Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

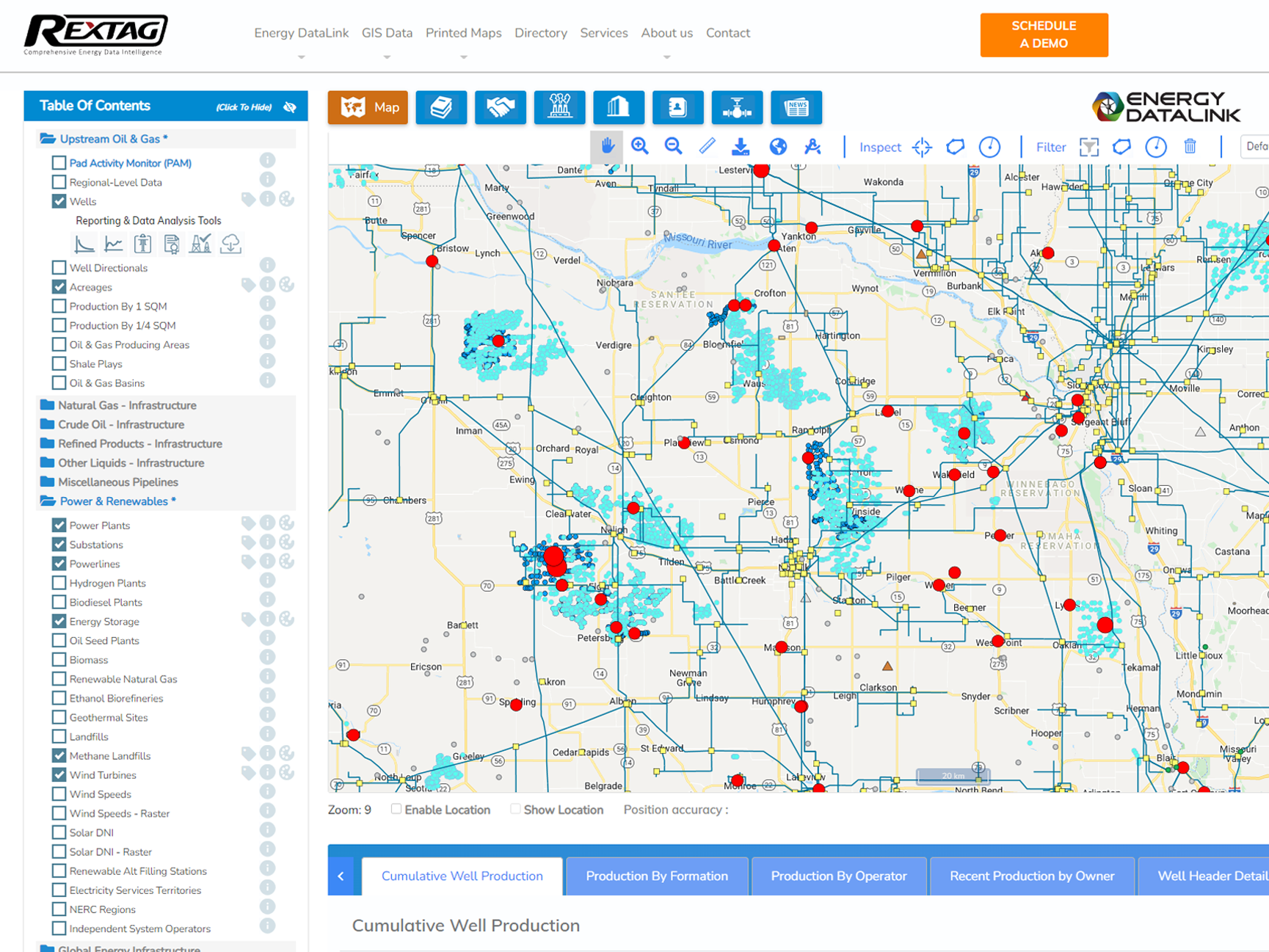

Co-Location Energy Infrastructure Analysis at Your Fingertips

06/24/2022

Below is our ESG-focused webinar review. We reviewed several cases how companies can improve their ESG performance. Many options have been demonstrated of how access to the data Rextag provides can help you make your companies business more “green”.

Rextag collects and maintains data on energy infrastructure (for well production, completions, permits, pipelines and gathering systems attached to those wells, facilities involved in processing and transportation of hydrocarbons, all the way to downstream to power generation, refining, electrical infrastructure and renewables assets).

We license the data by datasets, the ones you see on the left pane within the Energy DataLink application. Our customers can license access to the data based on the folders (or modules) here. e.g. Upstream oil and gas, operators and other modules below.

They are delivered to the customers in different ways. If you are familiar with GIS databases or SQL you can consume the data in those forms or set up web services connection to your cloud database. Otherwise, our web-based service is accessible to an unlimited number of users for visualization and consumption if you are not a GIS user.

If you do not need to save the raw data on your computer, you can access our web application that you now see in the video.

We also cover gathering systems, compressor stations and processing plans. Then we go down to the infrastructure for transportation, including pipelines, to downstream, i.e. refineries, refined pipelines, also including power generation, and all electrical infrastructural. You can choose one module or combine some of them.

Together with that, you have access to all the auxiliary datasets you see below here. If you want to get parcel data or any common interest data, PLSS, TX survey data, townships or even weather services, all those things are included in any license.

We have the largest document library, consisting of more than 5 million investment presentations and annual reports. All of these are accessible to you. You also have A&D transactions data, as we keep track of what activity is going on in the market, the merges, and the acquisition.

Another service is access to the Corporate Entities database. There is a lot of information on financial statements, public trades with companies, what assets they own, etc.

Speaking about the Directory, if you are in the business development or with a service company it can be used for lead generation. We have over 300,000 contacts including their telephone numbers and emails for almost all operators in this industry. Regardless of the information that you license, all these datasets are included in the price.

As you can imagine the key usage scenarios depend on what kind of customer you are. So if you are an Upstream oil and gas, an E&P company, the key scenarios could be

- looking for what is the production of a particular well,

- looking for production trends,

- looking at opportunities that might be for acquisitions or new field development.

On the other hand, if you are a midstream company or one of the vendors or you are from a consulting company, or somebody who does services for the midstream and infrastructure, you can use this application for the business-development purposes:

- filter by pipelines

- their types

- operators

- location

- get additional information about these pipelines

- see some of our customers in the midstream industry.

Being a midstream company, you know where your assets are, but we are here to tell you where some of your competitors are. For example, we license the data for about 90 per cent of major midstream companies in the US.

The data we use for making pipeline analysis and looking at where the pipelines are, where their potential acquisitions are, or empty connections that can be used to bring the product to market and where it is currently located.

Looking downstream, some companies and renewable energy industry companies look at our application, where the electrical infrastructure is, the location and perhaps the potential to locate new infrastructure for power generations. Through some functionalities within the application, many of our customers generate strong value out of it.

I will now pass this on to Tyler Reitmeier, our Ciorporate Business Development Director with Rextag (Hart Energy).

Thank you, Rey. I am pleased to share with you some cases of how Rextag can help you as a user to identify opportunities for ESG improvement. We title our webinar “Is ESG Improvement Next Door?” from the perspective of an owner and an operator of assets. This means you might find opportunities for lower carbon footprint operations through identification of the co-located infrastructure you can take advantage of.

It is also useful for services, companies who do the same for their clients and likewise oil and gas investors in utility companies and industrial power users.

So, what I filtered ещ on the screen is a particular set of Ovintiv assets north of Big Spring in TX in the Permian for utilization in our example of how to improve ESG performance today and how you can use Rextag to support that too.

I have filtered specifically to Ovintiv’s wells and turned on the labeling on the acreage, so you can see who operates that acreage - I can then turn it back off.

By default, we have colour-coding based on what well is predominantly producing. A green well will be predominantly producing oil, a red well will be producing gas. A yellow polygon here is Ovintiv’s acreage. Through the inspection tool, you can bring up the data associated with assets that are on the map. In this case I choose the area and draw a circle inside of which you can see all the data associated with this area. Starting from well details you are able to get information about production, completion, spud date, BOE, production rates, permit numbers, the API number, etc. Clicking on the eyeball icon of any well, there will be a Well Report Card with more details about the selected well, its location, depths and dates, completion and production summaries as well as permit information. I can also see monthly and daily production. Completion info can include the FracFocus data on who competed and worked on the well.

In the same way, you can choose another folder and see the data about acreage.

Similarly I can look at operators, who owns the asset, any type of documents and so on, BOE per SQM for the acreage, the associated shale play, etc.. Having an interest in a particular acreage you can go to additional documents by clicking on the link and search for different criteria mentioned before using the same interface.

Moving back to the main screen, I move now to the same wells, or a set of wells, to show you some ESG workflows that I have in mind here.

I now zoom in and change the background to show you the alignment of maps and Rextag data. (We have various backgrounds so looking at these wells using the satellite imagery map, we can see there are not many well pads there yet - actually three of these so that are some wells drilled recently that satellite images have not updated yet.

Now we are going to explore some theoretical ideas around demonstration of the ESG improvement.

Upstream Case. Using up the Flaring Gas

Let us suppose these two wells are flaring their associated gas - these are green (heavy crude producing) wells - so we want to figure out what to do with that associated gas.

The first step would be asking: 1) Are there any natural gas lines near here that can potentially tie to?

So I turn on the natural gas pipeline layer and then I identify who owns those pipelines near me. For that I can turn on labels and see Targa and WTG as operators around. I am also using inspection tool to find out more about these pipelines. I am able to see who owns the assets and some of the key aspects of those assets, such as what the pipeline diameter is, the type of it is, and sub-system names. I can see any transactions associated with these pipelines, so Targa owns some, WTG onws others. I can potentially get in contact with those who I determined if there is the capacity I can connect to. So that will be the first step.

2) What if it there was no capacity available to me? My next step for ESG improvement might be the following. Instead of flaring its associated gas I could produce power, possibly with temporary generators. So what I need to know is: can I return that power to the utility system? So coming down to our Power and Renewables folder, I will turn on substations which are going to be yellow boxes and powerlines which are the blue lines. I turned off the gas midstream ones and turned on the other layer. Hopefully, you will be able to see a substation just north of my set of wells. Now I am focused here and something that I can do is determine how far away (using a ruler tool) it is from those wells. And it looks to be about one mile away.

Likewise, I can determine other utilities being two-thirds of a mile away from the middle point between these wells. So that gives me an idea what is an easy way to determine how close these particular assets are. I can find this Luther substation that does actually exist here because I can see it on the satellite, which is helpful to me too. Now I know that one already exists and I can go find out who is the owner of that asset to determine is it something that I can connect into.

3) Moving to the next step, let us say I have been able to connect to the natural gas piping and thus I am able to take this associated gas and put it into the gathering system. Still, I want to improve my ESG performance further. If I need power for pumps, etc. at the side of these wells, I can look to source this power from renewable assets. I will add some of the renewable assets that can be potentially in the area - turn on Methane Landfills, Wind Turbines, Energy Storage (the battery storage associated with solar or wind). I will move back up and zoom out for you.

Now we can determine what types of assets will be in the area. It looks like there are a lot of them. So, now that I see power plants represented by red circles, I will change the color-scheme to show me the renewable vs. fossil-fuel ones. Green now represents renewables. I can thus determine what power sources are near me. The other thing that I want to show is the energy storage, they are these purples boxes and then batteries will be triangles. Likewise, I can zoom back in on the two wells that we were looking at earlier. I can now see there is a set of wind turbines near. In this case the two ones are yet proposed ones. (The light ones are proposed, the dark ones are operational. The way I can figure that out is by looking at the legend).

What I can do then is to measure and figure out that there is a couple of miles to get to this energy source that would be completely renewable coming from wind power. I can figure out who exactly owns that power plant and turn on its company name on the map. Then I can contact them and figure and if it would possible for me to work with them. That is just an example of how we can use Upstream and Midstream in association with the Power and Renewable energy datasets.

Midstream Case. Powering NG Compressors

Another screen is going to be associated with midstream. So I have midstream piping north-east of the previous location. As you can see, I have got the red gas piping and then compressor stations, which are represented by the blue squares, and I can label the compressor station, so I am going to focus on this one, in particular.

The idea being, I might run my compressors on gas for the most part and I might electrify some of those to improve my ESG score. The first step would be to determine what assets are related to the utility system near me. I see that I have these blue power lines and I can determine how far away those are. Coming a little bit to the west I can see that have the yellow square ones which represent the substation that I can potentially tie into. So I could build a substation here and take it into account. Taking the step further, I can see some proposed windmills over here and can go and figure out who is the owner. I can then connect with them and determine if supplying wind power for any power need that I would have would be a fit.

These have been just a few few examples of how Upstream and Midstream operators and service providers can utilize Rextag platform, to accelerate their ESG improvement opportunities.

The analysis of wells depends on what you want to get. So, you might start with choosing the filter “Natural Gas Pipelines” and then turn on labels in order to see who owns the assets in this place.

The next step might be looking at powerlines and substations in “Power and Renewables” folder. Put some power plants, substations, powerlines, and wind turbines. If you are a company that has an interest in electrical infrastructure, you can use this application for the same process in order to know

- who owns it,

- what is the nearest substation for your project that you can connect with,

- who is the operator of this line,

- all the information will be there and can be extracted in the same way.

To see how your wells are far away from them, it is possible to use a ruler tool. By choosing different filters you can save these maps for later and share them with our team.

If you work on multiple different projects, one of these for example in Texas and different operators, filters and layers you can save this map for later. In the addition, you can share it with your team, for somebody who leads the project and develops the infrastructure.

There is quite a lot of interactivity that is built into the application to work with teams because it is an unlimited number of users license that we offer. You have an ability to collaborate within your company.

You also can export the information in different formats CSV, PDF, Petra, PhDWin and Geographix to import into the other software to do more analysis.

There is an ability to upload the data. If you have your data or data of the third companies that you want to upload into the application, it accepts shapefiles as well as KMZs. You also can draw your assets in it. If you are involved in the development of the pipelines you can draw these pipelines within the application, save and export it, as well as share them with other people in your team. We haven’t covered other datasets that are above the map here, but we will give you FREE trial access to the application and you can through navigate some of these things on your own and see how they can be used in your teams.

Thank you for your attention and participation in this webinar. See you in our next sessions.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Exploring ESG in Upstream Operations: Examining Achievements, Obstacles, and Emerging Patterns

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R130_B_Exploring_ESG_in_Upstream_Operations .png)

ESG considerations are becoming increasingly essential for companies operating in the upstream sector. Failure to address ESG concerns may result in financial and reputational risks, given the growing focus from investors, regulators, and other stakeholders. Companies must prioritize ESG performance and engage with stakeholders to address concerns and mitigate risks. By doing so, they can improve their reputation, attract investment, and contribute to a more sustainable future

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R131_B_ESG_Management.png)

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/325_Blog_ Expand Energy's Operations (formerly Chesapeake) .jpg)

Before it was Expand Energy, the largest natural gas-weighted exploration and production company in the U.S., it was Chesapeake Energy. This company faced and survived nearly every extreme the energy industry could throw, including bankruptcy. With its recent $7.4 billion merger with Southwestern Energy, Expand Energy has achieved a new milestone: it’s the largest natural gas producer in the U.S., powered by substantial reserves and resources across crucial shale regions.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/324_Blog_Gulf Oil Operators Chevron, BP, Equinor, Shell Brace as Tropical Storm Rafael Threatens Production.jpg)

Oil companies across the Gulf of Mexico are springing into action as Tropical Storm Rafael bears down, marking yet another disruption in a storm-laden season. BP, Chevron, Equinor, and Shell are evacuating offshore staff and preparing for potential impacts on their platforms, an all-too-familiar ritual for Gulf operators this year.