Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

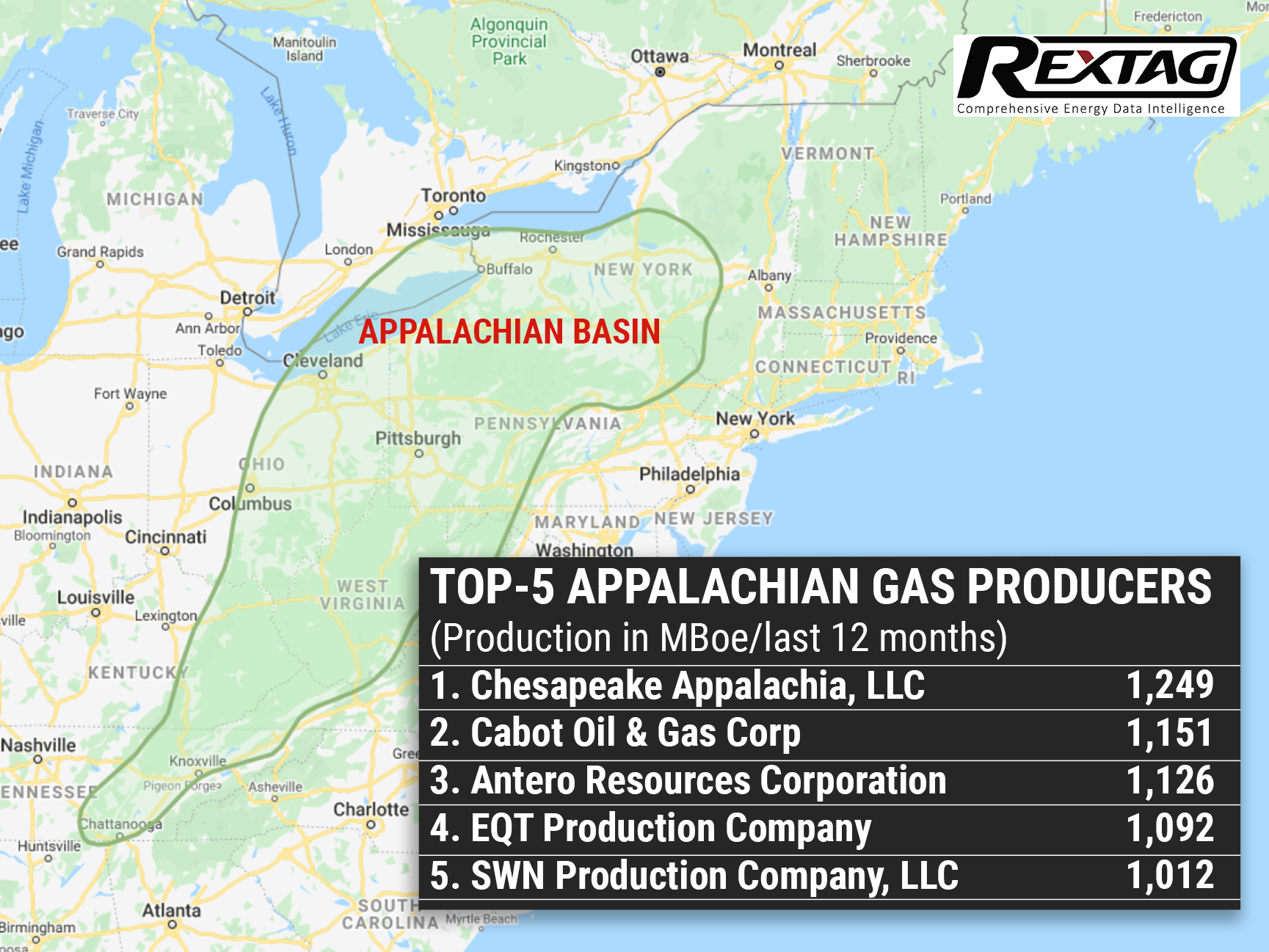

Look At The Future Of American And Appalachian Gas Production

01/24/2022

At Hart Energy's recent DUG East/Marcellus-Utica Midstream Conference, Rystad's analysts raised the possibility that Appalachia's natural gas production can actually be maintained or even increased without the significant investment in wells of the past.

As per Rystad's projection, natural gas prices will stay around $3-$4 per MMBtu all the way to 2030, which is a good point for economic feasibility at the asset level. The U.S. will also be able to stay a key player in energy supplies in the long run because of this.

It is inevitable: gas will replace coal in the power generation fuel mix because of the energy transition to electrification and lower emissions goals. At the moment, the coal industry dominates the power generation mix in Asia, including Australia, where coal produces 45% of electricity. This creates opportunities for natural gas, which won't be covered fully by local resources, leaving a possibility for import.

Despite the energy struggles of 2021, the importance of gas in the energy system has been reinforced. There is a potential for more energy crises to arise in the future, depending on when and how quickly the energy transition happens. Thus, to meet power demand and avoid emissions of greenhouse gasses, regions such as Europe and Asia need greater amounts of LNG. There will be intense competition between U.S. and Russian producers in those markets, but the U.S. maintains a supply advantage, while Russia will see its share of the market decline notably from the mid-2030s to 2050.

By the early 2040s, LNG demand will likely peak at 718 metric tons. But in the short term, the LNG market is relatively tight and unable to fulfill such needs, because U.S. export terminals have not yet been built. LNG export terminal projects must be completed promptly if the supply target of 700+ metric tonnes is to be reached by 2040.

It becomes quite important to consider the production capabilities of Appalachian producers in that context. Historically, productivity has ranged between 1 and 2 Bcf/d from 2014-to 2016, plateaued at around 2 Bcf/d in 2019, and then increased to 2 to 2.4 Bcf/d in 2020 and then started rising again in 2021. And the curves appear to be sustainable.

And it isn't only because operators are drilling better acreage that productivity gains have been stable. During 2016-2017, Tier 1 and Tier 2 locations produced lower output, implying that this learning curve continues to be steep and that the operators are actually realizing these capital efficiency gains.

The takeaway and regulatory constraints of the Northeast region are not to be ignored, but even if those obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins.

The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

$7 Billion Merger of Colgate and Centennial, the 2 Largest Permian Operators

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/68Blog_colgate_centennial_merger_announced_05_2022.png)

Despite the circulating rumors concerning Colgate’s attempt to launch an IPO, on May 19 the company decided to combine with Centennial Resource Development Inc. This merger of equals is estimated at $7 billion and will found the biggest pure-play E&P company in the Delaware Basin of the Permian. The transformative combination essentially enlarges companies’ potential and hastens the growth across all financial and operating metrics. According to Centennial CEO Sean Smith, the combined company is anticipated to furnish shareholders with quickened capital return program due to a fixed dividend coupled with a share repurchase plan. Due to a recent report, the merger would increase production 7%, to 145,000 boe/d by the fourth quarter would further ratchet up next year. By third-quarter 2023, the company predicted 160,000 boe/d based on a drilling program of 140 wells per year. Colgate Energy was reported to be getting an IPO last December that sources said would value the company at approximately $4 billion. The combined company will have over 15-years of drilling inventory, assuming its current drilling pace, the companies will produce over $1 billion of free cash flow in 2023 at current strip prices.

Colgate Energy's owners are planning to go public

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Colgate-Energy-owners-are-planning-to-go-public.png)

Colgate Energy is planning to float its shale oil producer in the Permian's Delaware Basin on the stock market. If successful, this IPO would be the first major U.S. oil producer offering since Jagged Peak Energy's IPO in January 2017. Looks like investors’ confidence in the sector is returning as U.S. crude prices hit their highest in seven years late last year S&P energy index delivered roughly twice the return of the S&P 500 in 2021.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/325_Blog_ Expand Energy's Operations (formerly Chesapeake) .jpg)

Before it was Expand Energy, the largest natural gas-weighted exploration and production company in the U.S., it was Chesapeake Energy. This company faced and survived nearly every extreme the energy industry could throw, including bankruptcy. With its recent $7.4 billion merger with Southwestern Energy, Expand Energy has achieved a new milestone: it’s the largest natural gas producer in the U.S., powered by substantial reserves and resources across crucial shale regions.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/324_Blog_Gulf Oil Operators Chevron, BP, Equinor, Shell Brace as Tropical Storm Rafael Threatens Production.jpg)

Oil companies across the Gulf of Mexico are springing into action as Tropical Storm Rafael bears down, marking yet another disruption in a storm-laden season. BP, Chevron, Equinor, and Shell are evacuating offshore staff and preparing for potential impacts on their platforms, an all-too-familiar ritual for Gulf operators this year.