Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area.

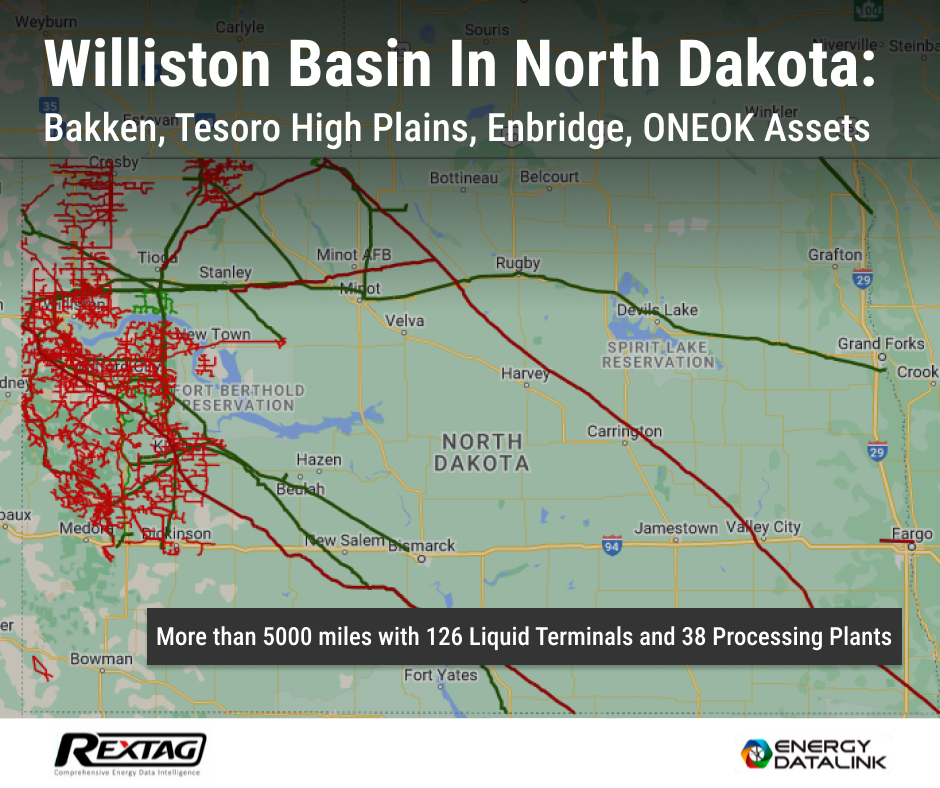

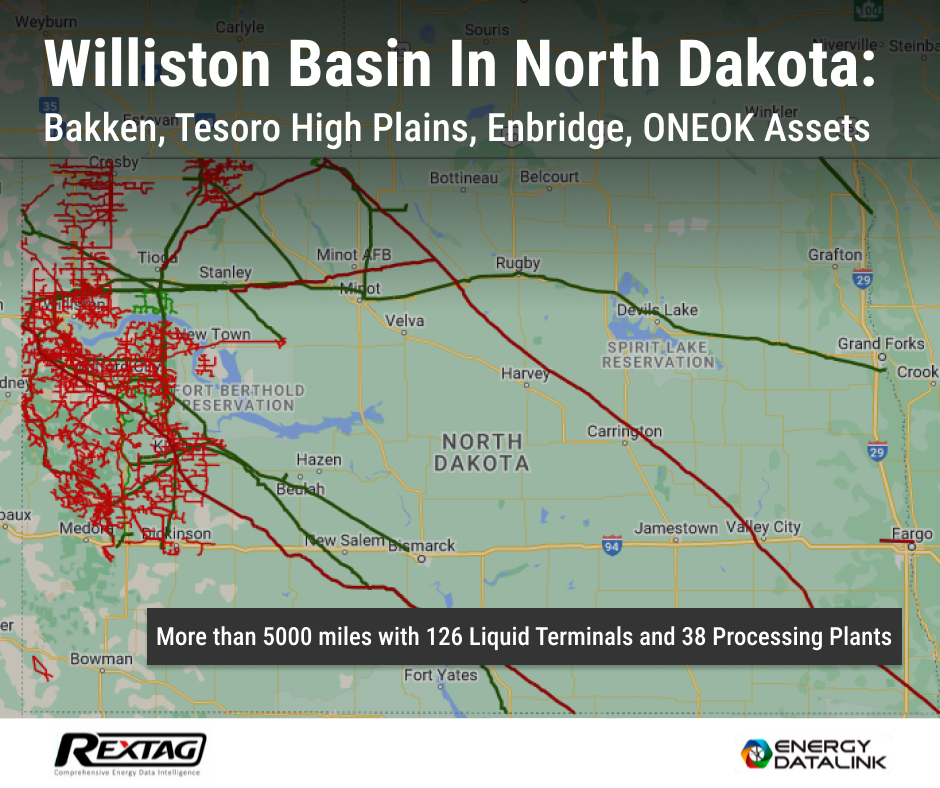

The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs:

- The Bakken is a major pipeline system that transports crude oil from the Bakken Formation in North Dakota to Illinois. It consists of the Dakota Access Pipeline, which runs from North Dakota to Illinois, and the Energy Transfer Crude Oil Pipeline, which runs from Illinois to Texas.

- The Tesoro High Plains Pipeline System transports crude oil from the Williston Basin to refineries in the Rocky Mountain region. It consists of several pipelines that run from North Dakota to Wyoming and Colorado.

- The Enbridge Pipeline System transports crude oil from the Western Canadian Sedimentary Basin, including the Williston Basin, to refineries in the United States and Canada. It includes the Enbridge Mainline, which runs from Alberta to Wisconsin, and the Enbridge North Dakota System, which runs from North Dakota to Saskatchewan.

- The ONEOK Bakken was built for the transit of natural gas liquids from the Williston Basin to processing facilities in Montana and Wyoming. It consists of several pipelines that run from North Dakota to Wyoming.

Meet the Key Players of Williston Basin

Hess

.png)

The Williston Basin has long been a staple in Hess' portfolio, but production there is expected to level out at around 200,000 boe/d in 2024 and remain at that rate for eight to 10 years.

Subsequently, Hess Midstream's assets are primarily located in the Bakken and Three Forks Shale plays in the Williston Basin area of North Dakota.

Energy Transfer

Energy Transfer is one of the largest pipeline operators in North America and operates several pipelines in the Williston Basin, including the Dakota Access Pipeline and the Energy Transfer Crude Oil Pipeline:

- The Bakken Pipeline System includes the Dakota Access Pipeline (DAPL) and the Energy Transfer Crude Oil Pipeline (ETCO). DAPL is a 1,172-mile pipeline that transports crude oil from the Bakken oil fields in North Dakota to Patoka, Illinois. ETCO is a 700-mile pipeline transporting crude oil from Patoka, Illinois to Nederland, Texas.

- The Little Missouri natural gas processing plant is located in Dunn County, North Dakota. The plant has a processing capacity of 200 million cubic feet per day and is used to process natural gas produced in the Bakken shale.

The Bakken Pipeline System transported an average of 531,000 barrels per day of crude oil in 2020, and the Little Missouri natural gas processing plant processed an average of 117 million cubic feet per day of natural gas during the same period.

Enbridge

.png)

Enbridge is another major pipeline operator in the region and operates the Enbridge Mainline, which transports crude oil from the Western Canadian Sedimentary Basin to refineries in the United States, as well as the Enbridge North Dakota System.

Enbridge's assets in the Williston Basin include:

- The Bakken Pipeline System includes the 600-mile-long Enbridge Bakken Pipeline and the 450-mile-long Enbridge North Dakota System. The Bakken Pipeline transports crude oil produced in North Dakota to Clearbrook, Minnesota, where it connects to Enbridge's mainline system. The North Dakota System consists of gathering pipelines and related infrastructure that transport crude oil from the Bakken Formation to the Bakken Pipeline.

- The Tioga Gas Plant is a natural gas processing plant located in Tioga, North Dakota. The plant has a processing capacity of 120 million cubic feet per day and is used to process natural gas produced in the Bakken shale.

- The Berthold Rail Facility is a crude oil rail loading facility located in Berthold, North Dakota. The facility has a capacity of 80,000 barrels per day and is used to load crude oil onto railcars for transport to refineries and other markets.

The report for the year ended 2020 noted that the Bakken Pipeline System transported an average of 624,000 barrels per day of crude oil in 2020 and that the Tioga Gas Plant processed an average of 75 million cubic feet per day of natural gas during the same period.

ONEOK

ONEOK is a midstream company that operates several natural gas gathering and processing facilities in the Williston Basin, as well as the ONEOK Bakken Pipeline System:

- The Bakken NGL Pipeline is a 600-mile-long pipeline that transports NGLs produced in the Williston Basin to ONEOK's Mid-Continent NGL Fractionation and Storage Complex in Bushton, Kansas. The pipeline has a capacity of 135,000 barrels per day.

- The Demicks Lake natural gas processing plant is located in McKenzie County, North Dakota. The plant has a processing capacity of 200 million cubic feet per day and is used to process natural gas produced in the Bakken shale.

- The natural gas processing plant, known as Stateline II, is situated in Williams County, North Dakota. Its processing capacity is 200 million cubic feet per day and it is primarily utilized to process natural gas extracted from the Bakken shale formation.

- The Garden Creek natural gas processing plant is located in McKenzie County, North Dakota. The plant with 100 million cubic feet per day is used to process natural gas produced in the Bakken shale.

The Bakken NGL Pipeline transported an average of 120,000 barrels per day of NGLs in 2020, and the Demicks Lake, Stateline II, and Garden Creek processing plants processed an average of 300 million cubic feet per day, 270 million cubic feet per day, and 84 million cubic feet per day of natural gas, respectively.

Tesoro Logistics

Tesoro Logistics, a subsidiary of Marathon Petroleum, operates the Tesoro High Plains Pipeline System, which transports crude oil from the Williston Basin to refineries in the Rocky Mountain region:

- The High Plains Pipeline System includes two crude oil gathering pipelines that transport crude oil produced in the Williston Basin to Tesoro Logistics' High Plains Terminal in Johnsons Corner, Wyoming. The High Plains Pipeline System has a capacity of 160,000 barrels per day.

- The COLT Hub in Epping, North Dakota. The terminal has a capacity of 200,000 barrels per day and is used to load crude oil onto railcars for transport to refineries and other markets.

- The Mandan Refinery in Mandan, North Dakota. The refinery has a processing capacity of 20,000 barrels per day and produces gasoline, diesel, and other petroleum products.

According to the North Dakota Pipeline Authority, as of September 2021, there were over 5,500 miles of crude oil pipelines and over 3,500 miles of natural gas pipelines in North Dakota alone, which is part of the Williston Basin. These pipelines transported over 1.1 million barrels of crude oil per day and over 2.6 billion cubic feet of natural gas per day.

Oasis Petroleum

Oasis Petroleum's assets in the Williston Basin include drilling leases, producing wells, and related infrastructure such as gathering systems and processing plants. The company's operations in the region are focused on the Bakken and Three Forks formations.

Oasis's assets in the region include:

- Over 300,000 net acres of drilling leases,

- Over 2,000 producing wells,

- Related infrastructure such as gathering systems, processing plants, and transportation assets.

According to Oasis Petroleum's 2020 report, the company had approximately 129 million barrels of oil equivalent (BOE) in proved reserves in the Williston Basin, with an estimated net present value (NPV) of $1.1 billion. The company's production from the Williston Basin in 2020 averaged approximately 48,300 BOE per day.

The Latest Upstream and Midstream Acquisitions Shaping Landscape of the Williston Basin

- Enerplus to Acquire Williston Basin Private Operator Bruin E&P

In March 2021, Enerplus completed the acquisition of private Williston Basin operator Bruin E&P Partners LLC for $465 million, adding 151,000 net acres to the Bakken play.

Enerplus's portfolio includes light oil assets in the Williston Basin across North Dakota and Montan.

- Northern Oil & Gas to Acquire Williston Basin Bolt-on for $170 Million

In 2022, Northern Oil and Gas entered an agreement with an undisclosed company to acquire non-operated interests in the Williston Basin primarily located in Dunn, McKenzie, and Williams counties, North Dakota.

“While the Permian continues to be a source of growth, we continue to find significant opportunities to grow our Williston Basin position,” Northern President Adam Dirlam commented.

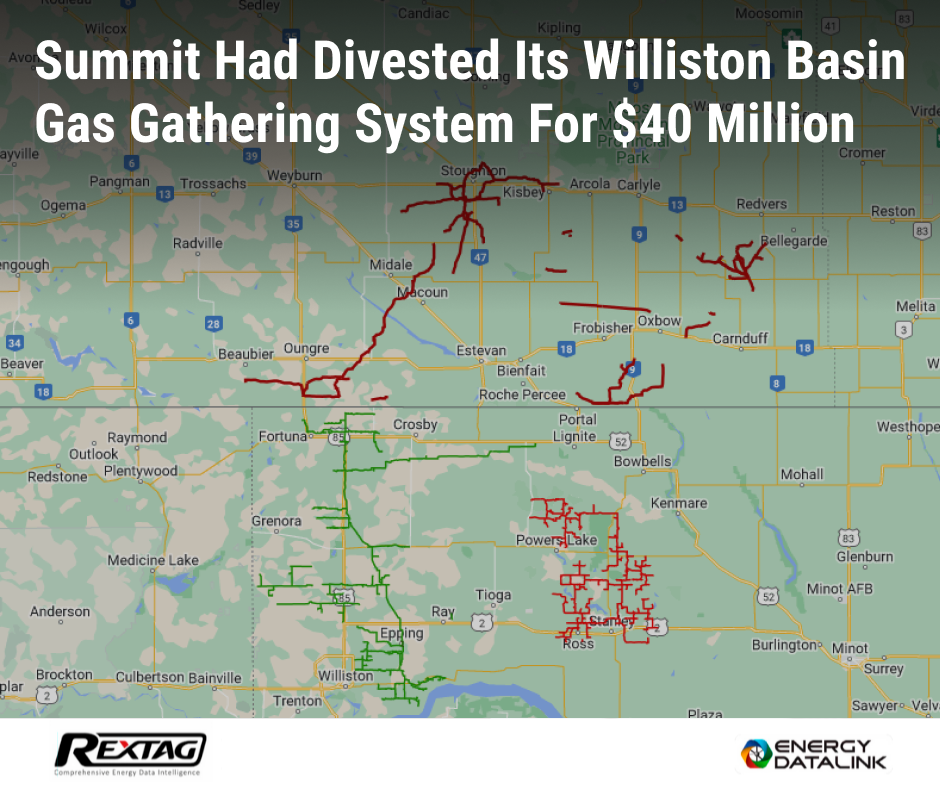

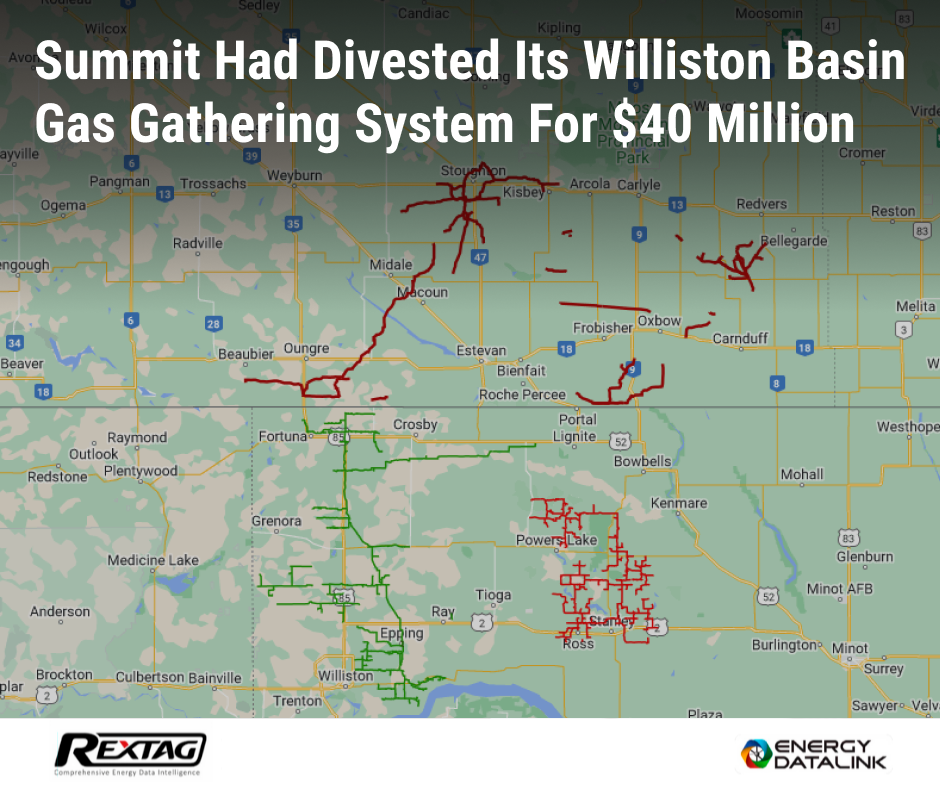

- Summit had divested its Williston Basin gas gathering system for $40 million

After the sale of the Bison gas gathering system to Steel Reef for $40 million in 2022, Summit Midstream Partners shifted its focus in the Williston Basin towards expanding its crude oil and produced water gathering systems.

With the sale of Bison Midstream, Summit's focus in the Williston Basin will be on growing its crude oil and produced water gathering systems primarily located in Williams and Divide Counties, North Dakota,” Deneke, who serves as president and chairman as well as CEO of Summit, commented in 2022.

“We remain excited about the level of customer development activity in central Williams County and pro forma for the transaction, we continue to expect over 50 new wells behind our liquids system in 2023,” Deneke said.

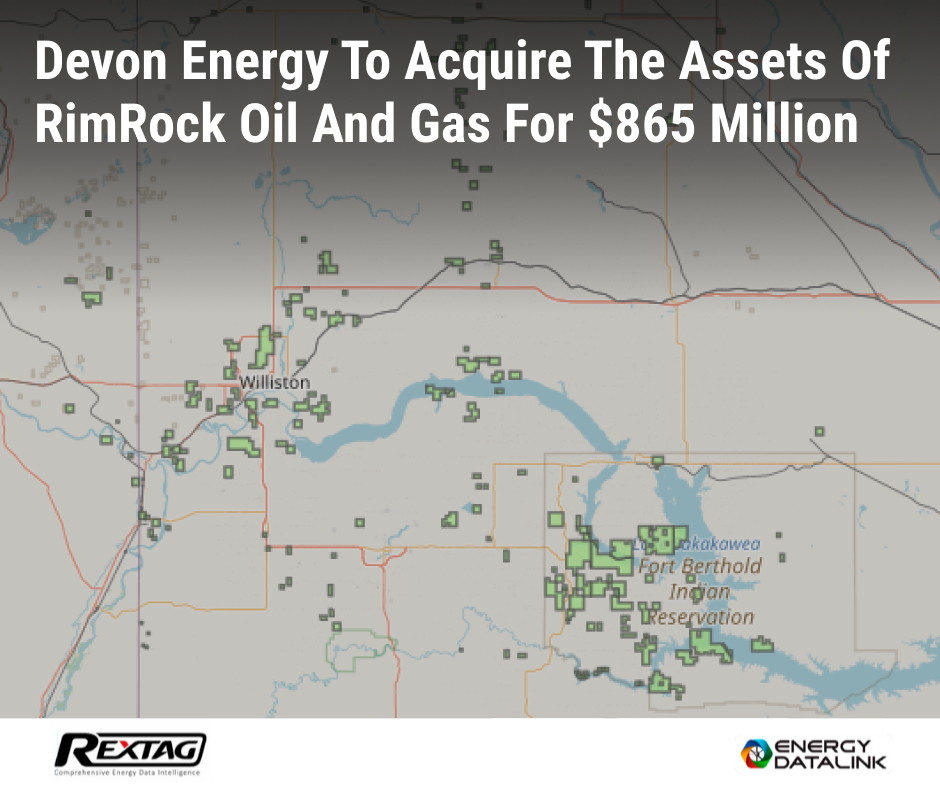

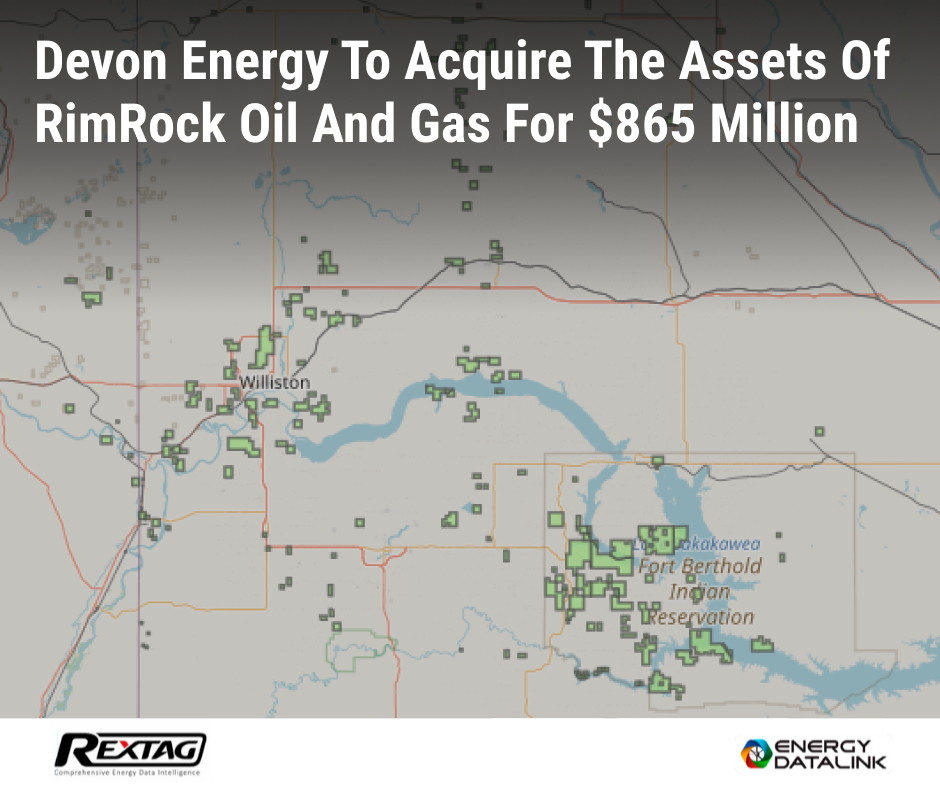

- Devon Energy to acquire the assets of RimRock Oil and Gas for $865 million, a Warburg Pincus portfolio company in the Williston Basin

The RimRock bolt-on transaction adds a contiguous position of 38,000 net acres (88% In a 2022 release, Devon announced that the RimRock bolt-on transaction had added a contiguous position of 38,000 net acres (88% working interest) directly overlapping and offsetting the company's existing position.

The acquisition had added over 100 highly undrilled inventory locations, which Devon had anticipated would position its Williston Basin assets to maintain 'high-margin production and strong cash flow for several years.'

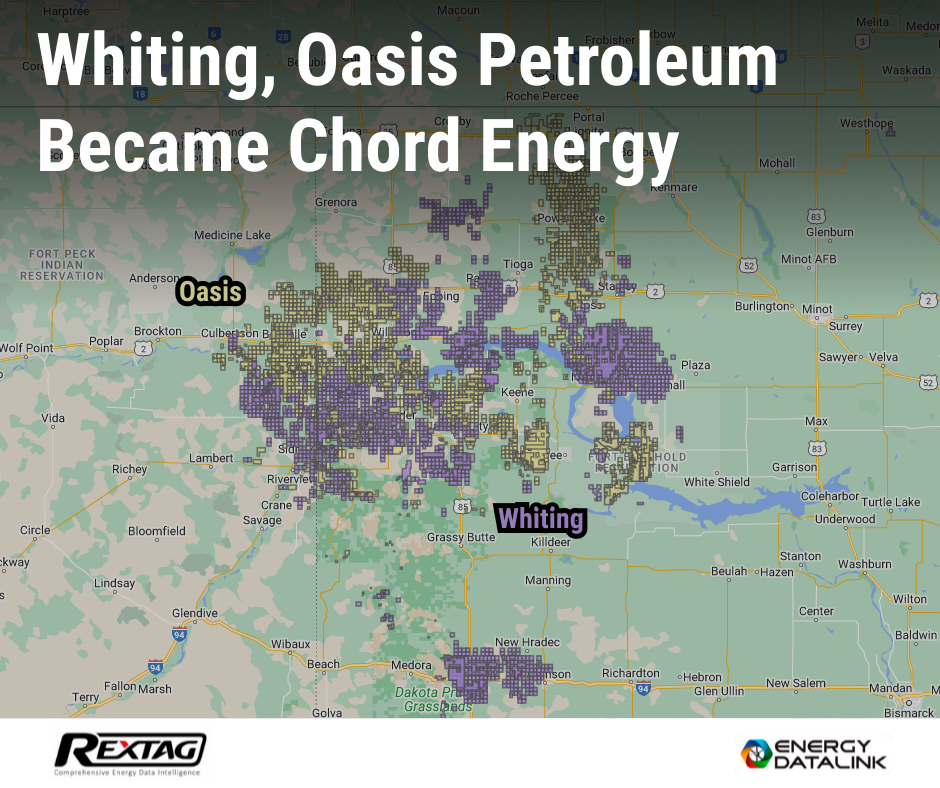

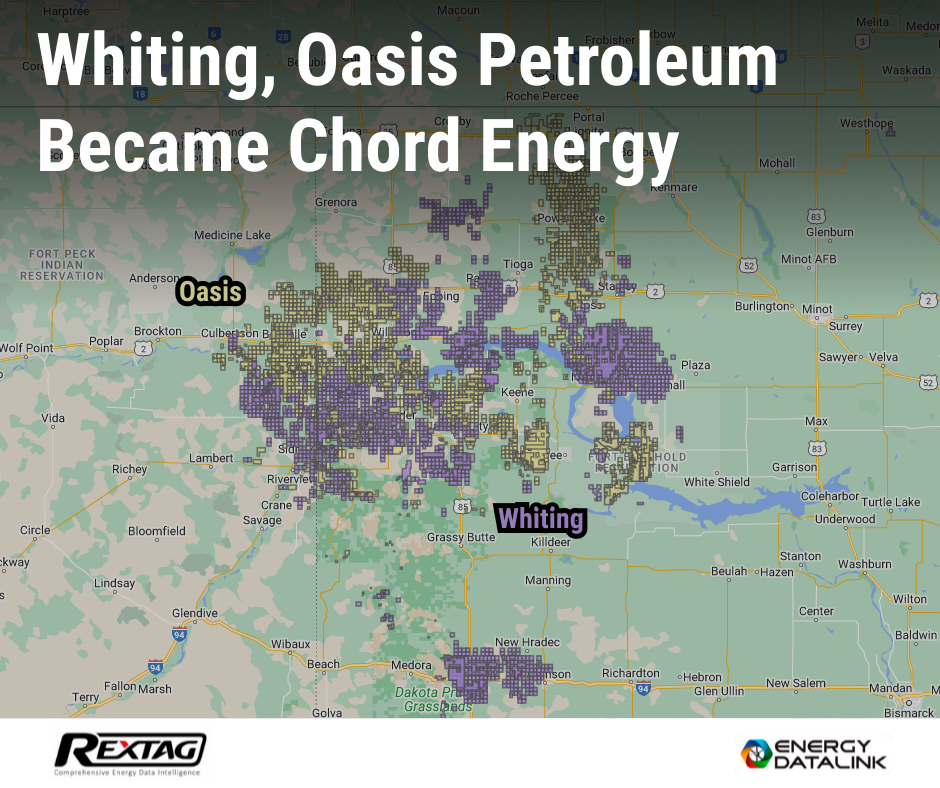

- Whiting, Oasis Petroleum Became Chord Energy

Chord Energy was created after a 2022 combination valued at $6 billion between Whiting Petroleum Corp. and Oasis Petroleum Inc. The resulting company is the largest net acreage holder and second-largest producer in the Williston Basin — with an estimated 10% of the basin's production.

Oasis is one of the top producers in the Williston Basin, primarily targeting the Middle Bakken and Three Forks formations.

- Diamondback Energy sold its Bakken asset to Oasis in a $745 million cash deal

The transaction in 2021, with Oasis Petroleum Inc., included the sale of select Williston Basin assets from Diamondback Energy in a $745 million transaction.

Diamondback signed definitive agreements to divest the Williston Basin assets and noncore Permian Basin assets for total consideration of $832 million. The assets being sold have an estimated full-year 2021 net production of approximately 28,000 boe/d.

Williston Basin Resume

The Williston Basin encompasses an area of over 5000 square miles and comprises 126 liquid terminals and 38 processing plants.

The Williston Basin has a rich and extensive history of producing critical resources for the United States and contains extensive infrastructure today for mining, transport, and processing of a variety of resources. The primary areas of resource development within the basin have been the Bakken oil and gas development, producing over 1.4 million barrels of oil per day. The state of North Dakota is the sixth largest overall energy producer in the U.S. largely due to the extensive oil and gas development within the Williston Basin.

The Williston Basin, which is located primarily in North Dakota, currently ranks as one of the top oil-producing regions in the United States. It is also a major natural gas-producing region. In terms of midstream infrastructure, the Williston Basin has seen significant investment in recent years to support the development of the region's oil and gas resources.

One of the challenges that operators in North Dakota are facing is the limited natural gas takeaway capacity. Many Williston wells have associated natural gas that is tied to the production of crude oil and with increasingly stricter flaring regulations, many operators are often faced with the decision to shut in wells to meet these requirements.

One of the trends that we are seeing in the Williston Basin where operators are faced with this problem is looking at ways to capture as much gas as possible vs. flaring or venting. One flare mitigation tactic that many are using is installing mobile data centers and natural gas generators to burn the gas to generate electricity and then using this electricity to power these computers to do things like mine bitcoin.

To put in perspective how big of an opportunity this is, around 92% of produced natural gas is currently captured and sold or used for things like electricity generation. This means that we still have around 8% of the gas that is flared. So there is a big opportunity to either leverage the current high gas prices to expand the gas gathering and processing capacity in the basin or to bring in mobile gas generators to tie into the grid or to do things like mine bitcoin at the wellsite.

.png)

.png)