Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

Decline in US Oil and Gas Rigs Signals Continued Supply and Price Stability

The U.S. oil and natural gas rig count experienced a slight decline, falling by four to a total of 633 rigs for the week ending August 21. Despite this modest drop, industry analysts have noted a surprising resilience in both oil supply and natural gas prices as the year progresses, suggesting that the market may be more robust than previously anticipated.

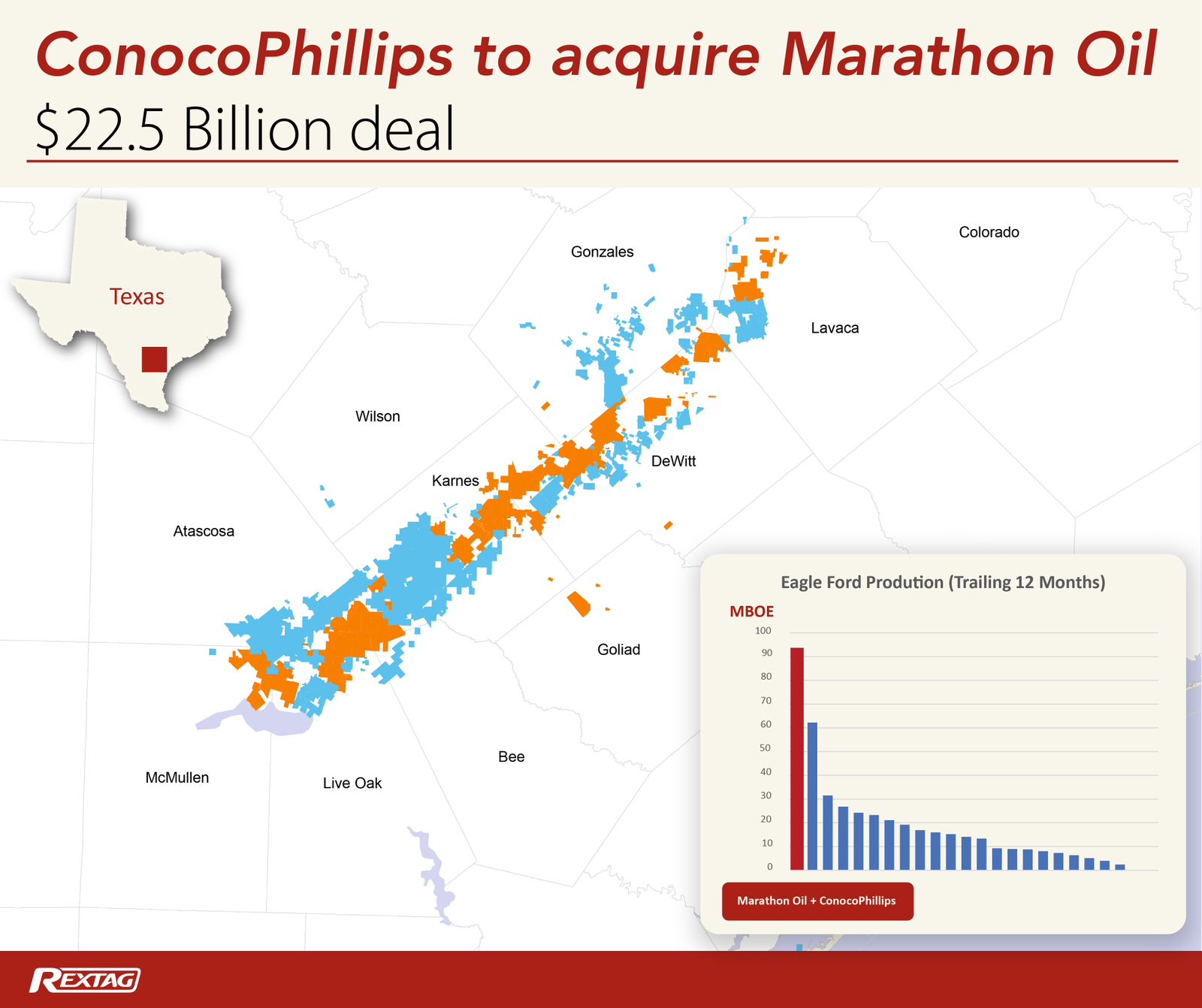

$22.5 Billion Shake-Up: ConocoPhillips Acquires Marathon Oil and Gains Major Influence in the Eagle Ford

The purchase of Marathon Oil adds 2,600 new drilling spots to ConocoPhillips' operations, boosting their total to over 13,000 across the U.S. After the deal, ConocoPhillips is set to significantly increase its production in the Eagle Ford region, potentially exceeding its current output in the Delaware basin.

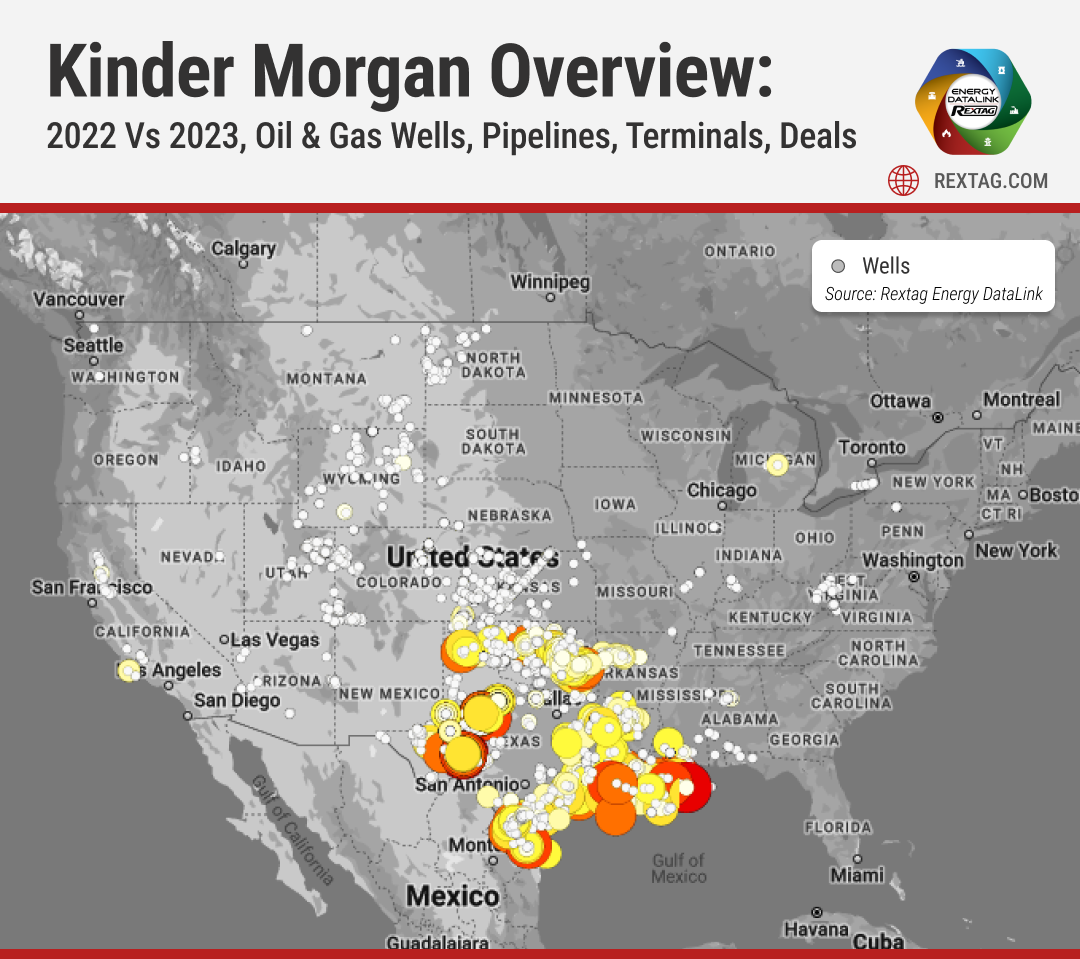

Kinder Morgan Overview: 2022 vs 2023, Oil & Gas Wells, Pipelines, Terminals, Deals

Kinder Morgan stands as North America's top independent mover of petroleum products with around 2.4 million barrels daily across the continent. The bulk of this flow happens through its Products Pipelines division, which navigates gasoline, jet fuel, diesel, crude oil, and condensate through a network of about 9,500 miles of pipelines. Alongside, the company maintains roughly 65 liquid terminals that not only store these fuels but also blend in ethanol and biofuels for a green touch.

U.S. Oil and Gas Drilling 2023-2024 Report: Rigs, Onshore, Offshore Activity, Biggest Companies

In January 2024, the United States saw a mix of ups and downs in the number of active drilling rigs across its major oil shale regions and states. Starting with the shale regions, the Permian Basin led with a slight increase, reaching 310 rigs, which is 3 more than in December. The Eagle Ford in East Texas held steady with 54 rigs, unchanged from the previous month. Meanwhile, both the Haynesville and Anadarko regions saw a decrease by 2 rigs each, landing at 42 rigs. The Niobrara faced a larger drop, losing 4 rigs to settle at 27. On a brighter note, the Williston Basin and the Appalachian region saw increases of 2 and 1 rigs, respectively, resulting in counts of 34 and 41 rigs.

Kinder Morgan Invests $1.8 Billion in South Texas Gas Infrastructure

Kinder Morgan's strategic acquisition of STX Midstream from NextEra is a significant move to enhance its infrastructure capabilities in South Texas. The area is witnessing an upsurge in natural gas production and demand, particularly towards Mexico and the Gulf Coast markets. The 462-mile pipeline system, which is highly contracted with an average contract length of over eight years, is expected to generate about $181 million in EBITDA for 2023.

Under Construction Pipelines: Outlook 2023 by Rextag

According to Globaldata, 196,130km of planned and announced trunk oil and gas pipelines are anticipated to become operational globally between 2023 and 2030. This consists of 113,099km of planned pipelines that have identified development plans, and 83,031km of early-stage announced pipelines currently under conceptual study, expected to receive development approval. Based on Global Energy Monitor's 2023 data, Africa and the Middle East account for 49% of the global oil transmission pipeline construction, valued at US$25.3 billion. The report indicates these regions are currently constructing 4,400 km of pipelines with an investment of US$14.4 billion. There are plans for an additional 10,800 km at an approximate cost of US$59.8 billion.

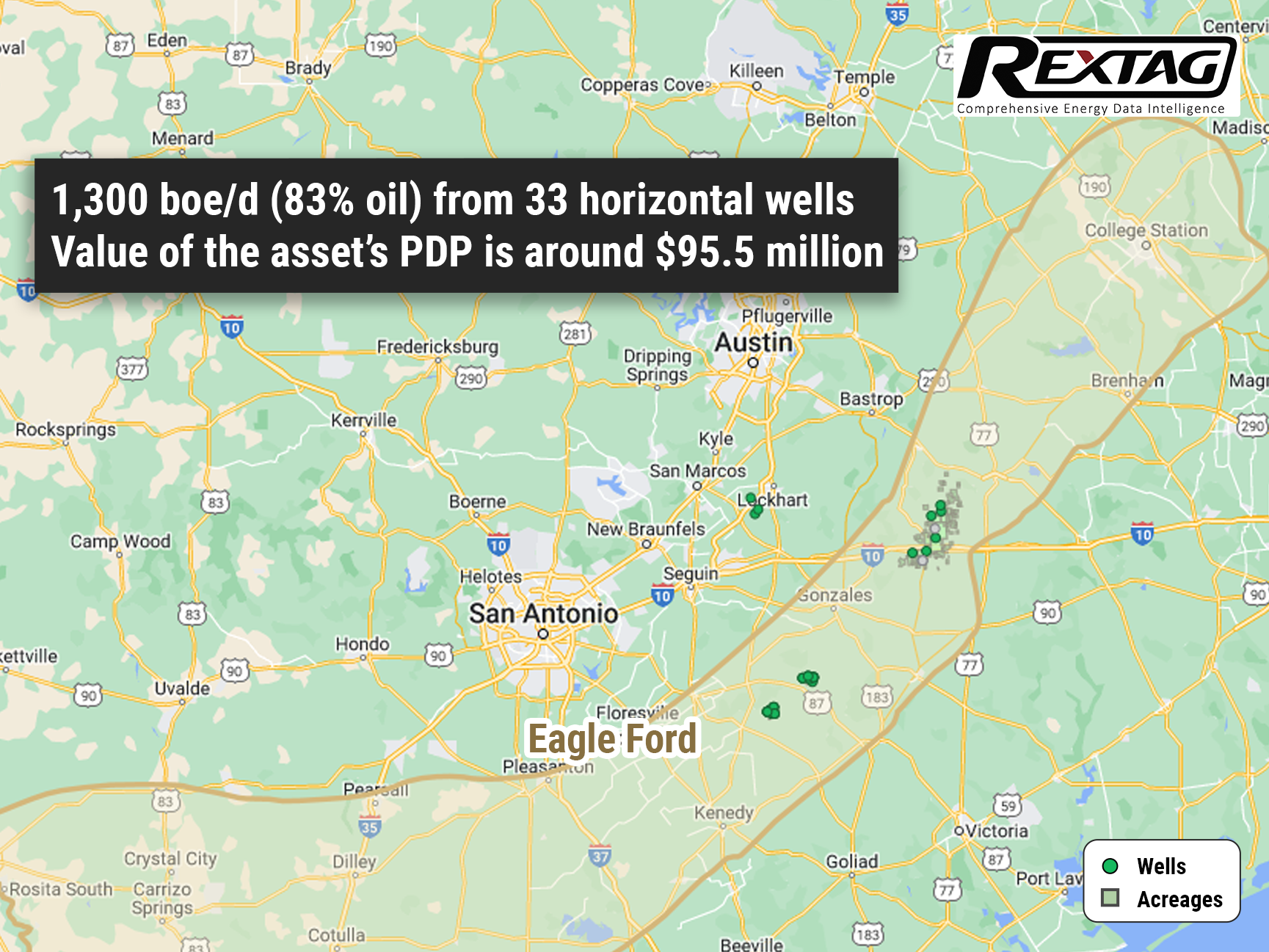

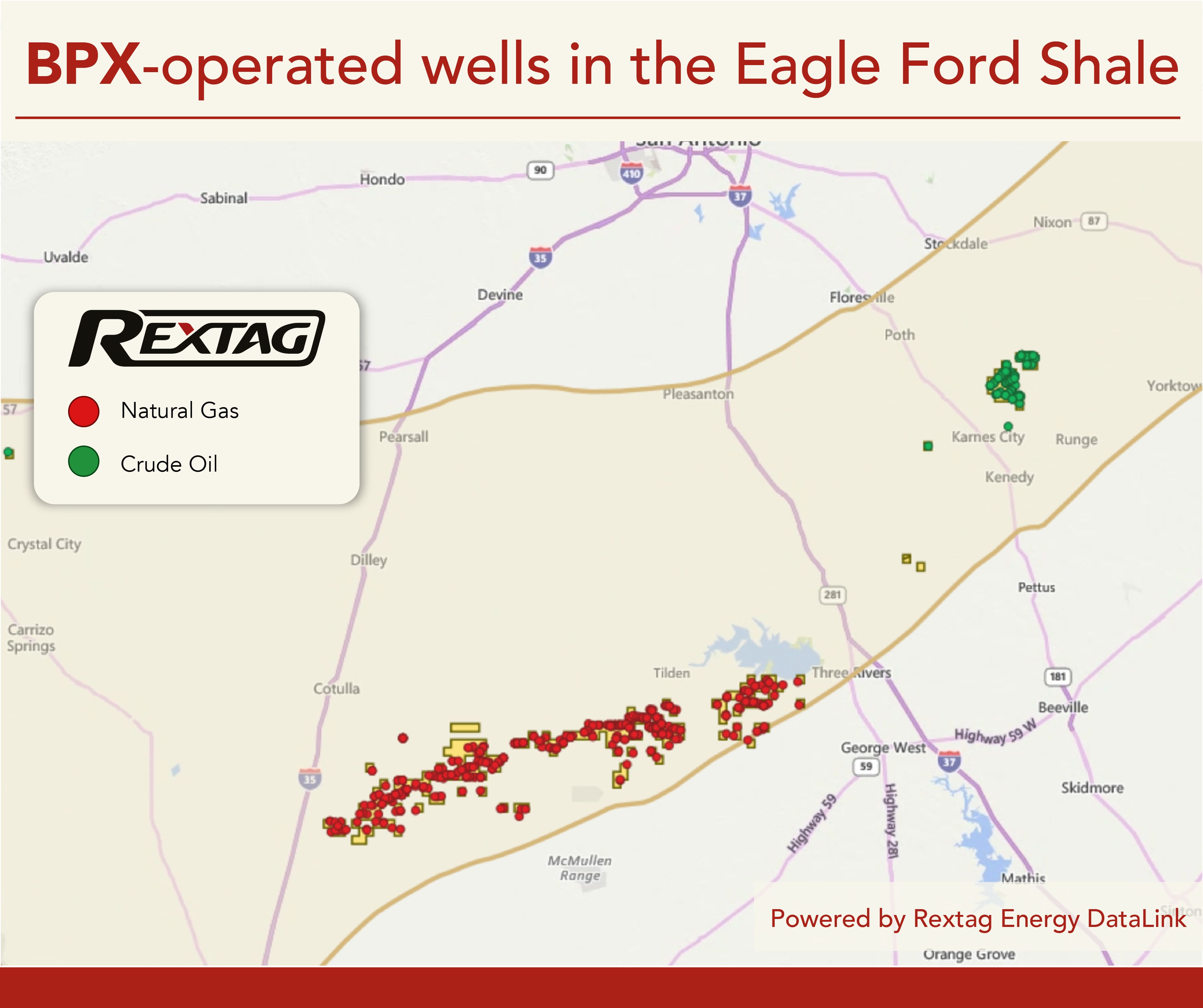

Earthstone Offers Eagle Ford Assets for Sale, Considers Departure from South Texas

Earthstone Energy is selling Eagle Ford locations to concentrate on the Permian Basin, streamlining its exploration and production focus. Earthstone Energy Inc., based in The Woodlands, Texas, is putting an Eagle Ford asset on the market as the company focuses on divesting non-core properties and directing investment towards the Permian Basin. The assets that Earthstone is planning to sell include production and land in northeast Karnes County, Texas, as well as in southern Gonzales County, Texas, as outlined in the marketing documents. For the sales process, Earthstone has engaged Opportune Partners LLC to serve as its exclusive financial adviser.

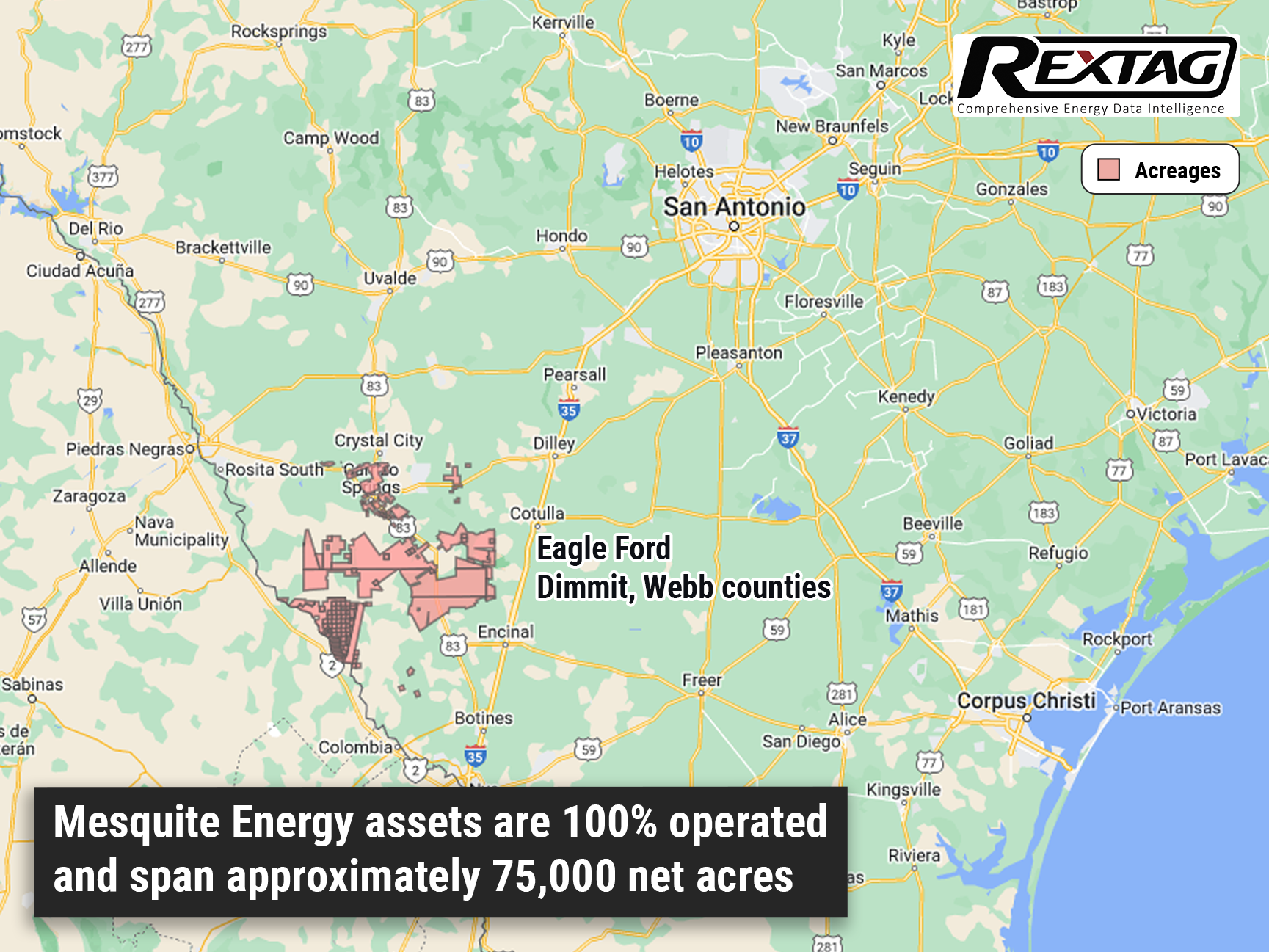

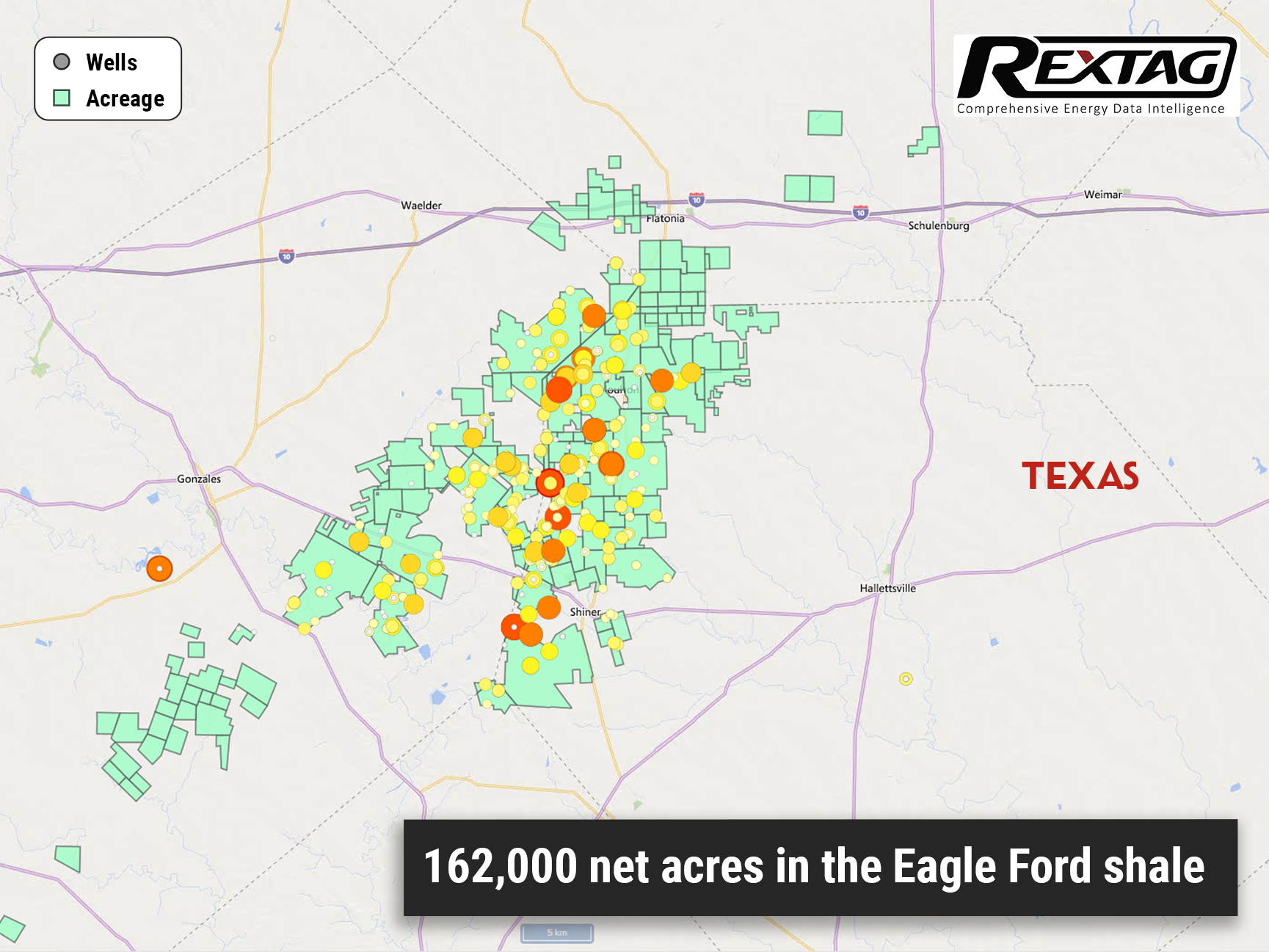

Crescent Energy Boosts Portfolio with Eagle Ford Acquisition: Expands Non-Operated Assets

Big announcement! Crescent Energy is set to bolster its inventory in the play by acquiring operated and working interests from Mesquite Energy. Crescent Energy Co. seals a $600 million cash deal to acquire assets in the Eagle Ford Shale from Mesquite Energy Inc. (formerly Sanchez Energy).

Callon Acquires $1.1 Billion Delaware Assets and Bows Out of Eagle Ford - Here's What You Need to Know

Callon is set to purchase Percussion Petroleum's Delaware assets for $475 million while selling its Eagle Ford assets to Ridgemar for $655 million. In a strategic step to optimize its operations, Callon Petroleum recently made headlines by sealing two deals on May 3, totaling a staggering $1.13 billion. The company is taking confident steps to bolster its presence in the Delaware Basin while bidding farewell to its stake in the Eagle Ford Shale.

Matador Acquires Additional Land in Delaware from Advance Energy for $1.6 Billion

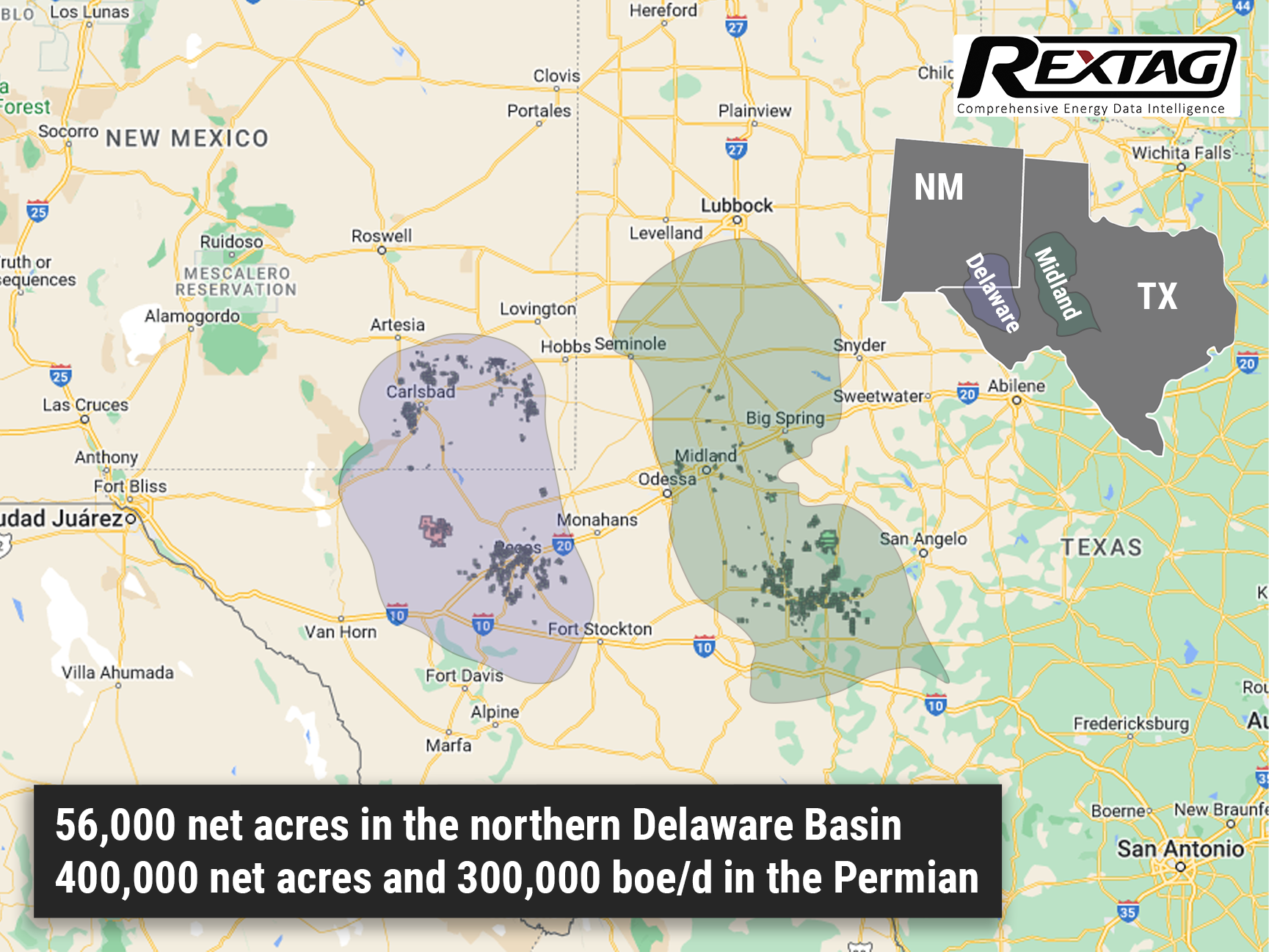

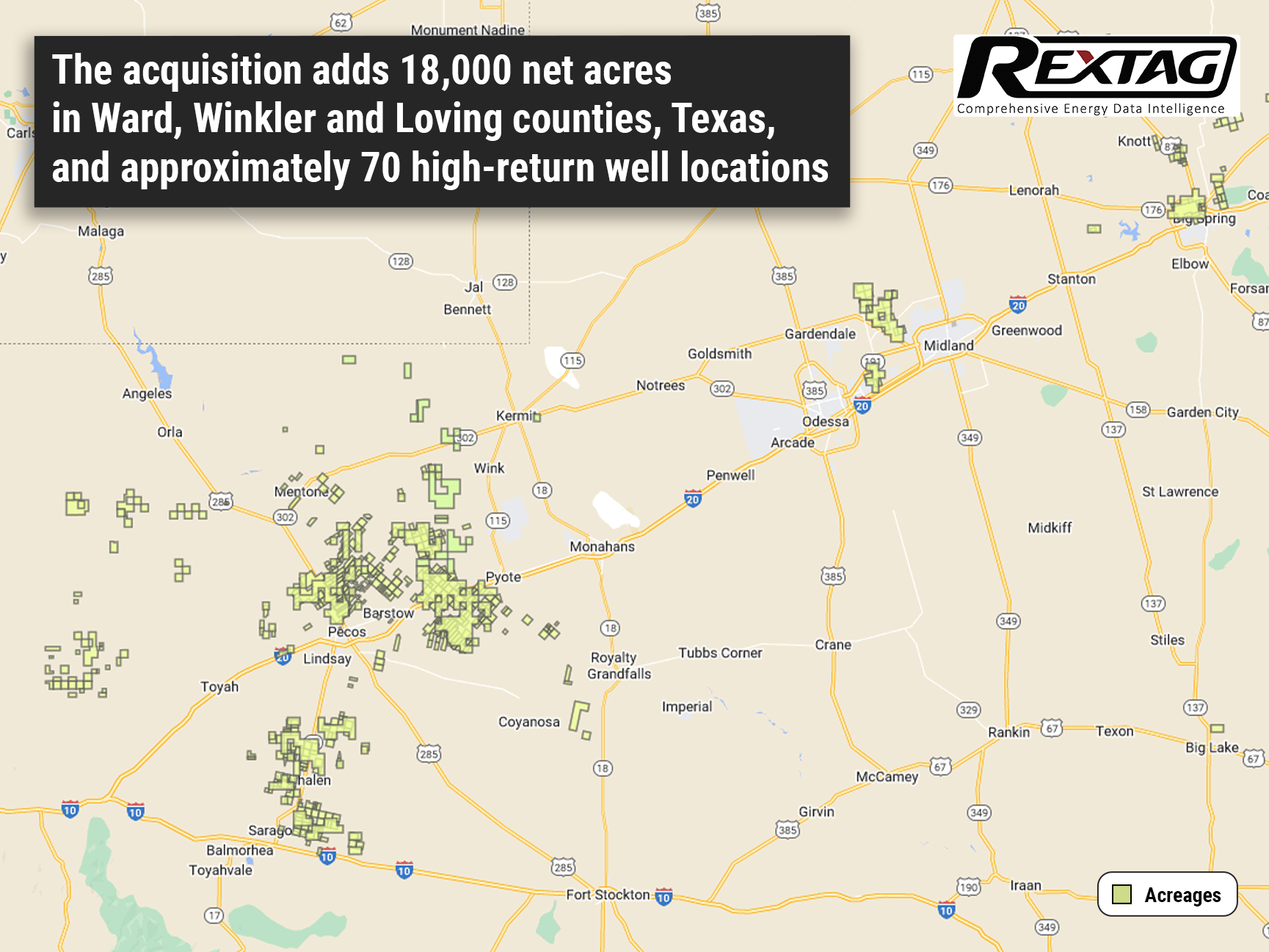

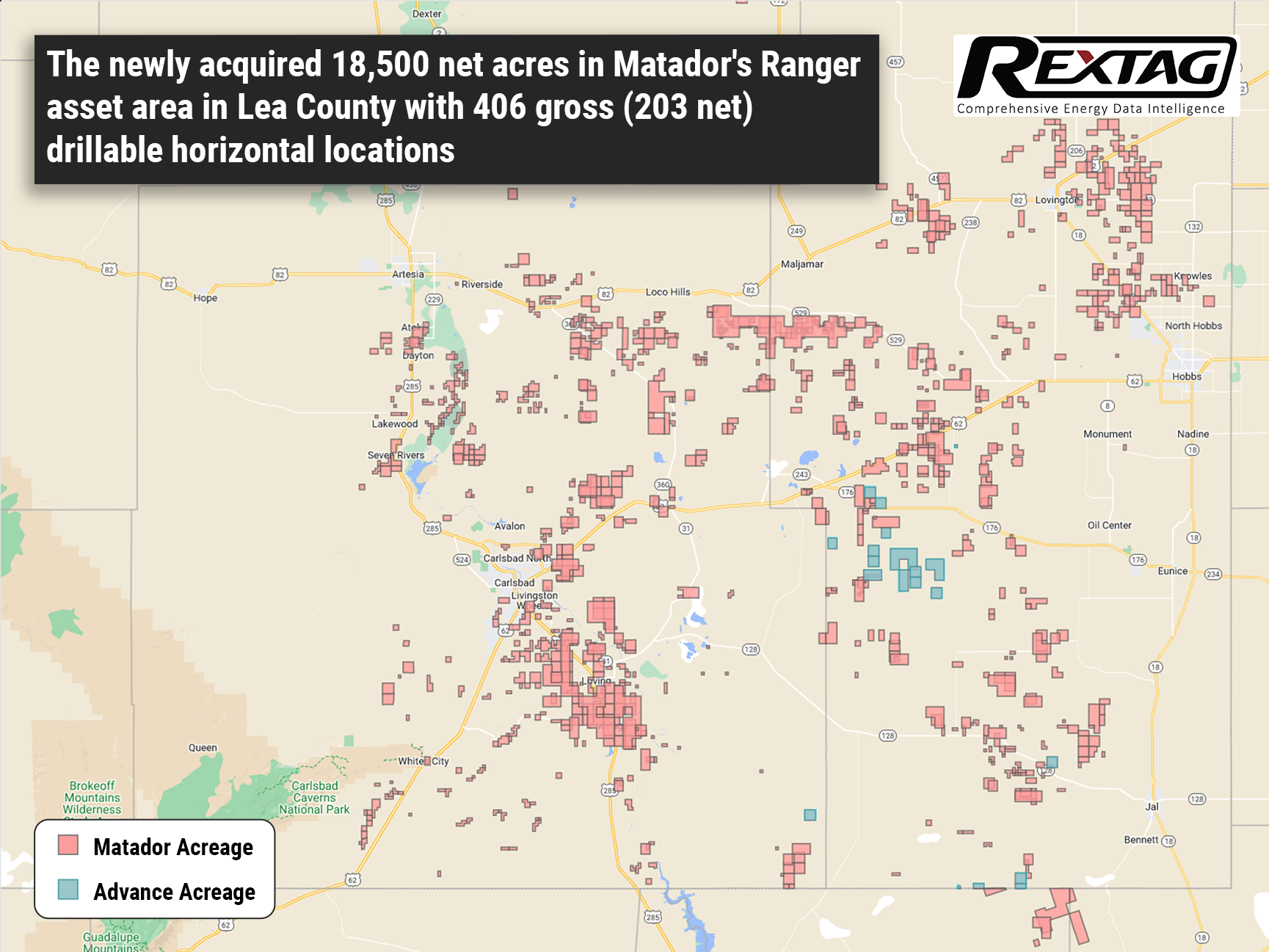

Matador Resources Co. is making a big move in the oil and gas industry by acquiring Advance Energy Partners Holdings LLC, a major player in the northern Delaware Basin. The acquisition, which comes with a hefty price tag of at least $1.6 billion in cash, includes valuable assets in Lea County, N.M., and Ward County, Texas, as well as key midstream infrastructure.

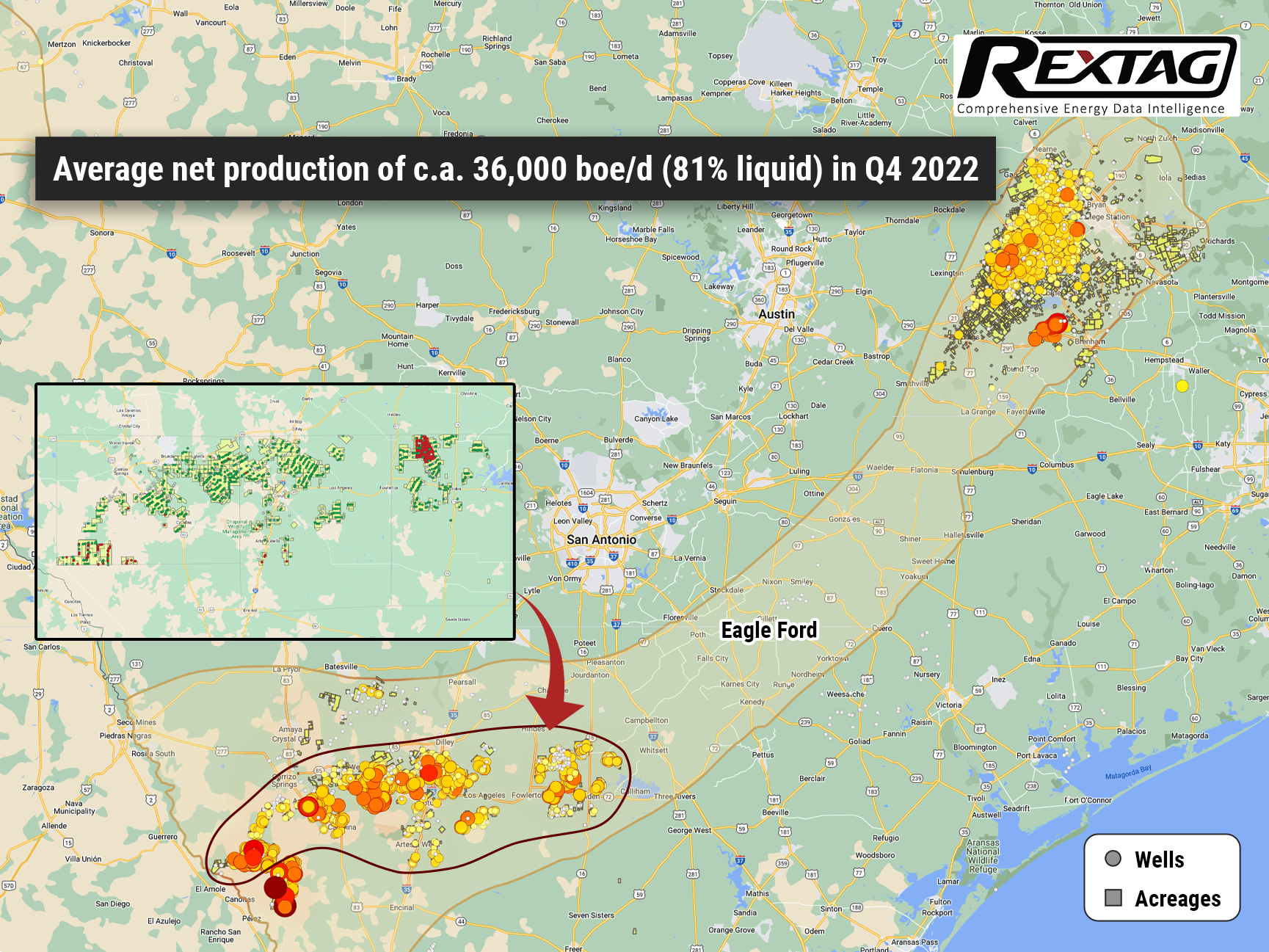

Energy Giant Baytex Makes a Bold Move: Snaps Up Ranger Oil in $2.5 Billion Deal

Baytex Energy Group has announced that it will acquire Eagle Ford exploration and production company, Ranger Oil, for approximately $2.5 billion in cash and stock, which includes taking over the company's existing debt. Upon the successful closure of the acquisition, Baytex will have a controlling stake of approximately 63% in the newly merged company, leaving Ranger shareholders with around 37%. This significant move is in line with a trend of substantial mergers and acquisitions in the Eagle Ford area, with Marathon Oil, Devon Energy, and Chesapeake Energy among the companies involved in recent transactions.

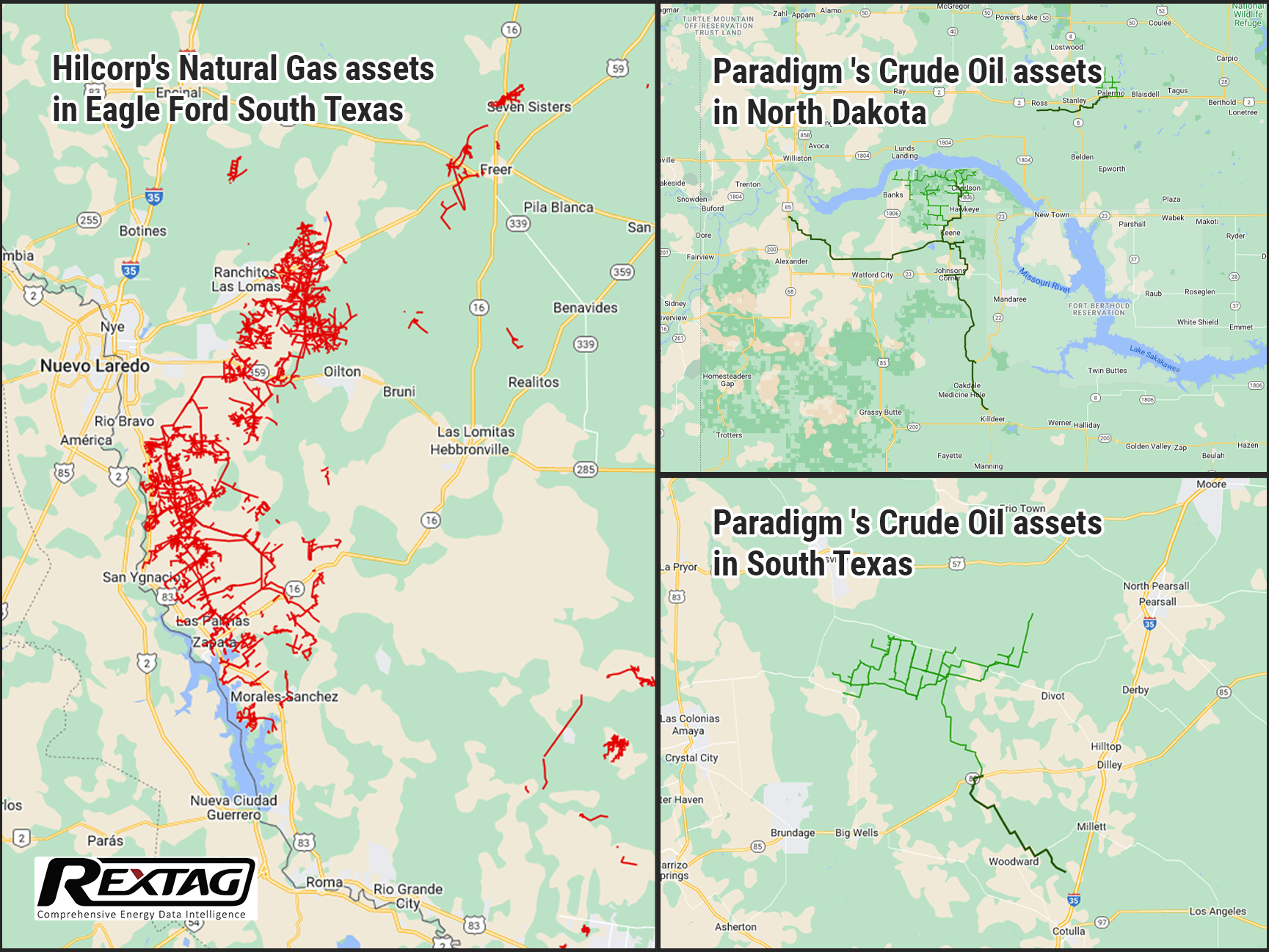

Fueling Up for Success: Harvest Midstream, Hilcorp's Affiliate, to Acquire Bakken and Eagle Ford Assets from Paradigm

Harvest Midstream, a Hilcorp affiliate, is set to acquire three midstream gathering systems that serve the Bakken, as well as system located in the Eagle Ford. Harvest, an affiliate of Hilcorp Energy Corp, has entered into an agreement to purchase three Bakken midstream gathering systems and one in the Eagle Ford from Paradigm. Paradigm is set to sell these midstream assets to Harvest in the near future.

Chesapeake Divests More Eagle Ford Assets; 172,000 n.a. and 2K+ Wells Sold to INEOS For $1.4 billion

Chesapeake Energy Corp. has announced that it will receive $1.4 billion from INEOS Energy for the sale of its remaining Eagle Ford asset, just a month after selling its Brazos Valley assets for a similar amount. This brings the total value of Chesapeake's Eagle Ford assets to over $2.82 billion. The Oklahoma City-based company will continue to market its other Eagle Ford assets.

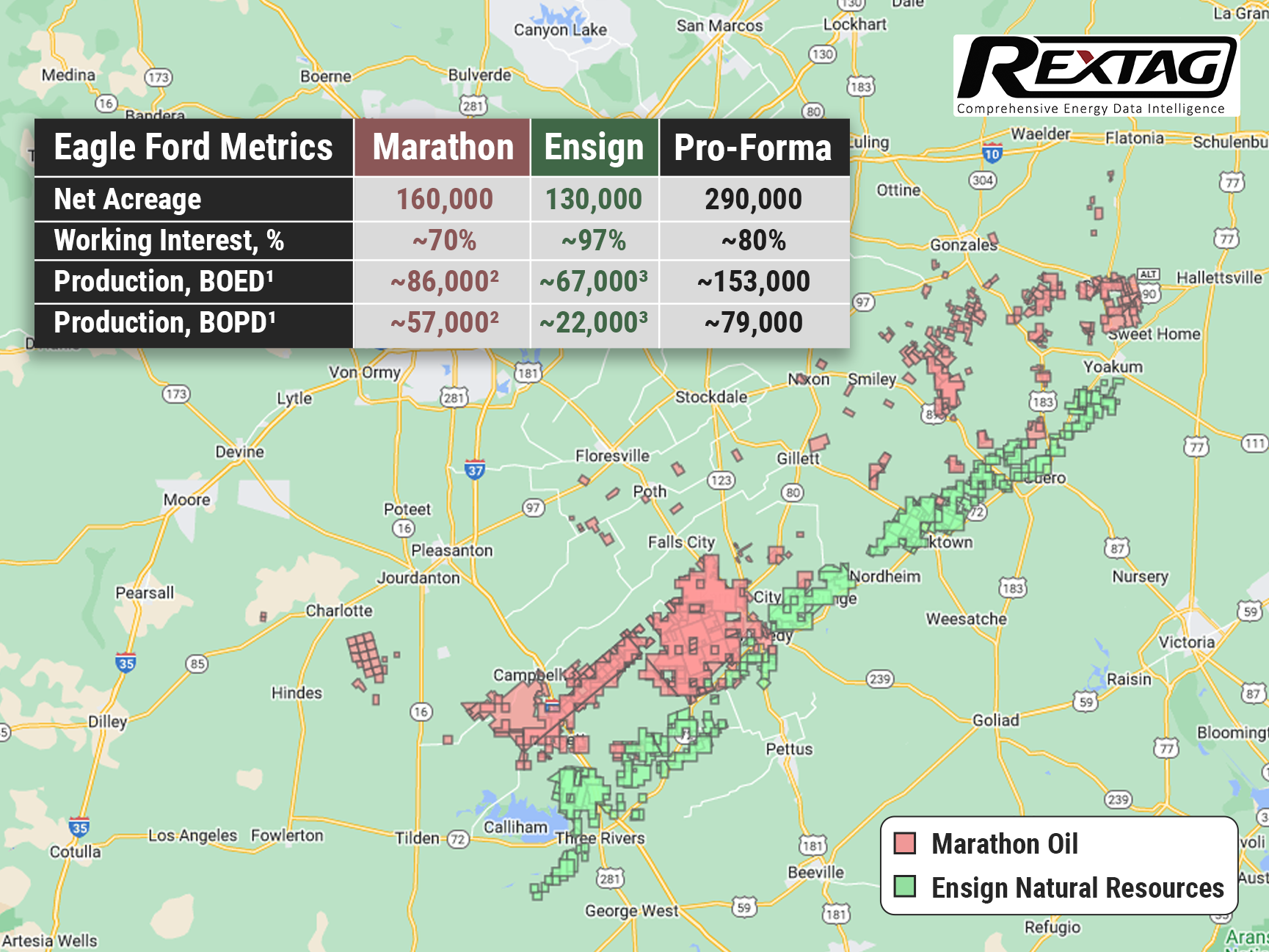

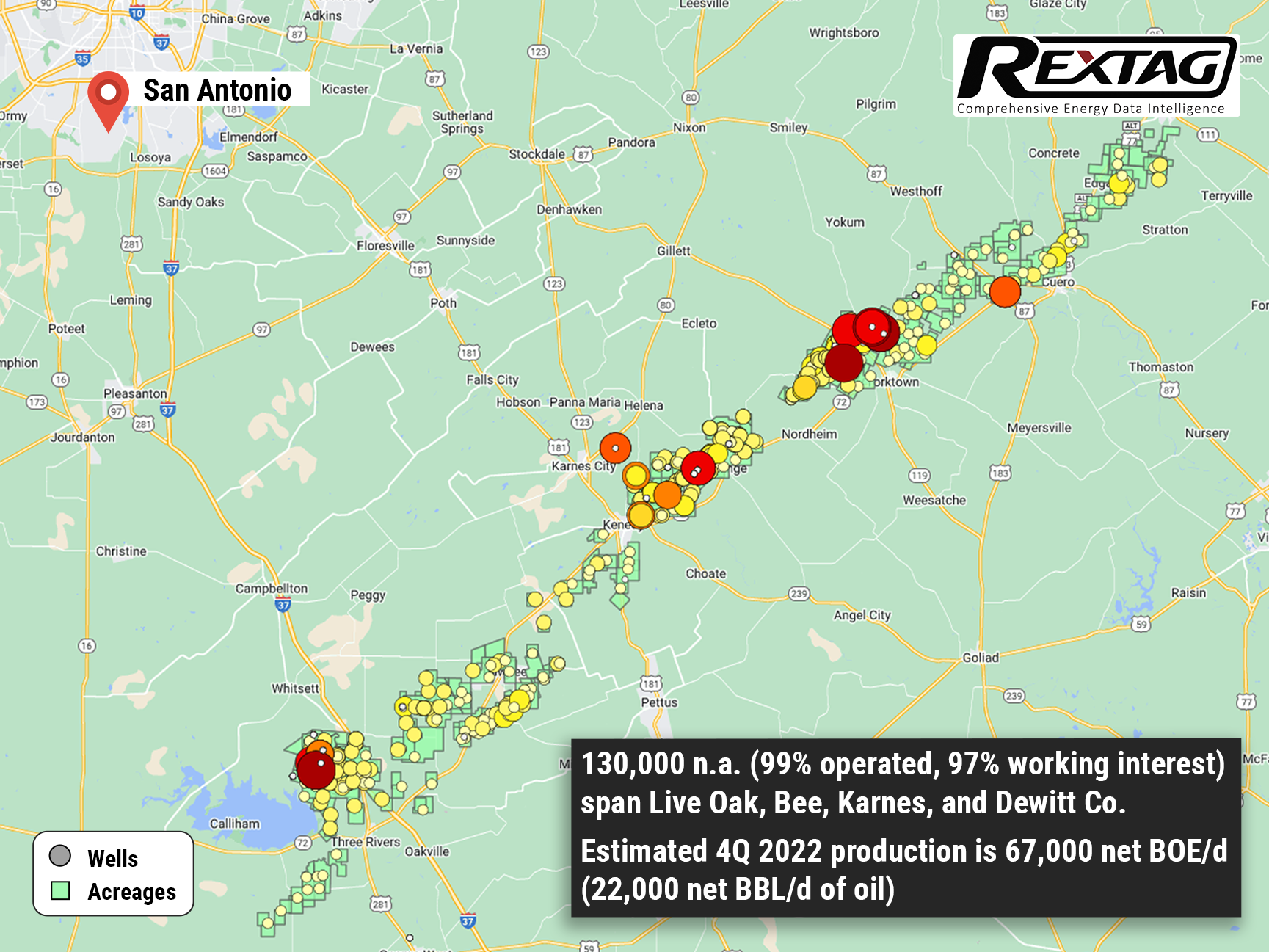

Ensign’s Assets Are Acquired by Marathon for $3 Billion

Marathon Oil Corp. closes the acquisition of Ensign Natural Resources’ Eagle Ford assets for $3 billion cash, according to the company’s release on December 27. The purchase includes 130,000 net acres (99% operated, 97% working interest) in acreage adjacent to Marathon Oil’s existing Eagle Ford position. Ensign’s estimated fourth-quarter production will average 67,000 net boe/d, including 22,000 net bbl/d of oil.

All In: Devon Energy is Banking on a Rebound for Anadarko

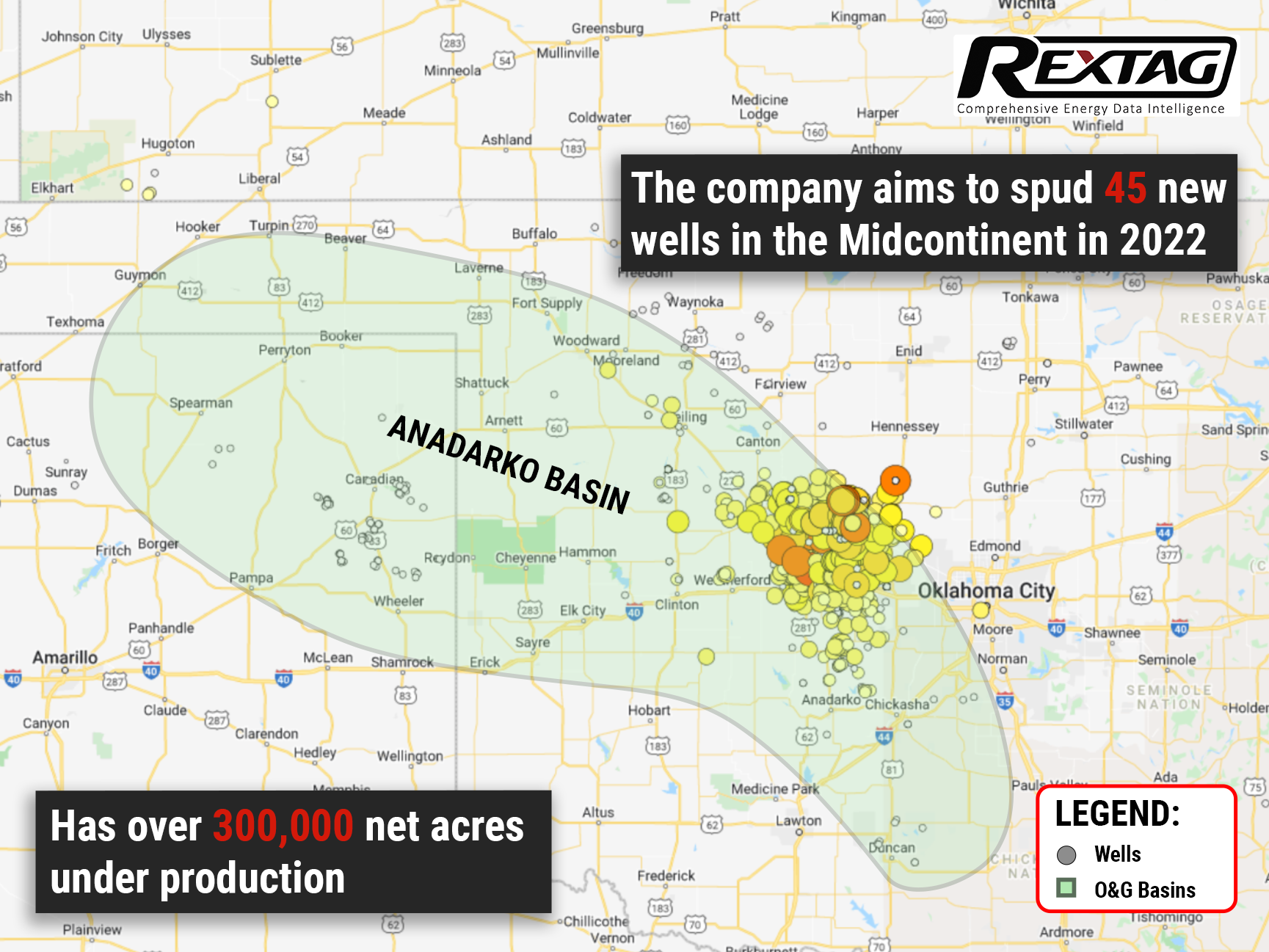

Devon Energy Corp. believes that the Anadarko Basin is a hidden treasure and aims to use its position in it to fuel a robust cash return model and establish itself as an industry leader in promoting ESG. This E&P company plans to drill 45 new wells in the Midcontinent by 2022, as well as to produce 600,000 boe/d across five operating basins, including the Eagle Ford Shale, Permian, Powder River, and Williston basins. And given that Devon's recent fourth-quarter results were better than Street estimates. It appears that they are doing something right, at least for the moment.

Lime Rock Resources Starts the Year With a Bang — a Money Bang!

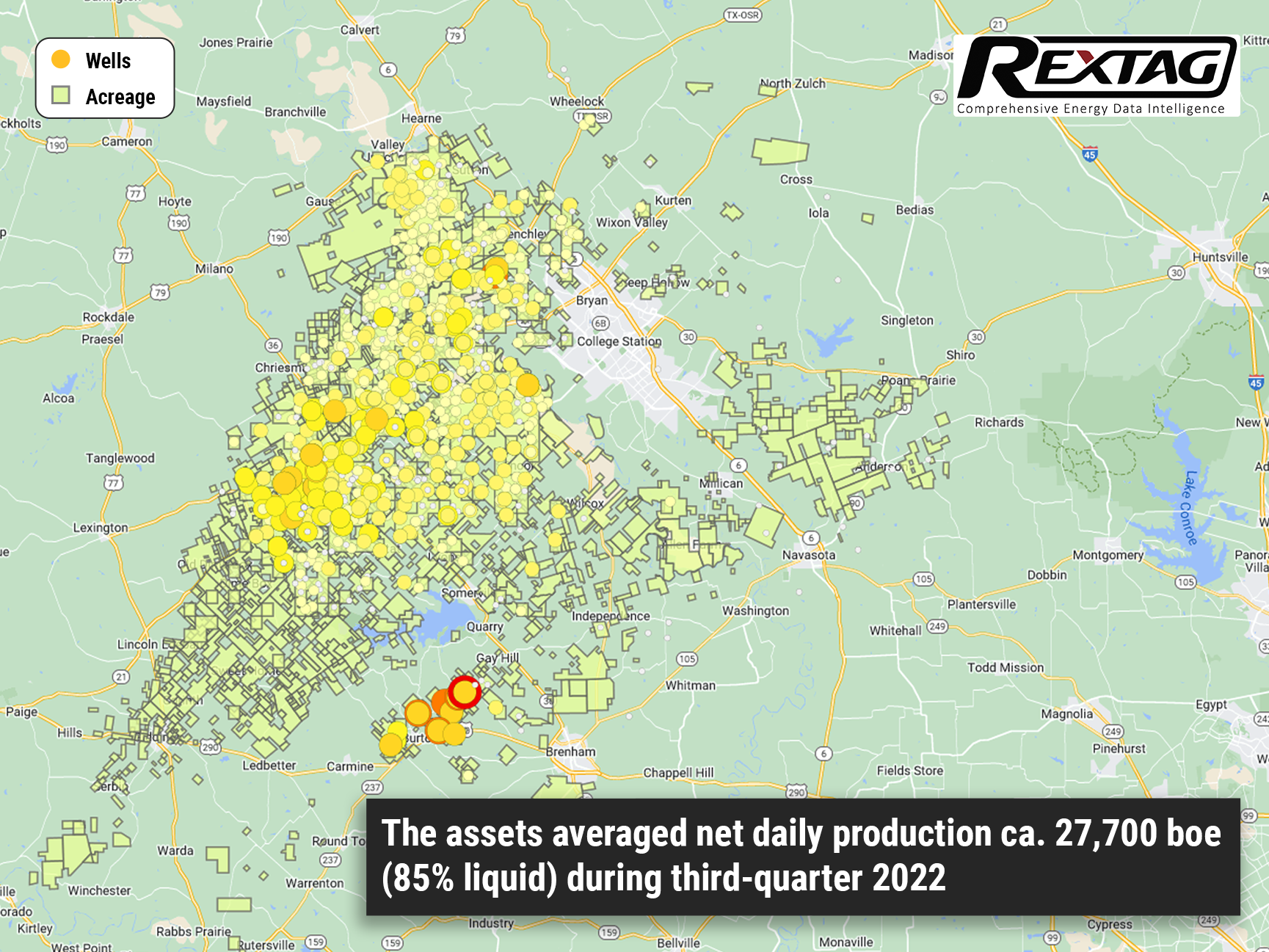

Still waters run deep: after patiently waiting for 2 years, Lime Rock Resources starts the year with a pair of acquisitions worth $358.5 million The two acquisitions include Abraxas Petroleum’s Williston Basin position in North Dakota: about 3,500 acres of land and 19,400 boed of net production, as well as properties situated in Burleson, Milam, and Robertson in Texas from a third party, that contain 46,000 contiguous net acres and produce 7,700 boed as of the closing of the deal. The company intends to intensify its focus on low-risk opportunities and margins, which will significantly boost Lime’s market position going further.

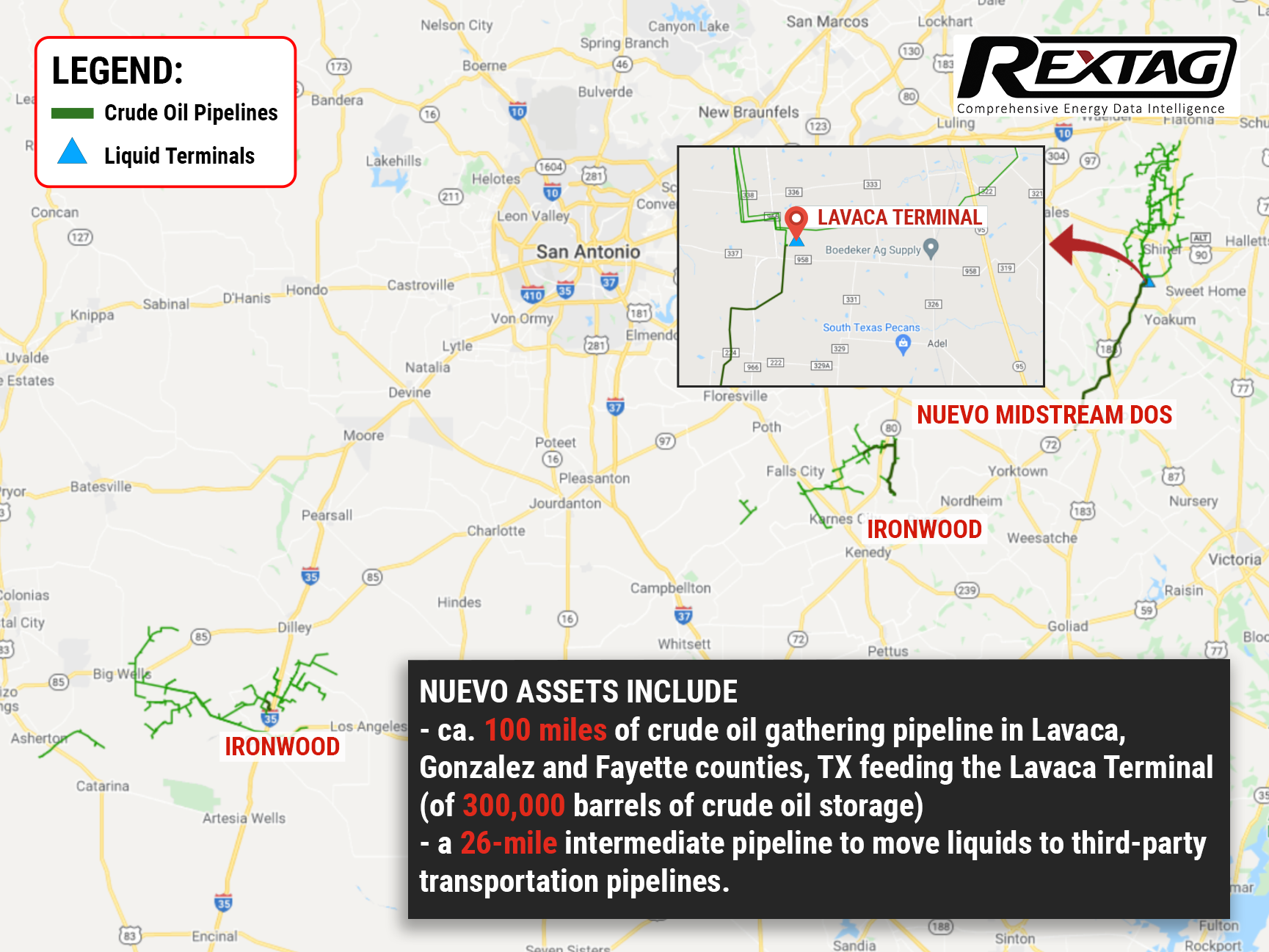

Expansion Is The Goal: Ironwood II Completes Asset Merger And Assumes Management of Nuevo Midstream Dos’ Eagle Ford Assets

Ironwood Midstream expanded its operations in the Eagle Ford region through its merger with Nuevo Midstream. Thanks to this, Ironwood II has increased its crude oil and natural gas throughput capacities in the famous shale to approximately 400,000 bbl/d and 410 MMcf/d, respectively. With 390 miles of pipelines, the company manages 245,000 acres of dedicated land.

.jpg)

.png)