Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

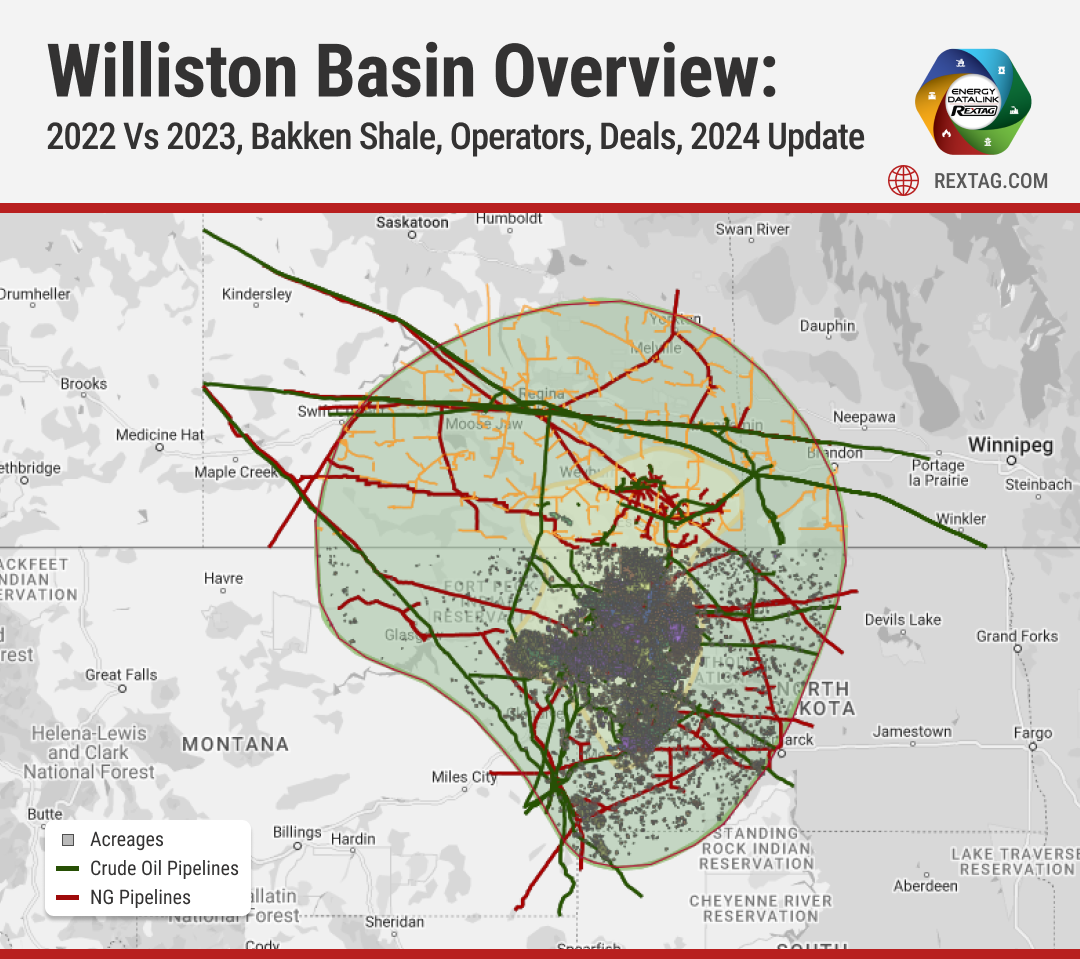

Williston Basin Overview: 2022 vs 2023, Bakken Shale, Operators, Deals, 2024 Update

The Williston Basin is a big area filled with layers of rock that sits next to the Rocky Mountains in western North Dakota, eastern Montana, and the southern part of Saskatchewan in Canada. This area covers roughly 110,000 square miles. Geologically, it's very similar to the Alberta Basin in Canada. People started drilling for oil in the Williston Basin back in 1936, and by 1954, most of the land where oil could likely be found was already claimed for drilling. The Bakken Formation with parts of Montana, North Dakota, Saskatchewan, and Manitoba has become one of only ten oil fields globally to yield over 1 million barrels per day (bpd) since the late 2000s. It is currently the third-largest U.S. shale oilfield, behind the Permian and Eagle Ford. The boom in the Bakken started around September 2008, coinciding with the U.S. housing market crash. The application of new technologies, such as swell packers enabling multiple-stage fracturing, significantly enhanced oil recovery, making the Bakken Formation a key player in the U.S. In 2022, the Bakken oil field saw big improvements in how much oil and gas it could produce. At the start of the year, 27 drilling rigs were working there, more than double the 11 rigs from the start of 2021. Important upgrades included making the Tioga Gas Plant able to process 150 million cubic feet more gas each day, and making the Dakota Access Pipeline bigger, increasing its oil transport capacity from 570,000 to 750,000 barrels every day.

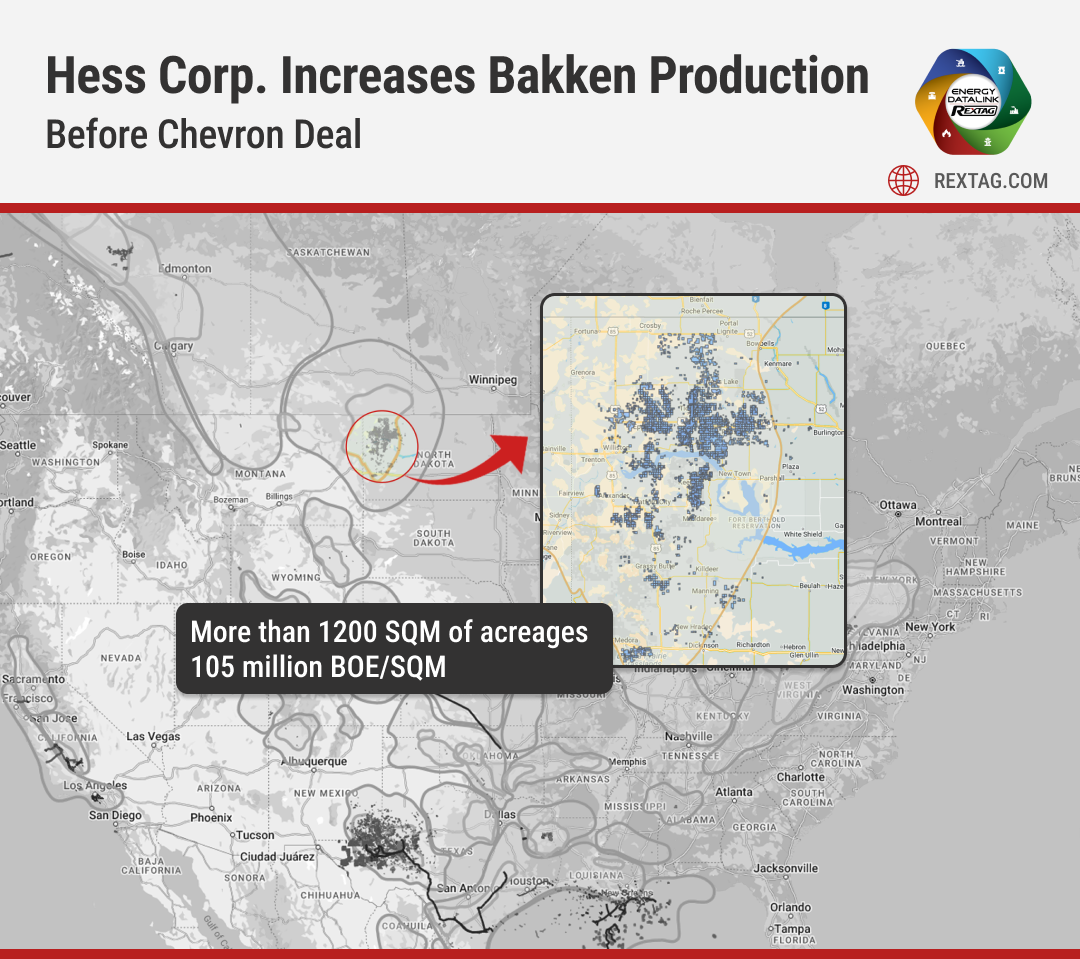

Hess Corp. Increases Drilling Activity Before Chevron Takeover

Hess Corp. is in the final stages of a major sale to Chevron, with increased drilling and production in the Bakken region noted in the last quarter. Hess announced its fourth-quarter net production in the Bakken reached 194,000 barrels of oil equivalent per day (boe/d), a slight increase from the third quarter's 190,000 boe/d and a significant 23% rise from the 158,000 boe/d seen in the fourth quarter of the previous year. This growth is attributed to more drilling and the impact of the previous year's severe winter weather.

Bakken's Tipping Point: Grayson Mill's Potential Fall After Chevron-Hess

The Permian Basin, a big oil area, is not seeing as many deals as before because lots of companies have already joined together. Now, experts think these companies might start looking for new places to invest in the U.S. One area getting attention is the Bakken play. Chevron Corp. has just made a big step there by buying Hess Corp. for $60 billion. Another company, Grayson Mill Energy, which got some help from a Houston investment firm EnCap Investments LP, might also be up for sale soon, worth about $5 billion.

Under Construction Pipelines: Outlook 2023 by Rextag

According to Globaldata, 196,130km of planned and announced trunk oil and gas pipelines are anticipated to become operational globally between 2023 and 2030. This consists of 113,099km of planned pipelines that have identified development plans, and 83,031km of early-stage announced pipelines currently under conceptual study, expected to receive development approval. Based on Global Energy Monitor's 2023 data, Africa and the Middle East account for 49% of the global oil transmission pipeline construction, valued at US$25.3 billion. The report indicates these regions are currently constructing 4,400 km of pipelines with an investment of US$14.4 billion. There are plans for an additional 10,800 km at an approximate cost of US$59.8 billion.

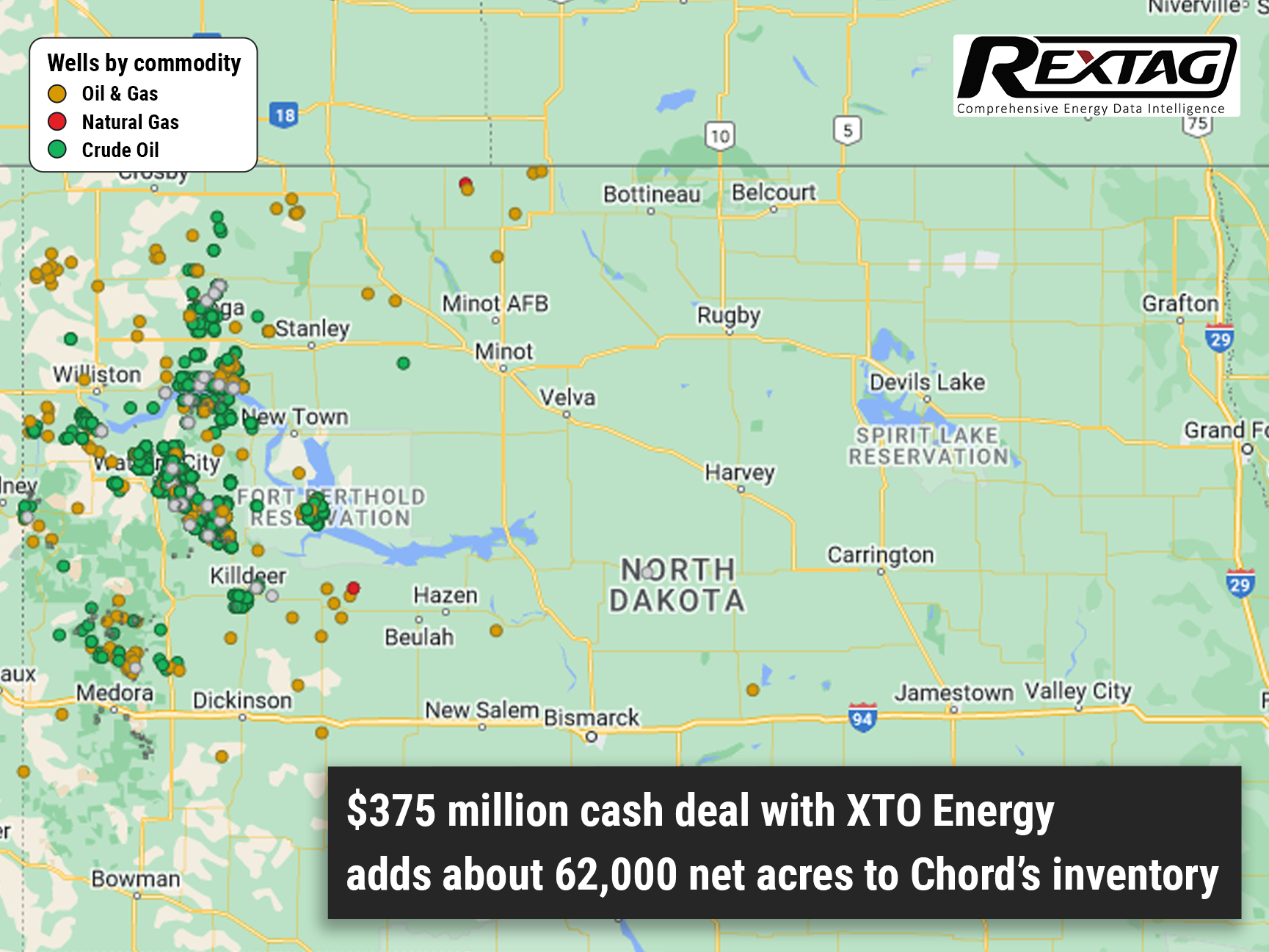

Chord Energy Corp. Expands Williston Basin Footprint with $375 Million Acquisition from Exxon Mobil

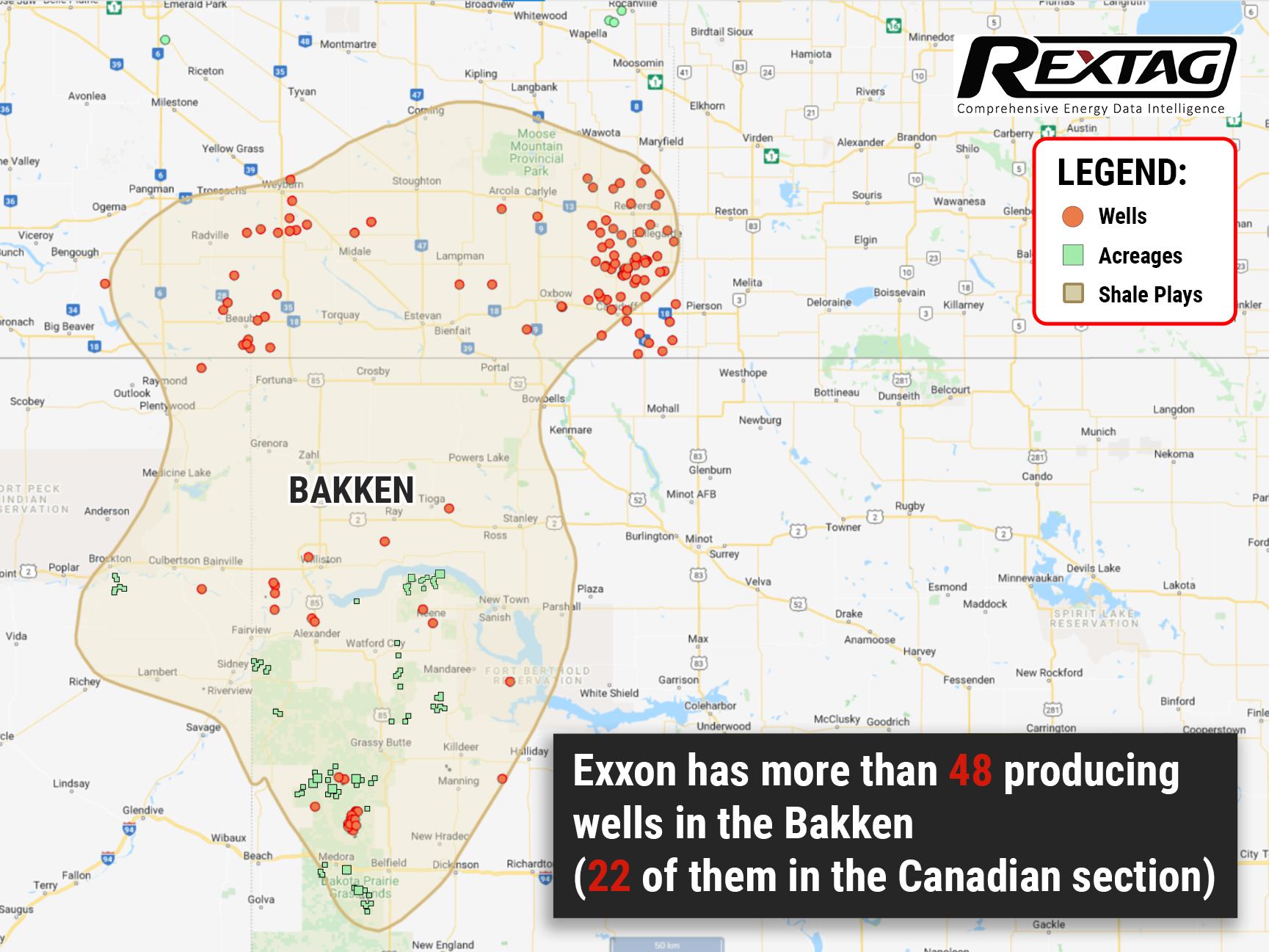

Chord Energy Corp.'s subsidiary has entered into an agreement to purchase assets in the Williston Basin from Exxon Mobil, and its affiliates for $375 million. Chord Energy, a US independent company, is strategically expanding its presence in the Williston Basin of Montana and the Dakotas. While industry attention remains fixated on the Permian Basin, Chord Energy recognizes the potential of the Williston Basin and is capitalizing on the opportunity to enhance its reserve portfolio. Chord Energy successfully completed the acquisition of 62,000 acres in the Williston Basin from XTO Energy for a substantial cash consideration of $375 million.

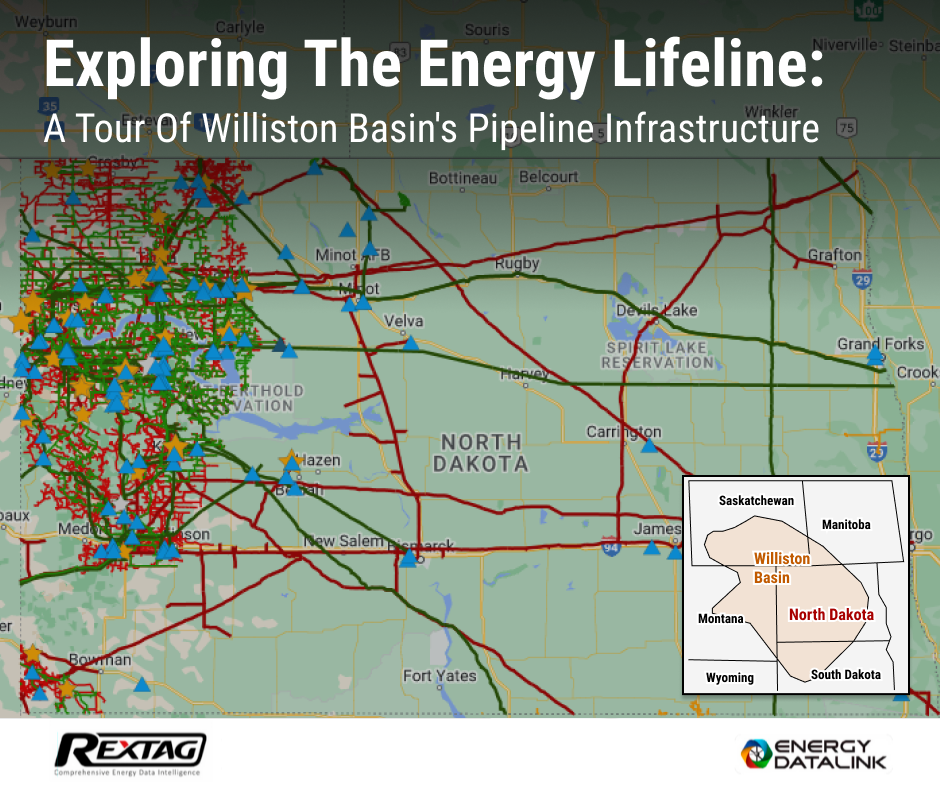

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

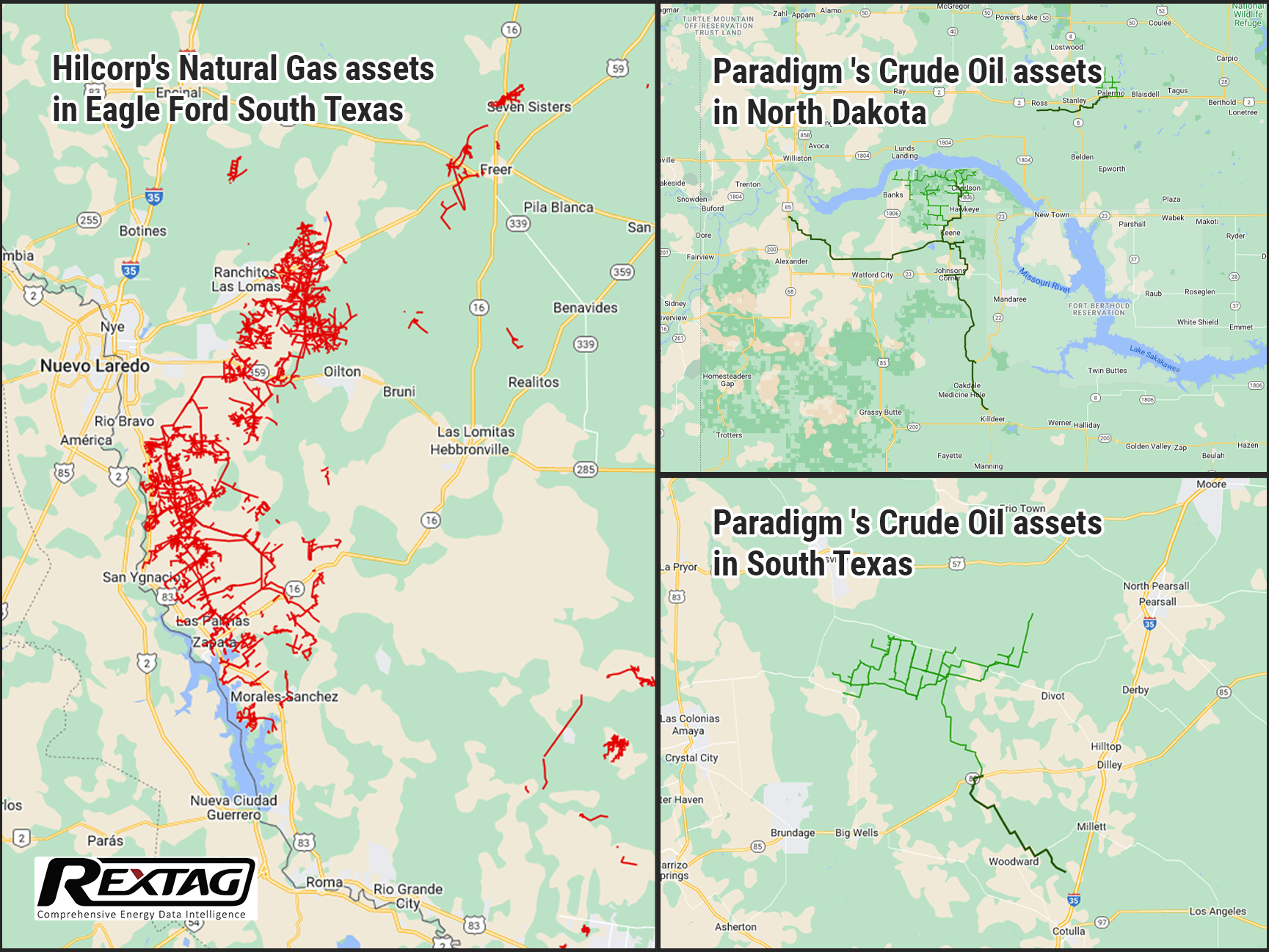

Fueling Up for Success: Harvest Midstream, Hilcorp's Affiliate, to Acquire Bakken and Eagle Ford Assets from Paradigm

Harvest Midstream, a Hilcorp affiliate, is set to acquire three midstream gathering systems that serve the Bakken, as well as system located in the Eagle Ford. Harvest, an affiliate of Hilcorp Energy Corp, has entered into an agreement to purchase three Bakken midstream gathering systems and one in the Eagle Ford from Paradigm. Paradigm is set to sell these midstream assets to Harvest in the near future.

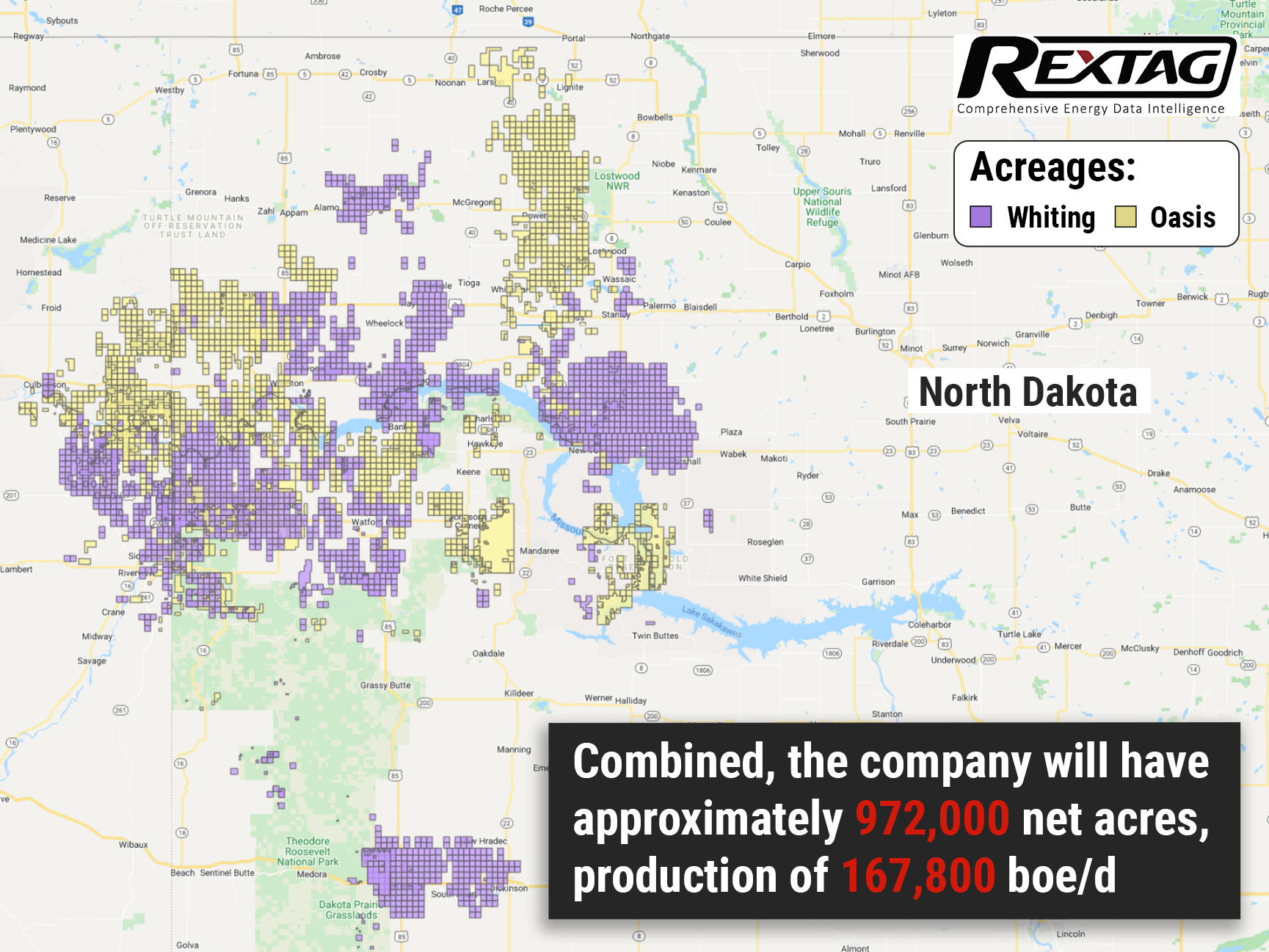

Merger of Equals: Whiting and Oasis $6B Deal

The two Bakken shale producers announced in a joint statement on March 7 that they had reached an agreement to unite in a $6 billion "merger of equals." Combining these two companies will create a leading Williston Basin position with assets covering approximately 972,000 net acres, production of 167,800 boe/d, and an enhanced free cash flow generation that will generate capital returns to shareholders. A historic collapse in oil prices prompted both Whiting and Oasis oil companies to file for Chapter 11 bankruptcy protection in 2020. Thus, the merger can be viewed as a preventive measure to avoid going out of business.

To Be or Not To Be: Bakken Assets Could Fetch $5 Billion for Exxon Mobil

Exxon Mobil Corp. is weighing prospects of selling its assets in North Dakota’s Bakken, after gauging interest from potential buyers — 5 billion is the issue price, at least according to rumors. The price point came about after the news that the oilgiant is in the final round of hiring bankers to help launch the sale. Yet Exxon Mobil itself stays tight-lipped regarding the situation.

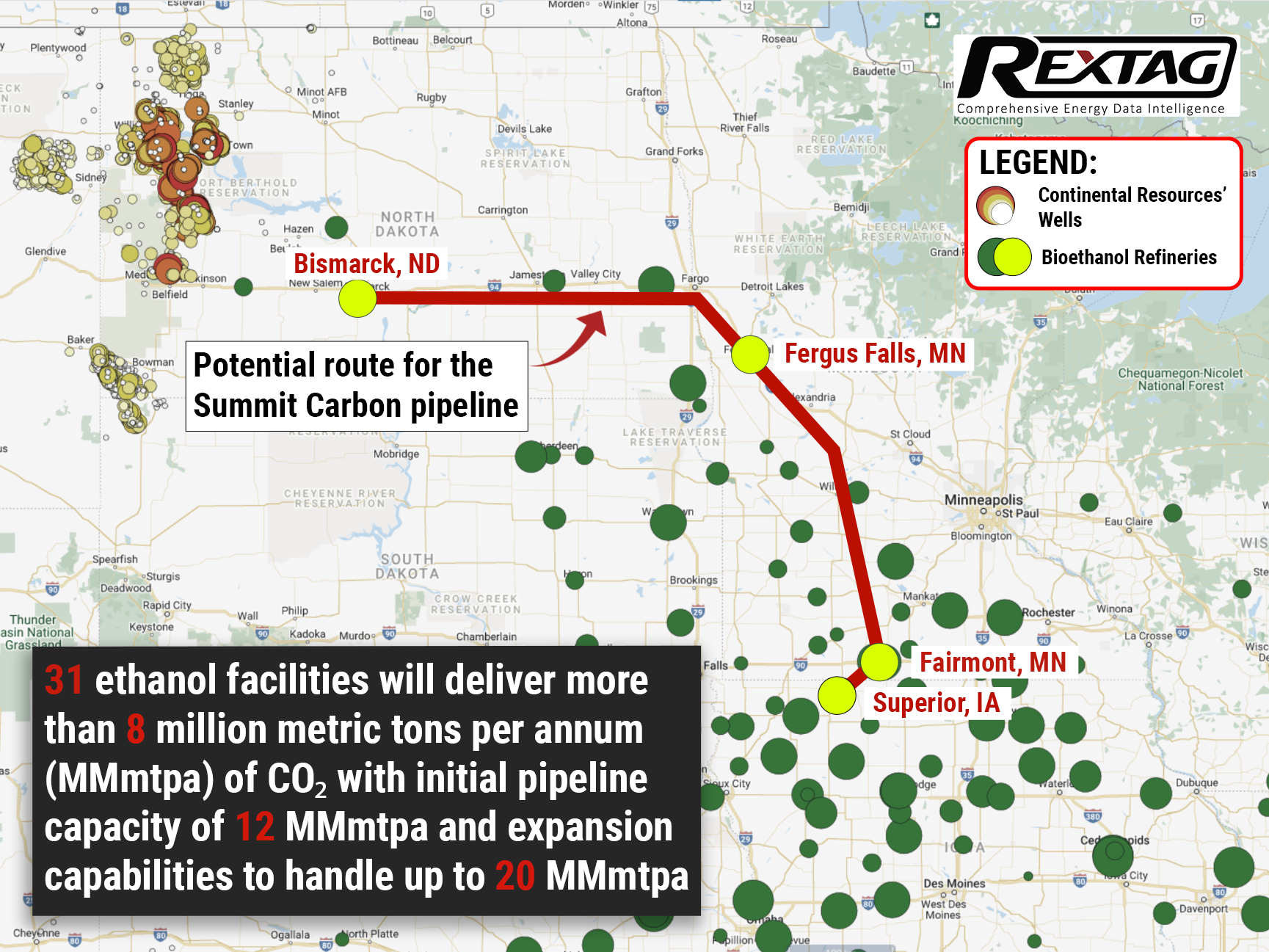

Continental Resources Inc. Invests a Quarter of a Billion Dollars in a Sequestration Project in North Dakota

The investment will happen in the next 2 years. The project intends to capture CO2 from ethanol plants and other sources in Iowa, Nebraska, Minnesota, North Dakota, and South Dakota. Upon aggregation, CO2 will be transported via pipeline to North Dakota, where it will be stored in subsurface geologic formations. The formations will be in the Williston Basin, where Continental Resources has been a dominant producer for more than half a century. At the moment it’s the world's most ambitious carboncapture venture of its kind. The sequestration itself should be underway by spring 2024.

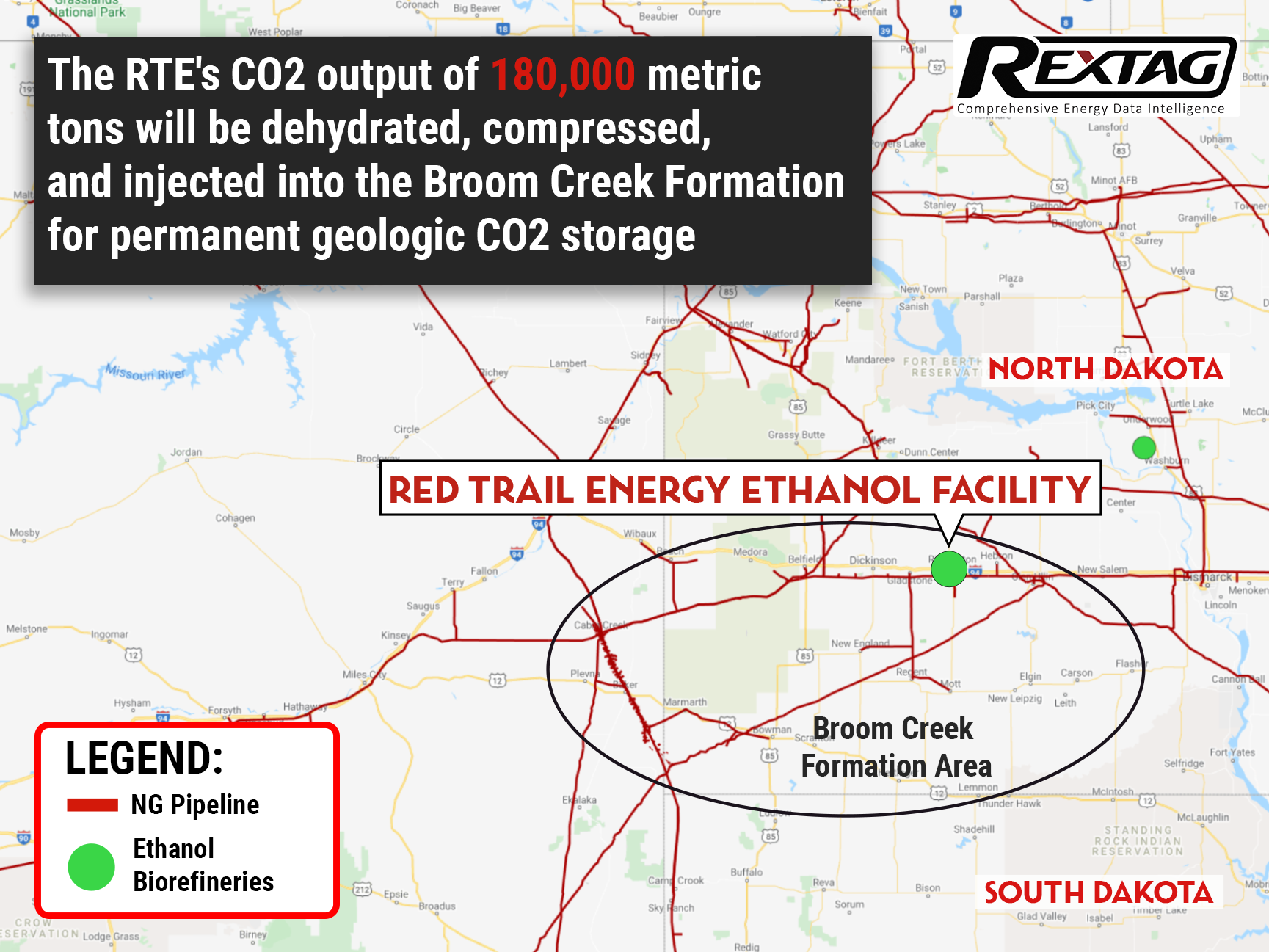

The race for landmark CCS project: North Dakota approves Class VI well for Red Trail Energy

New standards for carbon capture have been set in North Dakota earlier this month as NDIC greenlights Red Trail Energy’s project. The company will now be able to commercially capture, compress, and inject 180,000 tons of carbon dioxide per year into the Broom Creek Formation on its property for permanent geologic CO2 storage. This ensures that carbon dioxide can be stored safely for generations to come.

Blog_Grayson Mill acquired Ovintiv's Bakken assets for $825M in 2024.png)