Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

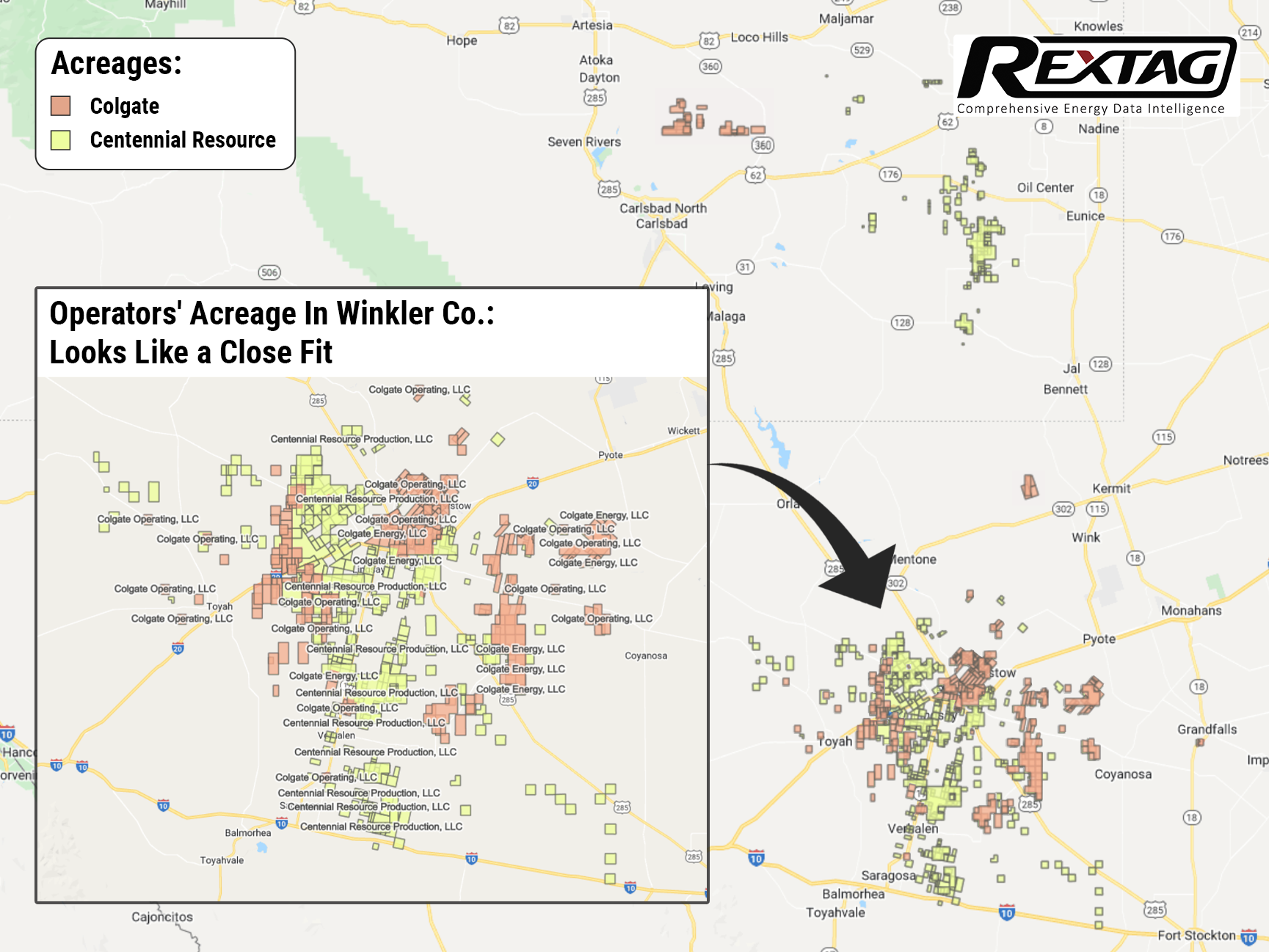

$7 Billion Merger of Colgate and Centennial, the 2 Largest Permian Operators

06/03/2022

Despite the circulating rumors concerning Colgate’s attempt to launch an IPO, on May 19 the company decided to combine with Centennial Resource Development Inc.

This merger of equals is estimated at $7 billion and will found the biggest pure-play E&P company in the Delaware Basin of the Permian. The transformative combination essentially enlarges companies’ potential and hastens the growth across all financial and operating metrics. The net leaseholds ran to 180,000 acres and the current production is estimated at 135,000 boe/d.

According to Centennial CEO Sean Smith, the combined company is anticipated to furnish shareholders with quickened capital return program due to a fixed dividend coupled with a share repurchase plan.

From a capital return perspective, it is noted that the deal unites Centennial’s share repurchase plan—the $350 million, 2-year share buyback authorization with Colgate’s $25 million quarterly base dividend.

Due to a recent report, the merger would increase production 7%, to 145,000 boe/d by the fourth quarter would further ratchet up next year. By third-quarter 2023, the company predicted 160,000 boe/d based on a drilling program of 140 wells per year.

Colgate Energy is a privately held oil and natural gas company based in Midland, Texas. Founded in 2015 with support from Pearl Energy Investments and NGP, the company made several noteworthy acquisitions this year that have significantly boosted its position in the Permian's Delaware Basin.

Moreover, Colgate Energy Partners III LLC gained a trio of purchases in 2021 in the Permian Basin, two with seller Occidental Petroleum Corp., totaling at least $700 million.

Colgate Energy was reported to be getting an IPO last December that sources said would value the company at approximately $4 billion.

Meanwhile, Centennial Resource Development is a Denver-based independent that went public in 2016 following its merger with Silver Run Acquisition Corp., a blank-check company led by industry icon Mark Papa who would continue to lead Centennial until his retirement in 2020.

The combined company will have over 15-years of drilling inventory, assuming its current drilling pace, the companies will produce over $1 billion of free cash flow in 2023 at current strip prices.

Existing Colgate owners will own about 47% and existing Centennial shareholders are expected to own about 53% of the combined company. The closing of the merger depends on customary closing conditions, including approval by Centennial shareholders and regulatory approvals.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Colgate Energy's owners are planning to go public

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Colgate-Energy-owners-are-planning-to-go-public.png)

Colgate Energy is planning to float its shale oil producer in the Permian's Delaware Basin on the stock market. If successful, this IPO would be the first major U.S. oil producer offering since Jagged Peak Energy's IPO in January 2017. Looks like investors’ confidence in the sector is returning as U.S. crude prices hit their highest in seven years late last year S&P energy index delivered roughly twice the return of the S&P 500 in 2021.

Look At The Future Of American And Appalachian Gas Production

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Look-At-The-Future-Of-American-And-Appalachian-Gas-Production.png)

The crux of the matter is rather simple: productivity gains of local energy operators have been stable not only because they are drilling better acreage, but also because players finally realized capital efficiency gains. And even if some new obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins. The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?