Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

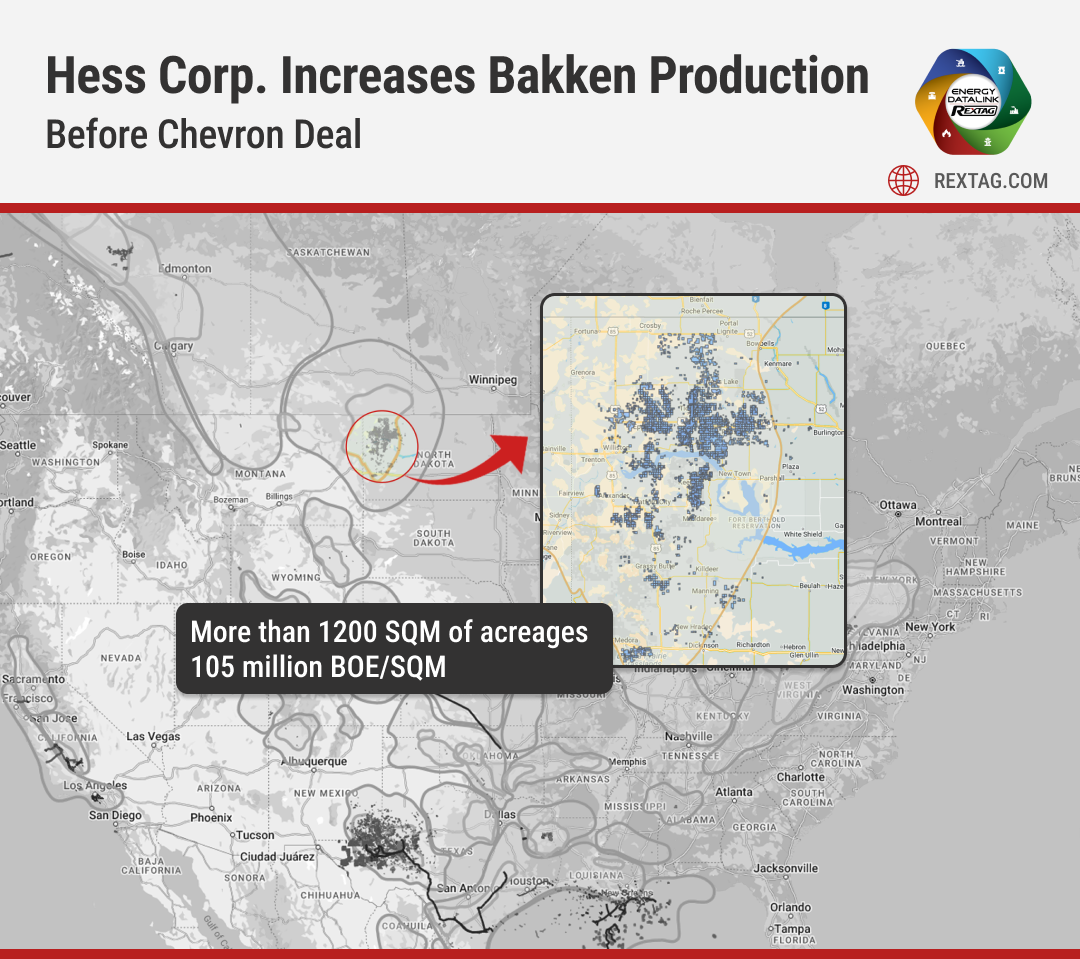

Hess Corp. Increases Drilling Activity Before Chevron Takeover

02/12/2024

Hess Corp. is in the final stages of a major sale to Chevron, with increased drilling and production in the Bakken region noted in the last quarter. Hess announced its fourth-quarter net production in the Bakken reached 194,000 barrels of oil equivalent per day (boe/d), a slight increase from the third quarter's 190,000 boe/d and a significant 23% rise from the 158,000 boe/d seen in the fourth quarter of the previous year. This growth is attributed to more drilling and the impact of the previous year's severe winter weather.

- Oil production in the Bakken averaged 89,000 barrels per day (bbl/d), slightly higher than the previous quarter's 87,000 bbl/d and a 20% increase from 74,000 bbl/d a year before.

- Hess operated four drilling rigs in the Bakken during this period, with plans to maintain this level of operation into 2024.

- The fourth quarter saw 33 new wells drilled, 30 completed, and 33 brought online, with Hess officials projecting Bakken production to average 200,000 boe/d by 2025, maintaining this level for almost a decade.

Chevron's planned $60 billion purchase of Hess Corp. should boost its U.S. production, especially with new operations in the Bakken shale area, expected by mid-2024. Chevron, already active in major areas like the Permian Basin and the Denver-Julesberg Basin, is also planning to sell its shares in the Duvernay Shale in Alberta, covering about 238,000 acres.

Huge Deal: Chevron to Offload Duvernay Assets

Chevron is planning to sell its 70% interest in Alberta's Duvernay shale, a key Canadian shale area spanning around 238,000 acres, with a daily production capacity of about 40,000 barrels of oil and gas. Valued at nearly $900 million, Chevron aimed to develop this region since 2017, resulting in 243 wells connected to production by the end of 2022. The 2022 output included 126 million cubic feet of natural gas and 17,500 barrels of liquids, using techniques like horizontal drilling and hydraulic fracturing.

Rextag consistently monitors and compiles data on Natural Gas. Discover detailed insights in our exclusive ‘American Gas Data & Map Book’.

This deal is part of Chevron's broader strategy to focus on more lucrative U.S. projects, aligning with its plan to divest up to $15 billion in assets by 2028. This strategy kicked into gear following the announcement of a $60 billion merger with Hess Corp. in October, expected to be completed by June 2024. Chevron is directing a significant portion of its 2024 budget, $14 billion, towards U.S. operations, particularly $5 billion to the Permian Basin projects.

Guyana's Oil Riches

Chevron's deal to buy Hess Corp. is largely about getting into Guyana, home to one of the biggest recent offshore oil finds. Hess owns a 30% share in the Stabroek Block in Guyana, which produced 128,000 barrels a day in the fourth quarter.

In November, the Prosperity FPSO project at Payara started, adding 14,000 barrels a day to Hess's production. Hess works with Exxon Mobil and CNOOC on this huge 6.6 million-acre block in Guyana.

Hess also has a strong presence offshore in the Gulf of Mexico, where it produced 30,000 barrels of oil equivalent a day in the last quarter. This shows Hess's strategic locations and how the Guyana operations are key for Chevron's future oil production.

Chevron Corp. Beats Records

Chevron Corp announced a significant 10.7% rise in its Permian Basin output, exceeding forecasts with a record 867,000 barrels daily in the fourth quarter. The company aims to hit 900,000 barrels daily by the end of the year and targets 1 million by 2025. This boost in production comes from faster drilling, longer wells, enhanced completions, and minimizing delays. Chevron is also focusing on additional improvements by adding a fracturing crew and applying successful techniques from its PDC Energy acquisition.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Bakken's Tipping Point: Grayson Mill's Potential Fall After Chevron-Hess

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R-230(1)Blog_Grayson Mill acquired Ovintiv's Bakken assets for $825M in 2024.png)

The Permian Basin, a big oil area, is not seeing as many deals as before because lots of companies have already joined together. Now, experts think these companies might start looking for new places to invest in the U.S. One area getting attention is the Bakken play. Chevron Corp. has just made a big step there by buying Hess Corp. for $60 billion. Another company, Grayson Mill Energy, which got some help from a Houston investment firm EnCap Investments LP, might also be up for sale soon, worth about $5 billion.

Who's Next after Diamondback? Potential Takeover Targets in the Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/239_Blog_Who's Next after Diamondback_ Potential Takeover Targets in the Permian Basin.png)

The $26 billion purchase of Endeavor Energy Resources by Diamondback Energy, with its stock up 2.6%, is the newest big deal combining oil and gas production in the Permian Basin under a few big companies

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?