Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Enterprise acquires Navitas Midstream for $3.25 billion in cash

01/24/2022

A Warburg Pincus LLC affiliate has approved Enterprise Products Partners' bid to acquire Navitas Midstream Partners, LLC, for $3.25 billion in cash. The deal is expected to close by the first quarter of 2022 and will be debt-free. In the Permian's Midland Basin, Navitas provides natural gas gathering, treatment, and processing services.

According to Tudor, Pickering, Holt & Co. (TPH), Enterprise's acquisition agreement with this privately held company came as a surprise, given its recent capital discussions and preference for downstream businesses. Since portfolios are relatively inexpensive, the implied DCF yield is only marginally higher than standalone EPD metrics, and increasing exposure to wellheads without a clear readthrough to NGL logistics is difficult to reconcile with the messaged strategy. However, little attention was paid to incremental downstream volumes to EPD's pipelines, fractionation, and exports, which will be crucial to justify expanding wellhead exposure.

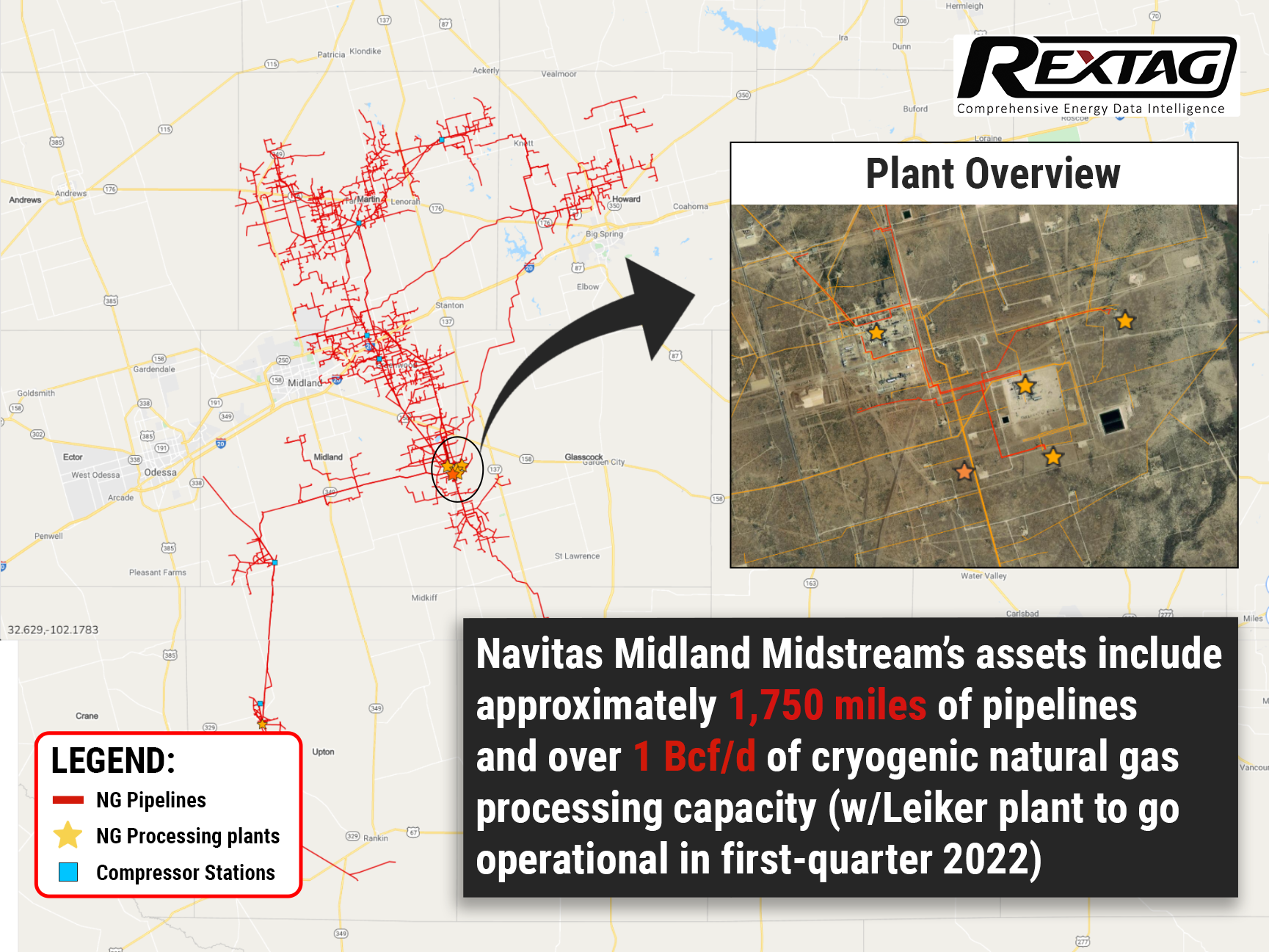

Meanwhile, Navitas Midstream itself has approximately 1,750 miles of pipeline in the Midland Basin and is working towards finishing its Leiker cryogenic natural gas processing plant in the first quarter of 2022.

In the heart of the Midland Basin, the Navitas management team has produced a premier system, according to Enterprise Co-CEO A. J. Teague. And this acquisition comes in handy, giving Enterprise access to the Midland Basin, as the company lacks natural gas or natural gas liquids infrastructure apart from downstream pipelines in the region.

Navitas was formed in 2014 with the assistance of Warburg Pincus and an experienced management team in The Woodlands, Texas. Before being sold to Kinder Morgan in 2013, Copano Energy LLC was built into a $5 billion enterprise by R. Bruce Northcutt, Bryan Neskora, and Jim Wade. And now, according to top management, the company is able to provide critical infrastructure to meet the needs of Midland Basin producers.

Today over 40 independent and publicly owned producers are connected to the Navitas system through long-term contracts. Furthermore, the system depends on fee-based contracts to generate additional revenues. With up to 10,000 drilling locations or 15 years of drilling inventory on the dedicated acreage, Navitas Midstream is positioned to provide visibility into future growth.

And as a result of the Navitas acquisition, Enterprise estimates that distributable cash flow accretion will be in the range of $0.18 to $0.22 per unit in 2023, which will be Enterprise's first full year of ownership. This investment should also support additional capital returns to their limited partners through distribution growth and buybacks of common units.

According to Warburg Managing Director John Rowan, this acquisition represents the largest private gas gathering and processing activity in the world. A combination of cash on hand and borrowings will be used to fund the acquisition, in addition to the partnership's existing commercial paper and bank credit facilities.

Merrill Lynch serves as Navitas' financial adviser, while Kirkland & Ellis occupies the role of its legal adviser.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Look At The Future Of American And Appalachian Gas Production

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Look-At-The-Future-Of-American-And-Appalachian-Gas-Production.png)

The crux of the matter is rather simple: productivity gains of local energy operators have been stable not only because they are drilling better acreage, but also because players finally realized capital efficiency gains. And even if some new obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins. The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

From Beginnings to a $7.1 Billion Milestone: Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 181_Blog_From Beginnings to a $7.1 Billion Milestone Deal-Making Histories of Energy Transfer and Crestwood - Complex Review by Rextag .png)

Energy Transfer's unit prices have surged over 13% this year, bolstered by two significant acquisitions. The company spent nearly $1.5 billion on acquiring Lotus Midstream, a deal that will instantly boost its free and distributable cash flow. A recently inked $7.1 billion deal to acquire Crestwood Equity Partners is also set to immediately enhance the company's distributable cash flow per unit. Energy Transfer aims to unlock commercial opportunities and refinance Crestwood's debt, amplifying the deal's value proposition. These strategic acquisitions provide the company additional avenues for expanding its distribution, which already offers a strong yield of 9.2%. Energized by both organic growth and its midstream consolidation efforts, Energy Transfer aims to uplift its payout by 3% to 5% annually.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?