Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

There is a new guy on the block: Penn Virginia rebrands to Ranger Oil

10/11/2021

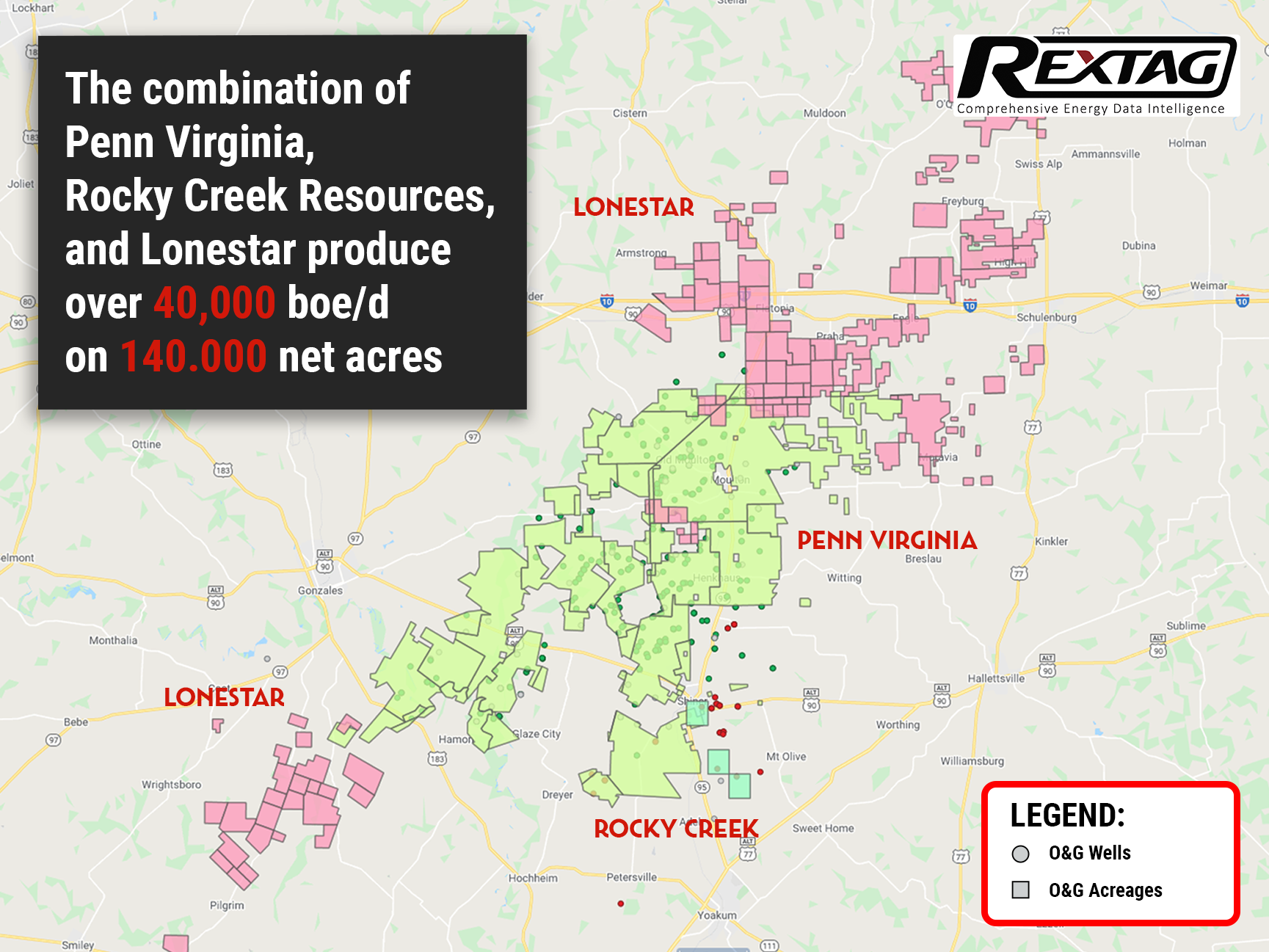

Following the close of the Lonestar acquisition, Penn Virginia Corp. plans to rename the combined company to Ranger Oil Corp., shifting its energy development in Texas towards safer and more efficient oil and gas operations.

This Texas oil & gas giant emerged as an Appalachian coal company in the late 1800s. Over time, the company evolved into a gas and oil manufacturer with assets largely in shale basins. And after the acquisition of Lonestar and Rocky Creek Resources within the past year, they decided to concentrate on Eagle Ford shale, reinventing itself and its values under the new name — Ranger Oil.

The company's consolidated assets now amount to over 140,000 net acres strategically positioned in the Eagle Ford play of south Texas.

It is expected that the company will continue with the two rig programs it operated before the signing of the $370 million merger agreement with Lonestar. Taking this rapid rate of development into account, CapEx is expected to be between $65 million and $75 million in the fourth quarter.

Along with Virginia's expansion through acquisitions, the management team also made a few changes, which positively impacted the company's operational and financial strength. Therefore, from early 2020 through the first half of 2021, Penn Virginia achieved the highest EBITDA margin per boe among all U.S. independent oil and gas companies.

This majorly happened because of the companies balance sheet extensive transformation: by bringing in significant equity capital from an experienced oil and gas equity group and issuing senior unsecured notes to extend maturities. Thus helping Virginia to create an estimated 1.5x LTM leverage.

It is anticipated that Ranger Oil Corp. will rebrand officially on Oct. 18, with the full rebranding to be complete by the year-end of 2021.

Concerning the strategy, the company will continue to leverage operational and capital efficiency to generate superior returns and continue its long-term free cash flow generation track record, which it has maintained every quarter since fourth-quarter 2019. At current strip prices, Ranger is projected to produce over $200 million in free cash flow in the next 12 months.

As Ranger, the company also plans to continue its disciplined approach to potential consolidation opportunities while maintaining an extremely liquid balance sheet, all the while pledging to achieve a leverage ratio of at least 1.0 times in the next four quarters.

In addition to these operational improvements, Ranger plans to grow its dominance by drilling longer laterals, creating more wells per pad, and utilizing enhanced completions techniques, hoping to grow in dominance and establish itself as an ESG leader in the industry.

Additionally, due to the merger closing, Lonestar's swapped hedge volumes will be assumed by the company, and most of them will be reset to reflect current market pricing. Although there may be no material impact on the Ranger's leverage metrics, the reset is expected to increase the company's free cash flow and adjusted EBITDAX going forward.

Starting Oct. 18, Ranger Oil will trade under the NASDAQ ticker ROCC.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

A $2 billion deal saw Dominion Energy sell Questar Pipelines to Southwest Gas

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Dominion-Energy-sell-Questar-Pipelines-to-Southwest-Gas.png)

A good asset will not sit on the market for long. After a deal with Berkshire Hathaway fell through, Dominion Energy managed to secure another one for Questar Pipelines in a drop of a hat. And get that, it is better than the former one by more than half a billion! Although not everyone is happy with such decisions, it seems that even Carl Icahn’s complaints won't be able to sway Southwest Gas Holdings’ decision. Though we will have our eyes peeled in any case… If everything goes as planned, a $2 billion deal will be closed before the end of the year.

The Hunting Season Is Not Over Yet: Exxon Mobil makes a $400 million commitment to Wyoming's carbon capture

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Exxon_Mobil_carbon_capture_storage.png)

Carbon footprint reduction is a new hot trend: Exxon Mobil makes a $400 million investment into its LaBarge facility to expand its carbon capture and storage capabilities by another million metric tons of CO2. Operational activities could begin as early as 2025 after a final investment decision is made in 2022. At present, about 20% of all CO2 captured worldwide each year is captured at the LaBarge. However, as one of the largest of the world's Big Oil companies, it is not the only project in Exxon's pipeline: aside from CCS capabilities, the LaBarge is one of the world's largest sources of helium, producing approximately 20% of global supply

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?