Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

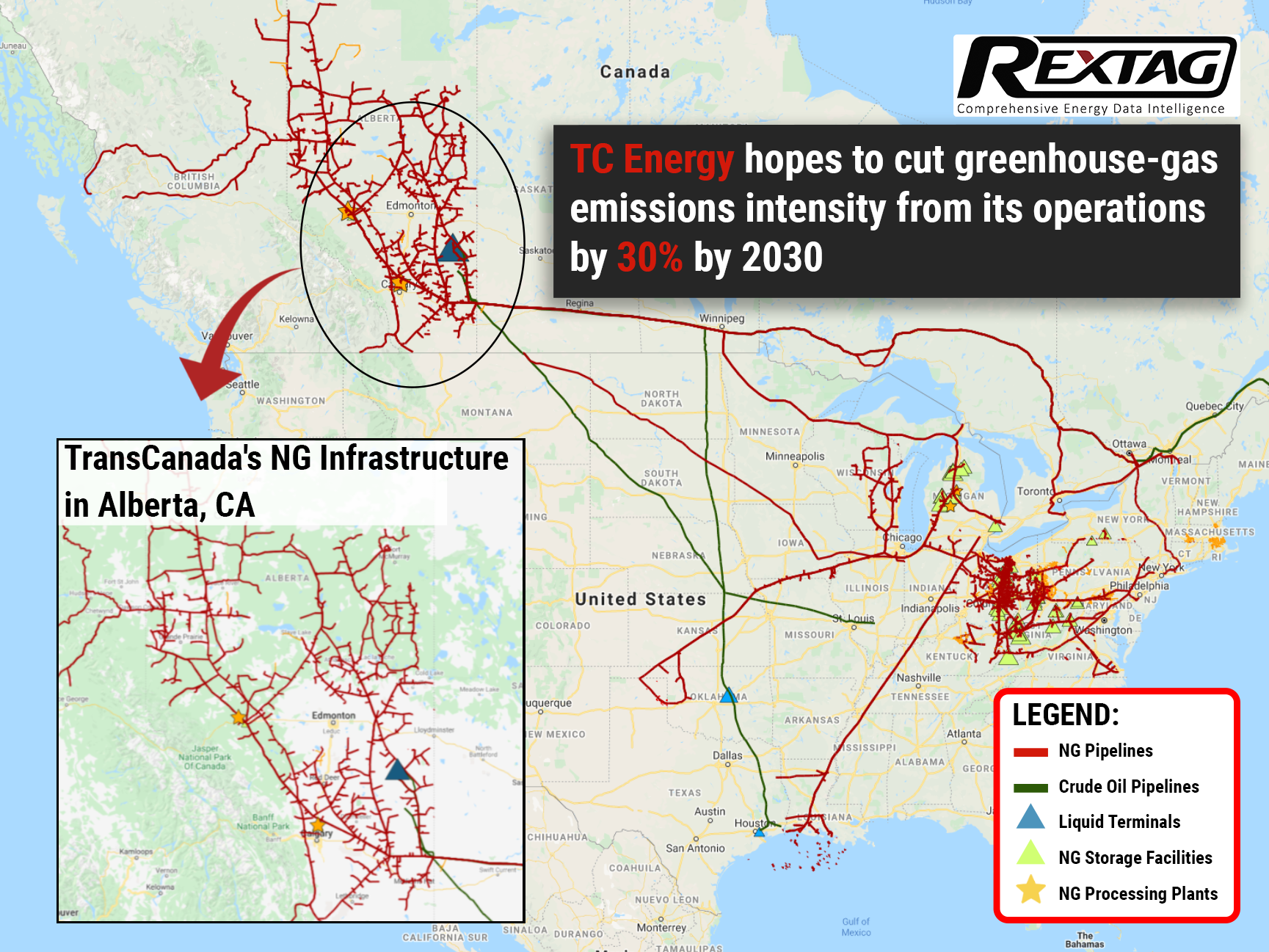

The green trend: TC Energy pledges to be carbon-free by 2050

11/01/2021

To achieve carbon neutrality from operations, TC Energy Corporation announced its environmental, social, and governance (ESG) goals, as well as emission reduction strategies.

Currently, this Calgary-based Canadian company is a leading midstream energy services provider among those focused on natural gas. Yet, aside from pipeline maintenance and power generation, the company also distributes and stores natural gas.

Over the past six months, TC Energy's stock has outperformed the industry average with almost a 3 point lead: gaining 11.3% versus 8.6%.

Due to the global industry moving towards green energy, an increasing number of investors and environmental groups are pushing the company to become 100% emission-free by 2050. In addition, these pressures align with the plans of Canada's prime minister, Justin Trudeau, which envisions a relatively quick transition for the country from carbon to renewable energy sources.

Thus, it came as no surprise when TC Energy announced that it would target this goal alongside them, as well as hope to cut greenhouse-gas emissions intensity from its operations by 30% by 2030.

Five major areas will be targeted by the company to reduce the intensity of its emissions. By acquiring low-carbon energy sources and investing in low-carbon energy, TC Energy will reduce its carbon emissions. It also plans to use carbon credits and offsets. Aside from this, the company also plans to improve efficiencies in its operations with some additional automation of the linear processes. It will help manage emissions, reduce methane leaks and flaring from normal operations.

The carbon dioxide, methane, and nitrogen oxide emissions that TC Energy targets pertain to Scope 1 and 2. The company's natural gas pipeline assets generate these emissions primarily from fuel combustion. It is commendable, that as an interim measure to reach net-zero emissions, TC Energy also commits to reducing Scope 3 emissions.

Additionally, a partnership between TC Energy and Nikola Corporation NKLA was announced in early October in order to build hydrogen production facilities in the U.S. and Canada, as part of each company's sustainability initiatives. Hydrogen is particularly important when it comes to carbon neutrality.

But TC Energy is not alone in this process. Investors' demands to reduce emissions have pushed a lot of industry's top players to set targets to increase renewable capacity and improve efficiency. And in order to clean up the environment, energy companies invested billions of dollars in renewable energy.

Pipeline operator Enbridge Inc. is a prime example of such a trend. Last year the company set emissions reduction targets, hoping to be a net-zero emitter of greenhouse gases by 2050 as well. In the future, we anticipate that there will be a significant increase in pledges like this one. But whether or not they will be fruitful still remains to be seen.

Watch how you can use Rextag to identify ESG improvement opportunities in our latest webinar here: https://youtu.be/XBa_MbL0FME

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Expansion Is The Goal: Ironwood II Completes Asset Merger And Assumes Management of Nuevo Midstream Dos’ Eagle Ford Assets

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Ironwood-II-Completes-Asset-Merger-And-Assumes-Management-of-Nuevo-Midstream-Dos-Eagle-Ford-Assets.png)

Ironwood Midstream expanded its operations in the Eagle Ford region through its merger with Nuevo Midstream. Thanks to this, Ironwood II has increased its crude oil and natural gas throughput capacities in the famous shale to approximately 400,000 bbl/d and 410 MMcf/d, respectively. With 390 miles of pipelines, the company manages 245,000 acres of dedicated land.

Ain't Nothing Like a $2 Billion Deal: Oasis Sells Midstream Affiliate to Crestwood

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Oasis_Petroleum_Crestwood_Equity_Partners_Oasis_Midstream_Partners.png)

Crestwood & Oasis Midstream merge to create a top Williston #basin player. $1.8 billion deal is expected to close during the Q1 of 2022. The transaction will result in a 21.7% ownership stake for Oasis in Crestwood common units. The remaining ownership of Oasis in Crestwood will also be of benefit to the company since it will create a diversified midstream operator with a strong balance sheet and a bullish outlook after this accretive merger.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?