Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

SCOOP/STACK Midstream Developments. Pipeline Projects Driving Gas Prices. Challenge of Getting Water for Fracking

12/20/2018

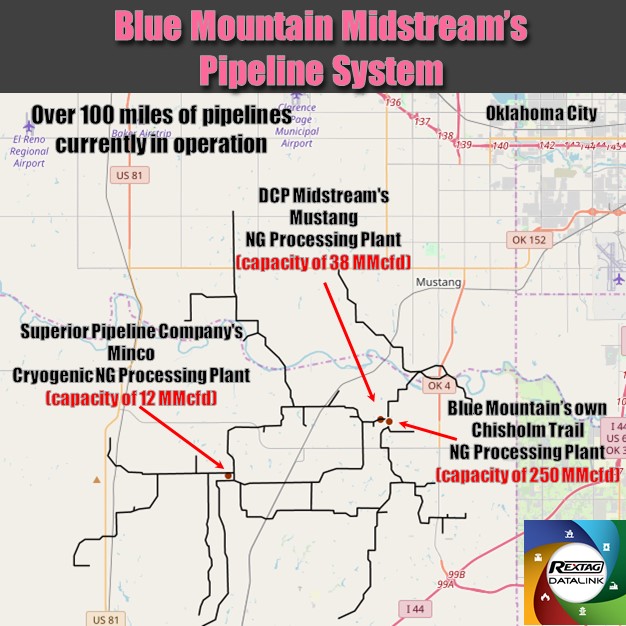

Positive Outlook on SCOOP / STACK’s Blue Mountain Midstream’s Pipeline System

Blue Mountain Midstream LLC Company operating in Merge play as well as in SCOOP and STACK plays, OK, continues to be a “fast-growing business”. Being a 100% subsidiary of the Riviera Resources, Inc., a recent spin-off from Linn Energy, Blue Mountain Midstream is said by David Rottino, Riviera’s president and CEO, during the recent company’s earnings call to remain one of its “tremendous growth assets”.

Blue Mountain provides natural gas, crude oil and natural gas liquids service solutions in the mentioned area. (See this on Rextag's map above).

Christmas Season Decorative Lighting and Power Demand. Does This Still Affect Gas Prices? (Or Have New Pipeline Projects Changed this Pattern?)

According to research (by EnVantage Inc.), a 10% increase in power demand near Christmas and the New Year was historically attributed to decorative lighting. Although diminishing due to the slow adoption of LED, this year the effect is hard to trace due to extreme volatility. Waha Hub prices were fluctuating from $3.85 /MMBtu on Nov. 13 down to $0.30 /MMBtu in two weeks and up to $1.36 /MMBtu by December 4.

Most of the movement is attributed to the excessive gas supply from Midland basin. The latter was a by-product (associated gas) from additional oil output delivered from Midland to Colorado City and Wichita Falls along newly introduced Sunrise Pipeline expansion by Plains All American LP. Estimated at over 750 MMcfd it contributed to the Waha plunging prices.

NGL prices likewise are thought to be affected by prospects of another group of pipelines under construction: Mariner East 1 and Mariner East 2 pipelines by Sunoco. Located in Pennsylvania, the pipelines are intended to facilitate the transfer of Natural Gas Liquids from the Utica and Marcellus Shale Formations to ports on the East, where ethane, butane, pentane, propane mixes will be exported.

Fracking Water Demand: Challenges and Their Treatment Approaches

It has been pointed out by experts that “rig count correlates with water source needs”. If a region lacks water-handling assets then development slows to a stop. Companies need to procure both water to drill and means of its future disposal. Cost is the main concern here.

The issue may be resolved by one of the following approaches:

- Adjusting the existing pipelines to become water-dedicated for bringing new water to the area.

- Use treated water from nearby municipals. (Several projects are being discussed in Oklahoma City in the Midcontinent, Carlsbad, N.M., and Odessa and Midland, Texas). However, supply of the treated water is quite limited so this will remain a niche market.

- Reuse of already produced water for frack jobs. This approach can be taken by regional players who would provide dedicated systems in place to handle all: gas, oil and water for their local customers.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Magellan Midstream Oil Transport Revenues Drop as Demand Slides

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Magellan_Midstream.png)

Magellan Midstream Partners L.P. sees a drop in revenues as demand for production of crude oil declines in the US. Yet the company remains optimistic in light of growing interest in gasoline, distillates, and jet fuels.

Let’s Take a Step Into The Future: Water Management

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Water-management.jpg)

As demands for water management solutions increase, service companies are looking for new ways to optimize their ability to recycle and store this water.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?