Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Rail Permit for New Fortress to Ship LNG Expired, Putting Future Projects at Risk

12/14/2021

The U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) granted Energy Transport Solutions a permit on Dec. 5, 2019, to transport refrigerated liquid methane in tank cars that meet specifications set by the Department of Transportation. Yet, the permit to ship liquefied natural gas (LNG) by rail expired on Nov. 30, prompting to wonder whether the company will proceed with related initiatives.

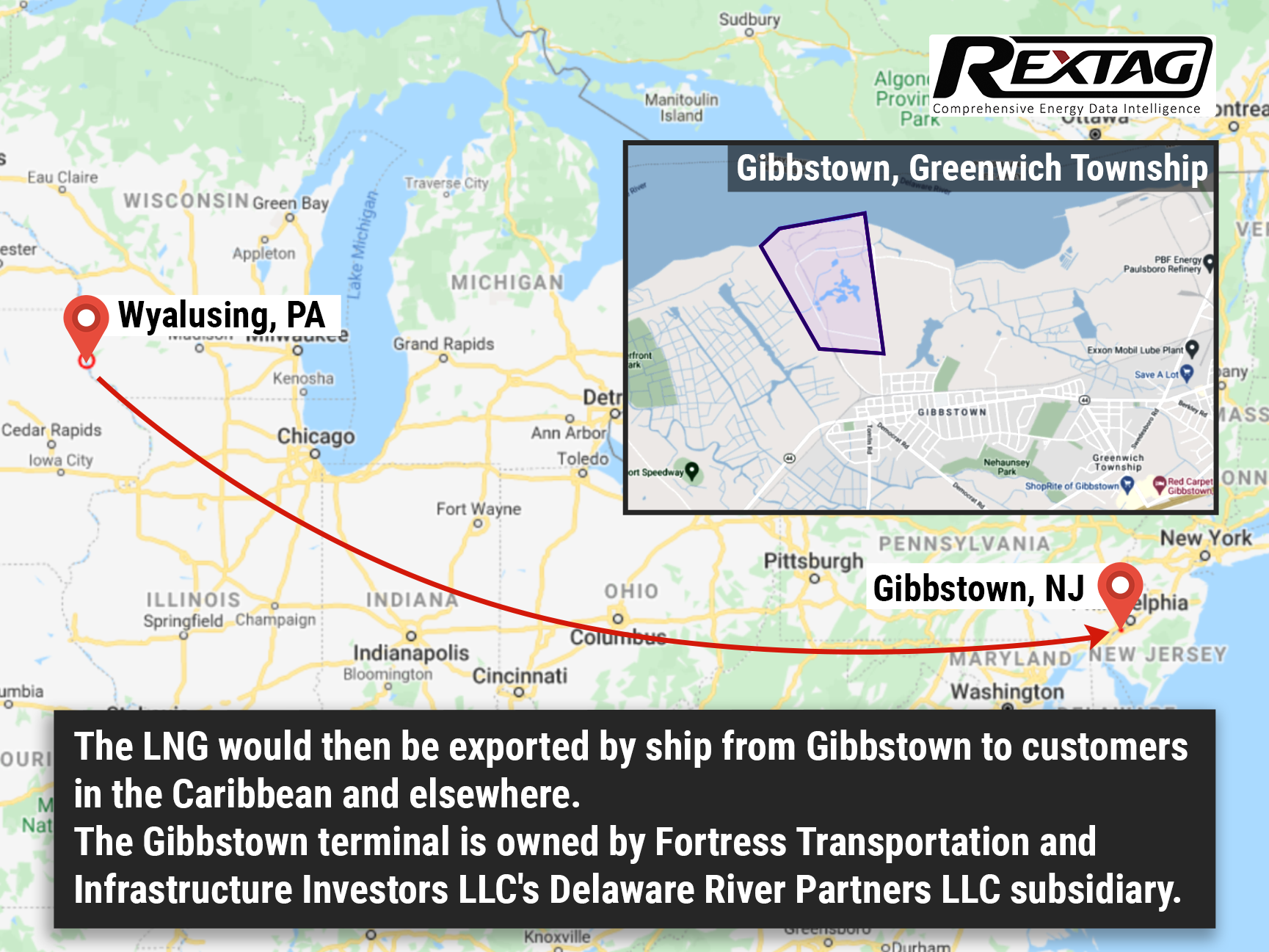

One of the projects in question is located in northeast Pennsylvania, Wyalusing: where New Fortress originally planned to transport NLG from its future liquefaction plant to Gibbstown, New Jersey. Afterward, customers in the Caribbean and elsewhere would have received LNG shipped from Gibbstown port.

However, The Pennsylvania liquefaction plant, which would liquefy natural gas from the Marcellus shale, still awaits a final decision about construction from New Fortress. It is unclear whether or not this development halted any plans.

According to PHMSA regulations, a special permit holder must apply for renewal at least 60 days before the expiration date in order to avoid expiration. Yet, Delaware Riverkeeper, a group opposing the LNG project, claims that there has not been a renewal request submitted for this permit.

Fortress Transportation, PHMSA, and New Fortress officials did not immediately return messages requesting comment.

Meanwhile, in the same period that the special permit is running out, President Joe Biden's administration is pausing regulations allowing LNG-by-rail so the PHMSA can study safety issues regarding this method of transportation. The action contrasts with that of former President Donald Trump, who in 2019 attempted to dramatically increase the export of LNG from the US, dubbing it as the molecules of freedom.

Despite concerns about the proposed Gibbstown LNG export terminal, Delaware Riverkeeper still believes that New Fortress may continue to pursue it. Even If LNG by rail cannot be accomplished, New Fortress could still transport LNG by truck to the port. After all, New Fortress already spent about $159 million developing the Pennsylvania facility through 2020, according to federal filings.

However, New Fortress appears to have abandoned or stalled its plans to build a liquefaction plant in Wyoming, introduce a new pipeline to deliver feed gas to Wyalusing from shale gas wells, and build a fleet of railcars for transporting LNG, according to Delaware Riverkeeper and other sources.

As a public company, New Fortress invests in, builds, and operates natural gas infrastructure and logistics in order to provide quick, turnkey energy solutions that promote economic growth, enhance environmental stewardship, and increase local prosperity.

For now, though, it remains to be seen, what changes if any, this development will bring to the Fortresses Pennsylvanians projects.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Look At The Future Of American And Appalachian Gas Production

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Look-At-The-Future-Of-American-And-Appalachian-Gas-Production.png)

The crux of the matter is rather simple: productivity gains of local energy operators have been stable not only because they are drilling better acreage, but also because players finally realized capital efficiency gains. And even if some new obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins. The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

Colgate Energy's owners are planning to go public

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Colgate-Energy-owners-are-planning-to-go-public.png)

Colgate Energy is planning to float its shale oil producer in the Permian's Delaware Basin on the stock market. If successful, this IPO would be the first major U.S. oil producer offering since Jagged Peak Energy's IPO in January 2017. Looks like investors’ confidence in the sector is returning as U.S. crude prices hit their highest in seven years late last year S&P energy index delivered roughly twice the return of the S&P 500 in 2021.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?