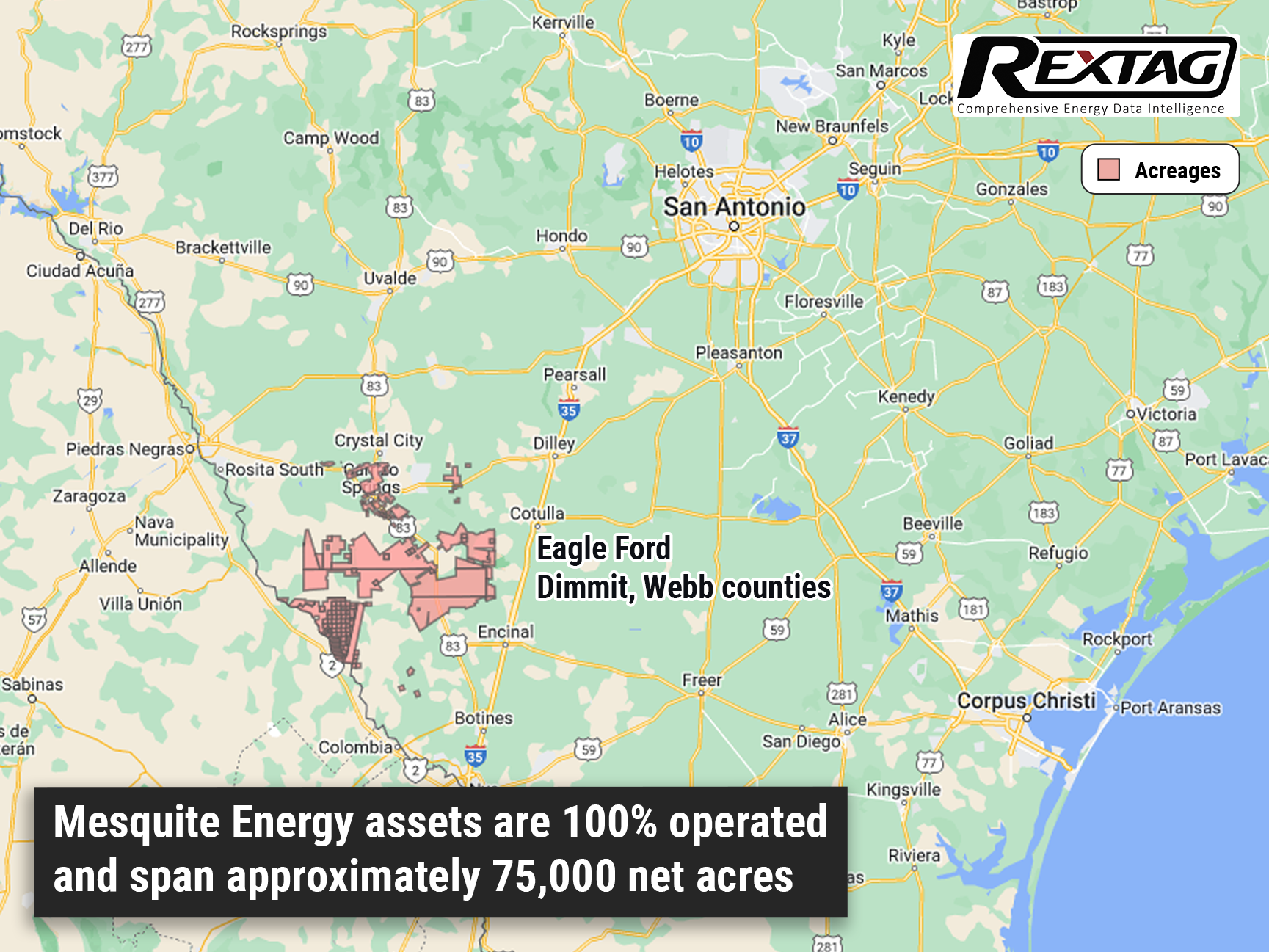

Crescent Energy Boosts Portfolio with Eagle Ford Acquisition: Expands Non-Operated Assets

Big announcement! Crescent Energy is set to bolster its inventory in the play by acquiring operated and working interests from Mesquite Energy. Crescent Energy Co. seals a $600 million cash deal to acquire assets in the Eagle Ford Shale from Mesquite Energy Inc. (formerly Sanchez Energy).

ONEOK Buys Magellan for $18.8 Billion: Overview of the Huge M&A Deal in the Pipeline Industry

In May, ONEOK (OKE) made an announcement regarding its acquisition of Magellan Midstream Partners LP (MMP) for a total value of $18.8 billion, which includes cash and stocks. This move drew attention as it positions ONEOK, primarily known for its involvement in the provision, gathering, and processing of Natural Gas (NG), to become one of the largest pipeline companies in the United States. The acquisition also allows ONEOK to expand its services by including Oil (CL), another significant energy commodity.

Global Oil Supply and Demand Trends Overview: Insights from Rextag

Global oil supply and demand saw notable changes in April 2023. Liquids demand declined by 0.7 MMb/d to 99.9 MMb/d, with gains in China and Europe offset by reduced demand in Japan and the Middle East. OPEC 10 production remained stable at 29.5 MMb/d, while Saudi Arabia increased output by 0.3 MMb/d. Non-OPEC production declined slightly, Russian production dropped further, and US shale production remained steady. Combined production in Iran, Venezuela, and Libya remained unchanged. Commercial inventories increased, and OPEC+ implemented production cuts. Economic sentiment remains uncertain amid rising global inflation.

Revolutionary Merger: ONEOK Set to Unleash $18.8 Billion Acquisition of Magellan Midstream Partners

ONEOK Inc. and Magellan Midstream Partners LP have announced a merger agreement that will result in the formation of a formidable midstream company headquartered in Tulsa, Oklahoma. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

Callon Acquires $1.1 Billion Delaware Assets and Bows Out of Eagle Ford - Here's What You Need to Know

Callon is set to purchase Percussion Petroleum's Delaware assets for $475 million while selling its Eagle Ford assets to Ridgemar for $655 million. In a strategic step to optimize its operations, Callon Petroleum recently made headlines by sealing two deals on May 3, totaling a staggering $1.13 billion. The company is taking confident steps to bolster its presence in the Delaware Basin while bidding farewell to its stake in the Eagle Ford Shale.

Permian Resources Secures a Major Deal in the Thriving Delaware Basin

Permian Resources bolsters dominance in the Delaware Basin with strategic land acquisitions, expanding its portfolio by over 5,000 net leasehold acres and 3,000 royalty acres. In a stunning display of growth and strategic maneuvering, Permian Resources Corp., based in Midland, Texas, has made waves in the first quarter by securing a series of deals worth over $200 million in the highly sought-after Delaware Basin. This move solidifies their position as a player in the region.

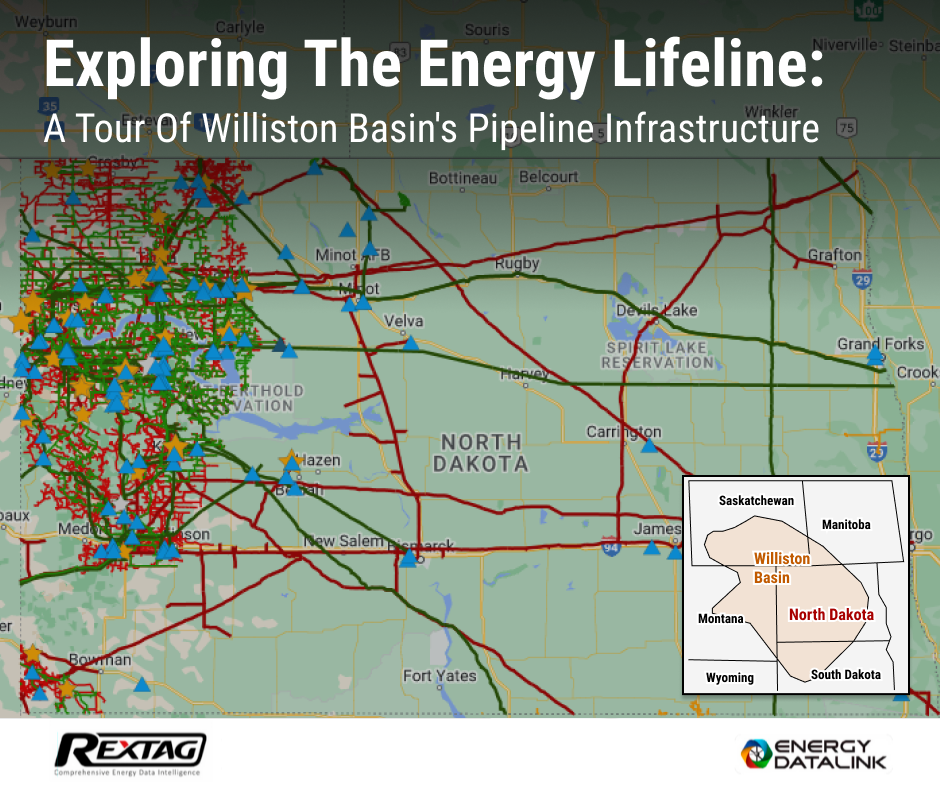

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

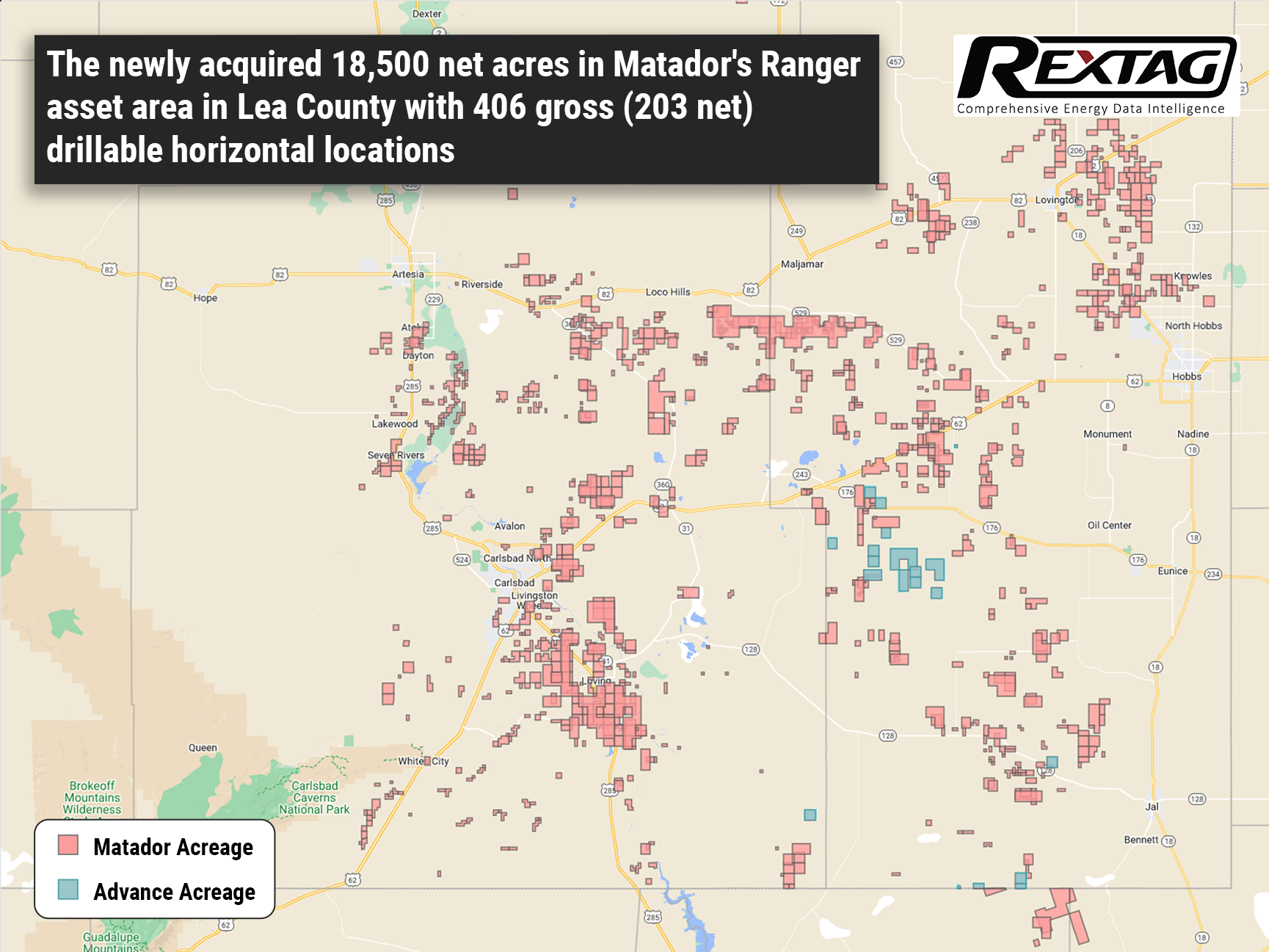

Matador Acquires Additional Land in Delaware from Advance Energy for $1.6 Billion

Matador Resources Co. is making a big move in the oil and gas industry by acquiring Advance Energy Partners Holdings LLC, a major player in the northern Delaware Basin. The acquisition, which comes with a hefty price tag of at least $1.6 billion in cash, includes valuable assets in Lea County, N.M., and Ward County, Texas, as well as key midstream infrastructure.

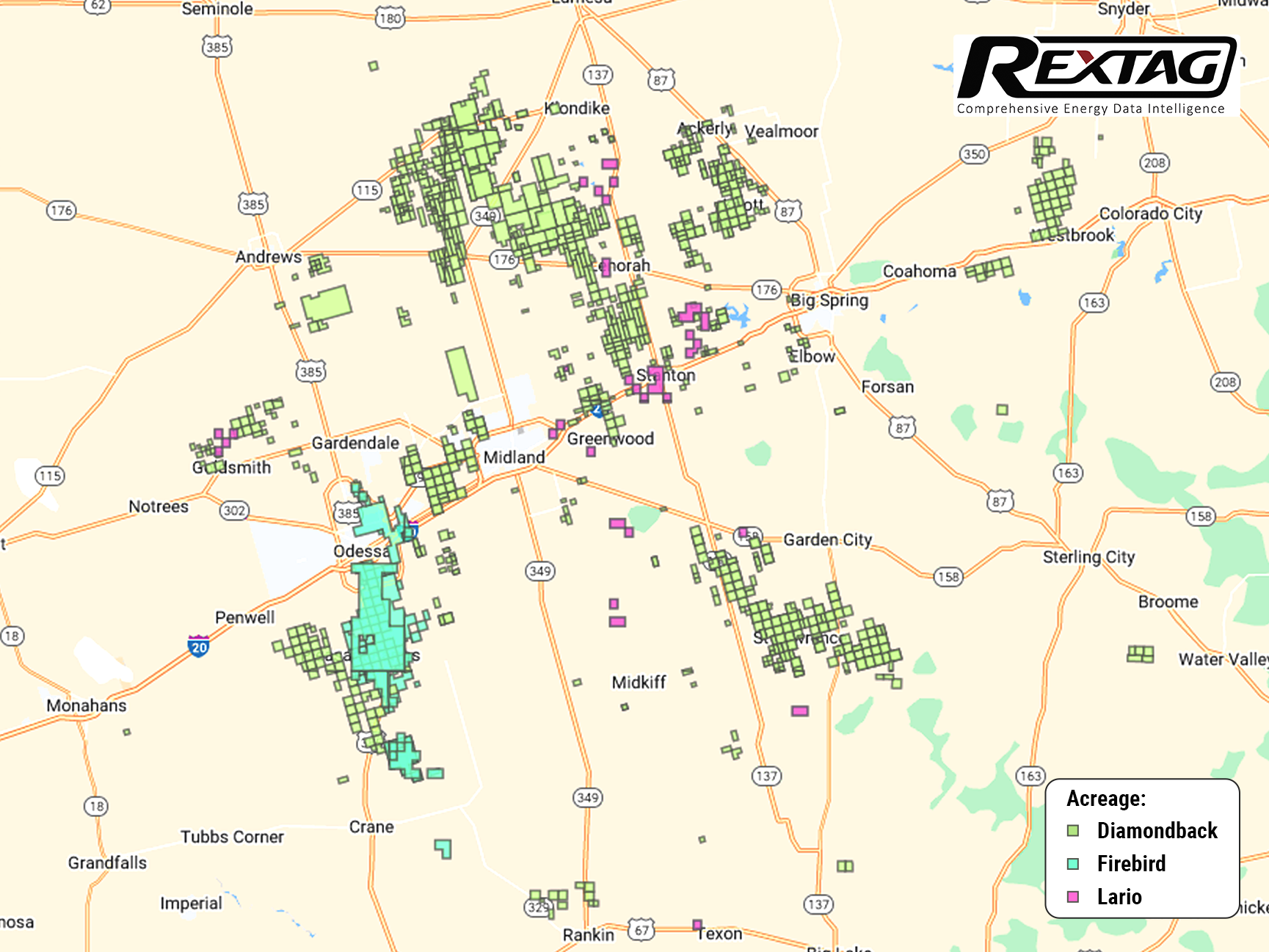

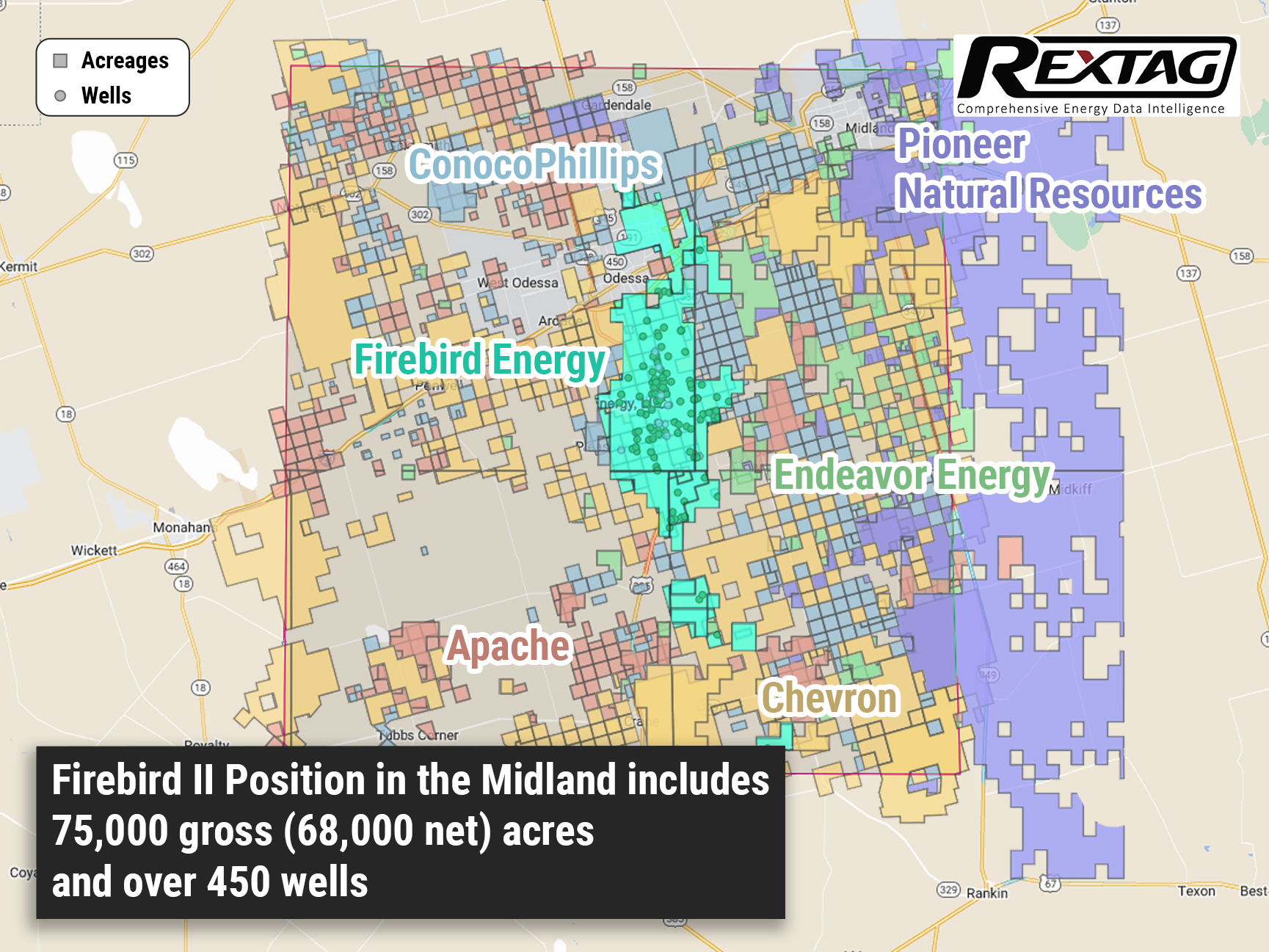

Breaking Barriers FireBird II, Empowered by Quantum Technology, Surpasses $500MM Funding Milestone for Permian Ventures

Following the success of FireBird Energy's $1.75 billion sale to Diamondback last year, the emergence of FireBird II signals a new chapter in the Permian Basin. Get ready for some exciting news from the energy industry. FireBird Energy II, the new player in the Permian Basin, has just secured $500 million in equity funding to fuel their acquisitions. With backing from the esteemed private equity firm Quantum Energy Partners, FireBird Energy II is poised to make waves in the industry.

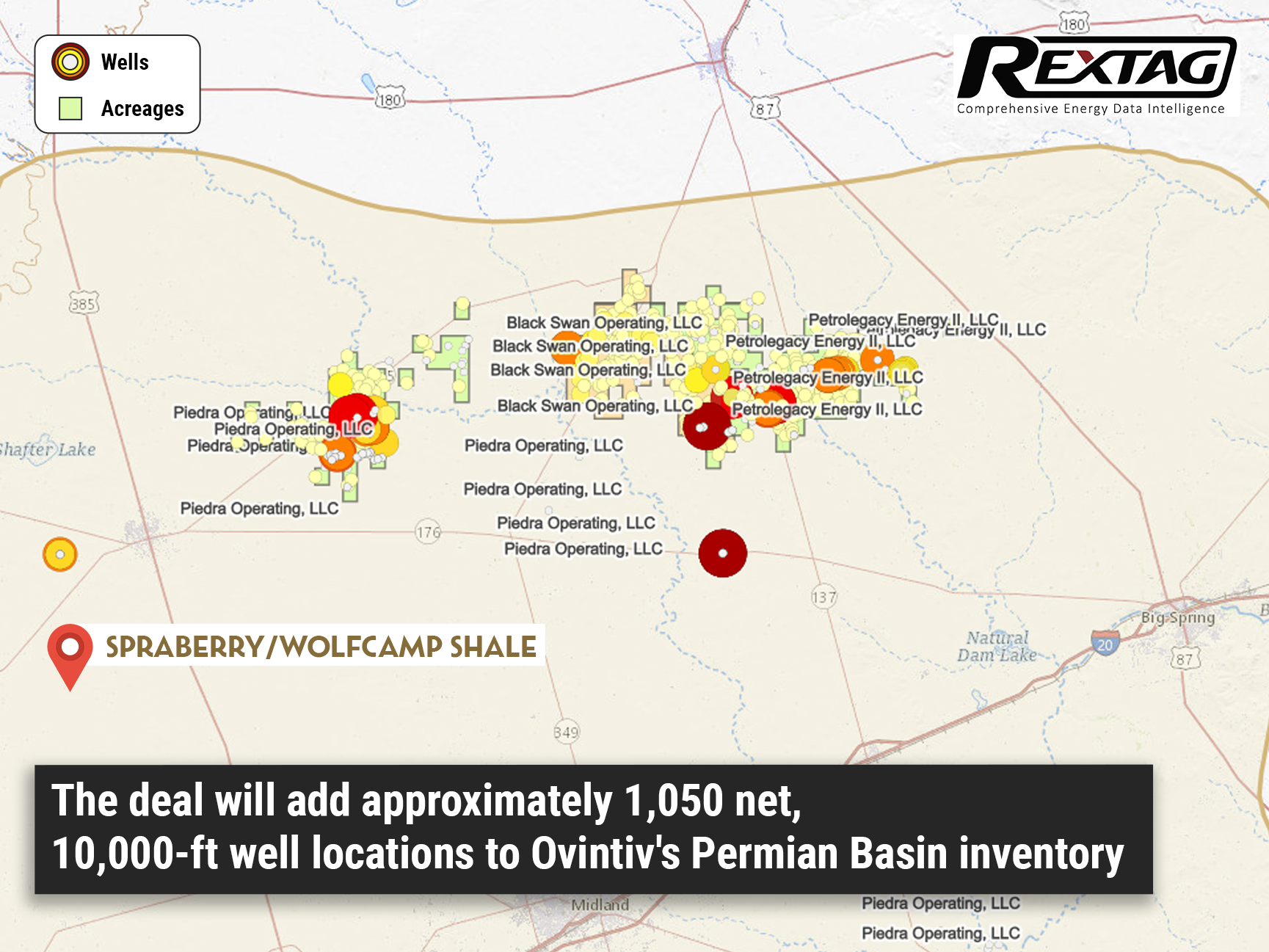

Multi-Billion Dollar Deal: Ovintiv to Expand Midland Basin Portfolio with EnCap Acquisition and Exit Bakken

Ovintiv Strikes Billion-Dollar Oil Deal, Doubling Production in Permian Basin with EnCap's Black Swan, PetroLegacy, and Piedra Resources. The deal, which was approved unanimously by Ovintiv's board, is slated to close on June 30. With over $5 billion in transactions announced on April 3, Ovintiv is set to expand its oil production by snatching up 65,000 net acres in the core of the Midland Basin. The deal with EnCap will give them a strategic edge in Martin and Andrews counties, Texas, with approximately 1,050 net, 10,000-ft well locations added to their inventory.

Riley Permian Secures $330 Million Acquisition in Thriving New Mexico: A Strategic Move with Promising Returns

In a big move for Riley Permian, the company has just closed a deal to acquire top-of-the-line oil and gas assets in the heart of New Mexico. The acquisition, which was made in February, saw Riley Permian snapping up these highly sought-after resources from none other than Pecos Oil & Gas LLC for $330 million.

Massive Energy Deal Alert: Energy Transfer to Acquire Lotus Midstream in Permian Basin for $1.45 Billion!

Energy Transfer's recent acquisition of Lotus Midstream's infrastructure for $1.45 billion is a remarkable feat that is bound to shake up the energy industry. This strategic move grants Energy Transfer access to the highly prized Centurion Pipeline, as well as an additional 3,000 miles of crude gathering and transportation pipelines. These pipelines span across the vast Permian Basin of West Texas, stretching all the way from New Mexico and culminating at the bustling energy hub of Cushing, Oklahoma.

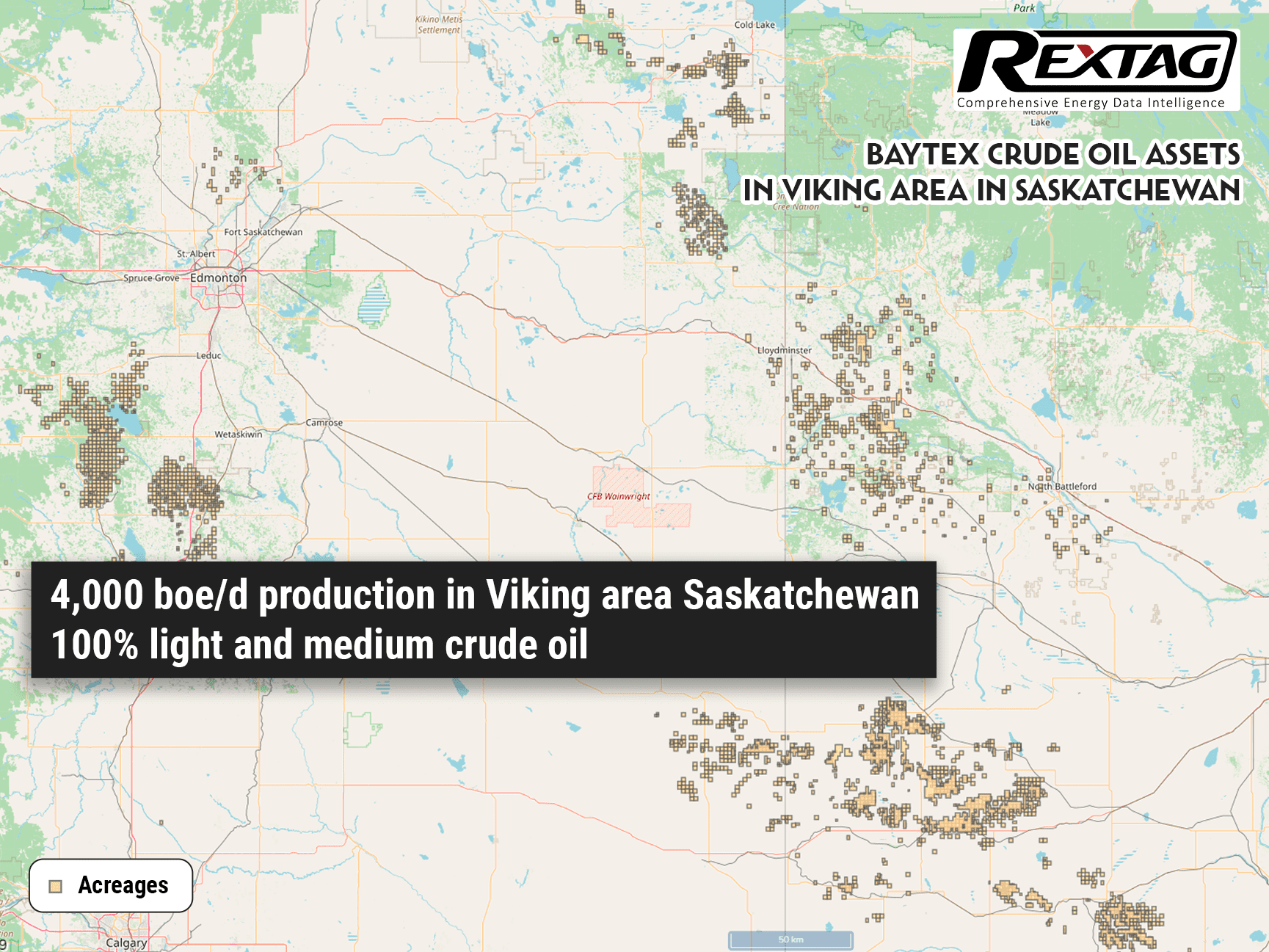

Energy Giant Baytex Makes a Bold Move: Snaps Up Ranger Oil in $2.5 Billion Deal

Baytex Energy Group has announced that it will acquire Eagle Ford exploration and production company, Ranger Oil, for approximately $2.5 billion in cash and stock, which includes taking over the company's existing debt. Upon the successful closure of the acquisition, Baytex will have a controlling stake of approximately 63% in the newly merged company, leaving Ranger shareholders with around 37%. This significant move is in line with a trend of substantial mergers and acquisitions in the Eagle Ford area, with Marathon Oil, Devon Energy, and Chesapeake Energy among the companies involved in recent transactions.

Enbridge agreed to acquire the Tres Palacios gas storage facility in Texas for $335 million

Enbridge acquired Tres Palacios natural gas storage facility in Texas for $335 million, adding approximately 35 Bcf of natural gas storage to their portfolio. The facility uses salt caverns for storage and has a gas header pipeline system that spans 62 miles and links to 11 major gas pipelines. Crestwood Equity Partners LP intends to divest its interests in Tres Palacios by the second quarter.

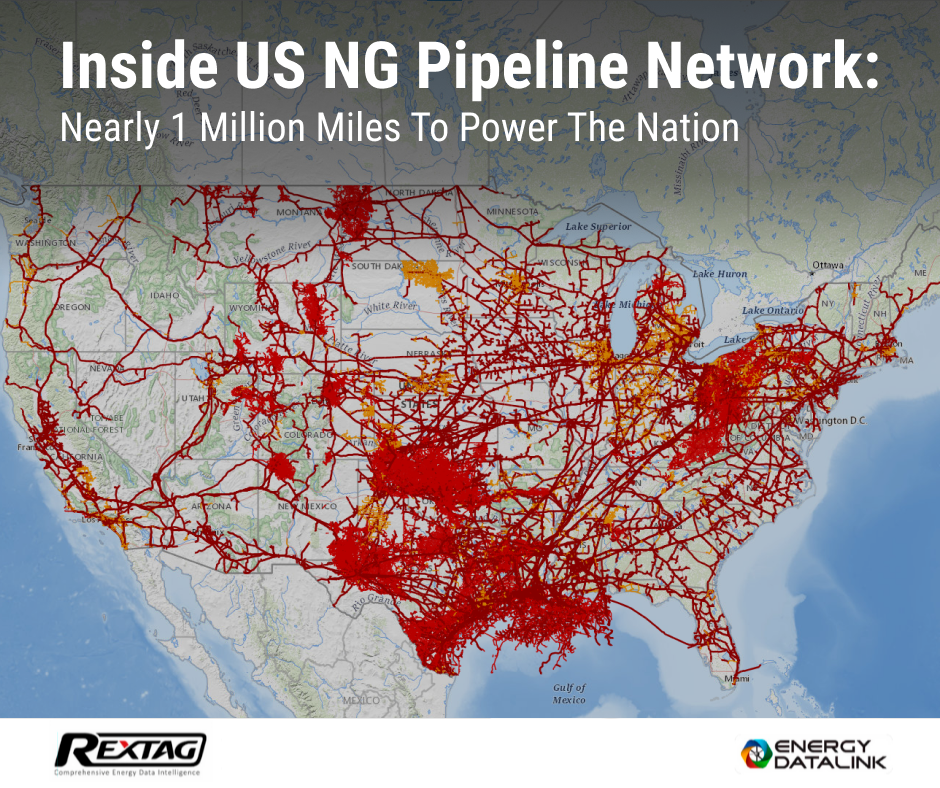

U.S. Natural Gas Pipelines Infrastructure Overview by Rextag

The U.S. natural gas pipeline network is a complex system of pipelines that transport natural gas from production areas to consumers across the country. The pipeline network consists of three main types of pipelines: gathering pipelines, transmission pipelines, and distribution pipelines. Gathering pipelines are small-diameter pipelines that transport natural gas from production wells to processing facilities or larger transmission pipelines. Transmission pipelines are large-diameter pipelines that transport natural gas over long distances, sometimes across multiple states. Distribution pipelines operate at low pressure and are located in or near urban areas. They are often referred to as "utility pipelines" because they are typically owned and operated by local gas utility companies.

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

Exploring ESG in Upstream Operations: Examining Achievements, Obstacles, and Emerging Patterns

ESG considerations are becoming increasingly essential for companies operating in the upstream sector. Failure to address ESG concerns may result in financial and reputational risks, given the growing focus from investors, regulators, and other stakeholders. Companies must prioritize ESG performance and engage with stakeholders to address concerns and mitigate risks. By doing so, they can improve their reputation, attract investment, and contribute to a more sustainable future

A&Ds in O&G forecast for 2023, trends and factors that influence this

“Our view is in 2023 M&A picks up. There was some this 2022 year, but again, it was such a funky, weird macro world. We expect fewer surprises in 2023.” — Dan Pickering, Pickering Energy Partners. Modern companies in the world operate in a rapidly changing external environment, so the process of reorganization is one of the basic tools for solving the problem of adapting companies to new conditions. Recently, the number of Acquisitions and Divestitures in the oil and gas industry has been growing rapidly, i.e. it can be said that the market for these deals is dynamically developing.

2022 A&Ds in O&G Summary and Trends for the past 4 years

More than 60% of all A&D deals by value are in US oil and gas companies. Despite their leading market position, U.S. fields are developing unevenly, and investors are quite cautious about investing in them at this stage. The top 5 oil & gas industry A&D deals in 2022 were concluded by Omega Acquisition, Tokyo Gas, Diamondback Energy, Suncor Energy, and IMM Private Equity. The main motives of oil and gas companies to carry out A&D transactions can be considered the achievement of the synergy effect, and the presence of fundamental shocks in the market.

ESG - what are the criteria O&G companies should meet?

Most companies have plans in place to identify and manage the normal operational risks of enterprise asset management (EAM). But, it is equally important to consider the potential emergence of ESG risks that a company may face. While predicting events such as hurricanes, pandemics, and regulatory violations is difficult, preparing for or mitigating the impact can avoid potentially devastating effects on an asset-rich organization, as well as its employees and shareholders. As a reminder, ESG investing looks at three elements: environmental (E), social (S), and governance (G) issues, with stakeholders looking not only at the financial parameters of a transaction but also the non-financial parameters. For example, oil and gas companies should develop plans to restore power lines or pipelines after an earthquake or other natural disaster. These plans should describe procedures for how employees will access remote sites, which assets will be prioritized, what additional equipment will be needed, and how it will be obtained.

Blockchain as a technology for smart contracts in O&G

The oil and gas industry has long relied on the recommendations of trusted experts to make key supply chain decisions. The growing popularity of Blockchain technology could significantly disrupt these relationships by providing an unbiased methodology for sourcing, tracking, and executing transactions on behalf of customers with transparent data sets across supply chain endpoints. Blockchain technology has already been used by many global companies in the last two years in various areas such as IoT (Internet of Things), smart contracts, and cryptocurrencies. It has enabled businesses to benefit from the inherent trust and transparency of the technology.

_Select Water Solutions Bolts On Haynesville, Rockies Assets for $90MM.png)

Blog_Grayson Mill acquired Ovintiv's Bakken assets for $825M in 2024.png)

- Occidental, CrownRock Merger Under Regulatory Review_ 2024 Update.png)

.png)

Welcome 2024_ A Look Back at 2023 Top Oil and Gas Sector Deals.png)

Rudolf reindeer VS. Transcontinental Pipeline - Which one moves the presents faster_.png)

- Christmas tree and Santa Against Permian Methane Emissions.png)

How Grinch Almost Made Off with All Oil from Santa's TX-based Barrels.png)

.png)

Tenaris Acquires Mattr's Pipe Coating Division for $166 Million.png)

.png)

Gulf Mexico Oil and Gas Map_ 2023 Review.png)

.png)

.png)

(1).png)

.png)

to Acquire PDC Energy for 6.3B.png)

.png)