Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

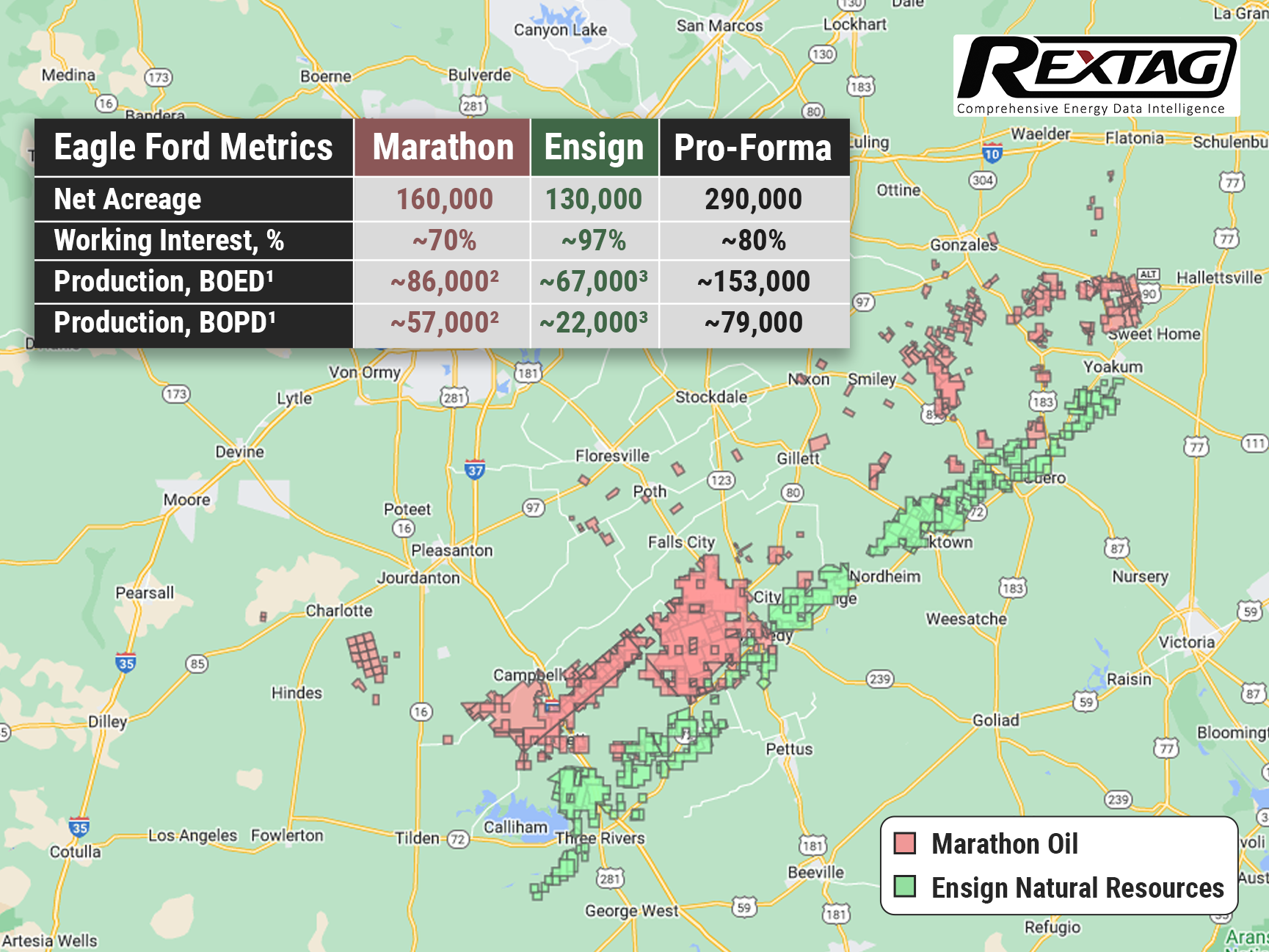

Ensign’s Assets Are Acquired by Marathon for $3 Billion

01/05/2023

Marathon Oil Corp. closes the acquisition of Ensign Natural Resources’ Eagle Ford assets for $3 billion cash, according to the company’s release on December 27.

The purchase includes 130,000 net acres (99% operated, 97% working interest) in acreage adjacent to Marathon Oil’s existing Eagle Ford position. Ensign’s estimated fourth-quarter production will average 67,000 net boe/d, including 22,000 net bbl/d of oil.

According to Marathon’s release, this acquisition complies with every element of its disciplined acquisition criteria. It is accretive to the key financial metrics, it is driving higher shareholder distributions consistent with the operating cash flow driven Return of Capital framework, it is accretive to its inventory life with attractive locations that immediately compete for capital and it offers truly compelling industrial logic given the existing Eagle Ford footprint and its track record of execution excellence in the play.

The acquisition was announced on November 2, following Devon Energy Corp.’s purchase of Validus Energy for $1.8 billion. Those deals and the impending sale of Chesapeake Energy Corp.’s Eagle Ford assets put the mature shale play back into the spotlight after years in which the Permian Basin has taken center stage for M&A.

Analysts and dealmakers admit the Eagle Ford appears to be an area of focus for companies seeking to add inventory, while the others are getting out. Chesapeake, with its pivot to natural gas, which has been marketing its Eagle Ford position, is anticipated commanding $4.6 billion to $5.9 billion in value. Other companies, such as BlackBrush Oil & Gas LLC, GulfTex Energy LLC, and 1776 Energy Operators LLC also have the potential to lure buyers.

The acquired assets from Ensign span Live Oak, Bee, Karnes, and Dewitt Counties across the condensate, wet gas, and dry gas phase windows of the Eagle Ford.

Marathon Oil can deliver maintenance-level production from the acquired asset of 67 net boe/d (22 net bbl/d of oil) with almost one rig and 35 to 40 wells to sales a year.

The company's estimation of the asset does not include any assumptions for synergies or upside redevelopment opportunities.

Based in Houston, Ensign was formed in 2017 in partnership with Warburg Pincus, a global growth investor. The company secured an equity commitment from the Kayne Private Energy Income Funds platform in 2019 as part of an acquisition of Pioneer Natural Resources Co.’s Eagle Ford assets.

Marathon Oil is an independent exploration and production (E&P) company based in Houston, which is focused on the most significant oil-rich resource plays in the U.S. — the Eagle Ford in Texas, Permian in New Mexico, STACK and SCOOP in Oklahoma, and the Bakken in North Dakota.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

$3 Billion Deal, Marathon Oil Buys Ensign Natural Resources

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/103Blog_Marathon_Acquires_Assets_in_Eagle_Ford_from_Ensign_11_2022.png)

A $3.0 billion cash definitive agreement to purchase the Eagle Ford assets of Ensign Natural Resources has been concluded by Marathon Oil Corporation on November 2.

Williams Buys MountainWest Pipeline System for $1.5 Billion

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/110Blog_Williams_Buys_MountainWest_Pipeline_System_12_202 (1).png)

On December 15, Pipeline giant Williams made a deal to purchase MountainWest Pipelines Holding Co. from Southwest Gas Holdings Inc. for almost $1.5 billion including debt. Williams is paying $1.07 billion in cash and assuming $0.43 billion of debt to buy MountainWest, which comprises approximately 2,000 miles of interstate natural gas pipeline systems mainly situated across Utah, Wyoming, and Colorado.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?