Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Major: Ameredev II Oil Producer to be Sold for $4 Billion by EnCap

03/29/2022

A US-based oil company, Ameredev II, that EnCap Investments owns as part of its portfolio, is on the verge of being sold for over $4 billion including debt — at least according to some inside sources. As part of the plan, EnCap appointed an undisclosed bank to launch an auction for Ameredev II in the coming weeks.

It’s important to note, however, that both EnCap and Ameredev II alike are declining to comment further on the matter.

Yet in light of the conflict in Ukraine, this move isn’t surprising. Buyout firms are currently scurrying to make cash from U.S. crude prices reaching their highest level since 2008, therefore bolstering their assets' value.

But the reason why these assets warrant such a price is not exclusively related to geopolitical shifts: at the end of last year, Ameredev II saw a huge overhaul, when EnCap combined it with another portfolio company, Advance Energy Partners, thus virtually creating one of the largest privately-owned oil producers in the country. And now the company looks to reap the benefits, while the iron is hot.

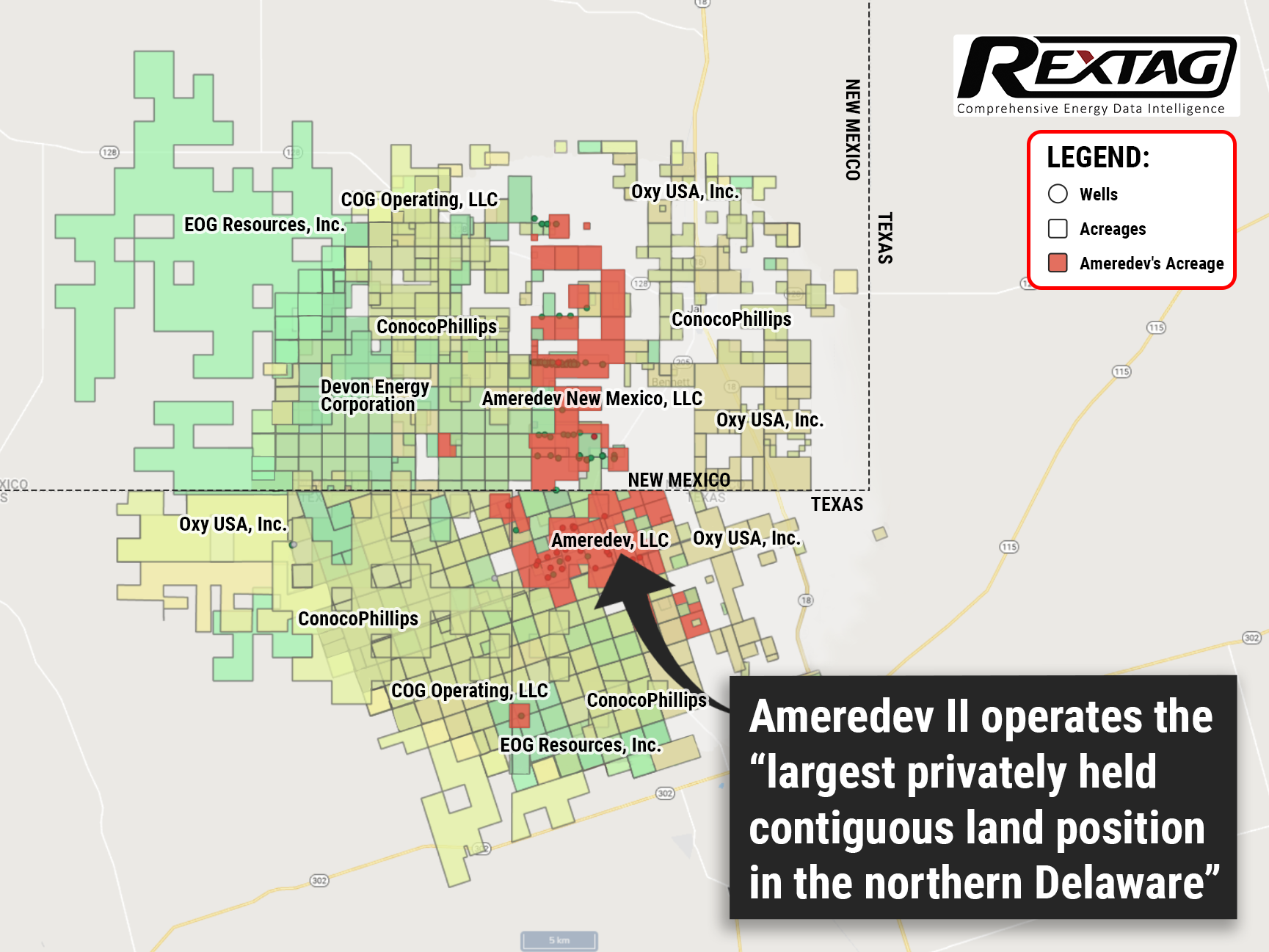

After selling its predecessor, Ameredev I, to Callon Petroleum Co. in 2017, EnCap invested $400 million in Ameredev II. And after continuous development, The company now operates the largest privately held contiguous land position in northern Delaware — the hub of the shale industry which spans Texas and New Mexico.

But EnCap is not the only one looking to earn a couple of brownie points off of its foresight. In addition to them, Aethon Energy Management, as well as NGP, are also currently exploring the sale of their acreage in North Louisiana for $6 billion. The two companies are aiming to exit Colgate Energy Partners III for more than $5 billion.

Tracking such movements is hard. In order to foresee possible opportunities or threats, one needs to be fully aware of not only the market, but assets, their locations, borders, and resource bases alike, which requires access to special energy data and deep analyses.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

$1B Deal: Williams Buys Out Houston-based Midstream in Haynesville Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/52Blog_Williams_Acquires_Assets_from_Trace_in_Haynesville.png)

By purchasing the gathering and processing assets of Trace Midstream, Williams' existing footprint gains expanded capacity in one of the nation's largest growth basins, bringing its Haynesville gathering capacity to over 4 Bcf/d — increasing more than 200% from 1.8 Bcf/d. The deal also includes a long-term commitment from Trace and Quantum to support Williams' Louisiana Energy Gateway project (LEG), which is aimed to deliver responsibly sourced Haynesville’s naturalgas to markets along the Texas and Louisiana GulfCoast

As Countries Shun Russian Crude, Canada Plans to Boost Its Oil Exports

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/54blog_Enbridge-TC_Energy_Cross_border_pipelines.png)

Canada is looking at ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its reliance on Russian oil At the moment, oil exports from Canada to the U.S. are approximately 4 million barrels of oil per day, with a portion reexported to other countries. At the end of 2021 Canadian oil companies exported a record amount of crude from the U.S. Gulf Coast, mostly to big importers India, China, and South Korea. And this will only increase in the future.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?