Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Talos Energy Buys EnVen for $1.1 Billion to Expand

10/21/2022

Talos Energy Inc. is acquiring EnVen Energy Corp. for $1.1 billion to raise Talos’ Gulf of Mexico production by 40%.

The purchase of EnVen, a private operator, increases Talos' operated deepwater facility footprint 2 times, expanding key infrastructure in existing Talos operating areas. Almost 80% of the assets will be deepwater, with Talos operating more than 75% of the acreage it holds interests in.

During a conference call on September 22, it was announced that the EnVen purchase “just checks a lot of boxes” in terms of scale, assets, similar strategies, and what Talos is doing from a technology standpoint.

The acquisition is anticipated to close by the end of the year and generate $30 million or more annually in synergies related to general and administrative cost reductions. Moreover, it extends the company’s Gulf of Mexico footprint with acreage Talos has previously attempted to purchase.

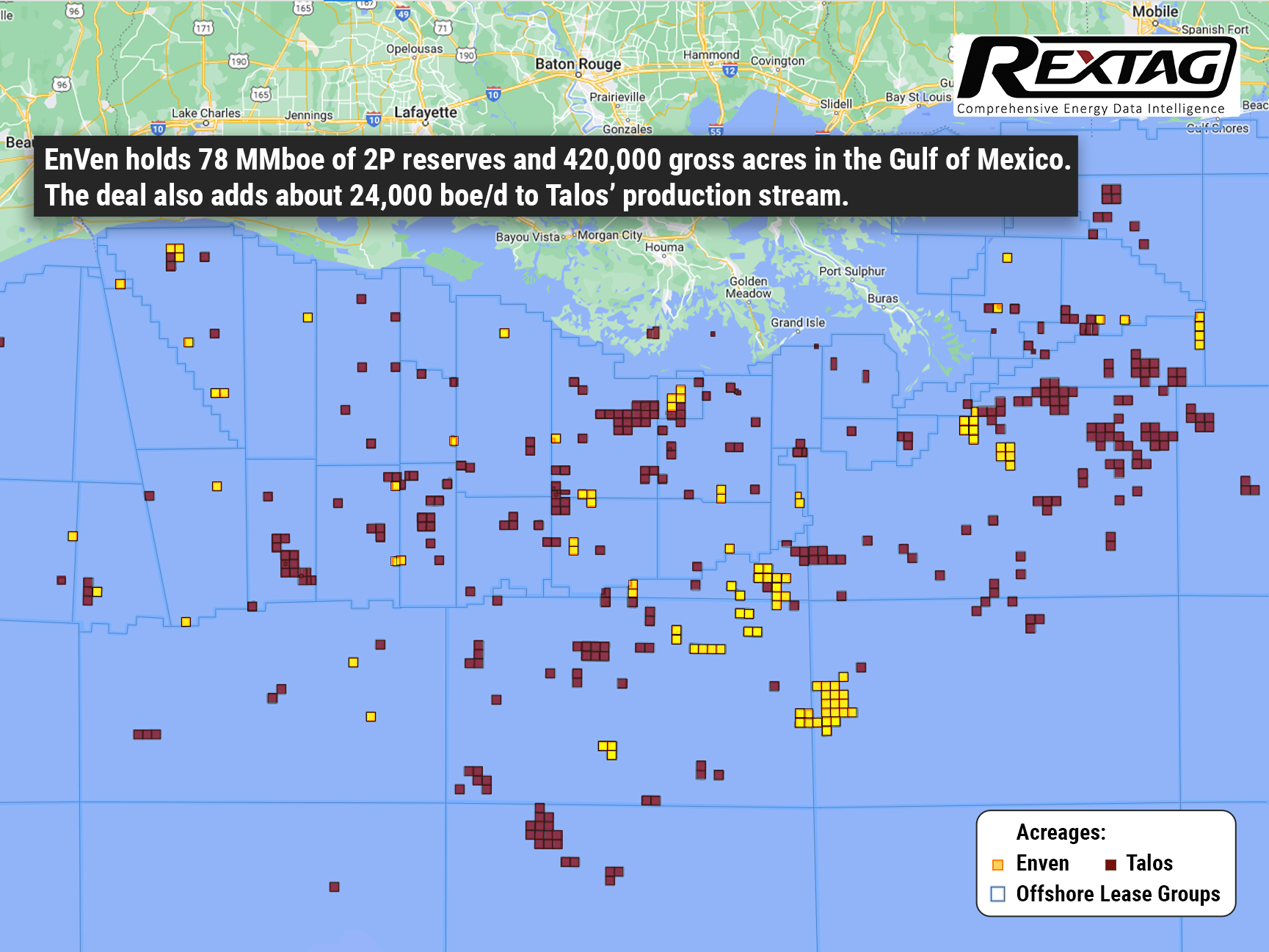

EnVen holds 78 MMboe of 2P reserves and 420,000 gross acres in the Gulf of Mexico. The deal also includes about 24,000 boe/d to Talos’ production stream.

EnVen operates the Brutus/Glider asset in 2,900 feet to 3,243 ft water depth with 100% interest. The production facility has a gross capacity of 120,000 bbl/d. EnVen’s operated Lobster Field in 775 ft of water and a gross oil capacity of 80,000 bbl/d. EnVen holds 67% working interest in the field.

The EnVen-operated Cognac Field in 1,023 ft of water has a gross oil capacity of 30,000 bbl/d. The company holds 63% interest in that field. EnVen manages Neptune with 65% interest. With a gross oil capacity of 50,000 bbl/d, the field is in 4,250 ft water depth.

Prince, which EnVen manages with 100% interest, is in 1,500 ft of water and has a gross oil capacity of 50,000 bbl/d. EnVen holds a 50% interest in the Chevron Corp.-operated Petronius Field in 1,754 ft water depth. It has a gross oil capacity of 60,0000 bbl/d.

The combination of Talos and EnVen deepwater facilities will encourage more subsea tieback activity for unused capacity at the various production units.

EnVen had around three dozen subsea tieback ideas rolling through their inventory. Talos would pull together those ideas during planning for the 2023, 2024, and 2025 spending programs.

Consideration for the transaction consists of 43.8 million Talos shares and $212.5 million in cash, plus the assumption of EnVen's net debt upon closing, currently valued to be $50 million at year-end 2022.

The transaction has been unanimously approved by each company's board of directors. Closing is expected by year-end 2022, subject to customary closing conditions. Following the transaction, Talos shareholders will get about 66% of the pro forma company and EnVen's equity holders will get the other 34%.

The company said the agreement implies a valuation of about 2.4x 2022 estimated hedged adjusted EBITDA with the transaction more than 13% accretive to Talos shareholders on 2023E free cash flow per share. Talos anticipates the transaction to be immediately de-leveraging at closing, with year-end 2022 leverage of less than 0.8x. Additionally, Talos will have no near-term maturities.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Talos Energy Plans to Close the EnVen Acquisition Soon: Stockholders to vote on $1.1B Deal on February 8

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/116Blog_Talos_Will_Close_the_Acquisition_of_the_EnVen_01_2023.png)

Talos Energy Inc. is closing its $1.1 billion purchase of private operator EnVen Energy. A special meeting for Talos’ stockholders to vote on the deal and other matters is set on February 8, according to a prospectus filed on January 11 with the Securities and Exchange Commission. Shareholders are being asked to approve the EnVen merger, which as the company considered in September would raise its Gulf of Mexico production up to 40%. According to a January 11 press release, Talos asserted that it anticipates closing the transaction soon after the meeting. Talos Energy Inc. supposes that adding EnVen would double its operated deepwater facility footprint, extending key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with the company operating more than 75% of the acreage it holds interests in. Talos is one of the largest independent operators in the U.S. Gulf of Mexico, with production operations, prospects, leases, and seismic databases spanning the basin in both Deep Water and Shallow Water. The company aims to actively grow through a balanced focus on asset optimization, development, and exploration while also seeking to add to its portfolio through acquisitions and business development.

Arena Energy Makes a Deal with Cox in GoM, Adding ca. 1,000 net boe/d to Arena's Total Production

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/128Blog_Arena_Energy_Makes_a_Deal_with_Cox_in_GoM.png)

On January 24 Independent E&P Arena Energy LLC acquired Cox Operating LLC's interests in the Eugene Island 330 and South Marsh 128 oil blocks. Cox Operating, based in Dallas, Texas, includes interests to Arena's existing ownership interest in the Gulf of Mexico fields, which it purchased from GOM Shelf LLC.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/297_Blog_Keystone XL Pipeline Controversy and Wildlife Disaster From Trump's Green Light to Biden's Red Light on the 15 Billion Project.jpg)

The pipeline industry in the USA faced and still faces a range of regulatory challenges, including permitting delays, environmental requirements, and public opposition to pipeline projects. In recent years, pipeline projects like the Keystone XL and Dakota Access pipelines had legal and regulatory obstacles that delayed or canceled their construction. Keystone XL Pipeline, proposed by TransCanada in 2008, aimed to transport crude oil from Canada (around Calgary and Edmonton) to refineries on the Gulf Coast (Port Arthur). The project faced opposition from environmental groups and indigenous communities, who argued that it would contribute to climate change and pose a risk to water resources. In 2015, President Obama rejected the project, citing concerns about its environmental impact. However, in 2017, President Trump revived the project, leading to further legal challenges. In June 2021, U.S. President Joe Biden officially canceled the project on his first day in office.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/282_Blog_Renewable Natural Gas How RNG Changes the Industry.jpg)

The renewable natural gas (RNG) industry in the United States is showing promising signs of growth. As of 2019, the U.S. consumed 261 billion cubic feet (BCF) of RNG, primarily utilized by independent power producers, electric utilities, and various commercial and industrial entities. However, this figure represents only a small fraction of its potential. Research indicates that the U.S. could theoretically produce up to 2,200 BCF of RNG through anaerobic digestion alone, which would equate to about 11% of daily national natural gas consumption.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/295_Blog_Renewable Efforts Lag as Global Oil and Gas Demand Continues to Rise.jpg)

Recently, the progress toward an energy transition is hitting a snag. Sales of electric vehicles are decelerating, and the growth in wind and solar power needs to be keeping pace with expectations. To make matters more challenging, electricity prices are climbing when they were expected to fall. Amidst these setbacks, the oil and gas sectors are proving resilient. According to BP's latest energy outlook, not only are these energy mainstays here to stay, but their demand is expected to remain relatively high even after reaching a peak. Interestingly, BP forecasts that oil demand will reach its zenith next year, marking a critical moment in energy consumption trends. This isn't the first time BP has projected a peak in oil demand. Back in 2019, their review anticipated a decline in demand growth, but the prediction fell flat. Instead, oil demand surged to unprecedented levels following the end of the global pandemic lockdowns, defying previous forecasts and underscoring the enduring dominance of traditional energy sources in the global market.