The Williston Basin is a big area filled with layers of rock that sits next to the Rocky Mountains in western North Dakota, eastern Montana, and the southern part of Saskatchewan in Canada. This area covers roughly 110,000 square miles. Geologically, it's very similar to the Alberta Basin in Canada. People started drilling for oil in the Williston Basin back in 1936, and by 1954, most of the land where oil could likely be found was already claimed for drilling.

The Bakken Formation with parts of Montana, North Dakota, Saskatchewan, and Manitoba has become one of only ten oil fields globally to yield over 1 million barrels per day (bpd) since the late 2000s. It is currently the third-largest U.S. shale oilfield, behind the Permian and Eagle Ford. The boom in the Bakken started around September 2008, coinciding with the U.S. housing market crash. The application of new technologies, such as swell packers enabling multiple-stage fracturing, significantly enhanced oil recovery, making the Bakken Formation a key player in the U.S.

In 2022, the Bakken oil field saw big improvements in how much oil and gas it could produce. At the start of the year, 27 drilling rigs were working there, more than double the 11 rigs from the start of 2021. Important upgrades included making the Tioga Gas Plant able to process 150 million cubic feet more gas each day, and making the Dakota Access Pipeline bigger, increasing its oil transport capacity from 570,000 to 750,000 barrels every day.

2024 Update

In January 2024, North Dakota's Oil & Gas Division reported a total oil production of over 34 million barrels, with an average daily output reaching about 1.1 million barrels across 18,674 producing oil wells. The month also saw significant drilling activity, including the start of 76 new wells, the extension of 76 others, and the completion of 108 workovers, all supported by 38 operational drilling rigs.

In February 2024, Chord Energy announced it would acquire Enerplus Corp. for nearly $4 billion in a combination of stock and cash, aiming to become the largest producer in the Williston Basin. The merger will result in an $11 billion operation in the basin, marking the end of Enerplus's nearly two-decade-long presence in the Bakken, which started with its early investments in Montana's horizontal shale formations.

The merged entity will operate as a leading company in the Williston Basin, controlling 1.3 million net acres with a combined production capacity of 287,000 barrels of oil equivalent per day (boe/d). Of this total production, about 100,000 boe/d will come from Enerplus. Crude oil will constitute 56% of the new company's total production output.

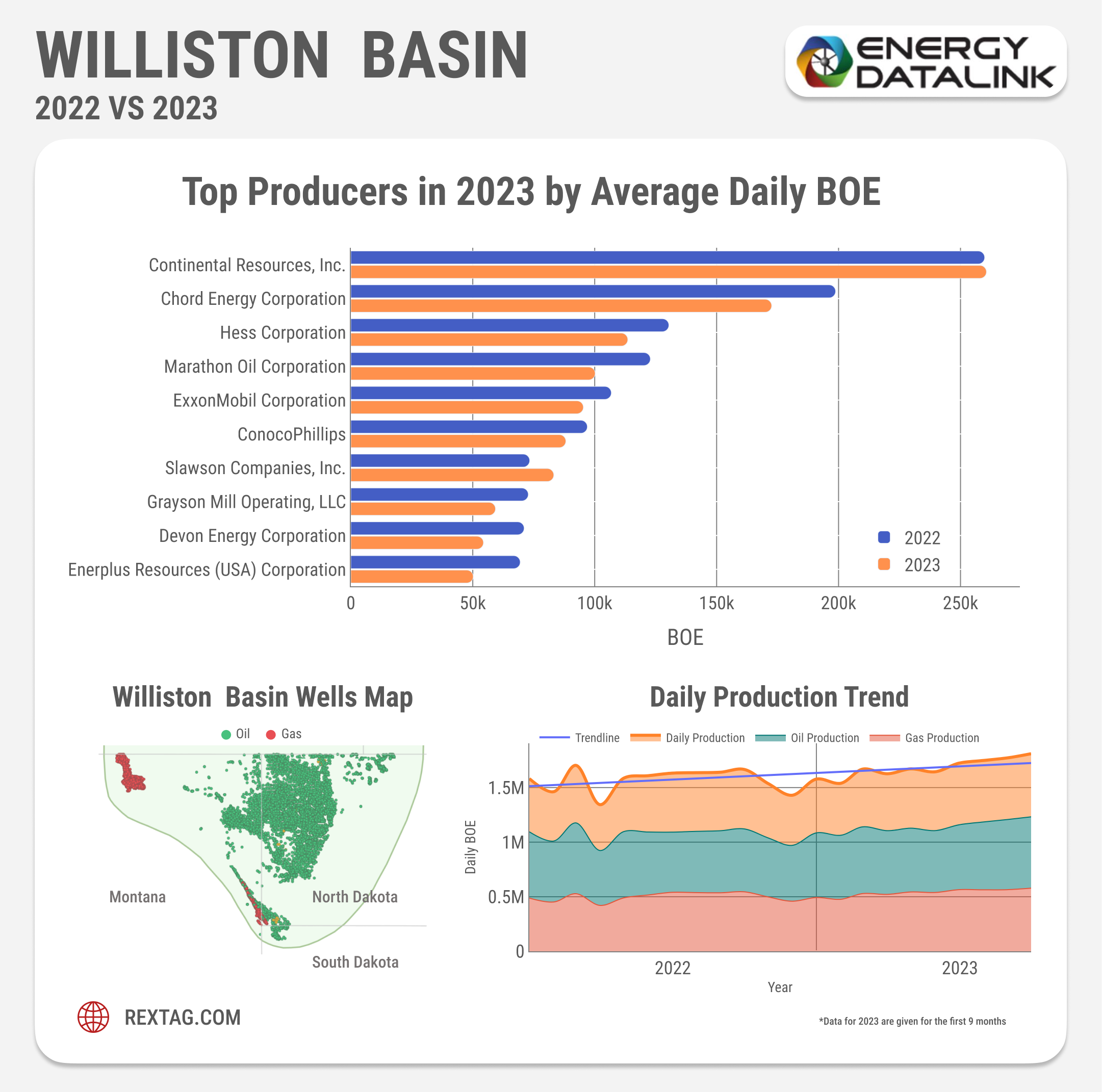

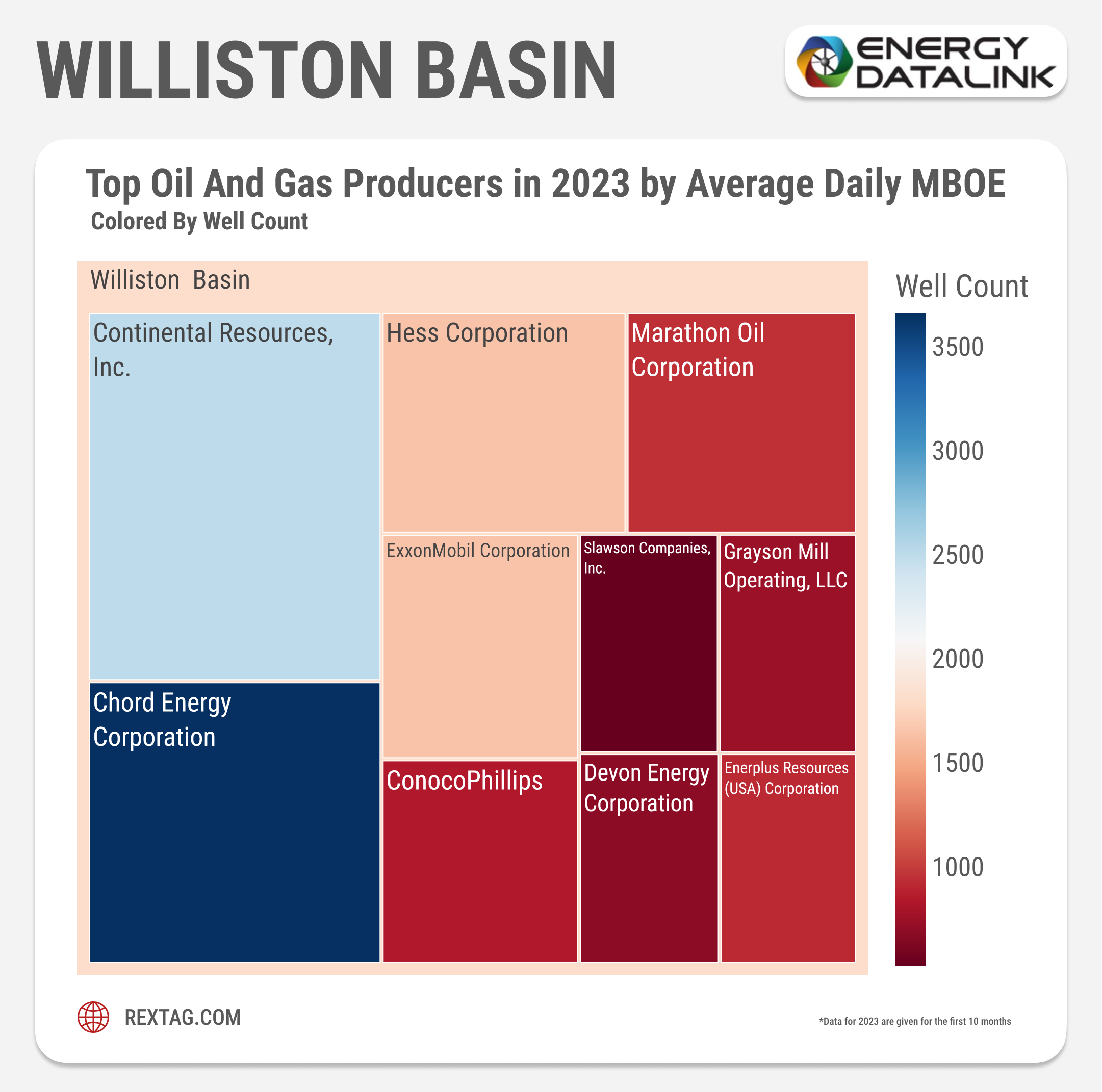

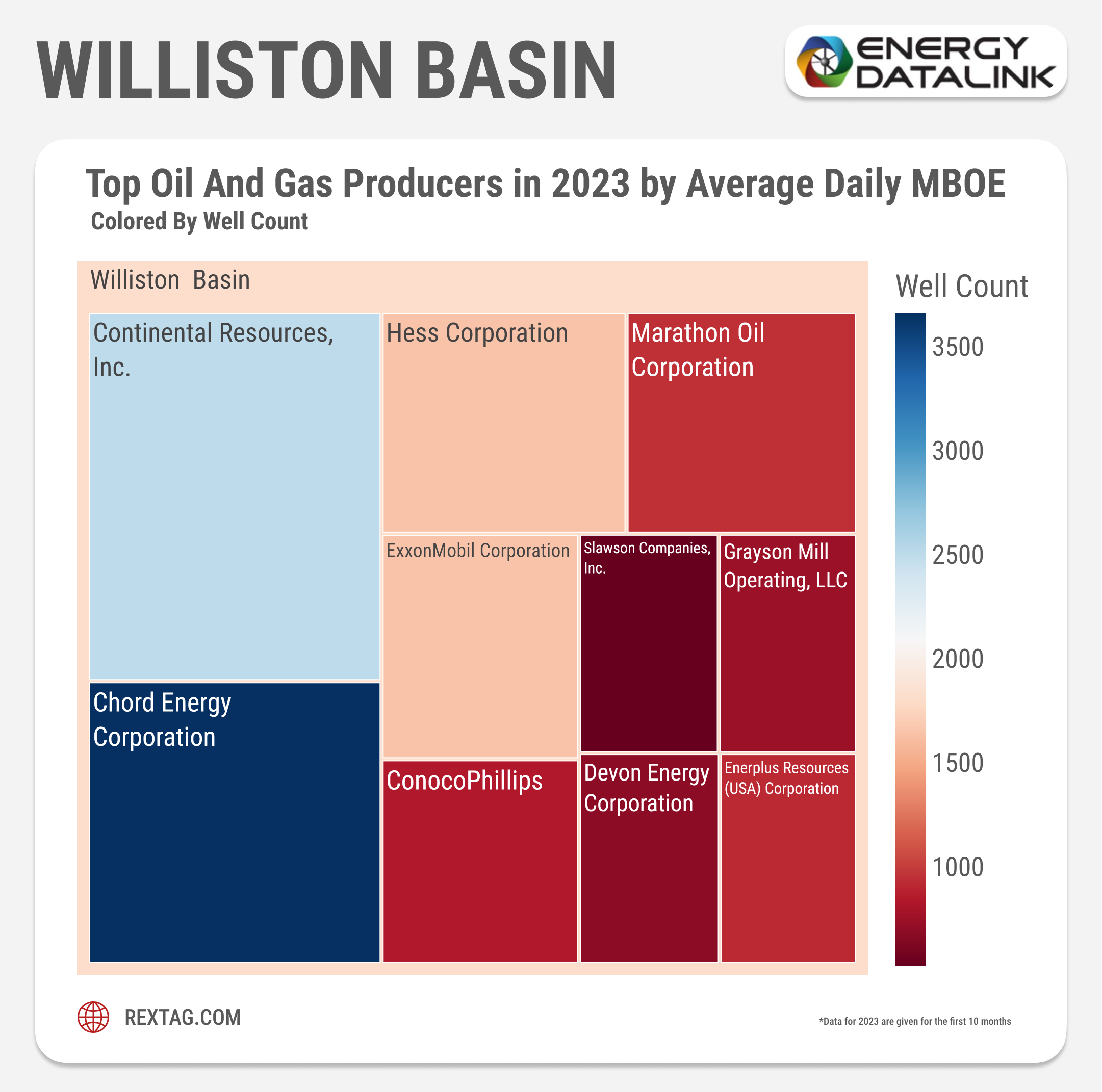

TOP Operators of Williston Basin and Bakken Formation

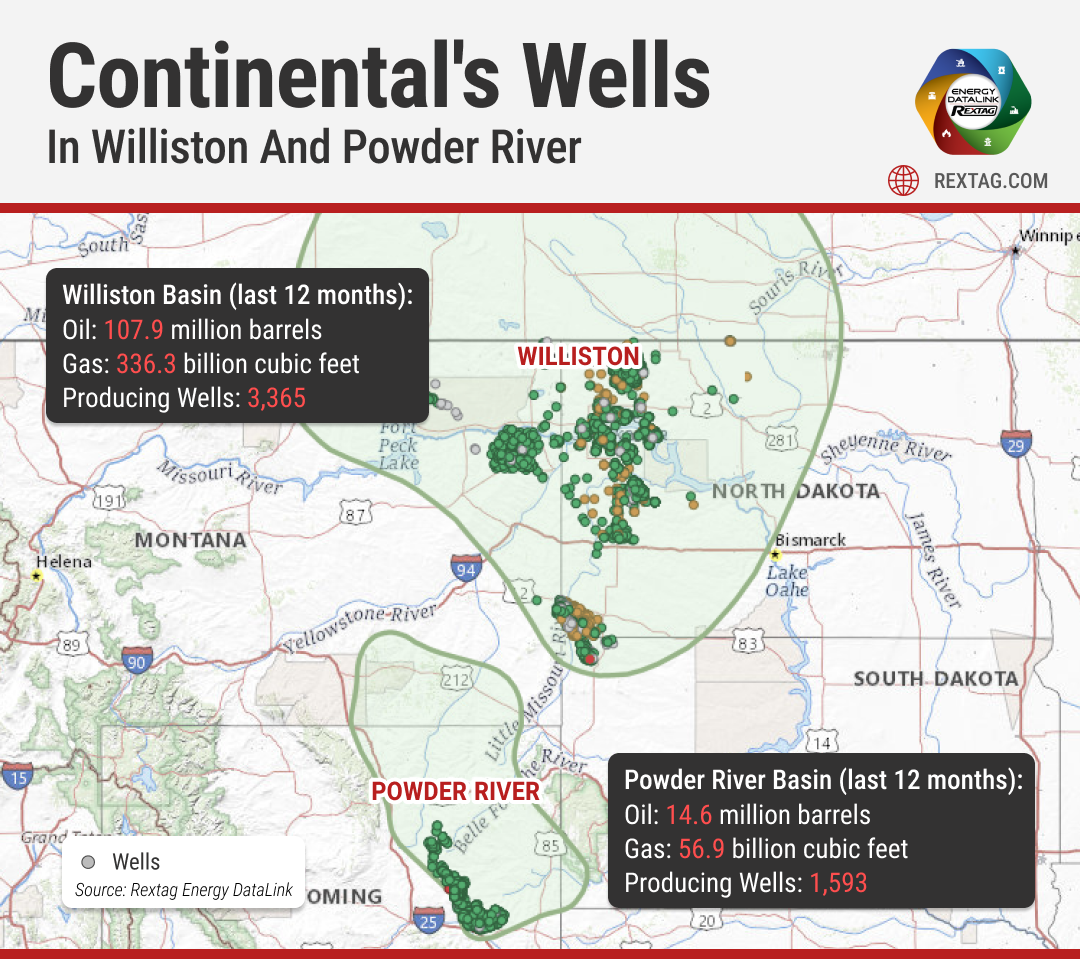

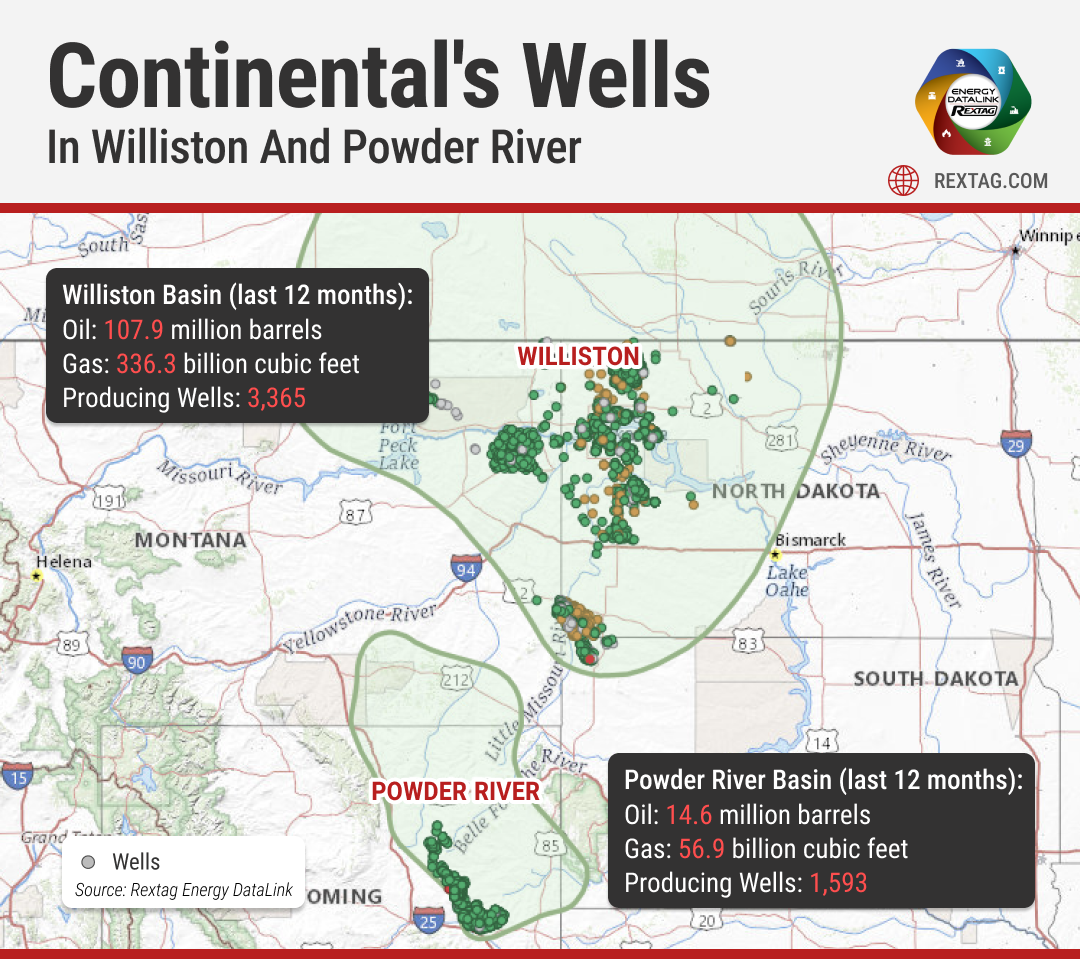

There was a 26% increase in Q4 year-over-year production, with Continental drilling 363 wells throughout 2023. This region contributed 35% to Continental's total proved reserves and accounted for 49% of its Q4 average daily production. The reserves stood at 647 million barrels of oil equivalent (MMBoe), with 1,006 undeveloped drilling locations remaining.

For proved reserves, the Bakken had 187,125 MBbls of developed crude oil, and 916,570 MMcf of developed natural gas, totaling 339,887 MBoe. Undeveloped reserves included 201,766 MBbls of crude oil and 630,987 MMcf of natural gas, totaling 306,931 MBoe. In terms of acreage, Continental held 1,189,834 gross acres and 753,175 net acres in the Bakken, with 1,115,481 acres developed and 74,353 acres still undeveloped.

By the last quarter of 2023, the Bakken area was producing an average of 220,428 boe/d, marking a 26% increase from the same period in 2022. Annually, the daily average production from the Bakken saw an 18% rise compared to 2022.

Continental reported that in 2023, it focused on drilling and completing 363 wells in the Bakken, a significant increase from the 266 wells addressed in 2022. By year's end, 539 wells in the Bakken were ready for development but had not yet been drilled.

-

Exxon Mobil and ConocoPhillips

Blog_Exxon%20Mobil%20and%20ConocoPhillips%20in%20the%20Bakken;%20Chevron%20joins%20by%20acquiring%20Hess.png)

Right next to Continental Resources, big oil companies like Exxon Mobil (with its XTO Energy group) and ConocoPhillips are working too in the Bakken.

.png)

Hess is set to keep its oil production in the Williston Basin steady at about 200,000 barrels of oil equivalent per day (boe/d) from 2024 for the next 8 to 10 years. Its Midstream assets, mainly in the Bakken and Three Forks Shale plays, support this sustained production.

In Q1 2023, Bakken production averaged 163,000 barrels of oil equivalent per day (boe/d), an increase from 152,000 boe/d in the same period of 2022. Bakken's production made up 44% of Hess Corporation's total production of 374,000 boe/d. This continues a trend of growth from previous years where the Bakken averaged 102,000 boe/d in Q1 2018 and 117,000 boe/d in Q1 2015.

Looking ahead, projections suggest that Bakken's share of Hess' total production is expected to decrease to 42% in 2024 and further decline to about 36% by 2025.

Energy Transfer stands as one of North America's premier pipeline operators, with a significant presence in the Williston Basin through key conduits like the Dakota Access Pipeline and the Energy Transfer Crude Oil Pipeline.

Within this portfolio, the Bakken Pipeline System is notable, comprising the Dakota Access Pipeline (DAPL) and the Energy Transfer Crude Oil Pipeline (ETCO). DAPL spans 1,172 miles, channeling crude oil from North Dakota's Bakken fields to Patoka, Illinois, while ETCO extends 700 miles to ferry oil from Patoka to Nederland, Texas.

The Little Missouri natural gas processing facility in Dunn County, North Dakota, with its 200 million cubic feet per day capacity. In 2020, the Bakken Pipeline System moved an average of 531,000 barrels of oil daily, and the Little Missouri plant processed an average of 117 million cubic feet of natural gas each day.

Energy Transfer completed its acquisition of Crestwood Equity Partners for $7.1 billion in the fall of 2023. The deal included Crestwood's assets in the Williston, Delaware, and Powder River basins. Notably, in the Williston Basin, Crestwood had dedicated 550,000 acres and a processing capacity of 430 million cubic feet per day.

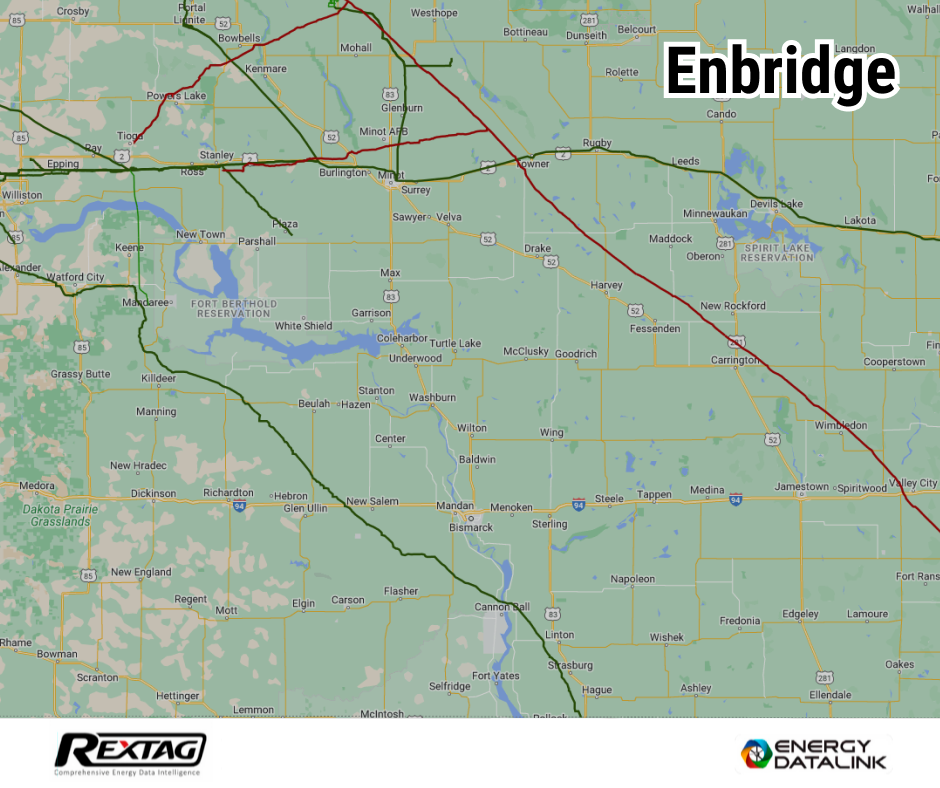

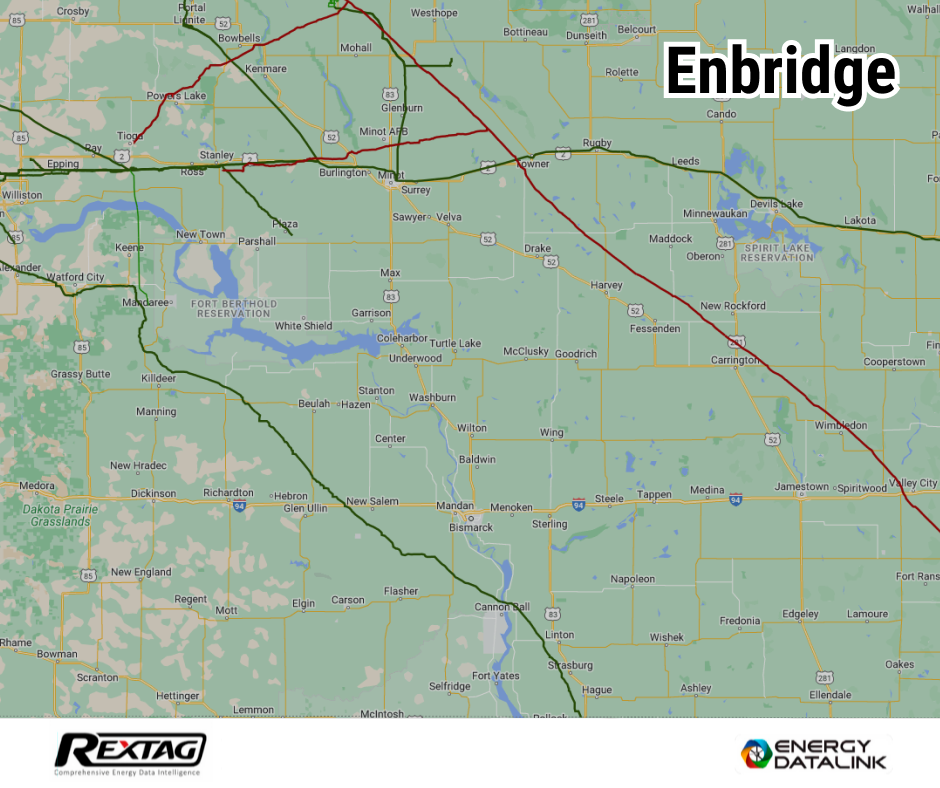

Enbridge operates the Enbridge Mainline and the Enbridge North Dakota System, crucial for transporting Western Canadian Sedimentary Basin crude oil to U.S. refineries. The Enbridge assets in the Williston Basin feature the 600-mile Enbridge Bakken Pipeline and the 450-mile Enbridge North Dakota System from North Dakota to Clearbrook, Minnesota, and further into the mainline system.

The Tioga Gas Plant in Tioga, North Dakota, with a capacity of 120 million cubic feet per day, and the Berthold Rail Facility, capable of loading 80,000 barrels of crude oil per day. In 2020, the Bakken Pipeline System transported an average of 624,000 barrels of oil daily, while the Tioga Gas Plant processed 75 million cubic feet of natural gas daily.

ONEOK administers numerous natural gas gathering and processing sites in the Williston Basin, including the ONEOK Bakken Pipeline System. This system features the 600-mile-long Bakken NGL Pipeline, which can transport 135,000 barrels per day and connects to ONEOK's complex in Bushton, Kansas.

In North Dakota, the Demicks Lake, Stateline II, and Garden Creek processing plants have capacities of 200 million, 200 million, and 100 million cubic feet of natural gas per day, respectively. In 2020, the Bakken NGL Pipeline moved an average of 120,000 barrels of NGLs daily, while the plants processed a combined average of 654 million cubic feet of natural gas each day.

Bakken Oil Production

Last year, Bakken Formation oil production unexpectedly increased, causing analysts to adjust their U.S. production growth forecast to 1.2 million barrels per day—an increase of 100,000 barrels per day. Despite this boost, which pushed Bakken's total production to 1.3 million barrels per day, such a high growth rate isn't expected to repeat.

The increase was primarily due to a brief rise in the number of active drilling rigs in North Dakota during 2022, fueled by higher oil prices, as well as the significant use of drilled but uncompleted wells (DUCs). These DUCs, left from a surge of drilling activity in 2019 when U.S. production peaked at 1.5 million barrels per day, underscore a broader slowdown in the region following the COVID-19 pandemic. For example, ExxonMobil has been consistently adding more than 40 wells annually for several years without new drilling, indicating that much of the best drilling locations have already been tapped in this mature shale region.

This trend was emphasized when Chevron acquired Hess, attracted by Hess's promising offshore fields in Guyana. This acquisition, according to Chevron's CEO Mike Wirth, would provide Chevron with about 15 years of drilling inventory in the Bakken.

Upstream and Midstream Acquisitions of the Williston Basin

- Enerplus to acquire Williston Basin private operator Bruin E&P

In March 2021, Enerplus completed the acquisition of private Williston Basin operator Bruin E&P Partners LLC for $465 million, adding 151,000 net acres to the Bakken play.

- Diamondback Energy sold its Bakken asset to Oasis in a $745 million cash deal

In 2021, Diamondback Energy sold certain assets in the Williston Basin to Oasis Petroleum Inc. in a deal worth $745 million. This was part of a larger transaction where Diamondback also divested non-core assets in the Permian Basin, bringing the total sale value to $832 million. The assets sold were projected to produce around 28,000 barrels of oil equivalent per day (boe/d) for the full year of 2021.

- Northern Oil & Gas to acquire Williston Basin bolt-on for $170 Million

In 2022, Northern Oil and Gas entered an agreement with an undisclosed company to acquire non-operated interests in the Williston Basin primarily located in Dunn, McKenzie, and Williams counties, North Dakota.

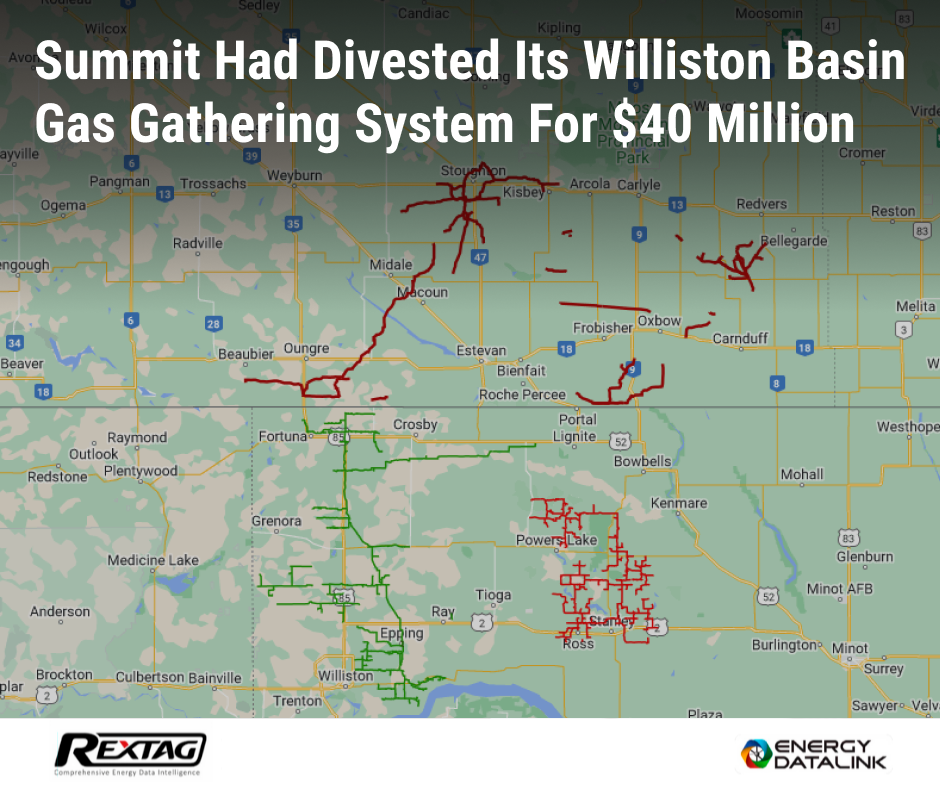

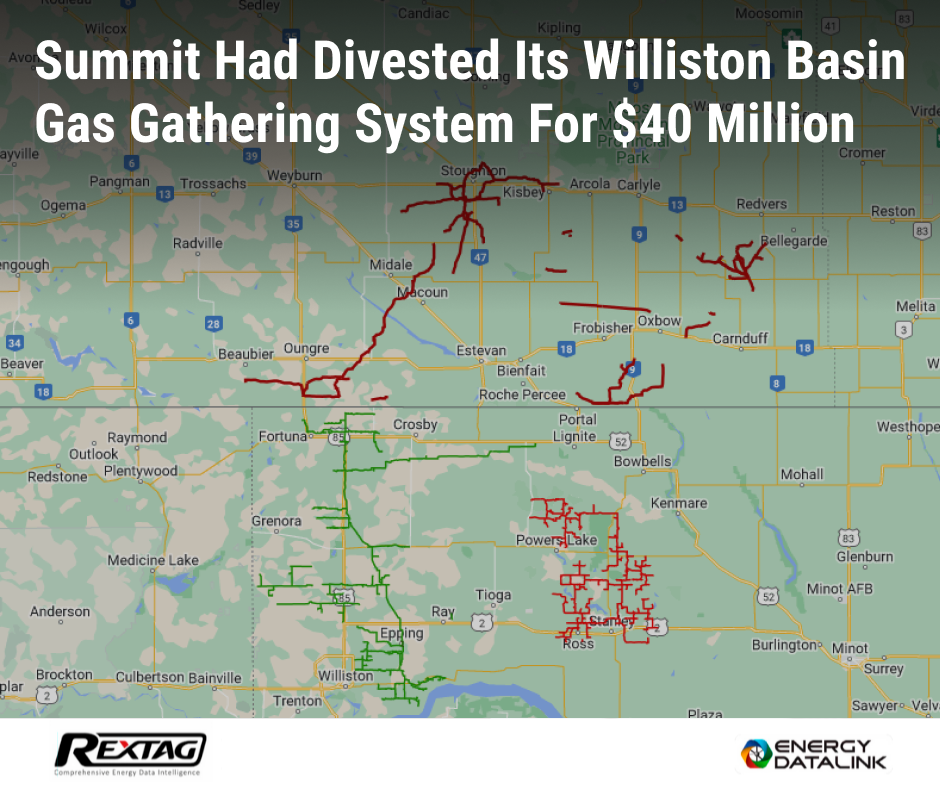

- Summit divested its Williston Basin gas gathering system for $40 million

After the sale of the Bison gas gathering system to Steel Reef for $40 million in 2022, Summit Midstream Partners shifted its focus in the Williston Basin towards expanding its crude oil and produced water gathering systems.

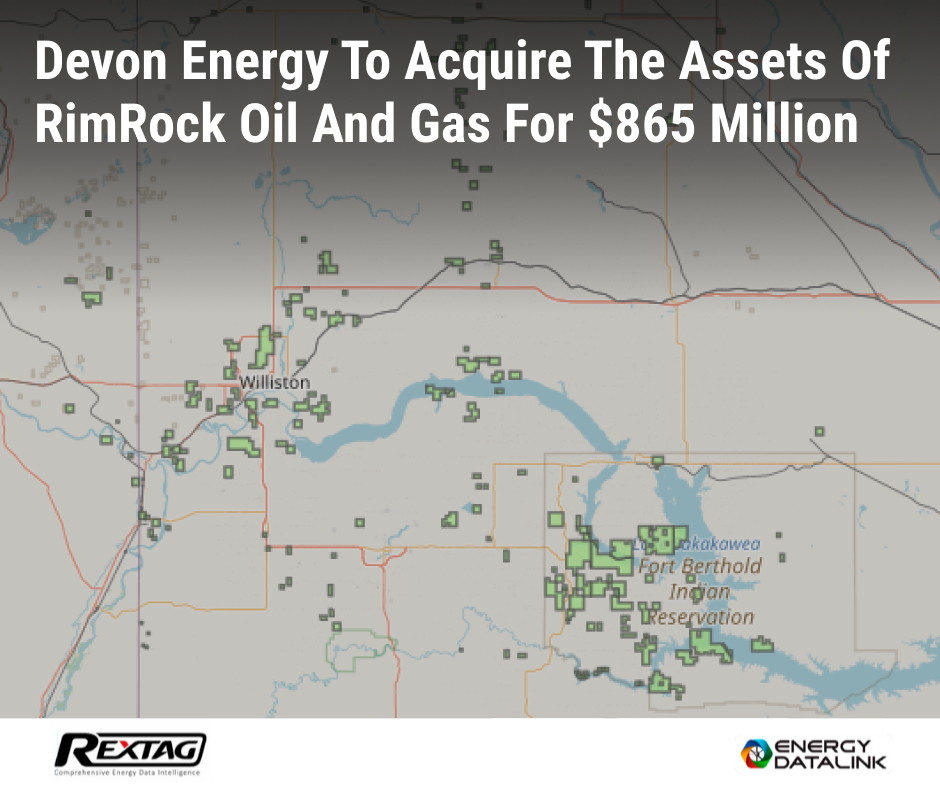

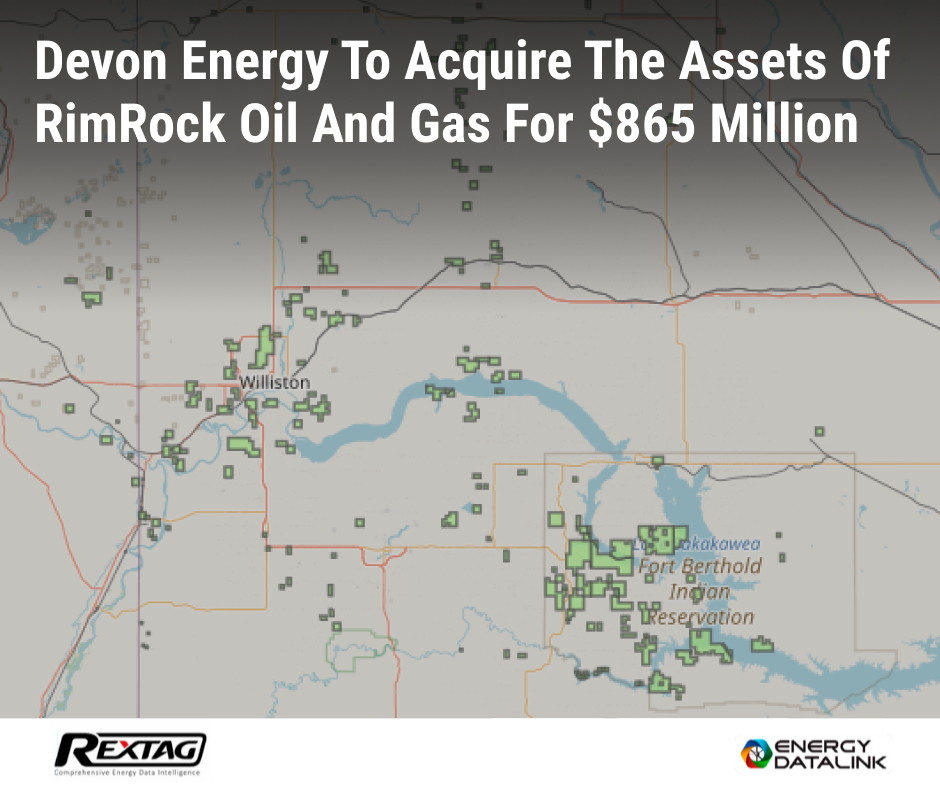

- Devon Energy to acquire the assets of RimRock Oil and Gas for $865 million

In 2022, Devon Energy expanded its territory in the Williston Basin by acquiring RimRock's adjacent 38,000 net acres, where it holds an 88% working interest. This acquisition brought in over 100 prime yet-to-be-drilled locations.

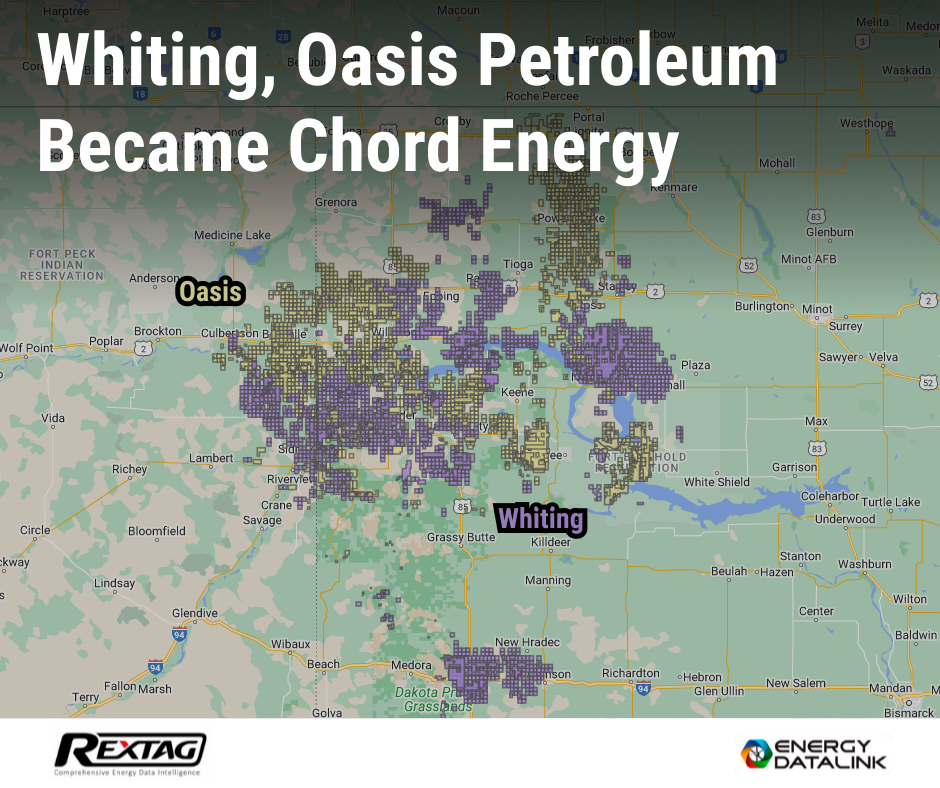

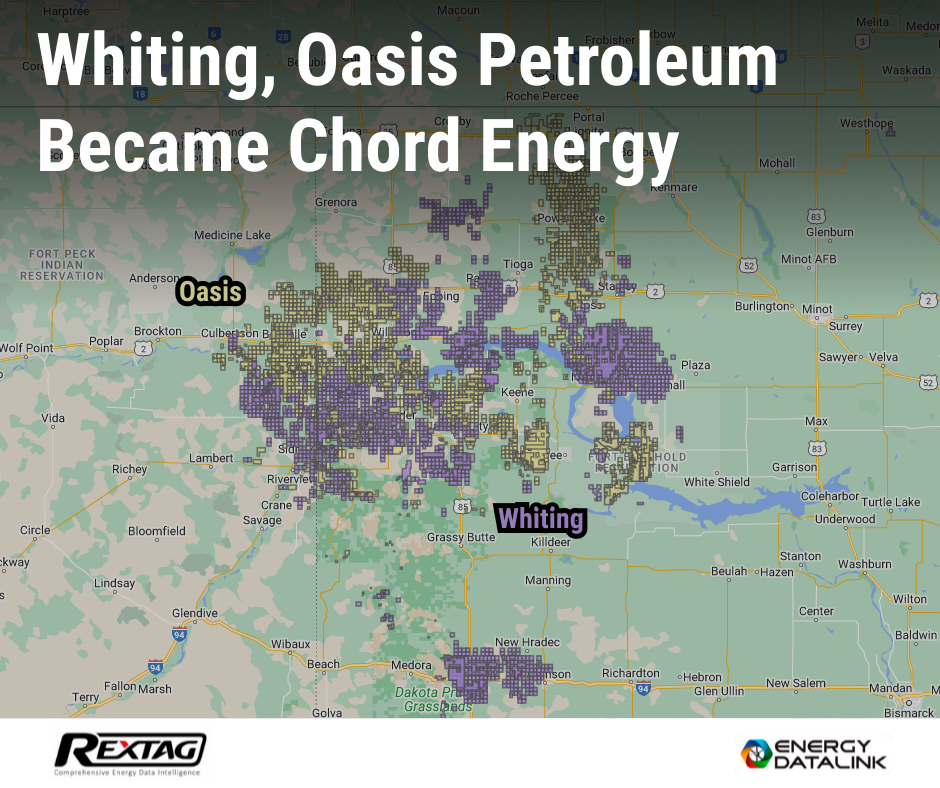

- Whiting, Oasis Petroleum became Chord Energy

Chord Energy was created after a 2022 combination valued at $6 billion between Whiting Petroleum Corp. and Oasis Petroleum Inc. The resulting company is the largest net acreage holder and second-largest producer in the Williston Basin — with an estimated 10% of the basin's production.

Currently, Chord is looking to increase its presence in the Williston Basin across North Dakota and Montana. At the end of Q1 2023, Chord controlled approximately 936,000 net acres in the area and produced 165,000 barrels of oil equivalent per day, including 95,000 barrels of oil.

In 2023 Chevron gained valuable assets including Guyana's rich oil fields, 465,000 net acres, and 190,000 barrels of oil a day in Bakken, assets in the Gulf of Mexico, and a steady cash flow from Southeast Asia's natural gas business.

- Grayson Mill Energy acquired Ovintiv's Bakken assets for $825 million

Blog_Grayson%20Mill%20acquired%20Ovintiv's%20Bakken%20assets%20for%20$825M%20in%202024.png)

Grayson Mill has become a leading exploration and production company in the Bakken region. It expanded significantly by buying Ovintiv's assets for $825 million, which added 46,000 net acres and increased its output to about 37,000 barrels of oil equivalent per day. The company operates three drilling rigs in the Bakken and grew its portfolio after an initial acquisition from Equinor for $900 million in 2021, supported by EnCap Investments LP, a private equity firm based in Houston.

Q2 2022

In the Williston Basin, there were 39 active drilling rigs. Within North Dakota specifically, 37 rigs were operational. Across the entire United States, there were 762 drilling rigs in service, marking an increase of 52% since the beginning of the year.

Top Oil Companies for June 2022:

- Continental Resources - leading with 7.6 million barrels of oil.

- Marathon Oil - got 4 million barrels.

- Burlington (owned by ConocoPhillips) - got 3.1 million barrels.

- XTO Energy - also got 3 million barrels.

- Grayson Mill - took out 2.2 million barrels.

In May, the production was 1,062,228 BOPD in North Dakota, 53,276 BOPD in Eastern Montana, 2,648 BOPD in South Dakota, totaling 1,118,152 BOPD.

For June, there was an increase with 1,099,366 BOPD in North Dakota, 63,256 BOPD in Eastern Montana, and 2,764 BOPD in South Dakota, totaling 1,165,386 BOPD.

July saw a decrease in production to 1,073,624 BOPD in North Dakota, 60,614 BOPD in Eastern Montana, and 2,774 BOPD in South Dakota, with a total of 1,137,012 BOPD.

In August, production was slightly up in North Dakota to 1,075,801 BOPD, slightly down in Eastern Montana to 60,587 BOPD, and decreased in South Dakota to 2,756 BOPD, totaling 1,139,144 BOPD.

- Pilot Project for Enhanced Oil Recovery Got the Green Light

The Public Service Commission had approved a pilot project for enhanced oil recovery (EOR). Continental Resources had been set to construct a 3.1-mile-long natural gas pipeline, which would carry gas from WBI's pipeline to the Buddy Domingo oil well pad located in Williams County. This gas was intended for use in EOR with the Huff and Puff technique, which, although widely used in the United States, hadn't been as common in the Bakken oilfield. With this project, Continental Resources aimed to evaluate how economically and technically viable it was to implement EOR in the Three Forks and Bakken formations. They had been hopeful about the project's success.

Four men from North Dakota had been accused of stealing crude oil worth approximately $2.4 million. Crestwood Midstream's representatives, backed by McKenzie County court records, reported that there were 149 instances of oil theft from November 2020 to March 2022. The accused had managed to divert 34,199 barrels of oil during this time.

Q2 2023

In June 2023, the Williston Basin had 35 active drilling rigs, which was the same number for the whole of North Dakota. The United States, at that time, had 675 active drilling rigs, marking an increase of 10.7% since the beginning of that year.

Nearly a year after selling its non-operated interests in a $1.8 billion transaction, Riverbend Energy Group has started buying again in the Williston Basin. In June 2023, the company acquired significant non-operated working interests in the core area of the basin.

Key Developments in the Basin:

Ovintiv had completed a significant transaction by purchasing Black Swan Oil and Gas, PetroLegacy Energy, and Piedra Resources for $4.275 billion. This acquisition added 65,000 acres in the Midland Basin to their holdings. At the same time, Ovintiv sold its Bakken assets to Grayson Mill Bakken LLC, another firm backed by EnCap, for $825 million.

The EIA had reported an expected slowdown in oil production growth for the Lower 48 states starting in July. The growth in the Permian Basin was to be minimal, with an increase of only 1,000 barrels per day over June. The Bakken was set to see a bit more growth, with 7,000 additional barrels per day, although this was less than the growth seen from May to June. Production in the Eagle Ford was anticipated to decrease by 5,000 barrels per day.

Chord Energy had been leading a trend of consolidation in the basin by purchasing 62,000 acres from XTO for $375 million. This acquisition significantly enhanced their drilling capabilities in North Dakota. Chord Energy reported an average extraction rate (EUR) of 80 barrels per foot from its Middle Bakken wells, slightly below Continental Resources, which achieved 86 barrels per foot. Though their average well length had not grown recently, the new land acquisition was expected to allow them to drill longer wells and potentially increase their EUR/ft.

Top Producers for April 2023:

- Continental Resources had been the top producer with 6,661 MBO.

- Chord Energy followed with 4,699 MBO.

- Hess was next with 3,207 MBO.

- Marathon Oil produced 2,615 MBO.

- Exxon rounded out the top five with 2,215 MBO.

In May, North Dakota produced 1,140,209 BOPD, Eastern Montana produced 61,279 BOPD, and South Dakota produced 2,560 BOPD, making a total of 1,204,048 BOPD for the basin.

June saw North Dakota's production increase to 1,174,388 BOPD, Eastern Montana decreased slightly to 59,707 BOPD, and South Dakota decreased to 2,275 BOPD. The basin's total was 1,236,370 BOPD.

In July, there was a further increase in North Dakota to 1,186,759 BOPD, a decrease in Eastern Montana to 56,865 BOPD, and a slight increase in South Dakota to 2,311 BOPD. The total for the basin was 1,245,935 BOPD.

August recorded the highest production, with North Dakota at 1,220,772 BOPD, Eastern Montana increasing to 62,197 BOPD, and South Dakota up to 2,540 BOPD. The total for the basin reached 1,285,510 BOPD.

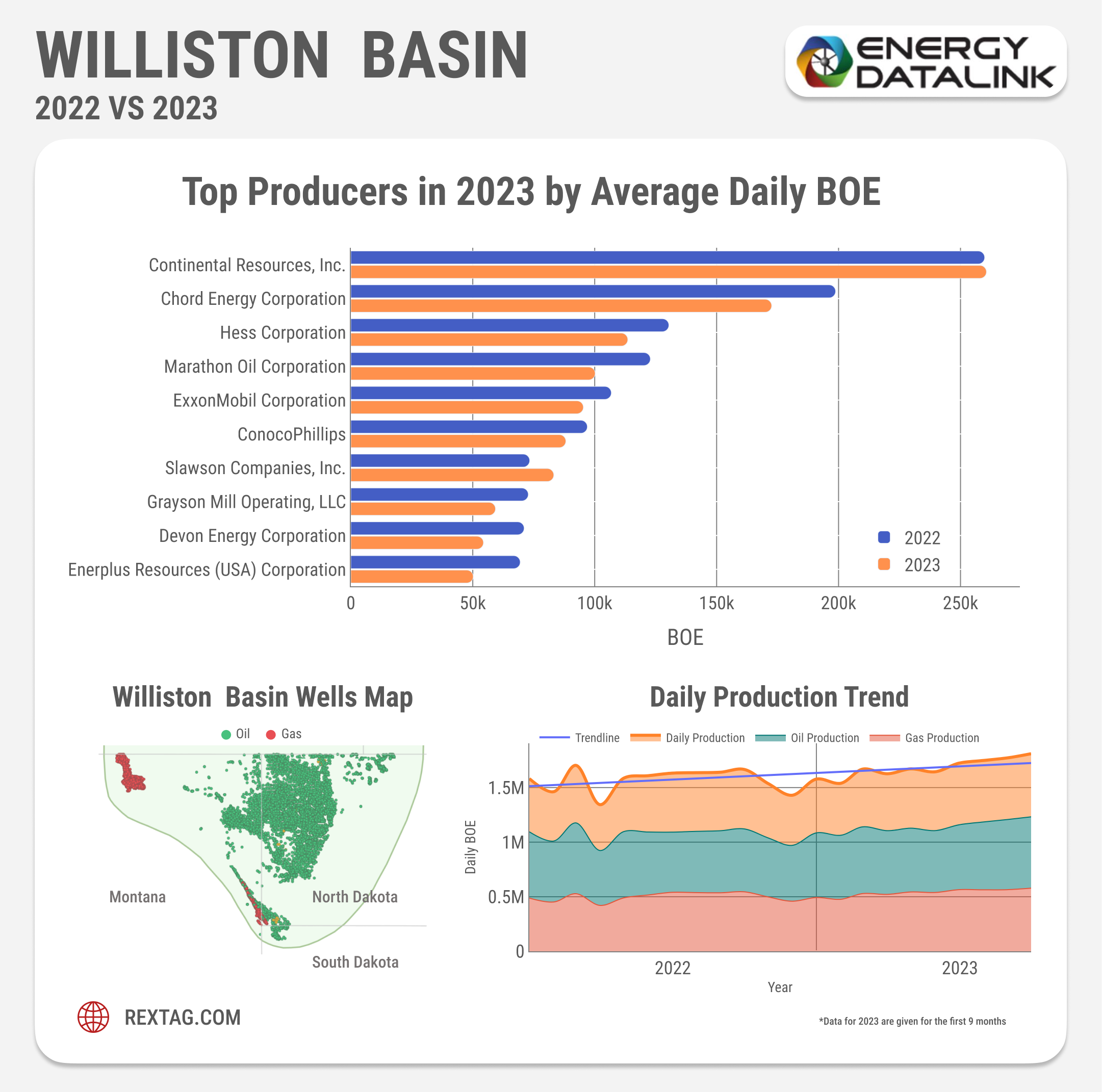

2022 vs 2023

May 2023 vs. May 2022:

North Dakota production went up from 1,062,228 BOPD to 1,140,209 BOPD.

Eastern Montana increased from 53,276 BOPD to 61,279 BOPD.

South Dakota decreased from 2,648 BOPD to 2,560 BOPD.

The total for the basin rose from 1,118,152 BOPD to 1,204,048 BOPD.

June 2023 vs. June 2022:

North Dakota rose from 1,099,366 BOPD to 1,174,388 BOPD.

Eastern Montana decreased from 63,256 BOPD to 59,707 BOPD.

South Dakota dropped from 2,764 BOPD to 2,275 BOPD.

The basin's total production went up from 1,165,386 BOPD to 1,236,370 BOPD.

July 2023 vs. July 2022:

North Dakota's production increased from 1,073,624 BOPD to 1,186,759 BOPD.

Eastern Montana's production decreased from 60,614 BOPD to 56,865 BOPD.

South Dakota's output went up slightly from 2,774 BOPD to 2,311 BOPD.

The basin's total rose from 1,137,012 BOPD to 1,245,935 BOPD.

August 2023 vs. August 2022:

North Dakota's production increased from 1,075,801 BOPD to 1,220,772 BOPD.

Eastern Montana's production increased from 60,587 BOPD to 62,197 BOPD.

South Dakota's production decreased from 2,756 BOPD to 2,540 BOPD.

The total for the basin rose significantly from 1,139,144 BOPD to 1,285,510 BOPD.

North Dakota

2022:

January kicked off with a solid 33.85 million barrels of oil. There were nearly 16,890 wells pumping oil, averaging about 1.09 million barrels a day. The industry was busy with 39 new drilling starts (spuds), matched by extensions, and there were 68 workovers to keep older wells productive, all with 31 rigs in action.

June showed a slight bump in total production to around 32.98 million barrels, maintaining a daily average of about 1.1 million barrels but from more wells — 17,312 to be exact. Drilling activity was higher, with 75 new wells and workovers rising to 94, supported by 42 rigs.

By December, production dipped to 29.69 million barrels, with a lower daily average of 957,864 barrels from 17,233 wells. Yet, drilling was up with 93 new starts, alongside a good number of workovers (64), and rig counts rose slightly to 44.

2023:

January, the industry slightly improved with about 32.95 million barrels. Daily production was close to last year's start, at around 1.06 million barrels, but from more wells — 17,388 this time. The drilling scene was more vibrant, with 76 new wells and workovers at 44, all supported by a higher number of rigs (46).

June, things looked better with production up to 35.24 million barrels and daily averages climbing to about 1.17 million barrels, thanks to 18,116 wells. Drilling efforts continued strong with 83 new starts and 65 workovers, though rigs dropped to 37.

December, the sector hit its stride with the highest monthly production at 39.53 million barrels, a daily average spike to about 1.28 million barrels from 18,770 wells. Drilling activities stayed robust with 57 new starts and workovers, and rig counts remained steady at 36.

Yearly Totals:

2022's yearly production summed up to 390.57 million barrels, with an average daily output of 1.07 million barrels. The industry initiated 784 new drills, plus a few extensions, leading to a bustling year with 792 workovers and an average of 40 rigs.

2023 saw everything going up — a total production of about 435.08 million barrels and a daily average increase to 1.19 million barrels. The drilling landscape was dynamic with 835 new starts, some extensions, and plenty of workovers (842), all amidst an average of 40 rigs.

Blog_Exxon%20Mobil%20and%20ConocoPhillips%20in%20the%20Bakken;%20Chevron%20joins%20by%20acquiring%20Hess.png)

.png)

Blog_Grayson%20Mill%20acquired%20Ovintiv's%20Bakken%20assets%20for%20$825M%20in%202024.png)