Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

As Countries Shun Russian Crude, Canada Plans to Boost Its Oil Exports

04/01/2022

Jonathan Wilkinson, Canada's natural resources minister, reports that his country is looking at ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its reliance on Russian oil.

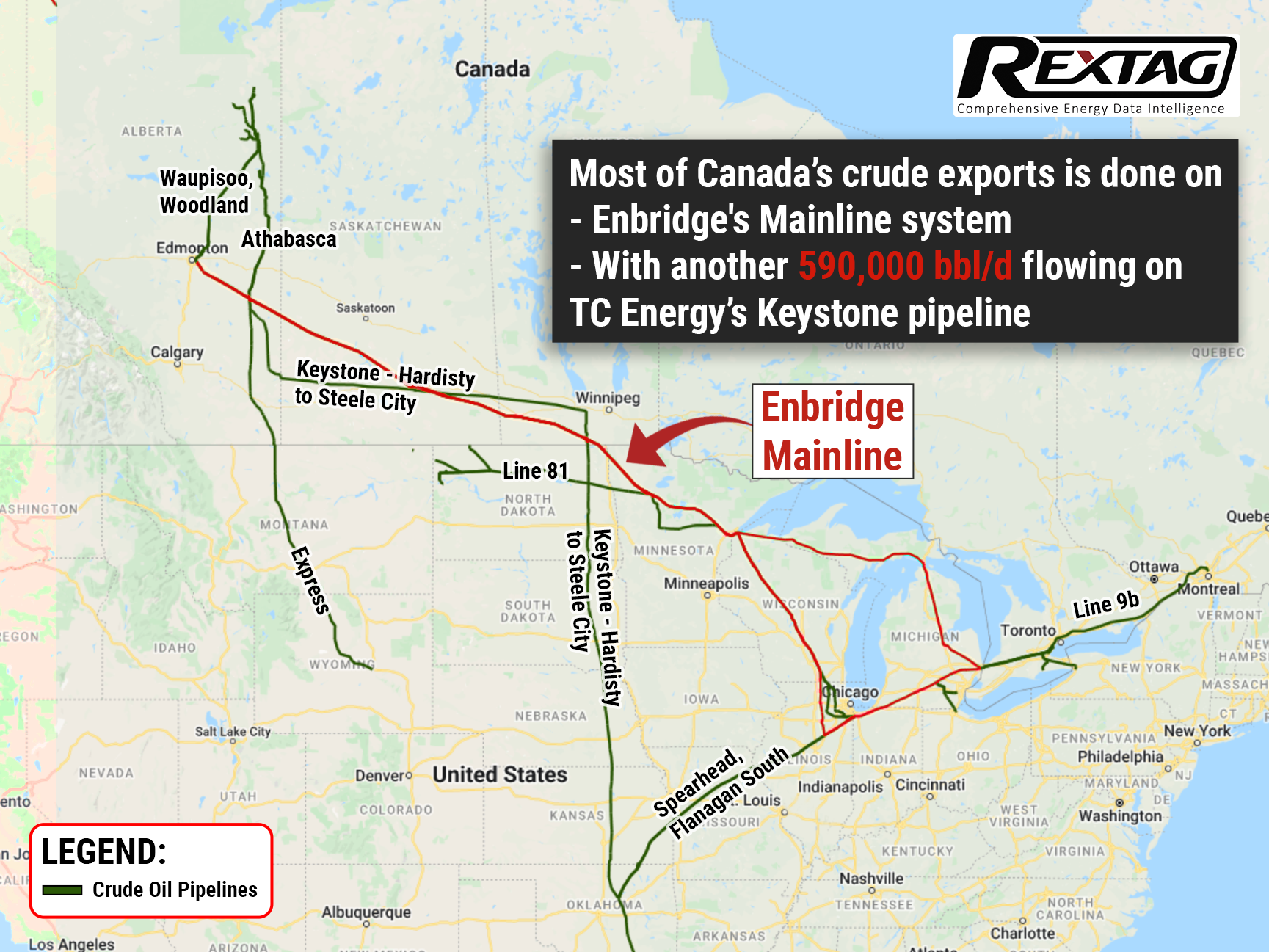

Enbridge Inc., the operator of the Southern Lights pipeline (part of the Mainline pipeline system), is in talks with the government, looking for ways to ease the current energy crisis. Network capabilities are the main point of discussion, as well as how fully they are utilized. Increasing exports to Europe is a key goal of the Canadian government.

At the moment, oil exports from Canada to the U.S. are approximately 4 million barrels of oil per day, with a small portion reexported to other countries. And this number is poised to rise.

In addition to Enbridge's Mainline pipeline, TC Energy's Keystone pipeline carries another 590,000 barrels/day of crude oil to the United States. However, no comment was provided by TC Energy as of yet.

What is known in the meantime, is that Enbridge's liquids and natural gas pipelines are near or at capacity, but the company has begun examining potential ways to supply more energy to U.S. and European markets. That strategy includes using facilities on the Gulf Coast for crude oil and natural gas export as one of the most feasible options.

This situation unveils following the geopolitical crisis in Eastern Europe. The Canadian government and other nations vowed not to import Russian oil. European leaders agreed to cut their reliance on Russian fossil fuels on March 10.

Ukraine's war has shown all of the European countries that they cannot be dependent on Russian oil and gas for long, which has sped up discussions about transitioning from natural gas to hydrogen. However, this cannot be done overnight.

Together with industry, the Canadian government is also analyzing how pipeline flows can be increased in response to such violence, but the extent of what can be done will not be known for another week.

Despite the fact that Canada is willing to increase pipeline export capacity, many producers have been reluctant to adjust their spending plans, which could significantly increase output.

There are currently no LNG export terminals in Canada, but a consortium led by Shell Plc and Petroliam Nasional Bhd is building a large facility on the west coast that will be open by the middle of the decade.

This will come in handy, as even by the end of 2021 Canadian oil companies exported a record amount of crude from the U.S. Gulf Coast, mostly to big importers India, China, and South Korea.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

To Be or Not To Be: Bakken Assets Could Fetch $5 Billion for Exxon Mobil

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/55Blog_Exxon's_Bakken_wells_2022.png)

Exxon Mobil Corp. is weighing prospects of selling its assets in North Dakota’s Bakken, after gauging interest from potential buyers — 5 billion is the issue price, at least according to rumors. The price point came about after the news that the oilgiant is in the final round of hiring bankers to help launch the sale. Yet Exxon Mobil itself stays tight-lipped regarding the situation.

$690 Million Deal Moves Ahead: Crescent Energy to Complete Purchase of EP Energy's Uinta Assets

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/56Blog_Crescent_Bought_EP_Energy's_Uinta_Assets.png)

Crescent Energy closed the acquisition of Uinta Basin assets in Utah that were previously owned by EP Energy for $690 million, a few hundred million dollars below the original price. The accretive deal increases Crescent's Rockies position and adds significant cash flow and a portfolio of high-quality oil-weighted undeveloped sites. In addition to its acquired Uinta assets, Crescent's pro forma year-end 2021 provided reserves totaled 598 million boe, of which 83% was developed, 55% was liquid, and its provided PV-10 was $6.2 billion.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?