Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

XCL Resources Requests FTC Green Light for Purchasing Altamont Energy

03/22/2024

XCL Resources is seeking approval from the Federal Trade Commission (FTC) for its proposed acquisition of Altamont Energy LLC, another Utah-based oil producer. This initiative is backed by XCL's parent entity, EnCap Investments LP, a notable private equity firm. Discussions about purchasing Colorado-based Altamont Energy began in the previous summer, as highlighted in FTC documentation.

For the acquisition to proceed, XCL Resources and its parent company, EnCap Investments, must secure FTC consent. This stipulation originates from a 2022 FTC settlement related to EnCap's acquisition of EP Energy Corp, necessitating the divestiture of EP Energy's Utah operations as part of the settlement's terms.

The companies argue that the acquisition of Altamont Energy would not disrupt the competitive dynamics within the waxy crude oil market. Instead, the acquisition aims to bolster Altamont Energy, which is smaller than XCL Resources, by providing it with the capital required for expansion and development.

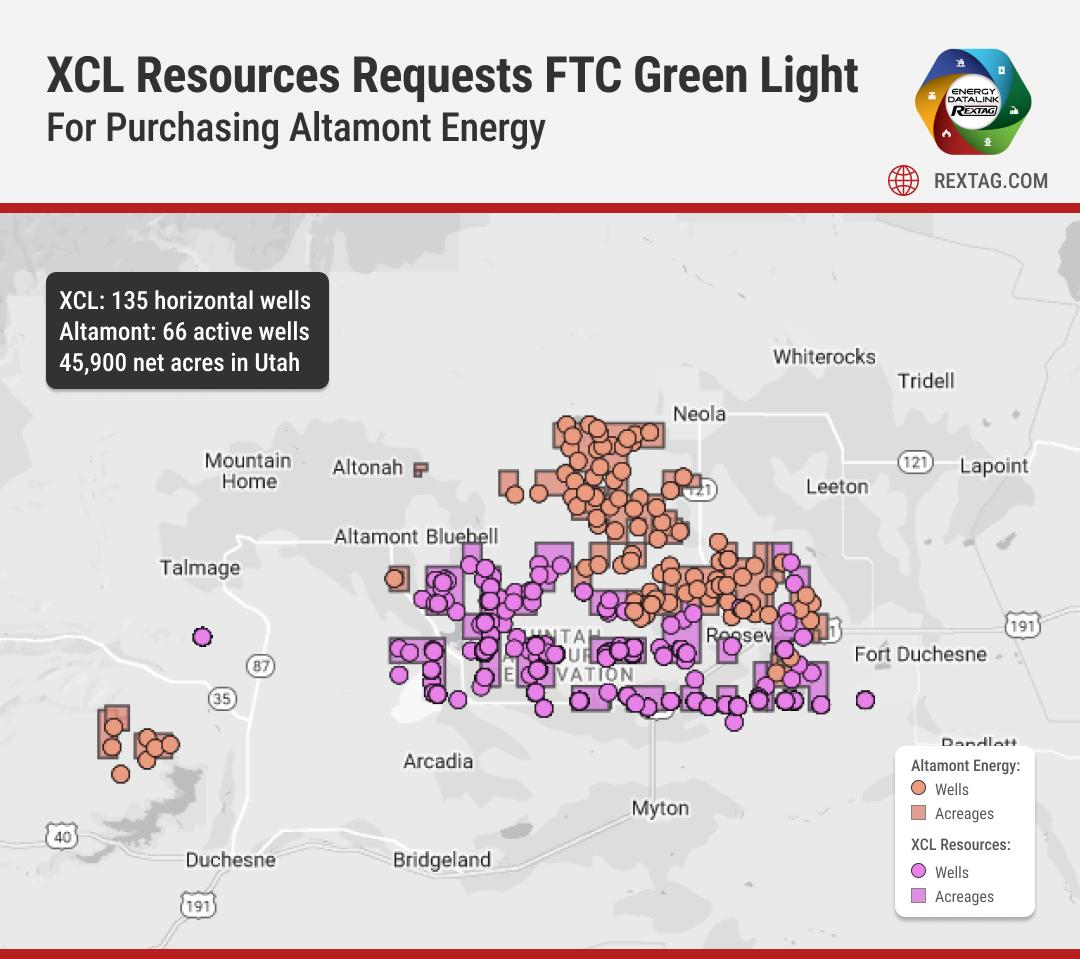

Both XCL Resources and Altamont Energy have significant operations within Duchesne and Uintah counties in Utah, with ownership and operation of oil wells and land assets. According to the most recent data, XCL Resources produced approximately 1.57 million barrels of oil in December 2023, translating to an average daily production of over 50,000 barrels. For the entire year, the average daily production was around 44,860 barrels. In comparison, Altamont Energy's production for December 2023 was 109,349 barrels, equating to approximately 3,527 barrels per day, with an annual average production of 4,052 barrels per day.

As of the last reporting period, Altamont Energy operated 66 active wells in Utah. XCL Resources reported managing 135 horizontal wells across approximately 45,900 net acres in Utah. The company maintains an active drilling program in the Uinta Basin, averaging the completion of about 70 new wells annually.

Altamont Energy's drilling efforts are concentrated on exploiting the Wasatch and Green River formations within the Uinta Basin, where it successfully brought eight new horizontal wells into production last year.

Competition in Uinta Basin

In August, XCL Resources started talks to buy another company called Altamont Energy. This happened after Altamont hired a company named Houlihan Lokey to help sell its business, which involves producing a type of oil called waxy crude. This is all mentioned in a document they sent to the FTC, which is a government agency that checks if companies can merge or not.

Altamont looked for a buyer by reaching out to over 300 potential ones. Out of all of them, XCL Resources offered the best deal and was chosen to buy Altamont.

XCL Resources explained to the FTC why it's a good fit to buy Altamont. One reason is that XCL already owns land next to Altamont's land in two places called Duchesne and Uintah counties. They think by joining forces, they can work more efficiently.

Altamont doesn't have the equipment to drill new wells and doesn't have plans to grow because it doesn't have enough money. XCL, on the other hand, is known for being good at running its operations without spending a lot of money in the same area, the Uinta Basin. By coming together, they believe they can save money on things like dealing with water, gas, and the process of drilling and completing wells.

The FTC once looked into a deal involving XCL's parent company and another company because they were worried it might lead to fewer choices and higher prices for a type of oil in the Uinta Basin, which could affect refineries around Salt Lake City. However, there's now so much oil being produced there that the refineries have more than they need. This means the refineries can set the prices, not the oil producers like before.

XCL also says there are more companies now drilling for oil in the Uinta Basin, making it a competitive place. In the last two years, new companies like Scout Energy Partners, Wasatch Energy Management Operating, Anschutz Corp., and Vaquero Energy have started working there. Plus, some companies that had stopped working in the area are now active again, like Berry Corp., Caerus Uinta, and KGH Operating. This makes the oil market there even more competitive.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Northern Paradox Basins Rediscovered by Zephyr

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Northern-Paradox-Basins-Rediscovered-by-Zephyr.png)

After probing the initial discovery of eight high-grade hydrocarbon reservoirs, Zephyr Energy estimates that up to 200 wells could be drilled, creating a potential resource of 125 million barrels of oil equivalent in the area. In an investor presentation, Zephyr said that gas rates may reach plateaus of 10 million square cubic feet per day and 500 boepd of liquids. Quite an impressive number. But The key to tapping in such potential lies in the development of hydraulically stimulated resources rather than treating them as natural fracture plays.

Williams Buys MountainWest Pipeline System for $1.5 Billion

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/110Blog_Williams_Buys_MountainWest_Pipeline_System_12_202 (1).png)

On December 15, Pipeline giant Williams made a deal to purchase MountainWest Pipelines Holding Co. from Southwest Gas Holdings Inc. for almost $1.5 billion including debt. Williams is paying $1.07 billion in cash and assuming $0.43 billion of debt to buy MountainWest, which comprises approximately 2,000 miles of interstate natural gas pipeline systems mainly situated across Utah, Wyoming, and Colorado.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?