This summer, J.P. Morgan Securities highlighted Endeavor Energy Resources as the Midland Basin's standout in mergers and acquisitions, suggesting its value might approach $30 billion.

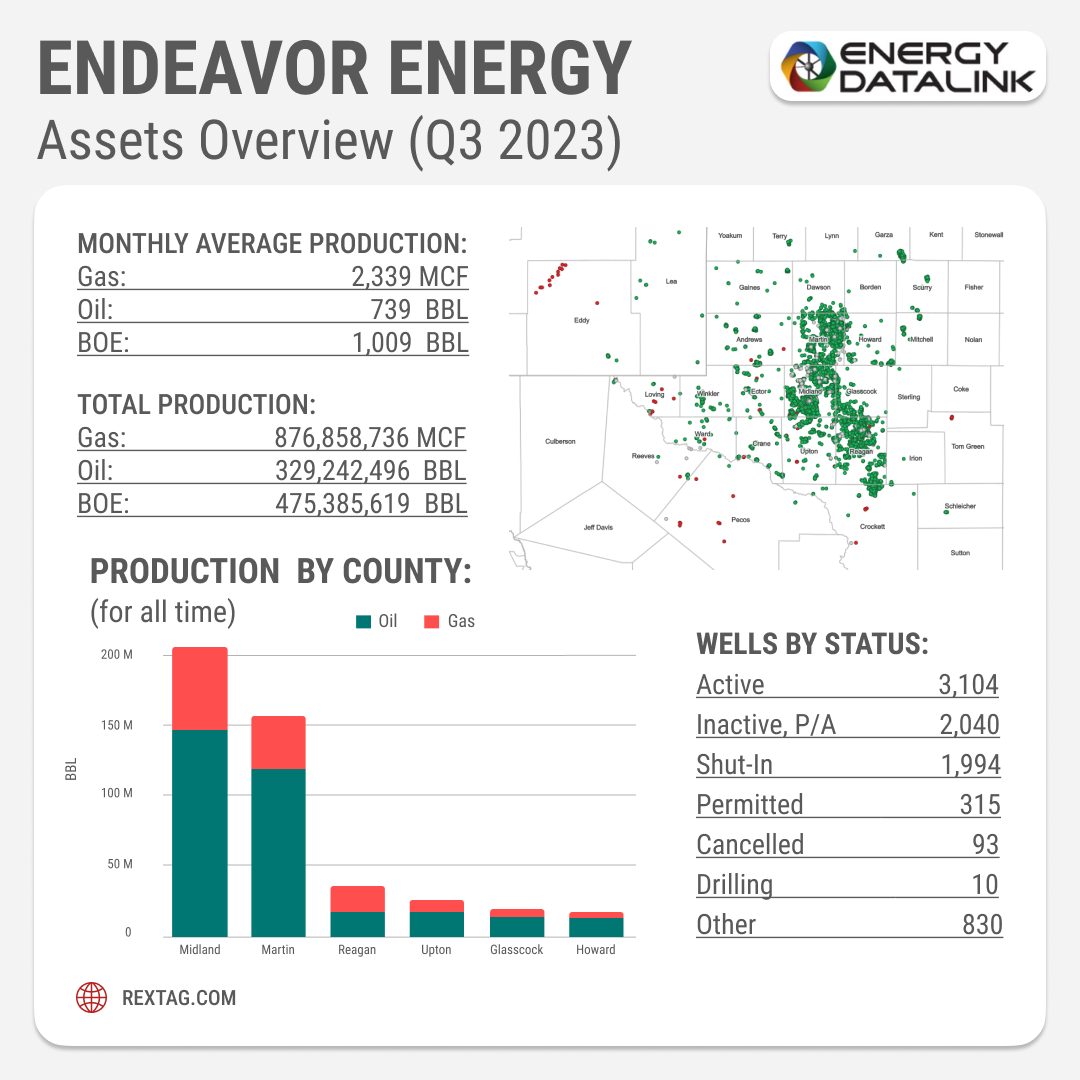

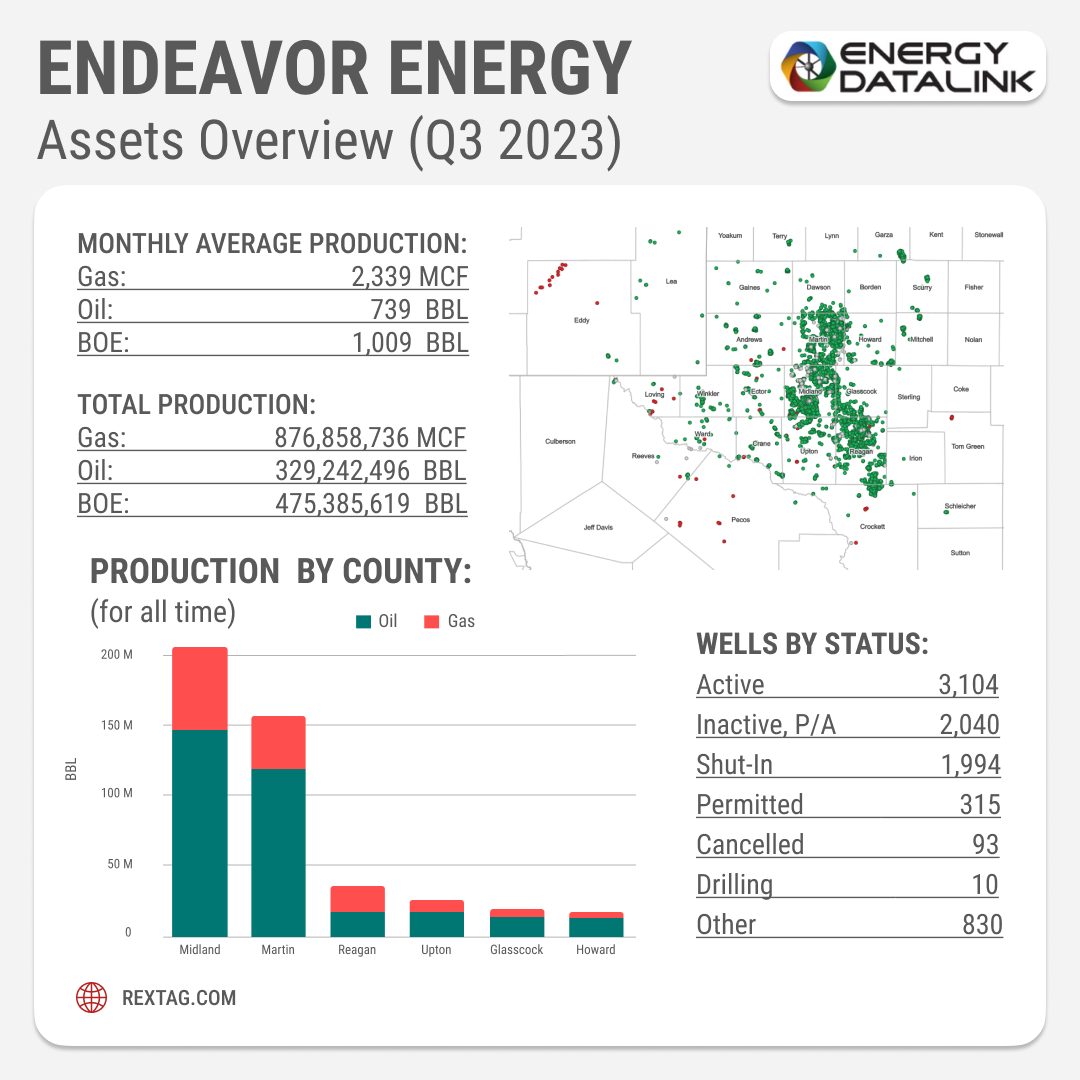

Endeavor Energy Resources, a privately-owned entity in Midland focusing solely on its operations, has seen a significant uptick in production. It now boasts a production rate of 331,000 barrels of oil equivalent per day (boe/d), marking a 25% increase from the previous year.

Fitch Ratings provides a new perspective on Endeavor, and when compared with Exxon Mobil's valuation of Pioneer Natural Resources (another Midland-focused company), it seems Endeavor's market value could hit the $30 billion mark. This estimate is based purely on quantitative data, setting aside the brand recognition that a company like Pioneer might have.

For context, Exxon Mobil's valuation of Pioneer is based on:

- A payment of $89,500 per flowing boe/d

- Pioneer currently averaging 721,000 boe/d

- Holding 900,000 net acres

- The all-stock deal by exxon values pioneer at $64.5 billion, debt included.

In comparison, Endeavor averages a production of 331,000 boe/d and has 350,000 net acres to its name, with a current gross debt of $907 million.

Fitch notes that Endeavor's leasehold includes about 9,800 economically viable future horizontal drilling locations at $60 per barrel.

In contrast, Pioneer is estimated to have around 11,000 such locations at over $55 per barrel, while Endeavor stands at about 4,500 at the same price.

Both companies maintain leverage below 0.5x EBITDA. Fitch's recent report and an October update on Pioneer confirm this.

Endeavor's production comprises 57% oil, as reported by Fitch. Pioneer, in its third-quarter 10-Q filing for 2023, notes that its production is 53% oil. Endeavor's total liquid production, including natural gas liquids (NGLs), stands at 80%, while Pioneer's NGL production was 25% of its total in the third quarter, bringing its total liquid production to 78%.

Fitch has also provided data on Endeavor's operating costs, which have improved significantly to $9 per boe/d, down from $15.40 per boe/d in 2017, a year after it began focusing on horizontal drilling and large-scale fracturing. This cost efficiency is among the best in Fitch's E&P peer group, as noted by analysts Daniel Michalik and Mark Sadeghian, who also affirmed Endeavor's BBB- rating.

The Highest Margin

- Endeavor's netback, unhedged, stands at $38.30 per boe, an 81% margin, the highest in its peer group.

- This is attributed to a high content of approximately 80% liquids, strong realized prices, and a competitive cost structure. In comparison, Pioneer's unhedged cash netback is $34.10 per boe/d, as reported by Fitch in October.

- Other companies' netbacks include Marathon Oil at $25.10/boe, Continental Resources at $30.90/boe, APA Corp. at $27.80/boe, and Diamondback Energy at $34/boe.

Michalik and Sadeghian commend Endeavor's management for its ability to grow while controlling drilling and exploration costs and boosting overall returns, despite inflationary pressures.

Looking ahead, Fitch anticipates Endeavor's free cash flow to reach $1 billion in both 2024 and 2025, assuming a base-case oil price of $70 next year and $65 in 2025. About 10% of its 2024 oil production is hedged at $70, with associated gas — about 20% — at $3.25.

The company's debt-to-EBITDA ratio is expected to stay below 0.5x, akin to Devon Energy, through 2027. Endeavor has $907 million in senior unsecured notes due in 2028.

Moreover, Endeavor has an untapped bank credit facility of $1.5 billion and holds $1.9 billion in cash.

In 2021, the company paid off $500 million of its senior notes due in 2026. The following year, it retired another $600 million in senior notes due in 2025 using its free cash flow, as per a 2022 Fitch report.

The analysts suggest that Endeavor's free cash flow could be channeled towards potential mergers and acquisitions. However, Fitch's BBB- credit rating assumes no such activity.

Factors potentially elevating the rating include steps to mitigate corporate governance-related risks. Endeavor, wholly owned by founder Autry Stephens since 1979, lacks independent board members. However, the company is progressively moving towards professional management, which includes

Over 1,000 Wells and Strategic Acquisitions in Texas

Endeavor Energy Resources owns a significant tract of land, primarily located in Martin, Midland, and Reagan counties in Texas. The company is currently operating over 1,000 horizontal wells across this largely continuous area. As of mid-October, Endeavor had 13 drilling rigs in operation.

Recent well completions, as reported by J.P. Morgan Securities, have been noteworthy. These include:

- In Martin County 11 wells on the Kronos lease, which have shown impressive initial production (IP) rates of 1,040 barrels of oil equivalent per day (boe/d), with 84% being liquid forms.

- In Midland County, 12 wells in the 'Interstate' unit averaged 1,654 boe/d with 87% liquids, and 22 wells on the Fasken property averaged 1,317 boe/d with 89% liquids.

In 2022, J.P. Morgan reported that Endeavor's drilling results yielded 11.24 barrels of oil per lateral foot. This performance placed the company fourth, ahead of Ovintiv's 11.02 but trailing behind Chevron (12.50), SM Energy (12.24), and APA Corp. (11.43).

Endeavor's mineral rights division, 1979 Royalties, has recently expanded its holdings. The unit acquired approximately 5,000 net royalty acres in Martin and Dawson counties from Peacemaker Royalties, supported by EnCap Investments, for a sum of $61 million. Much of this surface acreage is operated by Endeavor and Ovintiv.