Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

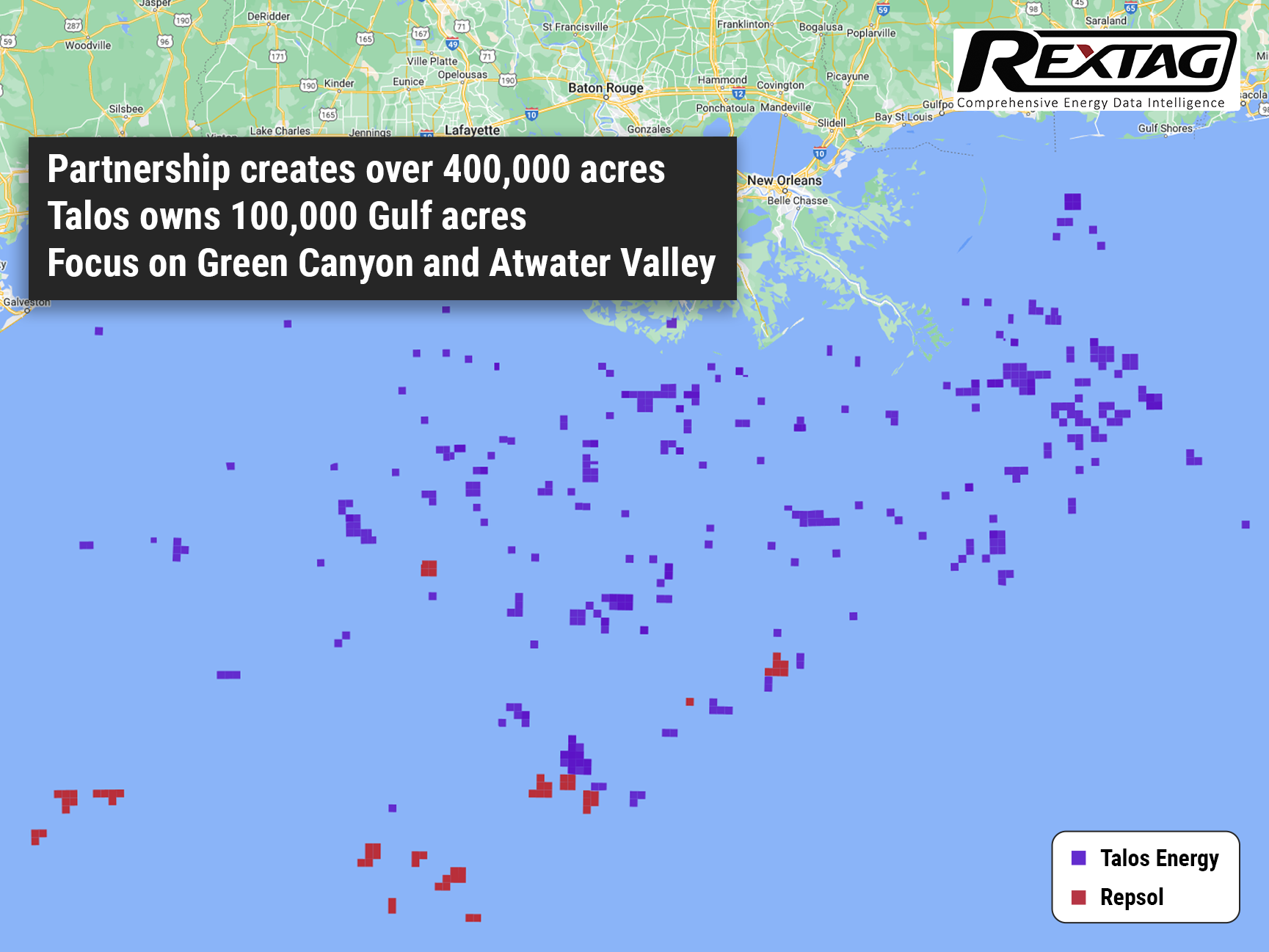

Talos Energy and Repsol Join Forces in Gulf Exploration JV

11/10/2023

- Talos Energy and Repsol have formed a 50-50 joint venture.

- The Bureau of Ocean Energy Management delayed Gulf of Mexico Lease Sale 261.

- The partnership will reprocess seismic data across about 400,000 gross acres.

- Talos controls nearly 100,000 acres in a key part of the U.S. Gulf of Mexico.

- The focus is the deepwater Green Canyon and Atwater Valley regions.

Talos Energy and Repsol have formed a partnership, each owning 50-50, to reexamine seismic data in a shared area to identify where to drill in the coming years.

Tim Duncan, the CEO of Talos, sees this as a strategic use of land they acquired from EnVen Energy Corp to enhance its value.

Talos Energy is putting to use the land they bought from EnVen Energy Corp for $1.1 billion. CEO Tim Duncan talked about this on November 7, explaining that it's a smart move because the government has delayed a big decision on new ocean drilling areas. By teaming up with Repsol, Talos plans to work on the land they already have, about 100,000 acres, so they don't have to wait for new permits.

The partnership between Talos and Repsol will focus on an extensive seismic reprocessing project in the Gulf of Mexico, highlighting the deepwater potential of the Green Canyon and Atwater Valley regions.

“This is more longer-term portfolio generation. These are types of prospects you see more in kind of the 2025 range and beyond,” Talos’ CEO Tim Duncan said. “But it's absolutely the type of work that you need to do to make sure you're building inventory in the Gulf of Mexico.”

Updates on Operations and Recent Developments

In November 2023, Talos Energy and a Repsol affiliate agreed to share efforts 50/50 on a seismic reprocessing project. This project spans about 400,000 acres, including 96,500 acres that Talos has rights to, located in the deepwater regions of Green Canyon and Atwater Valley in the U.S. Gulf of Mexico. Their plan is to find potential spots for new underwater connections and wells, using Talos's Neptune station as the central hub for these operations.

Talos concluded a transaction in September 2023, divesting a portion of its stake in Talos Mexico to Grupo Carso, netting $74.85 million upfront and more to follow, while still retaining a majority interest and a significant stake in the Zama project.

Updates on Exploration and Output

- Lime Rock and Venice: Work on Talos's Lime Rock and Venice projects is progressing as planned, with the goal of starting production from these sites in early 2024. These wells are connected to the Ram Powell facility, which is operated by Talos, and the company has a 60% interest in them.

- Collaboration on Non-Operated Ventures: Marmalard well, managed by Murphy Oil Corporation, has finished drilling and is on its way to being completed, aiming to start producing in early 2024. Talos has an 11.4% stake in this well. Additionally, the Odd Job subsea pump, handled by Kosmos Energy and designed for lasting output, is expected to be operational by mid-2024, with Talos owning a 17.5% interest.

Operational disruptions due to environmental factors led to reduced output in the third quarter of 2023. However, Talos is applying optimization strategies to mitigate these issues and expects to resume normal production levels by the first quarter of 2024.

"Weather-related disruptions in the Gulf of Mexico typically impact our production and drilling operations during the third quarter of the year. This quarter, we experienced production downtime related to sustained loop currents in the Green Canyon area which impacted the floating production unit in our Phoenix Field. However, our oil-weighted assets continued to deliver strong realizations, with a netback margin of close to $45 per barrel of oil equivalent. As that production is restored and new developments are added, we look forward to positive momentum as we close out the year."

- Talos President and Chief Executive Officer Timothy S. Duncan

Repsol isn't just investing money; they're also actively engaging in the geological analysis. Amidst regulatory delays for new drilling leases in the Gulf of Mexico, this collaboration is seen as a proactive step to utilize Talos's existing properties, focusing on areas where they can expand drilling activities without new leases.

About Talos Energy

Founded in 2012 in Houston, Texas, Talos Energy is a publicly traded company focused on oil and gas exploration. The company has achieved significant milestones, including major discoveries and strategic mergers, expanding its operational footprint primarily in the deepwater regions of the U.S. Gulf of Mexico and offshore Mexico.

About Repsol

Repsol is a Spanish multinational energy company, established in 1986 with a strong global presence. It is involved in all aspects of the oil and gas industry, including exploration, production, and refining. With its headquarters in Madrid, Spain, Repsol has a diverse business strategy that encompasses a renewable energy division, underpinning its status as a key player in the energy sector.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Talos Energy Confirms $1.29 Billion Takeover of QuarterNorth Energy

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/224Blog_Talos Energy acquires QuarterNorth Energy for $1.29 billion.png)

Houston-based Talos Energy Inc. has made a deal to buy QuarterNorth Energy Inc. for $1.29 billion. QuarterNorth is a company that explores and produces oil in the Gulf of Mexico and owns parts of several big offshore fields. This purchase will add more high-quality deepwater assets to Talos's business, which are expected to bring steady production and new opportunities for growth. The deal should immediately benefit Talos's shareholders and help the company reduce its debt faster.

Occidental, CrownRock Merger Under Regulatory Review: 2024 Update

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 228 (Blog)- Occidental, CrownRock Merger Under Regulatory Review_ 2024 Update.png)

CrownRock's 94,000+ net acres acquisition complements Occidental's Midland Basin operations, valued at $12.0 billion. This expansion enhances Occidental's Midland Basin-scale and upgrades its Permian Basin portfolio with ready-to-develop, low-cost assets. The deal is set to add around 170 thousand barrels of oil equivalent per day in 2024, with high-margin, sustainable production.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?