Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Renewable Natural Gas: How RNG Changes the Industry

06/03/2024

Power companies argue that natural gas is essential for meeting energy demands when renewable sources like wind and solar aren't producing enough electricity. Despite the increasing role of renewables, which are setting new records in U.S. power generation and are favored to replace coal, the intermittency of these sources presents challenges that could keep natural gas in the mix through at least 2030.

According to the U.S. Energy Information Association, the U.S. has enough natural gas reserves to last approximately 86 years. However, the finite nature of these reserves highlights the need for a continued shift towards more renewable and sustainable energy sources.

The next decade could see a significant rise in natural gas demand, driven by the surge in electricity consumption from artificial intelligence and data centers. Goldman Sachs predicts that natural then gas is expected to fulfill 60% of the power demand increase caused by AI, with renewables covering the remaining 40%. Wells Fargo projects that by 2030, natural gas demand could grow by an additional 10 billion cubic feet per day—a 28% increase over current levels used for electricity generation in the U.S., and a 10% total increase in national gas consumption.

In 2023, nearly a quarter of U.S. electricity was generated from renewable sources, while just under 9% of the total energy used came from these green sources, as reported by BloombergNEF. Meanwhile, natural gas power generation in the U.S. reached a record high of 1,809 terawatt hours last year, accounting for 43% of the country's total energy mix.

EQT Corp., the largest U.S. natural gas producer, emphasizes the need for reliable, affordable energy that can be quickly deployed to meet the escalating demand for electricity. Toby Rice, CEO of EQT, recently highlighted the company's acquisition of the Mountain Valley Pipeline, which connects substantial natural gas reserves in the Appalachian Basin to markets in southern Virginia, including the growing data center market.

Renewables are often installed in locations distant from data centers, adding to the complexity of meeting energy demands solely with green power. Dominion Energy, in its 2023 resource plan, has outlined scenarios for adding between 0.9 to 9.3 gigawatts of new natural gas capacity over the next 25 years. The company notes that gas turbines will be crucial for bridging gaps when renewable energy production is low, with the flexibility to eventually integrate clean hydrogen.

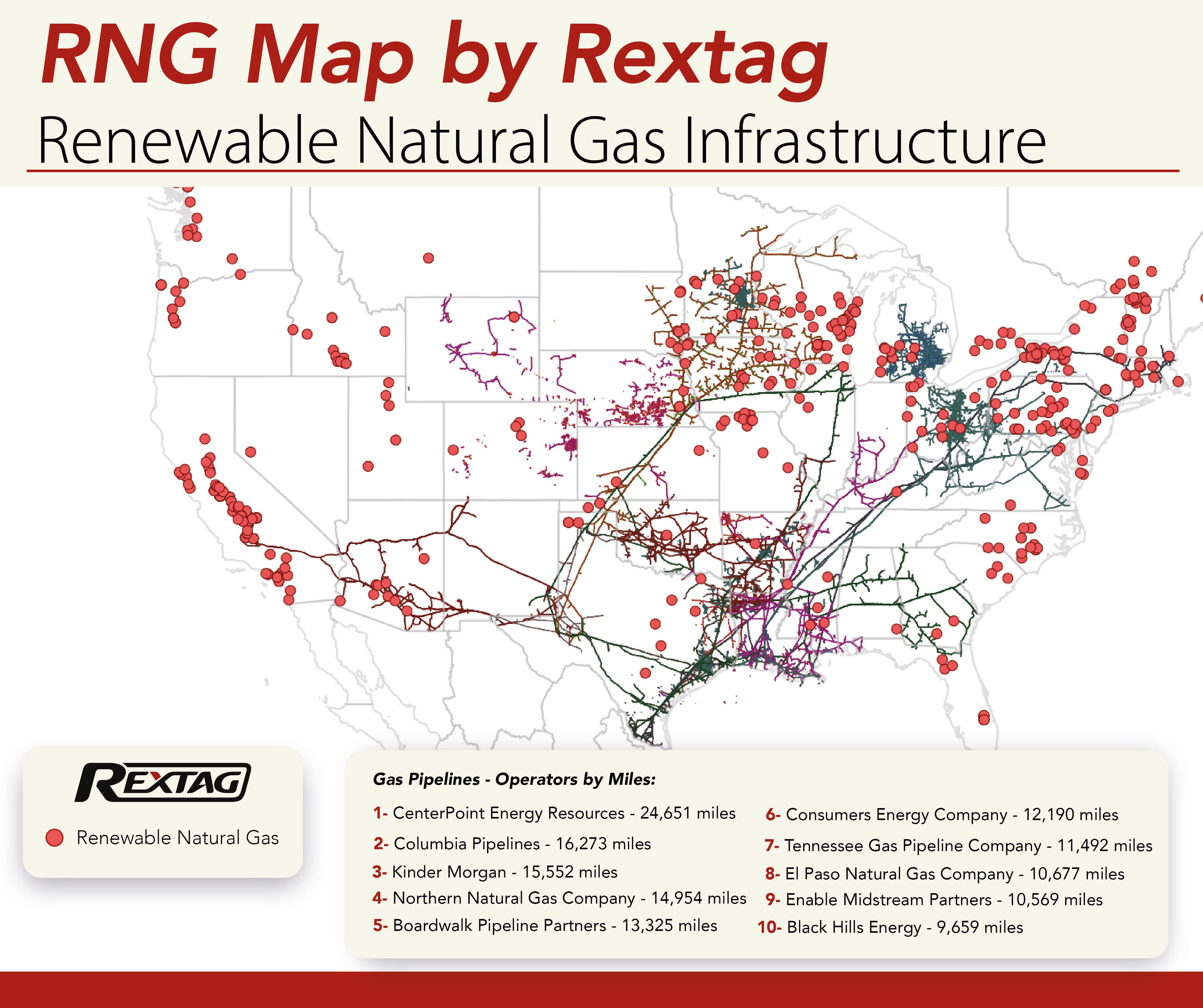

Rextag consistently monitors and compiles data on Natural Gas. Discover detailed insights in our exclusive ‘American Gas Data & Map Book’.

Pros of Renewable Natural Gas (RNG)

- Climate Impact Reduction: RNG captures methane emissions from natural sources and repurposes it, cutting down on the greenhouse gases that would have resulted from organic decomposition. Using RNG in place of fossil fuels can lead to a carbon-negative effect since it replaces more emissions-intensive sources like coal or natural gas.

- Flexibility in Energy Use: RNG offers a unique advantage by being usable at any time, unlike solar and wind energy which depend on weather conditions. This makes RNG a reliable complement to intermittent renewable energy sources.

- Economic Efficiency: Replacing just under 20% of conventional natural gas with RNG could achieve the same emissions reductions as electrifying 100% of buildings by 2030, but three times more cost-effectively. RNG can replace 4-7% of current fossil gas consumption, highlighting its potential as a scalable alternative.

- Infrastructure Advantage: RNG can utilize the existing gas pipeline and fueling infrastructure, which facilitates a smoother transition and lower upfront costs compared to building new infrastructure for alternative energies.

- Local Benefits: Using RNG reduces local waste and the volume of materials sent to landfills. It also minimizes long-distance transportation emissions since it's often produced and consumed locally.

Cons of Renewable Natural Gas (RNG)

- Emission Concerns: Although RNG reduces methane leakage, its combustion still emits CO2. At typical production intensities (around 2.3% methane intensity), it doesn’t eliminate greenhouse effects but modifies them. Achieving meaningful impact requires maintaining low leakage rates below 4% to sustain its climate benefits over coal.

- Market Dependency Risks: The economic viability of RNG can sometimes drive increased production of crops for RNG rather than food, which could shift agricultural priorities and negate environmental benefits if not managed sustainably.

- Potential to Sustain Fossil Fuel Usage: By integrating into the existing natural gas system, RNG could inadvertently prolong the use of fossil fuel infrastructure and slow down the shift to more sustainable, renewable energy sources.

- Cost and Scale Challenges: While beneficial, RNG is expensive and difficult to scale. Meeting large-scale energy demands with RNG alone is challenging, making it a complementary rather than a primary solution in the broader energy transition.

- Regulatory and Social Acceptance Challenges: Even with advancements, the need for stringent regulation and broad societal acceptance poses hurdles for RNG, particularly in regions heavily reliant on traditional energy sources.

The Rise of Natural Gas and Renewables

From the late 2010s through to the early 2020s, the U.S. energy sector underwent a notable transformation, shifting significantly towards natural gas and renewable sources while moving away from coal. By 2020, coal use had dropped dramatically to just 10.7 quadrillion BTUs, largely due to the shutting down of many coal-fired plants in favor of cleaner alternatives.

At the same time, natural gas usage saw a substantial increase, reaching 32.6 quadrillion BTUs by 2020. It played a crucial role in providing consistent, on-demand power and helped to stabilize the supply against the intermittent nature of renewable energy sources like wind and solar. The consumption of renewable energy also saw impressive growth, reaching 12.1 quadrillion BTUs in 2020, boosted significantly by advances in wind, solar, and biomass technologies.

By 2023, although there was a slight uptick in coal consumption, the usage of natural gas continued to rise, hitting a new peak at 36.5 quadrillion BTUs. Renewable energy sources also reached a record consumption level of 14.7 quadrillion BTUs, driven by continued investments in renewable infrastructure and the increasing integration of wind and solar into the national energy grid.

Over the span from 2000 to 2023, the shift in the U.S. energy landscape was profound. Coal consumption saw a sharp decrease of 13.0 quadrillion BTUs, while natural gas consumption increased by 13.4 quadrillion BTUs, and renewables saw an increase of 8.4 quadrillion BTUs.

Renewable Natural Gas vs. Fossil Gas

Traditional natural gas, typically accessed through deep underground drilling techniques such as fracking, has been a cornerstone of our energy supply. This method extracts fossil fuels that have been stored beneath the earth for millennia. Associated often with oil drilling, traditional natural gas has a considerable carbon footprint, especially when burned for electricity or heating. For every million British thermal units (Btu) generated, natural gas emits about 117 pounds of CO2. In comparison, this is about half the emissions of coal, but in 2020 alone, natural gas contributed to 1,651 million metric tons of CO2 emissions in the United States—twice as much as coal and representing 80% of the total emissions from oil.

Given these facts, how can another form of natural gas be part of an environmental solution? Enter Renewable Natural Gas (RNG), which differs from fossil gas in several key aspects:

- Origin: Unlike fossil gas, which is extracted from geological formations, RNG is produced from the decomposition of organic waste materials such as food scraps, lawn clippings, wood scraps, and agricultural waste.

- Production Process: RNG is generated through the anaerobic digestion of these organic materials, a natural process where bacteria break down the waste in the absence of oxygen, producing methane and CO2 as byproducts.

- Environmental Impact: Methane, a primary component of RNG, has over 80 times the warming power of CO2 over 20 years, making its capture and use critical. However, the methane from RNG is part of a short carbon cycle, where carbon released into the atmosphere was recently captured by the same or similar organic materials, making it nearly carbon-neutral.

- Utilization: Methane captured from organic decomposition can be used similarly to fossil natural gas but without new carbon emissions since it recycles carbon that's actively part of the current carbon cycle.

Interestingly, the entities that manage most of the country’s gas distribution also oversee the majority of solid waste and wastewater facilities, which together provide over 77% of the RNG feedstock—73% from solid waste and 4% from wastewater.

5 Ways of Decarbonization with Natural Gas

- Substituting Coal with Natural Gas

Coal-to-gas substitution reduces emissions by over 50%. Coal accounts for 43% of global energy-related greenhouse gas emissions. China, as the largest consumer, uses half of the global steam coal primarily for power generation and industrial processes, with India and the US also being significant users. By replacing old coal plants with efficient natural gas plants, emissions can be halved per electricity unit. Furthermore, natural gas plays a critical role in producing ammonia and methanol, often used in place of coal, especially in China’s steel sector through direct reduced iron technology.

- Partnering with Renewable

Power Natural gas supports variable renewable energy sources. Renewable energy, particularly variable sources like wind and solar, plays a crucial role in the energy transition but requires backup to manage long-duration storage needs. With current technology, gas-fired power remains the primary option to complement renewables due to its dispatchability, often providing more energy than the primary renewable sources themselves.

- Replacing Oil with Natural Gas

Natural gas can substitute oil in power and transport. In stationary setups, particularly in the Middle East, natural gas has the potential to replace 1.6 million barrels of oil used daily for power generation. Additionally, as electric vehicles (EVs) gain traction, natural gas-fired power will be essential to meet the increased electricity demand, serving as a transitional fuel for EVs and potentially for medium and heavy-duty vehicles through compressed natural gas or methanol.

- Advancing Carbon Capture, Utilization, and Storage (CCUS)

CCUS can capture up to 95% of emissions in industrial applications. Already established in the oil and gas sectors, CCUS needs scaling to address emissions from hard-to-decarbonize industries like steel, cement, and glass, which typically use natural gas. Projected to increase by over 30 times by 2050, CCUS could capture 1.5 to 6 gigatons of carbon annually.

- Expanding Hydrogen Production

Hydrogen from natural gas will complement green hydrogen. Recognized as a key decarbonization element, hydrogen could account for up to 25% of energy end-use by 2050. While green hydrogen will be produced through electrolysis using renewable power, the anticipated high demand for direct power and hydrogen means that blue hydrogen, made from natural gas, will be crucial.

Generating Green Gas Energy

Renewable natural gas (RNG) stands out as an environmentally friendlier alternative to conventional natural gas extracted through drilling and fracking. The latter process, which involves fracturing rock formations using water, chemicals, and sand, can have severe impacts on landscapes and ecosystems.

Conversely, biogas facilities utilize existing waste materials—like animal manure, crop residues, and food waste—that would otherwise contribute to landfill mass. These organic materials are processed in biogas plants or digesters where microorganisms break them down to produce biogas.

This biogas is then purified and conditioned to remove or reduce non-methane components, allowing it to meet the quality standards of conventional natural gas. This cleaned and upgraded biogas, or RNG can be fed into existing pipeline infrastructure, providing seamless integration into the energy system without the need for significant new infrastructure investments.

In the U.S., municipal solid waste landfills are the third-largest source of human-made methane emissions, accounting for 14.5% of such emissions in 2020. This is comparable to the greenhouse gases emitted by 20.3 million passenger vehicles in a year. Additionally, agriculture contributes another 25% of methane emissions, much of which comes from cattle farming—another source of organic waste for biogas production.

RNG’s ability to be stored and used on demand makes it a versatile and valuable component of the renewable energy landscape, offering a reliable alternative to intermittent energy sources like wind and solar.

Transitions Away From Coal

As the U.S. transitions away from coal and integrates more renewable energy sources, natural gas is poised to play a pivotal role in maintaining energy security. According to the Energy Information Administration (EIA), natural gas will continue to be a key energy source, generating approximately 1,700 billion kWh annually over the next few years. This steady output is crucial as the nation phases out coal plants and ramps up renewable energy production.

The decline in coal capacity is significant; from a peak of 318 GW in 2011, it is projected to fall to 159 GW by 2026 and further to 116 GW by 2030. The Institute for Energy Economics and Financial Analysis highlights that 173 coal plants are expected to retire by 2030. While renewable energy is expanding, it is not yet able to fully compensate for the reduction in coal-generated power.

Natural gas not only supports the grid during this transitional period but also ensures reliability in energy supply. The current infrastructure of the U.S. power grid is under transformation to better accommodate and store renewable energy, which presently shows a capacity factor of only 10-30% for wind and solar.

Renewable Natural Gas from Municipal Waste and Landfills

In the U.S., waste from landfills and wastewater treatment plants is the third-largest source of methane emissions, a potent greenhouse gas. Surprisingly, most of this methane is still uncollected, unused, and thus not monetized. Capturing biogas from these sources and converting it to energy instead of simply burning it off (flaring) can turn a waste problem into an energy solution while significantly reducing emissions. Currently, less than 10% of municipal wastewater treatment facilities in the U.S. capture biogas, and only 2% of these facilities upgrade the biogas to renewable natural gas.

Renewable natural gas projects are present in most states, with many more opportunities for development. About a dozen states are actively producing renewable natural gas from wastewater reclamation, while landfill gas projects are in operation in half of the states. Planned and ongoing projects are expected to double the number of landfill gas projects across 37 states. Almost all states are capturing landfill biogas for energy projects, with 1,538 landfills identified as potential sites for such projects, two-thirds of which are publicly owned.

A notable example from 2023 highlights New York City, which could replace up to 27% of its fossil gas usage with carbon-negative renewable natural gas derived from wastewater biogas combined with food waste. This would suffice to fuel the city’s entire municipal heavy-duty truck fleet. New York City is advancing towards this goal, with facilities like the Newtown Creek Wastewater Facility already producing renewable natural gas through the co-digestion of solid and water waste, helping the city progress toward its climate objectives.

In Texas, the rapid expansion of wind and solar energy, which now accounts for about 29% of the nation’s total electricity from nonhydroelectric renewable sources, brings lower energy prices and reduced emissions. This growth is projected to bring economic and environmental benefits worth up to $109 billion, saving consumers between $21 billion and $43 billion through 2025.

In Northeast Pennsylvania, the state boasts its largest landfill, sprawling nearly three square kilometers and filled with both household and industrial waste. This region illustrates a potential hotspot for renewable natural gas (RNG) production, though its geographic location means this gas won't directly supply markets on the West Coast.

Meanwhile, FortisBC, the largest natural gas utility in British Columbia, is looking to enhance its renewable energy portfolio by integrating RNG from distant locations like Pennsylvania. Despite the physical distance, FortisBC's strategy involves purchasing RNG from out-of-province sources like Pennsylvania to offset the emissions from the fossil gas it supplies to its British Columbia customers. The plan proposes that RNG purchased by FortisBC is used in Pennsylvania, allowing an equivalent amount of fossil gas consumed in British Columbia to be counted as renewable. This accounting trick is part of FortisBC's effort to present a greener image, even though the majority of its gas supply will remain non-renewable for the foreseeable future.

FortisBC's ambitious plan comes with significant costs due to the complexities and higher expenses associated with RNG production—up to five times more than conventional fossil gas. To manage these costs, FortisBC is seeking regulatory approval to pass on these costs to consumers through rate increases, which could total approximately $750 million by 2030.

On a broader scale, if the U.S. could fully harness and upgrade the biogas from all public and private landfills and wastewater treatment plants, RNG could potentially meet about 4.4% of the nation's total fossil gas demand. Specifically, it could satisfy 16.5% of the demand from core gas customers and over half of the gas demand in the chemicals subsector, which is the industrial sector’s largest consumer of natural gas.

The State of the US RNG Market in 2024

The renewable natural gas (RNG) industry in the United States, although still relatively small compared to traditional natural gas, has experienced remarkable growth over the last decade. As of 2023, RNG production was estimated to be between 0.2 and 0.4 billion cubic feet per day (bcf/d), a fraction of the domestic geological gas production which stood at approximately 103 bcf/d. The significant growth of RNG has primarily been observed in the on-road transportation sector.

This expansion has been largely driven by pivotal regulatory frameworks like the federal Renewable Fuel Standard (RFS) and the California Low Carbon Fuel Standard (LCFS). The RFS mandates that a minimum volume of the fuel used in the U.S. transportation sector must be derived from renewable sources. Similarly, the LCFS aims to reduce greenhouse gas emissions and promote the use of low-carbon fuels in California's transportation sector. These standards not only aim to lower the carbon intensity in transportation but also incentivize the adoption of cleaner fuel alternatives.

Oregon and Washington have also adopted state-level clean fuel programs inspired by California's LCFS, further bolstering the growth of RNG within their transport sectors. These programs provide pathways to generate credits for compliance markets, significantly altering the economic landscape for RNG projects. Such financial incentives have allowed RNG to capture a substantial 84% market share in the natural gas vehicle transportation sector as of 2022,

The Future Scale of the RNG Market

The renewable natural gas (RNG) market, while poised for growth, is projected to remain a relatively minor component of the overall U.S. natural gas supply. Even under optimal conditions, if the entire estimated potential for RNG in the U.S. were to be realized, it would still represent less than 10% of today's production from geologic sources. Forecasts for RNG production by 2050 vary significantly, ranging from 2 to 4 billion cubic feet per day (bcf/d). This variability highlights several factors influencing RNG growth, including fluctuating transportation market credit incentives, the scalability of feedstock sources, and the high incremental costs compared to geologic natural gas.

Currently, around 70% of U.S. RNG is produced from landfill sources, with the remaining 20% primarily derived from agricultural waste, notably manure from dairy farms. The dominance of landfill-derived RNG is attributed to several factors: economies of scale in typical projects, readily available feedstock, existing infrastructure for landfill gas collection, and the capacity for on-site utilization of non-upgraded biogas for electricity and combined heat and power generation. Moreover, using RNG helps avoid the need to flare biomethane, and in many instances, facilities are strategically located near potential customers, enhancing the economic feasibility of these projects.

The renewable natural gas (RNG) industry in the United States is showing promising signs of growth. As of 2019, the U.S. consumed 261 billion cubic feet (BCF) of RNG, primarily utilized by independent power producers, electric utilities, and various commercial and industrial entities. However, this figure represents only a small fraction of its potential. Research indicates that the U.S. could theoretically produce up to 2,200 BCF of RNG through anaerobic digestion alone, which would equate to about 11% of daily national natural gas consumption.

The growth trajectory of the RNG sector is particularly impressive. Over the last five years, the number of RNG production facilities has more than tripled, reaching 115 operational sites. This upward trend is expected to continue, bolstered by the support from states like California, Washington, and Oregon. These states, known for their proactive climate policies, have incorporated RNG into their official climate goals and targets, underscoring the sector's potential to play a significant role in the transition to a more sustainable energy future.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Can Oil-Rich Texas Be a Clean Energy Titan: Sugary Sweet Attempt at Leading the Renewable Revolution

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/315_blog_Can Oil-Rich Texas Be a Clean Energy Titan Sugary Sweet Attempt at Leading the Renewable Revolution.jpg)

Texas is taking bold steps toward a future powered by clean energy. Once known mainly for its oil and gas, the state is now a leader in wind, solar, and battery storage. But as electricity demand grows, so do the challenges of balancing energy needs with infrastructure limits. Here’s a look at how Texas is transforming and what hurdles lie ahead + find out who works with Facebook’s parent company Meta on new technology across the U.S.

New York's Race Against Time: Can Solar and Wind Power Save the Big Apple from an Energy Crisis?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/313_Blog_New York's Race Against Time Can Solar and Wind Power Save the Big Apple from an Energy Crisis_.jpg)

Power Plants: 124955 MW Solar: 63726 MW Wind: 2204 MW Biodisel Plants: 1.5 Mmgal/yr capacity Source: Rextag Energy DataLink

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?