Blog

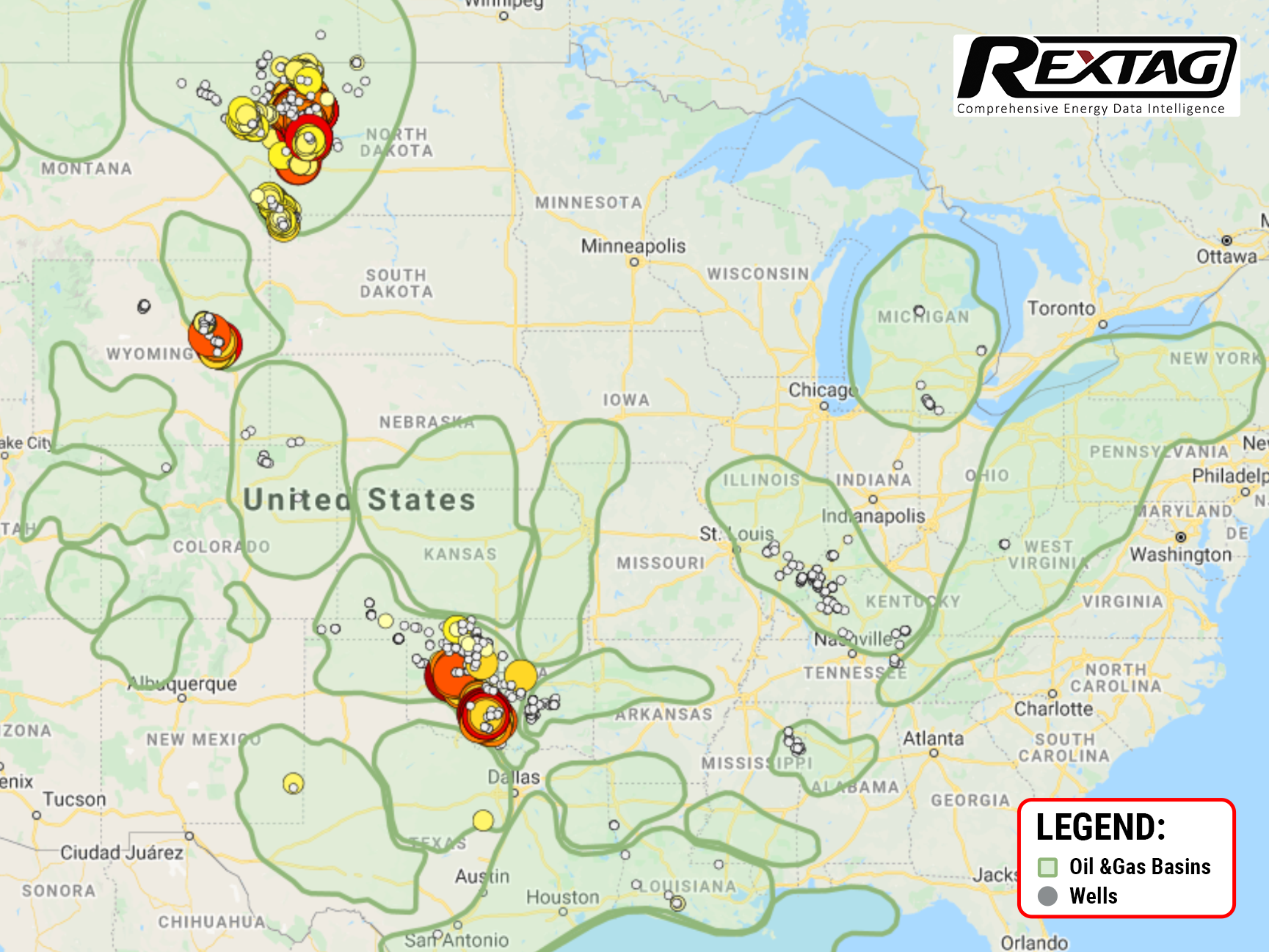

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

Bakken's Tipping Point: Grayson Mill's Potential Fall After Chevron-Hess

The Permian Basin, a big oil area, is not seeing as many deals as before because lots of companies have already joined together. Now, experts think these companies might start looking for new places to invest in the U.S. One area getting attention is the Bakken play. Chevron Corp. has just made a big step there by buying Hess Corp. for $60 billion. Another company, Grayson Mill Energy, which got some help from a Houston investment firm EnCap Investments LP, might also be up for sale soon, worth about $5 billion.

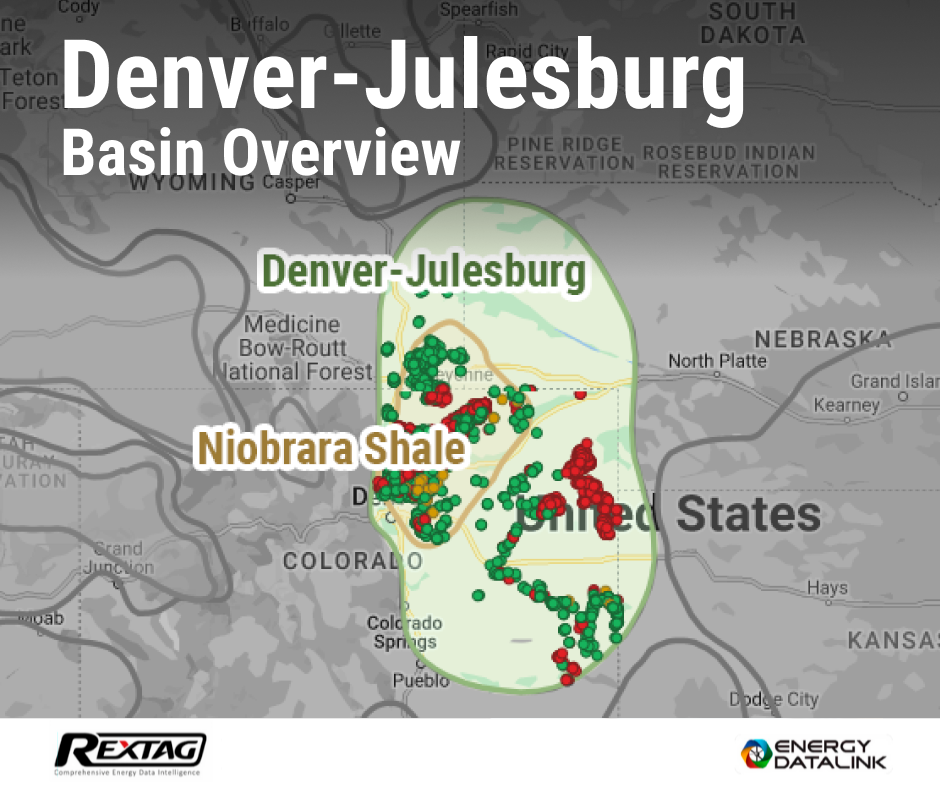

The Denver-Julesburg Basin Overview

Geologically, the Denver-Julesburg (DJ) Basin is a large structural basin with a complex history of sedimentary deposition, tectonic activity, and hydrocarbon generation. The basin covers approximately 20,000 square miles and extends into parts of Colorado, Wyoming, Nebraska, and Kansas. It is primarily composed of several stacked formations, including the Niobrara, Codell, and Greenhorn formations, which contain significant amounts of oil and gas reserves.

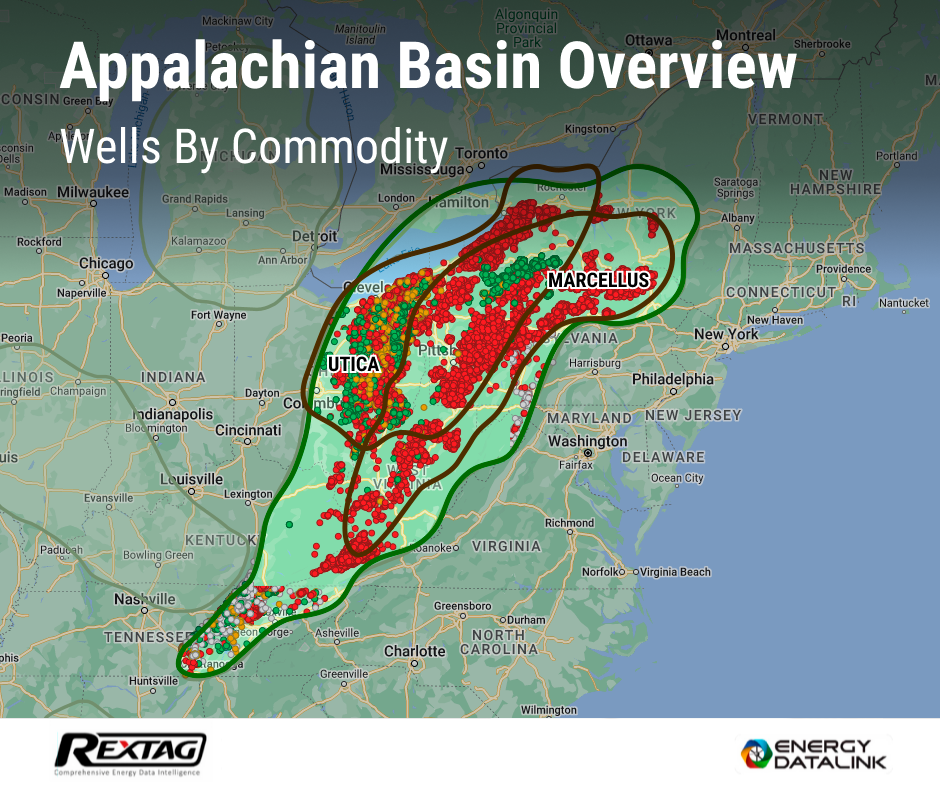

Appalachian O&G Basin 2022 Review

The Appalachian oil and gas basin is a geological formation that spans several states in the eastern United States, including Pennsylvania, West Virginia, Ohio, and New York. It is one of the largest natural gas reserves in the world, with estimates of recoverable natural gas exceeding 141 trillion cubic feet. The Marcellus Shale formation was formed over 350 million years ago and is composed of sedimentary rocks. Initially, the Marcellus Shale was not considered a significant source of natural gas due to the low permeability of the rock, which made it difficult for gas to flow through it and be extracted. However, with the development of hydraulic fracturing and horizontal drilling technologies in the early 2000s, it became economically viable to extract natural gas from the Marcellus Shale, and it has since become a major source of natural gas production in the United States.

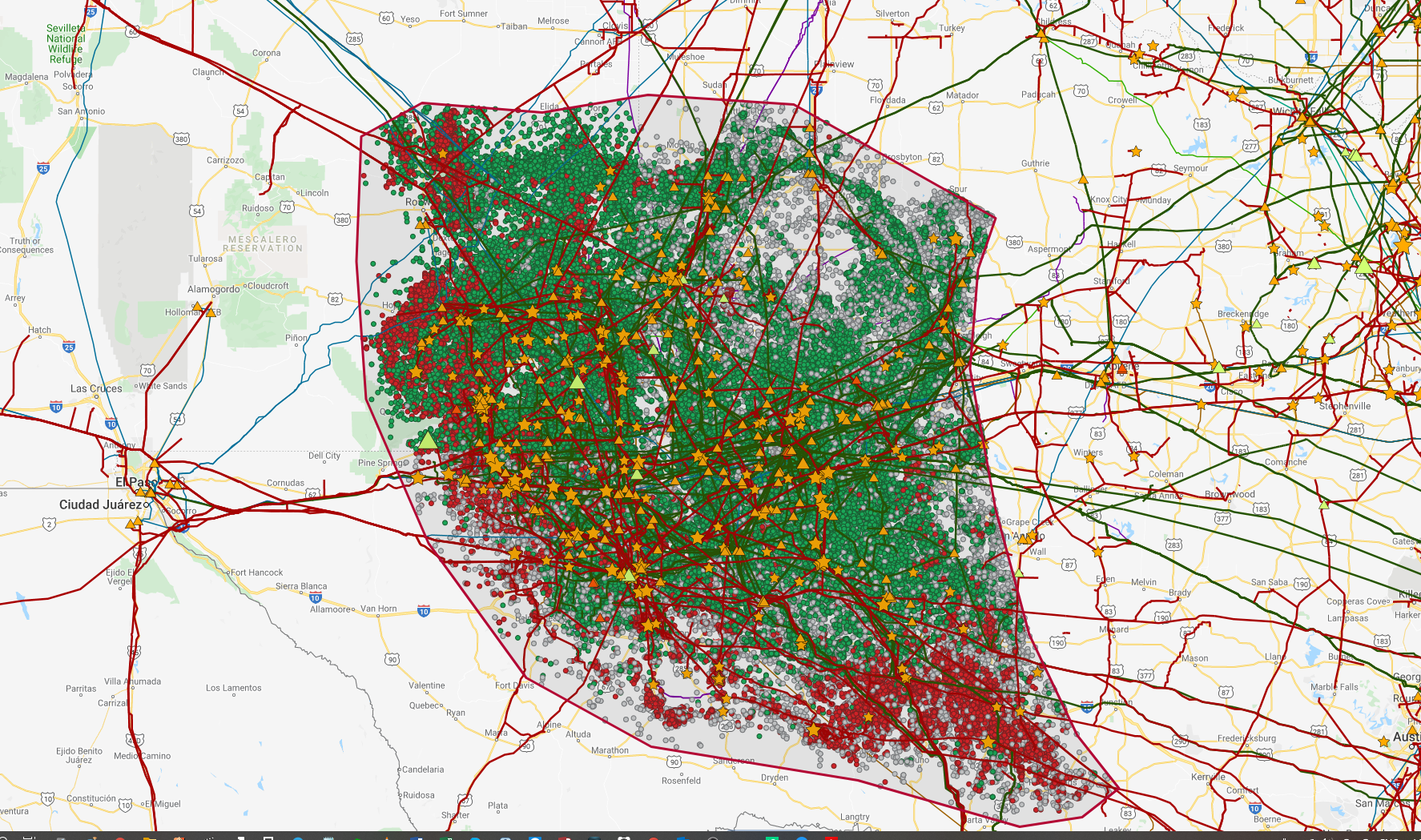

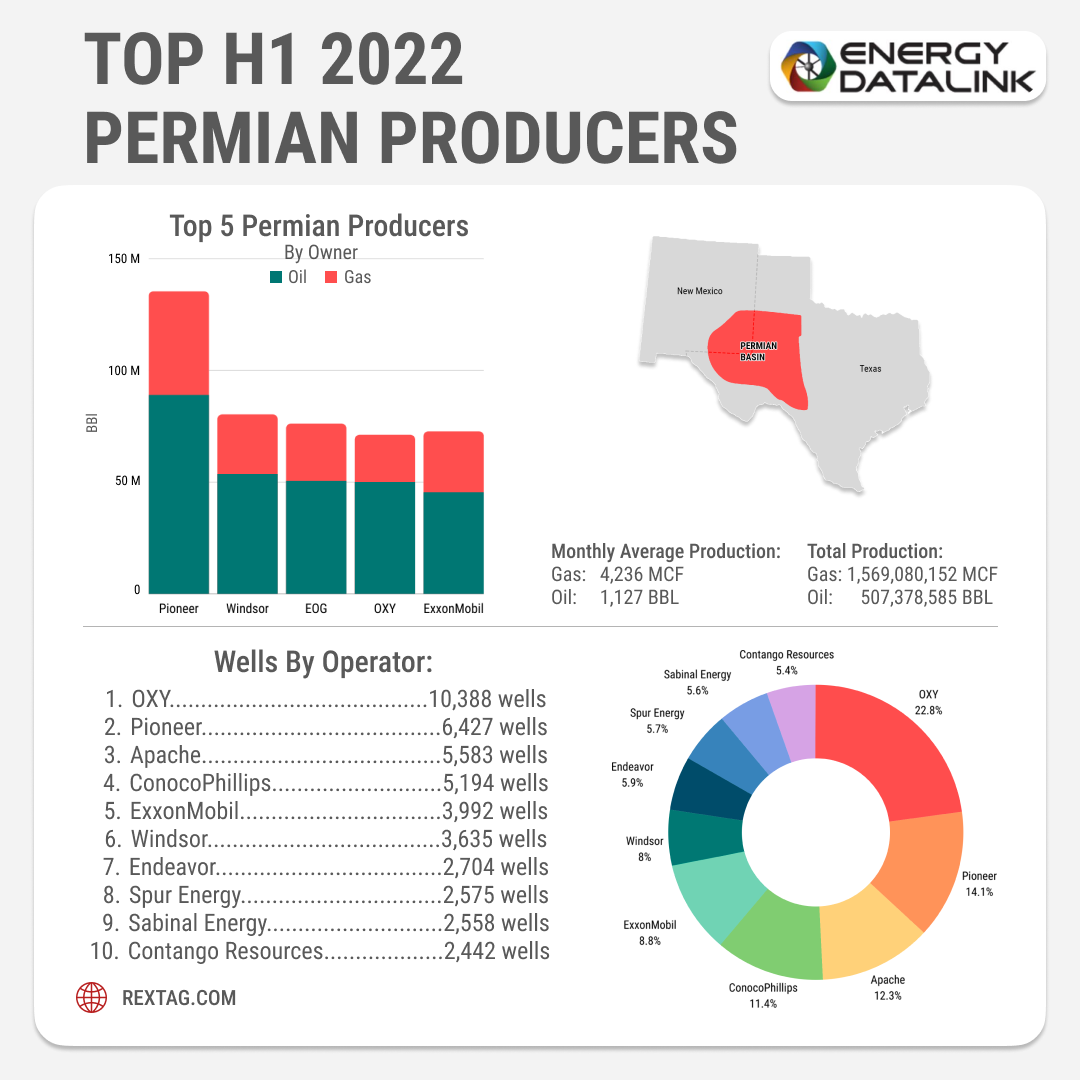

Permian O&G Basin 2022 Review

The Permian Basin is one of the most important oil and gas basins in the world, located in western Texas and southeastern New Mexico in the United States. Oil drilling and production in the Permian Basin began in the early 1920s. The first significant discovery in the region was made in 1923 in the Westbrook field in Mitchell County, Texas. This discovery led to a boom in oil exploration and production in the area. By the 1930s, the Permian Basin had become one of the major oil-producing regions in the United States, and it continued to grow in importance throughout the 20th century.

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

Exploring ESG in Upstream Operations: Examining Achievements, Obstacles, and Emerging Patterns

ESG considerations are becoming increasingly essential for companies operating in the upstream sector. Failure to address ESG concerns may result in financial and reputational risks, given the growing focus from investors, regulators, and other stakeholders. Companies must prioritize ESG performance and engage with stakeholders to address concerns and mitigate risks. By doing so, they can improve their reputation, attract investment, and contribute to a more sustainable future

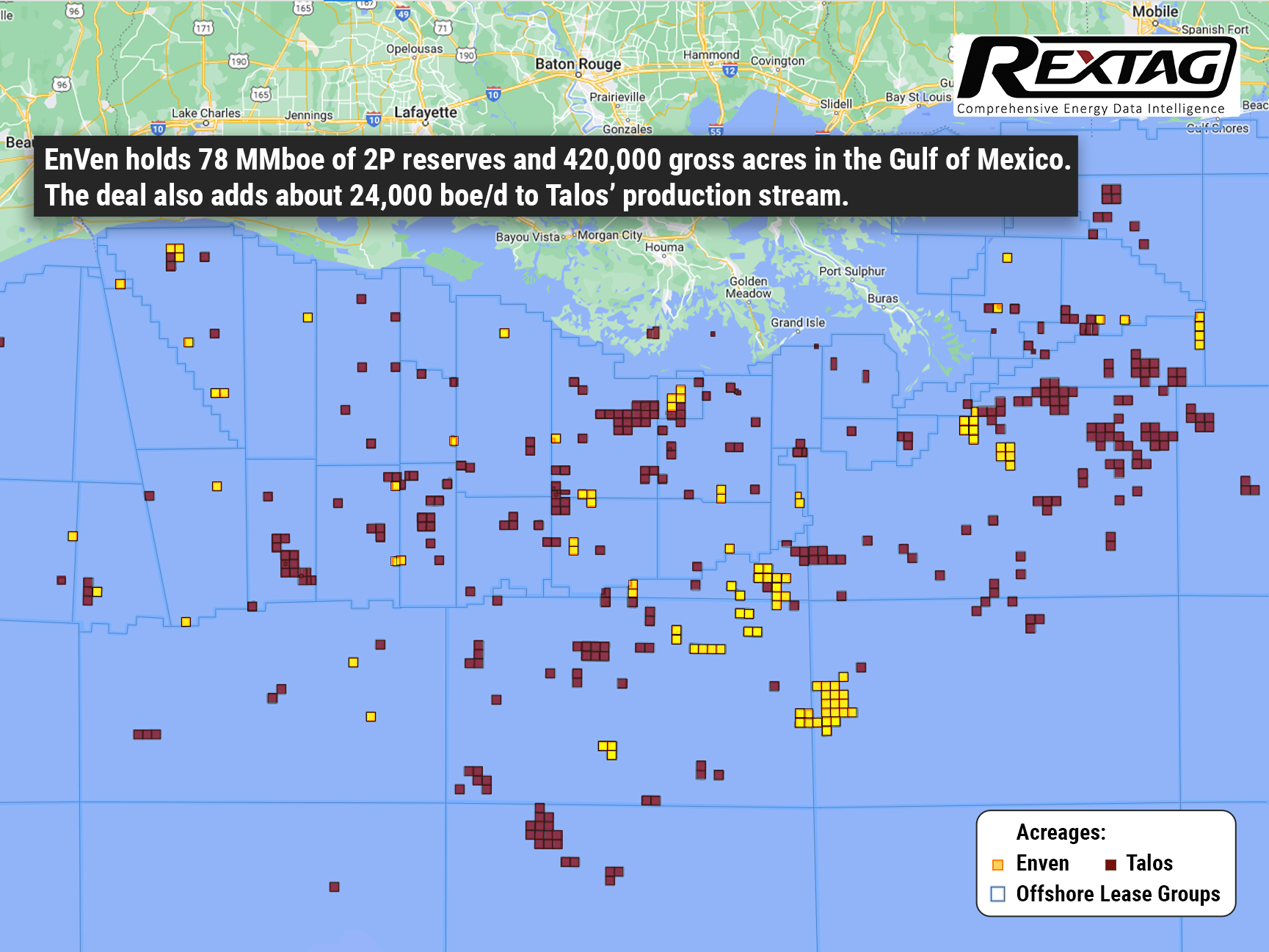

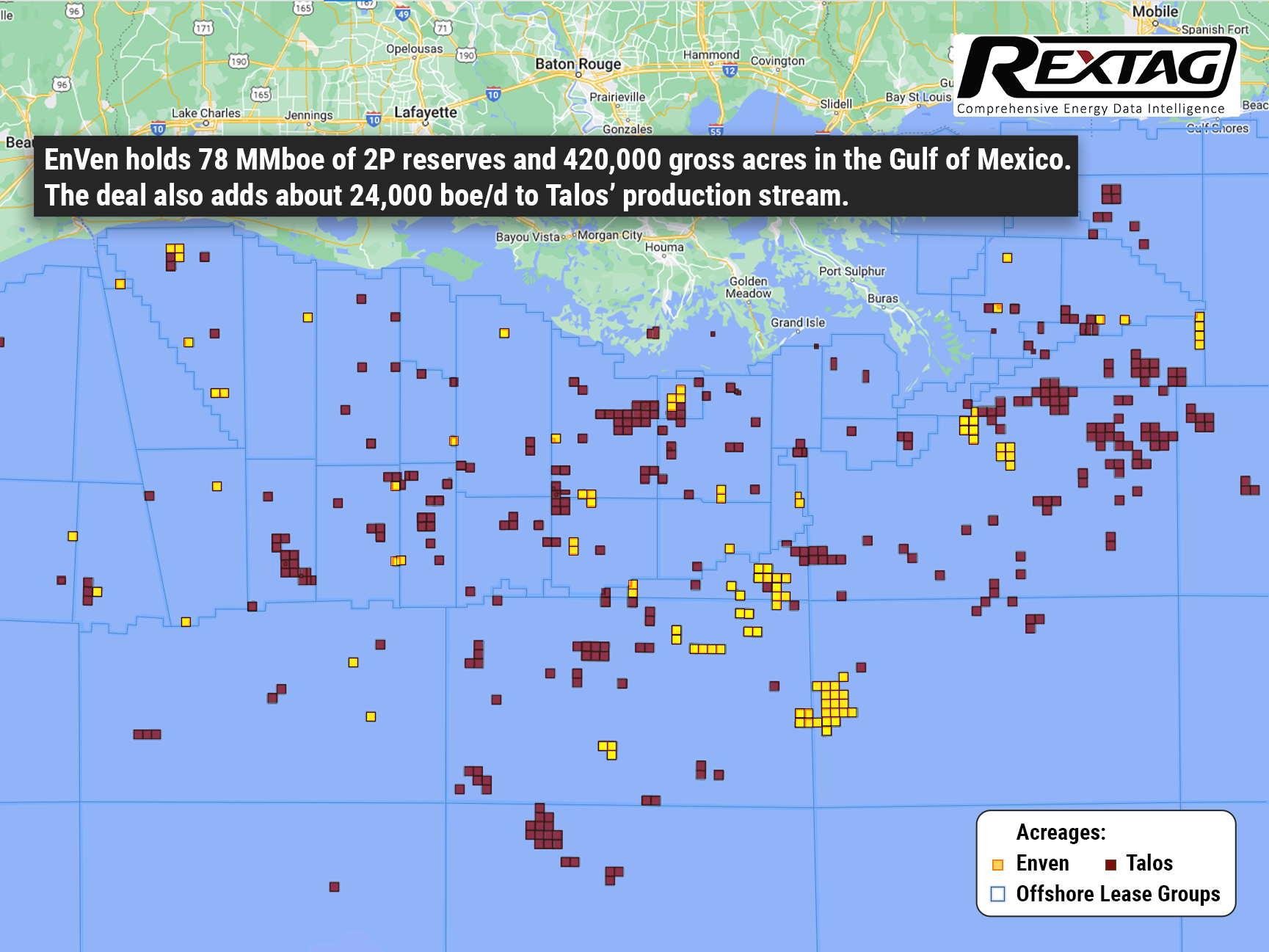

Talos Energy Plans to Close the EnVen Acquisition Soon: Stockholders to vote on $1.1B Deal on February 8

Talos Energy Inc. is closing its $1.1 billion purchase of private operator EnVen Energy. A special meeting for Talos’ stockholders to vote on the deal and other matters is set on February 8, according to a prospectus filed on January 11 with the Securities and Exchange Commission. Shareholders are being asked to approve the EnVen merger, which as the company considered in September would raise its Gulf of Mexico production up to 40%. According to a January 11 press release, Talos asserted that it anticipates closing the transaction soon after the meeting. Talos Energy Inc. supposes that adding EnVen would double its operated deepwater facility footprint, extending key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with the company operating more than 75% of the acreage it holds interests in. Talos is one of the largest independent operators in the U.S. Gulf of Mexico, with production operations, prospects, leases, and seismic databases spanning the basin in both Deep Water and Shallow Water. The company aims to actively grow through a balanced focus on asset optimization, development, and exploration while also seeking to add to its portfolio through acquisitions and business development.

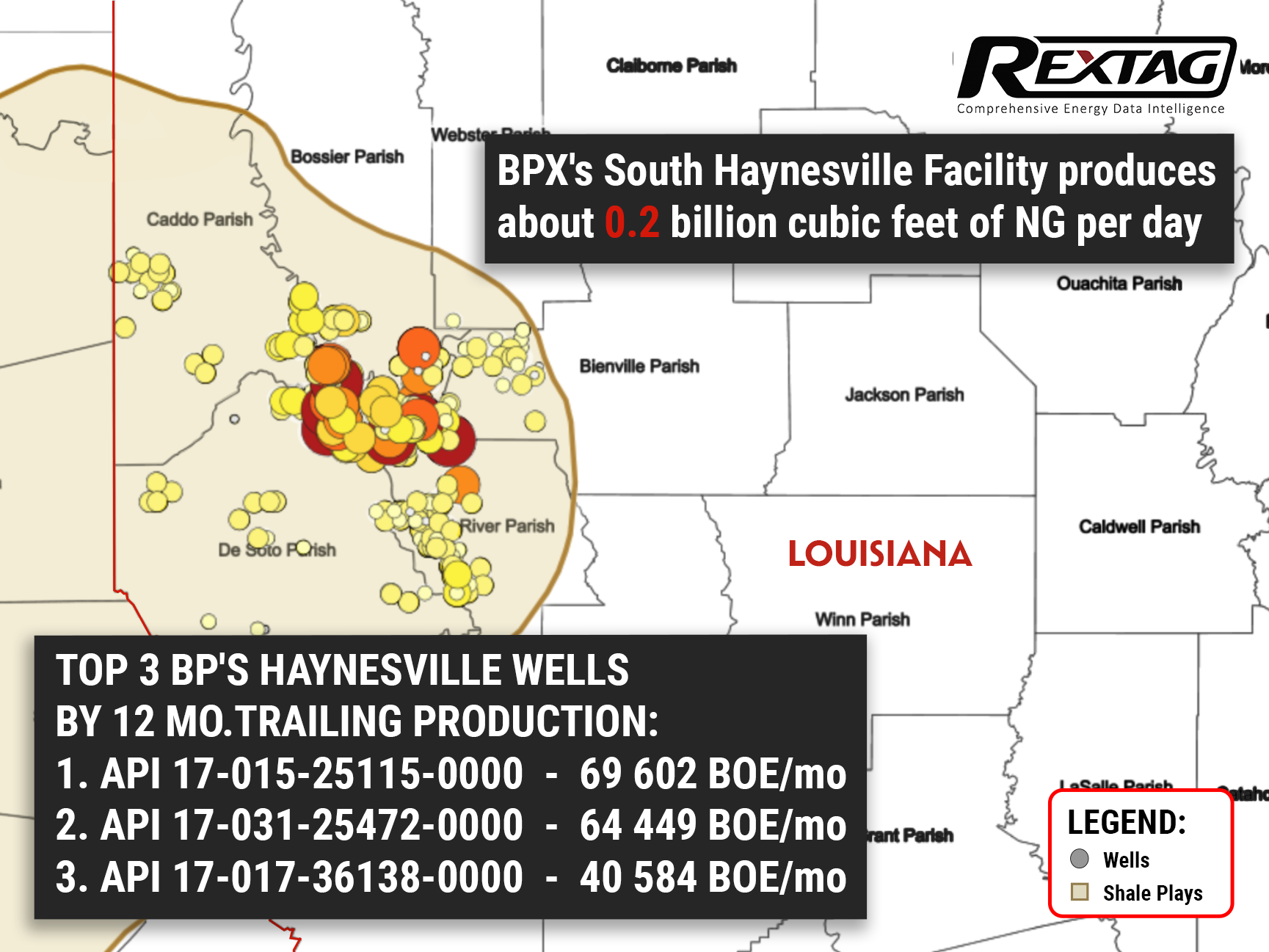

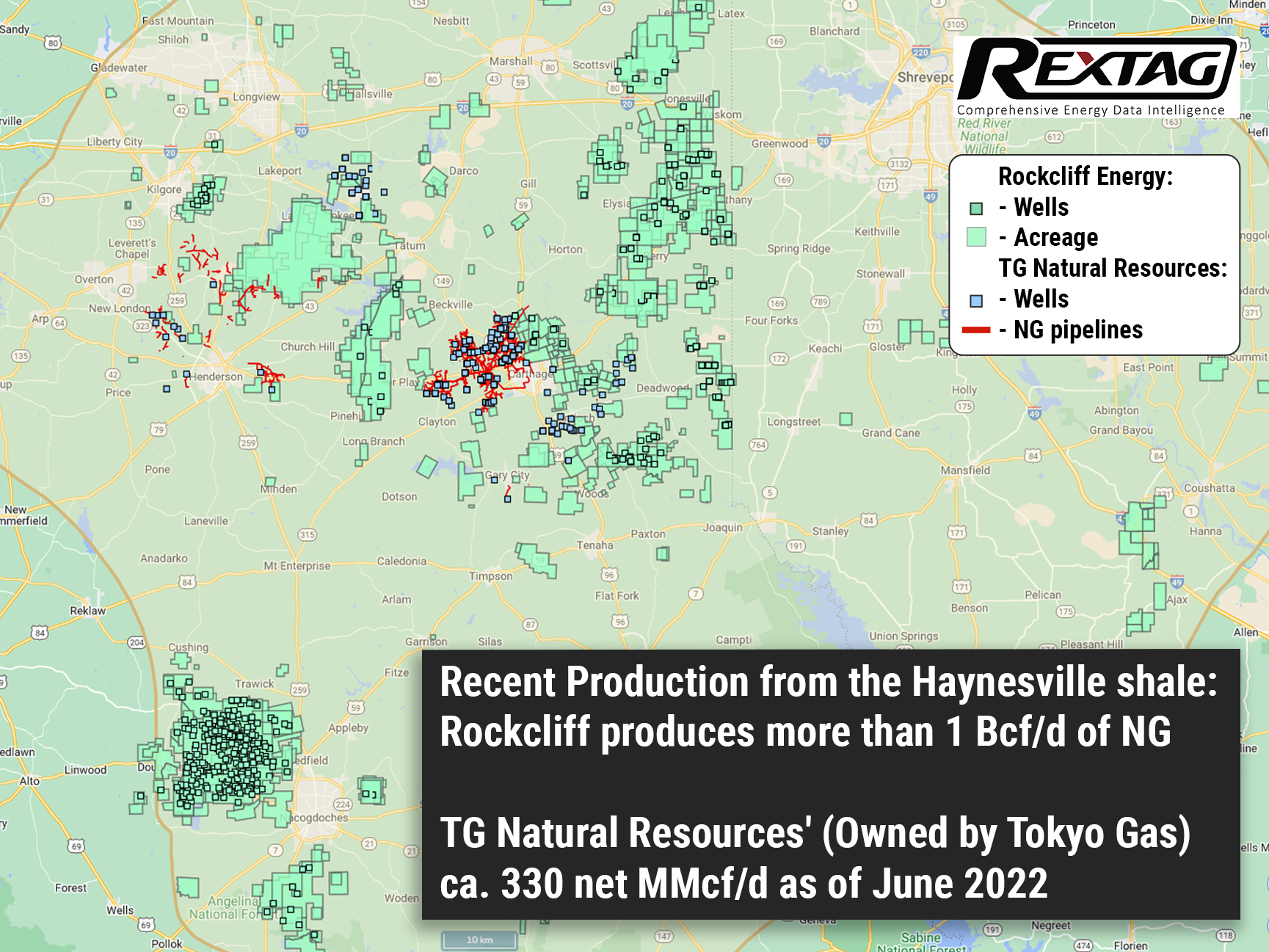

Tokyo Gas Is Set to Buy Rockcliff Energy: One of the Top Haynesville's Producers

On January 3, U.S. natural gas producer Rockcliff Energy from private equity firm Quantum Energy Partners was set to be sold to a unit of Tokyo Gas Co. Ltd. for roughly $4.6 billion, including debt. The all-cash agreement with Houston-based TG Natural Resources, which is 70% possessed by the Japanese energy firm, is decided to be claimed this month, according to anonymous resources, as the discussions were requested to be confidential. Castleton Commodities International (CCI) owns the rest of TG Natural Resources.

NOG Grows Its Acreage Position in Delaware

According to the company’s press release on December 19, Northern Oil and Gas Inc. (NOG) closed its announced deal with a private seller of non-operated interests in the Northern Delaware Basin for $131.6 million in cash. The acquisition was announced with a $13 million deposit in October and is the third Permian Basin acquisition since August, adding to NOG’s $400 million of Permian Basin acquisitions in 2022. The assets of 2,100 net acres are primarily operated by a private company Mewbourne Oil Co., with production anticipated to total almost 2,500 boe/d in 2023. Also, Coterra Energy Inc. and Permian Resource Corp. are operators of the assets. The assets contain high-quality, low breakeven development that is leveraged to some of NOG’s top operating partners, as our investors have come to expect.

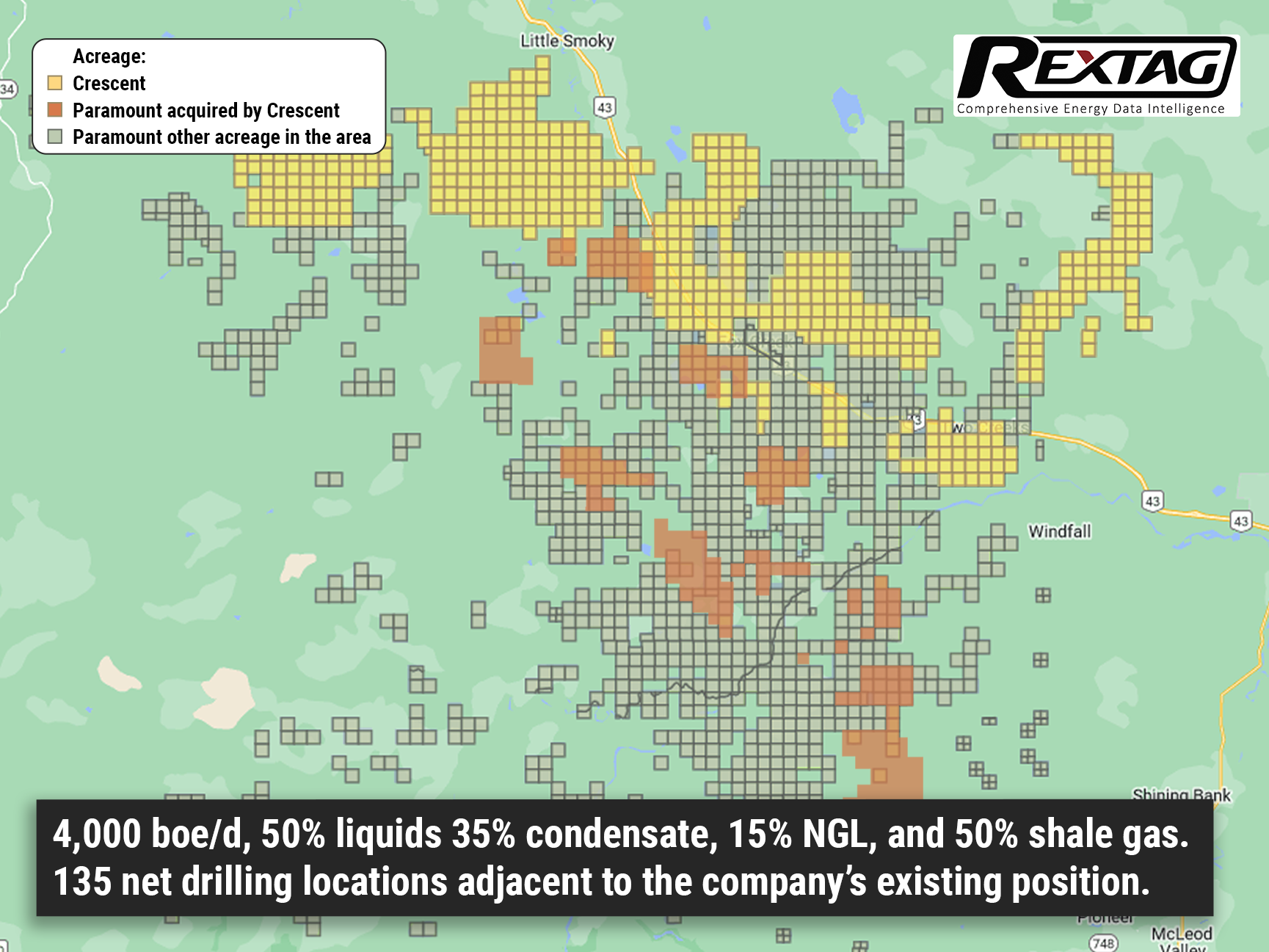

CA$375 Million Bolt-on Deal to Expand Crescent Point

On December 9, Crescent Point Energy Corp. announced a purchase and sale agreement to develop its core Kaybob Duvernay assets, which will bolt on production, the midstream infrastructure and technical data. With the deal, the company has committed more than US $1 billion to the play. Crescent Point, the Alberta-based company, is purchasing almost 65,000 net acres from Paramount Resources Ltd. for CA $375 (US $274 million) cash. The assets estimate more than 4,000 boe/d, 50% liquids, and include a gas plant, associated pipelines, water infrastructure, and seismic data. The acquired asset’s production consists of 35% condensate, 15% NGL, and 50% shale gas.

Talos Energy Buys EnVen for $1.1 Billion to Expand

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%. The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in. During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint. EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream. Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

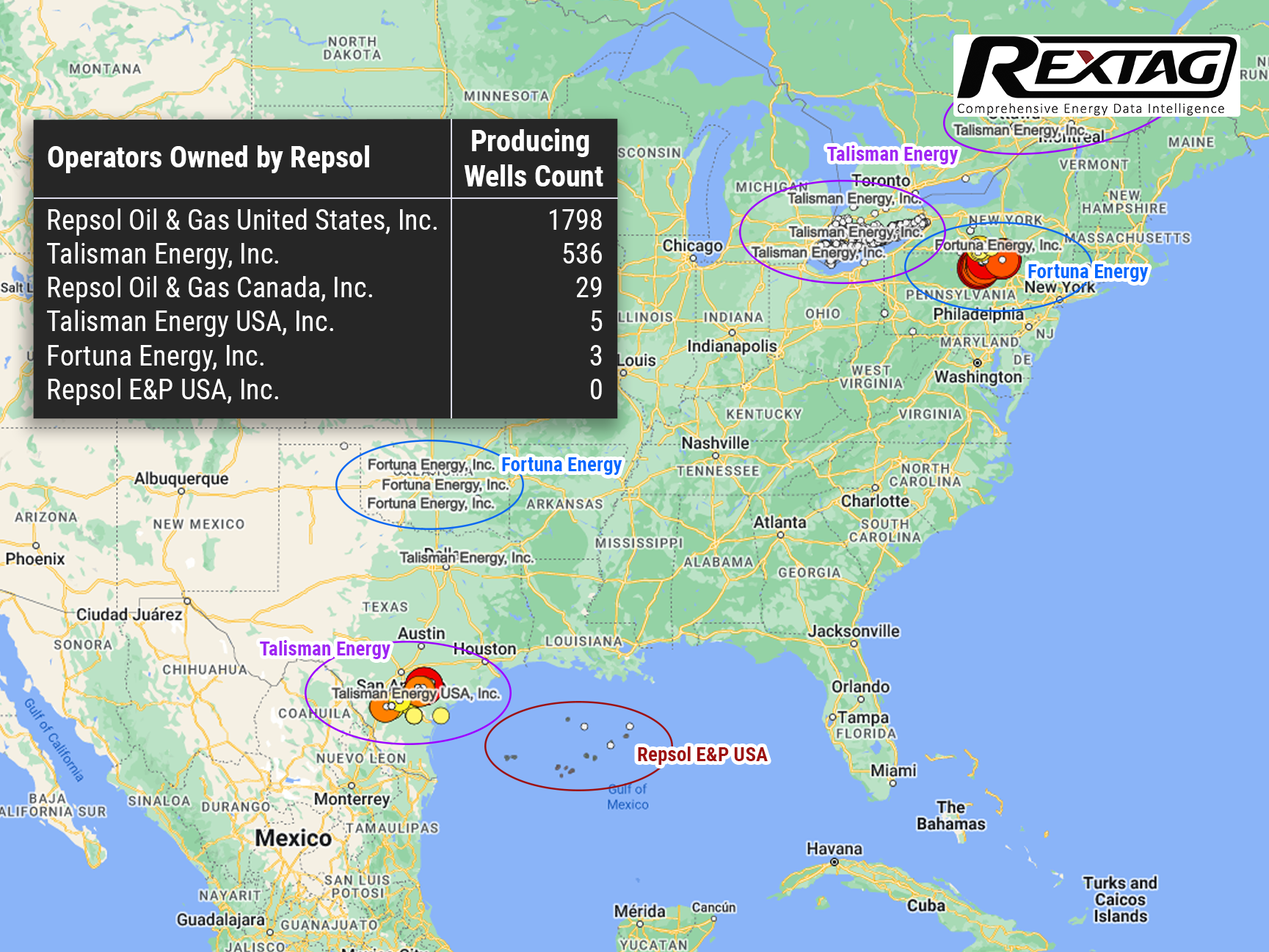

EIG Buys 25% of Repsol’s Oil and Gas Unit for $4.8 Billion

Spanish energy group Repsol is putting a 25% stake in its oil and gas exploration division on the market. U.S. fund EIG purchases it for $4.8 billion and builds up a war chest for renewables projects due to the transition of the energy industry to a lower-carbon future. As Reuters reported earlier this year, the deal values the whole business at $19 billion including debt, and may conduct a U.S. stock market listing of a stake in the unit after 2026, according to Repsol’s statement. The process commenced with an unsolicited offer from EIG, Reuters said in June, increasing Repsol's shares to a 14-year high. Moreover, shares grew up after an announcement on September 7 before declining 1.8% by 7:46 GMT. Nevertheless, they outperformed the European oil and gas index, which was down 2.3%.

Earthstone Expands Due to Acquisition of Titus’ Delaware

Earthstone Energy Inc., based in Texas, announced the transaction on June 28: the acquisition of Titus Oil&Gas which will raise production in the Delaware Basin by 26%. The $627 million acquisition fills the Permian Basin in Eddy and Lea counties, N.M. with 86 net locations on 7,900 net acres of leasehold, while it is not clear how much of the leasehold might be on federal acreage It is Earthstone’s seventh acquisition since 2021, a span that includes the closing of approximately $1.89 billion in acquisitions in the Permian Basin. The purchase of Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies backed by NGP Energy Capital Management LLC, is estimated at $575 million in cash and it is the equivalent of $52 million in stock (3.9 million shares of its Class A common stock based on the June 24 closing price). Titus shared that its net production in June was 31,800 boe/d. The company had reserves of approximately 28.9 MMboe. Earthstone is sure its net production will increase, at the midpoint, by 20,500 boe/d (65% oil) in the fourth quarter.

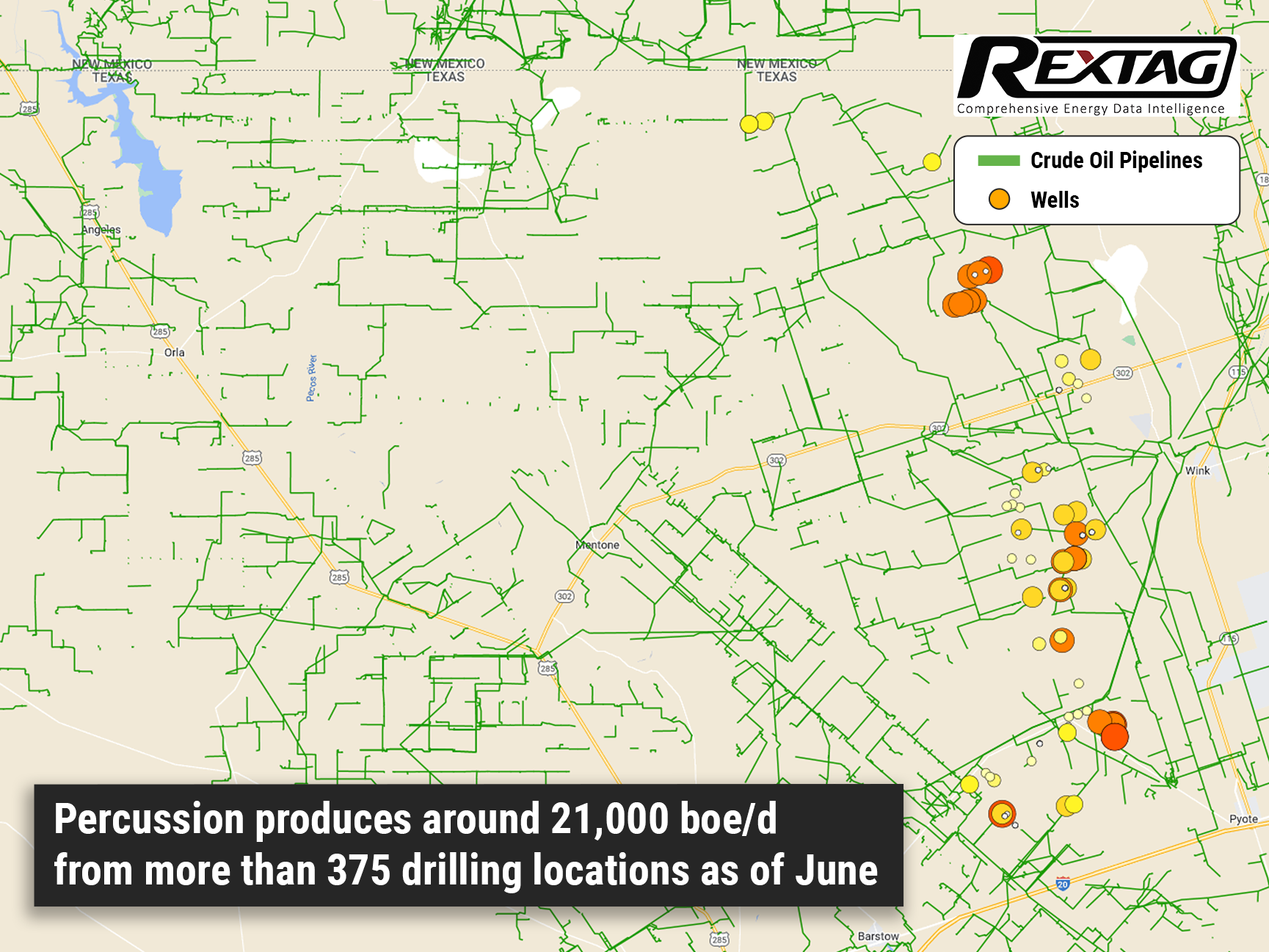

Up to $1.5 Billion for Percussion Petroleum in the Permian Basin

Around 25,000 net acres in the Permian are being sold by Percussion Petroleum II, looking to fetch up to $1.5 billion, as some sources bet on rising oil prices to pocket more than double what it paid in 2021. The company spent $375 million plus contingent payments a year ago to buy the bulk of its assets in one of the most prolific crude-producing areas in the U.S. from Oasis PetroleumInc. The oil prices increased to triple digits and buyers wanted to gain a toehold in the basin, whereas backers of private shale companies such as Percussion use it as a chance to exit their investments with big profits. Remarkably, U.S. crude oil futures have grown about 50% to approximately $109/bbl since June 29, 2021, when Percussion closed its deal with Oasis.

Crude oil pipelines in North America: a current perspective

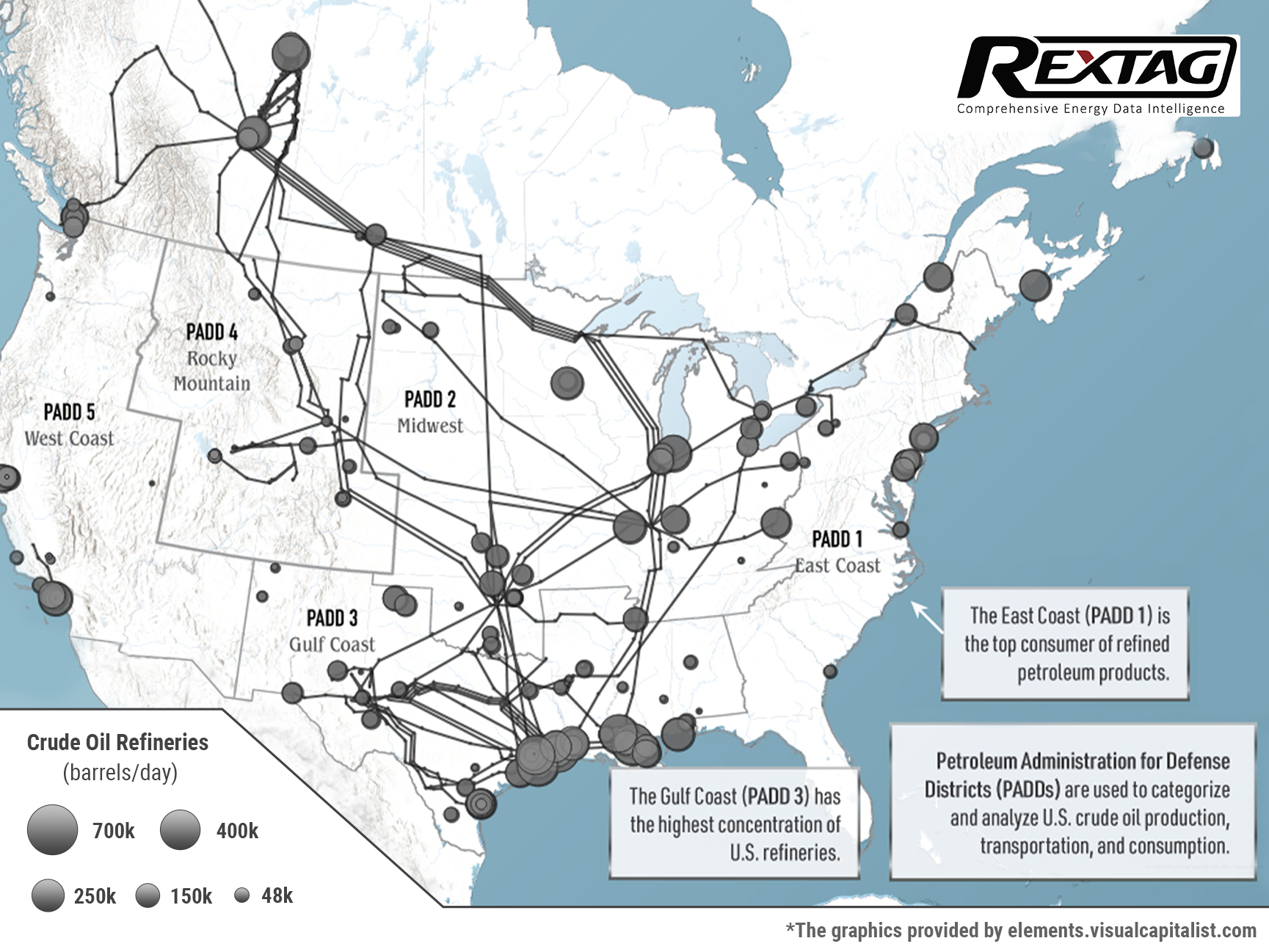

Being the main means of transferring crude oil around the world, pipelines rapidly route oil and its derivative products (gasoline, jet fuel, diesel fuel, heating oil, and heavier fuel oils) to refineries and empower other businesses. The U.S. and Canada solely make North America a major oil hub for more than 90,000 miles of crude oil and petroleum product pipelines, which are connected to more than 140 refineries daily processing about 20 million barrels of oil. Compared to 2010, U.S. crude oil production has increased more than twice: from 5.4 to 11.5 million barrels a day. Therefore, newly produced oil obliged energy companies to expand their pipeline networks, but it has only increased by 56%. According to the latest data, Plains manages the largest pipeline network across the U.S. and Canada (its diameter is at least 10 inches) which is the 14,919-mile network that spans from the northwestern tip of Alberta down to the southern coasts of Texas and Louisiana. The place where all these various spreading pipeline networks carry crude oil is refineries, where it is transformed into different petroleum products. Gulf Coast (PADD 3) possesses several refineries with the largest throughput in North America that process more than 500,000 barrels per day. Not only does the development of new pipelines give a plethora of opportunities for economic growth but also it remains a contentious issue in Canada and the U.S., with the cancellation of the KeystoneXL pipeline emblematic of growing anti-pipeline sentiment. In 2021, only 14 petroleum liquids pipeline construction plans were completed in the U.S., which is considered the lowest amount of new pipelines and expansions ever since 2013. Anti-pipeline sentiment did not come out unexpectedly as leaks and spills in just the last decade have resulted in billions of dollars of damages. From 2010 to 2020, the Pipelineand Hazardous Materials Safety Administration reported 983 incidents that resulted in 149,000 spilled and unrecovered barrels of oil, even five fatalities, 27 injuries, and more than $2.5B in damages.

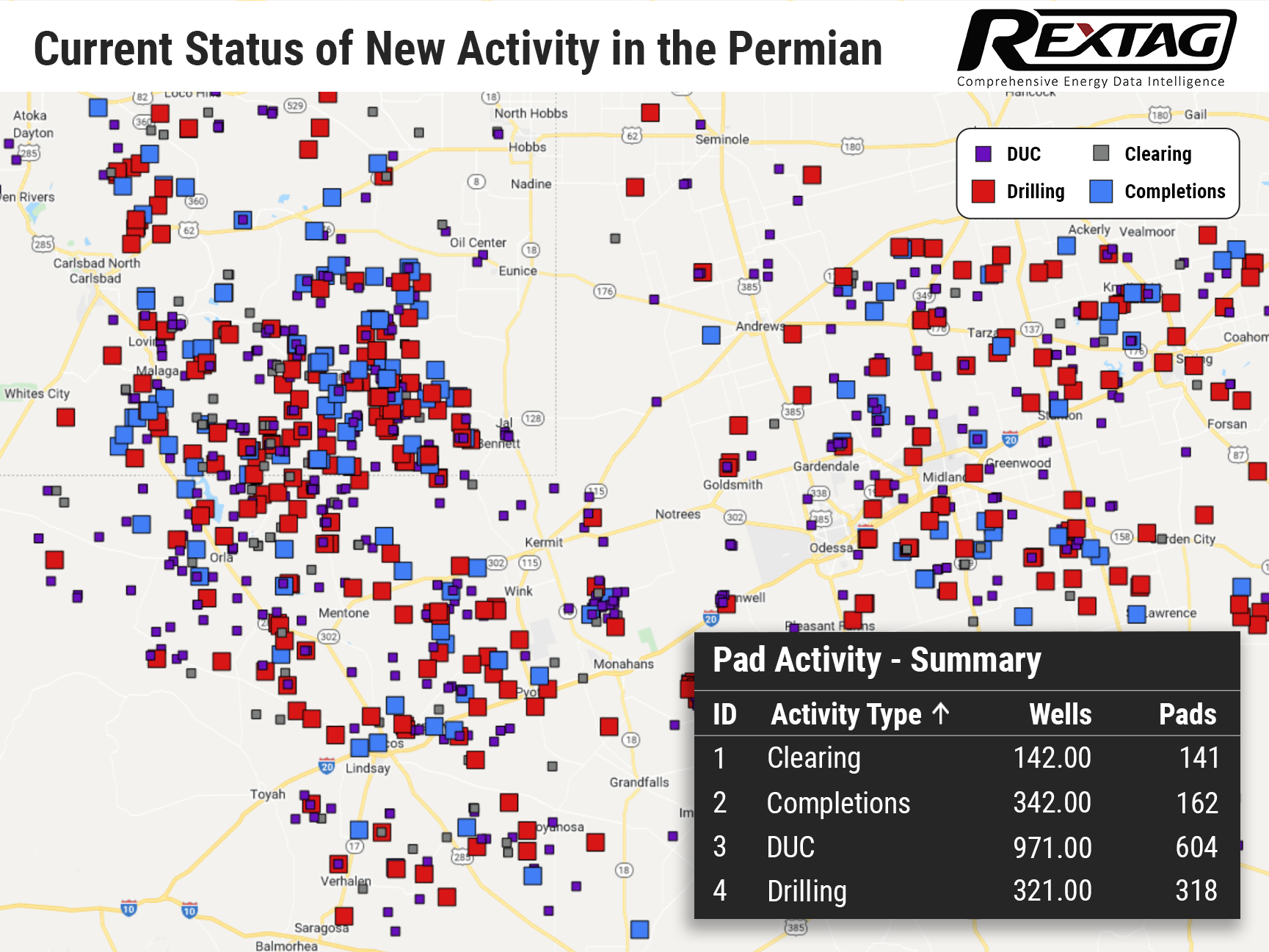

Staying on Top of Drilling Activity Trends in the Permian Basin

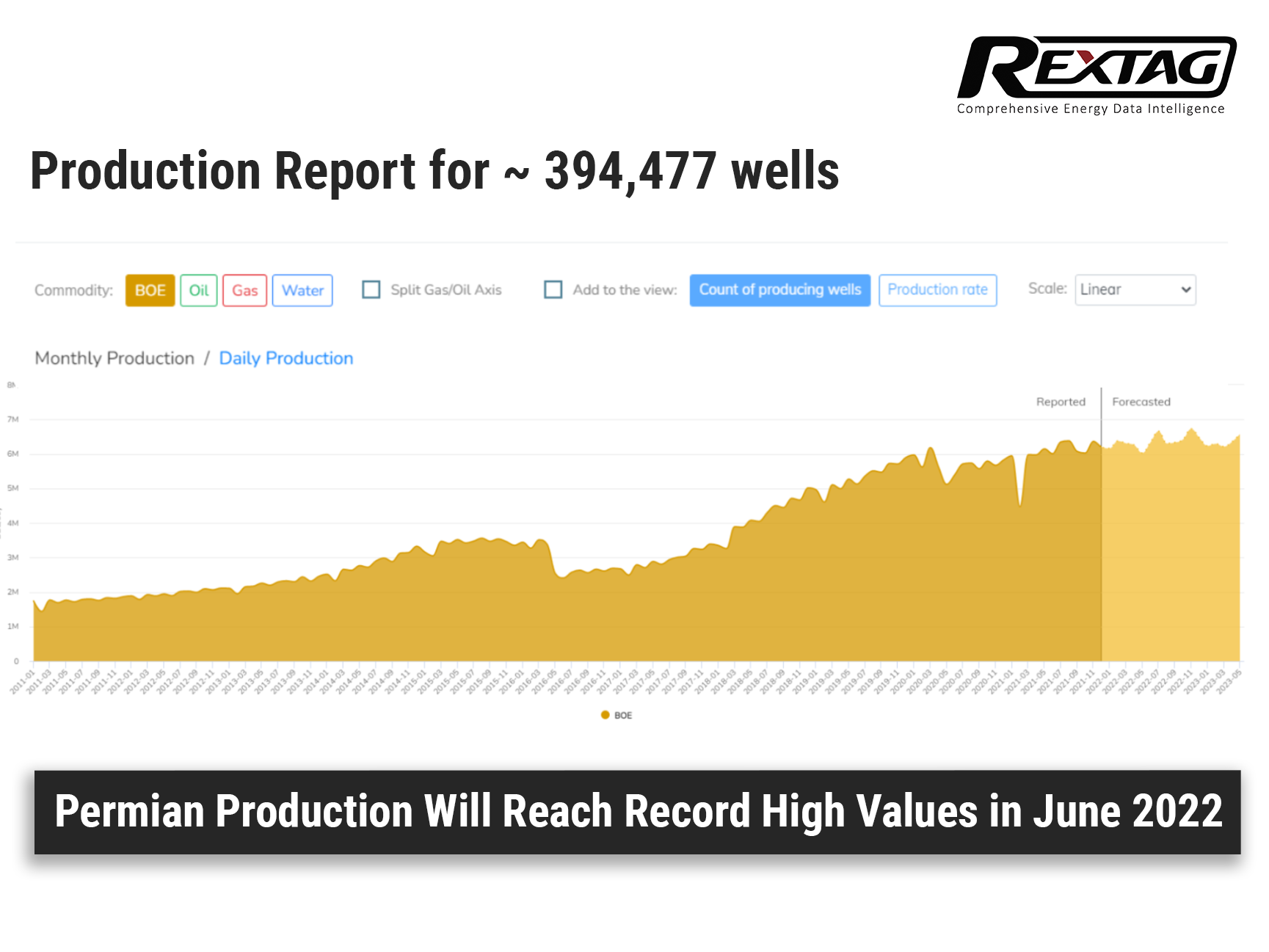

Oil output in the Permian Basin in Texas and New Mexico is supposed to go up 88,000 bbl/d to a record 5.219 million bbl/d in June, as the U.S. Energy Information Administration (EIA) announced in its report on May 16. Additionally, gas productivity in the Permian Basin and the Haynesville in Texas, Louisiana and Arkansas will rise to record highs of 20 Bcf/d and 15.1 Bcf/d in June, respectively. Given that this growth has been expected, recent global market changes make forecasting the output even more challenging. Learning how production will change is easier with early activity tracking, a new service recently launched by Rextag – Pad Activity Monitor. With the help of PAM, you are able to monitor well pad clearing, drilling operations, fracking crew deployment and completions with new data collected approximately every 2 days. Additionally, it cuts down activity reporting lag times by at least 98%, from 120-180 days down to just 5-8 days. In order to access reports, charts, tables, and mapping visualizations via Rextag’s Energy DataLink use a web-based application allowing users to filter, download and identify activity on a map or data table. Moreover, customers will be able to set up daily, weekly, and monthly email report notifications.

EIA: Permian Basin Oil and Gas Output is Thought to Beat Record in June

The EIA forecasts that total output in the main U.S. shale oil basins will increase 142,000 bbl/d to 8.761 million bbl/d in June, the most since March 2020. Oil productivity in the Permian Basin in Texas and New Mexico is supposed to go up 88,000 bbl/d to a record 5.219 million bbl/d in June, as the U.S. Energy Information Administration (EIA) announced in its report on May 16. In the largest shale gas basin, the productivity in Appalachia in Pennsylvania, Ohio and West Virginia will grow up to 35.7 Bcf/d in June, its highest since beating a record 36 Bcf/d in December 2021. Gas output in the Permian Basin and the Haynesville in Texas, Louisiana and Arkansas will rise to record highs of 20 Bcf/d and 15.1 Bcf/d in June, respectively. Speaking of the Permian future output, putting hands on upcoming changes in production has recently been made easier with the new Rextag's service - Pad Activity Monitor. Thanks to satellite imagery and artificial intelligence, customers are able to monitor the oil and gas wells and are provided with near real-time activity reports related to drilling operations. However, it is noticed that productivity in the largest oil and gas basins has decreased every month since setting records of new oil well production per rig of 1,544 bbl/d in December 2020 in the Permian Basin, and new gas well production per rig of 33.3 MMcf/d in March 2021 in Appalachia.

Persistent Production Uptick in the Permian Basin

No sooner had the crude prices soared above $100/bbl than the industry professionals believed in an incredible growth of drilling activity in North America’s largest shale patch. Analysts speculate that additional output of 500,000 barrels of oil daily would become a significant part (4%) of overall U.S. daily production. That is going to flatter oil and gasoline prices. Drilling permits in the Permian Basin are persistently growing, averaging approximately 210 at the beginning of April. Moreover, the permits trend is noticed as an all-time high as a total of 904 horizontal drilling permits were awarded last month. Nowadays, learning and analysing the current situation and predicting the future development become easier with early activity tracking, a new service recently launched by Rextag. Rextag's Pad Activity monitor (PAM) allows you to see well pad clearing, drilling operations, fracking crew deployment and completions with new data collected approximately every 2 days with the help of satellite imagery and artificial intelligence. While the increase in drilling will result in higher production, U.S. shale producers will have to overcome several hurdles including labor shortages and supply constraints.

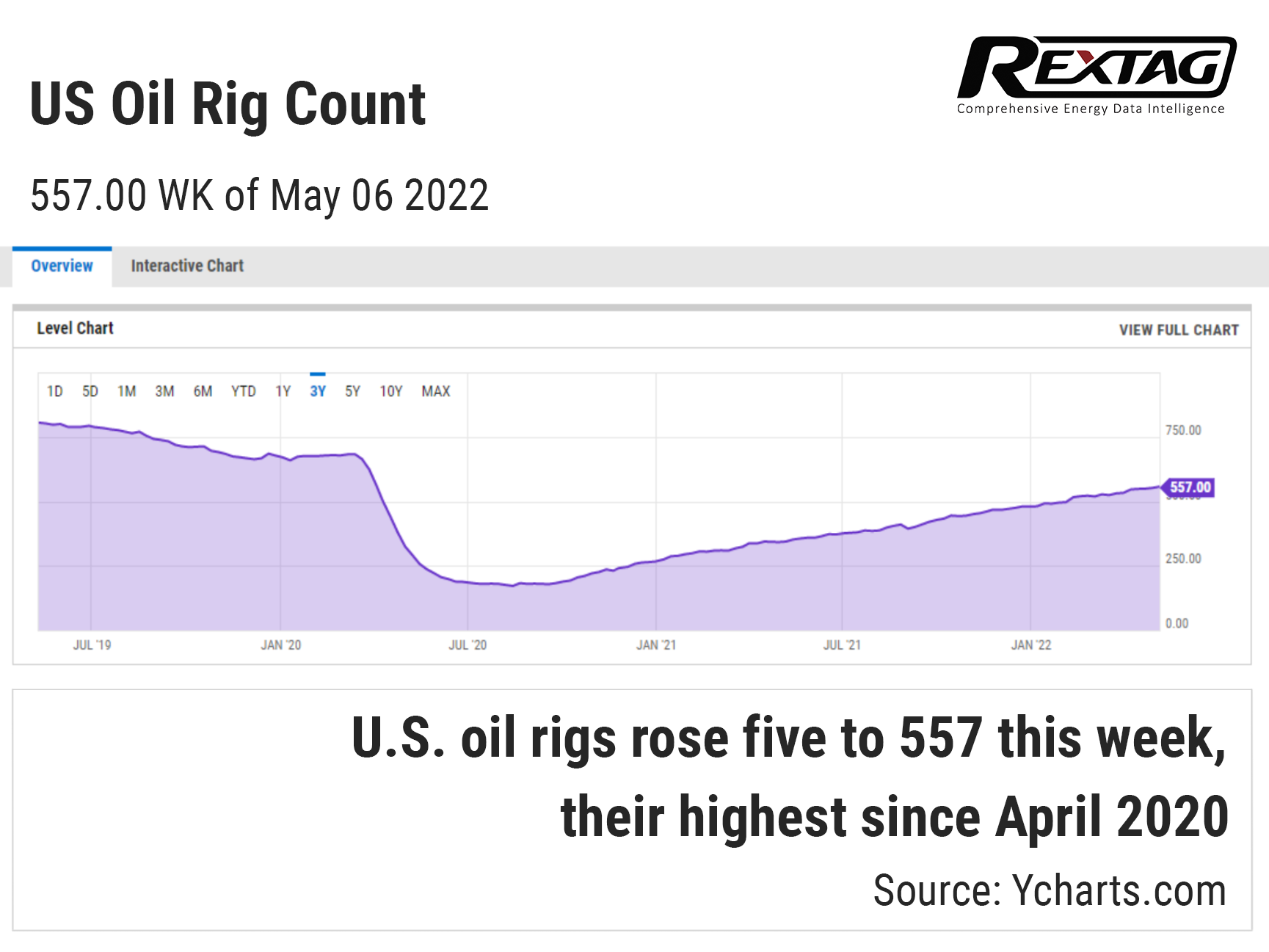

7th week of Oil and Gas Rigs’ Growth

In the midst of the high prices and the U.S. government’s pushing, in the last week, the number of oil rigs increased by 5 and in total makes 557, its highest since April 2020, according to Baker Hughes Co BKR.N. Concerning the gas rigs, they gained 2 to 146, their highest since September 2019. Moreover, crude production was aimed to rise from 11.2 million barrels per day (bpd) in 2021 to 12.0 million bpd in 2022 and 13.0 million bpd in 2023, according to federal energy data. Given that this growth has been expected, recent global market changes make forecasting the output even more challenging. Learning how production will change is easier with early activity tracking, a new service recently launched by Rextag’s Pad Activity monitor (PAM). The overall amount of rigs in the U.S. would grow to an average of 684 in 2022 and 783 in 2023, due to U.S. investment bank Piper Sandler forecast. As Baker Hughes claimed that compares with an average of 478 in 2021.

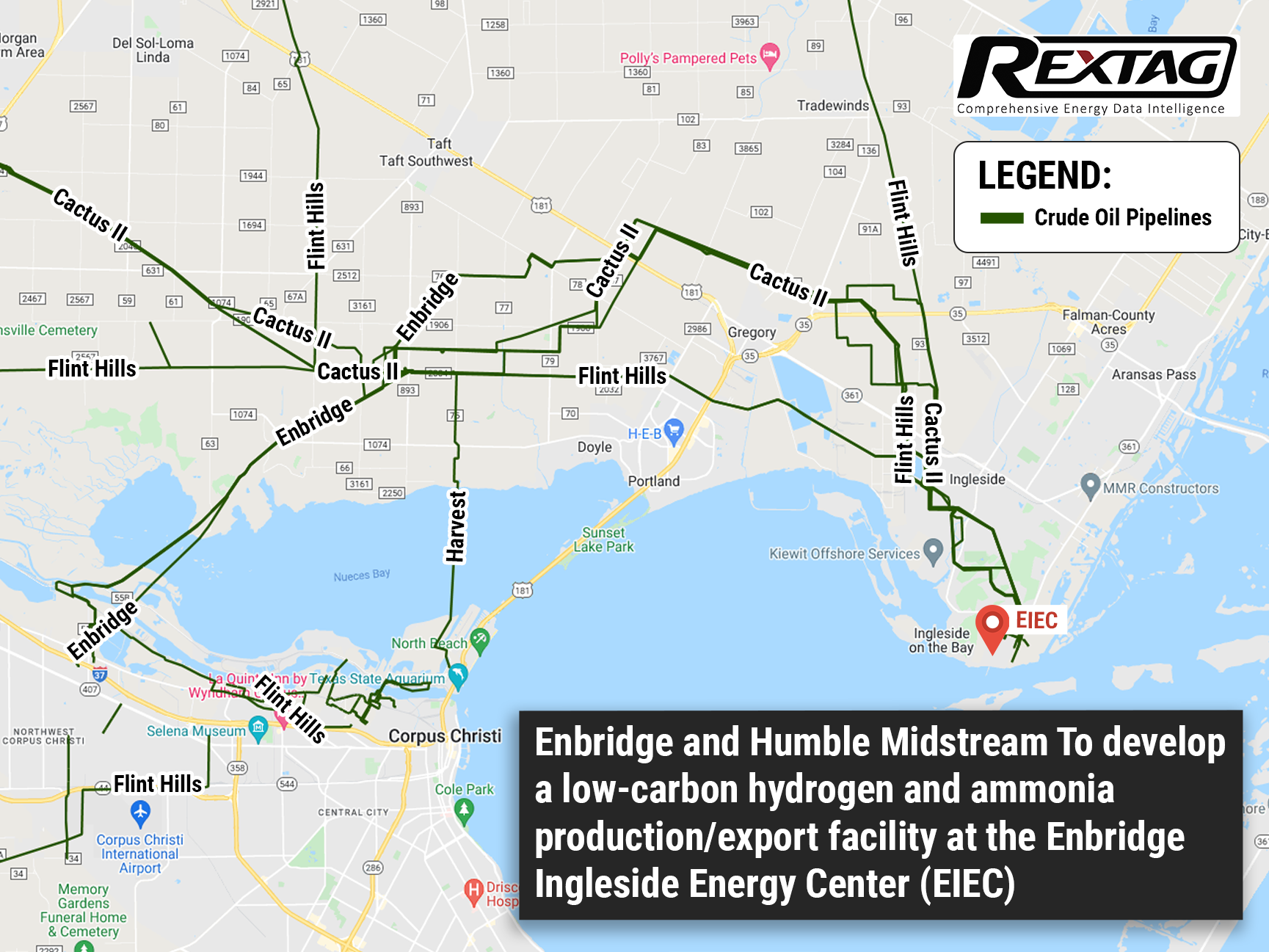

Crude Pipelines Infrastructure Developing at Enbridge Ingleside Energy Center

The joint project to improve and market a low-carbon hydrogen and ammonia production and export facility was presented on May, 6 by Enbridge Inc. and Humble Midstream LLC. Deployment of the facility is taken under the Enbridge Ingleside Energy Center (EIEC) basis close by Corpus Christi. Being the premier export facility on the U.S. Gulf Coast, the EIEC plays a vital role in world energy security and sustainability. Companies plan to develop a utility-scale efficiently low carbon production facility, able to combine both low-carbon hydrogen and ammonia to meet the growing global and domestic demand. It is expected to sequester up to 95% of CO2 generated in the production process in carbon capture facilities, especially ones owned and operated by Enbridge which makes this process a fully integrated low-carbon solution.

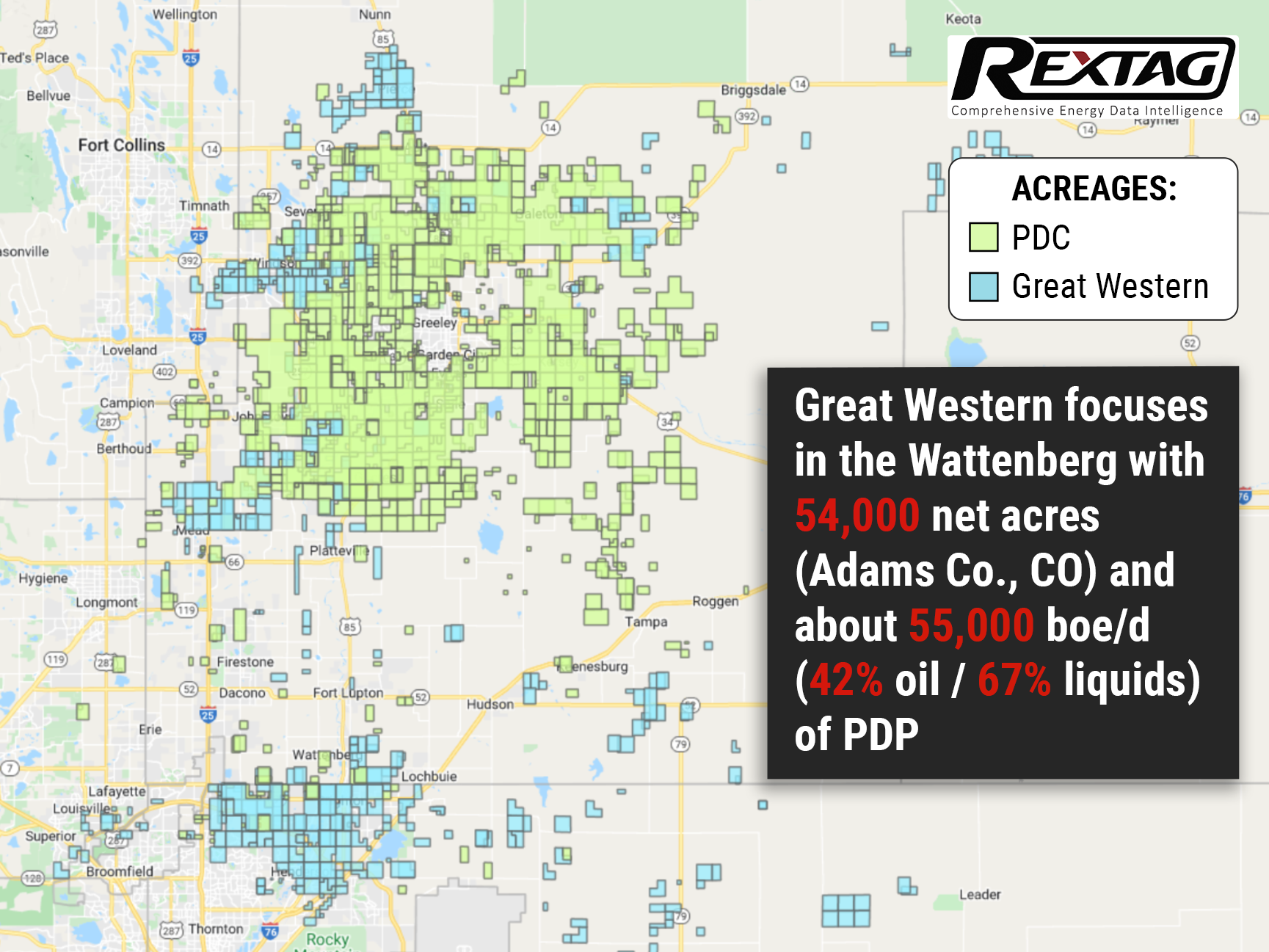

All Eyes Are on the Rocky Mountains State, as PDC Acquires Great Western for $1.3B

Great Western Petroleum's assets will be acquired by PDC Energy for $1.3 billion. Via this deal, PDC Energy’s position in the D-J basin increases roughly to 230,000 net acres. Denver-based Great Western has core operations in Weld and Adams counties in Colorado with 54,000 net acres and about 55,000 boe/d (42% oil / 67% liquids) of PDP. As part of the agreement, the acquisition will be financed by issuing 4 million shares of common stock to existing Great Western shareholders and by providing $543 million in cash to the company. All in all, PDC expects to increase its total production by 25% and its oil production by 35% as a result of the deal. The deal should also result in some synergies including a 15% reduction in overall cost per BOE.

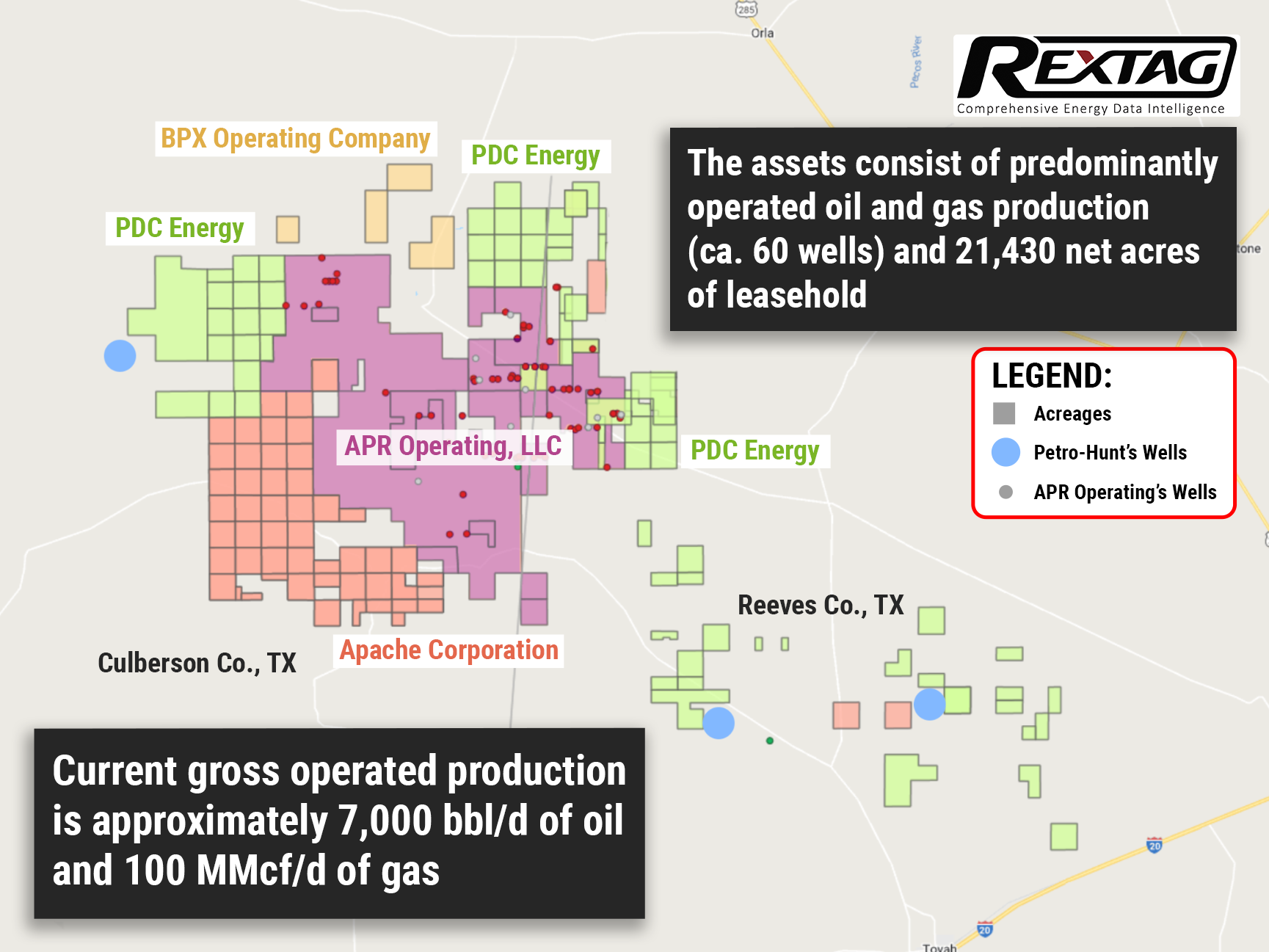

Winds of Change: Admiral Sold Its Assets in Delaware Basin

And Petro-Hunt E&P is the new sheriff in town with 21,430 net acres of leasehold in the Basin, production of which surpasses 7,000 bbl/d and 100 MMcf/d respectively. To take advantage of it, Petro-Hunt plans to begin an active development drilling program on these assets in the coming months heavily upgrading the numbers of its 775 operating oil wells and contributing to over 8,100 non-operated wells. Time will tell, however, whether or not this move will be able to deliver such results.

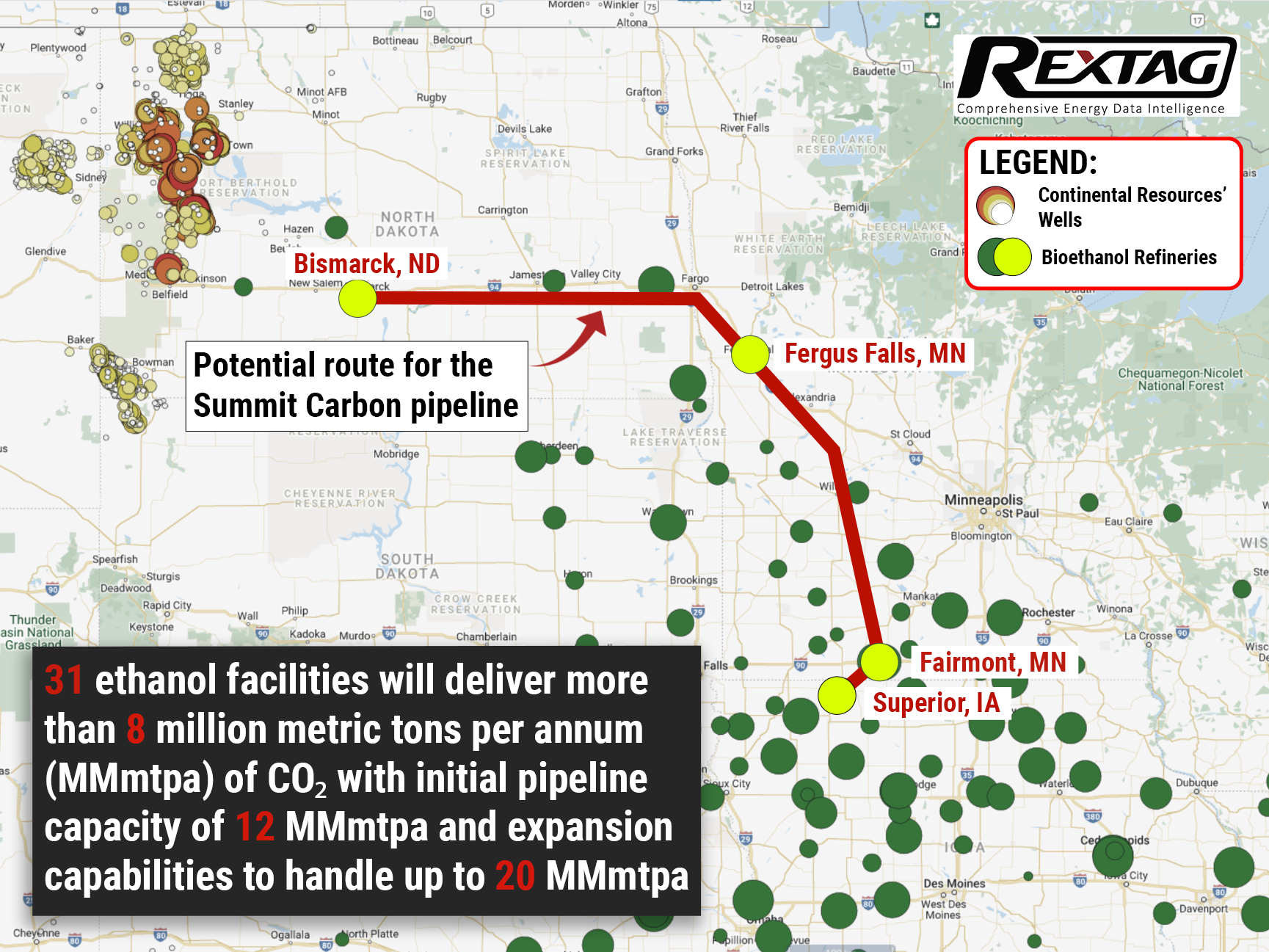

Continental Resources Inc. Invests a Quarter of a Billion Dollars in a Sequestration Project in North Dakota

The investment will happen in the next 2 years. The project intends to capture CO2 from ethanol plants and other sources in Iowa, Nebraska, Minnesota, North Dakota, and South Dakota. Upon aggregation, CO2 will be transported via pipeline to North Dakota, where it will be stored in subsurface geologic formations. The formations will be in the Williston Basin, where Continental Resources has been a dominant producer for more than half a century. At the moment it’s the world's most ambitious carboncapture venture of its kind. The sequestration itself should be underway by spring 2024.

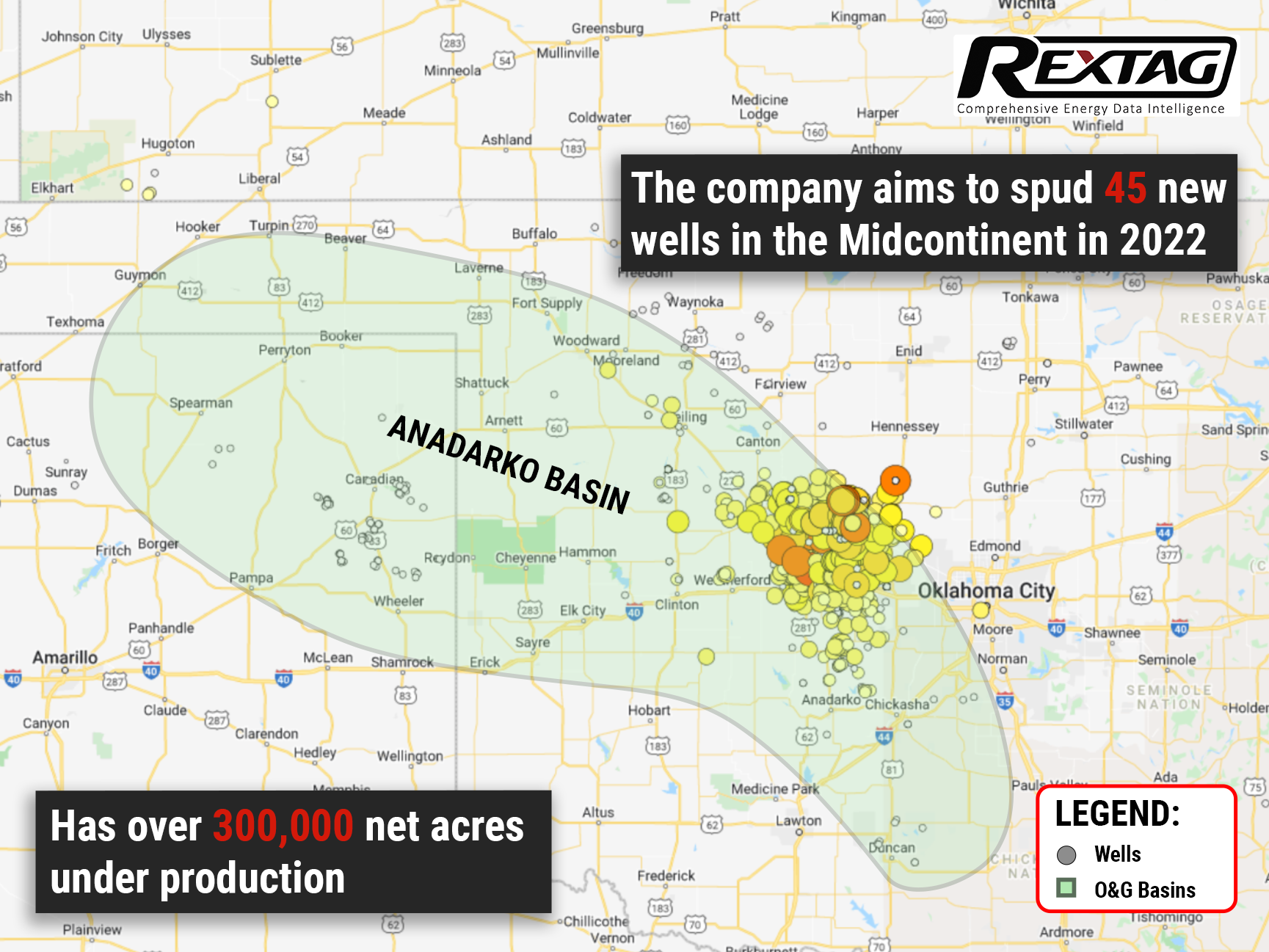

All In: Devon Energy is Banking on a Rebound for Anadarko

Devon Energy Corp. believes that the Anadarko Basin is a hidden treasure and aims to use its position in it to fuel a robust cash return model and establish itself as an industry leader in promoting ESG. This E&P company plans to drill 45 new wells in the Midcontinent by 2022, as well as to produce 600,000 boe/d across five operating basins, including the Eagle Ford Shale, Permian, Powder River, and Williston basins. And given that Devon's recent fourth-quarter results were better than Street estimates. It appears that they are doing something right, at least for the moment.

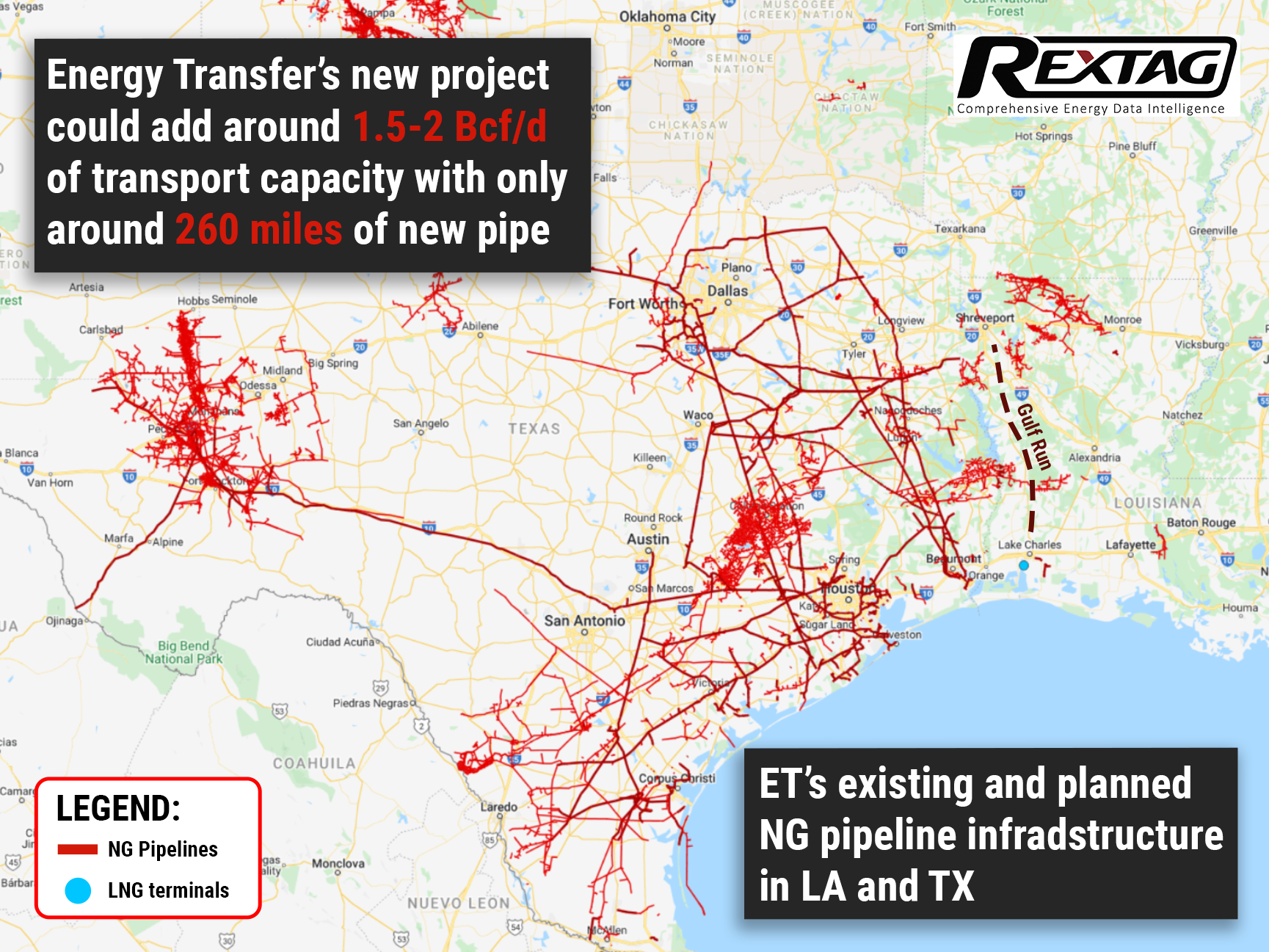

Energy Transfer LP Races to Carry Permian Basin Gas to Gulf Coast Hubs

The ever-increasing demand for natural gas exports from the Gulf Coast started a race to further develop Permian Basin. Various companies, including Kinder Morgan and MPLX, are among those looking at building new pipelines in the region due to the demand spike. But Energy Transfer seems to edge past them into the lead since its project strikes as the most economical option for the basin outside of capacity expansions on existing pipelines and could essentially add 1.5-2 Bcf/d of transport capacity with just 260 miles of new pipe.

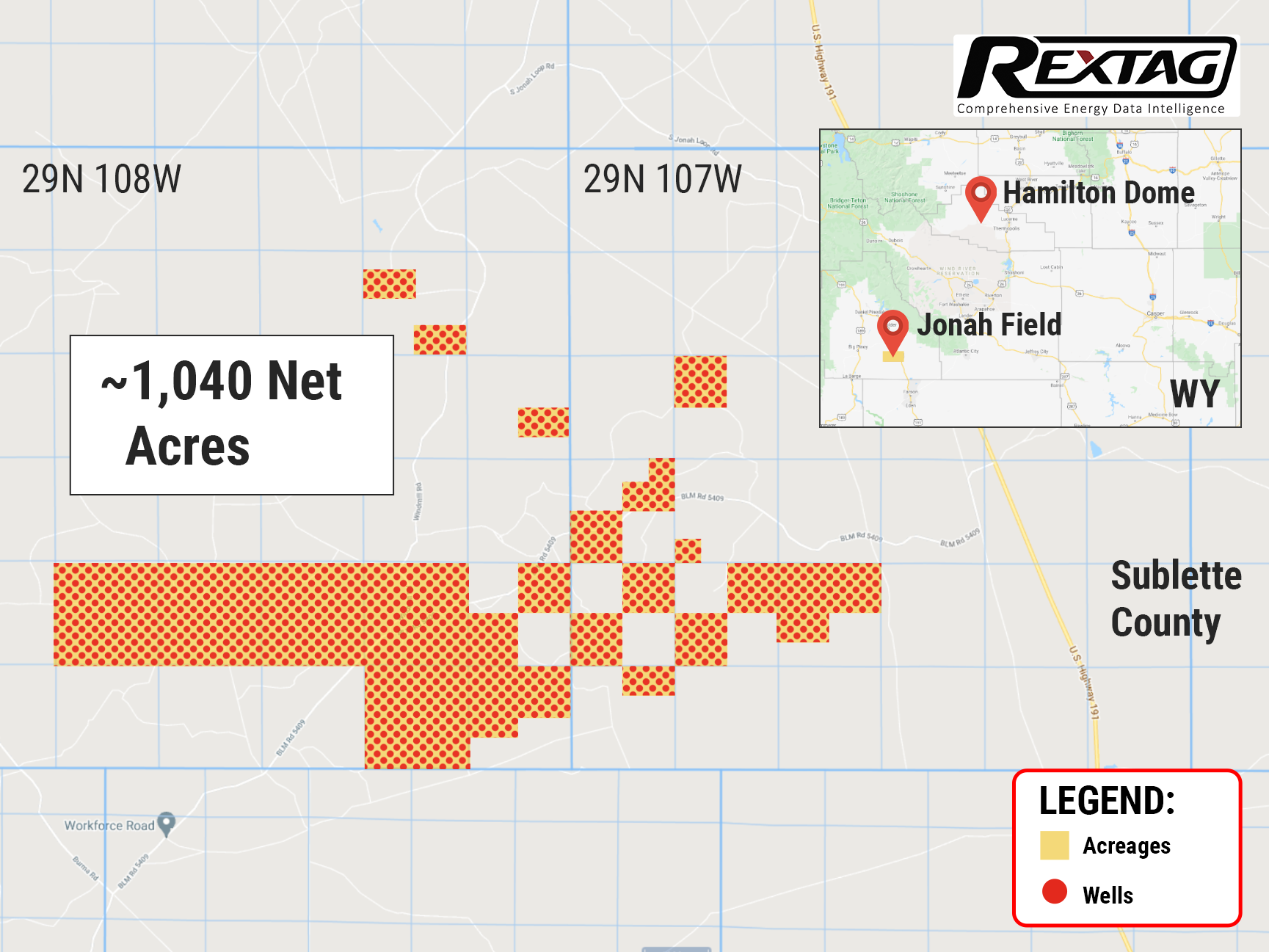

Evolution Acquires Non-operated Wyoming Natural Gas Interests

Evolution Petroleum just spend a fortune on Jonah’s Field right after acquiring Hamilton Dome Field in Wyoming. The price of the transaction is $29.4 million. The Houston-based company aims to diversify into natural gas assets, providing access to the western markets through the Opal market hub, with the optionality to flow to the east. That transaction took effect on February 1. We anticipate closing on or about April 1.

Continental Resources Raises Dividends Following a Quarter of Profit

The future of shale is looking bright: economic recovery and a spike in travel lifted oil prices to multi-year highs, helping Continental Resources to a fourth-quarter profit that exceeded Wall Street expectations. Coming off such a high note, the company plans to increase its dividend rates by 15% to 23 cents per share!

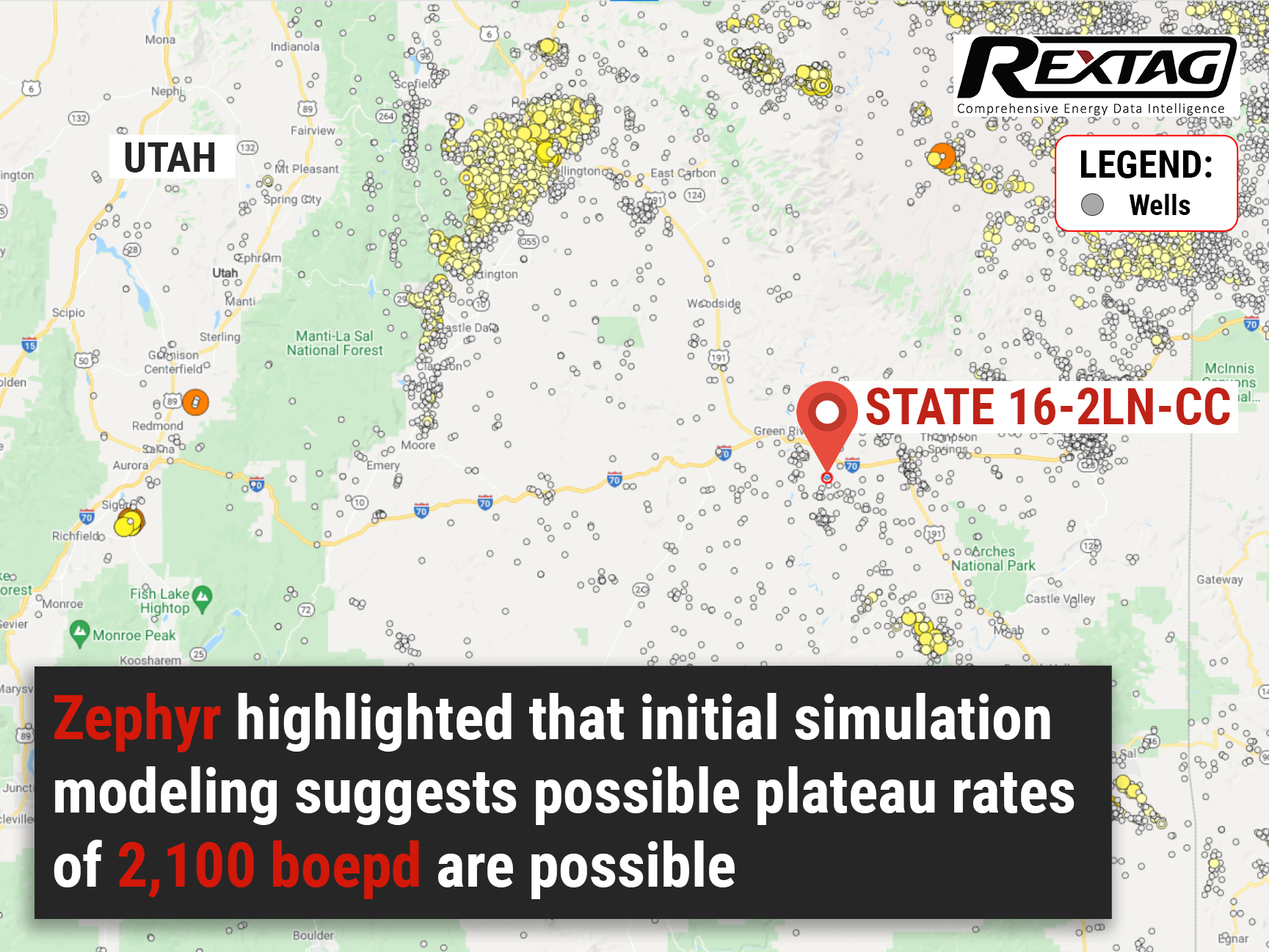

Northern Paradox Basins Rediscovered by Zephyr

After probing the initial discovery of eight high-grade hydrocarbon reservoirs, Zephyr Energy estimates that up to 200 wells could be drilled, creating a potential resource of 125 million barrels of oil equivalent in the area. In an investor presentation, Zephyr said that gas rates may reach plateaus of 10 million square cubic feet per day and 500 boepd of liquids. Quite an impressive number. But The key to tapping in such potential lies in the development of hydraulically stimulated resources rather than treating them as natural fracture plays.

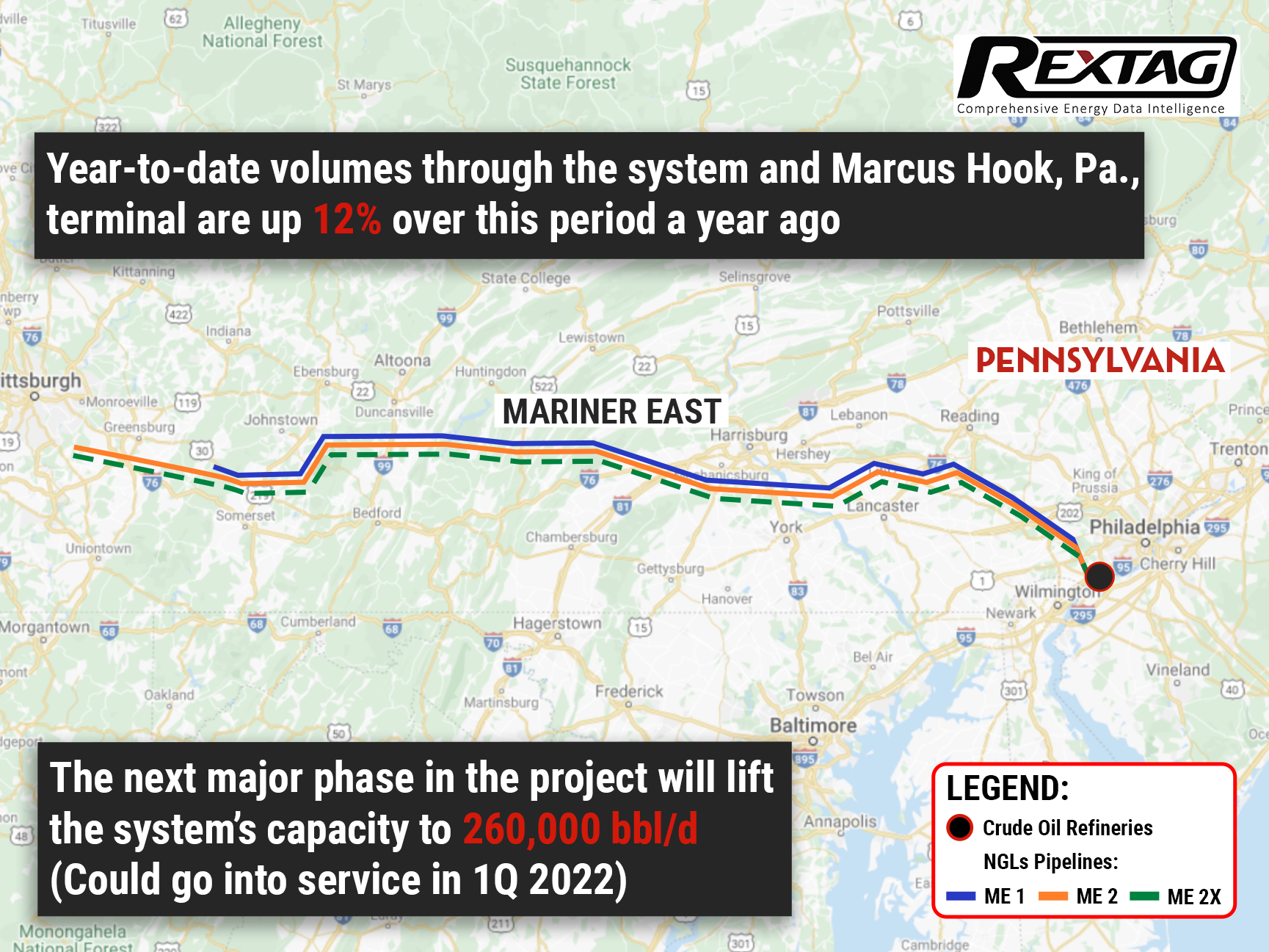

The Final Stretch: Energy Transfer Pushes For Mariner East Project Ahead Of The Stunning Q3 Results

Energy Transfer's lead in the world's NGL exports booked the company another successive quarter. With a global market share of almost 20%, the company is nigh unstoppable. But will it be enough to, finally, push the Mariner East project over the edge? If everything goes as planned, Mariner East's last segment could be operational by the end of the first half of 2022.

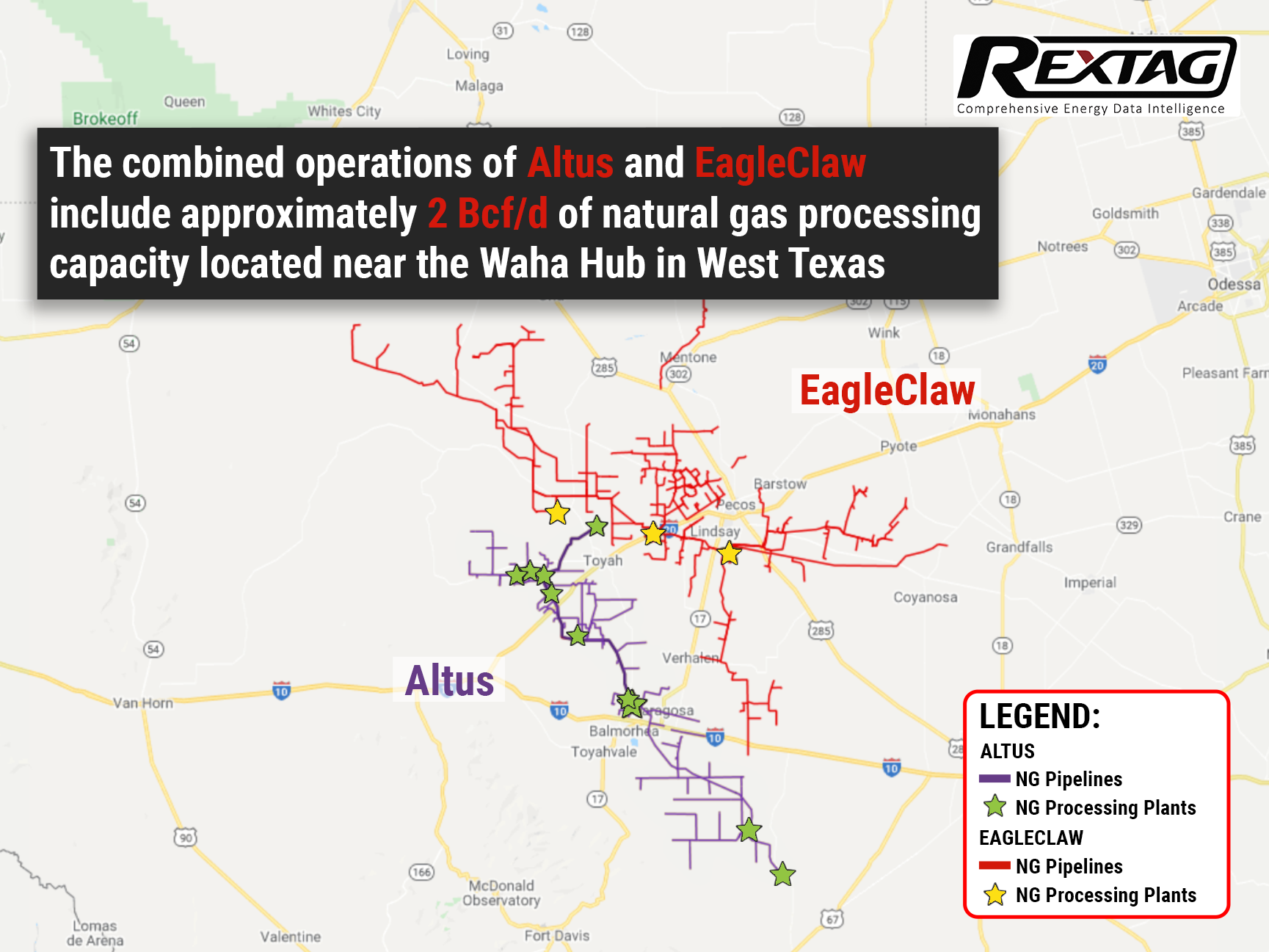

Apache's Altus Midstream to Merge with EagleClaw in All-stock Deal

Altus Midstream and EagleClaw Midstream agreed to combine operations in order to become the meanest midstream player in the Permian Basin! Following this merger, Altus will become the largest natural gas processor in the Delaware Basin, as well as the third-largest for the entire Permian Basin.

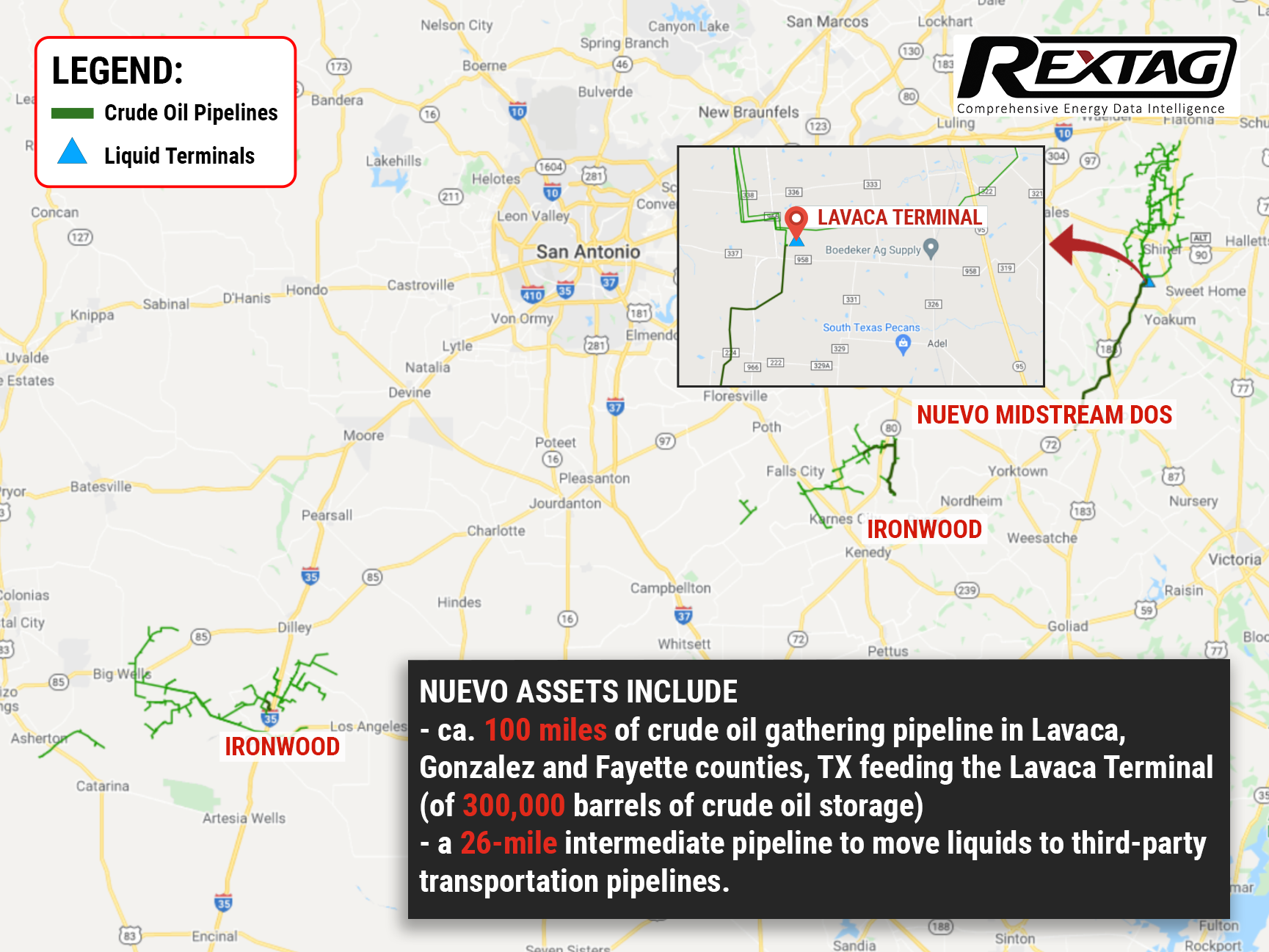

Expansion Is The Goal: Ironwood II Completes Asset Merger And Assumes Management of Nuevo Midstream Dos’ Eagle Ford Assets

Ironwood Midstream expanded its operations in the Eagle Ford region through its merger with Nuevo Midstream. Thanks to this, Ironwood II has increased its crude oil and natural gas throughput capacities in the famous shale to approximately 400,000 bbl/d and 410 MMcf/d, respectively. With 390 miles of pipelines, the company manages 245,000 acres of dedicated land.

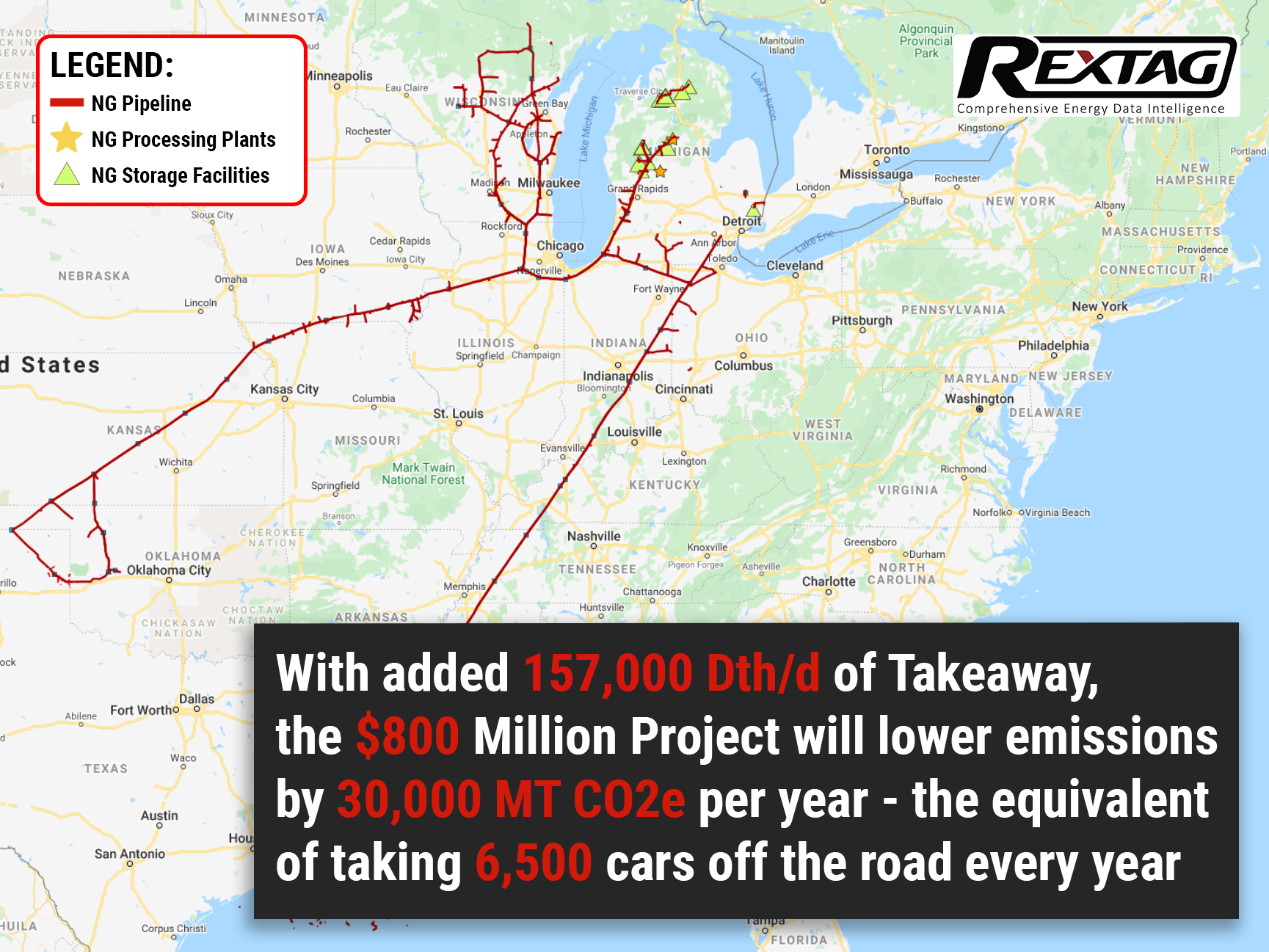

Expansion for TC Energy in Midwest US to cost $800 million

TC Energy splurged $0.8 billion on the project that targets emissions. Well, sorta. According to the idea, existing lines of the ANR Pipeline Company will be expanded to serve markets in the #Midwestern US and simultaneously updated to reduce discharge by 30,000 metric tons CO2e per year - equivalent to removing almost 7000 cars from the road annually. Remarkable goals. With the current timeline, the project will be fully operational by the end of 2025, thanks to long-term transportation agreements secured by ANR.

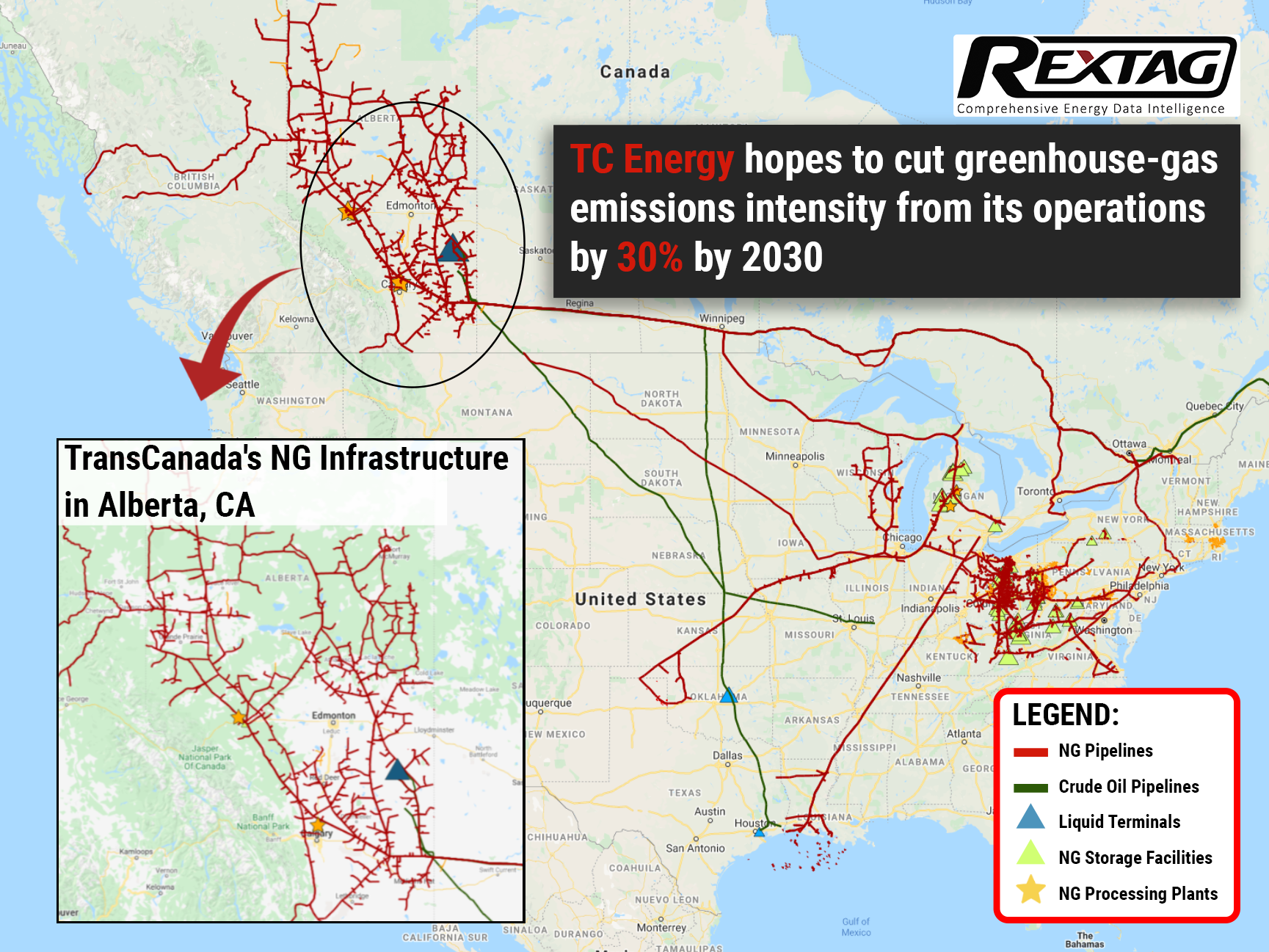

The green trend: TC Energy pledges to be carbon-free by 2050

TC Energy, the Canadian gas giant, recently announced its environmental, social, and governance goals, as well as emission reduction strategies. The company aims to become 100% emission-free by 2050 while promising to cut greenhouse gas emissions intensity from its operations by 30% by 2030 as an interim measure.

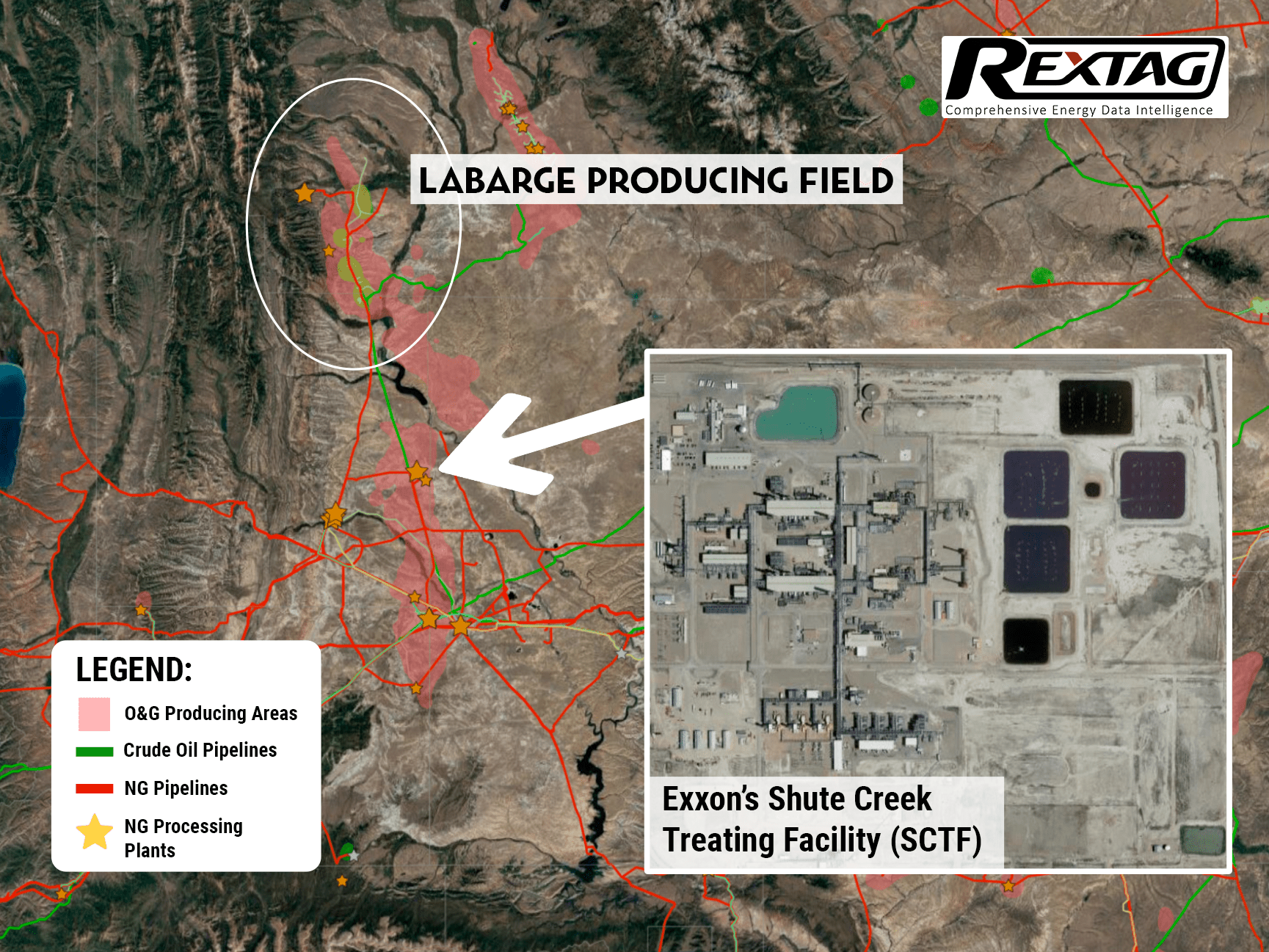

The Hunting Season Is Not Over Yet: Exxon Mobil makes a $400 million commitment to Wyoming's carbon capture

Carbon footprint reduction is a new hot trend: Exxon Mobil makes a $400 million investment into its LaBarge facility to expand its carbon capture and storage capabilities by another million metric tons of CO2. Operational activities could begin as early as 2025 after a final investment decision is made in 2022. At present, about 20% of all CO2 captured worldwide each year is captured at the LaBarge. However, as one of the largest of the world's Big Oil companies, it is not the only project in Exxon's pipeline: aside from CCS capabilities, the LaBarge is one of the world's largest sources of helium, producing approximately 20% of global supply

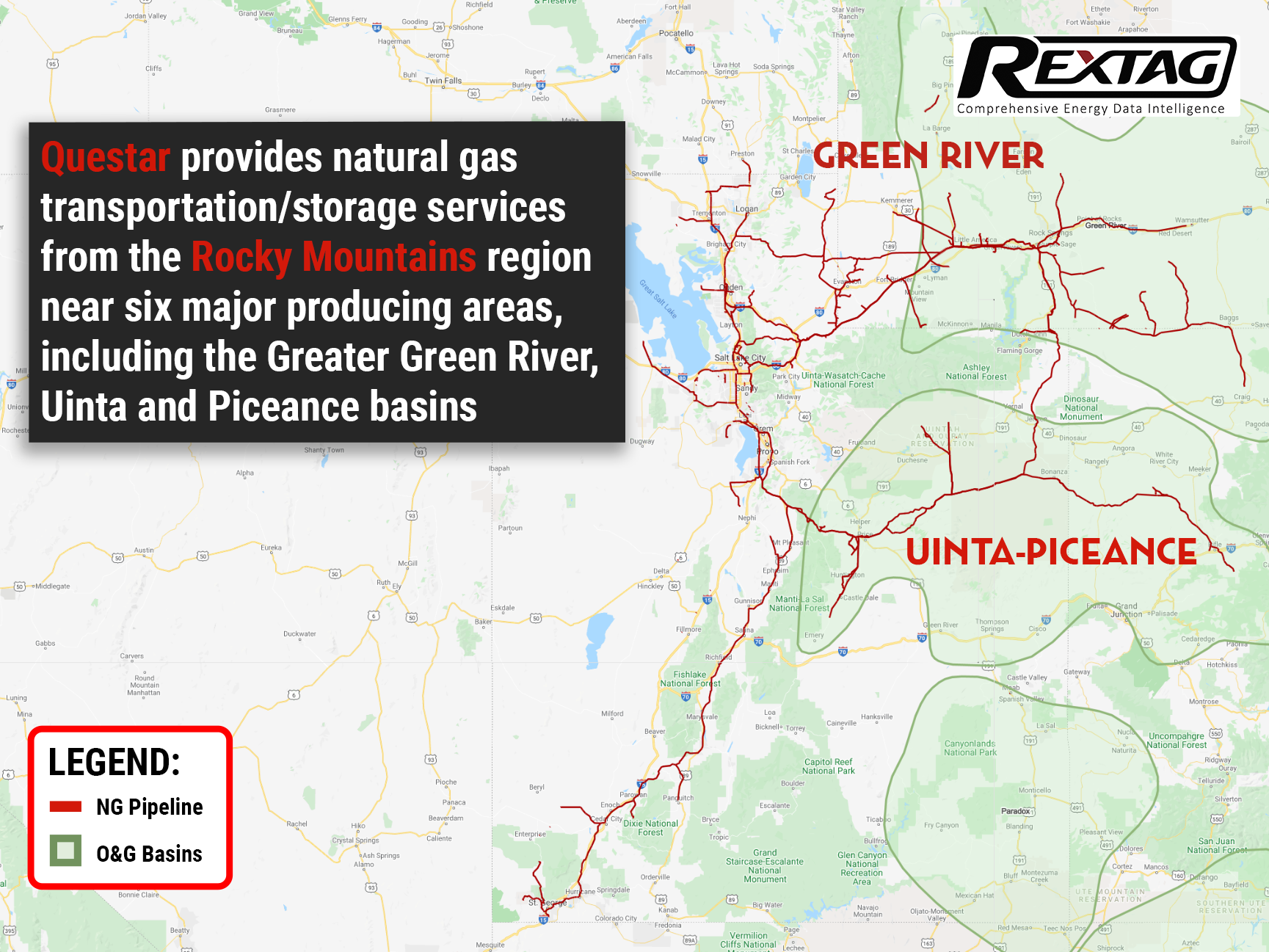

A $2 billion deal saw Dominion Energy sell Questar Pipelines to Southwest Gas

A good asset will not sit on the market for long. After a deal with Berkshire Hathaway fell through, Dominion Energy managed to secure another one for Questar Pipelines in a drop of a hat. And get that, it is better than the former one by more than half a billion! Although not everyone is happy with such decisions, it seems that even Carl Icahn’s complaints won't be able to sway Southwest Gas Holdings’ decision. Though we will have our eyes peeled in any case… If everything goes as planned, a $2 billion deal will be closed before the end of the year.

Restructuration is in a full-speed: Comstock to sell Bakken for $154 million

Comstock Resources decided to go through with asset divestment, selling its Bakken Shale actives for $150M to Northern Oil and Gas. The proceeds from these sales will be reinvested by Comstock Resources Inc. into the Haynesville Shale, at which point the company may acquire additional leasehold and fund drilling activities starting in 2022. Meanwhile, Northern clearly gunning for the pack leading position in the Texas shale play, but whether they succeed or not is remains to be seen.

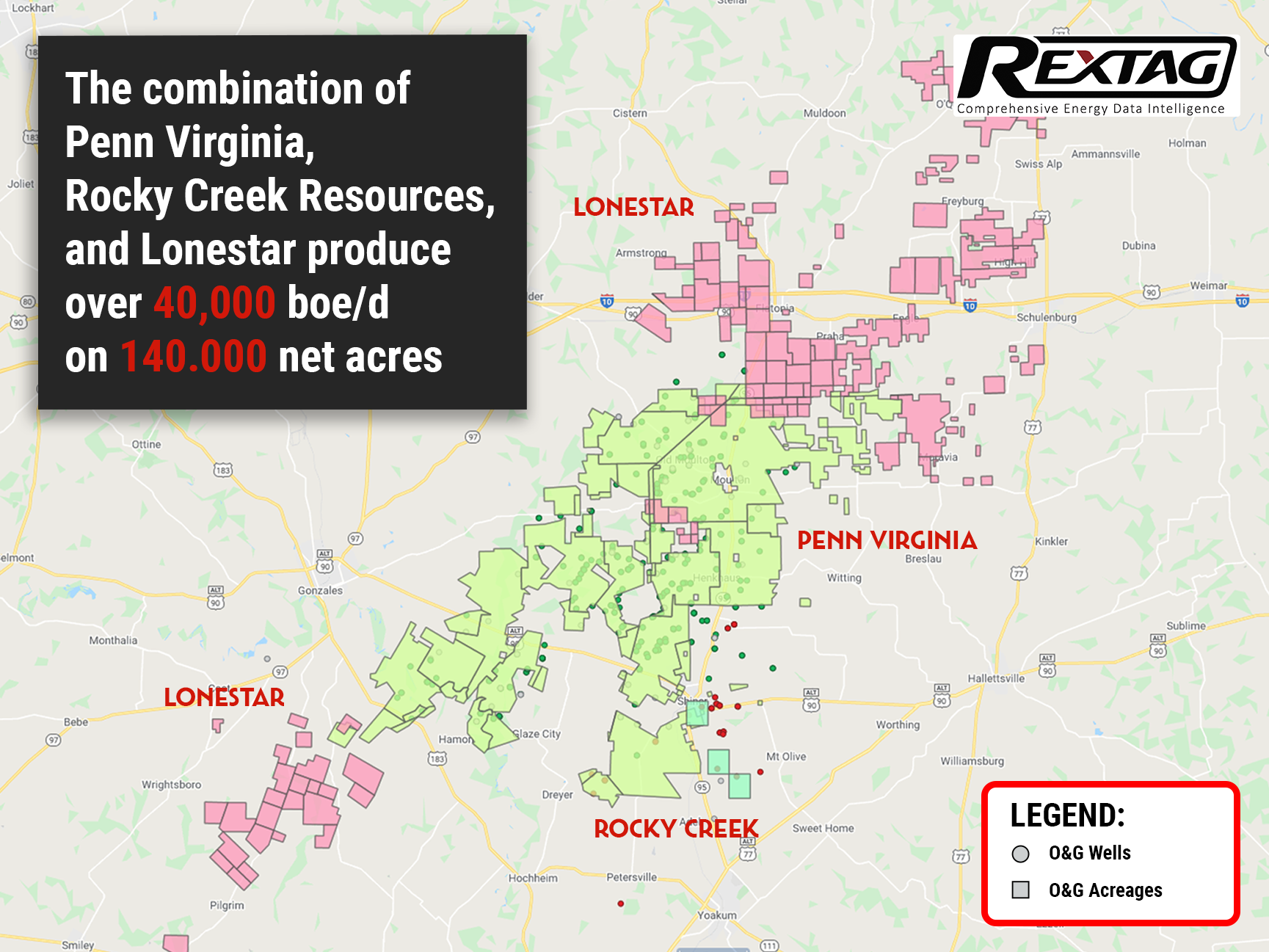

There is a new guy on the block: Penn Virginia rebrands to Ranger Oil

Penn Virginia announced a rebranding to Ranger Oil on 6 Oct. following the close of the Lonestar acquisition. This Texas oil & gas giant reinvents itself anew, shifting its energy development in the lone star state towards safer and more efficient oil and gas operations. The company's consolidated assets now amount to over 140,000 net acres strategically positioned in the Eagle Ford play of south Texas, making it one of the biggest players. It is anticipated that the full rebranding will be complete by the year-end of 2021. For the full rundown of the situation visit our blog.

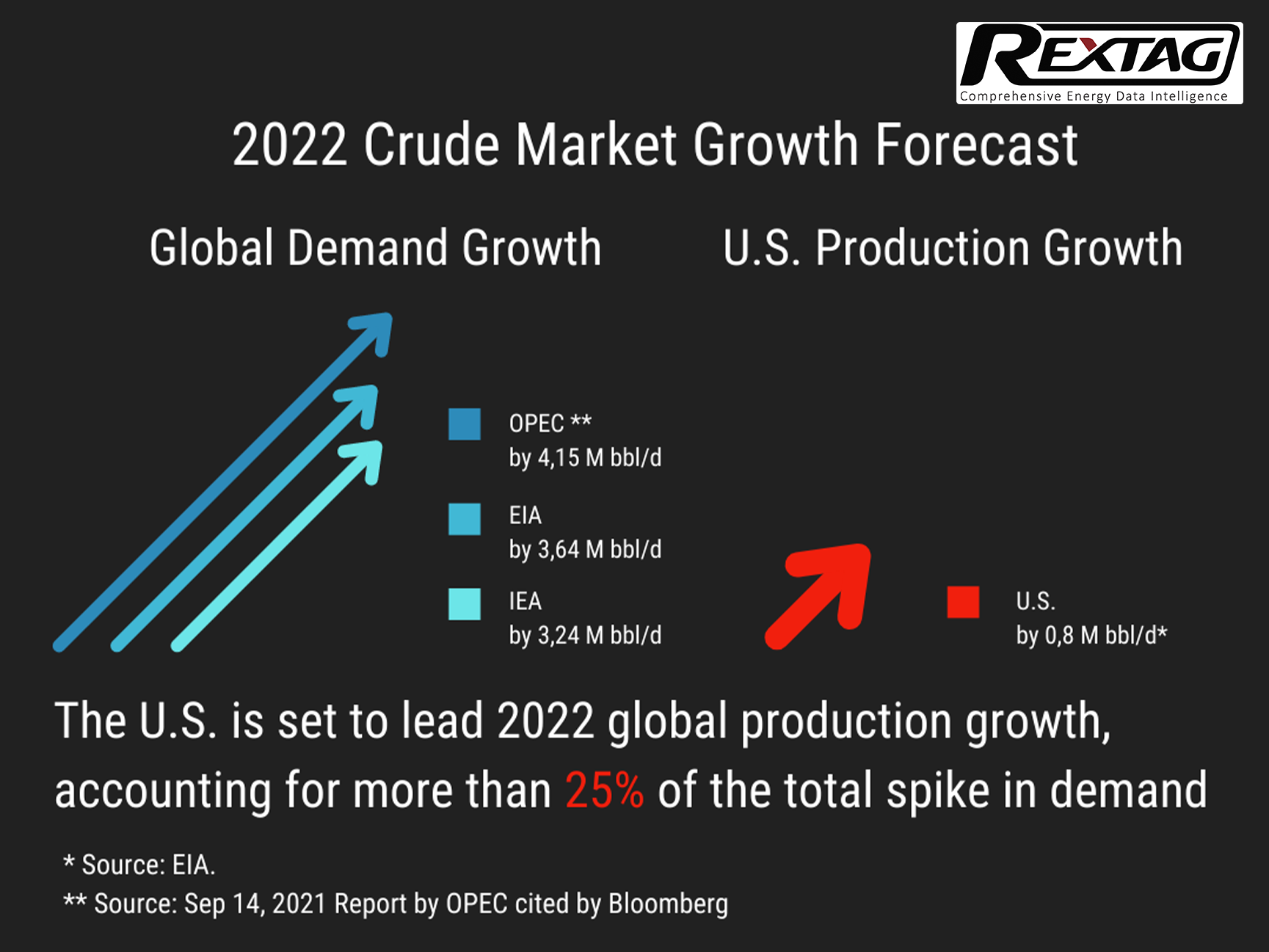

The growth of the U.S. oil and gas industry in 2022 will come from smaller companies and private businesses

Forecast: Bank of America expects to see a major bump in US crude oil production in 2022. Such growth from a non OPEC member will impact world oil market balances in times of tight supplies. Still, crude prices should hold well above $70/bbl next year and could, potentially, jump as high as $100/bbl. By 2022, oil output is expected to grow by 800,000 bbl/d, and more than half of that growth will come from #privately-held producers. For a more in-depth analysis of the forecast check out our blog.

Blog_Grayson Mill acquired Ovintiv's Bakken assets for $825M in 2024.png)

.png)