Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

February Top U.S. Midstream Deals: Delaware Appears As the Key Area

03/04/2019

As production in key locations continue to steadily grow, most midstream companies continued expanding their infrastructure to connect their major producing areas to the promising market delivery locations. Delaware saw most of this activity, where gathering infrastructure is still thought to be underdeveloped. Experts point out the proximity of Mexican and U.S. Gulf of Mexico market as well as growth of the U.S. exports capacity to be primary drivers of CAREX going into new projects.

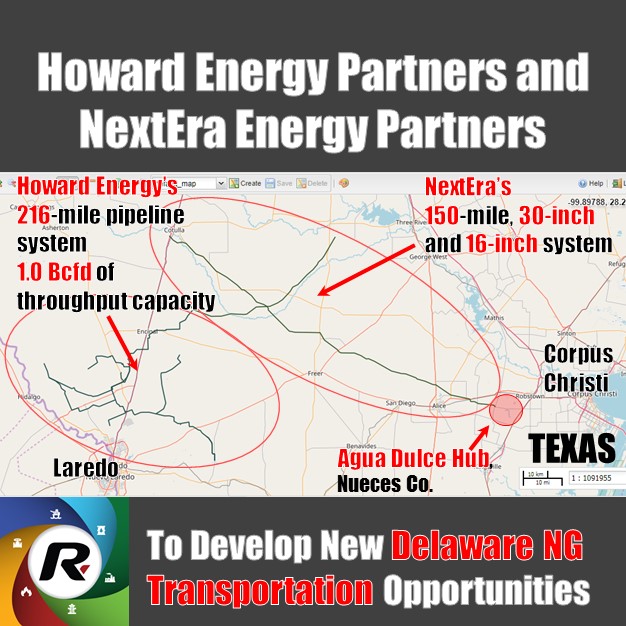

For instance, see how Howard Energy Partners and NextEra Energy Partners connect their systems to reach both domestic downstream as well as exports market.

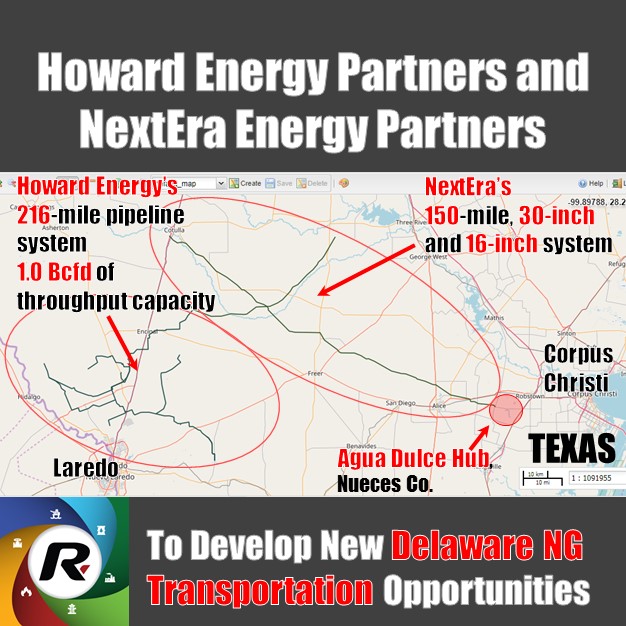

Similar capital inflow was seen in Agua Blanca NG Pipeline Deal as First Infrastructure Capital Advisors increased its stake in the pipeline.

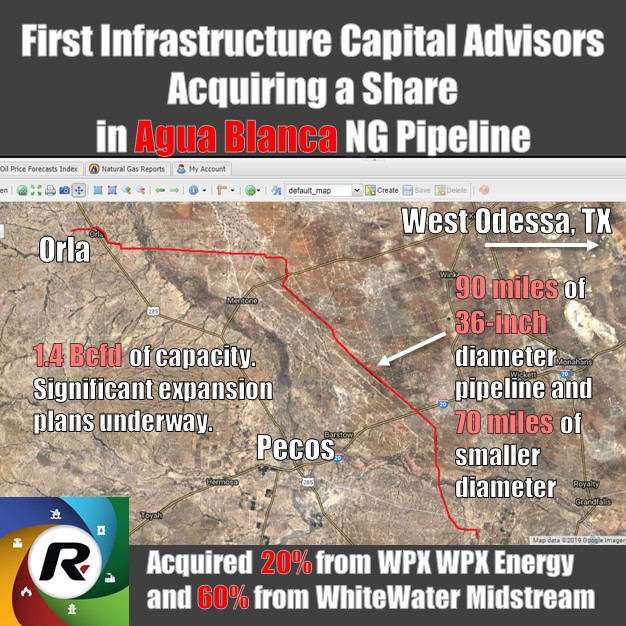

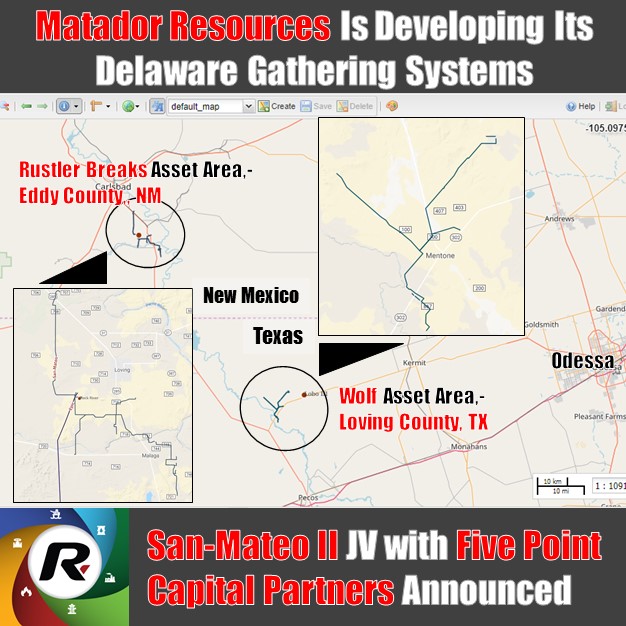

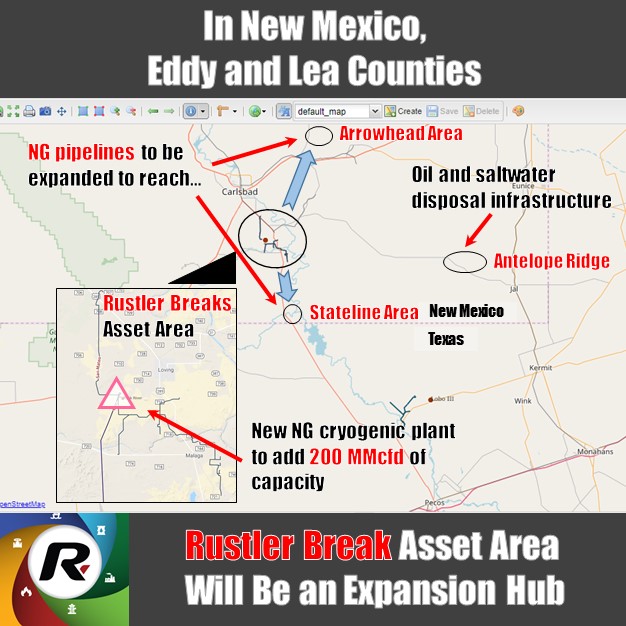

Another activity - not quite in Delaware but close enough - was seen at New Mexico - Texas border area, where Matador Resources continued expand its gathering, storage and processing facilities as it enetered the San-Mateo II JV, second one with Five Point Energy.

All the midstream sector February 2019 deals that drew our attention can be found in the table below.

More information still can be discovered with Rextag's Energy Datalink as well as with its GIS data services. Request a free-trial access with us today.

| Date announced | Buyer(s) | Seller(s) | Assets | Location | Deal Value | Date closed |

|---|---|---|---|---|---|---|

| Feb 4, 2019 | First Infrastructure Capital Advisors LLC | WPX Energy Inc. | 20% equity interest in WhiteWater Midstream’s 36-inch Agua Blanca natural gas pipeline (see the map) | Delaware Basin | $300 MM | Expected to close 1Q 2019 |

| Feb 4, 2019 | First Infrastructure Capital Advisors LLC | WhiteWater Midstream LLC, Denham Capital Management LP, Ridgemont Equity Partners | WhiteWater Midstream wholly acquired including its 60% stake in Agua Blanca (see the map) | Expected to close 1Q 2019 | ||

| Feb 13, 2019 | NextEra Energy Partners LP | >Howard Energy Partners | Formed JV to develop additional natural gas transportation opportunities in the Eagle Ford shale region of South Texas | South Texas: Webb, Duval, Zapata, Dimmit, La Salle, McMullen, Live Oak and Jim Wells counties | Undisclosed | Feb 13, 2019 |

| Oct 3, 2018 | Salt Creek Midstream LLC, Ares Management LP ARM, Energy Holdings LLC | Noble Midstream Partners LP | Formed 50/50 JV partnership to develop a crude oil pipeline and gathering system | Delaware Basin | Feb 8, 2019 | |

| Feb 19, 2019 | The Blackstone Group LP, GSO Capital Partners LP | Targa Resources Corp. | 45% stake in Targa Badlands, which operates oil and gas gathering and processing assets (see the map) | Bakken and Three Forks shale plays, Williston Basin of ND. | $1,600 MM | Expected to close 2Q 2019 |

| Feb 25, 2019 | Five Point Energy LLC, San Mateo Midstream LLC | Matador Resources Co. | Formed a new midstream JV, San Mateo II, to expand current gathering, processing and saltwater disposal capacity. 51% owned by Matador plus operational control | Northern Delaware Basin | Undisclosed | Feb 25, 2019 |

| Feb 26, 2019 | Hess Infrastructure Partners LP | Summit Midstream Partners LP | Water gathering assets of the Tioga Gathering System in Williams County, Western ND. | Williston Basin; Bakken | $67 MM | Expected to close 1Q 2019 |

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Energy Transfer Secures $7.1 Billion Deal to Take Over Crestwood

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/176Blog_Crestwood's assets to be acquired in Williston, Delaware, and Powder River basins.png)

Energy Transfer is taking on $3 billion of Crestwood's debt in a stock deal. This move expands their reach in the Williston and Delaware basins and gets them into the Powder River Basin for the first time.

Ain't Nothing Like a $2 Billion Deal: Oasis Sells Midstream Affiliate to Crestwood

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Oasis_Petroleum_Crestwood_Equity_Partners_Oasis_Midstream_Partners.png)

Crestwood & Oasis Midstream merge to create a top Williston #basin player. $1.8 billion deal is expected to close during the Q1 of 2022. The transaction will result in a 21.7% ownership stake for Oasis in Crestwood common units. The remaining ownership of Oasis in Crestwood will also be of benefit to the company since it will create a diversified midstream operator with a strong balance sheet and a bullish outlook after this accretive merger.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/325_Blog_ Expand Energy's Operations (formerly Chesapeake) .jpg)

Before it was Expand Energy, the largest natural gas-weighted exploration and production company in the U.S., it was Chesapeake Energy. This company faced and survived nearly every extreme the energy industry could throw, including bankruptcy. With its recent $7.4 billion merger with Southwestern Energy, Expand Energy has achieved a new milestone: it’s the largest natural gas producer in the U.S., powered by substantial reserves and resources across crucial shale regions.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/324_Blog_Gulf Oil Operators Chevron, BP, Equinor, Shell Brace as Tropical Storm Rafael Threatens Production.jpg)

Oil companies across the Gulf of Mexico are springing into action as Tropical Storm Rafael bears down, marking yet another disruption in a storm-laden season. BP, Chevron, Equinor, and Shell are evacuating offshore staff and preparing for potential impacts on their platforms, an all-too-familiar ritual for Gulf operators this year.