Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

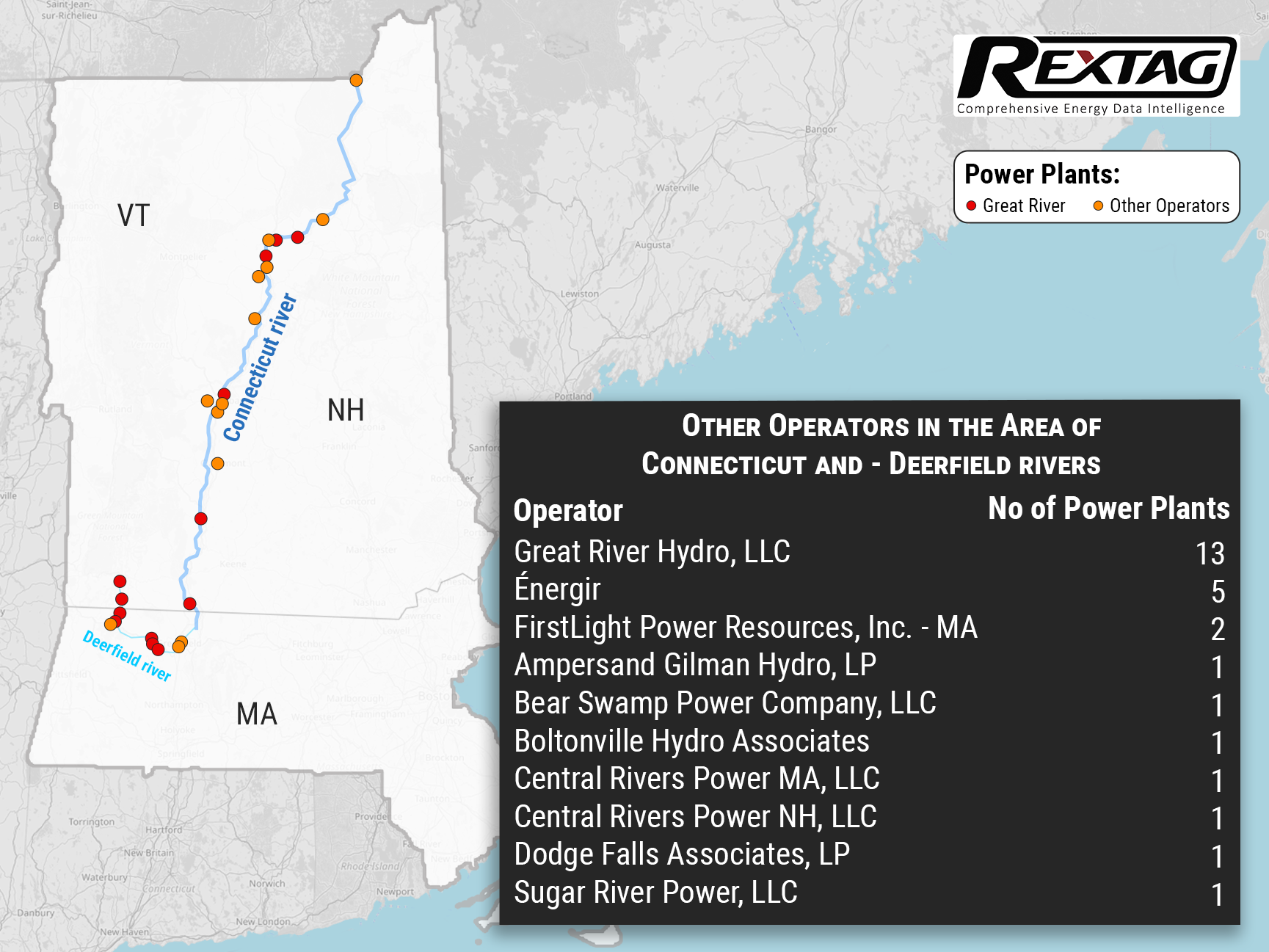

Hydro-Québec to acquire Great River Hydro With 13 hydropower generating stations in New England

11/02/2022

Vermont Business Magazine HQI US Holding LLC, a wholly-owned subsidiary of Hydro-Québec, concluded the agreement to purchase Great River Hydro, LLC, which possesses 13 hydropower generating stations with a total capacity of 589 megawatts along New England's Connecticut and Deerfield rivers in Vermont, New Hampshire and Massachusetts.

The affiliates of ArcLight Capital Partners, LLC is selling Great River Hydro for a price of roughly US $2 billion. The facilities are situated along the Connecticut and Deerfield rivers. Hydro-Québec is the largest single supplier of electricity to Vermont, comparing to the closed Vermont Yankee nuclear power station in Vernon which produces 620 megawatts.

Additionally, Hydro-Québec is buying the greates hydropower fleet in New England, where ambitious decarbonization and electrification aims have been set out and where the amount of electricity provided from variable renewable energy sources are poised to soar.

H-Q informed that hydropower is the solely renewable energy capable of balancing the intermittency of the wind and solar resources that are organized for the coming years.

Hydro-Québec has a long-term energy partnership with New England, as it has been exporting the hydropower to the region since the 1980s. This purchase represents a unique opportunity to connect the know-how in managing and leveraging hydro facilities with Great River Hydro's thorough understanding of the New England market. By combining these strengths, the company holds up the development of new renewable energy projects, in a market where such resources are wanted.

Together with management, ArcLight successfully conveyed Great River Hydro from a high-quality portfolio of assets to a standalone platform positioned for further expansion. ArcLight is confident that Hydro-Québec will be an excellent steward to Great River Hydro's stakeholders in the next chapter of its corporate life.

Great River Hydro has about 100 skilled employees. Given that Hydro-Québec wants it to remain a distinct entity, all jobs and working conditions will be kept.

The deal of Great River Hydro will also enable Hydro-Québec to expand its revenue streams in its main export market. The deal will make additional income for Hydro-Québec as of the first year.

Consummation of the transaction remains subject to customary closing conditions, including applicable regulatory approvals.

Great River Hydro has A 589-MW hydropower fleet, 13 cascading generating stations and 3 storage-only reservoirs along some 310 miles (500 km) of the Connecticut and Deerfield rivers. Moreover, its annually supply has enough energy to power over 213,000 homes in New England. One fifth of the energy generated is subject to long-term supply contracts, guaranteeing revenue stability. Land holdings of almost 30,000 acres (12,140 hectares), allowing for the possibility of various renewable energy projects.

Hydro-Québec generates, transmits and distributes electricity. It is Canada's largest electricity producer and ranks among the world's largest hydropower producers. Its sole shareholder is the Québec government.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Talos Energy Plans to Close the EnVen Acquisition Soon: Stockholders to vote on $1.1B Deal on February 8

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/116Blog_Talos_Will_Close_the_Acquisition_of_the_EnVen_01_2023.png)

Talos Energy Inc. is closing its $1.1 billion purchase of private operator EnVen Energy. A special meeting for Talos’ stockholders to vote on the deal and other matters is set on February 8, according to a prospectus filed on January 11 with the Securities and Exchange Commission. Shareholders are being asked to approve the EnVen merger, which as the company considered in September would raise its Gulf of Mexico production up to 40%. According to a January 11 press release, Talos asserted that it anticipates closing the transaction soon after the meeting. Talos Energy Inc. supposes that adding EnVen would double its operated deepwater facility footprint, extending key infrastructure in existing Talos operating areas. More than 80% of the combined assets will be deepwater, with the company operating more than 75% of the acreage it holds interests in. Talos is one of the largest independent operators in the U.S. Gulf of Mexico, with production operations, prospects, leases, and seismic databases spanning the basin in both Deep Water and Shallow Water. The company aims to actively grow through a balanced focus on asset optimization, development, and exploration while also seeking to add to its portfolio through acquisitions and business development.

Continental Resources Becomes Private, Harold Hamm Purchases it for $4.3 Billion

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/101Blog_Continental_Resources_Goes_Private_10_2022 (1).png)

Continental ResourcesInc. agreed to be purchased by its founder, Harold G. Hamm, in a $4.3 billion cash deal that would take the U.S. shale giant private. On October 17 Continental, based in Oklahoma City, concluded an agreement to be acquired by Omega AcquisitionInc., an entity owned by Hamm, for $74.28 per share. The offer price denotes a 15% premium to the closing price on June 13 — the day before Hamm’s family revealed their initial $70 per share proposal. Even with the proposed incremental leverage from the buyout, CLR would be almost 0.6x leveraged in 2023, and expected FCF, even before assuming reduced costs from going private (else dividend), would have the term loan repaid in about 1.5 years. As a private company, Continental should have greater freedom to operate, particularly in areas such as exploration. Being a chairman of Continental Resources, Hamm and his family own 83% of the company’s stock. Based on the shares outstanding as of October 12, the tender offer would be for almost 58 million shares of common stock, according to the Continental release. The tender offer values Continental at roughly $27 billion. The offer price is slightly under Siebert Williams Shank & Co. LLC’s $75 price target and compares to the consensus price target of $72.86 on FactSet and $71.73 on Bloomberg.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?