Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

New Territories, New Opportunities: Continental's Acreage Addition in Midland

04/17/2024

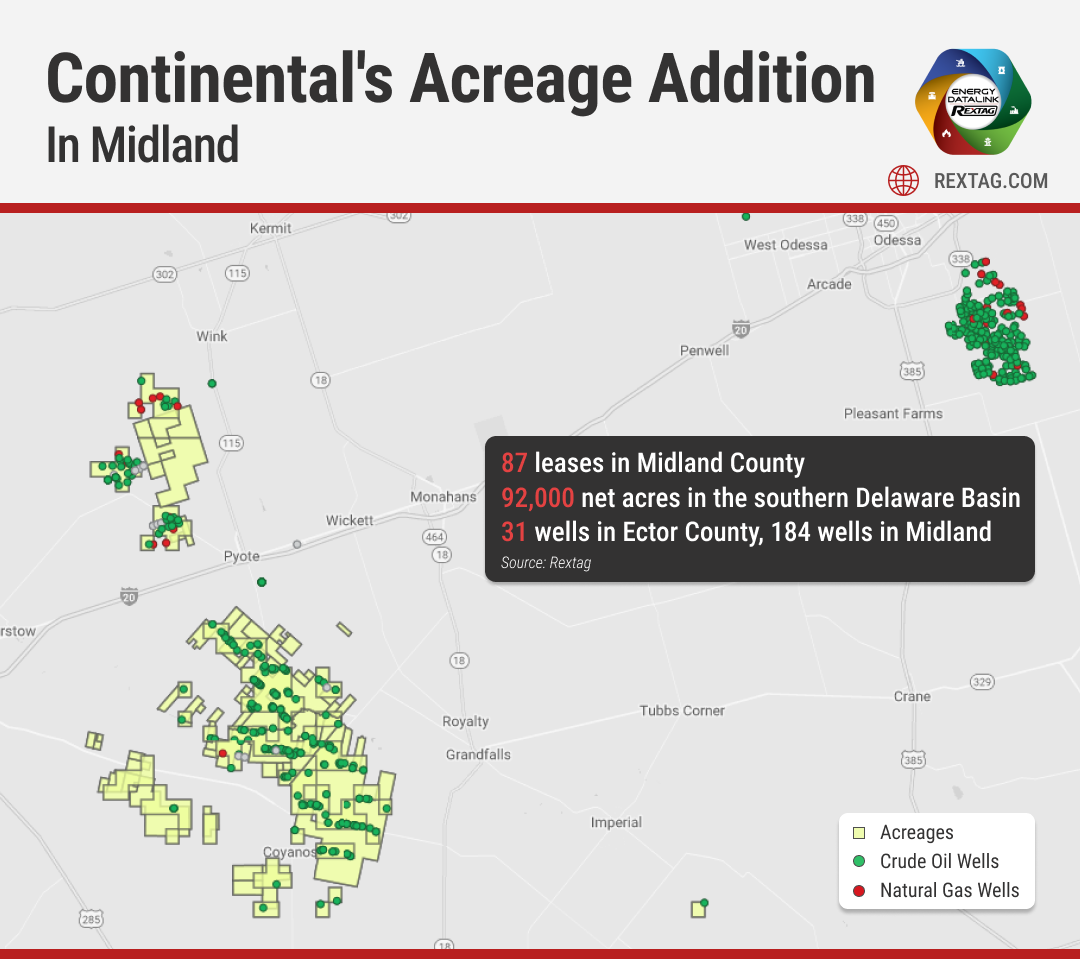

- Continental Resources acquired 87 leases in Midland County from an Occidental Petroleum subsidiary.

- The newly acquired Midland and Ector assets produced 76,000 barrels of crude and 123.1 million cubic feet of gas in their first three months.

- Since going private in 2022, Continental has continuously expanded in the Permian Basin.

- A recent acquisition added 92,000 net acres in Texas's southern Delaware Basin to Continental's holdings.

“Our main focus is on the Delaware side, but we’re looking also on the Midland side, as well.”

- Continental CEO Doug Lawler.

Continental Resources is expanding its operations in the Midland Basin, including taking over some assets that used to belong to Occidental Petroleum. The company plans to use its expertise in exploration in this area.

Owned by Harold Hamm, a billionaire known for his pioneering work in horizontal drilling in the Bakken region, Continental is a leading oil producer there.

Despite being well-established, Continental surprised many industry analysts by entering the Permian Basin with a big move. In late 2021, the company acquired Pioneer Natural Resources' assets in the Delaware Basin for $3.25 billion.

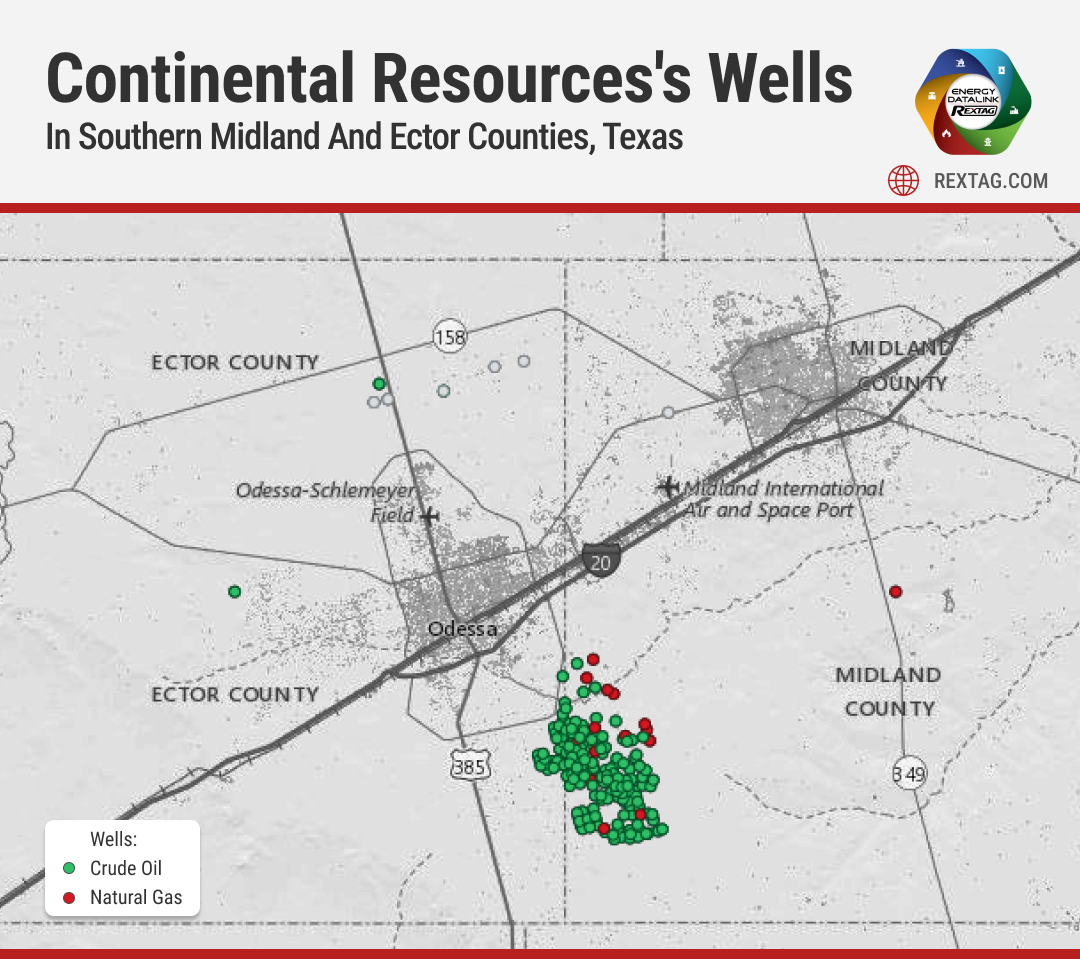

Now, Continental is pushing further east into the Midland Basin. According to records from the Texas Railroad Commission, in November 2023, Continental took on operatorship of several new leases in Midland and Ector counties, Texas.

Continental Resources has taken over 87 leases in Midland County from an Occidental Petroleum subsidiary, as shown by records from the Texas Railroad Commission (RRC).

In addition, Continental has started managing a few leases from Occidental in Ector County, just west across the county line, starting in November.

From November 2023 to January 2024, these assets in Midland and Ector counties produced around 76,000 barrels of crude oil in their first three months under Continental's operation, per the latest data from the RRC. They also produced a total of 123.1 million cubic feet of gas during the same period.

Most of the active leases have legacy vertical wells that tap into the Dora Roberts Field.

Occidental recently reported in its annual report that it sold some non-core proved and unproved properties in the Permian Basin for $202 million, recording a $142 million gain from these sales.

Continental has been tight-lipped about the specifics of the lease transfers in Midland and Ector counties but indicated that it continues to explore mergers and acquisitions in the Permian.

"We prefer not to discuss any specific transactions in detail, but expect Continental to keep looking for more acquisition opportunities and bolt-ons in the basin," said a Continental spokesperson.

Meanwhile, Occidental is expanding its presence in the Midland Basin through a $12 billion acquisition of CrownRock LP, a private producer. However, this deal increases Occidental's debt load. The Houston-based company has plans to sell between $4.5 billion and $6 billion worth of non-core assets within 18 months of closing the CrownRock deal to cut down its debt, including selling off some of its Permian assets.

Delaware Basin

In the Delaware Basin, Continental Resources is among a few companies venturing into deeper drilling, particularly targeting the Woodford formation.

So far, Continental has submitted detailed production data to regulators for three of its Woodford wells—two located in Winkler County and one in Pecos County. These wells have been drilled to significant depths, ranging from 13,000 feet to nearly 16,000 feet.

The production from the two Woodford wells in Winkler County, which have lateral lengths of 8,621 feet and 9,714 feet respectively, has totaled 248,747 barrels since they began operations in March 2023.

In Pecos County, the Magnolia State Unit well, with a lateral of 9,760 feet, has produced 144,590 barrels since it came online in April 2023. However, production data for another Woodford well in Pecos County, the Trees Ranch 0807 #1A, is not yet available.

Historically, the Permian Basin hasn't been a focus for exploratory drilling as it offers numerous easily accessible drilling sites. However, according to Lawler, Continental sees considerable potential for future gains, especially from the Barnett and Woodford intervals.

Rising Permian Portfolio

Continental Resources, which became privately owned after a $4.3 billion buyout by the Hamm family in 2022, has been steadily expanding its holdings in the Permian Basin since it first entered the area about two years ago.

The initial acquisition from Pioneer Natural Resources gave Continental about 92,000 net acres primarily in the southern part of the Delaware Basin, spanning Reeves, Ward, Winkler, and Pecos counties in Texas.

By the end of 2023, Continental had grown its Permian holdings to 193,275 net acres, as revealed in a filing in late February. Despite being privately held and not required to, Continental continues to publicly share its earnings and production details through quarterly filings.

Today, Continental's holdings in the Permian exceed 200,000 net acres, according to Lawler, the company's spokesperson.

Most of Continental's expansion in the Permian has been through smaller, accretive bolt-on acquisitions rather than large-scale mergers and acquisitions that have been common among other operators in the region.

Continental has primarily focused on acquiring assets with significant undeveloped potential rather than those with high existing production. This strategy was evident in the acquisition of the Delaware assets from Pioneer, which at the time of the purchase had a relatively low output of about 35,000 barrels of oil per day (50,000 barrels of oil equivalent per day).

In 2022, oil production from Continental's Delaware assets averaged around 32,416 barrels per day, growing to 40,443 barrels per day in 2023.

Most of the new wells Continental drilled in the Delaware assets targeted the popular Wolfcamp and Bone Spring formations, as indicated by RRC records.

Additionally, Continental is leveraging its expertise to identify horizontal drilling sites aimed at deeper geological layers, specifically the Woodford and Barnett Shale intervals across its Permian operations.

RRC data reveals production details for two Barnett wells in Ector County. The first well, Gardendale 121 13B #1H, with a lateral length of 10,565 feet, produced 201,408 barrels in its first 16 months. It also yielded 1,718 barrels during a 24-hour production test in December. The second well, H.S. Ratliff 85-17A #1H, which came online in December 2022 with a 10,219-foot lateral, produced 194,725 barrels over 14 months and initially tested at 380 barrels per day.

Continental has recently drilled five more Barnett wells, though full production data for these wells is not yet available due to regulatory provisions that allow producers to withhold post-completion well results for six months. The latest four wells on the Ratliff Red 0904 lease, all drilled to depths exceeding 11,000 feet, started production in late December 2023.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Oil and Gas: Diamondback and Endeavor's $26 Billion Merger Redefines Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/238_Blog_Oil and Gas_ Diamondback and Endeavor's $26 Billion Merger Redefines Permian Basin.png)

Diamondback's buyout of Endeavor happened about four months after ExxonMobil and Chevron made huge deals, with Exxon buying Pioneer Natural Resources for $59 billion and Chevron getting Hess for $53 billion. Even though 2023 was a slow year for company buyouts and mergers, with the total deals at $3.2 trillion (the lowest since 2013 and 47% less than the $6 trillion peak in 2021), the energy sector was still active. Experts think this buzz in energy deals is because these companies made a lot of money in 2022.

Denver-Julesburg DJ Basin: Wattenberg, Niobrara, Codell, 2022 and 2023 Overview

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R263_Blog_Denver-Julesburg DJ Basin_ Wattenberg, Niobrara, Codell, 2022 and 2023 Overview.png)

The Denver-Julesburg (DJ) Basin, spanning Northern Colorado, Eastern Wyoming, Western Kansas, and parts of Nebraska, stretches from north to south, from north of Cheyenne, Wyoming, down to Colorado Springs. Its primary production field, the Wattenberg gas field, is located in Weld County and Northwestern Adams County in Northeast Colorado. Oil and gas production in the D-J Basin traces back to a discovery in Boulder County, Colorado, in 1901, marking a long history of energy development in the area. The basin is highly productive, primarily due to its stacked plays, similar to those in other regions like the Anadarko Basin (with its SCOOP and STACK plays) and the Permian Basin. This geological feature is a key reason for the high productivity of wells in the DJ Basin.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?