Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Black Bear Roars with Success: Mississippi Gas Gathering Assets Sold

07/03/2023

Skye MS LLC purchased a package deal from Black Bear, which included over 120 miles of natural gas pipelines and eight active metered locations.

Black Bear Transmission LLC, based in Houston, successfully finalized the sale of gas gathering assets owned by BBT Mississippi LLC (BBT MS) to Skye MS LLC of Columbia, Mississippi. The specific amount of the transaction remains undisclosed.

BBT MS is the proud owner and operator of a fee-based, natural gas transmission system that efficiently supplies gas to utility, industrial, and power generation customers. It facilitates the connection of wellhead production in Mississippi to regional long-haul pipelines.

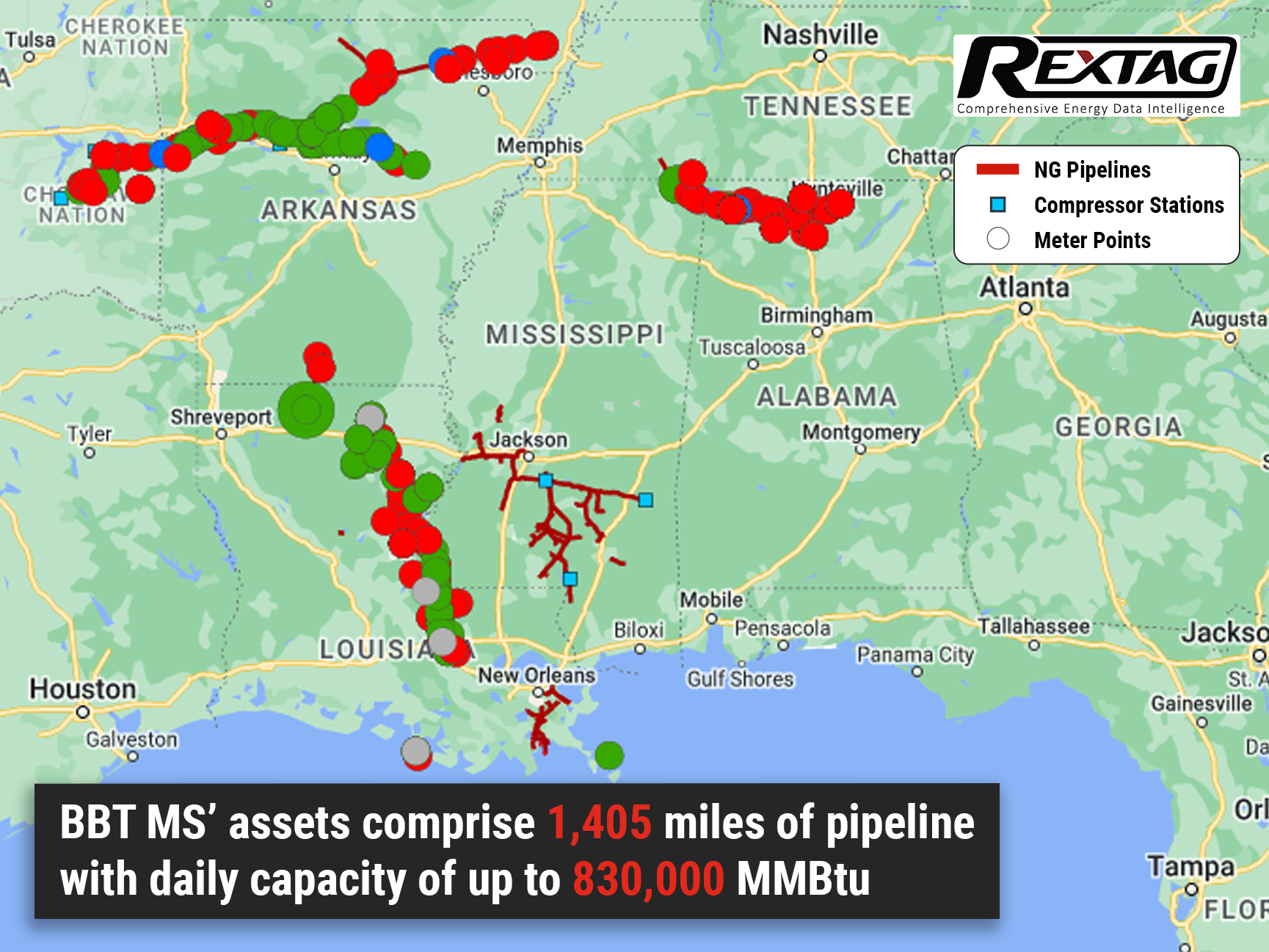

Based on the information available on Black Bear's website, BBT MS boasts an extensive asset portfolio, which includes:

- 1,405 miles of pipeline with a daily capacity of up to 830,000 MMBtu.

- The system is equipped with 8,101 horsepower of compression and has established 20 interstate pipeline connections.

- This asset sale encompasses a remarkable package, including over 120 miles of natural gas pipelines and eight operational metered locations.

- Transfer of over 700 miles of supply-driven gathering pipelines, along with 20 compressors and 250 metering stations.

Scott Langston, the senior vice president and chief commercial officer of Black Bear, highlighted the company's successful track record of transferring significant assets over the past three years.

“We will continue to identify and advance all opportunities to improve our business via corporate development and organic growth initiatives,” he said.

Divestiture in BBT MS Transaction

Black Bear CEO Rene Casadaban reiterates commitment to core business and safe, reliable service

In an ongoing effort to streamline their pipeline portfolio, Black Bear CEO Rene Casadaban emphasizes the significance of the BBT MS transaction. The divestment of non-core, production-focused assets aligns with the company's mission to maintain and expand their market-driven natural gas transmission network.

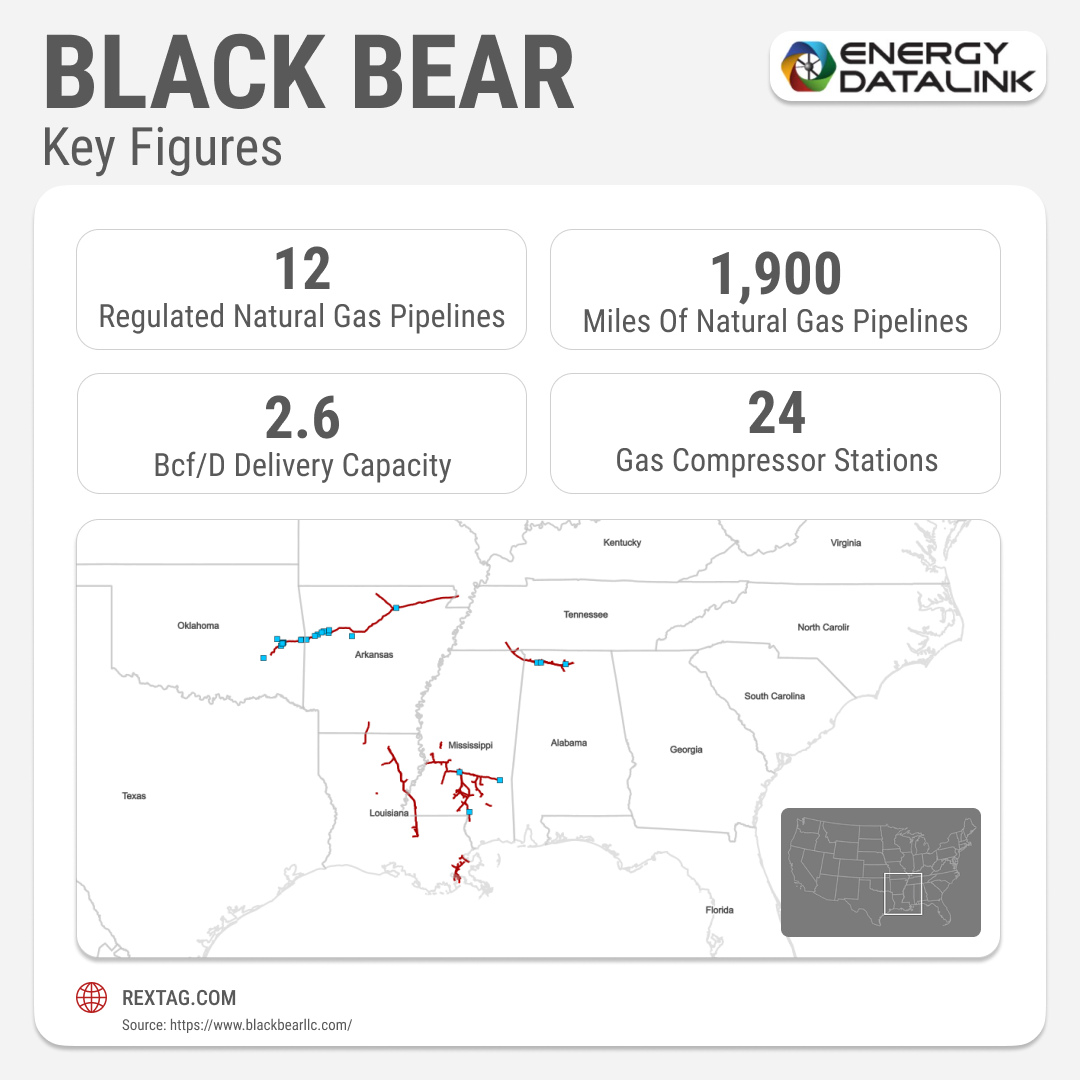

With ownership of 12 regulated natural gas pipelines spanning over 1,900 miles, Black Bear Transmission boasts a remarkable total delivery capacity exceeding 2.6 Bcf/d. These pipelines are seamlessly integrated into 18 major long-haul pipelines, effectively supplying customers in Alabama, Arkansas, Louisiana, Mississippi, Missouri, Oklahoma, and Tennessee.

About Black Bear Transmission

- Black Bear Transmission, LLC is a natural gas transportation company based in Houston, TX.

- They transport and deliver natural gas to utility, power generation, and industrial customers in the Southeast United States.

- The company owns and operates 12 regulated natural gas pipelines spanning over 1,900 miles.

- The total delivery capacity of these pipelines is more than 2.6 billion cubic feet (Bcf) per day.

- Black Bear's pipelines are connected to 18 major long-haul pipelines, ensuring a reliable gas supply to customers across seven states: Alabama, Arkansas, Louisiana, Mississippi, Missouri, Oklahoma, and Tennessee.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Diamondback Wraps Up Permian Divestitures, Sets Sights on Midstream Deals

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/156Blog_Diamondback Closes Permian Divestitures_ Eyes More Midstream Sales.png)

Diamondback Energy is on a roll! In the first quarter, they made impressive strides towards their goal of divesting $1 billion in non-core assets by year-end. They successfully sold their upstream and midstream assets, marking a significant achievement.

Crescent Energy Boosts Portfolio with Eagle Ford Acquisition: Expands Non-Operated Assets

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/158Blog_Crescent will acquire Mesquite Energy Incs assets.png)

Big announcement! Crescent Energy is set to bolster its inventory in the play by acquiring operated and working interests from Mesquite Energy. Crescent Energy Co. seals a $600 million cash deal to acquire assets in the Eagle Ford Shale from Mesquite Energy Inc. (formerly Sanchez Energy).

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?