Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Enterprise, Oxy Low Carbon Ventures Will Join Efforts on Houston Area CO2 Project

04/29/2022

Oxy Low Carbon Ventures and Enterprise Products Operating will partner in order to provide services to carbon emitters from Houston to Port Arthur, Texas, due to the development of CO2 transportation and sequestration.

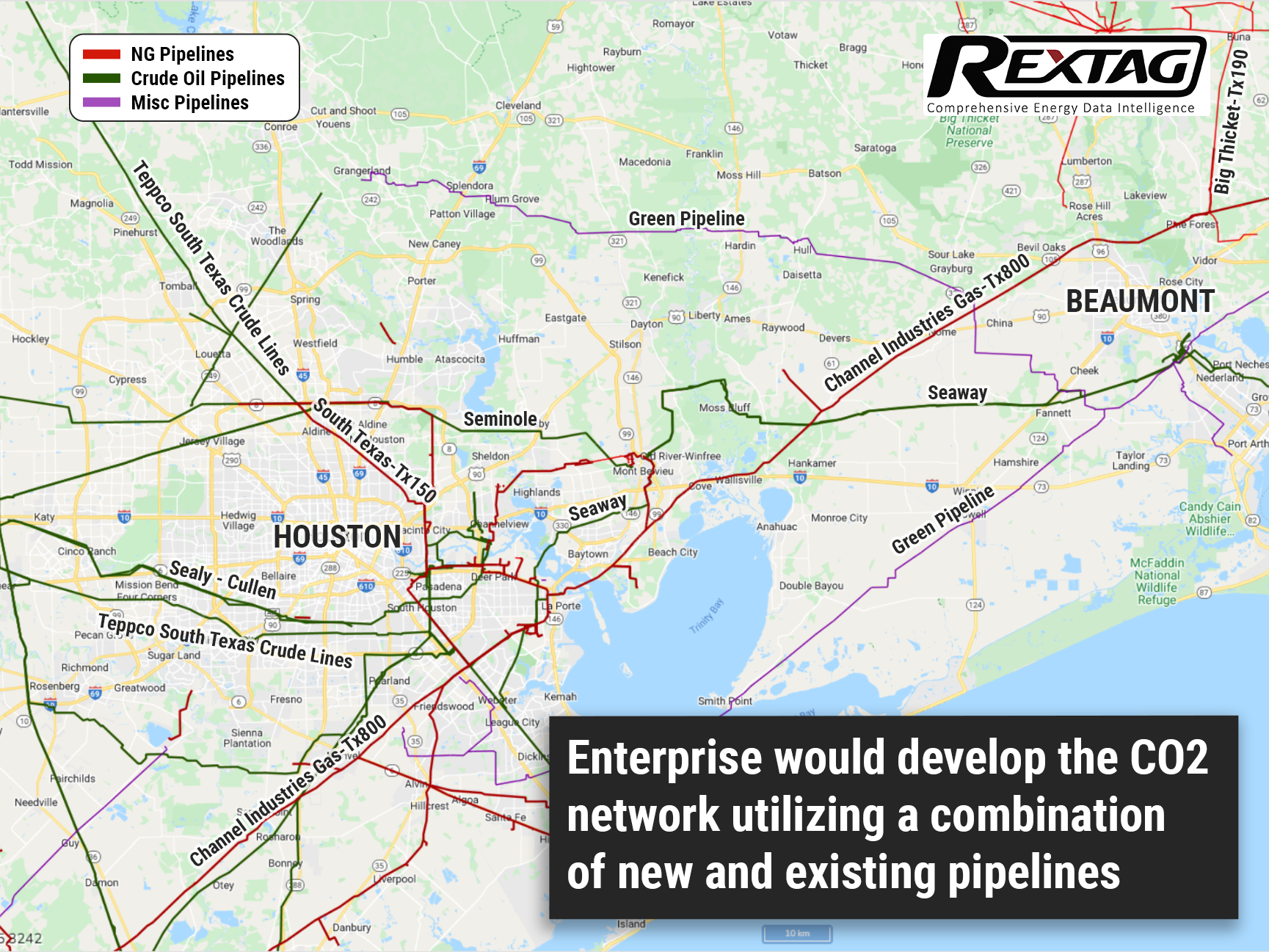

A letter of intent for a potential CO2 transportation and sequestration solution was inked on April 25 by Oxy Low Carbon Ventures (OLCV) and Enterprise Products Operating LLC (Enterprise). This joint project could primarily be focused on providing services to emitters in the industrial corridors from the greater Houston to Beaumont/Port Arthur in Texas, a region that is filled with refineries and petrochemical plants.

Due to the press release, the initiative would combine Enterprise’s leadership position in the midstream energy sector with OLCV’s extensive experience in subsurface characterization and CO2 sequestration.

“We look forward to collaborating with Enterprise to develop a sequestration solution to help industrial emitters reach their net-zero goals,” said Richard Jackson, Occidental president of U.S. onshore resources and carbon management and operations. “We believe that our low-carbon strategy enhances Oxy’s business value and creates a path to net-zero for ourselves while providing organizations everywhere with the tools they need to achieve net-zero or net-negative emissions.”

No financial terms were disclosed in the announcement. Nevertheless, Occidental's latest annual report noted that OLCV plans to invest approximately $300 million into the development and commercialization of new technologies and low-carbon business models in 2022.

It’s an international energy company with assets primarily in the United States, the Middle East and North Africa. OLCV is focused on advancing cutting-edge, low-carbon technologies and business solutions that enhance Oxy’s business while reducing emissions. Therefore, OLCV also invests in the development of low-carbon fuels and products, as well as sequestration services to support carbon capture projects globally.

Enterprise would develop the CO2 aggregation and transportation network utilizing a combination of new and existing pipelines along with its expansive Gulf Coast footprint. OLCV, through its 1PointFive business unit, is developing sequestration hubs on the Gulf Coast and across the U.S., some of them are thought to be anchored by direct air capture facilities. The hubs will provide access to high-quality pore space for industrial plants trying to find a way to capture their carbon emissions and efficient transportation infrastructure, bringing more options to emitters looking to explore viable carbon management strategies. The partnership’s assets include more than 50,000 miles of pipelines; over 260 million barrels of storage capacity for NGLs, crude oil, refined products and petrochemicals; and 14 billion cubic feet of natural gas storage capacity.

Both companies have begun exploring the commercialization of the potential joint service for these carbon emitters. “For many years, Enterprise and Oxy have successfully collaborated in developing traditional oil and gas projects," A.J. “Jim” Teague, co-CEO of Enterprise’s general partner, commented. “We are excited to evolve that relationship with OLCV to provide reliable and cost-efficient CO2 transportation and sequestration services to advance a low-carbon economy for the energy capital of the world.”

Moreover, it is noticed that Oxy is one of only three oil and gas companies aspiring to set emissions reduction aims which are quite ambitious to reach Net Zero by 2050 and the alignment with TPI’s 1.5°C benchmark.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R131_B_ESG_Management.png)

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

The green trend: TC Energy pledges to be carbon-free by 2050

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/TC_Energy_carbon-free_greenhouse-gas_emissions_ESG_midstream_GIS_NG_data_hydrogen_pipeline_maps.png)

TC Energy, the Canadian gas giant, recently announced its environmental, social, and governance goals, as well as emission reduction strategies. The company aims to become 100% emission-free by 2050 while promising to cut greenhouse gas emissions intensity from its operations by 30% by 2030 as an interim measure.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?