Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Continental Resources Raises Dividends Following a Quarter of Profit

02/21/2022

As a recovery in economic activity and travel boosted oil prices to multi-year highs, shale producer Continental Resources Inc posted a fourth-quarter profit that surpassed Wall Street expectations.

In general, for the last three months of 2021, world crude oil prices averaged $80 per barrel as demand recovered from a pandemic-induced crash. Results of such a hike are pleasing to the eye: a barrel of crude in the U.S. is currently trading for close to $95 a barrel.

In response to this, Continental Resources' adjusted average net sales price in the fourth quarter rose to $55.27 per barrel of oil equivalent (boe) — easily doubling the numbers of the year prior.

After pumping out 160,600 barrels of oil per day (bopd) in 2021, the company set its full-year target to average between 195,000 to 205,000 bbl/d of oil. And in order to achieve this, purchased near the end of the last year Pioneer's Delaware Basin position in the Permian area (covering approximately 92,000 net acres in Pecos, Reeves, Ward, and Winkler Counties with net production of approximately 50,000 boe/d) will come in handy.

It is estimated that natural gas will be produced at a rate of 1.04 billion to 1.14 billion cubic feet per day (cfpd) in 2022.

Aiming to boost the rates, Continental already forecasted, that it will spend $2.3 billion in the coming year, including an increase of 15% in legacy costs in Bakken and Anadarko, as well as a rise of $500 million related to its Permian acquisition and the purchase of Chesapeake Energy assets in Wyoming.

To compare, in 2021 the company’s capital expenditures totaled just $1.56 billion.

And it’s not just a bunch of empty promises: last week Continental Resources raised its quarterly dividend by 15% to 23 cents per share. In addition, the company will increase its share repurchase program from $1 billion to $1.5 billion.

The market reported an adjusted net income for the Continental of $651 million, or $1.79 per share during the quarter, beating analysts' expectations per share by no small margin of 0.09 cents. While it may seem not that impressive, during the same period a year prior the company reported a loss of $82 million, or 23 cents per share — a great comeback!

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Up to $1.5 Billion for Percussion Petroleum in the Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/75Blog_Percussion_Petroleum_Delaware_Assets_on_Sale_07_2022.png)

Around 25,000 net acres in the Permian are being sold by Percussion Petroleum II, looking to fetch up to $1.5 billion, as some sources bet on rising oil prices to pocket more than double what it paid in 2021. The company spent $375 million plus contingent payments a year ago to buy the bulk of its assets in one of the most prolific crude-producing areas in the U.S. from Oasis PetroleumInc. The oil prices increased to triple digits and buyers wanted to gain a toehold in the basin, whereas backers of private shale companies such as Percussion use it as a chance to exit their investments with big profits. Remarkably, U.S. crude oil futures have grown about 50% to approximately $109/bbl since June 29, 2021, when Percussion closed its deal with Oasis.

Continental Resources Profile: 2022 vs 2023 Overview with 2024 M&A Moves

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/259_Blog_Continental's Wells in Permian, Greater Anadarko and Arkoma.png)

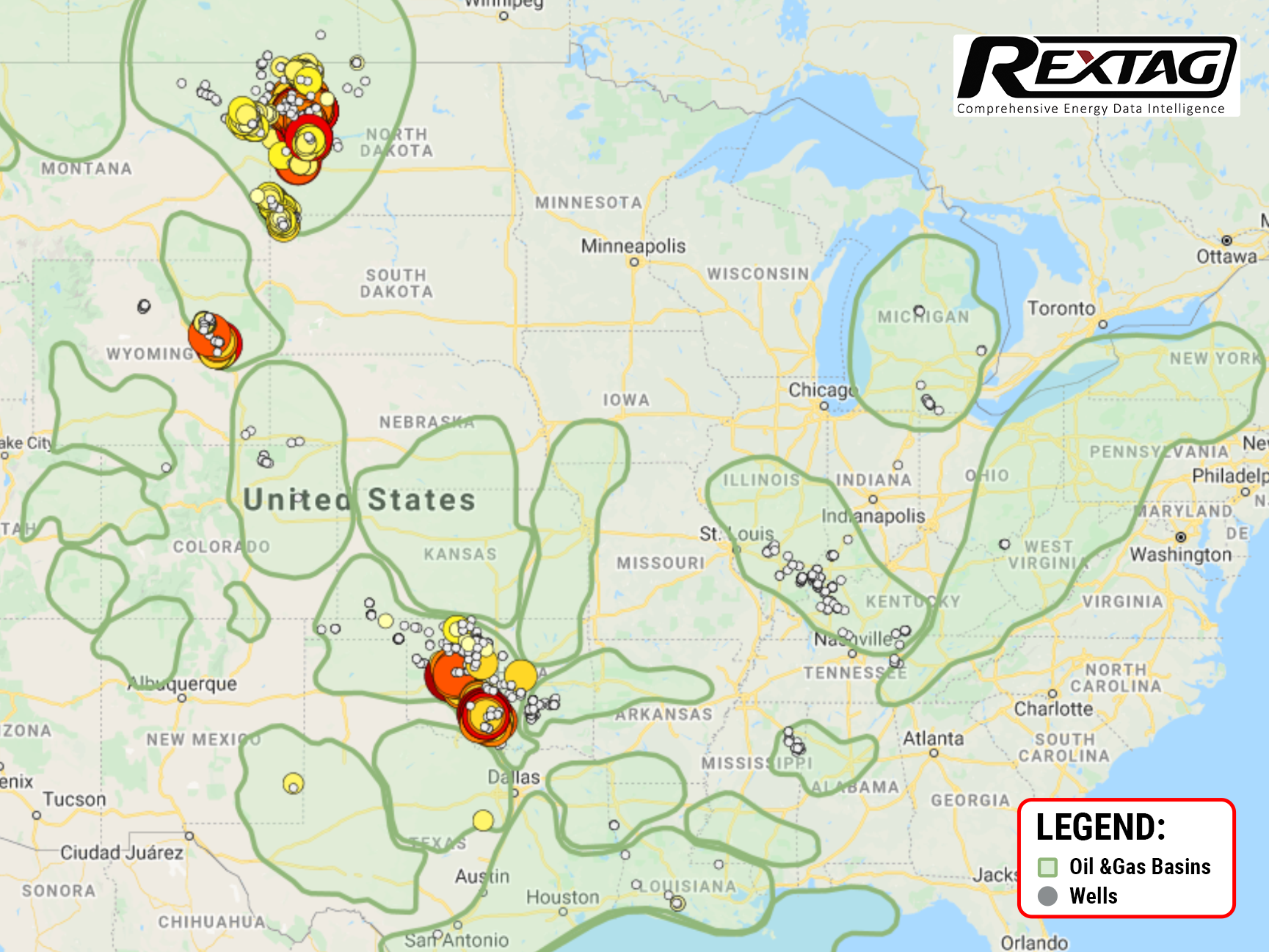

Continental Resources is actively involved in innovative energy projects to enhance oil production and environmental sustainability. The company has invested $250 million in the world's largest carbon capture and sequestration (CCS) project, a partnership with Summit Carbon Solutions. This project aims to capture CO2 from industrial sources in the Midwest and store it in North Dakota's Williston Basin, where Continental has significant experience and presence. In the Powder River Basin, Continental has expanded its operations by acquiring 400,000 acres. It is now the second-largest producer in this area, achieving high initial productivity from its Niobrara wells. The company aims to develop a competitive program across its portfolio, drawing on its successes in the Williston Basin. In the Williston Basin, known for its Bakken play, Continental is enhancing oil recovery through innovative well completion designs and exploring the potential of refracturing existing wells. These efforts are part of Continental's broader strategy to increase oil extraction efficiency and contribute to environmental sustainability.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?