Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

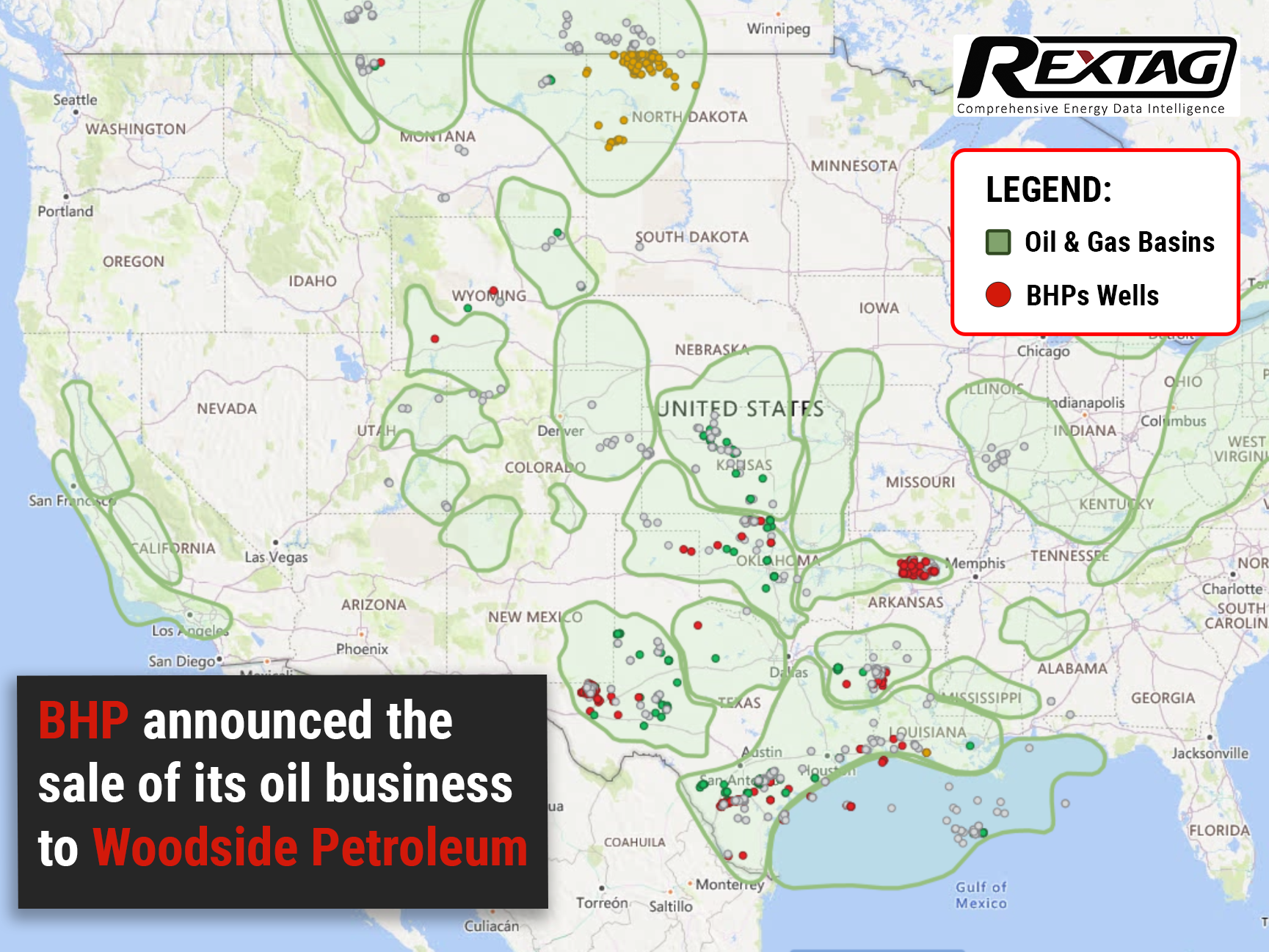

What you need to Know About the Sale of BHP's Oil Business

08/20/2021

BHP is one of the biggest names in the oil business, and to this end, the announcement that a trade deal has possibly been reached for its purchase is undeniably massive news. Indeed, the sale of BHP’s oil and gas company would also lead to developing a brand new “super independent” oil business between BHP and its purchaser, Woodside Petroleum Ltd.

BHP is an Anglo-Australian group that has its headquarters in Melbourne, and the company has been trading in oil and gas for over 60 years since the 1960s. It is likely that future attention will be turned to high-profit returns to recoup the initial investment. Some such examples of these high-margin short and medium turn focuses could include deepwater oil.

After the announcement of the sale, BHP’s share price fell by around 6%. However, the cause for this drop was less to do with the announcement of the sale and more due to the company’s choice to bring to a close U.K. dual listing. This decision was made as BHP’s shares have traditionally performed poorly here, but this still impacted the company’s share price all the same.

However, more concerning is the sudden fall in Woodside Petroleum’s share price, which suffered a 4% drop after the deal's announcement. Indeed, shareholders and investors seem less thrilled by the announcement.

Of course, one of the biggest concerns raised by shareholders is for the risk associated with investing in the oil and gas industries now. Indeed, the oil and gas industries are currently facing a challenging situation, with the rollout of renewable energy options placing a great deal of pressure on the industry.

In fact, the industry is widely taking the stance that this pressure, coupled with the extensive liability held by one of BHP’s New South Wales mines, is what has triggered the trade deal in the first place. It seems that Woodside’s investors, too, are concerned about the potential riskiness of this move to invest so heavily in oil and gas at a time when the reputation of such is low and sustainable alternatives are becoming ever more available and affordable.

In addition to this, shareholders’ have also questioned whether Woodside Petroleum Ltd. will actually be able to handle a deal of this manner, with its current reputation making it one of the poorest performing post-Covid energy industries. Moreover, Woodside would also have to fund the Scarborough project; shareholders are further concerned about the company’s financial position to accomplish this.

To this end, it is hence understandable that BHP would conclude now to be the ideal time to sell the oil and gas share of their firm to balance the profitability of the sale with the successes of the business.

The announcement for sale was made on the 16th of August and is one that is likely to grow and develop over time. Indeed, while there are currently no set in stone dates, it is believed that the transaction will likely go ahead sometime around the middle of 2022, and the progress of this deal is sure to be followed with the petroleum industry’s great interest.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Oklahoma Natural Gas Infrastructure Map: TOP Companies, Deals, Latest Update

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 222 (blog) SEO - Oklahoma Natural Gas Infrastructure.png)

In 2023, Oklahoma's natural gas industry continued to be a significant force in the state's economy, contributing a substantial $57 billion. This hefty contribution firmly positions Oklahoma as a major natural gas and crude oil producer, not just locally but also in the U.S. Mid-Continent region, which spans across neighboring states like Kansas, Texas, Arkansas, Louisiana, and New Mexico.

Texas Crude 2019 Production: Rigs Down, Production Up

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Texas-Oil-Rigs-Count.jpg)

As you know the US Oil Rig Count has dropped by over 20% from January to December 2019. In Texas we saw oil rigs count dropping over 30% in that same time frame.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/325_Blog_ Expand Energy's Operations (formerly Chesapeake) .jpg)

Before it was Expand Energy, the largest natural gas-weighted exploration and production company in the U.S., it was Chesapeake Energy. This company faced and survived nearly every extreme the energy industry could throw, including bankruptcy. With its recent $7.4 billion merger with Southwestern Energy, Expand Energy has achieved a new milestone: it’s the largest natural gas producer in the U.S., powered by substantial reserves and resources across crucial shale regions.