Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

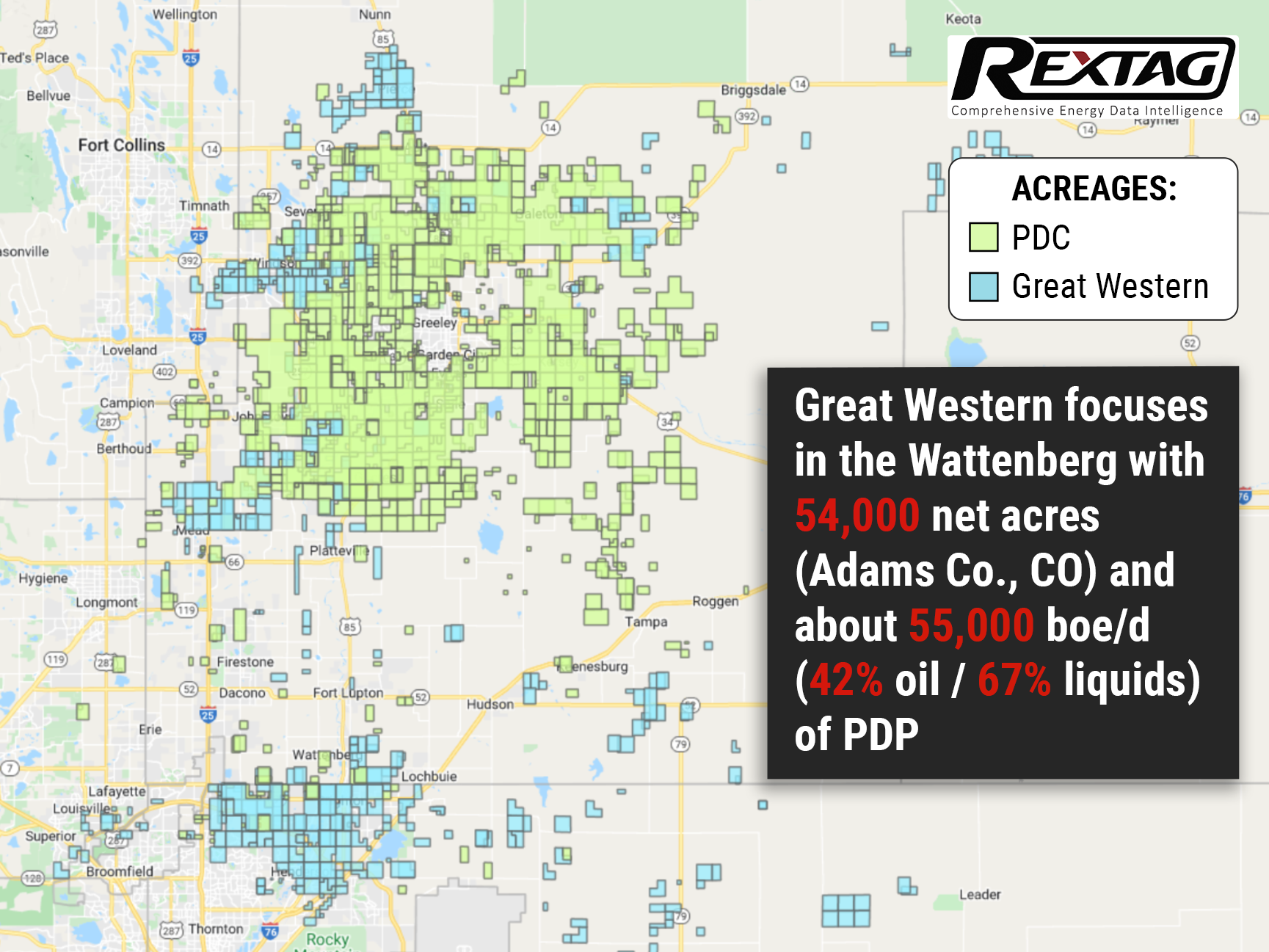

All Eyes Are on the Rocky Mountains State, as PDC Acquires Great Western for $1.3B

04/13/2022

Great Western Petroleum's assets will be acquired by PDC Energy for $1.3 billion.

A Denver-based producer, Great Western has core operations in Weld and Adams counties in Colorado with 54,000 net acres and about 55,000 boe/d (42% oil / 67% liquids) of PDP. In total, Great Western has 315 operating locations, of which about 125 are DUCs/approved permits. It is owned by affiliates of EIG, TPG Energy Solutions, and The Broe Group.

As part of the agreement, the acquisition will be financed by issuing 4 million shares of common stock to existing Great Western shareholders and by providing $543 million in cash to the company.

According to PDC’s president and CEO Bart Brookman, besides adding meaningful scale to the company itself, this acquisition simultaneously signals to the market PDC's commitment to ensuring that reliable and sustainable energy production will continue in Colorado for years to come.

Via this deal, PDC Energy’s position in the D-J basin increases roughly to 230,000 net acres, additionally, shareholder returns will be boosted thanks to the M&A overhang that will be removed. Besides these assets, the company also holds some 25,000 net acres in the Delaware Basin in the Permian.

If undeveloped acreage is not included, the analysts estimated that the purchase price would be about $24,000 per boe/d of flowing gas.

It is expected that the transaction will result in industry-leading shareholder returns, according to CFO Scott Meyers. The company plans to finance the transaction with cash on hand and borrowings under its credit facility. The Pro forma leverage ratio for PDC is not expected to exceed 1.0x at closing.

In addition to honoring and growing the base dividend, PDC intends to aggressively buy back nearly 60% of its shares while they are trading at an unwarranted discount to intrinsic value. It is planned that PDC will retire more shares by the end of the third quarter than it will issue in connection with the Great Western merger.

As of 2022, PDC Energy expects to run three rigs and 1.5 crews on the combined D-J asset, which is estimated to cost between $900 million and $1 billion in Pro-forma CAPEX. On a Pro-forma basis, pre-tax production will be between 250,000 and 260,000 boe/d, and oil will be between 82,000 and 87,000 barrels/day.

All in all, PDC expects to increase its total production by 25% and its oil production by 35% as a result of the deal. The deal should also result in some synergies including a 15% reduction in overall cost per BOE.

Davis, Graham, and Stubbs LLP provides PDC with legal counsel, and PJT Partners is the exclusive financial adviser. The financial adviser to Great Western is Citi, while the legal counsel is Latham & Watkins LLP.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Winds of Change: Admiral Sold Its Assets in Delaware Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Admiral_Permian_Assets_Acquired_by_Petro_Hunt.png)

And Petro-Hunt E&P is the new sheriff in town with 21,430 net acres of leasehold in the Basin, production of which surpasses 7,000 bbl/d and 100 MMcf/d respectively. To take advantage of it, Petro-Hunt plans to begin an active development drilling program on these assets in the coming months heavily upgrading the numbers of its 775 operating oil wells and contributing to over 8,100 non-operated wells. Time will tell, however, whether or not this move will be able to deliver such results.

$690 Million Deal Moves Ahead: Crescent Energy to Complete Purchase of EP Energy's Uinta Assets

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/56Blog_Crescent_Bought_EP_Energy's_Uinta_Assets.png)

Crescent Energy closed the acquisition of Uinta Basin assets in Utah that were previously owned by EP Energy for $690 million, a few hundred million dollars below the original price. The accretive deal increases Crescent's Rockies position and adds significant cash flow and a portfolio of high-quality oil-weighted undeveloped sites. In addition to its acquired Uinta assets, Crescent's pro forma year-end 2021 provided reserves totaled 598 million boe, of which 83% was developed, 55% was liquid, and its provided PV-10 was $6.2 billion.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?