Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Grand Prix Pipeline Will Be Completely Owned by Targa: To Buy Remaining Stake For $1.05 Billion

01/18/2023.png)

On January 3, Targa Resources Corp asserted that it is purchasing the remaining stake for $1.05 billion in cash from Blackstone Inc's energy unit in its Grand Prix NGL Pipeline that it does not already own.

Targa, which is going to acquire a 25% stake from Blackstone Energy Partners, purchased 75% interest in the pipeline last year when it repurchased interests in its development company joint ventures from investment firm Stonepeak Partners LP for almost $925 million.

The Stonepeak agreement also included 100% interest in its Train 6 fractionator in Mont Belvieu, Texas, and a 25% equity interest in the Gulf Coast Express Pipeline.

Grand Prix has the capacity to transfer up to 1 MMbbl/d of NGL to the NGL market hub at Mont Belvieu.

As Targa CEO Matt Meloy claimed, the performance of Grand Prix NGL Pipeline has exceeded anticipations since it began full operations in the third quarter of 2019, integrating the company’s leading NGL supply aggregation position in the Permian Basin to key demand markets in Mont Belvieu and along the U.S. Gulf Coast.

The advantage of the pipeline is that it connects Targa's gathering and processing positions throughout the Permian Basin, North Texas, and Southern Oklahoma to Targa's fractionation and supply complex at Mont Belvieu.

The same day Targa maintained the price of the Blackstone Energy Partners agreement, which is anticipated closing in the first quarter of 2023, representing roughly 8.75 times Grand Prix's valued 2023 adjusted EBITDA multiple.

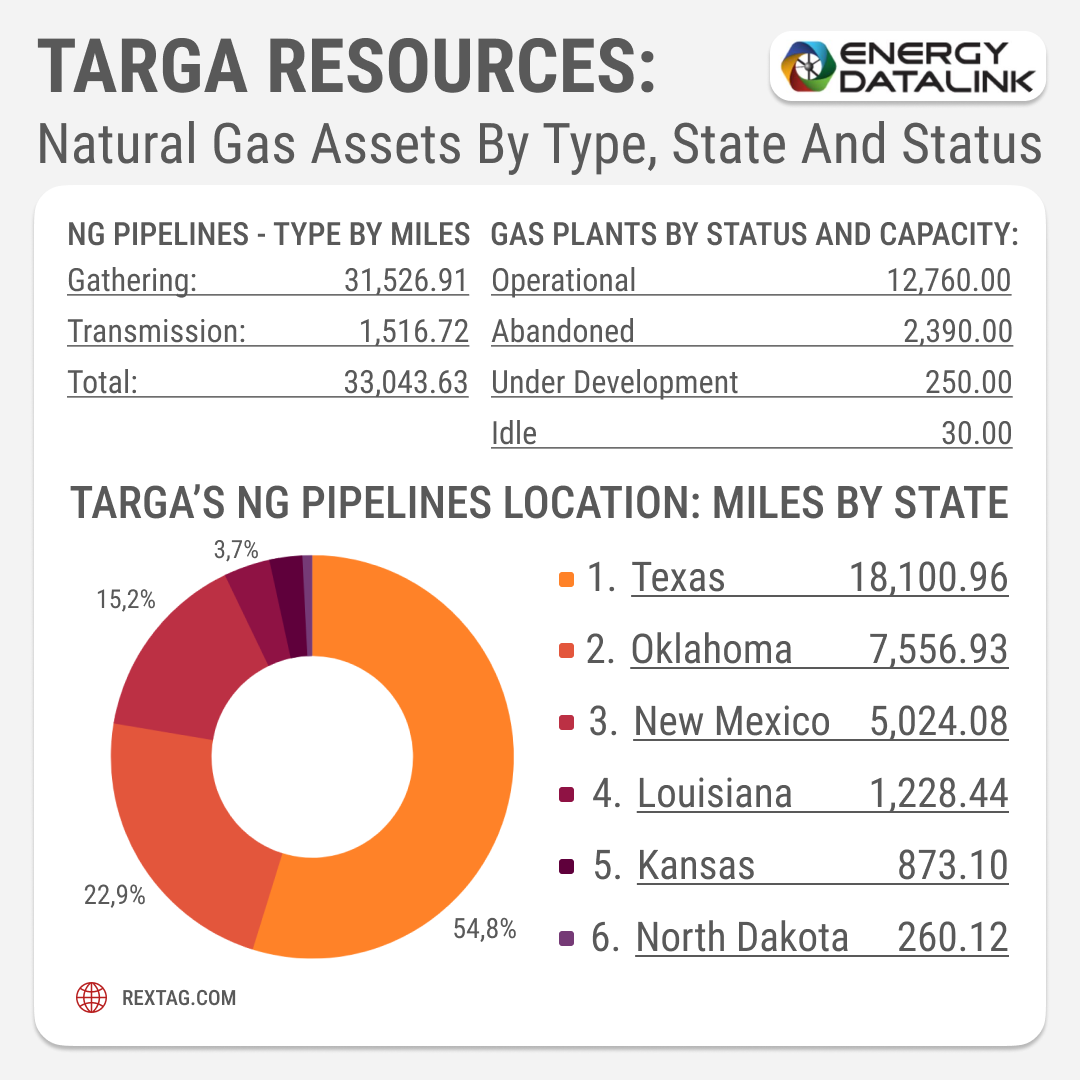

Targa Resources Corp is mainly engaged in the business of gathering, compressing, treating, processing, and selling natural gas; transporting, storing, fractionating, treating, and selling NGL and NGL products, including services to liquefied petroleum gas (LPG) exporters.

It has a leading position in Mont Belvieu, Texas the NGL hub of North America, as the company has one of the largest fractionation ownership positions in Mont Belvieu and world-class LPG export facilities on the Gulf Coast at its Galena Park Marine Terminal, which is interconnected to Mont Belvieu.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Matador Expands In Delaware; Purchases Acreage from Advance Energy at $1.6 Billion

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/127Blog_Matador_Expands_In_Delaware_Purchases_Acreage_from_Advance_Energy.png)

On January 24, Matador spread the word that it will add oil- and gas-producing assets in Lea County, N.M., and Ward County, Texas, and some midstream infrastructure. Most of the acreage is strategically situated in Matador’s Ranger asset area in Lea County. The bolt-on includes about 18,500 net acres, 99% held by production, in the core of northern Delaware. The deal would also extend Matador’s inventory by 406 gross (203 net) drillable horizontal locations with prospective targets in the Wolfcamp, Bone Spring, and Avalon formations.

Permian O&G Basin 2022 Review

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Top H1 2022 Permian Producers.png)

The Permian Basin is one of the most important oil and gas basins in the world, located in western Texas and southeastern New Mexico in the United States. Oil drilling and production in the Permian Basin began in the early 1920s. The first significant discovery in the region was made in 1923 in the Westbrook field in Mitchell County, Texas. This discovery led to a boom in oil exploration and production in the area. By the 1930s, the Permian Basin had become one of the major oil-producing regions in the United States, and it continued to grow in importance throughout the 20th century.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?