Matador Resources Co. is making a big move in the oil and gas industry by acquiring Advance Energy Partners Holdings LLC, a major player in the northern Delaware Basin. The acquisition, which comes with a hefty price tag of at least $1.6 billion in cash, includes valuable assets in Lea County, N.M., and Ward County, Texas, as well as key midstream infrastructure.

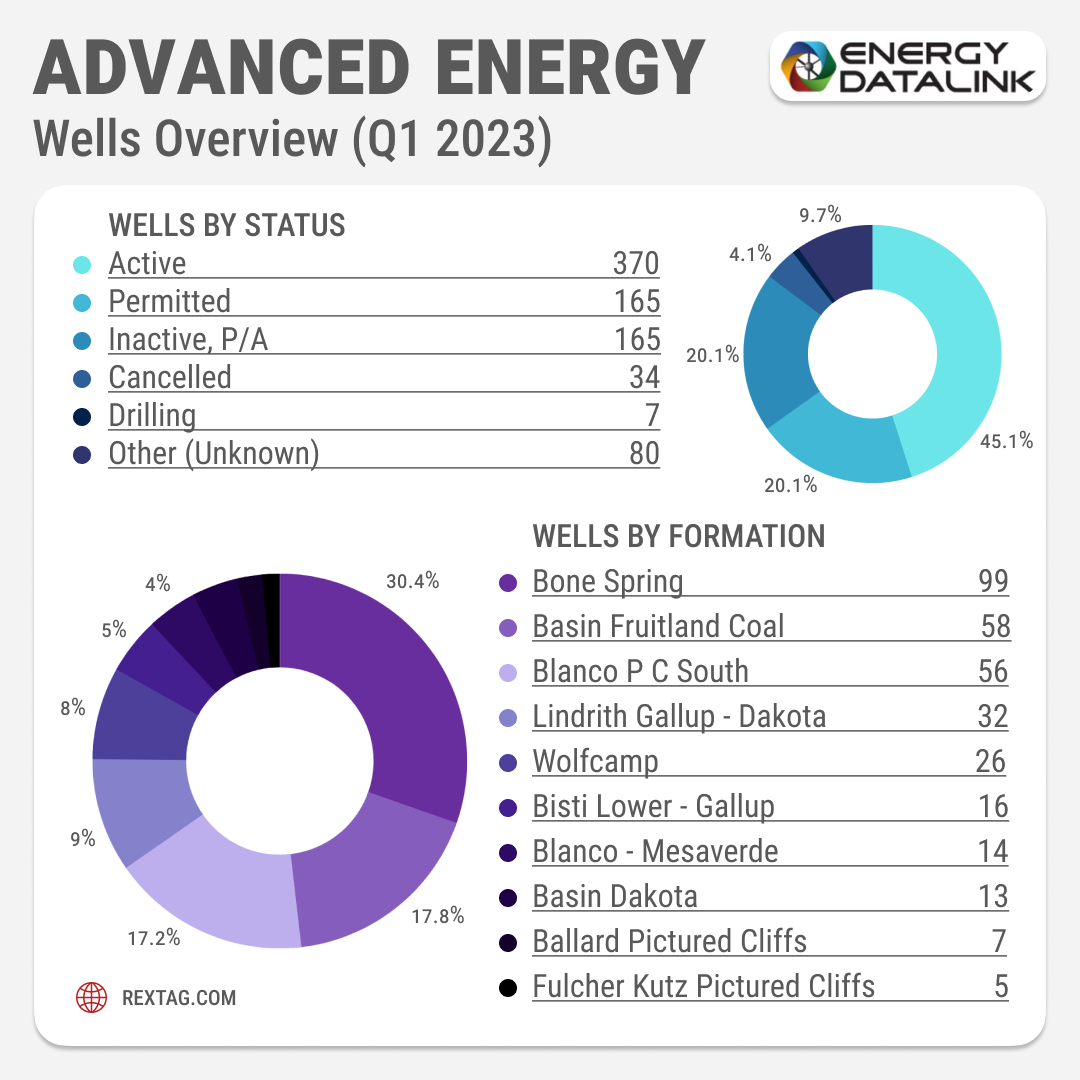

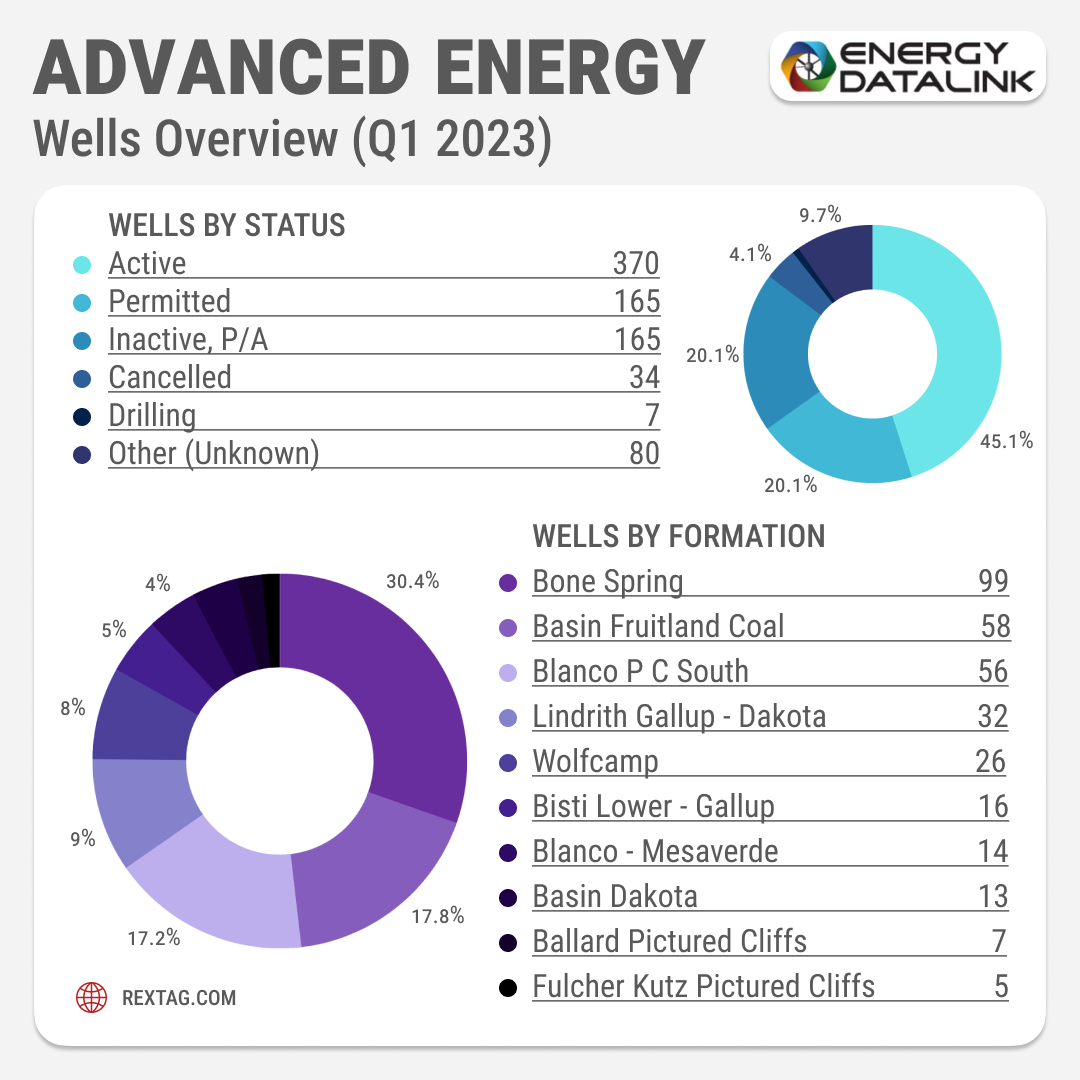

The newly acquired 18,500 net acres, with 99% held by production, are strategically located in Matador's Ranger asset area in Lea County, providing the company with a significant boost in its drilling inventory. With 406 gross (203 net) drillable horizontal locations in the Wolfcamp, Bone Spring, and Avalon formations, Matador's prospects for growth are looking very promising indeed.

The Advance Energy acquisition has brought significant drilling potential to Matador, as Advance Energy is currently operating one drilling rig to drill 21 gross (19 net) wells in the northern part of Matador's Antelope Ridge asset area in Lea County. While the wells are not expected to be turned to sales until early 2024, the potential for increased production is high.

Matador's acquisition of Advance Energy has also resulted in the addition of approximately 35 miles of gas and water gathering pipelines to their infrastructure. Additionally, the company has purchased an active Devonian Salt Water Disposal well with strong injection capabilities, further enhancing its capacity for oil and gas production.

One of the most exciting aspects of the Advance Energy deal for Matador is the potential for undedicated acreage to be connected to their midstream subsidiary, Pronto Midstream LLC. This could provide enhanced flow assurance and even increase midstream value, offering significant benefits for the company's growth and success in the industry.

Matador's Assets in Spotlight

Matador Resources is a leading oil and gas company with a focus on the exploration, development, and production of oil and gas assets:

- Over 190,000 net acres in the Delaware Basin, one of the most productive areas in the Permian Basin.

- Within the Delaware Basin, Matador's assets include the Wolf and Rustler/Spraberry formations, which are rich in oil and natural gas liquids.

- The company also has significant holdings in the Eagle Ford shale in South Texas, where the company is a major player in the region's oil and gas industry.

- Focus on horizontal drilling, which allows for greater efficiency and increased production. The company has a successful track record of horizontal drilling programs in the Delaware Basin and other regions.