Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

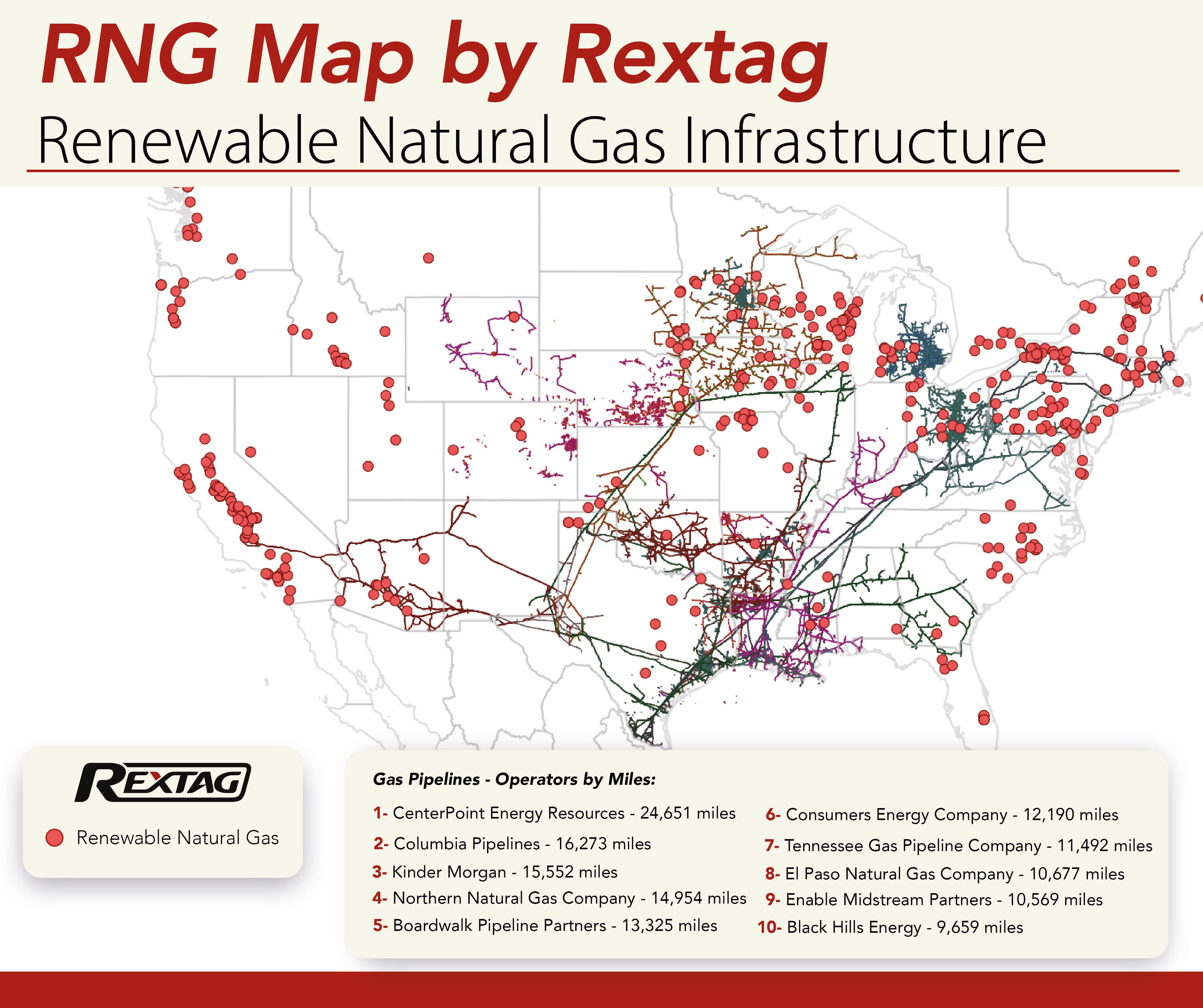

How Big is America in the RNG Market: USA Renewable Natural Gas Ups and Downs

07/22/2024

The renewable natural gas (RNG) industry in the United States is showing promising signs of growth. As of 2019, the U.S. consumed 261 billion cubic feet (BCF) of RNG, primarily utilized by independent power producers, electric utilities, and various commercial and industrial entities. However, this figure represents only a small fraction of its potential. Research indicates that the U.S. could theoretically produce up to 2,200 BCF of RNG through anaerobic digestion alone, which would equate to about 11% of daily national natural gas consumption.

The renewable natural gas (RNG) industry in the United States, although still relatively small compared to traditional natural gas, has experienced remarkable growth over the last decade. As of 2023, RNG production was estimated to be between 0.2 and 0.4 billion cubic feet per day (bcf/d), a fraction of the domestic geological gas production which stood at approximately 103 bcf/d. The significant growth of RNG has primarily been observed in the on-road transportation sector.

This expansion has been largely driven by pivotal regulatory frameworks like the federal Renewable Fuel Standard (RFS) and the California Low Carbon Fuel Standard (LCFS). The RFS mandates that a minimum volume of the fuel used in the U.S. transportation sector must be derived from renewable sources. Similarly, the LCFS aims to reduce greenhouse gas emissions and promote the use of low-carbon fuels in California's transportation sector. These standards not only aim to lower the carbon intensity in transportation but also incentivize the adoption of cleaner fuel alternatives.

Oregon and Washington have also adopted state-level clean fuel programs inspired by California's LCFS, further bolstering the growth of RNG within their transport sectors. These programs provide pathways to generate credits for compliance markets, significantly altering the economic landscape for RNG projects. Such financial incentives have allowed RNG to capture a substantial 84% market share in the natural gas vehicle transportation sector as of 2022.

Check out more about RNG in the USA and read our full article How RNG Changes the Industry.

Pioneers of the RNG: Kinder Morgan

In August 2021, Kinder Morgan made a significant move into the RNG market by acquiring Kinetrex Energy for $310 million. Based in Indianapolis, Kinetrex stood out as the Midwest's leading LNG supplier and a rapidly emerging force in the RNG production and supply sector.

In August 2022, Kinder Morgan further expanded its RNG footprint by acquiring North American Natural Resources Inc. (NANR) and its associated entities, North American Biofuels LLC and North American-Central LLC, for $135 million. These acquisitions were projected to add approximately 2 Bcf of RNG to KMI's annual production. Like previous acquisitions of Kinetrex Energy and Mas CanAm, it was part of company's broader strategy to enhance its role across the entire RNG value chain. With all RNG facilities up and running, the company's total RNG production capacity was expected to hit around 7.7 Bcf per year. Three NANR assets were anticipated to contribute 4.8 megawatt-hours in 2023, further diversifying Kinder Morgan's renewable energy portfolio.

Kinder Morgan is advancing its commitment to renewable energy, targeting an increase in its RNG production to 6.4 billion cubic feet annually by the end of 2024. The company has successfully launched three RNG facilities in 2023 and has plans for another addition in the second half of the year. Furthermore, Kinder Morgan is exploring the potential to repurpose its landfill-gas-to-electricity assets for RNG production.

KMI has allocated $84 million towards its energy transition projects, with a significant 92% of this investment dedicated to RNG development. This investment is distributed over a period and represents a modest portion of Kinder Morgan's total spending, which is predominantly focused on traditional energy infrastructure.

They anticipate that, once fully operational, these RNG projects will significantly enhance their financial performance, projecting that the earnings before interest, taxes, depreciation, and amortization from these projects could increase sixfold.

In January 2024, Kinder Morgan expanded its renewable natural gas (RNG) offerings with the start of the Prairie View RNG facility, which became operational on December 20, 2023. Located in Wyatt, Indiana, this facility processes landfill gas from the Prairie View Landfill to produce about 0.8 billion cubic feet (Bcf) of RNG each year.

This addition, along with the earlier completion of the Twin Bridges and Liberty landfill RNG projects in 2023, developed in partnership with one of the top landfill operators in the U.S., increased Kinder Morgan's annual RNG production by roughly 3.9 Bcf.

The RNG produced from these facilities can replace about 28 million gallons of diesel fuel annually, significantly reducing greenhouse gas emissions—around 280,000 tons. This achievement aligns with efforts to mitigate climate change impacts, considering methane's high potency as a greenhouse gas, more than 28 times that of carbon dioxide for trapping heat in the atmosphere as noted by the Environmental Protection Agency.

The Future Scale of the RNG Market

The renewable natural gas (RNG) market, while poised for growth, is projected to remain a relatively minor component of the overall U.S. natural gas supply. Even under optimal conditions, if the entire estimated potential for RNG in the U.S. were to be realized, it would still represent less than 10% of today's production from geologic sources. Forecasts for RNG production by 2050 vary significantly, ranging from 2 to 4 billion cubic feet per day (bcf/d). This variability highlights several factors influencing RNG growth, including fluctuating transportation market credit incentives, the scalability of feedstock sources, and the high incremental costs compared to geologic natural gas.

The growth trajectory of the RNG sector is particularly impressive. Over the last five years, the number of RNG production facilities has more than tripled, reaching 115 operational sites. This upward trend is expected to continue, bolstered by the support from states like California, Washington, and Oregon. These states, known for their proactive climate policies, have incorporated RNG into their official climate goals and targets, underscoring the sector's potential to play a significant role in the transition to a more sustainable energy future.

Currently, around 70% of U.S. RNG is produced from landfill sources, with the remaining 20% primarily derived from agricultural waste, notably manure from dairy farms. The dominance of landfill-derived RNG is attributed to several factors: economies of scale in typical projects, readily available feedstock, existing infrastructure for landfill gas collection, and the capacity for on-site utilization of non-upgraded biogas for electricity and combined heat and power generation. Moreover, using RNG helps avoid the need to flare biomethane, and in many instances, facilities are strategically located near potential customers, enhancing the economic feasibility of these projects.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

US Midstream Research 2022 Overview: TOP Providers, Their Assets and Stories

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 161_ Blog - US Midstream Research Overview TOP Providers, Their Assets and Stories.png)

The midstream sector plays a vital role in the oil and gas supply chain, serving as a crucial link. As the energy transition continues, this industry, like the broader sector, encounters various risks. Yet, existing analyses have predominantly concentrated on the risks faced by the upstream and downstream sectors, leaving the fate of the midstream relatively unexplored. In a nutshell, midstream operators differentiate themselves by offering services instead of products, resulting in potentially distinct revenue models compared to extraction and refining businesses. However, they are not immune to the long-term risks associated with the energy transition away from oil and gas. Over time, companies involved in transporting and storing hydrocarbons face the possibility of encountering a combination of reduced volumes, heightened costs, and declining prices.

Energy Transfer LP Races to Carry Permian Basin Gas to Gulf Coast Hubs

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Energy-Transfer-LP-Races-to-Carry-Permian-Basin-Gas-to-Gulf-Coast-Hubs.png)

The ever-increasing demand for natural gas exports from the Gulf Coast started a race to further develop Permian Basin. Various companies, including Kinder Morgan and MPLX, are among those looking at building new pipelines in the region due to the demand spike. But Energy Transfer seems to edge past them into the lead since its project strikes as the most economical option for the basin outside of capacity expansions on existing pipelines and could essentially add 1.5-2 Bcf/d of transport capacity with just 260 miles of new pipe.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?