Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Up to $1.5 Billion for Percussion Petroleum in the Permian Basin

07/11/2022

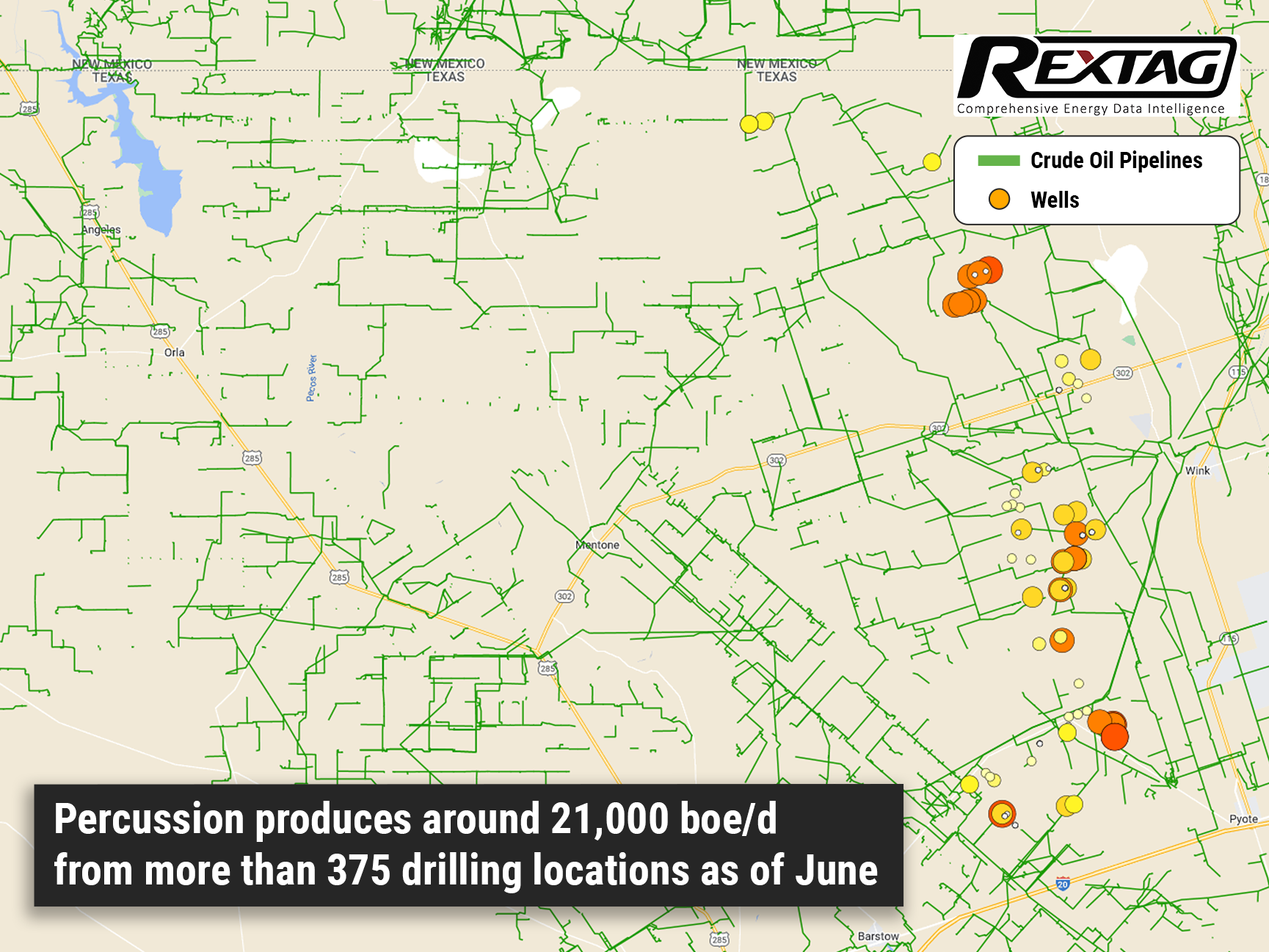

Around 25,000 net acres in the Permian shale basin are being sold by Percussion Petroleum II, looking to fetch up to $1.5 billion, as some sources bet on rising oil prices to pocket more than double what it paid in 2021.

Percussion, a Houston-based oil and gas company, produces over 10,000 bopd from approximately 100 wellbores across 20,000+ net acres in Loving, Ward, and Winkler County in the Delaware Basin.

The company spent $375 million plus contingent payments a year ago to buy the bulk of its assets in one of the most prolific crude-producing areas in the U.S. from Oasis Petroleum Inc.

The oil prices increased to triple digits and buyers wanted to gain a toehold in the basin, whereas backers of private shale companies such as Percussion use it as a chance to exit their investments with big profits.

Remarkably, U.S. crude oil futures have grown about 50% to approximately $109/bbl since June 29, 2021, when Percussion closed its deal with Oasis.

Since Percussion has been founded in 2020 with investment from private equity firm Carnelian Energy Capital, it generates around 21,000 boe/d from more than 375 drilling locations.

The company expects the growth of production of 33,000 boe/d by the end of the year from the asset as the company is now working with an adviser for the sale of assets. Percussion and Carnelian did not give any answers to commenting requests. Private equity firm Old Ironsides Energy, also an investor in Percussion, refused to comment.

Being a part of the Delaware formation, Percussion’s assets have been among the most active and favorable regions for multibillion-dollar deals in recent months. The Permian Basin, spread over Texas and New Mexico, is forecast to set a record production of 5.316 million bbl/d in July.

In June, a well-known oilman Harold Hamm proposed to take Continental Resources Inc. private at a valuation of more than $25 billion, several months after it entered the Permian Basin by purchasing Delaware Basin acreage from its rival.

Meanwhile, Centennial Resource Development Inc. decided to merge with Colgate Energy Partners in May to form a $7 billion Permian-focused oil producer.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

What's Behind the Rise in U.S. Drilling Rigs?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/293_Blog_ What's Behind the Rise in U.S. Drilling Rigs_.jpg)

The total number of drilling rigs actively exploring and producing oil and natural gas in the United States increased to 585 for the week ending July 5, up from 581 the previous week. Despite this recent uptick, the current count still falls short of last year's 680, indicating a slowdown in drilling activities. Analysts suggest that this reduction may reflect greater efficiency among shale producers, who now require fewer rigs. Nonetheless, concerns remain about whether some producers have enough viable drilling land

Triple Advantage Vital Energy's $1 Billion M&A Enhances Permian Portfolio, Cash Flow

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/190Blog_Triple Threat Vital Energy's $1B M&A.png)

Vital Energy, focused on the Permian Basin, plans quick debt reduction after securing $1.165 billion in deals, adding key Midland and Delaware basin inventory.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?