Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

New York's Race Against Time: Can Solar and Wind Power Save the Big Apple from an Energy Crisis?

10/01/2024

- Power Plants: 124955 MW

- Solar: 63726 MW

- Wind: 2204 MW

- Biodisel Plants: 1.5 Mmgal/yr capacity

Source: Rextag Energy DataLink

Can Renewables Meet New York's Ambitious Energy Goals?

- New York may miss the 2030 target by 3 years, with the 70% goal now projected to be reached by 2033 (NYSERDA report, July 2024).

New York has set itself some of the most ambitious clean energy targets in the country, aiming to generate 70% of its electricity from renewable sources by 2030 and achieve a completely carbon-free power grid by 2040. However, despite being a leader in renewable energy, with over half of its electricity already coming from clean sources as of 2022, the state is facing significant challenges. Rising costs, project delays, regulatory bottlenecks, and staffing shortages could all jeopardize these ambitious goals.

In 2022, New York generated 51% of its electricity from clean energy sources, with nuclear power and hydroelectric energy leading the way. While solar and wind are growing in prominence, recent setbacks have called into question whether the state can reach its 2030 and 2040 deadlines.

The Solar Surge: A Bright Spot Amid Challenges

- Installed Solar Capacity: 5.7 GW installed by April 2024, approaching 2025 target of 6 GW.

- Additional 3.4 GW of projects in advanced stages of development.

- Contribution: 4% of total energy in 2022, two-thirds from small-scale distributed solar (rooftop panels).

- Incentives: 30% federal tax credit (Inflation Reduction Act) + NY rebates and property tax abatements (up to 90% of installation costs covered).

- System Lifespan: Solar pays for itself within 10 years, lasts 25+ years.

One of the few bright spots in New York’s clean energy transition is its progress with solar energy. Solar power is playing an increasingly vital role in the state’s energy mix, thanks to aggressive policies and incentives that have made it financially feasible for both residents and businesses to adopt solar technology.

As of April 2024, New York had installed nearly 5.7 gigawatts of solar power, placing it just shy of its 2025 goal of 6 gigawatts. The state is expected to exceed this target due to an additional 3.4 gigawatts of projects currently in advanced stages of development.

Solar power’s rapid expansion has been driven primarily by small-scale, distributed installations, such as rooftop solar panels on homes, businesses, and public buildings. Two-thirds of New York’s solar power output comes from these smaller installations, which are faster and easier to deploy than larger utility-scale projects. Programs like net metering, combined with federal and state incentives, have made solar adoption more accessible and financially attractive for individuals and businesses alike.

Federal incentives, particularly the 30% tax credit provided by the Inflation Reduction Act, have been a major driver of this growth. On top of that, New York offers various up-front rebates and tax credits, including property tax abatements for New York City property owners who install solar panels. For many New Yorkers, these incentives can cover as much as 70% to 90% of the total installation cost, significantly reducing the financial burden and accelerating adoption.

Solar’s success in New York provides a critical pillar of the state’s clean energy plan, but despite this progress, solar alone won’t be enough to meet the state’s ambitious goals. Solar’s contribution to the overall energy mix remains small compared to nuclear and hydroelectric power, accounting for just 4% of the state’s total energy in 2022. Therefore, New York needs other renewable sources, especially wind, to catch up if it is to achieve its 2030 and 2040 targets.

Offshore Wind: Immense Potential, Persistent Problems

- Current Wind Contribution: 12% of New York’s renewable energy in 2022, with 2,500 MW installed across 32 wind farms.

- Expansion Goal: 9,000 MW of offshore wind by 2035.

- Challenges: 3 offshore wind projects canceled due to turbine supply issues and rising costs.

- Cost Impact: Empire Wind 1 and Sunrise Wind re-contracted at 30% higher costs, raising consumer bills by 2% ($2/month) over 25 years.

Wind energy, both onshore and offshore, holds immense potential for helping New York meet its renewable energy goals, but it also faces some of the biggest hurdles. In 2022, wind contributed about 12% of the state’s renewable energy generation, making it a significant player in the energy mix. New York has already installed over 2,500 megawatts across 32 wind farms, with ambitious plans to expand offshore wind projects, particularly in areas like the Great Lakes and off the coast of Long Island.

The state’s long-term goal is to add at least 9,000 megawatts of offshore wind by 2035. Projects like Empire Wind 1, Sunrise Wind, and Beacon Wind were expected to anchor New York’s offshore wind expansion, providing clean electricity to millions of homes. However, these projects have encountered a range of challenges, including rising costs, technical difficulties, and supply chain disruptions.

One of the most significant setbacks occurred earlier this year when three major offshore wind projects were canceled due to issues with turbine delivery and rising construction costs. GE Vernova, the company supplying the turbines, scaled back production of its 18-megawatt turbines, forcing developers to redesign projects with smaller, less efficient turbines. This not only delayed project timelines but also made the projects economically unviable. Additionally, the cost of building offshore wind farms has skyrocketed, increasing by 60% between 2021 and 2024 due to inflation, supply chain disruptions, and higher interest rates.

Despite these challenges, New York continues to move forward with its offshore wind plans. Recently, the state re-awarded contracts for key projects, such as Empire Wind 1 and Sunrise Wind, though at a significantly higher cost to consumers. The cost of these projects increased by about 30%, resulting in a forecasted increase in energy bills of about 2% per month for New Yorkers over the next 25 years. This has raised concerns about the long-term affordability of offshore wind, even as the state continues to prioritize its development.

The offshore wind industry is still seen as a crucial component of New York’s renewable energy strategy. The shallow waters off New York’s coast offer some of the best wind resources in the world, making it an ideal location for offshore wind development. However, the path forward will require overcoming both economic and technical challenges, as well as addressing concerns about the long-term cost to consumers.

New Projects: Building Toward a Greener Future

Despite the challenges, New York continues to push forward with new renewable energy projects. In September 2024, the state approved two major renewable projects:

- Rich Road Solar Energy Center: Located in St. Lawrence County, this 240-megawatt solar farm, paired with 20 megawatts of battery energy storage, is expected to generate enough clean energy to power more than 61,000 homes. This project represents a significant investment in solar energy, further boosting New York’s growing solar portfolio.

- Prattsburgh Wind LLC: This 147-megawatt wind farm, located in Steuben County, is expected to generate enough electricity to power 62,000 homes. This project is part of New York’s ongoing effort to expand its wind capacity, particularly onshore, as the state seeks to diversify its renewable energy sources.

Delays in Siting and Permitting: A Major Roadblock

One of the most significant obstacles to New York’s clean energy transition is the slow pace of approving renewable energy projects. The state’s Office of Renewable Energy Siting (ORES) was created under the Climate Leadership and Community Protection Act (CLCPA) to accelerate the siting of large-scale renewable energy projects, but the process has remained frustratingly slow.

A recent audit from the New York State Comptroller revealed that it takes an average of 3.7 years for renewable energy projects to receive siting permits, well beyond the timeline necessary to meet the state’s 2030 goals. The primary cause of these delays is the complex nature of environmental reviews and the community engagement processes required for large-scale renewable energy projects. Additionally, many of these delays stem from staffing shortages within the New York State Department of Public Service (DPS) and other regulatory agencies.

The DPS, which oversees utilities and manages the state’s transition to renewable energy, has been severely understaffed for years. At its peak in the 1990s, the DPS had over 700 employees. Today, it has fewer than 500, despite having far greater responsibilities. These staffing shortages have slowed everything from permitting renewable projects to managing customer complaints, leaving many developers frustrated by the pace of progress.

In response to these challenges, the state has passed new legislation, including the Renewable Action Through Project Interconnection and Deployment (RAPID) Act, which aims to streamline the permitting process by transferring ORES from the Department of State to the larger and more experienced Department of Public Service. This change is expected to reduce delays and improve efficiency, though it remains to be seen whether these efforts will be enough to meet New York’s looming deadlines.

The 2030 Shortfall: A Looming Challenge

- Projected Shortfall: Only 63% renewable energy expected by 2030, falling short of the 70% target.

- Challenges: Rising costs, supply chain disruptions, permitting delays; 51 renewable projects backed out in 2023.

- Environmental Impact: Extended reliance on fossil fuels will disproportionately affect low-income and minority communities with increased pollution.

While New York has made significant strides in its clean energy transition, the state is unlikely to meet its 2030 goal of sourcing 70% of its electricity from renewable energy. A draft report from NYSERDA and the Department of Public Service recently acknowledged that the state could miss the 2030 target by three years, pushing the deadline to 2033.

The reasons for this shortfall are varied but include the rising costs of renewable projects, supply chain issues, and delays in the permitting process. Additionally, many renewable energy projects have been canceled or delayed in recent years, further compounding the challenge. For example, 51 projects that had previously secured contracts with NYSERDA backed out in 2023, largely due to financial concerns.

Missing the 2030 deadline would not only delay New York’s clean energy transition but also prolong the state’s reliance on fossil fuels. This would have serious environmental and health consequences, particularly for low-income and minority communities that are disproportionately affected by pollution from fossil fuel plants. Moreover, missing the 2030 target could undermine public confidence in New York’s ability to achieve its longer-term goal of a zero-emission electric grid by 2040.

Conclusion: The Clock Is Ticking

New York is at a critical juncture in its clean energy transition. The state has made significant progress in expanding its solar capacity and remains committed to developing offshore wind, but delays in project siting, staffing shortages, and rising costs threaten to derail its ambitious goals.

Solar energy offers a bright spot, with New York on track to exceed its 2025 solar target, but offshore wind faces more persistent challenges. The state’s ability to streamline the permitting process and invest in workforce development will be crucial in determining whether it can meet its 2030 and 2040 targets.

The path forward will require continued investment in both public and private renewable energy projects, along with reforms to reduce regulatory delays. If New York can overcome these challenges, it still has a chance to lead the nation in the transition to a carbon-free future—but the clock is ticking, and there’s no time to waste.

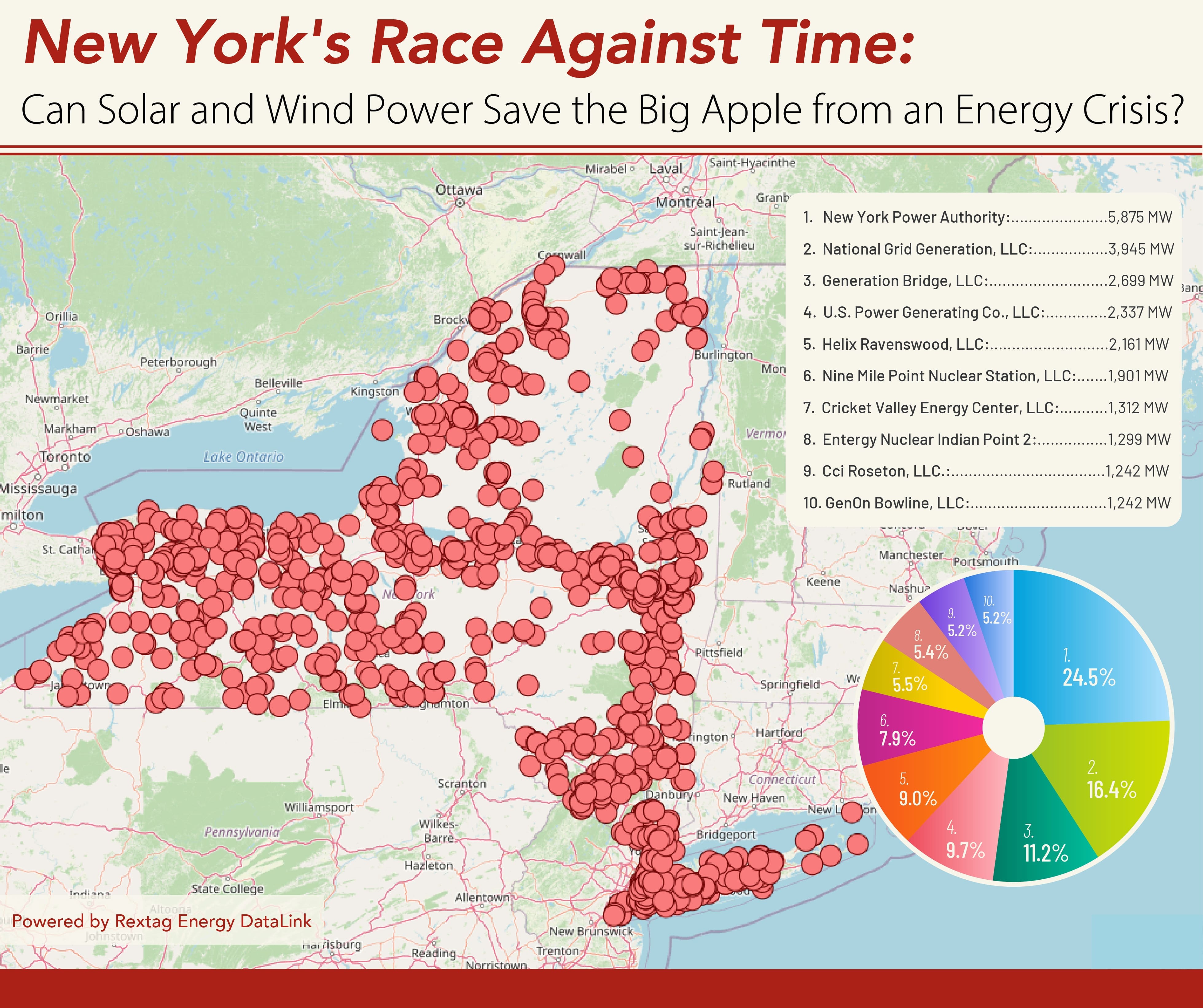

313_TOP 10 Operators in the New York State by Capacity (MW).jpg)

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

A Green Future: $2 Trillion Investment in Clean Energy on the Horizon for 2024

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/285_Blog_A Green Future_ $2 Trillion Investment in Clean Energy on the Horizon for 2024.jpg)

The global investment in upstream oil and gas is also set to rise by 7% in 2024 to $570 billion, continuing the growth trend from 2023. National oil companies in the Middle East and Asia primarily drive this increase. This year, the global shift toward clean energy will see investments reaching a monumental $2 trillion, according to the International Energy Agency (IEA). This amount is double what is being invested in fossil fuels. In its annual World Energy Investment report, the IEA highlights that for the first time, total energy investment will surpass $3 trillion in 2024.

After Hurricane Beryl, U.S. Aims High to Sustain Solar Energy Growth and Stay Top in Renewables

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/294_blog_After Hurricane Beryl, U.S. Aims High to Sustain Solar Growth and Stay Top in Renewables.jpg)

Texas energy companies are picking up the pieces after Hurricane Beryl, an early Category 5 hurricane, hit the U.S. Gulf Coast earlier this week. However, it weakened to Category 1 by the time it made landfall in Texas. The hurricane brought heavy rainfall and sparked fears of storm surges, flooding, and tornadoes. As Hurricane Beryl neared, the natural gas supply to Freeport LNG’s export facility in Texas nearly stopped the day before the storm struck. Houston was particularly hard-hit, with the storm knocking out power for two million residents. CenterPoint Energy, a key power provider in the area, felt the brunt of the hurricane but aimed to have power restored to half the affected customers by the following day.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/325_Blog_ Expand Energy's Operations (formerly Chesapeake) .jpg)

Before it was Expand Energy, the largest natural gas-weighted exploration and production company in the U.S., it was Chesapeake Energy. This company faced and survived nearly every extreme the energy industry could throw, including bankruptcy. With its recent $7.4 billion merger with Southwestern Energy, Expand Energy has achieved a new milestone: it’s the largest natural gas producer in the U.S., powered by substantial reserves and resources across crucial shale regions.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/324_Blog_Gulf Oil Operators Chevron, BP, Equinor, Shell Brace as Tropical Storm Rafael Threatens Production.jpg)

Oil companies across the Gulf of Mexico are springing into action as Tropical Storm Rafael bears down, marking yet another disruption in a storm-laden season. BP, Chevron, Equinor, and Shell are evacuating offshore staff and preparing for potential impacts on their platforms, an all-too-familiar ritual for Gulf operators this year.