Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

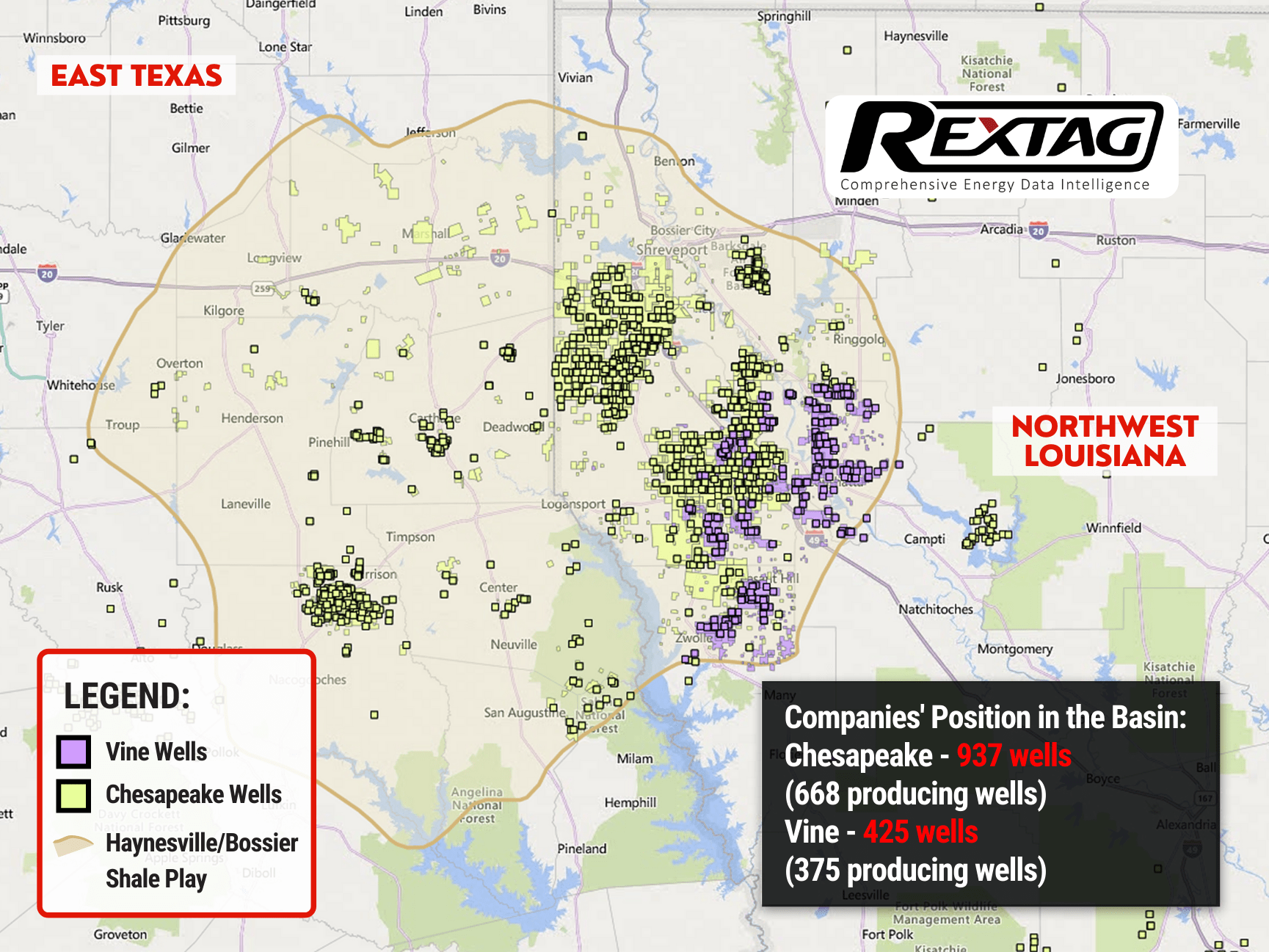

Chesapeake Energy Corporation Consolidates Haynesville With At- Market Acquisition Of Vine Energy Inc.

08/19/2021

OKLAHOMA CITY, Aug. 11, 2021 /PRNewswire/ -- Chesapeake Energy Corporation (NASDAQ:CHK) ("Chesapeake") and Vine Energy Inc. (NYSE:VEI) ("Vine") today announced that they have entered into a definitive agreement pursuant to which Chesapeake will acquire Vine, an energy company focused on the development of natural gas properties in the over-pressured stacked Haynesville and Mid-Bossier shale plays in Northwest Louisiana. The acquisition is a zero premium transaction valued at approximately $2.2 billion.

Transaction Details

Under the terms of the merger agreement, which was unanimously approved by the Board of Directors of each company, Vine shareholders will receive a fixed exchange ratio of 0.2486 Chesapeake shares of common stock and $1.20 of cash for each share of Vine common stock owned. Upon closing, Chesapeake shareholders will own approximately 86% and Vine shareholders will own approximately 14% of the fully diluted shares of the combined company.

The transaction, which is subject to customary closing conditions, including certain regulatory approvals, and the approval of Vine shareholders, is expected to close in the fourth quarter of 2021. Funds managed by The Blackstone Group Inc. own approximately 70% of outstanding shares of Vine common stock and have entered into a support agreement to vote in favor of the transaction.

Preliminary 2022 Pro Forma Outlook

Pending the successful closing of the transaction in the fourth quarter of 2021, Chesapeake's preliminary plan is to operate 10 to 12 rigs in 2022, with 8 to 9 rigs focused on its gas portfolio and 2 to 3 rigs concentrating on its oil assets. The company will maintain its commitment to a disciplined capital reinvestment strategy, anticipating a 2022 reinvestment rate of 50 – 60%. At NYMEX strip pricing as of July 30, 2021, this preliminary capital program is anticipated to generate between $2.55 billion to $2.75 billion in total adjusted EBITDAX. Chesapeake also anticipates this preliminary capital program will result in its average annual 2022 oil production remaining flat from 2021 fourth quarter average levels.

About the Companies

Headquartered in Oklahoma City, Chesapeake Energy Corporation's (NASDAQ: CHK) operations are focused on discovering and responsibly developing its large and geographically diverse resource base of unconventional oil and natural gas assets onshore in the United States.

Vine Energy Inc., based in Plano, Texas, is an energy company focused on the development of natural gas properties in the stacked Haynesville and Mid-Bossier shale plays in the Haynesville Basin of Northwest Louisiana. The Company is listed on the New York Stock Exchange under the symbol "VEI".

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Why Are Oil Giants Backing Away from Green Energy: Exxon Mobil, BP, Shell and more

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

Crude oil pipelines in North America: a current perspective

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/74blog__Crude_oil_pipelines_in_North_America_a_current_perspective.png)

Being the main means of transferring crude oil around the world, pipelines rapidly route oil and its derivative products (gasoline, jet fuel, diesel fuel, heating oil, and heavier fuel oils) to refineries and empower other businesses. The U.S. and Canada solely make North America a major oil hub for more than 90,000 miles of crude oil and petroleum product pipelines, which are connected to more than 140 refineries daily processing about 20 million barrels of oil. Compared to 2010, U.S. crude oil production has increased more than twice: from 5.4 to 11.5 million barrels a day. Therefore, newly produced oil obliged energy companies to expand their pipeline networks, but it has only increased by 56%. According to the latest data, Plains manages the largest pipeline network across the U.S. and Canada (its diameter is at least 10 inches) which is the 14,919-mile network that spans from the northwestern tip of Alberta down to the southern coasts of Texas and Louisiana. The place where all these various spreading pipeline networks carry crude oil is refineries, where it is transformed into different petroleum products. Gulf Coast (PADD 3) possesses several refineries with the largest throughput in North America that process more than 500,000 barrels per day. Not only does the development of new pipelines give a plethora of opportunities for economic growth but also it remains a contentious issue in Canada and the U.S., with the cancellation of the KeystoneXL pipeline emblematic of growing anti-pipeline sentiment. In 2021, only 14 petroleum liquids pipeline construction plans were completed in the U.S., which is considered the lowest amount of new pipelines and expansions ever since 2013. Anti-pipeline sentiment did not come out unexpectedly as leaks and spills in just the last decade have resulted in billions of dollars of damages. From 2010 to 2020, the Pipelineand Hazardous Materials Safety Administration reported 983 incidents that resulted in 149,000 spilled and unrecovered barrels of oil, even five fatalities, 27 injuries, and more than $2.5B in damages.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?