From Bankruptcy to #1!

Before it was Expand Energy, the largest natural gas-weighted exploration and production company in the U.S., it was Chesapeake Energy. This company faced and survived nearly every extreme the energy industry could throw, including bankruptcy.

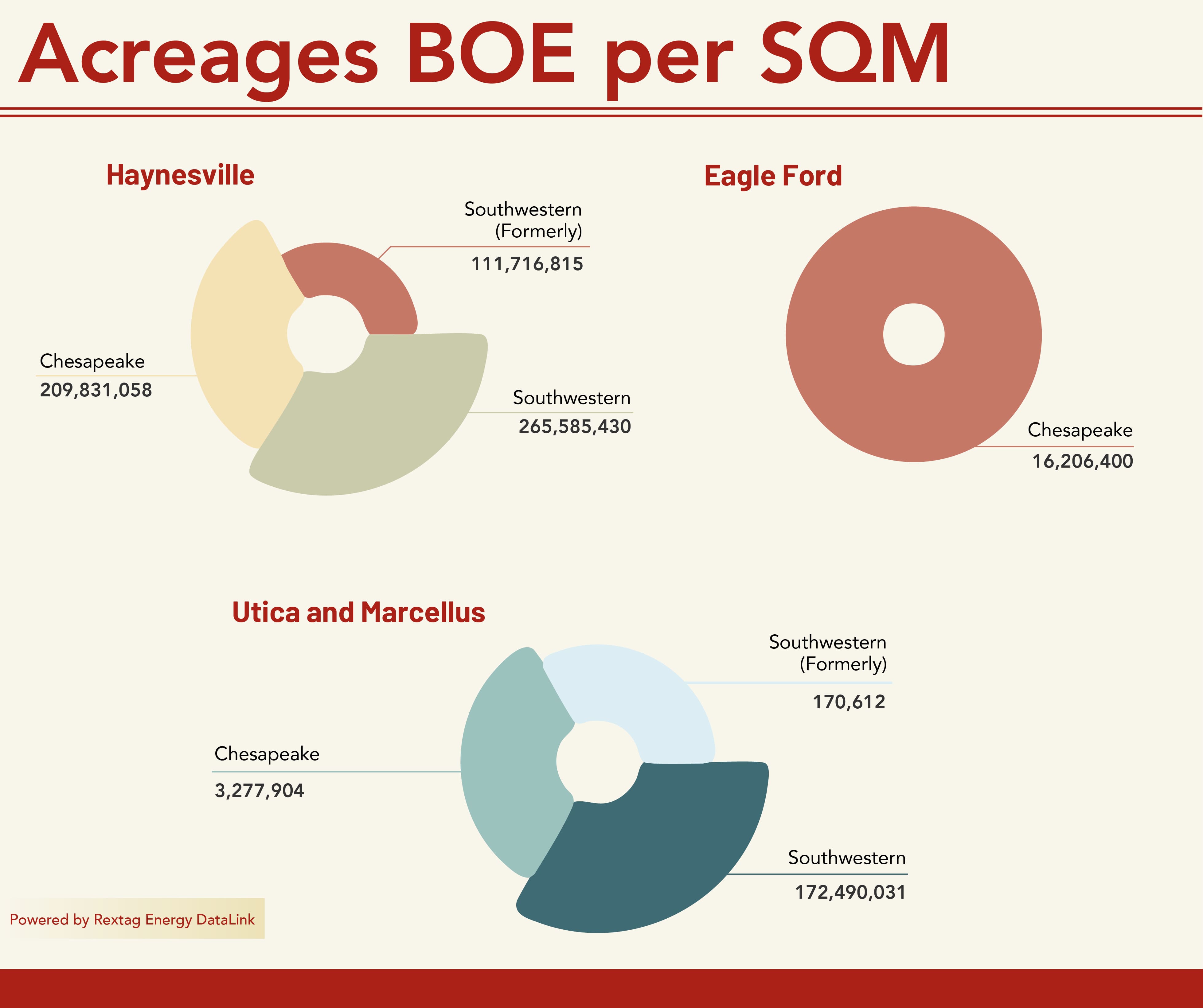

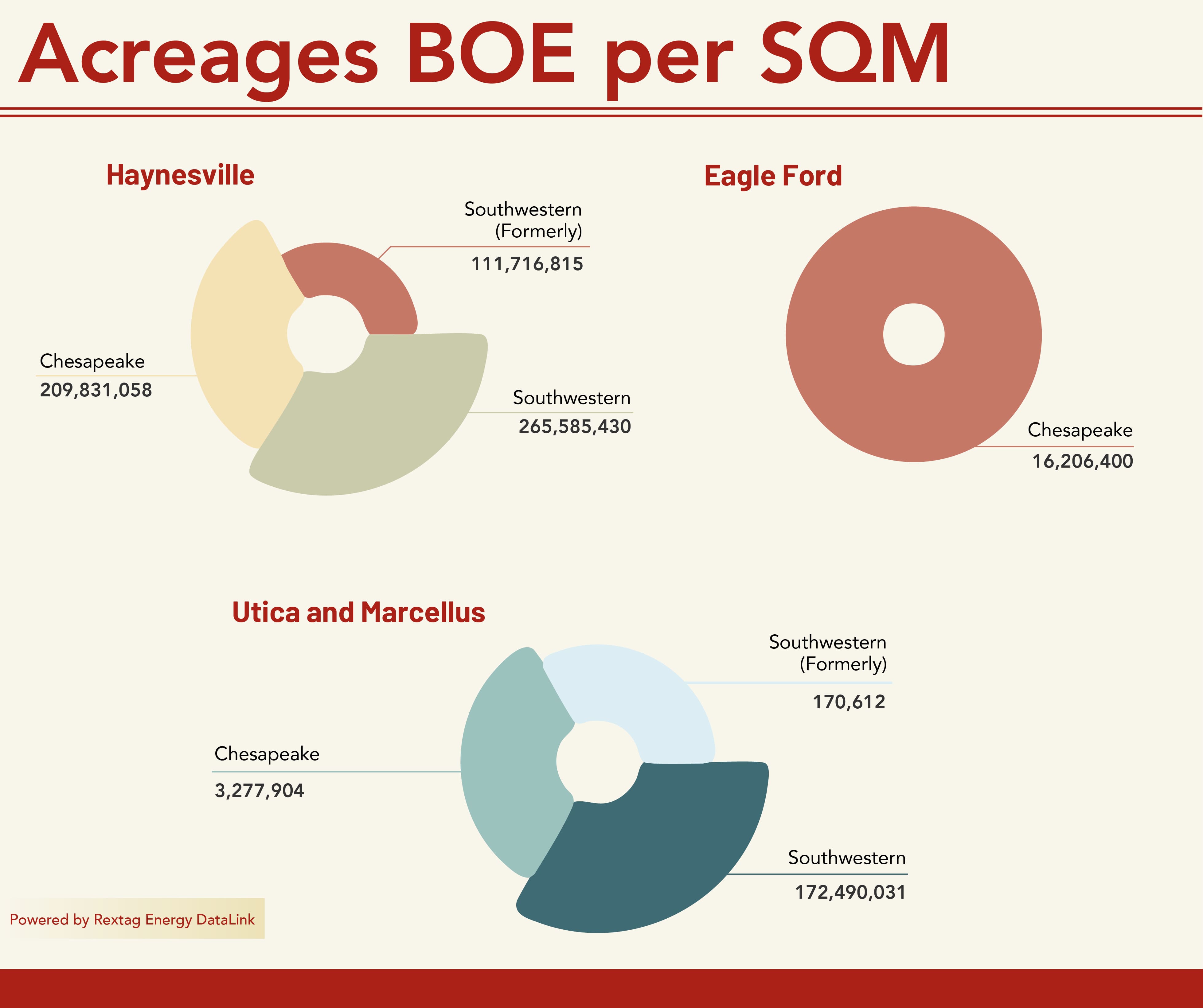

With its recent $7.4 billion merger with Southwestern Energy, Expand Energy has achieved a new milestone: it’s the largest natural gas producer in the U.S., powered by substantial reserves and resources across crucial shale regions.

Chesapeake and Southwestern’s $7.4 Billion Merger – The Road to Expansion

On October 1, 2024, Chesapeake Energy officially closed a $7.4 billion all-stock acquisition of Southwestern Energy despite delays due to regulatory hurdles. The newly formed company, now known as Expand Energy, operates under the Nasdaq ticker “EXE,” symbolizing its fresh identity in the energy landscape.

In September, the merger cleared antitrust requirements under the Hart-Scott-Rodino Antitrust Improvements Act, allowing Expand Energy to leverage both companies’ significant footprints in the Appalachia and Haynesville shale plays. Together, these assets solidify its position as America’s largest natural gas producer.

Vision for a Global Energy Player

Nick Dell’Osso, former Chesapeake CEO and now the CEO of Expand Energy, emphasizes the company’s potential on an international stage. “The world is short on energy,” Dell’Osso said, adding that the company is “uniquely positioned to compete on an international scale to expand America’s energy reach and deliver opportunity for the world’s energy customers.”

Dell’Osso and industry analysts believe combining a premium portfolio across top U.S. gas basins, rising LNG demand and domestic consumption growth is well-aligned to support long-term gas price improvements and sustained company growth.

Chronology of Key Events: Chesapeake to Expand Energy

Tracing Chesapeake’s journey provides insight into its transformation into Expand Energy, from a small startup in the late 1980s to a market powerhouse.

1989 – Chesapeake Founded

Aubrey McClendon and Tom Ward, both 29, launched Chesapeake Energy with $50,000 and 10 employees. The company went public within four years and was valued at $25 million.

Late 1990s – Early Challenges

Natural gas prices collapsed, and Chesapeake’s stock took a hit. However, the company was resilient and soon launched an aggressive expansion phase, acquiring vast natural gas assets.

2005 – A Major U.S. Player

Following a multibillion-dollar acquisition spree, Chesapeake emerged as the second-largest natural gas producer in the U.S., behind only ExxonMobil, and owned rights to 16 million acres.

2006 – Tom Ward Resigns

Ward, who co-founded the company, left Chesapeake in 2006. He later became CEO of Mach Natural Resources.

2008 – McClendon’s Major Sell-Off

During the economic downturn, McClendon sold much of his Chesapeake stock, raising concerns about the company’s future and his leadership.

2012 – Financial Scrutiny

As gas prices dropped and debt mounted, Chesapeake’s board began scrutinizing McClendon’s financial activities. In 2013, after a shareholder revolt, McClendon stepped down as CEO.

2016 – McClendon’s Indictment and DeathMcClendon faced a federal indictment for alleged oil and gas lease bidding conspiracy. Tragically, he died in a car crash in Oklahoma City the day after his indictment.

2013–2020 – A Series of CEOs and Strategy Shifts

Chesapeake underwent multiple leadership changes, including Archie Dunham and Doug Lawler, who refocused the company’s assets to try to boost oil production.

2021 – Bankruptcy and Rebirth

Amid mounting debt and sustained low prices, Chesapeake filed for Chapter 11 bankruptcy. Later that year, Dell’Osso, who had been CFO, took the reins as CEO, overseeing a return to financial health and a strategic refocus on natural gas.

2024 – Merger and Formation of Expand Energy

The merger with Southwestern Energy closed on October 1, marking Expand Energy's official debut and a new chapter for the combined company, which is now the largest natural gas producer in the U.S.

Strategic Shifts and Future Plans

Expand Energy’s dual presence in the Appalachia and Haynesville shale regions offers it an operational edge in meeting the growing demand for natural gas in the U.S. and globally.

Analysts at Jefferies, including Lloyd Byrne, see Expand Energy as a “must-own” for investors. They cite the company’s “strong, complementary acreage” and extensive inventory, which could provide more than 15 years of steady production and robust cash returns. Byrne also points to the potential for higher-than-expected synergies, a debt reduction strategy, and a focus on share buybacks as key elements driving future performance.

Challenges Ahead and Industry Outlook

Natural gas prices remain relatively low, but Dell’Osso and many analysts are bullish on their long-term growth, particularly as liquefied natural gas (LNG) demand rises with new export facilities.

There’s also domestic solid demand for data centers, infrastructure electrification, and other sectors. The upcoming third-quarter reporting period promises more details on Expand Energy’s integration strategy and financial outlook, providing the market with insight into the company’s plans for operational and strategic execution.

A New Era for America’s Energy Giant

Expand Energy’s path from Chesapeake’s turbulent history underscores the volatility and potential in America’s energy sector. From its headquarters in Oklahoma City, with a presence in Houston, the company is poised for growth as it capitalizes on high-value U.S. gas reserves and an increasingly energy-hungry world.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.