Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Southwestern Energy Company: M&A, 2022 vs 2023 Review, 2024 Forecast

04/01/2024

Southwestern plans to keep its production steady, with a budget of $2.0 to $2.3 billion allocated for capital expenditures in 2024. This budget includes about $200 million for capitalized interest and expenses, which means the spending on drilling, completion, and other costs would be in the range of $1.8 to $2.1 billion to maintain a production level similar to 2023's output of approximately 4.57 Bcfe per day.

The company anticipated closing 2023 with a debt of around $4.1 billion. Given the current market prices, Southwestern aims to reduce its debt to about $4 billion by the end of 2024, targeting a production level close to 4.5 Bcfe per day. Furthermore, the company has set a goal to lower its debt to under $3.5 billion.

To reach the debt reduction target of approximately $3.5 billion by the end of 2024 or early 2025, Southwestern may need to adjust its capital expenditure budget to around $1.2 billion. This adjustment could lead to a slight decrease in production to about 4.2 to 4.25 Bcfe per day in 2024, representing a 7% to 8% reduction from the production levels in 2023.

Let’s Take a Look at Q3 2023 Results

In Q3, Southwestern achieved a notable production volume: 368 billion cubic feet of natural gas, 8.23 million barrels of natural gas liquids (NGLs), such as ethane and propane, and 1.31 million barrels of crude oil. Overall, the company's production amounted to 425.2 Bcfe, predominantly in natural gas (86.5%), with NGLs 11.6%, and crude oil 1.8%.

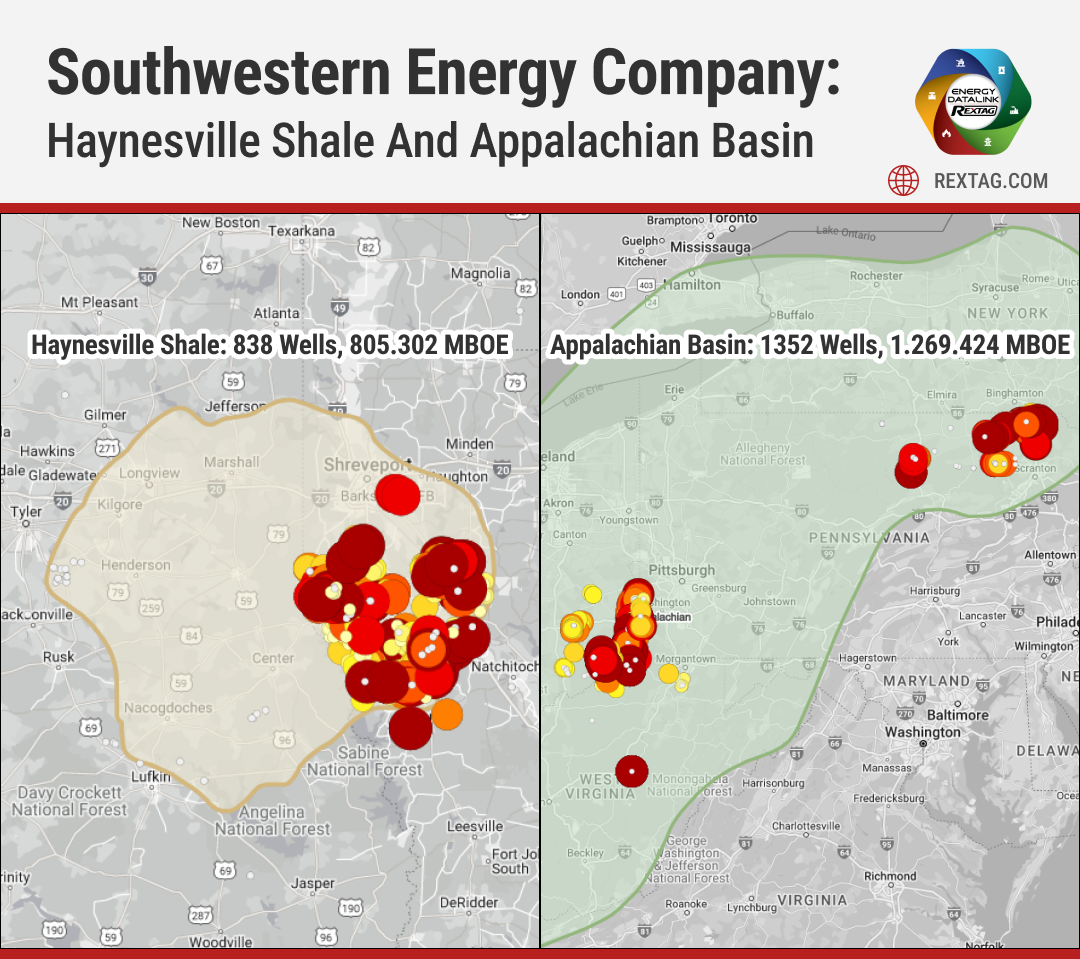

The operational expenses of Southwestern extend beyond production; they encompass the costs associated with gathering, processing, and transporting the resources, all of which are included in the Lease Operating Expenses. The company's operations span two key geological formations: the Marcellus Shale in the Appalachian region and the Haynesville Shale in Louisiana. The local demand for natural gas in Appalachia tends to be low.

To address this issue, Southwestern and other producers in the Marcellus Shale region use a strategy of securing pipeline space to send their natural gas to places where prices are better. This approach mainly aims at areas like the Gulf Coast, which has a strong demand for natural gas from chemical plants, refineries, and industrial users, as well as the Eastern Seaboard and Florida, where the need for natural gas for electricity generation is growing.

In the Northeast, where gas prices are typically higher due to proximity to Appalachia, the challenge of transportation has been amplified by regulatory decisions. New York and other neighboring states have rejected several key pipeline proposals aimed at moving Marcellus shale gas, such as the Constitution Pipeline and Northeast Supply Enhancement Projects, both of which were canceled in 2020. This regulatory environment forces producers to transport gas over longer distances to access regions with higher demand, consequently driving up transportation costs.

The Marcellus shale distinguishes itself as the most productive gas field in the United States, with an output of approximately 35.95 billion cubic feet per day in November 2023. It also benefits from having the lowest extraction costs among U.S. shale gas fields.

In comparison, the Haynesville Shale, another significant production area for Southwestern, is situated in Louisiana and parts of eastern Texas. Its location, in close proximity to the major U.S. LNG export facilities along the Louisiana and Texas Gulf Coasts, enables it to achieve much higher realized pricing than the Appalachian region, coupled with lower transportation costs.

The Outlook for Q4 2023

Total Production: 410 Bcfe with a mix of 86% natural gas, 12% NGLs, and 2% oil. Annual production was 1.7 Tcfe.

Capital Investments: $417 million in Q4, reaching $2,131 million for the year. The company completed 132 wells, drilled 110, and finished 124.

Production Overview

- Gas: 352 Bcf in Q4, 1,438 Bcf annually.

- Oil: 1,433 MBbls in Q4, 5,602 MBbls annually.

- NGL: 8,144 MBbls in Q4, 32,859 MBbls annually.

Regional Highlights

- Appalachia: 264 Bcfe in Q4, with yearly production of 1.0 Tcfe. Drilled 60 wells, completed 63, and placed 67 to sales in 2023.

- Haynesville: 146 Bcf in Q4, yearly production of 635 Bcf. Drilled 50 wells, completed 61, and placed 65 to sales in 2023.

Capital Expenditure Details

- Appalachia: $154 million total in Q4; $938 million annually.

- Haynesville: $237 million total in Q4; $1,138 million annually.

Wells Activity

- Appalachia: Drilled 9, completed 5, placed 11 to sales in Q4.

- Haynesville: Drilled 8, completed 12, placed 12 to sales in Q4.

Q4 production dipped below Q3 levels, declining from 425.2 Bcfe to 410 Bcfe. This decline was somewhat anticipated, following a reduction in capital expenditures (CAPEX) from $454 million to $436 million. Typically, a decrease in CAPEX correlates with a reduction in the number of wells drilled, completed, and brought into production.

This downturn in Q4 production implies that the company's expenditure is falling short of the necessary maintenance CAPEX, which is the investment required to keep production levels stable. Shale gas and oil wells are known for their steep initial production declines, which gradually stabilize, leading to a longer phase of slower decline.

For a company like SWN to maintain steady production figures, it must drill a sufficient number of new wells to counteract the natural decrease in output from its existing, aging wells. To achieve growth, it must not only cover this inherent decline but also drill additional wells to enhance overall production.

The Haynesville region is identified as a dry gas play, indicating a low presence of liquid hydrocarbons such as natural gas liquids (NGLs) and oil in its gas. In contrast, SWN's holdings in the Marcellus Shale include areas within the "wet gas" window, where gas production yields a substantial volume of hydrocarbons like propane, butane, natural gasoline, and crude oil.

In response to the predominantly lower gas prices throughout much of 2023, SWN has strategically reallocated some of its CAPEX towards drilling in Marcellus's wet gas window. This shift has led to an increase in the proportion of liquid hydrocarbons in its total production. As oil and NGLs command higher market prices compared to gas, this adjustment has positively influenced the company's earnings per Mcfe for the quarter.

An M&A Situation

In October 2023, Chesapeake Energy, a big player in the energy world, considered buying Southwestern Energy. This interest is part of a trend where large energy companies are merging or buying each other out, such as Exxon Mobil's $68 billion acquisition of Pioneer Natural Resources and Chevron's $59 billion attempt to buy Hess.

In January 2024 Chesapeake Energy has agreed to purchase its competitor, Southwestern Energy, in a $7.4 billion all-stock deal. The acquisition anticipates a boost in natural gas demand with new U.S. LNG export terminals coming online in 2025.

.png)

Chesapeake's idea to acquire Southwestern Energy is smart for a few reasons. Chesapeake had previously sold its operations in Texas to focus more on the Marcellus Shale in Appalachia and the Haynesville Shale in Louisiana. Interestingly, both companies work in some of the same areas in Louisiana and Pennsylvania, which means their operations could nicely complement each other.

In 2021, Southwestern Energy expanded into the Haynesville Shale by purchasing Indigo Resources and GEP Haynesville. Before this, Chesapeake had sold some of its Haynesville properties to Indigo Minerals, which is connected to Indigo Resources, in 2017. So, buying Southwestern would allow Chesapeake to get back some assets it had sold off about six years earlier.

From a financial perspective, merging the two companies could lead to big savings, especially in interest payments. Southwestern is in debt by about $4.25 billion, while Chesapeake's debt was just under $1.28 billion at the end of the third quarter of 2023. Chesapeake also recently sold some assets for $700 million, which will help lower its debt further. Considering Southwestern's market value is $7.3 billion and Chesapeake's is over $10.5 billion, the combined company would be better placed to handle its debt.

Most importantly, this merger would make a big splash in the U.S. natural gas market. EQT Corp., the biggest independent natural gas producer, made 491.5 billion cubic feet of gas in the third quarter of 2023. Southwestern made 352.5 billion cubic feet, and Chesapeake made 310.8 billion cubic feet. Together, Southwestern and Chesapeake would become one of the top gas producers in the U.S., especially in the key regions of the Marcellus and Haynesville shales

2022 vs 2023

- Financial Results

2022: Southwestern Energy recorded a net income of $1,849 million. Net cash provided by operating activities stood at $3,154 million, net cash flow was $3,057 million, and free cash flow totaled $848 million.

2023: The Company saw a net income of $1,557 million. Net cash provided by operating activities was $2,516 million, net cash flow was $2,273 million, and free cash flow significantly decreased to $142 million.

- Operational Results

2022: Total annual production was 1.7 Tcfe, with production comprising 87% natural gas, 11% NGLs, and 2% oil. Capital investments totaled $2,209 million for the year. The Company drilled 138 wells, completed 139, and brought 133 wells to sales.

2023: Total annual production remained steady at 1.7 Tcfe, with a slight composition shift to 86% natural gas, 12% NGLs, and 2% oil. Capital investments decreased slightly to $2,131 million. The Company saw a reduction in drilling activity to 110 wells, completed 124, and brought 132 wells to sales.

- Proved Reserves

2022: Proved reserves increased to 21.6 Tcfe by the end of the year, up from 21.1 Tcfe at the end of 2021, showing growth mainly through extensions, discoveries, and other additions.

2023: Proved reserves declined to 19.7 Tcfe, a reduction primarily attributed to downward price revisions, reflecting adverse market conditions impacting reserve valuations.

- Appalachia

In 2022, Appalachia saw a total annual production of 1.1 Tcfe, with liquid outputs at 97 MBbls per day. The region witnessed the drilling and completion of 67 wells each, and 63 wells were placed for sale. The average lateral length for wells was 14,587 feet, and the average well cost came to $821 per lateral foot.

Moving into 2023, the total annual production slightly decreased to 1.0 Tcfe, but liquids production increased to 105 MBbls per day. The region experienced a slight decrease in activity with 60 wells drilled and 63 completed, but an improvement was seen in wells placed to sales, rising to 67. The average lateral length of wells extended to 15,978 feet.

The comparison reveals that while overall production in Appalachia saw a slight decline in 2023, the increase in liquids production and the efficiency in completing and placing wells to sales reflect an operational enhancement.

- Haynesville

For 2022, Haynesville's total annual production was reported at 679 Bcf. The region had a busy year with 71 wells drilled, 72 wells completed, and 70 wells placed for sale. The average lateral length for wells was 8,984 feet, with the average well cost at $1,758 per lateral foot.

In 2023, total annual production in Haynesville decreased to 635 Bcf. The number of wells drilled reduced to 50, but wells completed were 61, and wells placed for sale slightly decreased to 65. The average lateral length of wells was shorter, at 8,532 feet.

This indicates a strategic adjustment in Haynesville, with a reduction in drilling activities while maintaining a strong focus on completing and placing wells to sales, aligning with operational efficiencies despite a slight dip in total production.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

U.S. Oil and Gas Drilling 2023-2024 Report: Rigs, Onshore, Offshore Activity, Biggest Companies

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R249_Blog_ U.S. Oil and Gas Drilling 2023-2024 Report_ Rigs, Onshore, Offshore Activity, Biggest Companies.png)

In January 2024, the United States saw a mix of ups and downs in the number of active drilling rigs across its major oil shale regions and states. Starting with the shale regions, the Permian Basin led with a slight increase, reaching 310 rigs, which is 3 more than in December. The Eagle Ford in East Texas held steady with 54 rigs, unchanged from the previous month. Meanwhile, both the Haynesville and Anadarko regions saw a decrease by 2 rigs each, landing at 42 rigs. The Niobrara faced a larger drop, losing 4 rigs to settle at 27. On a brighter note, the Williston Basin and the Appalachian region saw increases of 2 and 1 rigs, respectively, resulting in counts of 34 and 41 rigs.

SilverBow Successfully Completes $700MM Purchase of Chesapeake’s South Texas Holdings

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/209blog_SilverBow Successfully Completes 700MM Purchase of Chesapeake’s South Texas Holdings.png)

SilverBow Resources Inc. finished buying Chesapeake Energy Corp.'s oil and gas areas in South Texas. They agreed to this $700 million deal back in August. The deal included SilverBow paying $650 million in cash when the deal was closed. They will also pay another $50 million in cash a year later, with some usual changes in the amount. Chesapeake might get an additional $50 million later, depending on the prices of oil and gas in the future. SilverBow paid for this big purchase with the money they had, by borrowing from their credit line, and by selling more of their second lien notes.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?