Eagle Ford Shale is a hotspot for international investment.

While U.S. companies continue to focus heavily on the Permian Basin, the Eagle Ford Shale in South Texas has become a magnet for international energy firms.

BP Plc, through its subsidiary BPX Energy, has been actively investing in new drilling projects within Eagle Ford, data from the Texas Railroad Commission confirms. Following its acquisition of a joint venture partner in 2020, Spanish energy behemoth Repsol has also escalated its drilling activities in the area, indicating a strong commitment to its South Texas assets.

Other global companies, like Canada's Baytex Energy and the UK's INEOS, have deepened their involvement in the Eagle Ford Shale following mergers and acquisitions last year. Similarly, French firm TotalEnergies has increased its stake in shale gas by acquiring a 20% interest from Lewis Energy Group in the Dorado leases, managed by EOG Resources.

Much of the energy sector's deal-making has focused on the Permian Basin, known for spearheading U.S. crude production growth. However, industry experts predict increased activities in South Texas as international firms continue to explore new opportunities.

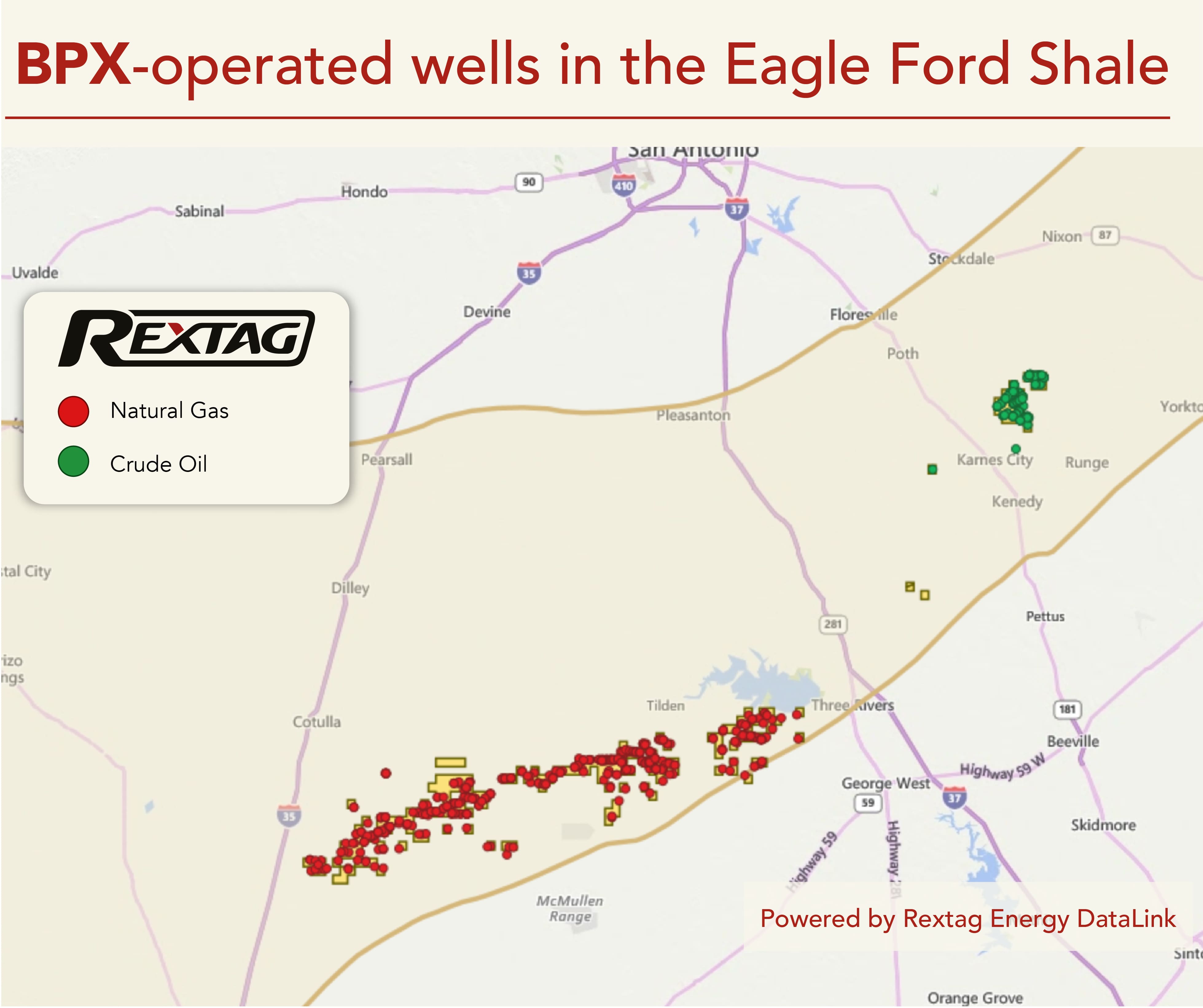

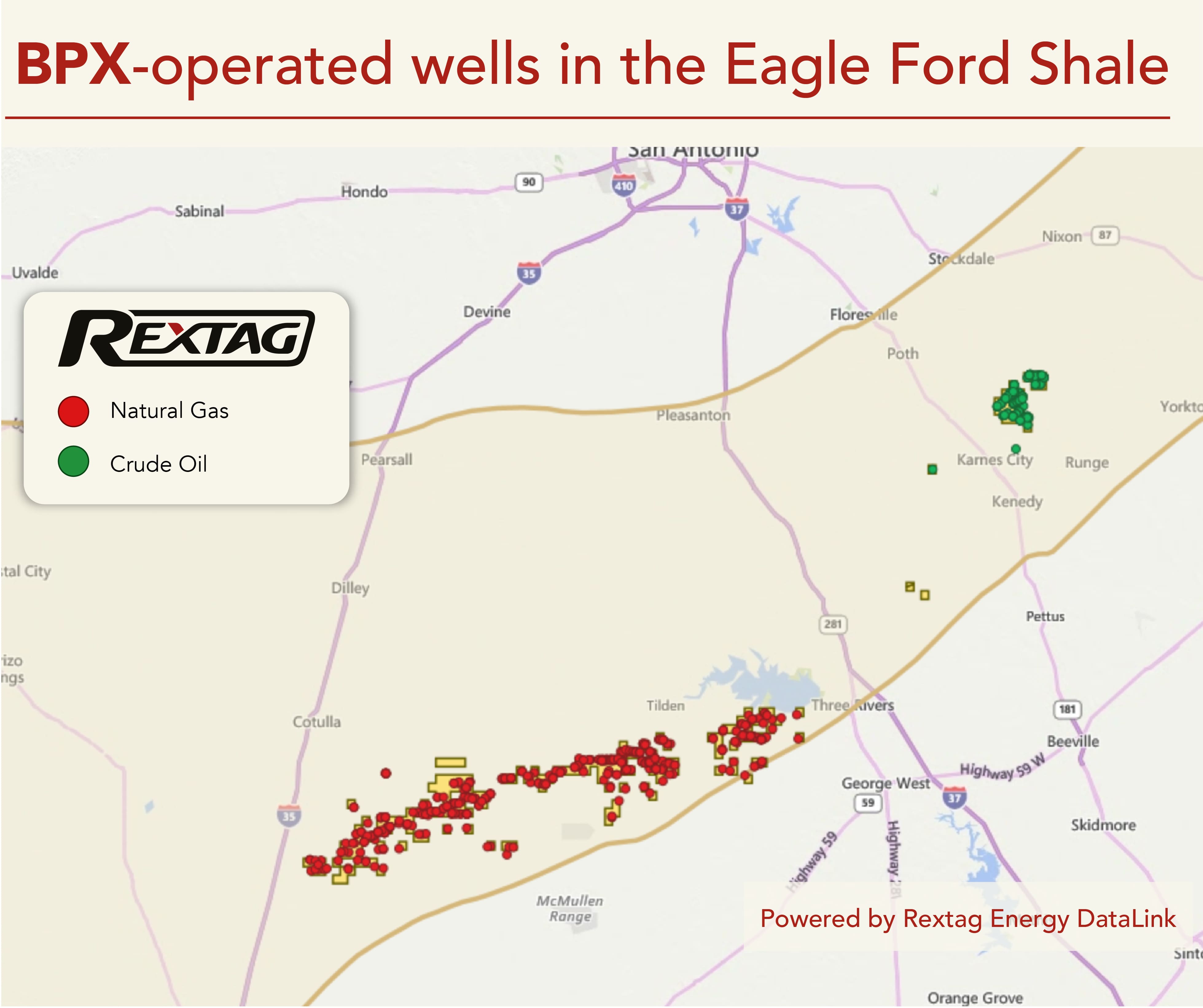

BPX Expands Its U.S. Shale Operations

BPX controls over 450,000 net acres in the Eagle Ford Shale.

In 2018, BP expanded its presence in the U.S. shale industry with a significant acquisition of BHP's onshore assets valued at $10.5 billion. This acquisition substantially increased BP's stake in the Eagle Ford Shale, particularly enhancing BPX Energy’s operations.

BPX Energy has strategically concentrated its activities in the richer oil segments of Karnes and DeWitt counties in Texas. Additionally, the company is actively revitalizing older wells through a refrac program in partnership with Devon Energy

Karnes County is a major site for BPX, where it produced over 294,800 barrels of crude in April alone, which averages about 9,800 barrels per day. BPX also extracts significant volumes of liquid condensate from the more gas-rich areas of McMullen County, achieving around 12,300 barrels per day, and from La Salle County, where the production was about 2,900 barrels per day in the same period.

In Eagle Ford during April, BPX managed an average production of roughly 25,120 barrels per day of crude and condensate. Across its entire Texas operations, the production reached about 65,800 barrels per day. Additionally, BPX taps into considerable amounts of natural gas and condensate from its operations in the Permian’s Delaware Basin.

Eagle Ford has become a focal point for redevelopment as BPX and other operators like ConocoPhillips, Marathon Oil, Devon, and SilverBow Resources implement refrac programs to enhance well productivity. BPX in particular has seen encouraging results from its refrac efforts in DeWitt County, with new wells outperforming their original outputs.

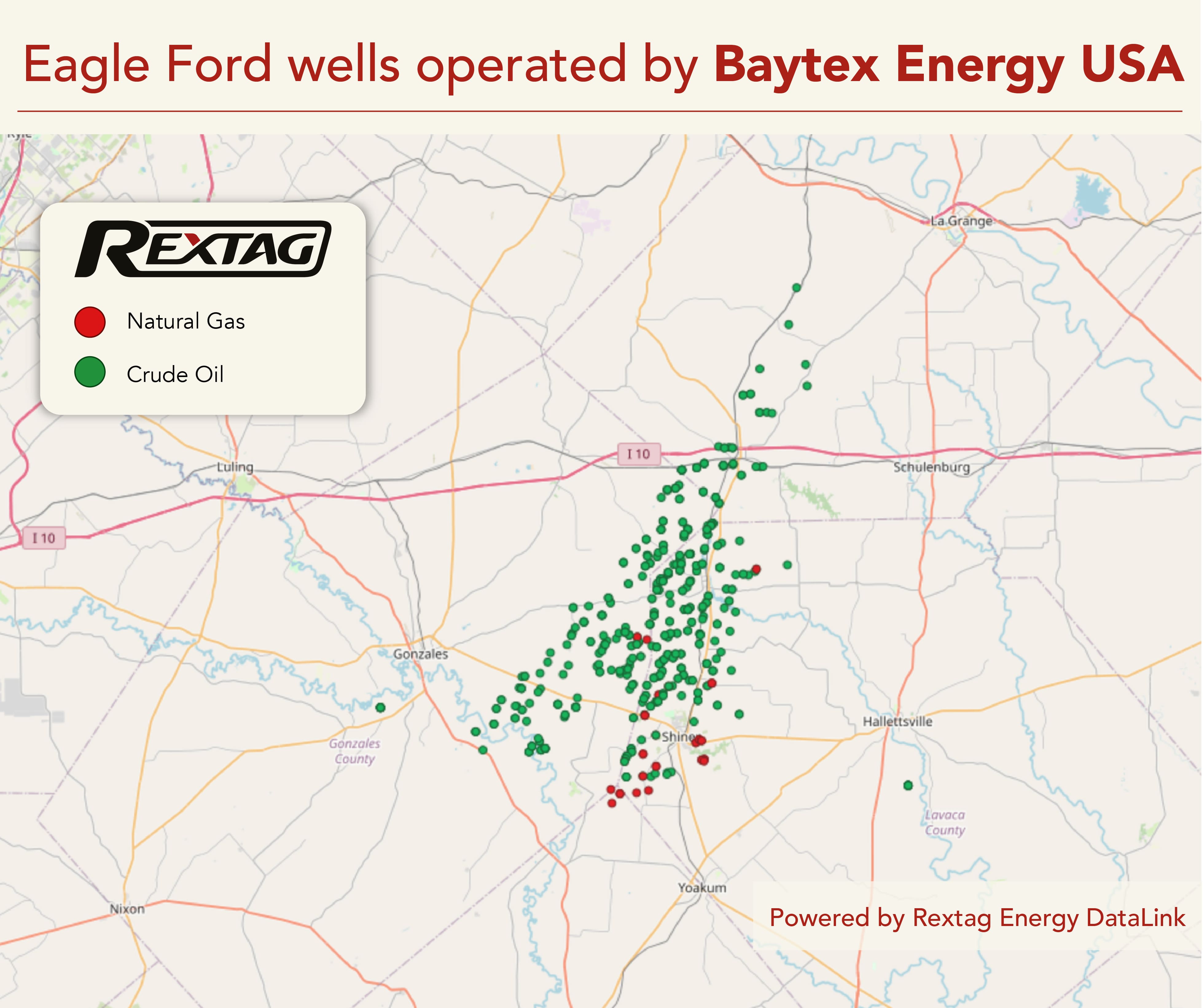

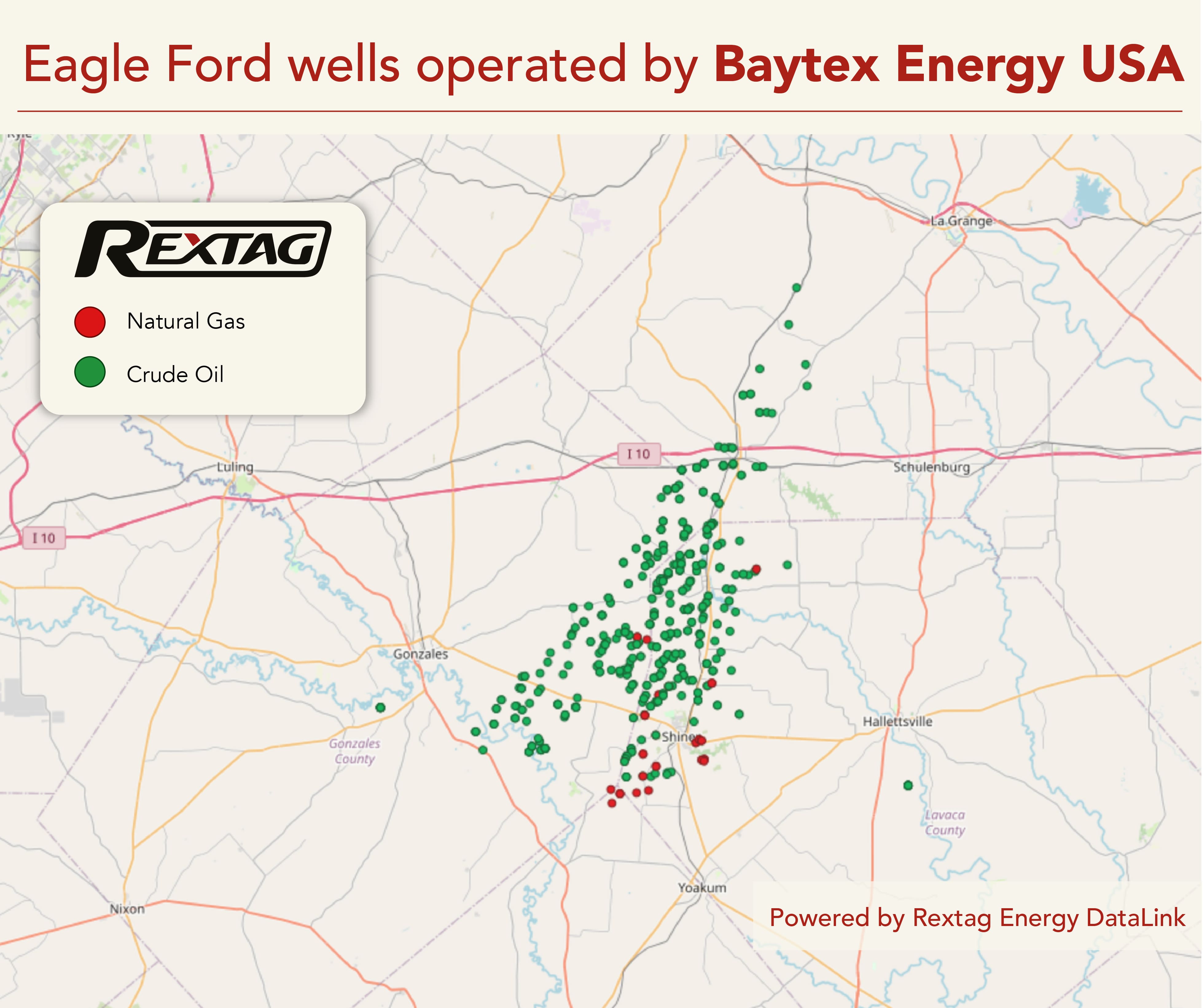

Baytex

Baytex recently completed a refracturing project on their Medina Unit No. 3H well, which is expected to yield a return of over 100%.

Calgary-based Baytex Energy has been looking to expand its drilling reach and recently set its sights southward, beyond the Canadian border. Last summer, they acquired Ranger Oil Corp., a Houston-based company, for $2.2 billion. This deal greatly expanded Baytex's presence in the Eagle Ford Shale, adding 162,000 net acres and 741 potential drilling sites across oil-rich regions, such as Dimmit, La Salle, and Karnes counties in Texas.

This strategic acquisition reinforced Baytex's holdings in the Karnes Trough and broadened its operations beyond its typical regions in Western Canada, where it has been selling off less essential assets.

Since incorporating Ranger Oil's assets, Baytex Energy USA Inc. has actively engaged with the Texas Railroad Commission (RRC), reporting on new horizontal wells in Eagle Ford earlier this year. In the first quarter, Baytex successfully brought 19 operated wells online. This included 15 in the lower Eagle Ford area, three in the upper Eagle Ford, and one refractured well. These new wells are proving fruitful, with the lower Eagle Ford wells averaging an initial peak production rate of 1,298 barrels of oil equivalent per day (boe/d) — mainly oil and natural gas liquids. The upper Eagle Ford wells also showed promising results, averaging 1,214 boe/d at peak.

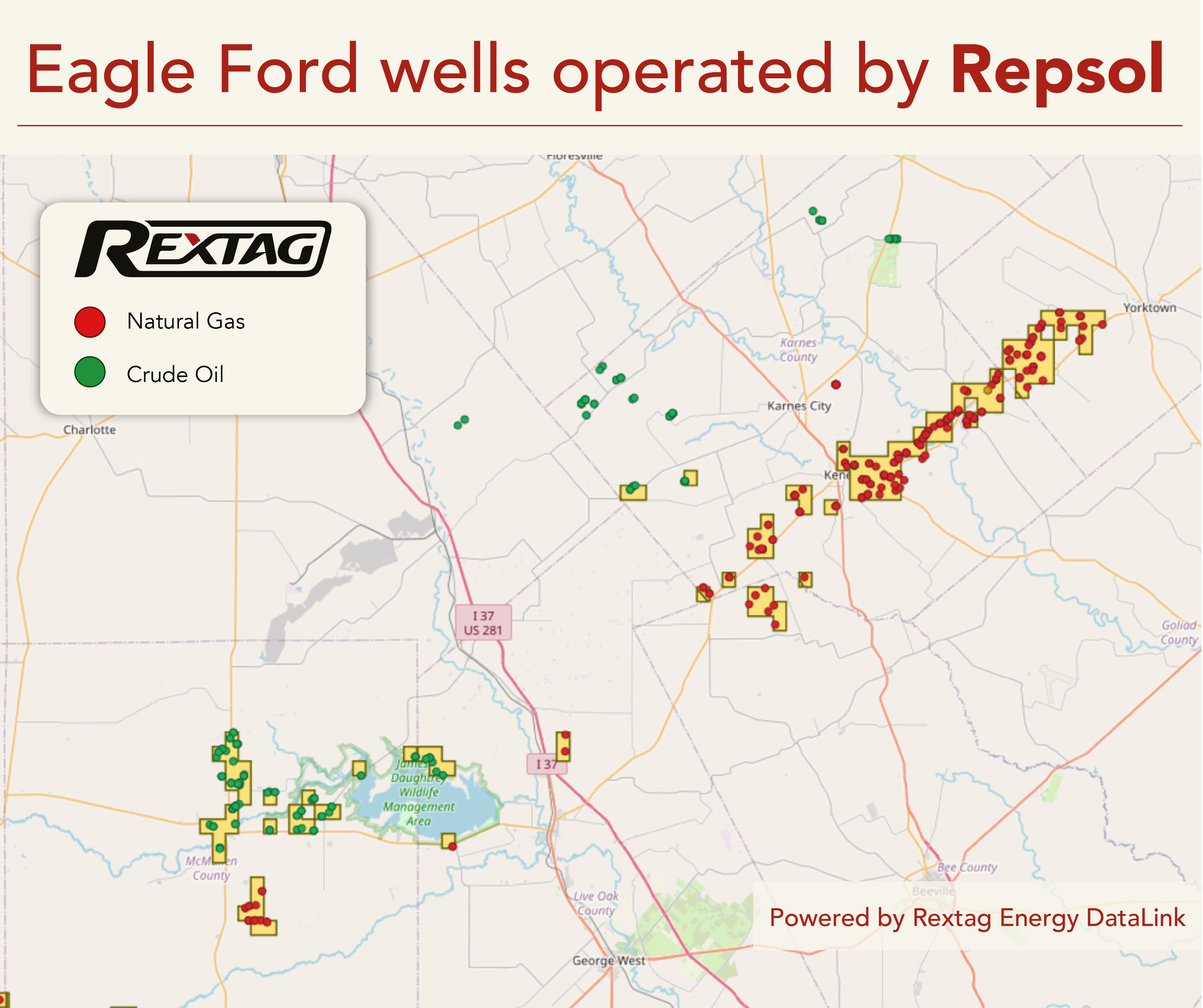

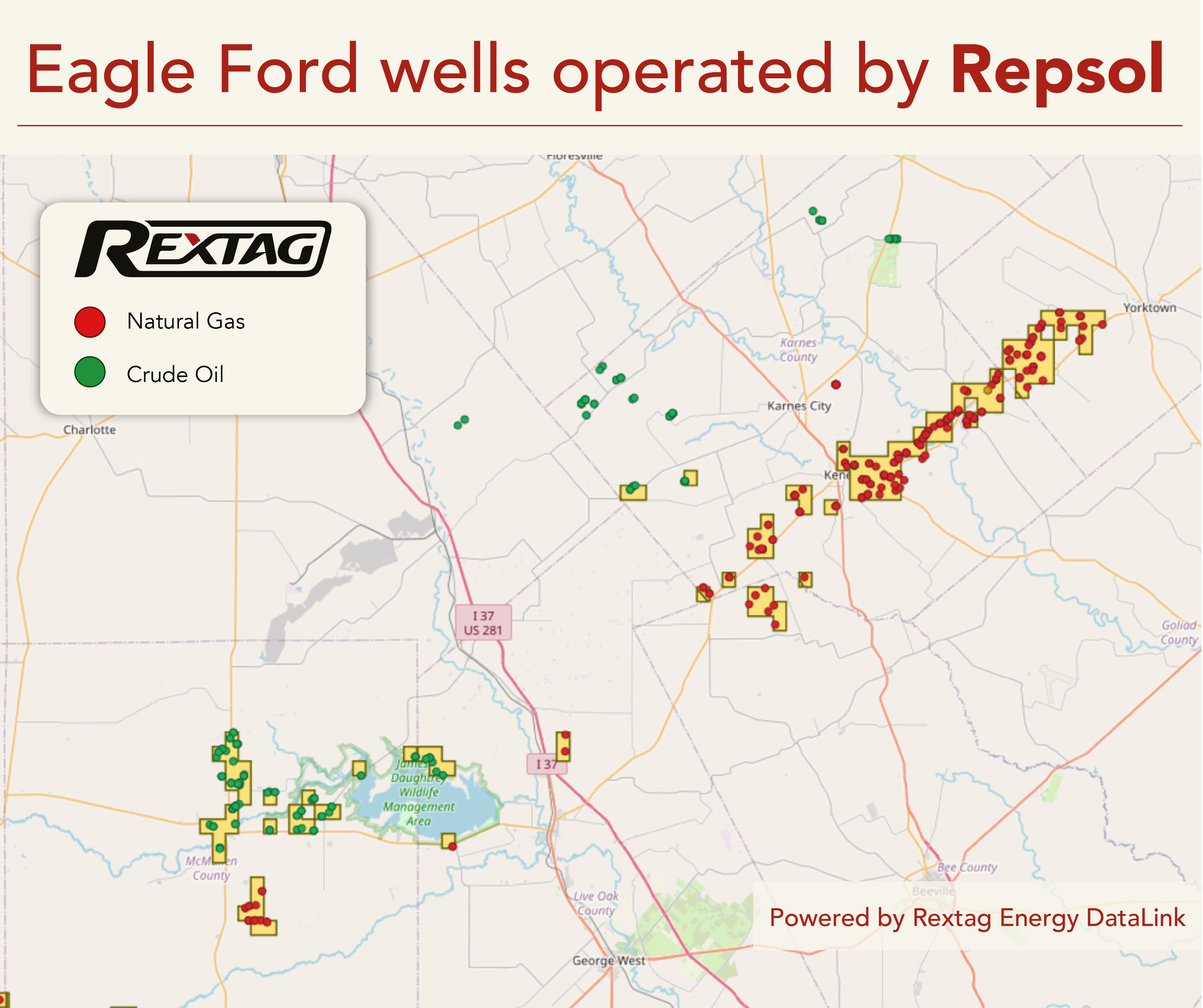

Repsol

Repsol reported an output of about 10,800 barrels per day of crude oil and condensate from its Eagle Ford operations in April. Additionally, gas production averaged around 116 million cubic feet per day.

Spanish Repsol has been actively expanding its operations in the Eagle Ford Shale, a region known for its liquids-rich fairways. In 2020, Repsol Oil & Gas USA significantly increased its presence by acquiring leases from Equinor that span several Texas counties including Live Oak, La Salle, DeWitt, McMullen, Karnes, Dimmit, and Bee.

Further expanding its holdings, last year Repsol acquired additional acreage and assets in Eagle Ford's tight oil window from Inpex Eagle Ford LLC, a subsidiary of Japan's INPEX Corp. This acquisition primarily enhanced Repsol's production in Karnes County and extended its reach into Atascosa, Gonzales, and La Salle counties, as recorded by the Texas Railroad Commission (RRC).

Currently, Repsol operates one rig in Eagle Ford, as noted in their first-quarter earnings report. Despite challenges in the gas market, which led to the planned release of a rig in their Marcellus operations, Repsol is setting ambitious growth plans. Between 2024 and 2027, the company plans to invest approximately $2.4 billion in developing its unconventional resources in both the Eagle Ford and Marcellus regions.

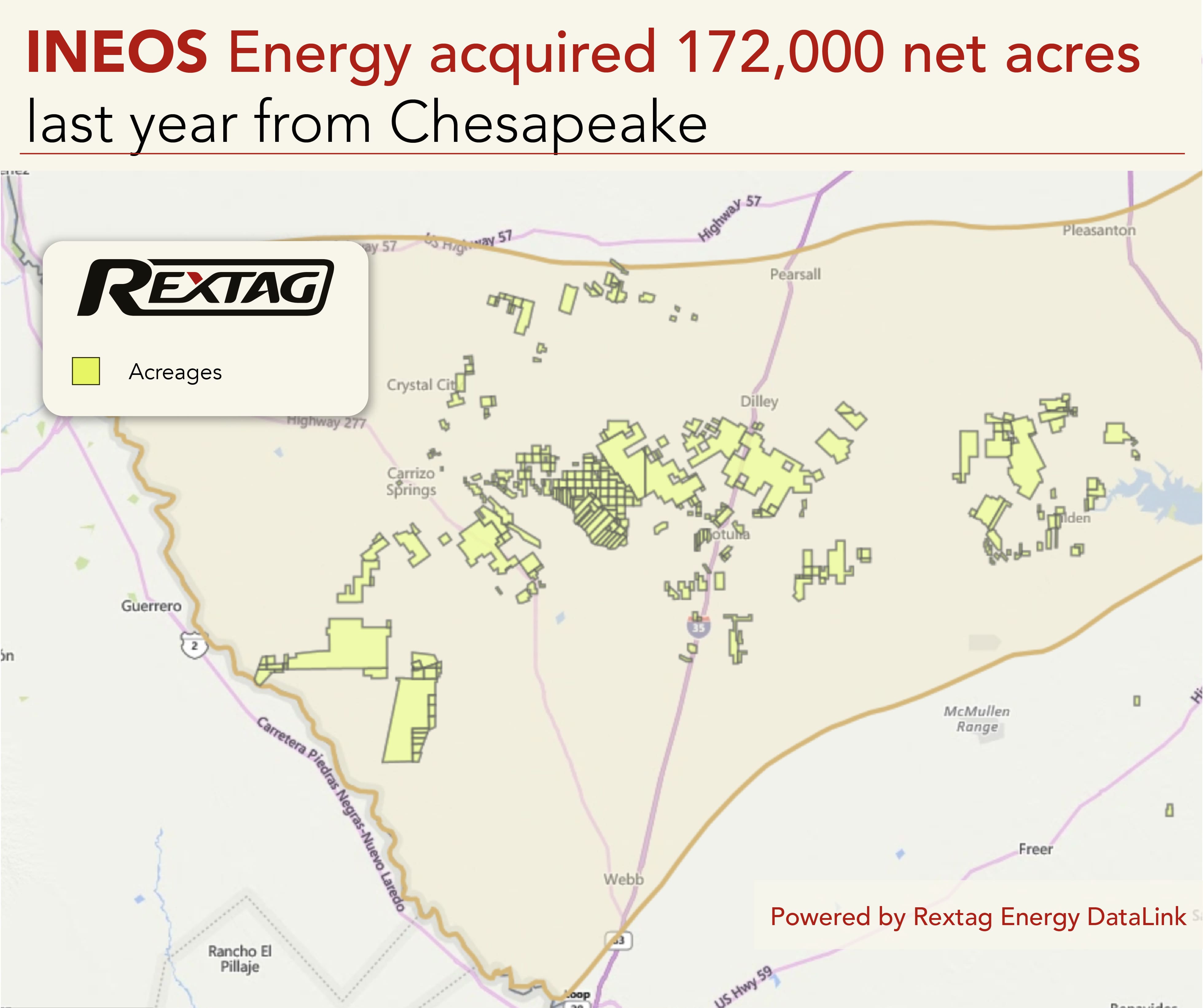

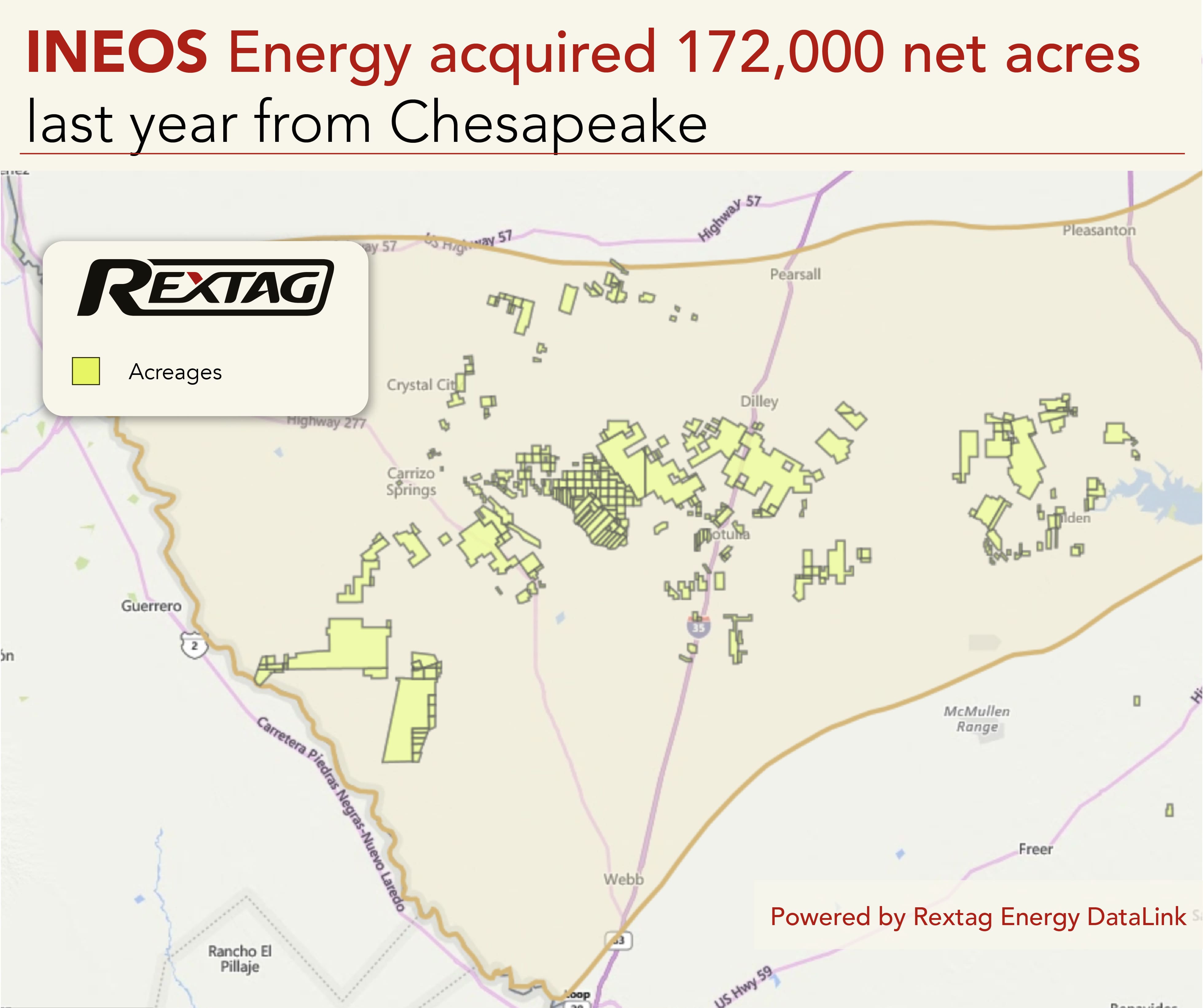

INEOS Energy

INEOS USA Oil & Gas produced an average of nearly 42,000 barrels per day of crude and condensate in April.

More recently, INEOS has focused its drilling efforts on these South Texas assets acquired from Chesapeake.

Last year, INEOS Energy, part of the UK-based chemical giant INEOS Group, expanded its operations into the Eagle Ford Shale through a significant acquisition from Chesapeake Energy. Chesapeake, focusing on becoming a purely natural gas producer, sold its assets in the region for $1.4 billion. This deal gave INEOS Energy around 172,000 net acres and 2,300 wells, primarily located in Dimmit, La Salle, and McMullen counties in Texas.

INEOS had already made a quieter entry into the U.S. market back in 2019 by acquiring assets in the Giddings Field from Crawford Hughes Operating Co.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.