Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

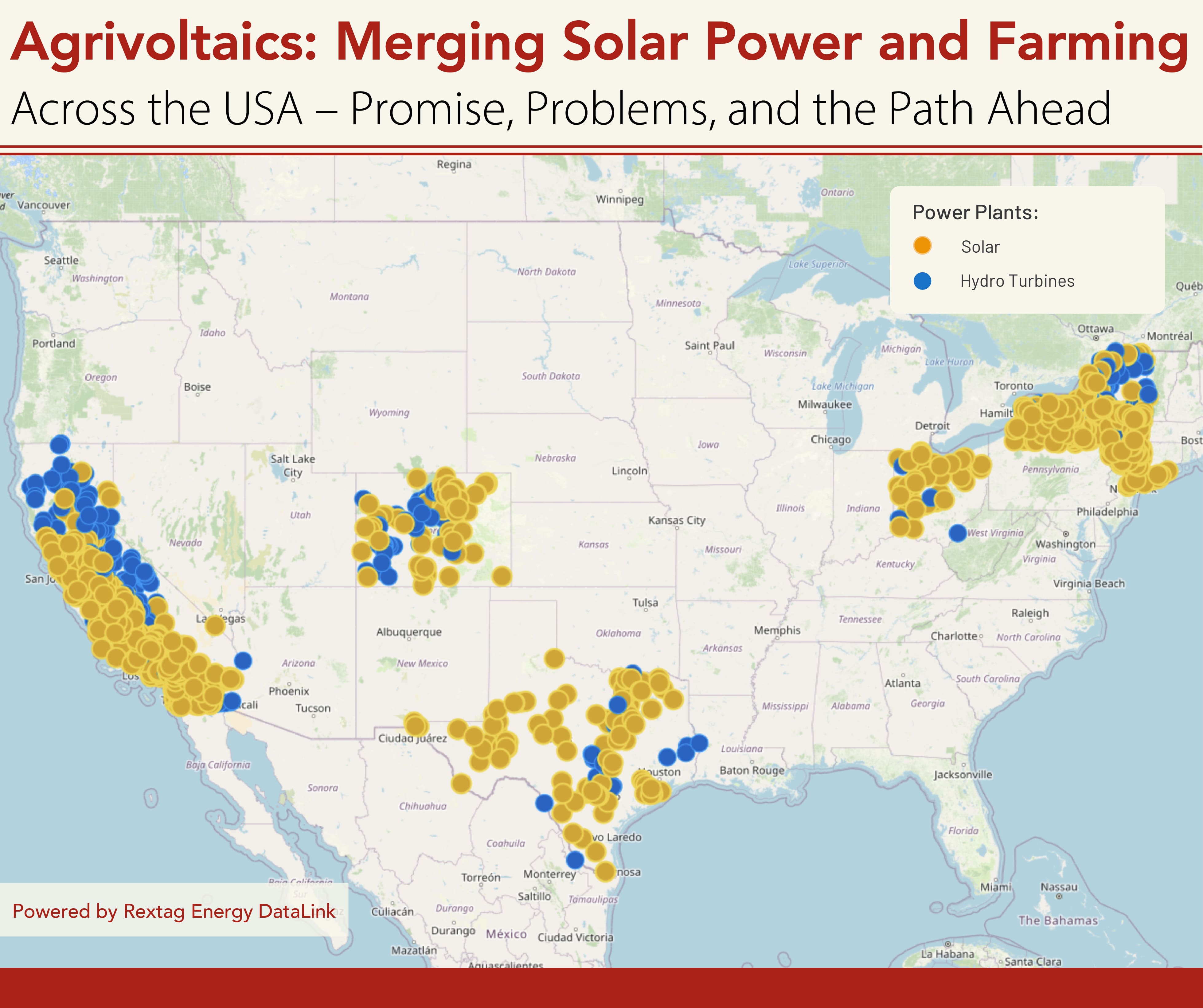

Agrivoltaics: Merging Solar Power and Farming Across the USA – Promise, Problems, and the Path Ahead

Agrivoltaics, a combination of agriculture and solar power generation on the same land, is quickly gaining traction across the United States as a solution to balancing the demand for renewable energy and the need to preserve farmland. As the country pushes toward its goal of achieving net-zero emissions, solar power is expected to play a significant role in this transition. However, concerns about the loss of agricultural land have led to the rise of agrivoltaics, where farming and solar energy production coexist.

These 8 US States Now Get Most of Their Renewables: Solar, Wind and More

Last year, a Pew Research Center survey revealed that 67% of Americans are in favor of developing alternative energy sources. Similarly, an Eligo Energy survey indicated that 65% of U.S. consumers are prepared to pay a premium for renewable energy. According to Mordor Intelligence, the U.S. renewable energy market is projected to reach 434.5 GW in 2024, with further growth expected at an annual rate of 10.01%, reaching 700.15 GW by 2029.

Renewable Efforts Lag as Global Oil and Gas Demand Continues to Rise

Recently, the progress toward an energy transition is hitting a snag. Sales of electric vehicles are decelerating, and the growth in wind and solar power needs to be keeping pace with expectations. To make matters more challenging, electricity prices are climbing when they were expected to fall. Amidst these setbacks, the oil and gas sectors are proving resilient. According to BP's latest energy outlook, not only are these energy mainstays here to stay, but their demand is expected to remain relatively high even after reaching a peak. Interestingly, BP forecasts that oil demand will reach its zenith next year, marking a critical moment in energy consumption trends. This isn't the first time BP has projected a peak in oil demand. Back in 2019, their review anticipated a decline in demand growth, but the prediction fell flat. Instead, oil demand surged to unprecedented levels following the end of the global pandemic lockdowns, defying previous forecasts and underscoring the enduring dominance of traditional energy sources in the global market.

After Hurricane Beryl, U.S. Aims High to Sustain Solar Energy Growth and Stay Top in Renewables

Texas energy companies are picking up the pieces after Hurricane Beryl, an early Category 5 hurricane, hit the U.S. Gulf Coast earlier this week. However, it weakened to Category 1 by the time it made landfall in Texas. The hurricane brought heavy rainfall and sparked fears of storm surges, flooding, and tornadoes. As Hurricane Beryl neared, the natural gas supply to Freeport LNG’s export facility in Texas nearly stopped the day before the storm struck. Houston was particularly hard-hit, with the storm knocking out power for two million residents. CenterPoint Energy, a key power provider in the area, felt the brunt of the hurricane but aimed to have power restored to half the affected customers by the following day.

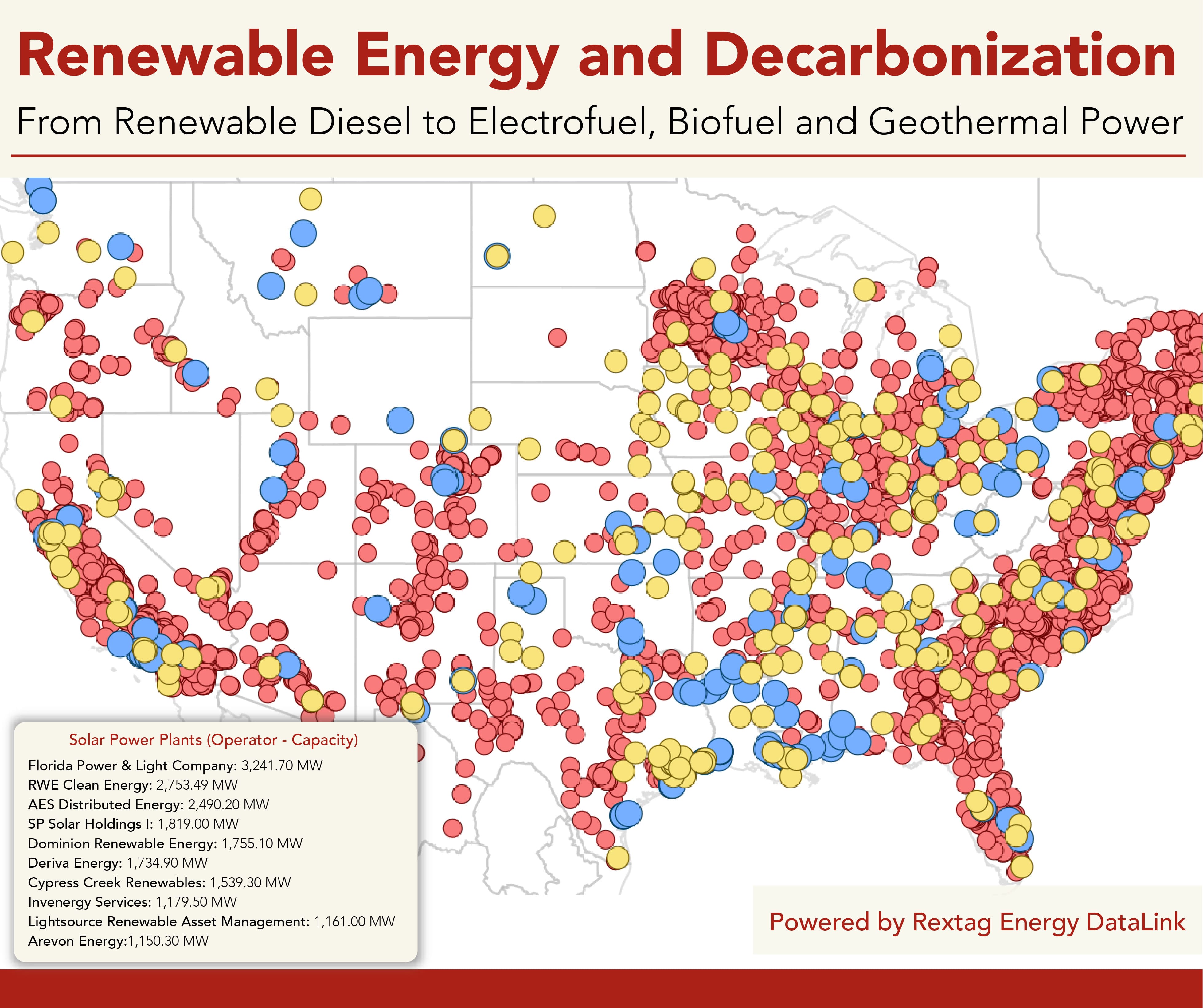

Renewable Energy and Decarbonization: From Renewable Diesel to Electrofuel, Biofuel and Geothermal Power

Renewable diesel, a cousin to traditional petroleum diesel, stands out as a standalone fuel and a blendable option. In 2022, it accounted for about 8% of all U.S. biofuel production and 9% of its consumption. For decades, diesel has been the stalwart choice for both shippers and carriers, valued for its reliability. Yet, as sustainability becomes a priority, these industries are now navigating the complex world of alternative fuels. This shift has its challenges; the array of choices comes with varying information about availability, cost, performance, and environmental impact. Amidst these options, renewable diesel is gaining traction.

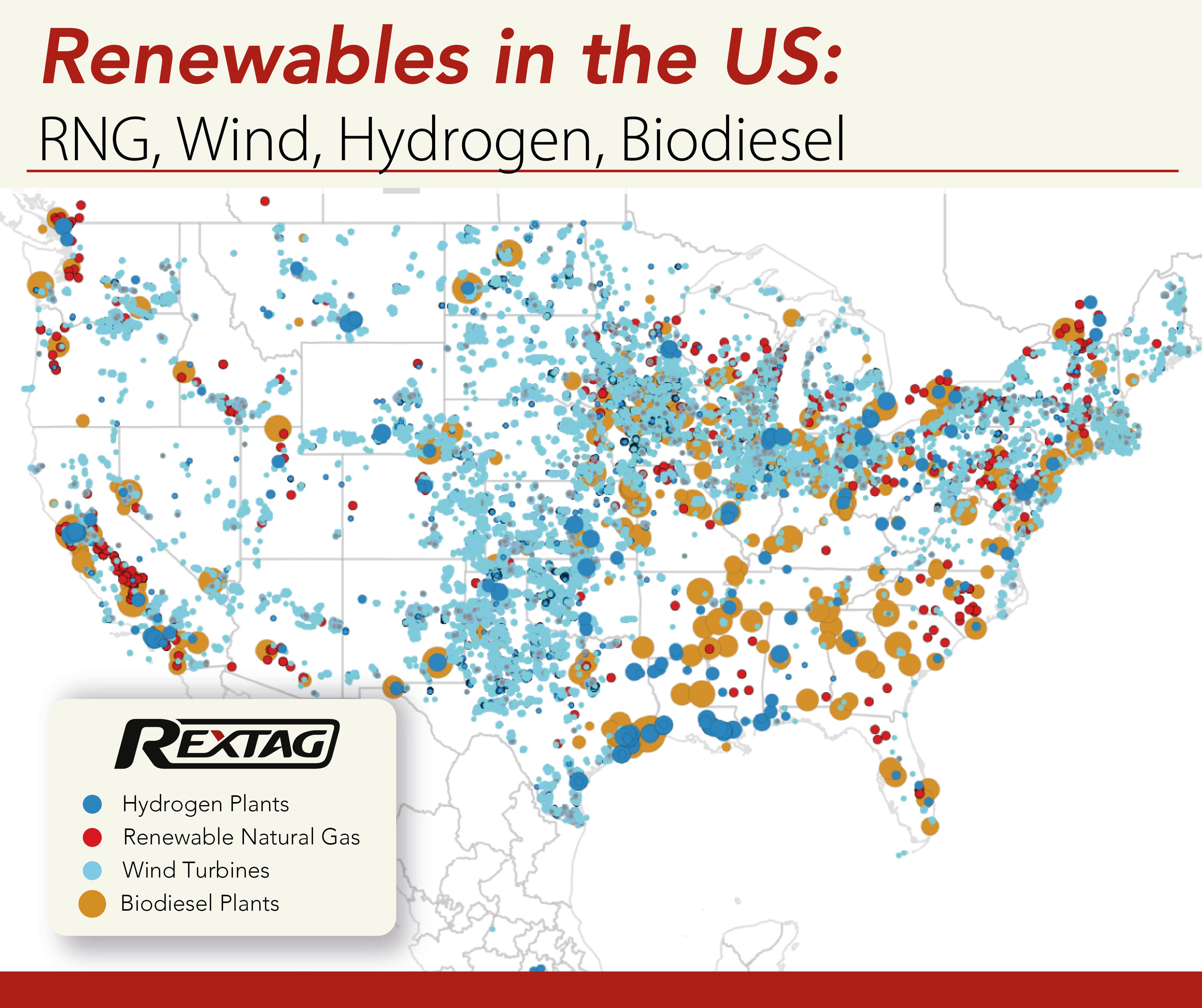

Renewables in Oil and Gas Industry: Solar, Wind, Hydroelectric, Innovations, From Texas to Arizona and Who’s The Best?

Last year, a Pew Research Center survey revealed that 67% of Americans are in favor of developing alternative energy sources. Similarly, an Eligo Energy survey indicated that 65% of U.S. consumers are prepared to pay a premium for renewable energy. Scott Zimmerman, the project manager at the Global Oil and Gas Extraction Tracker of Global Energy Monitor (GEM), expressed skepticism about the oil and gas industry's rationale for exploring and developing new fields. "The justifications offered by oil and gas producers do not stand up to scrutiny," he commented. "The scientific consensus is clear: we cannot afford to open new oil and gas fields without risking severe environmental consequences." Despite these warnings, last year saw significant advancements in the oil and gas sector, with at least 20 fields worldwide reaching the "final investment decision" stage. This stage marks the commitment to proceed with construction and development, leading to the approval of projects that will collectively produce about 8 billion BOE. By the end of this decade, there is an ambition to approve projects that will quadruple this output, aiming to extract 31.2 billion BOE from 64 fields. Notably, the United States has been at the forefront of sanctioning new oil and gas initiatives over the past two years, according to GEM's analysis.

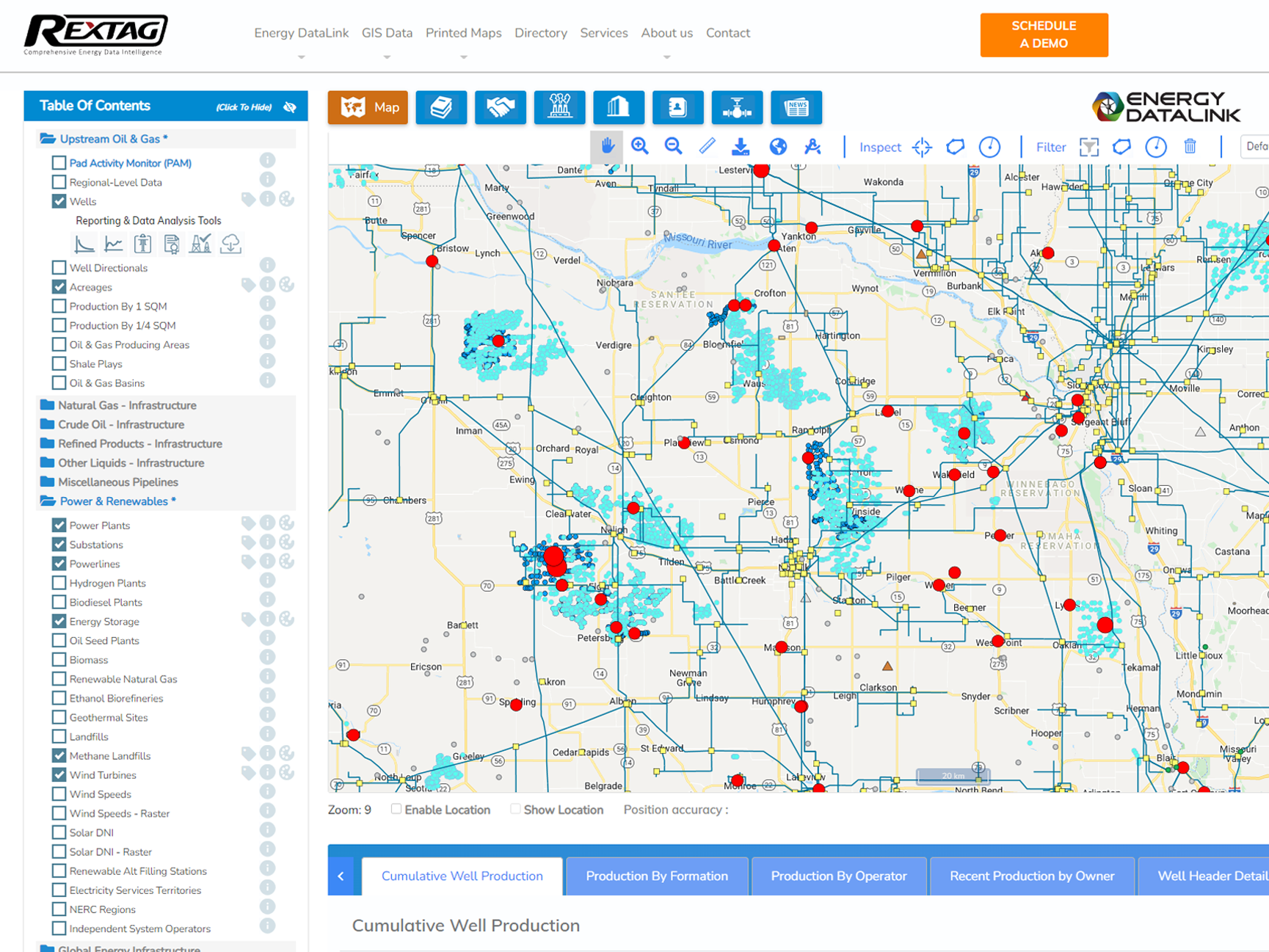

Co-Location Energy Infrastructure Analysis at Your Fingertips

Your team’s ESG performance can be greatly improved applying the asset co-location analysis within upstream or midstream use cases. This has been a topic for a discussion at Rextag’s ‘Is ESG Improvement Next Door?’ webinar. We reviewed some cases like curbing gas flaring or renewable energy sourcing to power the fossil fuel infrastructure. Many combinations are available with access to the data Rextag provides on wells, acreages, power lines, substations, and such renewable infrastructure as wind turbines, methane landfills, etc.

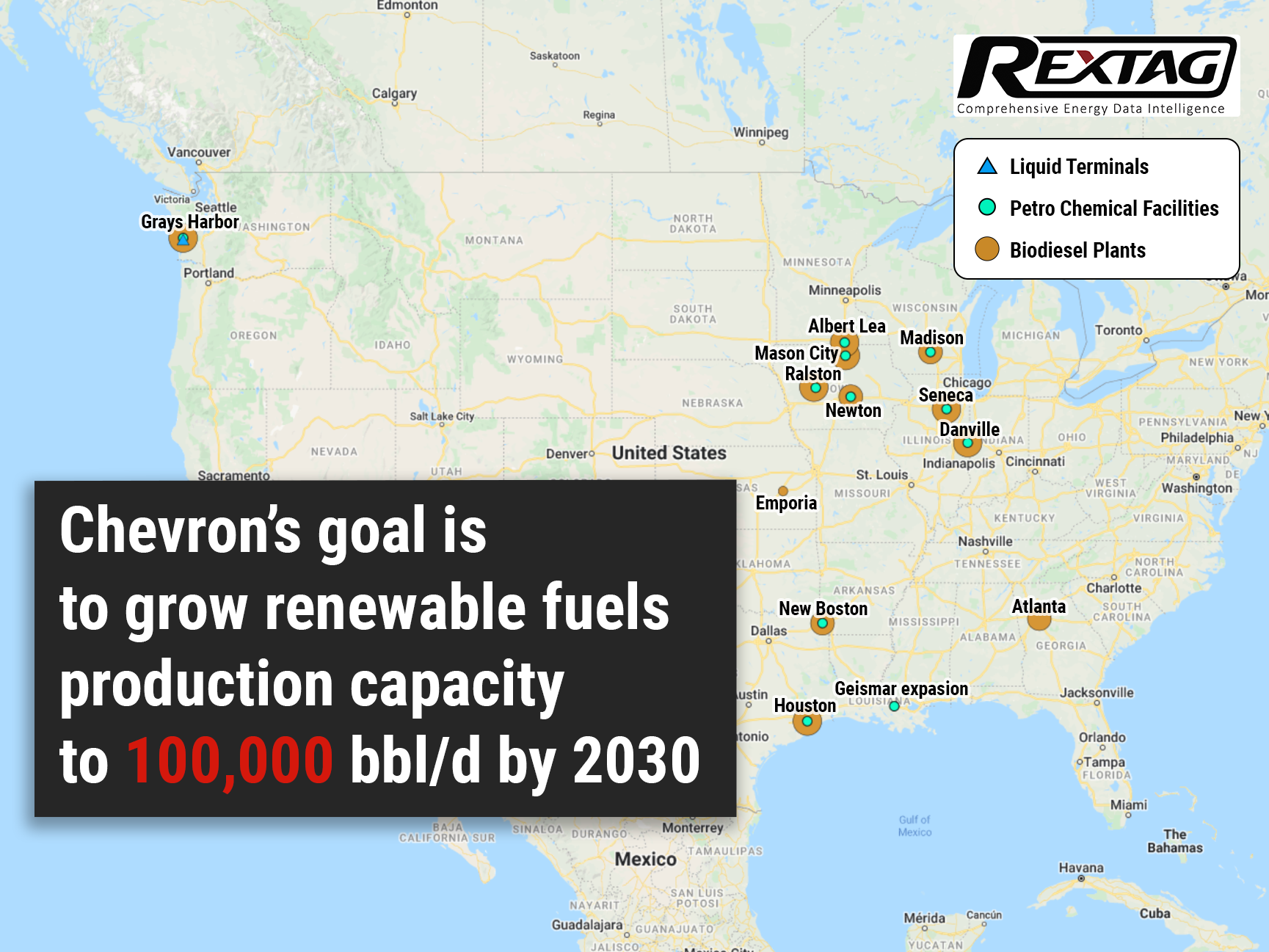

All-in: Chevron Invests $3 Billion in Alternative Fuels

With the purchase of Renewable Energy Group Inc. for $3.15 billion, Chevron makes its largest investment in alternativefuels. This turn in investments highlights the shift in the world’s attitude toward climatechange. Since oil companies contribute heavily to global #emissions, governments and investors are increasingly urging them to reduce their #carbonfootprints and join the fight against emissions. As state and federal subsidies to decarbonize fuels increase, U.S. refineries have likewise increased the production of renewable diesel. In line with this, by 2050, Chevron aims to cut gas emissions to zero.

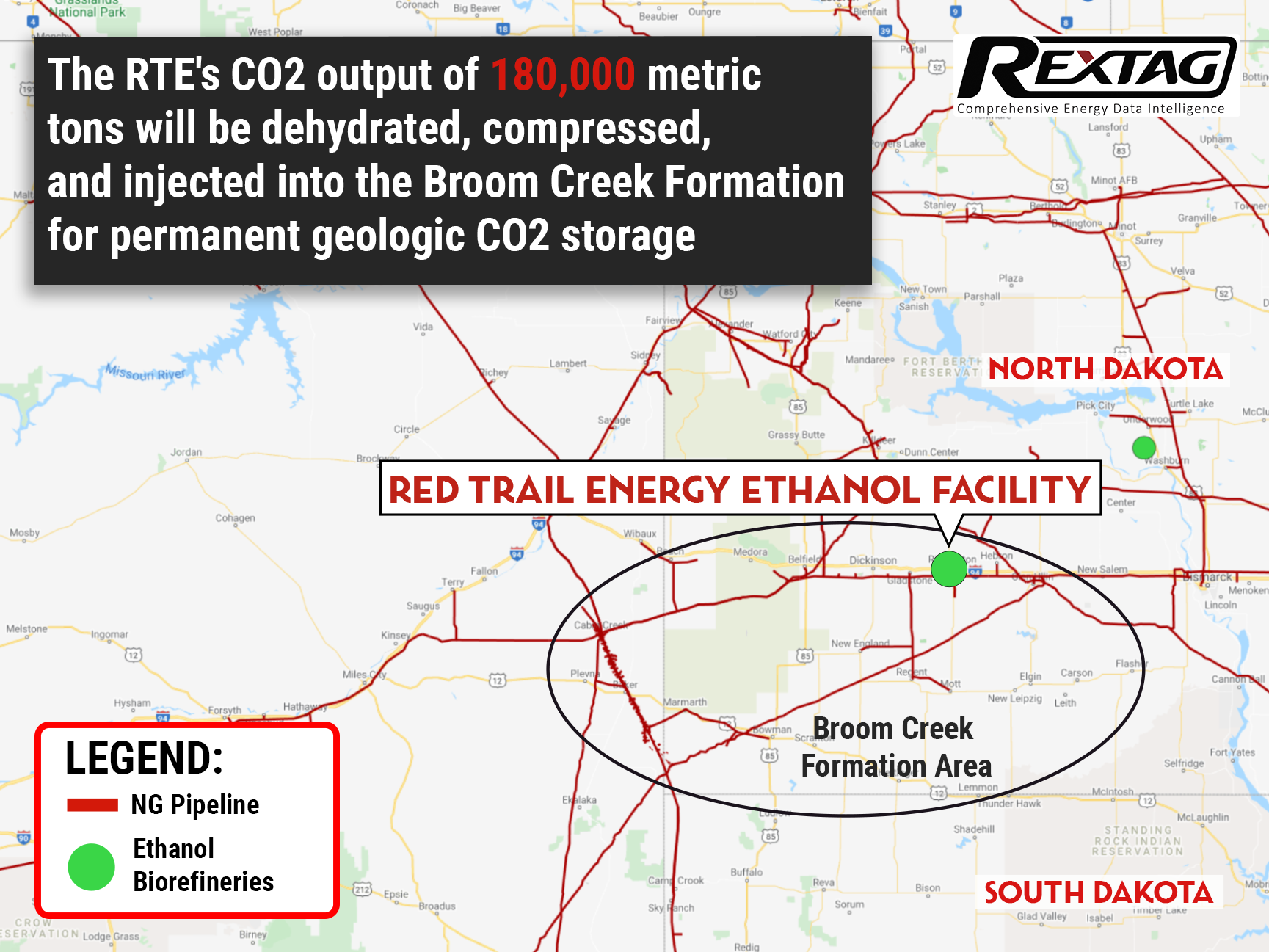

The race for landmark CCS project: North Dakota approves Class VI well for Red Trail Energy

New standards for carbon capture have been set in North Dakota earlier this month as NDIC greenlights Red Trail Energy’s project. The company will now be able to commercially capture, compress, and inject 180,000 tons of carbon dioxide per year into the Broom Creek Formation on its property for permanent geologic CO2 storage. This ensures that carbon dioxide can be stored safely for generations to come.