Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

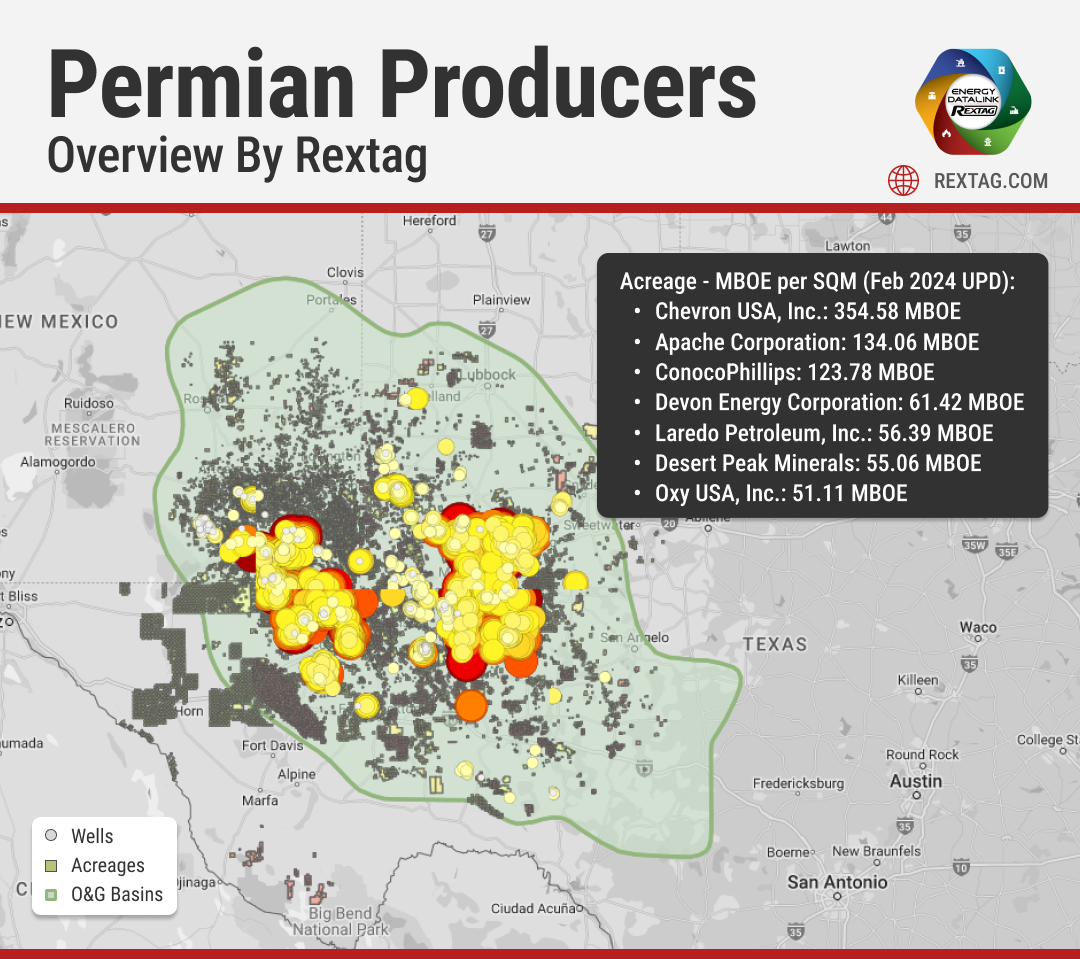

TOP 2022 vs 2023 Permian Producers Overview by Rextag

The Permian Basin, America's prime oil region, faced significant challenges during the COVID-19 pandemic. The industry saw a drastic reduction in rigs and fracking crews and had to close some operations as oil prices plummeted, leading to widespread restructuring. Now, the Permian is making a strong comeback. Over the last three years, exploration and production companies (E&Ps) have increased their drilling activities. They're focusing on spending wisely and maximizing returns to their investors. The Permian's role is crucial. It was projected to contribute over 5.98 million barrels of oil per day in December, making up about 62% of the total oil production in the Lower 48 states, as per the EIA.

Significant Rise in U.S. Crude Oil and Gasoline Inventory Levels

This week, the American Petroleum Institute (API) reported that U.S. crude oil stocks increased by 7.168 million barrels, ending February 16. This rise exceeded analysts' expectations of a 4.298 million barrel increase. Last week, the API noted an 8.52 million barrel jump in crude inventories.

The End of Easy Oil Money for Saudi Arabia?

Last year, Saudi Arabia's sovereign wealth fund spent more than any other country in the world, making up a quarter of the $124 billion total spent by such funds globally. The kingdom has been pouring money into huge projects both inside and outside its borders, including the ambitious $500-billion Neom City and launching a new airline. Due to this massive spending spree, the Public Investment Fund saw its cash and assets decrease from over $105 billion in 2022 to around $37 billion by September, as the Wall Street Journal reported. With oil prices hovering around $80 per barrel, financing these large-scale projects is becoming more difficult.

Occidental to Streamline Operations with $20 Billion Western Midstream Sale?

Occidental Petroleum is looking into selling Western Midstream Partners. OXY focuses on natural gas pipelines in the U.S. and is worth around $20 billion, including its debt. This sale could help the company cut down its large debt of $18.5 billion, which grew due to buying other companies. Recently, Occidental agreed to buy CrownRock for $12 billion, adding more debt to its books. This comes after its huge $54 billion purchase of Anadarko Petroleum four years ago. The news about possibly selling Western Midstream made its shares go up by 5.7% to $30.81, reaching their highest value since July 2019. However, Occidental's shares fell by 1.6% to $59.56, as part of a wider drop among energy companies.

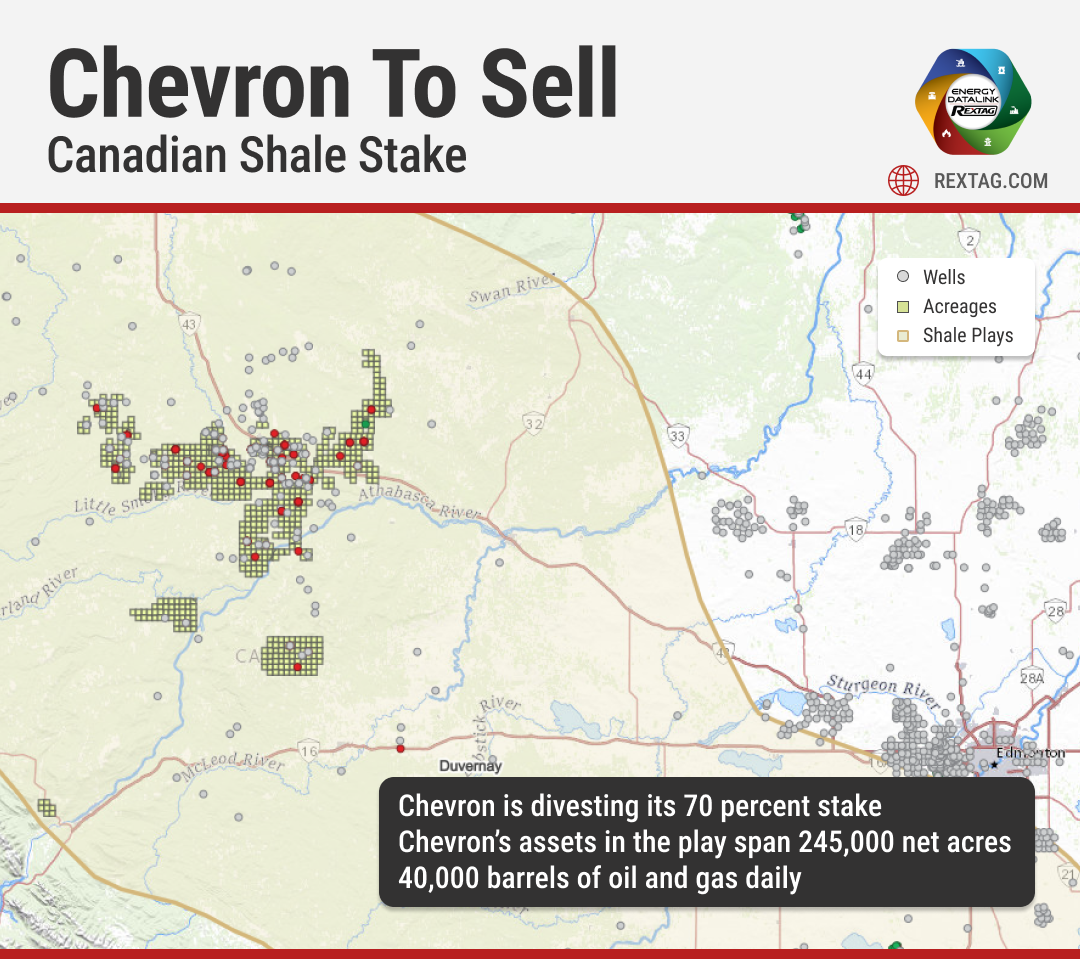

Why Canada's Oil Giants Are Skipping the Global M&A?

The Canadian oil and gas sector announced 27 M&A deals in the last quarter of 2023, totaling $4.2 billion in value. The biggest deal of the quarter was Pembina Pipeline's $2.3 billion acquisition of several companies including Alliance Pipeline and Aux Sable Canada. Compared to the previous quarter, the total value of M&A deals in Canada grew by 20% from $3.5 billion and jumped 95% compared to the same quarter the previous year. However, the number of deals dropped slightly by 4% from the previous quarter and was 23% less than the year before.

Permian Basin Giants: 2024 Net Production Forecasts

Rystad Energy predicts that the merged company of Diamondback Energy and Endeavor Energy will produce 819,500 barrels of oil per day in the Permian Basin in 2024. Rystad, an energy research and business intelligence company from Norway, expects the ExxonMobil-Pioneer Natural Resources merger to lead the Permian in total net production for the year, with a projection of nearly 1.4 million barrels per day. Notably, about 53% of this production will be oil. Chevron is set to produce slightly more than Diamondback-Endeavor, with Occidental-CrownRock following closely. ConocoPhillips ranks fifth, with a production forecast of just under 800,000 barrels per day. Chevron's production is 47% oil, while Diamondback-Endeavor and ConocoPhillips have 57% oil in their mix, and Occidental-CrownRock is just below 50%.

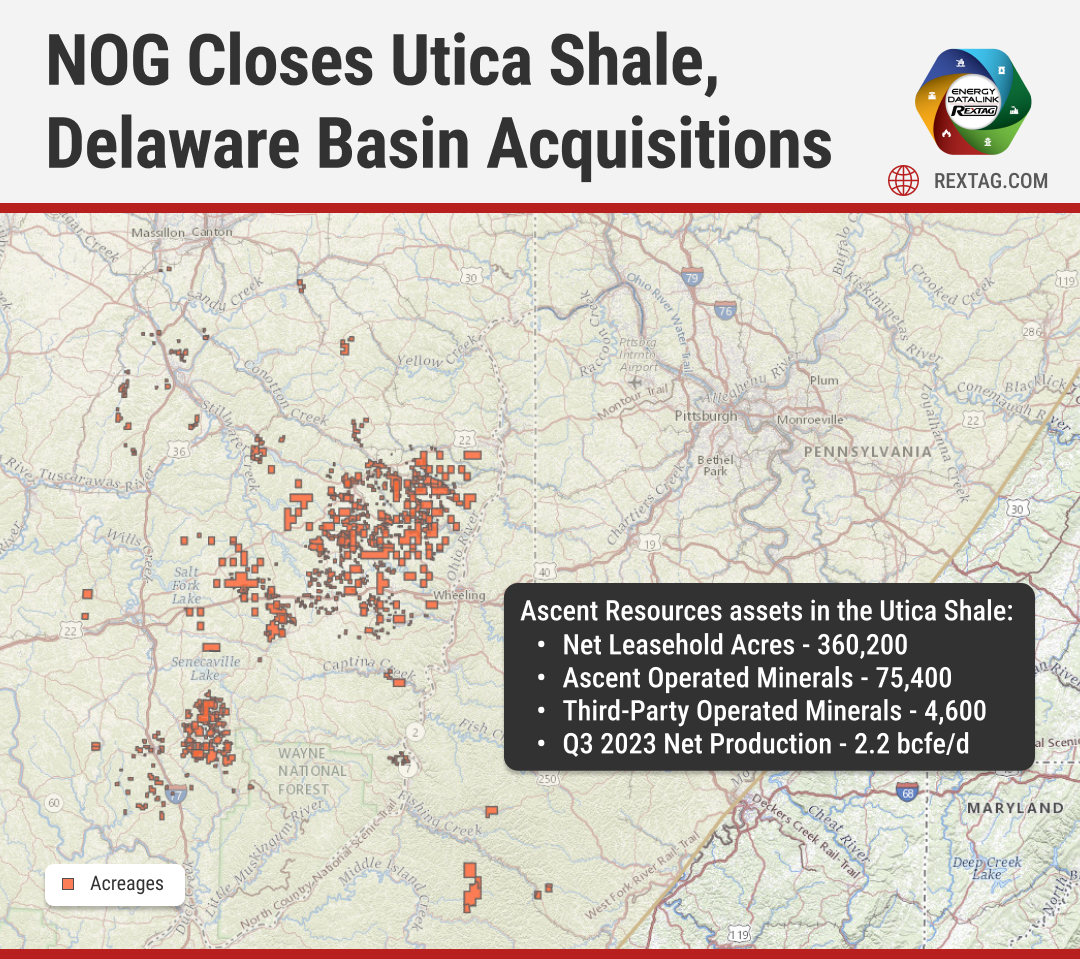

NOG Successfully Acquires Utica Shale and Delaware Basin Operations

Northern Oil and Gas (NOG) has successfully completed two acquisitions, investing $162.6 million in properties within the Utica Shale and the northern Delaware Basin. In November 2023, NOG ventured into the Utica Shale by acquiring interests from a private seller, including less than one producing well and slightly over one well in development, spanning several counties in Ohio. These areas, primarily operated by Ascent Resources, focus on extracting oil and gas from the Point Pleasant Formation and the Utica Shale, with the Ohio assets being a significant part of this strategy.

From Peanuts to Richest Oil Tycoon in America: Autry Stephens Built an Empire, his net worth is...

Diamondback Energy is buying Autry Stephens's company, Endeavor Energy Resources, for $26 billion. This deal (learn more) will make Stephens the richest oil driller in the U.S., with a $25.9 billion fortune, jumping him up to 64th place on a list of the world's richest people. He'll be wealthier than other big names in oil, like Harold Hamm with $15.4 billion and Jeff Hildebrand with $17 billion. However, Charles and Julia Koch are still richer, but their money comes from different businesses, not just oil.

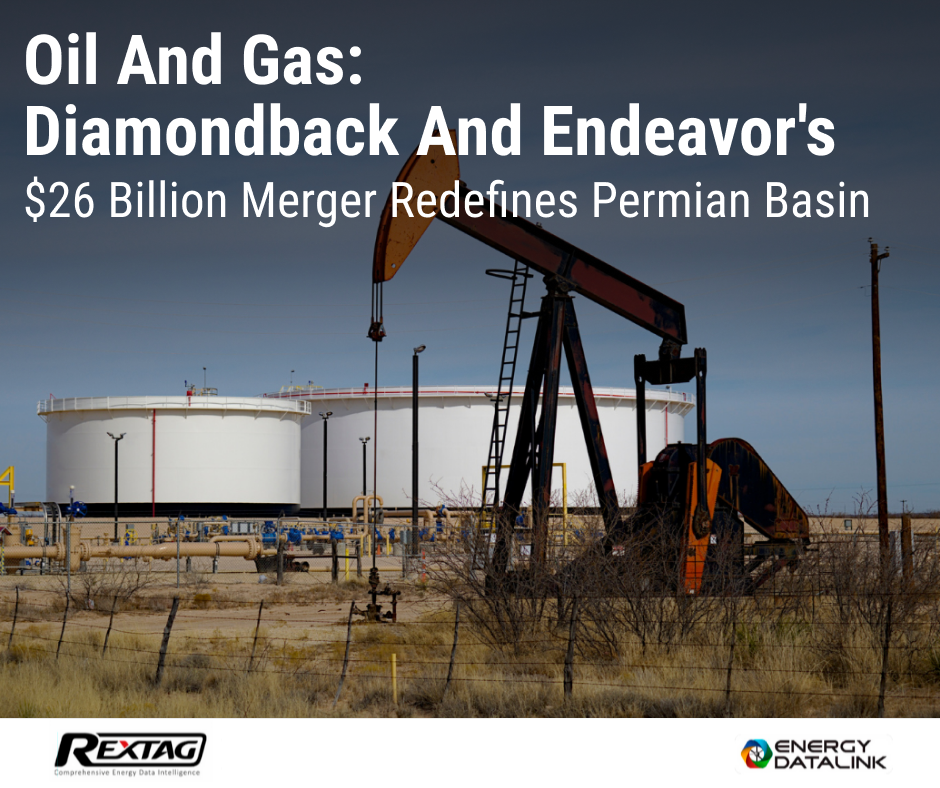

Oil and Gas: Diamondback and Endeavor's $26 Billion Merger Redefines Permian Basin

Diamondback's buyout of Endeavor happened about four months after ExxonMobil and Chevron made huge deals, with Exxon buying Pioneer Natural Resources for $59 billion and Chevron getting Hess for $53 billion. Even though 2023 was a slow year for company buyouts and mergers, with the total deals at $3.2 trillion (the lowest since 2013 and 47% less than the $6 trillion peak in 2021), the energy sector was still active. Experts think this buzz in energy deals is because these companies made a lot of money in 2022.

Select Water Solutions Acquires Haynesville and Rockies Assets

Select Water Solutions, a leader in water and chemical services for the energy industry has bought key water assets in the Haynesville Shale and Rockies for $90 million. This deal adds 450,000 barrels per day of capacity with disposal wells and treatment facilities, boosting Select's operations.

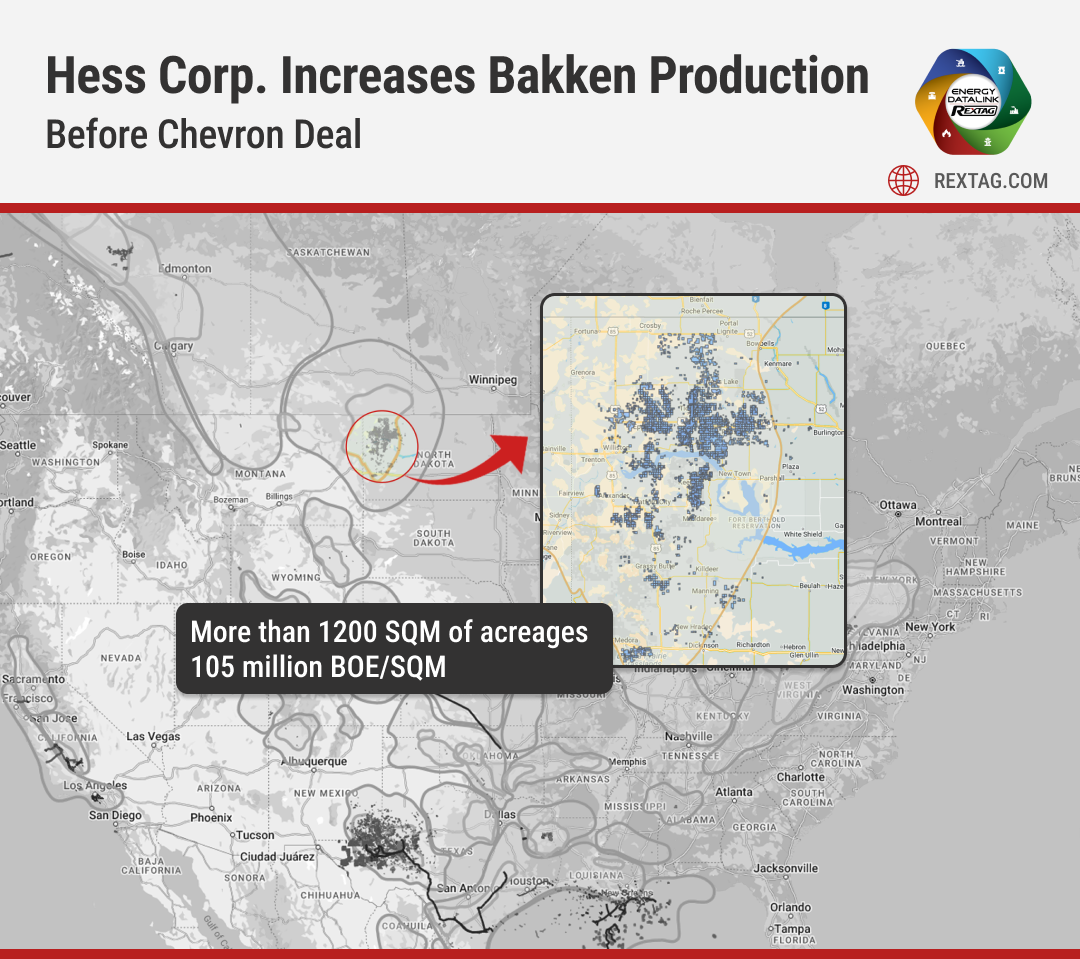

Hess Corp. Increases Drilling Activity Before Chevron Takeover

Hess Corp. is in the final stages of a major sale to Chevron, with increased drilling and production in the Bakken region noted in the last quarter. Hess announced its fourth-quarter net production in the Bakken reached 194,000 barrels of oil equivalent per day (boe/d), a slight increase from the third quarter's 190,000 boe/d and a significant 23% rise from the 158,000 boe/d seen in the fourth quarter of the previous year. This growth is attributed to more drilling and the impact of the previous year's severe winter weather.

Santander, Lloyds Implicated in Helping Iranian Entity Sidestep Western Sanctions

A state-owned petrochemical company from Iran was operating from an office located near Buckingham Palace. Reports suggest that Santander UK and Lloyds Banking Group, two big UK banks, are involved in managing accounts for companies that reportedly helped Iranian organizations avoid US sanctions. These banks are said to have supported companies linked to an Iranian petrochemical company, which has been facing sanctions from Western countries since 2018.

Bakken's Tipping Point: Grayson Mill's Potential Fall After Chevron-Hess

The Permian Basin, a big oil area, is not seeing as many deals as before because lots of companies have already joined together. Now, experts think these companies might start looking for new places to invest in the U.S. One area getting attention is the Bakken play. Chevron Corp. has just made a big step there by buying Hess Corp. for $60 billion. Another company, Grayson Mill Energy, which got some help from a Houston investment firm EnCap Investments LP, might also be up for sale soon, worth about $5 billion.

Occidental, CrownRock Merger Under Regulatory Review: 2024 Update

CrownRock's 94,000+ net acres acquisition complements Occidental's Midland Basin operations, valued at $12.0 billion. This expansion enhances Occidental's Midland Basin-scale and upgrades its Permian Basin portfolio with ready-to-develop, low-cost assets. The deal is set to add around 170 thousand barrels of oil equivalent per day in 2024, with high-margin, sustainable production.

_Select Water Solutions Bolts On Haynesville, Rockies Assets for $90MM.png)

Blog_Grayson Mill acquired Ovintiv's Bakken assets for $825M in 2024.png)

- Occidental, CrownRock Merger Under Regulatory Review_ 2024 Update.png)