Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Let’s Take a Step Into The Future: Water Management

05/14/2020

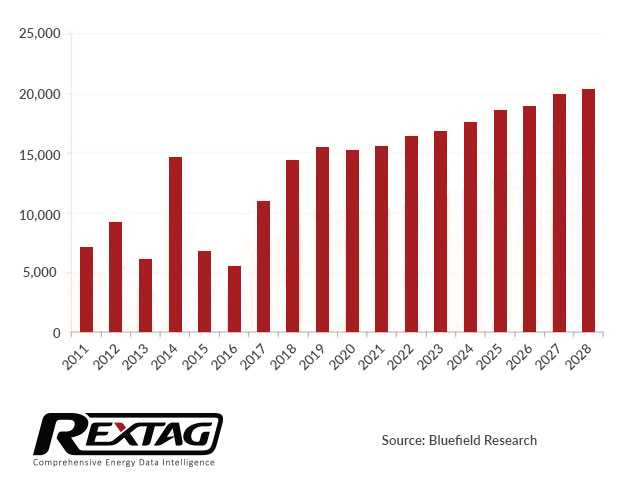

Water management in oil and gas operations has become an industry itself. According to Bluefield’s report, “Midstream Water Management: U.S. Hydraulic Fracturing Strategies, Solutions & Outlook,” water management for hydraulic fracturing has been steadily growing from 2017. All indicators, according to the same report, say this trend will be kept for the next few years.

As demands for water management solutions increase, service companies are looking for new ways to optimize their ability to recycle and store this water.

Total Water Management Spent 2011 - 2028

According to Evan Tikka, senior consultant, at Wood Mackenzie, the water midstream sector growth can now be associated with long-term acreage dedications. WaterBridge has acquired almost 10 different systems which resulted in a 10-plus-year acreage dedication. ”From an E&P perspective, it’s been a year of a trust as we’ve started to see some of the larger U.S. independent and supermajors’ views change on the types of contracts and types of relationships that they’re willing to enter into with the water midstream players, characterized by longer-term acreage dedications and some larger divestments.”, Tikka says.

When asked if more E&P companies will be selling their water infrastructure assets to water midstream companies, Matthias Bloennigen, director of upstream consulting at Wood Mackenzie said ”The short answer is yes.” He also said that water midstream companies need to be thorough when researching assets to be purchased because E&P companies are selling ”their less strategic and underutilized water infrastructure assets”. Although these purchases may be risky for water midstream companies, there is a clear opportunity for them if they manage to integrate infrastructure and increase utilization.

From what cost is concerned, Laura Capper, president and CEO of EnergyMakers Advisory Group, stated ”Cost is absolutely a key driver to overall oil and gas profitability.” She also pointed out that for the big players, cost with water management will decrease over time as volume and resource contributes to the effectiveness of the water management programs. Smaller players will however have a more difficult time in keeping the costs low in the long run.

When referring to the challenges that water teams are facing in the year ahead, Rob Bruant, director of products at B3 Insights said ”Things will continue to be challenging on the regulatory front.” As an example, due to current regulations, New Mexico operators will have greater costs to dispose of the water into deeper formations. ”There is going to be a continued net movement of water from New Mexico to Texas, where the regulations are getting stricter but not nearly as strict.”

Andy Adams, director of water management and infrastructure for Select Energy Services, said ”The greatest issue I see is the logistical challenges of managing and sharing water. Everybody wants to share the water; everybody wants to reuse produced water. But the most difficult aspect of this is actually managing the logistics of delivering the water safely and on time.”

Source: https://www.hartenergy.com/exclusives/bringing-balance-water-demands-186176

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Look At The Future Of American And Appalachian Gas Production

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Look-At-The-Future-Of-American-And-Appalachian-Gas-Production.png)

The crux of the matter is rather simple: productivity gains of local energy operators have been stable not only because they are drilling better acreage, but also because players finally realized capital efficiency gains. And even if some new obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins. The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

U.S. Crude Breakevens at Less Than $50/Bbl - Pipelines Help

![$data['article']['post_image_alt']](https://rextag.com/images/public/blog/U.S.-Crude-Breakevens-at-Less-Than-50-per-Bbl.jpg)

U.S. Shale Breakevens now at $50 instead of $68/bbl. Pipeline management (field and maintenance data), as well as new projects introduced lower operation costs and provide path to future industrial success.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?