Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Outrigger Sells Its DJ Basin Assets to Summit for $305 Million to Focus on the Williston Basin

12/15/2022

Recent acquisitions totaling $305 million in cash bring Summit Midstream the opportunity to build up its Denver-Julesburg basin assets.

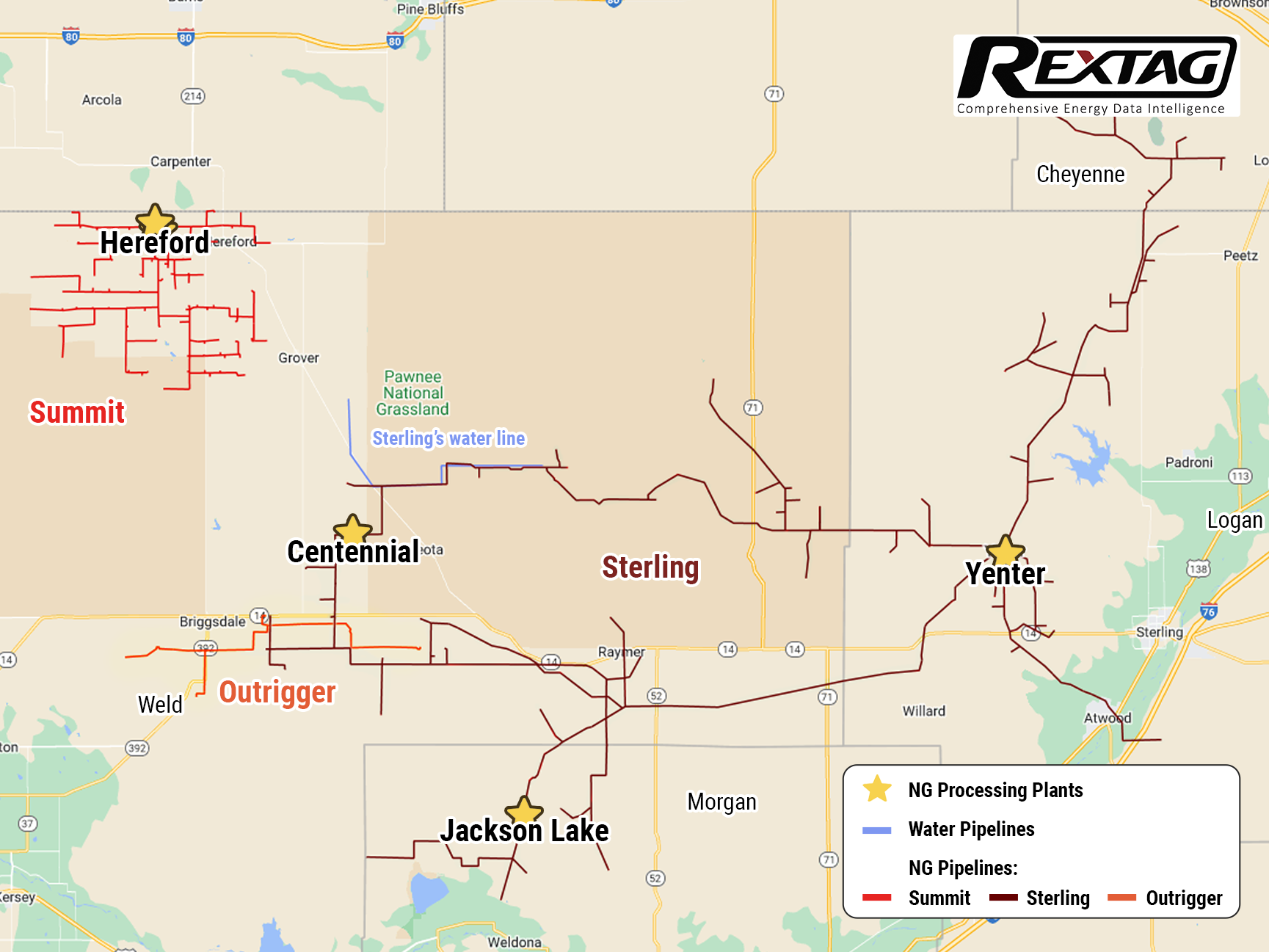

Its subsidiary, Summit Midstream Holdings, concluded a deal to purchase Outrigger DJ Midstream from Outrigger Energy II and Sterling Energy Investments, Grasslands Energy Marketing, and Centennial Water Pipelines from Sterling Investment Holdings.

Weld County-based Outrigger’s assets in Colorado are significant as they include a 60 MMcfd cryogenic natural gas processing plant, almost 70 miles of low-pressure natural gas gathering lines, 90 miles of high-pressure natural gas gathering lines, 12,800 horsepower of field and plant compression, and roughly 30 miles of crude oil gathering pipelines.

The DJ system’s high-pressure gas gathering footprint will now provide Summit with a connection to multiple midstream systems in the DJ Basin, Outrigger president and CEO Dave Keanini said in a company release.

The gathering agreements for Outrigger DJ system are comprised of long-term, fee-based contracts with a weighted average term of over 10 years. Volume throughput on the Outrigger DJ system is underpinned by acreage dedications, with a valued 310,000 leased acres from its key customers, including Mallard Exploration and other producers in the region.

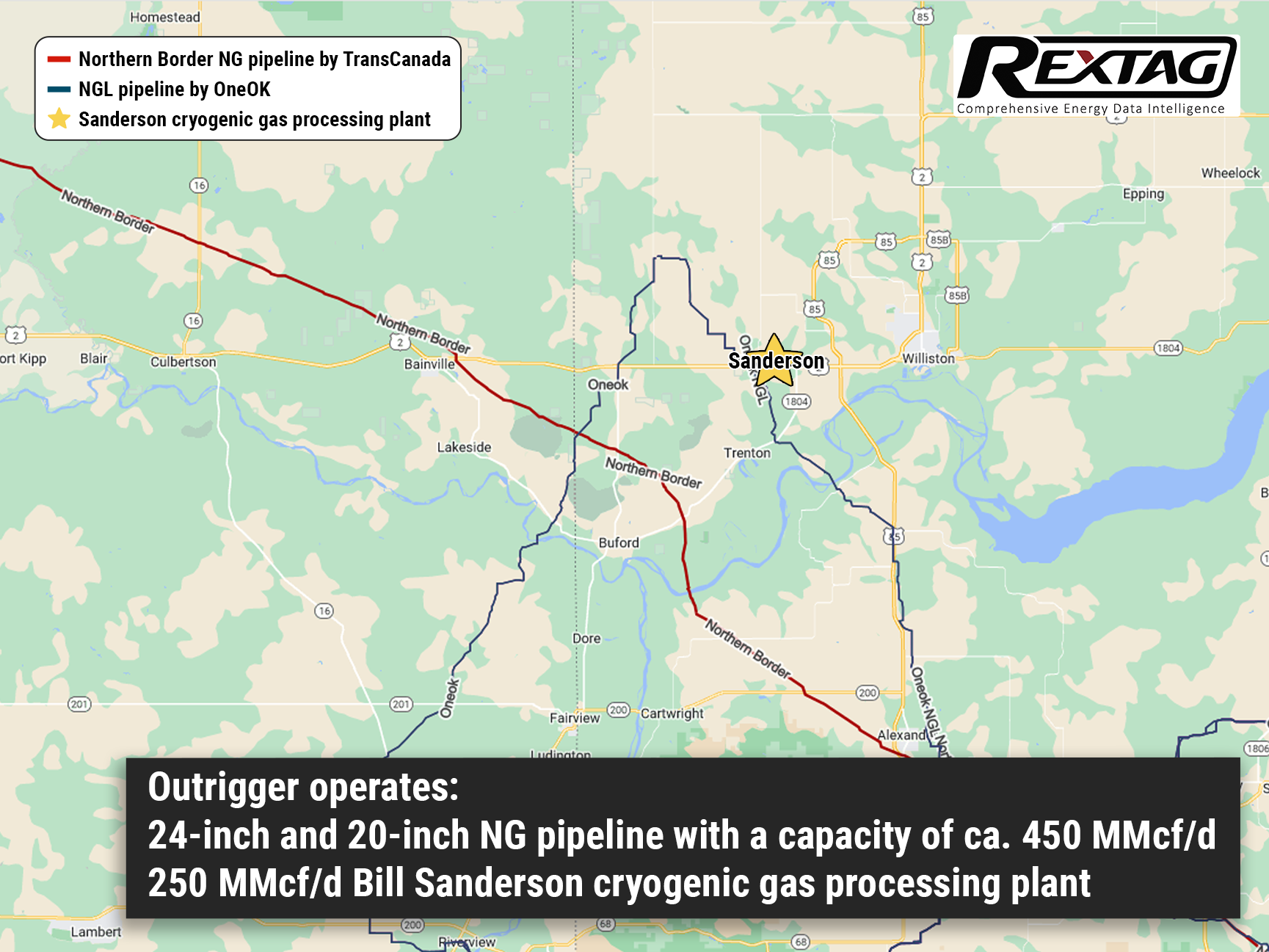

Meanwhile, Outrigger is focusing on expanding its Williston Basin midstream system in Williams and Mountrail counties, N.D. Positioned to supply reliable service upstream in addition to the other midstream operators in the basin, its 24-inch and 20-inch diameter pipeline extends over 100 miles and has a capacity of about 450 MMcf/d.

Multiple customers at different points are serviced by the Williston Basin system pipeline after lengthening the high-pressure, rich gas pipeline from east Williams County into Mountrail County.

Since June Outrigger’s 250 MMcf/d Bill Sanderson cryogenic gas processing plant west of Williston, N.D. maintains nearly 100% runtime. It has ethane recovery and rejection capabilities with direct market access to the Northern Border Pipeline system for residue gas and the ONEOK NGL pipeline system for NGL.

Outrigger anticipates gas deliveries to the company’s system to enlarge throughout 2023, as it creates a system capable of servicing several thousand drilling locations. The company has commenced developing the next processing expansion at the Sanderson plant to handle producers growing gas volumes through the drill bit and GOR increases.

RBC Capital Markets was the lead financial adviser on the Outrigger DJ acquisition. TD Securities was the lead financial adviser on the Sterling DJ acquisition. Locke Lord LLP served as legal adviser to Summit.

Evercore served as the exclusive financial adviser and Vinson & Elkins LLP served as the legal adviser to Outrigger Energy II LLC. TPH & Co., the energy business of Perella Weinberg Partners, served as exclusive financial adviser and Vinson & Elkins LLP served as legal advisor to Sterling Investment Holdings LLC.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R-149 - Blog Exploring the Energy Lifeline_ A Tour of Williston Basin's Pipeline Infrastructure.png)

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

Summit Midstream to Acquire Assets in DJ Basin for $305 Million

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/102Blog_Sterling_Outrigger_in_DJ_Basin_Sold_to_Summit_10_2022.png)

Recent acquisitions totaling $305 million in cash bring Summit Midstream the opportunity to build up its Denver-Julesburg basin assets. Its subsidiary, Summit Midstream Holdings, concluded a deal to purchase Outrigger DJ Midstream from Outrigger Energy II and Sterling Energy Investments, Grasslands Energy Marketing, and Centennial Water Pipelines from Sterling Investment Holdings. Weld County-based Outrigger’s assets in Colorado are significant as they include a 60 MMcfd cryogenic natural gas processing plant, almost 70 miles of low-pressure natural gas gathering lines, 90 miles of high-pressure natural gas gathering lines, 12,800 horsepower of field and plant compression, and roughly 30 miles of crude oil gathering pipelines. The gathering agreements for Outrigger DJ system are comprised of long-term, fee-based contracts with a weighted average term of over 10 years. Volume throughput on the Outrigger DJ system is underpinned by acreage dedications, with a valued 310,000 leased acres from its key customers, including Mallard Exploration and other producers in the region. Moreover, the Sterling DJ assets, in Weld, Morgan, and Logan Counties, Colorado, and Cheyenne County, Nebraska, have three cryogenic processing plants with a nameplate capacity of 100 MMcfd, some 450 miles of natural gas gathering lines, 8,500 horsepower of field compression, freshwater rights, and 40 miles of subsurface freshwater delivery infrastructure.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?