Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Oil Market Outlook: A Year of Growth, but Slower Than Before

11/18/2024

Are We Heading Toward Record Highs?

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

A Year of Growth, but Slower Than Before

The International Energy Agency (IEA) has revised its forecast for global oil demand in 2024, projecting growth of 921,000 barrels per day (bpd)—a slight increase from earlier predictions of 862,000 bpd.

This brings expected global demand for next year to 103.8 million bpd, compared to 102.8 million bpd in 2023. However, the growth pace has slowed considerably from the 2 million bpd surge seen last year as the post-pandemic recovery cools off.

One reason for this deceleration is the growing adoption of cleaner energy technologies, tempering oil’s dominance in global markets. Another is China’s economic slowdown. Once a cornerstone of global demand growth, Chinese consumption has been weak, with demand falling by 70,000 bpd year-over-year in September, marking the sixth consecutive monthly decline.

The IEA said, “China’s marked slowdown has been the main drag on demand, with its growth this year expected to average just a tenth of the 1.4 million barrels a day increase seen in 2023.”

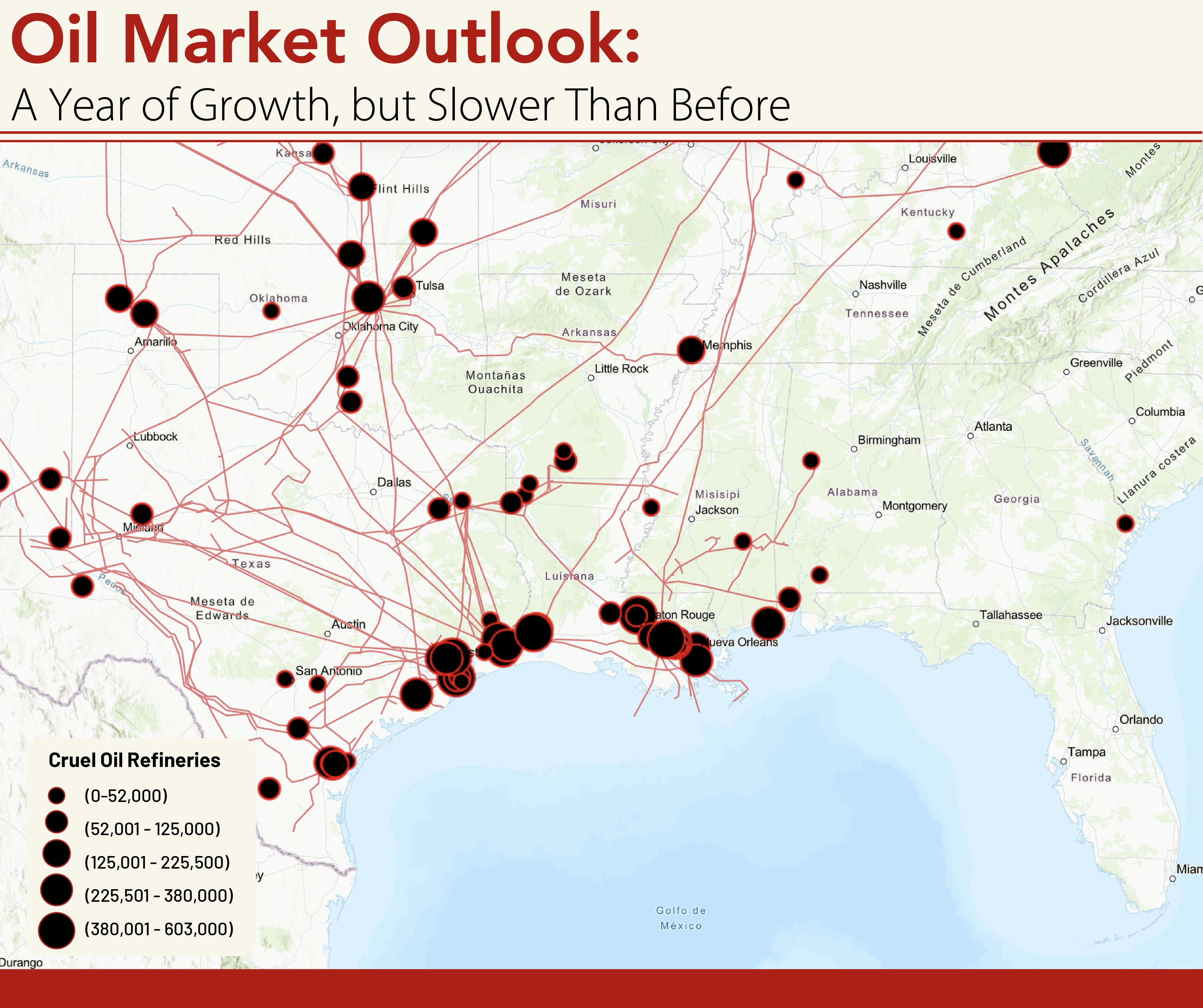

The U.S.: Leading the Way in Supply

The U.S. continues to be the driving force behind global oil supply. According to the U.S. Energy Information Administration (EIA), U.S. crude oil production is forecast to average 13.23 million bpd in 2024, up from last year’s record of 12.93 million bpd. By 2025, that number is expected to climb to 13.53 million bpd.

This surge in production cements the U.S. as the world’s top oil producer. Non-OPEC supply, led by the U.S., is projected to grow by 1.5 million bpd in both 2024 and 2025, helping to offset cuts made by OPEC+. Much of this growth stems from higher output in the Permian Basin, where technological advancements and efficiency boost yields.

The EIA also highlighted that U.S. oil exports remain robust, with shipments averaging 7.3 million bpd in recent months. Commercial export revenue rose by $1.2 billion in October alone, reflecting higher volumes and slightly firmer prices.

Challenges on the Horizon

Despite these substantial numbers, the oil market is grappling with significant hurdles.

China’s Economic Slowdown

China, one of the world’s biggest oil consumers, is struggling. The IEA expects Chinese demand to grow by only 140,000 barrels per day in the fourth quarter, far below last year’s 1.4 million-barrel increase. This is a worrying trend for a market that often depends on China’s growth.

OPEC+ Cuts Under Pressure

OPEC+ has cut production by 2.2 million barrels per day to support prices. While these cuts have provided some stability, there are signs that patience among member countries is running thin. Compliance with these cuts has been inconsistent, and some producers may soon push for more flexibility to increase revenue.

The IEA noted, “Although we assess that OPEC+ producers will likely continue to limit production below recently announced targets in 2025, the potential for weakening commitment among OPEC+ producers adds downside risk to oil prices.”

The Shift to Renewables

The rise of electric vehicles and renewable energy is no longer a future concern—it’s happening now. This shift is slowly reducing oil demand, especially in transportation. While it won’t transform the market overnight, it’s a trend producers can’t ignore.

A Mixed Outlook for 2024

The oil market is in a state of flux. On one hand, we’re seeing record production levels, led by the U.S., and a steady increase in global demand. On the other, prices remain underwhelming, and long-term changes in energy consumption are reshaping the landscape.

The U.S., for its part, remains the standout performer. Its projected production of 13.23 million bpd in 2024 reflects a robust and resilient oil sector. Yet globally, challenges like China’s slowdown and the push toward renewables overshadow the market.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 161_ Blog - US Midstream Research Overview TOP Providers, Their Assets and Stories.png)

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

Permian Basin Gas Production Pushes Limits – Infrastructure Expansion Needed

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/321_Blog_ Permian Basin Gas Production Pushes Limits – Infrastructure Expansion Needed.jpg)

The rapid growth of natural gas production in the Permian Basin is pushing existing infrastructure to its limits, and additional pipeline projects are on the horizon to meet rising demand, according to East Daley Analytics. Despite ongoing price volatility—marked by repeated declines—demand for expanded energy markets continues to surge.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/325_Blog_ Expand Energy's Operations (formerly Chesapeake) .jpg)

Before it was Expand Energy, the largest natural gas-weighted exploration and production company in the U.S., it was Chesapeake Energy. This company faced and survived nearly every extreme the energy industry could throw, including bankruptcy. With its recent $7.4 billion merger with Southwestern Energy, Expand Energy has achieved a new milestone: it’s the largest natural gas producer in the U.S., powered by substantial reserves and resources across crucial shale regions.