Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

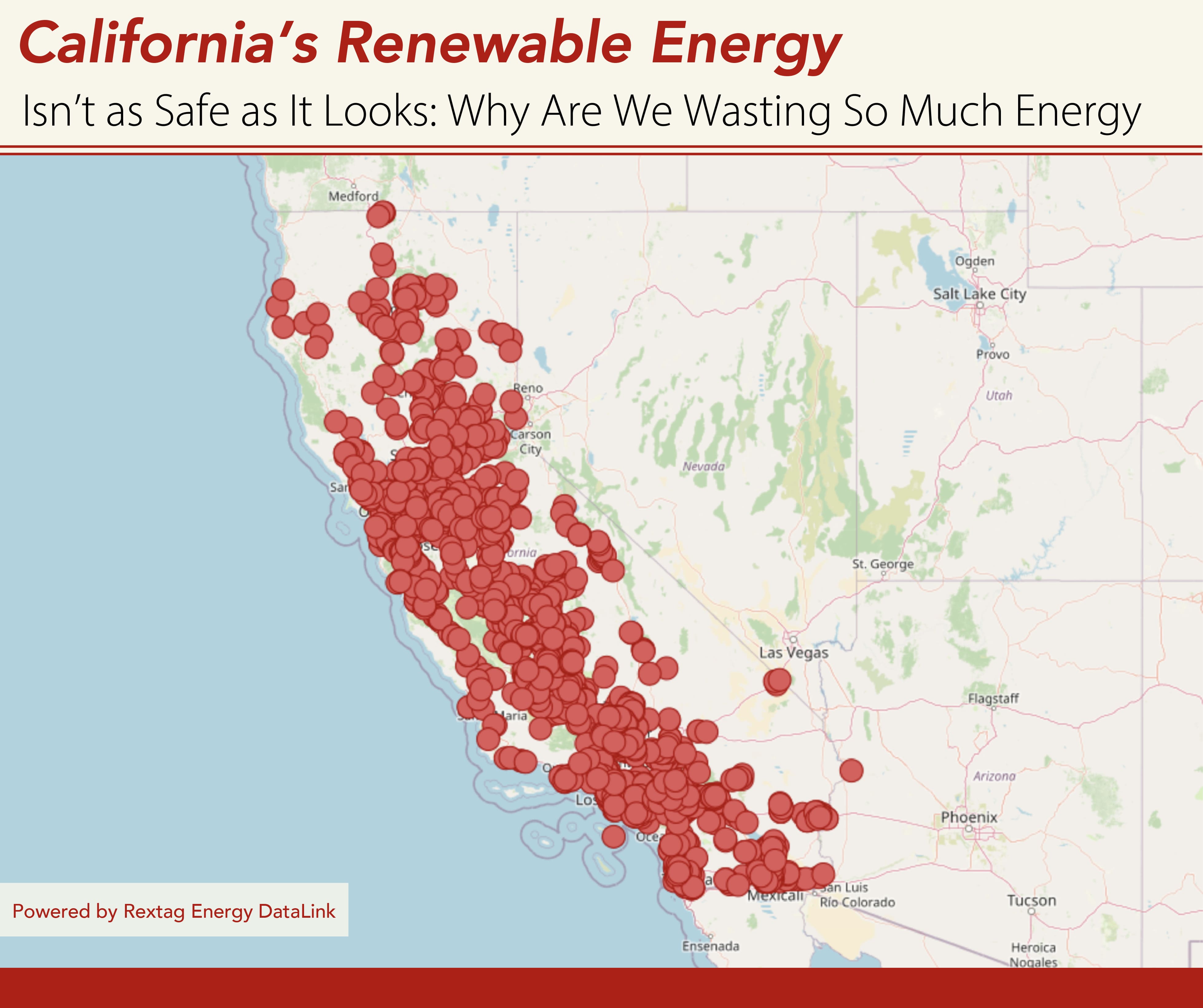

California’s Renewable Energy Isn’t as Safe as It Looks: Why Are We Wasting So Much Energy?

California has long been at the forefront of renewable energy in the United States, from its vast solar farms to its growing battery storage capacities. But beneath the headlines of a "clean energy revolution" lies a complex reality—one shaped by ambitious targets, grid challenges, and the everyday experiences of Californians grappling with rising energy costs and increasing grid instability. As California pushes towards its 100% clean energy goal, the road is full of both promise and pitfalls.

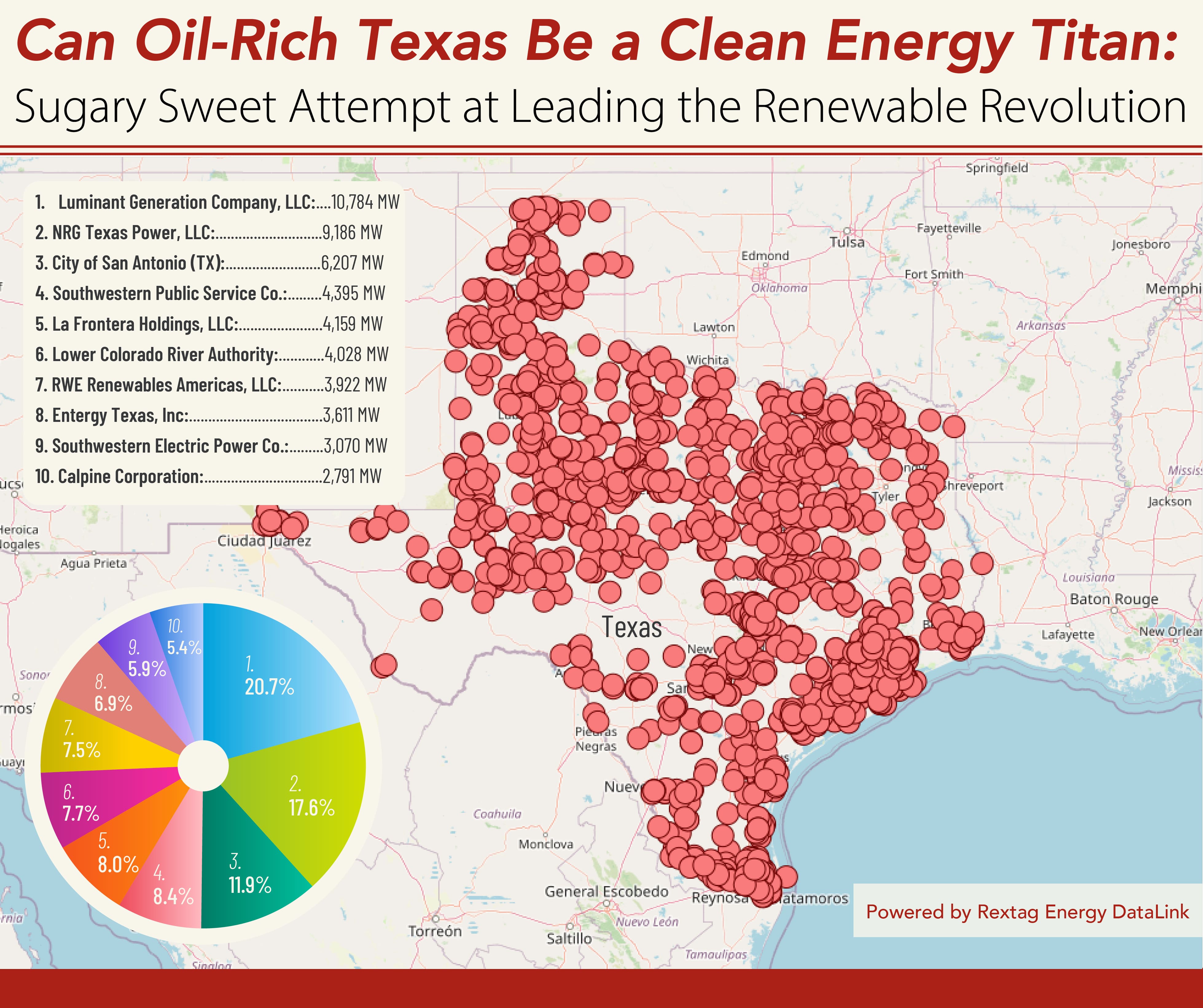

Can Oil-Rich Texas Be a Clean Energy Titan: Sugary Sweet Attempt at Leading the Renewable Revolution

Texas is taking bold steps toward a future powered by clean energy. Once known mainly for its oil and gas, the state is now a leader in wind, solar, and battery storage. But as electricity demand grows, so do the challenges of balancing energy needs with infrastructure limits. Here’s a look at how Texas is transforming and what hurdles lie ahead + find out who works with Facebook’s parent company Meta on new technology across the U.S.

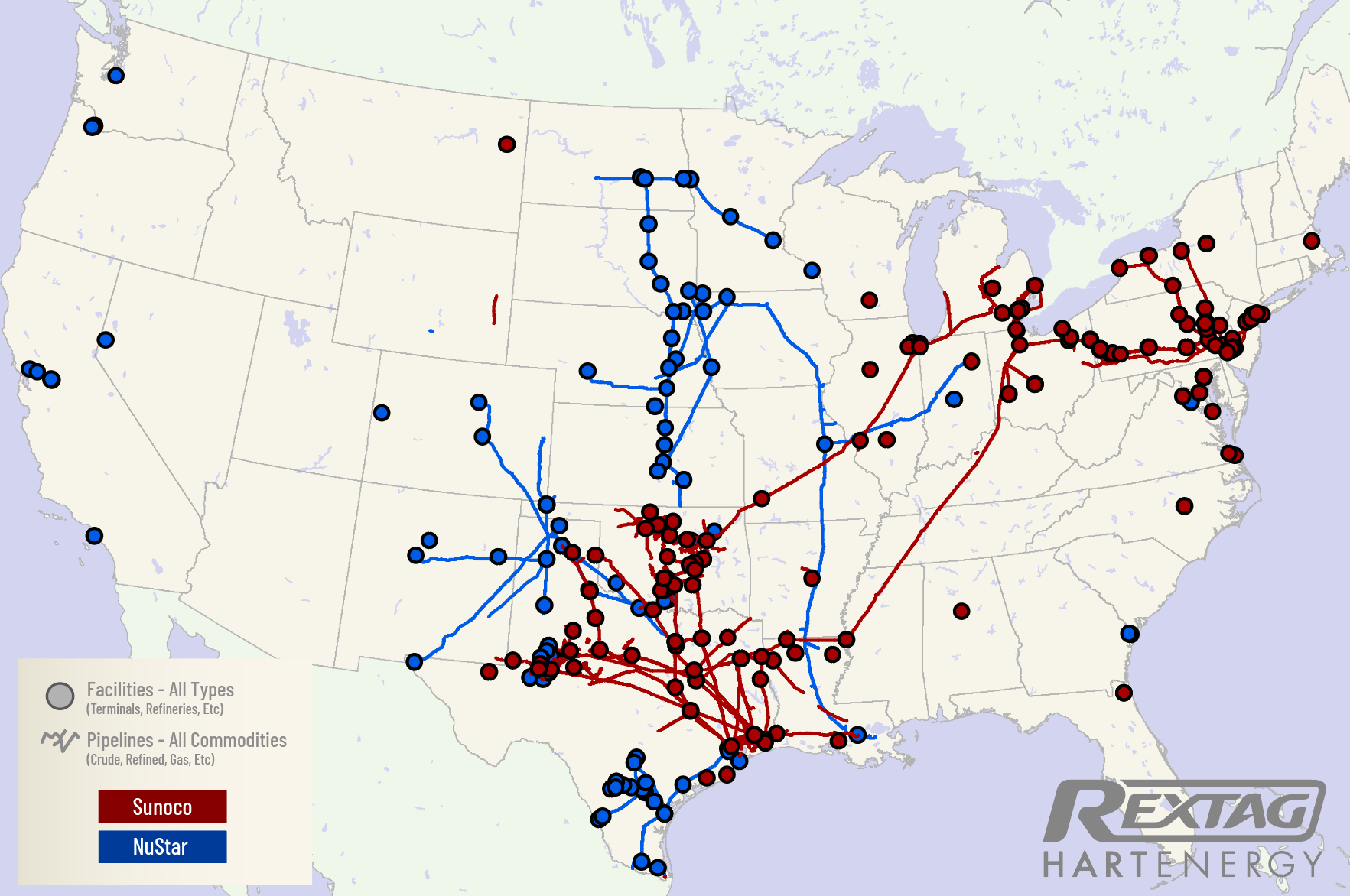

Dallas-Based Sunoco Buys NuStar Energy for $7.3 Billion

Sunoco, a gas station company based in Dallas, will buy NuStar Energy, a major operator of liquid storage and pipelines, for $7.3 billion. The acquisition of NuStar Energy by Sunoco not only enlarges Sunoco's fuel distribution business but also moves it into the crude oil middle market, especially in the important Permian Basin area.

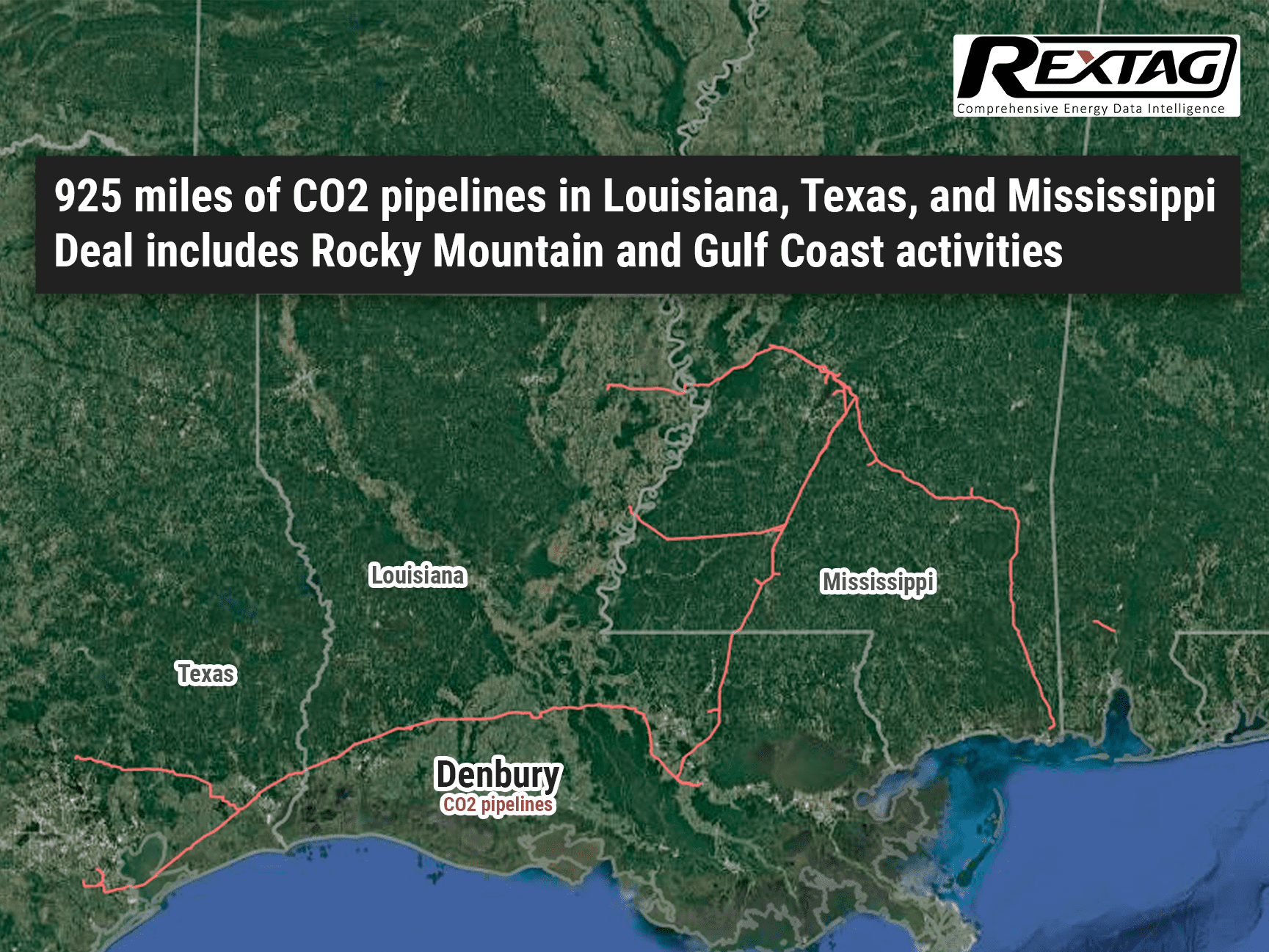

ExxonMobil Acquires Denbury and Enhances carbon, capture, and storage efforts

ExxonMobil's joined assets speed up their Low Carbon Solutions business, offering better decarbonization options for customers. ExxonMobil's top CCS network supports their commitment to low carbon value chains, like hydrogen and biofuels. The transaction synergies will cut over 100 MTA of emissions, leading to strong growth and returns. Exxon Mobil Corporation revealed that it will acquire Denbury Inc., a company specializing in carbon capture, utilization, and storage (CCS) solutions and enhanced oil recovery. $4.9 billion deal will be completed through an all-stock transaction. Darren Woods, Chairman and CEO said “Acquiring Denbury reflects our determination to profitably grow our Low Carbon Solutions business by serving a range of hard-to-decarbonize industries with a comprehensive carbon capture and sequestration offering”.

Enterprise, Oxy Low Carbon Ventures Will Join Efforts on Houston Area CO2 Project

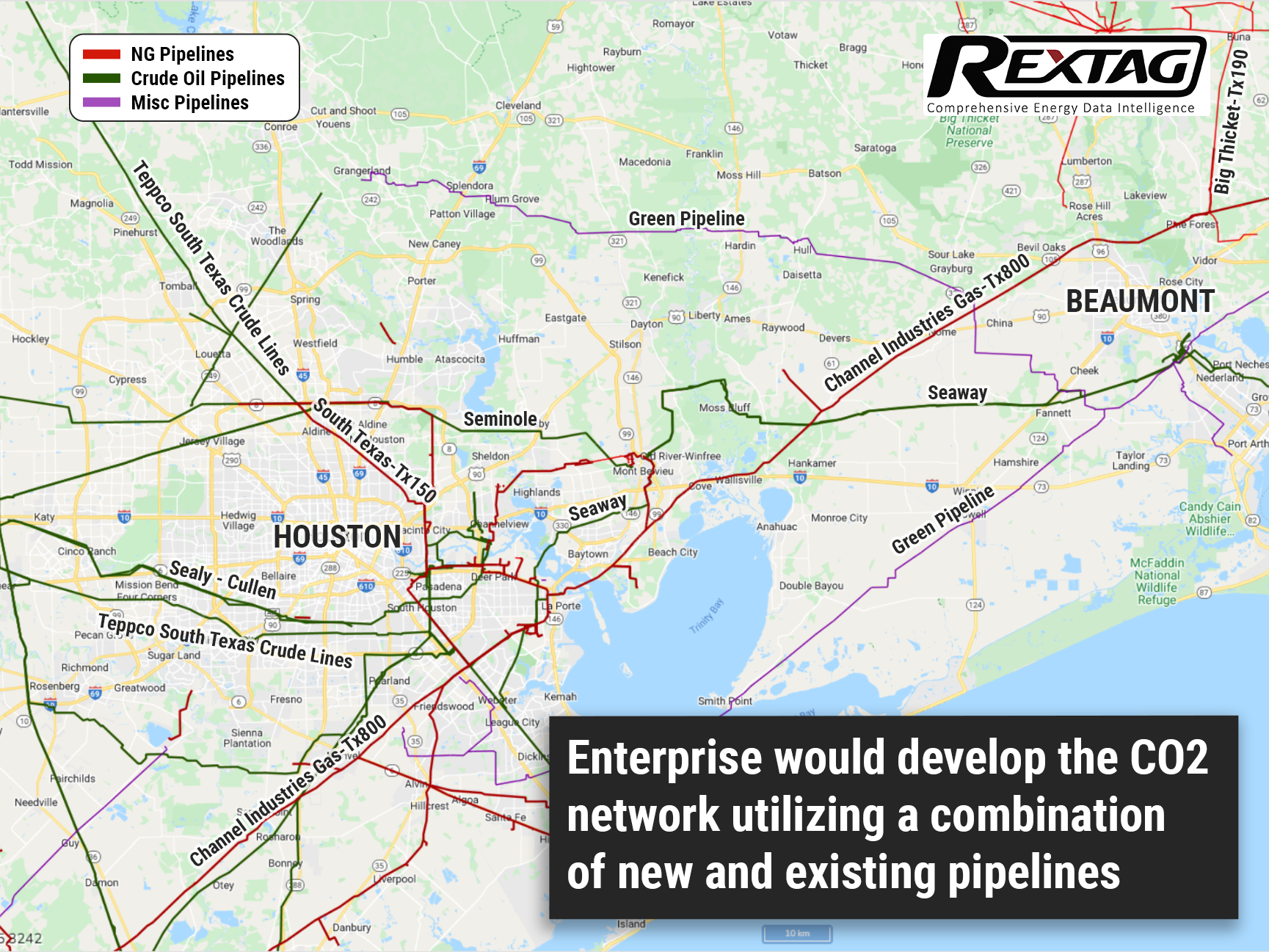

Oxy Low Carbon Ventures and Enterprise Products Operating will partner in order to provide services to carbon emitters from Houston to Port Arthur, Texas, due to the development of CO2 transportation and sequestration. Enterprise would develop the CO2 aggregation and transportation network utilizing a combination of new and existing pipelines along with its expansive Gulf Coast footprint. The partnership’s assets include more than 50,000 miles of pipelines; over 260 million barrels of storage capacity for NGLs, crude oil, refined products and petrochemicals; and 14 billion cubic feet of natural gas storage capacity.

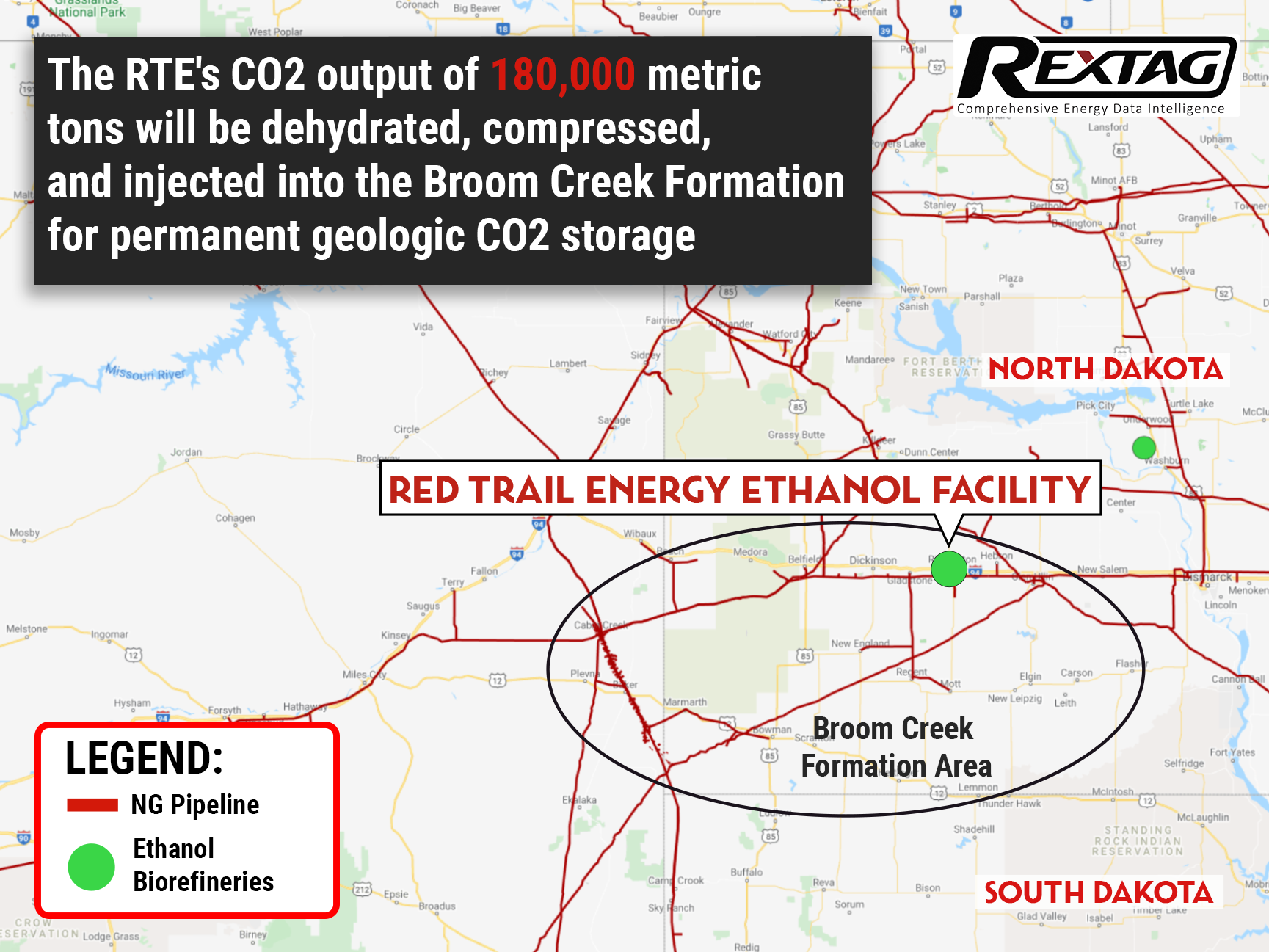

The race for landmark CCS project: North Dakota approves Class VI well for Red Trail Energy

New standards for carbon capture have been set in North Dakota earlier this month as NDIC greenlights Red Trail Energy’s project. The company will now be able to commercially capture, compress, and inject 180,000 tons of carbon dioxide per year into the Broom Creek Formation on its property for permanent geologic CO2 storage. This ensures that carbon dioxide can be stored safely for generations to come.

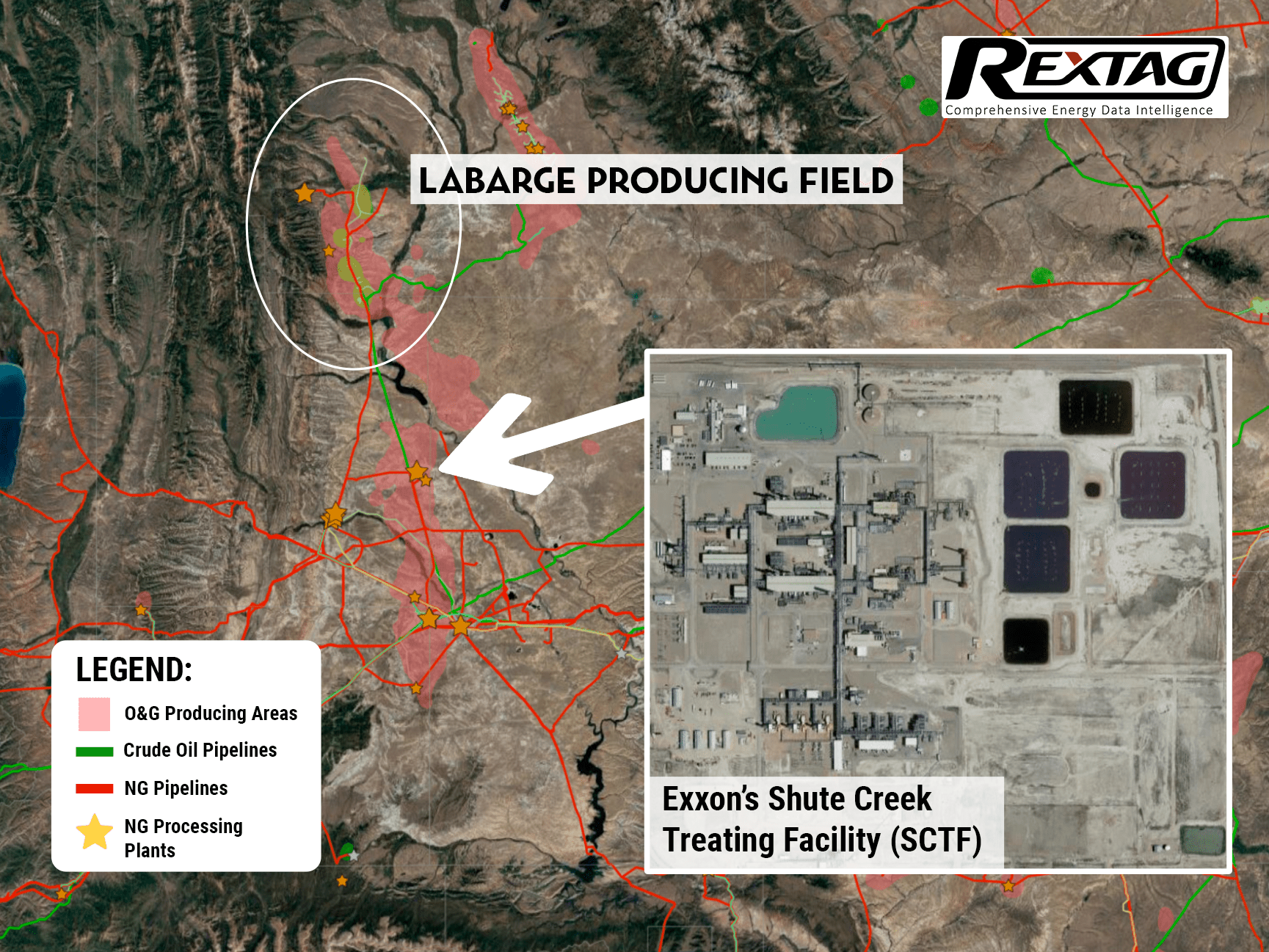

The Hunting Season Is Not Over Yet: Exxon Mobil makes a $400 million commitment to Wyoming's carbon capture

Carbon footprint reduction is a new hot trend: Exxon Mobil makes a $400 million investment into its LaBarge facility to expand its carbon capture and storage capabilities by another million metric tons of CO2. Operational activities could begin as early as 2025 after a final investment decision is made in 2022. At present, about 20% of all CO2 captured worldwide each year is captured at the LaBarge. However, as one of the largest of the world's Big Oil companies, it is not the only project in Exxon's pipeline: aside from CCS capabilities, the LaBarge is one of the world's largest sources of helium, producing approximately 20% of global supply