Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

Gulf Oil Operators Chevron, BP, Equinor, Shell Brace as Tropical Storm Rafael Threatens Production

Oil companies across the Gulf of Mexico are springing into action as Tropical Storm Rafael bears down, marking yet another disruption in a storm-laden season. BP, Chevron, Equinor, and Shell are evacuating offshore staff and preparing for potential impacts on their platforms, an all-too-familiar ritual for Gulf operators this year.

The Worst is Over: Gulf of Mexico Oil and Gas Production Nearly Restored After Hurricane Francine

The Gulf of Mexico’s oil and gas production is bouncing back quickly following the disruption caused by Hurricane Francine. According to a statement from the Bureau of Safety and Environmental Enforcement (BSEE) on Monday, nearly all of the region's energy output has been restored, signaling a significant recovery after the storm passed. As of Monday morning, about 12.18% of oil production and 16.02% of natural gas production in the Gulf remained shut down, according to operator reports. This marks a vast improvement from the peak of the storm’s impact when more than half of the region’s natural gas output and over 40% of its oil production were offline.

Massive Shutdown in U.S. Gulf of Mexico as Tropical Storm Francine Approaches

A significant portion of the U.S. Gulf of Mexico's oil and natural gas production has come to a halt as Tropical Storm Francine barrels toward Louisiana, threatening the region's crucial energy infrastructure. In what is shaping up to be one of the most impactful events for U.S. energy this year, approximately 24% of crude oil production and 26% of natural gas output in the Gulf are now offline, according to the U.S. Bureau of Safety and Environmental Enforcement (BSEE). Francine, with winds reaching 65 mph (100 kph), is currently situated 380 miles (610 km) southwest of Morgan City, Louisiana, and is expected to strengthen into a hurricane by the end of the day. The storm's trajectory is causing widespread disruptions to offshore operations in the Gulf, which plays a vital role in the country’s energy supply.

Gulf of Mexico: TotalEnergies Extracts First Oil from Anchor Field

TotalEnergies has announced the start of oil production from the Anchor field, located 225 km off the coast of Louisiana in the Gulf of Mexico. The Anchor field began development in December 2019 and is a joint project between TotalEnergies, which holds a 37.14% stake, and Chevron, the operator, which has the remaining 62.86%.

Exxon Mobil and the $60 Billion Deal That Changes Everything in Permian

Exxon Mobil recently completed its acquisition of Pioneer Natural Resources, a deal worth about $60 billion. This transaction, which is the biggest in shale oil history, significantly changes the competitive landscape in the Permian Basin, a major oil field. This marks Exxon Mobil's largest deal since its $84.4 billion merger with Mobil Corp. in 1999. With this acquisition, Exxon Mobil's production in the Permian Basin will double to 1.3 million barrels of oil equivalent per day.

Kinder Morgan Overview: 2022 vs 2023, Oil & Gas Wells, Pipelines, Terminals, Deals

Kinder Morgan stands as North America's top independent mover of petroleum products with around 2.4 million barrels daily across the continent. The bulk of this flow happens through its Products Pipelines division, which navigates gasoline, jet fuel, diesel, crude oil, and condensate through a network of about 9,500 miles of pipelines. Alongside, the company maintains roughly 65 liquid terminals that not only store these fuels but also blend in ethanol and biofuels for a green touch.

U.S. Oil and Gas Drilling 2023-2024 Report: Rigs, Onshore, Offshore Activity, Biggest Companies

In January 2024, the United States saw a mix of ups and downs in the number of active drilling rigs across its major oil shale regions and states. Starting with the shale regions, the Permian Basin led with a slight increase, reaching 310 rigs, which is 3 more than in December. The Eagle Ford in East Texas held steady with 54 rigs, unchanged from the previous month. Meanwhile, both the Haynesville and Anadarko regions saw a decrease by 2 rigs each, landing at 42 rigs. The Niobrara faced a larger drop, losing 4 rigs to settle at 27. On a brighter note, the Williston Basin and the Appalachian region saw increases of 2 and 1 rigs, respectively, resulting in counts of 34 and 41 rigs.

TOP 2022 vs 2023 Permian Producers Overview by Rextag

The Permian Basin, America's prime oil region, faced significant challenges during the COVID-19 pandemic. The industry saw a drastic reduction in rigs and fracking crews and had to close some operations as oil prices plummeted, leading to widespread restructuring. Now, the Permian is making a strong comeback. Over the last three years, exploration and production companies (E&Ps) have increased their drilling activities. They're focusing on spending wisely and maximizing returns to their investors. The Permian's role is crucial. It was projected to contribute over 5.98 million barrels of oil per day in December, making up about 62% of the total oil production in the Lower 48 states, as per the EIA.

Occidental to Streamline Operations with $20 Billion Western Midstream Sale?

Occidental Petroleum is looking into selling Western Midstream Partners. OXY focuses on natural gas pipelines in the U.S. and is worth around $20 billion, including its debt. This sale could help the company cut down its large debt of $18.5 billion, which grew due to buying other companies. Recently, Occidental agreed to buy CrownRock for $12 billion, adding more debt to its books. This comes after its huge $54 billion purchase of Anadarko Petroleum four years ago. The news about possibly selling Western Midstream made its shares go up by 5.7% to $30.81, reaching their highest value since July 2019. However, Occidental's shares fell by 1.6% to $59.56, as part of a wider drop among energy companies.

NOG Successfully Acquires Utica Shale and Delaware Basin Operations

Northern Oil and Gas (NOG) has successfully completed two acquisitions, investing $162.6 million in properties within the Utica Shale and the northern Delaware Basin. In November 2023, NOG ventured into the Utica Shale by acquiring interests from a private seller, including less than one producing well and slightly over one well in development, spanning several counties in Ohio. These areas, primarily operated by Ascent Resources, focus on extracting oil and gas from the Point Pleasant Formation and the Utica Shale, with the Ohio assets being a significant part of this strategy.

Hess Corp. Increases Drilling Activity Before Chevron Takeover

Hess Corp. is in the final stages of a major sale to Chevron, with increased drilling and production in the Bakken region noted in the last quarter. Hess announced its fourth-quarter net production in the Bakken reached 194,000 barrels of oil equivalent per day (boe/d), a slight increase from the third quarter's 190,000 boe/d and a significant 23% rise from the 158,000 boe/d seen in the fourth quarter of the previous year. This growth is attributed to more drilling and the impact of the previous year's severe winter weather.

Occidental, CrownRock Merger Under Regulatory Review: 2024 Update

CrownRock's 94,000+ net acres acquisition complements Occidental's Midland Basin operations, valued at $12.0 billion. This expansion enhances Occidental's Midland Basin-scale and upgrades its Permian Basin portfolio with ready-to-develop, low-cost assets. The deal is set to add around 170 thousand barrels of oil equivalent per day in 2024, with high-margin, sustainable production.

Talos Energy Confirms $1.29 Billion Takeover of QuarterNorth Energy

Houston-based Talos Energy Inc. has made a deal to buy QuarterNorth Energy Inc. for $1.29 billion. QuarterNorth is a company that explores and produces oil in the Gulf of Mexico and owns parts of several big offshore fields. This purchase will add more high-quality deepwater assets to Talos's business, which are expected to bring steady production and new opportunities for growth. The deal should immediately benefit Talos's shareholders and help the company reduce its debt faster.

Welcome 2024: A Look Back at 2023 Top Oil and Gas Sector Deals

2023 was quite a year for the oil and gas sector, with some big deals making the news. In the US, giants like ExxonMobil and Chevron grabbed headlines with their plans to acquire companies like Pioneer and Hess. Internationally, ADNOC wasn't left behind, expanding its reach as well. As we ring in the new year, let's recap the biggest oil and gas deals of 2023.

Christmas tree and Santa Against Permian Methane Emissions

Once upon a Christmas, Santa Claus, while checking his list, noticed something different. Far away in Texas, there was a place called the Permian Basin, not filled with snow, but with oil fields. These fields were letting out a gas called methane, which wasn't good for the air. Santa, always caring for our planet, decided this year he'd do something about it. So, he set off on a special journey, with his bag of toys and a plan to help the Earth. Let's join Santa on this unique adventure as he tries to make the Permian Basin a bit greener this Christmas.

Tenaris Acquires Mattr's Pipe Coating Division for $166 Million

Tenaris has successfully finalized the purchase of Mattr's Pipe Coating Division, previously known as Shawcor, for a total of $182.6 million. This figure includes working capital and $16.9 million in cash. Announced back on August 14, 2023, the acquisition has now received the green light from regulatory bodies in both Mexico and Norway.

Talos Energy and Repsol Join Forces in Gulf Exploration JV

alos Energy and Repsol have formed a partnership, each owning 50-50, to reexamine seismic data in a shared area to identify where to drill in the coming years. Tim Duncan, the CEO of Talos, sees this as a strategic use of land they acquired from EnVen Energy Corp to enhance its value. Talos Energy is putting to use the land they bought from EnVen Energy Corp for $1.1 billion. CEO Tim Duncan talked about this on November 7, explaining that it's a smart move because the government has delayed a big decision on new ocean drilling areas. By teaming up with Repsol, Talos plans to work on the land they already have, about 100,000 acres, so they don't have to wait for new permits.

Kinder Morgan Invests $1.8 Billion in South Texas Gas Infrastructure

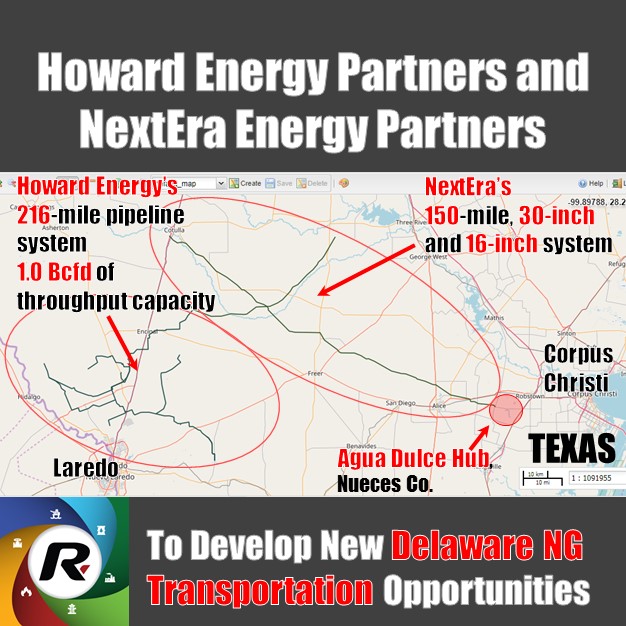

Kinder Morgan's strategic acquisition of STX Midstream from NextEra is a significant move to enhance its infrastructure capabilities in South Texas. The area is witnessing an upsurge in natural gas production and demand, particularly towards Mexico and the Gulf Coast markets. The 462-mile pipeline system, which is highly contracted with an average contract length of over eight years, is expected to generate about $181 million in EBITDA for 2023.

Mexico Pacific LNG: A New Export Era Anchored by Permian Gas

Natural gas from the U.S. Permian Basin is set to be the primary source for Mexico's Pacific's Saguaro Energía LNG facility. Located in Puerto Libertad, Sonora, the Saguaro Energía LNG export facility will feature three processing trains. The site is primed for potential expansion with plans for three additional trains of similar capacity. Its strategic Pacific Coast location offers a 55% shorter shipping route to Asia, providing significant savings and reduced carbon emissions.

Baker Hughes Confirms a Third Weekly Decline in US Oil and Gas Rigs

In a recent announcement, energy services firm Baker Hughes stated that U.S. energy companies have decreased the number of operating oil and gas rigs for the third successive week. This development marks the first such consistent reduction since early September. As of October 6, the count for oil and gas rigs, considered a precursor to future production levels, has seen a decline by four, positioning it at 619. This is the lowest figure recorded since February of the preceding year. The overall rig count has decreased by 143 or 19% when compared to last year's statistics.

LM Energy Unloads 130 Miles of Pipelines in New Mexico Oil Gathering Asset Sale

LM Energy Holdings is set to sell assets including over 130 miles of pipelines, terminals, and other facilities in Eddy and Lea, New Mexico, Delaware Basin. LM Energy Holdings LLC has concluded definitive agreements to divest subsidiaries and assets associated with its Touchdown Crude Oil Gathering System situated in Eddy and Lea counties, New Mexico. The purchasing entity and financial particulars remain undisclosed.

Civitas Makes $4.7B Entry into Permian Basin

Civitas Resources Expands into Denver-Julesburg Basin through $4.7B Cash and Stock Deals for NGP's Tap Rock and Hibernia. Civitas Resources has recently secured two definitive agreements to expand its presence in the Permian Basin's Midland and Delaware basins. The company will achieve this expansion through the acquisition of two private exploration and production companies, namely Hibernia Energy III LLC and Tap Rock Resources LLC. The total value of the deal, paid in both cash and stock, amounts to $4.7 billion. Both Hibernia Energy III LLC and Tap Rock Resources LLC are supported by NGP Energy Capital Management LLC. These acquisitions reflect the increasing demand for oil and gas reserves in the Permian Basin, with companies specializing in the region actively seeking new opportunities. Currently, Civitas Resources' primary production operations are focused in the Denver-Julesburg Basin (D-J Basin).

Chevron Announces Intent to Divest Oil and Gas Properties in New Mexico and Texas

According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas. As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets. Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

Permian Resources Secures a Major Deal in the Thriving Delaware Basin

Permian Resources bolsters dominance in the Delaware Basin with strategic land acquisitions, expanding its portfolio by over 5,000 net leasehold acres and 3,000 royalty acres. In a stunning display of growth and strategic maneuvering, Permian Resources Corp., based in Midland, Texas, has made waves in the first quarter by securing a series of deals worth over $200 million in the highly sought-after Delaware Basin. This move solidifies their position as a player in the region.

Riley Permian Secures $330 Million Acquisition in Thriving New Mexico: A Strategic Move with Promising Returns

In a big move for Riley Permian, the company has just closed a deal to acquire top-of-the-line oil and gas assets in the heart of New Mexico. The acquisition, which was made in February, saw Riley Permian snapping up these highly sought-after resources from none other than Pecos Oil & Gas LLC for $330 million.

Arena Energy Makes a Deal with Cox in GoM, Adding ca. 1,000 net boe/d to Arena's Total Production

On January 24 Independent E&P Arena Energy LLC acquired Cox Operating LLC's interests in the Eugene Island 330 and South Marsh 128 oil blocks. Cox Operating, based in Dallas, Texas, includes interests to Arena's existing ownership interest in the Gulf of Mexico fields, which it purchased from GOM Shelf LLC.

Talos Energy Plans to Close the EnVen Acquisition Soon: Stockholders to vote on $1.1B Deal on February 8

Talos Energy Inc. is closing its $1.1 billion purchase of private operator EnVen Energy. A special meeting for Talos’ stockholders to vote on the deal and other matters is set on February 8, according to a prospectus filed on January 11 with the Securities and Exchange Commission. Shareholders are being asked to approve the EnVen merger, which as the company considered in September would raise its Gulf of Mexico production up to 40%. According to a January 11 press release, Talos asserted that it anticipates closing the transaction soon after the meeting. Talos Energy Inc. supposes that adding EnVen would double its operated deepwater facility footprint, extending key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with the company operating more than 75% of the acreage it holds interests in. Talos is one of the largest independent operators in the U.S. Gulf of Mexico, with production operations, prospects, leases, and seismic databases spanning the basin in both Deep Water and Shallow Water. The company aims to actively grow through a balanced focus on asset optimization, development, and exploration while also seeking to add to its portfolio through acquisitions and business development.

Talos Energy Buys EnVen for $1.1 Billion to Expand

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%. The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint. EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream. Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

The Deal between TC Energy and Mexican Utility is Concluded to Build $4.5 Billion Gas Pipeline

TC Energy Corp. had reached a deal with a Mexican state utility to build a $4.5 billion natural gas pipeline, according to a company release on Aug. 4. The natural gas to Mexico's central and southeast regions will be furnished by the 1.3 bcfd offshore Southeast Gateway Pipeline, the Canadian pipeline operator said. Due to the most serious trade spat with #Mexico over the United States-Mexico-Canada Agreement, Canada and the United States made the deal with Comisión Federalde Electricidad (CFE). TC Energy and CFE in conjunction with the alliance also took the final investment decision (FID) on the 715-km Southeast Gateway. The pipeline will serve southeast Mexico, starting onshore in Tuxpan, Veracruz, then proceeding offshore, making landfall at Coatzacoalcos, Veracruz, and Dos Bocas, Tabasco.

No More Gas Flaring: the Permian's Double E Pipeline is brought into service in West Texas

Permian Basins gas infrastructure boom: Summit Midstream puts into service a new pipeline system, aimed at reducing gas flaring in the area. Besides ecological concerns, the project will also transport almost 1,5 billion cubic feet of gas per day — enough to supply 5 million U.S. homes every day. According to Federal Energy Statistics, the project cost a whopping $450 million.

Pivot to the South: LNG Plants Under Development by Sempra Energy in Louisiana and Mexico

Sempra Energy would develop the 4.0-mmtpa Vista Pacifico LNG export facility located next to the company's Terminal for Refined Products in Topolobampo in a bid to provide gas from the Permian basin in Texas and New Mexico to Asian markets. Once marketing begins, Sempra's management expects Vista Pacifico to be oversubscribed.

.jpg)

- Occidental, CrownRock Merger Under Regulatory Review_ 2024 Update.png)

Welcome 2024_ A Look Back at 2023 Top Oil and Gas Sector Deals.png)

- Christmas tree and Santa Against Permian Methane Emissions.png)

Tenaris Acquires Mattr's Pipe Coating Division for $166 Million.png)

Gulf Mexico Oil and Gas Map_ 2023 Review.png)

.png)