Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Lime Rock Resources Starts the Year With a Bang — a Money Bang!

03/03/2022

Lime Rock Resources, acquirers and operators of producing oil and gas properties in the United States, announces two acquisitions: the company acquired the Williston Basin properties of Abraxas Petroleum for $87.2 million, as well as properties from a private seller in the Austin Chalk and Eagle Ford in Texas for $271.3 million.

Founder and CEO Eric Mullins said Lime Rock Resources' start to the year with two acquisitions worth $358.5 million signaled a change in the upstream A&D sector.

Since Lime Rock Resources was founded in 2005, it has acquired over 25 oil and gas properties in the U.S. Just over the last four months, Lime Rock Resources team has made over $850 million in total property acquisitions. In October, Lime Rock Resources closed on the acquisition of oil and gas properties in the Permian Basin from Rosehill Resources. The acquisition was described as a “unique opportunity,” and was worth $508.3 million.

Having acquired nearly one billion dollars of venture capital in the last few months demonstrates changing market dynamics, a robust opportunity set, and Lime Rocks' ability to partner with sellers over many months on agreements that work for all parties.

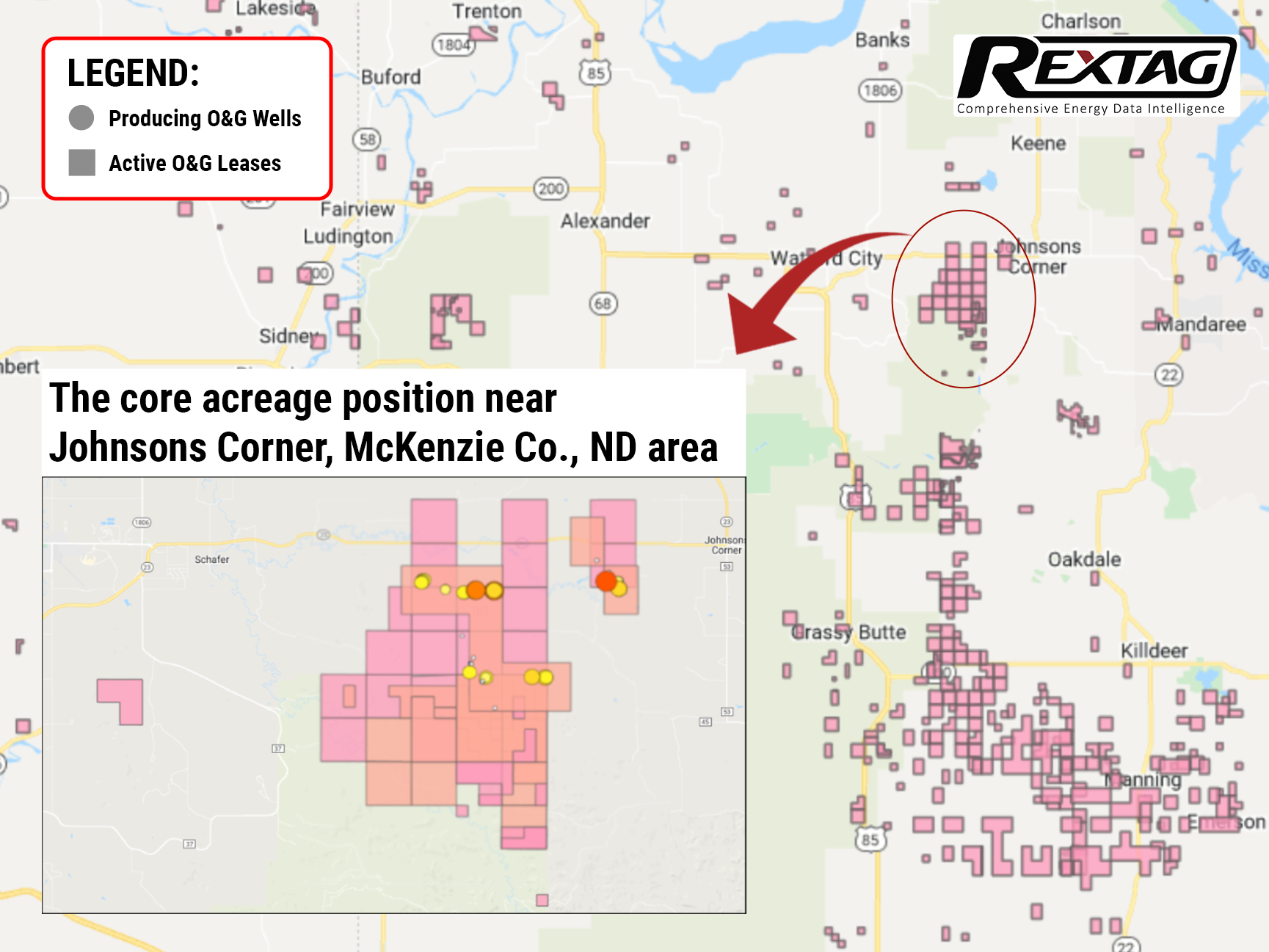

Among the two acquisitions announced recently by Lime Rock were Abraxas Petroleum’s Williston Basin position in North Dakota as well as properties situated in Burleson, Milam, and Robertson in Texas from a third party.

According to Abraxas, the $87.2 million transactions are part of a business restructuring plan that will result in it becoming a pure-play firm focused on the Delaware Basin. About 3,500 acres of land in McKenzie County are involved in this transaction. By acquiring these assets, Lime Rock Resource now controls approximately 19,400 boed of net production in all of North Dakota.

With respect to the Texas properties, which were acquired for $271.3 million from an undisclosed seller, they contain 46,000 contiguous net acres and produce 7,700 boed as of the closing of the deal.

It also seems that the company will be able to integrate the new assets seamlessly into its existing operations in both Texas and North Dakota, as well as intensify its focus on low-risk opportunities and margins, which will significantly boost Lime’s market position going further.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

All In: Devon Energy is Banking on a Rebound for Anadarko

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Devon-Energy-is-Banking-on-a-Rebound-for-Anadarko.png)

Devon Energy Corp. believes that the Anadarko Basin is a hidden treasure and aims to use its position in it to fuel a robust cash return model and establish itself as an industry leader in promoting ESG. This E&P company plans to drill 45 new wells in the Midcontinent by 2022, as well as to produce 600,000 boe/d across five operating basins, including the Eagle Ford Shale, Permian, Powder River, and Williston basins. And given that Devon's recent fourth-quarter results were better than Street estimates. It appears that they are doing something right, at least for the moment.

Kinder Morgan Overview: 2022 vs 2023, Oil & Gas Wells, Pipelines, Terminals, Deals

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R264_Blog_Kinder Morgan Overview_ 2022 vs 2023, Oil & Gas Wells, Pipelines, Terminals, Deals.png)

Kinder Morgan stands as North America's top independent mover of petroleum products with around 2.4 million barrels daily across the continent. The bulk of this flow happens through its Products Pipelines division, which navigates gasoline, jet fuel, diesel, crude oil, and condensate through a network of about 9,500 miles of pipelines. Alongside, the company maintains roughly 65 liquid terminals that not only store these fuels but also blend in ethanol and biofuels for a green touch.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/297_Blog_Keystone XL Pipeline Controversy and Wildlife Disaster From Trump's Green Light to Biden's Red Light on the 15 Billion Project.jpg)

The pipeline industry in the USA faced and still faces a range of regulatory challenges, including permitting delays, environmental requirements, and public opposition to pipeline projects. In recent years, pipeline projects like the Keystone XL and Dakota Access pipelines had legal and regulatory obstacles that delayed or canceled their construction. Keystone XL Pipeline, proposed by TransCanada in 2008, aimed to transport crude oil from Canada (around Calgary and Edmonton) to refineries on the Gulf Coast (Port Arthur). The project faced opposition from environmental groups and indigenous communities, who argued that it would contribute to climate change and pose a risk to water resources. In 2015, President Obama rejected the project, citing concerns about its environmental impact. However, in 2017, President Trump revived the project, leading to further legal challenges. In June 2021, U.S. President Joe Biden officially canceled the project on his first day in office.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/282_Blog_Renewable Natural Gas How RNG Changes the Industry.jpg)

The renewable natural gas (RNG) industry in the United States is showing promising signs of growth. As of 2019, the U.S. consumed 261 billion cubic feet (BCF) of RNG, primarily utilized by independent power producers, electric utilities, and various commercial and industrial entities. However, this figure represents only a small fraction of its potential. Research indicates that the U.S. could theoretically produce up to 2,200 BCF of RNG through anaerobic digestion alone, which would equate to about 11% of daily national natural gas consumption.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/295_Blog_Renewable Efforts Lag as Global Oil and Gas Demand Continues to Rise.jpg)

Recently, the progress toward an energy transition is hitting a snag. Sales of electric vehicles are decelerating, and the growth in wind and solar power needs to be keeping pace with expectations. To make matters more challenging, electricity prices are climbing when they were expected to fall. Amidst these setbacks, the oil and gas sectors are proving resilient. According to BP's latest energy outlook, not only are these energy mainstays here to stay, but their demand is expected to remain relatively high even after reaching a peak. Interestingly, BP forecasts that oil demand will reach its zenith next year, marking a critical moment in energy consumption trends. This isn't the first time BP has projected a peak in oil demand. Back in 2019, their review anticipated a decline in demand growth, but the prediction fell flat. Instead, oil demand surged to unprecedented levels following the end of the global pandemic lockdowns, defying previous forecasts and underscoring the enduring dominance of traditional energy sources in the global market.