Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

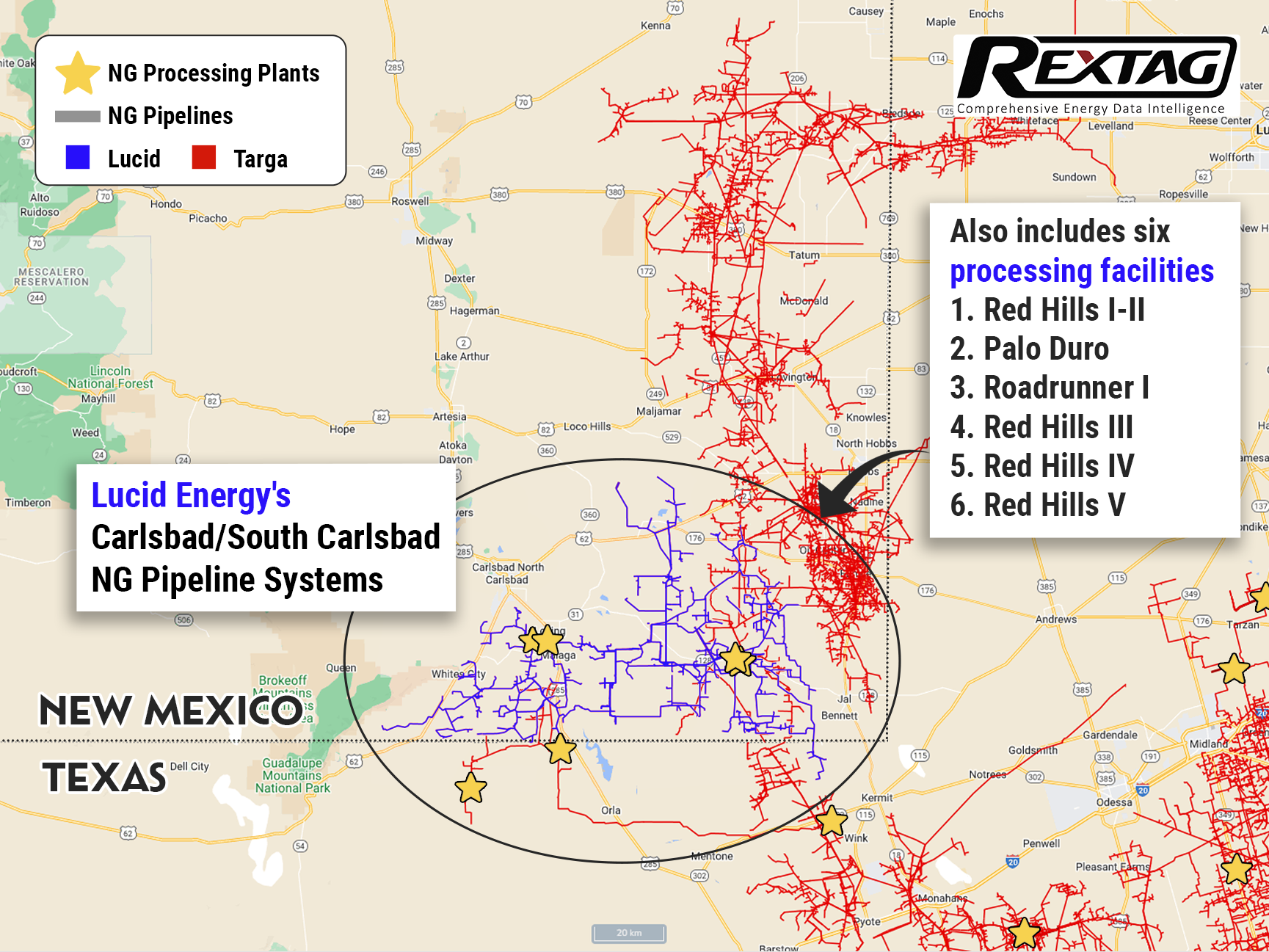

Targa Resources: $3.55 Billion Cash Transaction to Acquire Lucid Energy

06/30/2022

On June 16 Targa Resources Corp. decided to acquire Lucid Energy Group, located in the Permian Basin, which is a part of Riverstone Holdings LLC and Goldman Sachs Asset Management.

Firstly, Targa grew due to the recent “blot-on” acquisition of Southcross Energy in the Eagle Ford for $200 million and it will become bigger thanks to the $3.55 billion cash transaction. Targa’s financial position allowed it to utilize convenient opportunities to extend its company so it bought Lucid using available cash and debt with an estimated pro forma year-end 2022 leverage around 3.5 times.

Lucid Energy Group is a leading privately held natural gas processor in the Permian Basin, supported by growth capital commitments from a joint venture formed by Riverstone Global Energy and Power Fund VI LP, whose investment funds are managed by Riverstone Holdings LLC and Goldman Sachs Asset Management.

This acquisition will allow Lucid and Tagna to reach the next stage of development together, as they found more opportunities for their employees, customers, and communities.

Before that Lucid Energy had been acquired in 2018 by the joint venture of Riverstone and Goldman Sachs from Lucid Energy Group I LLC (Cogent Midstream) for $1.6 billion cash, whereas Cogent has since been acquired by Canes Midstream LLC. Their transaction closed in the first quarter of 2018 and included committed debt financing provided by Jefferies LLC.

Its assets, well-known as the South Carlsbad Natural Gas Gathering and Processing System and the Artesia Natural Gas Gathering and Processing System, were situated in the northern Delaware Basin.

According to Targa’s estimates, the acquisition of Lucid will increase the number of natural gas pipelines by 1,050 miles and add about 1.4 Bcf/d of cryogenic natural gas processing capacity in service or under construction located mainly in Eddy and Lea counties of New Mexico. The investment-grade producers source approximately 70% of current system volumes.

Lucid created an attractive position in the Delaware Basin and is going to continue providing value-added services to the producer customers. Their assets are anchored by long-term, fixed-fee agreements and acreage dedications from a manifold set of high-quality customers reaching more than 600,000 dedicated acres.

It aligns with its integrated strategy of extending and differentiating the Permian Basin footprint with Lucid’s presence at an attractive investment multiple that is expected to enhance the development of shareholder value in the future and continue to drive additional volumes through Targa’s downstream businesses.

As the company considers, Lucid’s Delaware Basin footprint overlays some of the most economic crude oil and natural gas producing acreage in North America. Also, it is noted that current rig activity supports over 20 years of drilling inventory on Lucid’s greater than 600,000 dedicated acres, which are further supplemented by important volumes subject to minimum volume commitments.

According to the press release, a full-year standalone adjusted EBITDA is expected to be between $2.675 billion and $2.775 billion and reported year-end leverage ratio of about 2.7 times. Targa’s updated financial expectations assume NGL composite prices average $1.05 per gallon, crude oil prices average $100/bbl, and Waha natural gas prices average $6 per MMBtu for the remainder of 2022.

The Lucid acquisition will close in the third quarter and the completion of the transaction is subject to customary closing conditions, including regulatory approvals. It is expected to be accretive at once to distributable cash flow per share and further supports the already strong cash flow profile and can return an increasing amount of capital to the shareholders through common dividend increases and common share repurchases.

Each M&A agreement cardinally changes the situation on the market.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Riley Will Pay $330 MM to Acquire Assets in NM from Pecos Oil & Gas

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/134Blog_Riley_Will_Pay_330_MM_to_Acquire_Assets_in_NM_from_Pecos_Oil_and_Gas.png)

Oklahoma City-based Riley Exploration Permian Inc. is extending its presence in New Mexico through the acquisition of oil and gas assets from Pecos Oil & Gas LLC, valued at $330 million in cash, according to the company's announcement on February 28.

Triple Advantage Vital Energy's $1 Billion M&A Enhances Permian Portfolio, Cash Flow

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/190Blog_Triple Threat Vital Energy's $1B M&A.png)

Vital Energy, focused on the Permian Basin, plans quick debt reduction after securing $1.165 billion in deals, adding key Midland and Delaware basin inventory.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?